-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Inflation Worries Linger

EXECUTIVE SUMMARY

- ECB CONSIDERS BOOSTING PURCHASES OF EU RECOVERY FUND DEBT (FT)

- ECB'S LAGARDE: INFLATION SPIKE IS 'LARGELY TRANSITORY' (BBG)

- BAILEY: BANK OF ENGLAND 'WILL HAVE TO ACT' ON INFLATION (BBG)

- PBOC'S YI SAYS CHINA CAN 'CONTAIN' THE RISK FROM EVERGRANDE (BBG)

- CHINA DATA MIXED, Q3 GDP PROVIDES MARGINAL MISS

- NZ CPI SURGES

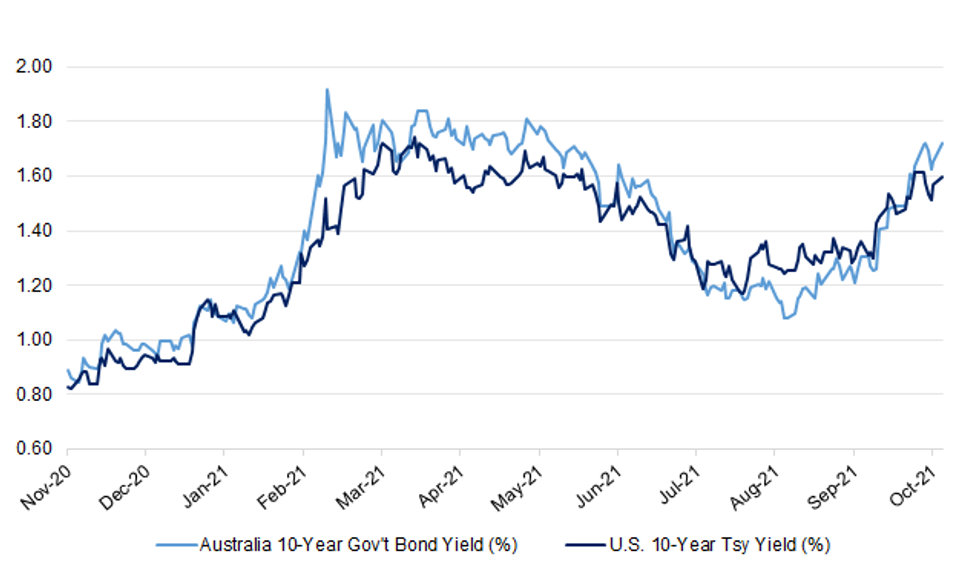

Fig. 1: Australia 10-Year Gov't Bond Yield vs. U.S. 10-Year Tsy Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Governor Andrew Bailey moved to strengthen the case for raising interest rates, saying the central bank will "have to act" to curb inflationary forces and warning higher energy costs mean price pressures will linger. Speaking to an online panel organized by the Group of 30, Bailey said that while central banks don't have the tools to counter supply disruptions and he still believes the recent acceleration of inflation will be temporary, officials need to seek to prevent higher inflation expectations from becoming entrenched. Rising energy prices mean inflation "will last longer and it will of course get into the annual numbers for longer as a consequence," he said. "That raises for central banks the fear and concern of embedded expectations. That's why we, at the Bank of England have signaled, and this is another signal, that we will have to act. But of course that action comes in our monetary policy meetings." (BBG)

FISCAL: Rishi Sunak is stepping up plans for an online sales tax to level the playing field between tech behemoths and high street retailers after delaying an overhaul of business rates. (Telegraph)

FISCAL: Chancellor Rishi Sunak is considering a cut to the 5 per cent rate of value added tax on household energy bills, in a move which would allow Boris Johnson to deliver a supposed "Brexit dividend" and help families through a tough winter. Some Conservative MPs have demanded Sunak reduce the VAT rate in his October 27 Budget to show the government is responding to a looming cost of living crisis. But the chancellor is generally resisting pressure to loosen the purse-strings in a very tight Budget and is wary of the political risks of a VAT cut on domestic energy bills, as well as an annual cost of about £1.5bn. (FT)

FISCAL: Motorists face paying to use Britain's road network to make up for the loss of revenue from fuel duties as the country moves towards net zero under plans being discussed in government. Preliminary talks have taken place between ministers over a nationwide road pricing scheme to replace fuel duties that bring about £30 billion a year to the Treasury. Government sources said there was an acceptance across Whitehall that ministers should be "making the case" for road pricing to avoid a black hole in public finances. (The Times)

BREXIT: The Northern Ireland Protocol will need to be renegotiated in the future even if a new Brexit deal is struck in the coming weeks, government insiders have said. Lord David Frost was in Brussels on Friday to open a period of intensive negotiations over the post-Brexit arrangements to solve trade disruption and political tension caused by the protocol. British negotiators believe the Brexit arrangements for Northern Ireland will require more changes in the future, because of the ever-changing political landscape in the province and technological developments which could further reduce customs controls. (Telegraph)

ECONOMY: The number of businesses that failed in England and Wales last month was the largest since the Covid pandemic began. Company insolvencies in September totalled 1,446, increasing from 1,349 in August and 56% higher than the same month last year, data from the Insolvency Service shows. September saw many firms contend with rising energy and labour costs and the tapering of Covid government support. Some insolvency experts fear the number will rise further. (BBC)

POLITICS: In the latest Opinium poll for the Observer today the Tories retain a four-point lead after a party conference season that Labour MPs hoped might see a revival of their party's and Starmer's fortunes. While Johnson's approval ratings have dropped to their lowest levels since the last election, the Tories are still up two points on a fortnight ago on 41%, while Labour, also up two, lags behind on 37%. The Conservatives and Labour are each holding on to the vast majority of their respective general election voters: 86% of 2019 Conservatives and 85% of 2019 Labour voters. (Observer)

POLITICS: Boris Johnson's lead over Sir Keir Starmer has shrunk to one point – but he is still nine points ahead of his Labour rival as the public's choice of best Prime Minister, a Mail on Sunday Superpoll finds today. The Deltapoll survey puts the Conservatives on 38 per cent and Labour on 37 per cent – compared with a lead of five per cent in the pollster's previous poll in July. (Mail on Sunday)

POLITICS: Confidential documents leaked to the Observer reveal an extraordinary rift between Boris Johnson and his chancellor, Rishi Sunak, over the potential economic effects of moving towards a zero-carbon economy, with just weeks to go before the crucial Cop26 climate summit. As Johnson prepares to position the UK at the head of global efforts to combat climate change and curb greenhouse gas emissions as host of the Glasgow Cop26 meeting, the documents show the Treasury is warning of serious economic damage to the UK economy and future tax rises if the UK overspends on, or misdirects, green investment. (Observer)

EUROPE

ECB: The European Central Bank is exploring raising its limit on purchases of EU-issued bonds, in a move that would enhance its flexibility in asset-buying schemes and boost the status of the bloc's groundbreaking joint debt programme launched this year. Four ECB governing council members told the Financial Times they would support increasing the share of public sector bond purchases that target debt issued by international bodies such as the EU, from the current cap of 10 per cent. They expect to discuss the idea at two special council meetings starting in November to decide how much support to provide for financial markets from next year. The plan would need majority support from the ECB council's 25 members. The ECB declined to comment. The mooted shift in ECB strategy comes as the European Commission plans to expand the amount of bonds it issues next year under its €800bn NextGenerationEU recovery fund — the vehicle agreed in the summer of 2020 to fund the pandemic response with debt backed jointly by member states. (FT)

ECB: The current spike in inflation is unlikely to last, European Central Bank President Christine Lagarde said, while vowing to continue aiding the euro-area economy as the fallout from the pandemic lingers. (BBG)

ECB: Interest rates will start to edge up once central banks begin unwinding their most important stimulus programs in the first half of next year, Klaas Knot, a European Central Bank Governing Council member, said Sunday. "You can assume that the time of high interest rates won't come back, a high rate in the future would be 3 to 4 percent," Knot said on the WNL television program on Sunday. The Dutch central bank governor, considered one of the more hawkish members of the Governing Council, also said he he sees the current jump in inflation as a mostly transitory. (BBG)

EU: Poland has no intention of leaving the European Union, the country's de facto leader Jaroslaw Kaczynski has said. "Anyone sane in politics can't strive to change" Poland's status as an EU member, Kaczynski told radio RMF FM in an interview. "Polexit is fake news used by the opposition." His clarification comes in the wake of a Polish top-court ruling that challenged the legislative primacy of the bloc and sparked criticism the ruling Law & Justice Party is steering the nation toward an eventual exit. (BBG)

GERMANY: Germany's Green Party agreed to enter formal talks with the center-left Social Democrats and pro-business Free Democrats about forming a three-way coalition government. A large majority of the Greens' 70 delegates voted at a party conference in Berlin on Sunday in favor of a motion to start talks, with just two no votes and one abstention. FDP leadership is expected to approve the talks on Monday; the Social Democrats did already did so Friday. (BBG)

FRANCE: France's health agency wants more details on the effects of Moderna's Covid vaccine on younger people amid concerns about potential side effects, Dominique Le Guludec, who heads the agency, told Le Journal du Dimanche. "We want to be sure about the vaccine's benefits" on younger people, and an alert in Scandinavia this month "made us change our strategy," the head of Haute Autorite de Sante said. The agency has also recommended not using the vaccine as a third booster shot for elderly people until it gets European Medicines Agency approval. (BBG)

FRANCE: Emmanuel Macron is leading in the run-up to the first round of French presidential elections in April with 25% to 27% support and will likely face a far-right candidate in a decisive runoff vote, according to a poll by Ifop-Fiducial for Le Figaro newspaper. (BBG)

ITALY: The contentious issue of Italy's Green Pass, the strictest national vaccine mandate in Europe, helped spur some 200,000 demonstrators to the streets of Rome on Saturday. The protest, organized by the main Italian unions, was a counter-protest to a large demonstration last week, in which far-right protesters occupied the Rome headquarters of the union Ggil in opposition to the Green Pass. (BBG)

ITALY: Italy is in talks to inject at least 5 billion euros ($5.6 billion) into Banca Monte Paschi di Siena SpA ahead of a sale of the troubled lender to UniCredit SpA, according to people familiar with the matter. The finance ministry, which controls Monte Paschi, is considering a cash infusion for the Tuscan bank through a rights offering that would allow minority shareholders to opt out of the increase, said the people, who asked not to be identified discussing the private deliberations. The end result would be a larger financial contribution from the government -- compared with 3 billion euros estimated earlier -- to meet conditions set by UniCredit's Chief Executive Officer Andrea Orcel for his purchase of Monte Paschi following the financial boost, they said. (BBG)

SWITZERLAND: Switzerland will warn major industrial users they could be forced to save electricity this winter in a bid to avoid large-scale blackouts, NZZ am Sonntag reported. About 30,000 companies that each consume more than 100,000 kilowatt hours per year are being sent a letter from Ostral, the crisis-management organization for the sector. They could be asked to reduce consumption by 10% to 30% in the event of a shortage, the newspaper said. (BBG)

RATINGS: Ratings reviews of note from Friday included:

- DBRS Morningstar confirmed France at AA (high), Stable Trend

- DBRS Morningstar confirmed Norway at AAA, Stable Trend

U.S.

ECONOMY: Uncomfortably high inflation will grip the U.S. economy well into 2022, as constrained supply chains keep upward pressure on prices and, increasingly, curb output, according to economists surveyed this month by The Wall Street Journal. The economists' inflation projections are up dramatically from July, while short-term growth outlooks are lower. Economists on average see inflation at 5.25% in December, just slightly less than the rate that has prevailed since June. Assuming a similar level in October and November, that would mark the longest inflation has been above 5% since early 1991. (WSJ)

FISCAL: A major program in the Democrats' push to fight climate change is likely to be removed from their spending plan amid opposition from Sen. Joe Manchin (D-W.Va.), according to multiple reports. Both The New York Times and CNN reported the likely cut on Friday night, with the Times citing congressional staffers and lobbyists familiar while CNN cited three congressional sources. The program in question is called the Clean Electricity Payment Program, which would incentivize utilities to shift toward clean sources of energy using a mix of grants and fines. (The Hill)

FISCAL: Sen. Joe Manchin (D-W.Va.) has told the White House the child tax credit must include a firm work requirement and family income cap in the $60,000 range, people familiar with the matter tell Axios. While Manchin's demands would dramatically weaken one of President Biden's signature programs to help working families, they also would reduce the package's overall costs. (Axios)

FISCAL: President Joe Biden said Friday that his social safety net budget reconciliation package won't hit the $3.5 trillion price tag outlined by Democratic leaders over the summer. His comments, delivered during remarks at a Connecticut child care center, mark the first time the president appeared to concede fully that he would need to reduce the scope of the bill in order to secure votes from centrist Democratic Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona. (Washington Examiner)

CORONAVIRUS: Members of the Food and Drug Administration's key advisory committee on vaccines criticized the speed with which the agency was reviewing Johnson & Johnson's Covid booster trials as well as the lack of verified data presented before the panel Friday. Their comments came before the panel of outside experts unanimously voted to recommend the company's booster shots for all individuals over 18. J&J submitted its booster data to the FDA 10 days before the Vaccines and Related Biological Products Advisory Committee's meeting. (CNBC)

CORONAVIRUS: President Joe Biden's chief medical adviser said he expects U.S. regulators to consider whether people who got the one-dose Johnson & Johnson vaccine should get an mRNA shot against Covid-19 as a booster. (BBG)

CORONAVIRUS: An influential Food and Drug Administration advisory committee on Friday said the agency should authorize boosters of Johnson & Johnson's single-shot Covid-19 vaccine to the more than 15 million Americans who have already received the initial dose. The unanimous vote – by the agency's Vaccines and Related Biological Products Advisory Committee – is a critical step before the U.S. can begin giving second shots to J&J recipients, some of whom have said they are anxious to get the additional protection. One dose of J&J's vaccine has been shown in studies to be comparatively less effective than the two-dose messenger RNA vaccines made by Pfizer-BioNTech and Moderna. (CNBC)

CORONAVIRUS: The risk of mRNA Covid booster shots causing heart inflammation in young adults continues to worry top scientists weighing whether to approve third doses for anyone over 12, Dr. Ofer Levy, a voting member of the Food and Drug Administration's advisory panel, said Friday. (CNBC)

CORONAVIRUS: New York City subway ridership topped 3.2 million for the first time since the start of the pandemic, an "encouraging" signal that the city is recovering, Governor Kathy Hochul said. There were more than 3.2 million subway customers and more than 7,000 Staten Island Railway customers on Thursday, which had seen steep declines during the coronavirus health crisis. The average weekday subway ridership totals fell to about 300,000 daily trips in April 2020 during the height of the pandemic, a 95% drop from over 5.5 million trips pre-Covid-19, Hochul said in a news release. (BBG)

CORONAVIRUS: Governor Tim Walz put Minnesota's National Guard on alert Friday to help free up space in hospitals increasingly overcrowded by Covid-19 patients. The guard members will help staff long-term facilities that could be used for more than 400 current hospital patients, he said. (BBG)

CORONAVIRUS: New Mexico's hospitals are close to imposing "crisis standards of care," which set the protocols for rationing medical care, according to a statement from Governor Michelle Lujan Grisham. Such crisis standards have already been put in place in Alaska, Idaho and Montana, among the states hardest hit by the delta variant. Hospital beds "remain in dangerously short supply," she said in the statement on Friday. (BBG)

RATINGS: Ratings reviews of note from Friday included:

- DBRS Morningstar confirmed the United States of America at AAA, Stable Trend

TSYS: The U.S. Treasury Department is asking dealers for their views on how market-structure changes in their interactions with customers have affected liquidity, and whether it should make 17-week bill issuance routine. The department on Friday released its agenda for its calls with primary dealers in advance of the quarterly refunding announcement on Nov. 3. It asks them to discuss market-structure developments in the areas of "specific participant types, methods of execution, margining practices, means of clearing." Separately the agenda asks about "the appropriate level of bills outstanding in the medium and long-term," and how much the current benchmark bill auctions could grow "without causing significant yield deviations from fair value." Survey, as usual, also asks dealers to discuss their forecasts for economic, fiscal and monetary policy and Treasury financing forecasts. (BBG)

OTHER

GLOBAL TRADE: Factory owners in China and their customers worldwide have been told to prepare for power supply disruptions becoming part of life as President Xi Jinping doggedly weans the world's second-biggest economy off its dependence on coal. Months of shortages have cut power to households in China's north-east and caused outages at factories across the country. But energy demand is still surging amid record demand for Chinese exports, and the problems will be compounded by the prospect of freezing temperatures in winter. Despite a flurry of central government interventions, spearheaded by premier Li Keqiang, Chinese manufacturers and multinationals alike have been urged to boost energy efficiency in their factories and speed up investment in renewable energy. (FT)

GLOBAL TRADE: Global ports are growing more gridlocked as the pandemic era's supply shocks intensify, threatening to spoil the holiday shopping season, erode corporate profits and drive up consumer prices. Bloomberg's Port Congestion Tracker shows a typhoon in Asia spawned another wild week for shipping in a year with multiple challenges -- a vessel wedged in the Suez Canal, a dozen major storms, rolling Covid lockdowns disrupting key manufacturring hubs in China and Vietnam, a shortage of truckers and dockworkers, and a resurgence of consumer demand. As of Friday, at least 107 container ships were waiting off Hong Kong and Shenzhen, the data show. The pileup worsened when the storm brushed past Hong Kong around midweek, shutting down its stock exchange and idling its ports. Globally, RBC Capital Markets reckons 77% of ports are experiencing abnormally long times to turnaround traffic. The latest congestion won't be isolated to Asia for long, as delayed ships loaded with merchandise soon start sailing for the U.S. and Europe. (BBG)

GLOBAL TRADE: A trio of House Democrats is asking party leaders to "pause" their plans to raise taxes on big companies' overseas profits, adding a new complication to Democrats' negotiations over their next big legislative package. In a letter to House Speaker Nancy Pelosi obtained by POLITICO, the lawmakers say they first want to see how other countries implement a new agreement to create a global minimum tax on multinationals — something that could be years away. (POLITICO)

GLOBAL TRADE: Japan will establish a 100 billion yen ($875 million) fund to help accelerate research and development of advanced technologies and enhance economic security, Nikkei has learned. (Nikkei)

GEOPOLITICS: China tested a nuclear-capable hypersonic missile in August that circled the globe before speeding towards its target, demonstrating an advanced space capability that caught US intelligence by surprise. Five people familiar with the test said the Chinese military launched a rocket that carried a hypersonic glide vehicle which flew through low-orbit space before cruising down towards its target. The missile missed its target by about two-dozen miles, according to three people briefed on the intelligence. But two said the test showed that China had made astounding progress on hypersonic weapons and was far more advanced than US officials realised. (FT)

GEOPOLITICS: The Editor in Chief of the Global Times tweeted the following on Sunday: "China has no intention to engage in a nuclear arms race. But it'll certainly improve quality of its nuclear deterrence to ensure that the US abandons the idea of nuclear blackmail against China, or using nuclear forces to fill the gap as US conventional forces cannot crush China." (MNI)

GEOPOLITICS: The Chinese military on Sunday condemned the United States and Canada for each sending a warship through the Taiwan Strait last week, saying they were threatening peace and stability in the region. (RTRS)

GEOPOLITICS: The Russian Defense Ministry has summoned the US military attache and pointed out the unprofessional actions of the crew of the US Navy's destroyer Chafee that attempted to cross the Russian border in the Sea of Japan, the military agency told journalists on Friday. "The position of the Russian military agency was conveyed to the representative of the US armed forces in relation to the US Navy's destroyer Chafee's attempted violation of the state border of the Russian Federation in the area of the Peter the Great Bay on October 15," the statement said. (TASS)

ASIA: Japanese Prime Minister Fumio Kishida made an offering to a controversial war shrine only weeks after becoming leader of the government, a move that angered both China and South Korea. Kishida donated religious ornaments to mark the Yasukuni Shrine's autumn festival, the Associated Press reported. Yoshihide Suga, whose resignation paved the way for Kishida to become prime minister on Oct. 4, visited the shrine on Sunday, the AP said. (BBG)

JAPAN: Japan's minister in charge of virus response said restrictions on bars and restaurants could be lifted next month if the current infection trend continues. Daishiro Yamagiwa was speaking on a program broadcast by Fuji TV. The government is also considering softening border restrictions, he added. Tokyo bars are being instructed to stop serving alcohol by 8 p.m. and close by 9 p.m. The daily number of infections recorded in the capital has been less than 100 for a week. (BBG)

AUSTRALIA: New South Wales, Australia's most populous state, achieved the milestone of fully vaccinating 80% of its adult population, Premier Dominic Perrottet said in a tweet, adding virus-related curbs will be further eased Monday. Prime Minister Scott Morrison wrote on Facebook that the country is just over 2.5 million jabs away from hitting a similar 80% target nationally. (BBG)

AUSTRALIA: Melbourne, which has spent more time under COVID-19 lockdowns than any other city in the world, is set to lift its stay-at-home orders this week, officials said on Sunday. By Friday, when some curbs will be lifted, the Australian city of 5 million people will have been under six lockdowns totalling 262 days, or nearly nine months, since March 2020. (RTRS)

AUSTRALIA: Fortress Australia's walls have cracked further after Queensland state outlined plans to reopen its borders to the rest of the nation. Queensland won't require fully vaccinated travelers from other states to quarantine on arrival from Dec. 17 or once 80% of the population are inoculated, whichever is earlier, Premier Annastacia Palaszczuk told reporters Monday. Overseas arrivals will be allowed to quarantine at their place of residence, she said. All border restrictions will be lifted for vaccinated travelers -- both domestic and international -- should the 90% threshold be met. The plan follows pressure from Australia's Prime Minister Scott Morrison on states to end border closures by Christmas. (BBG)

NEW ZEALAND: Auckland, the city at the centre of New Zealand's Covid outbreak, will remain in level 3 lockdown for another two weeks, despite rising vaccination levels. The decision from prime minister Jacinda Ardern comes as experts remain concerned that an early move out of lockdown could be disastrous, and risk overwhelming the health system. (Guardian)

TURKEY: Turkey's President Recep Tayyip Erdogan hit back at the opposition for urging bureaucrats to disobey "unlawful orders" from the government, calling such comments a "crime." "Urging the bureaucrats to oppose the elected government is nothing short of wishing for a regime of tutelage," Erdogan said at a press conference Sunday, responding to a video message by leader Republican People's Party Kemal Kilicdaroglu. (BBG)

MEXICO: Mexico central bank Deputy Governor Jonathan Heath said on Twitter the data on workers registered with the social security institute in September "were very good." Numbers were higher than they were for the same month two years ago, before the pandemic, Heath said. "It's possible that in October (and if not later in November) we will see a new all-time high." (BBG)

MEXICO: The Biden administration will reinstate a Trump-era border policy in November that forces asylum seekers to stay in Mexico until their U.S. immigration court date. The decision comes after the Supreme Court declined the administration's request to block an order by a federal judge to reinstate the policy, leaving the administration with a deadline on Thursday to comply. (CNBC)

SOUTH AFRICA: South Africa's indebted Eskom Holdings SOC Ltd. has started court proceedings to review the regulator's rejection of a price plan into 2025 that outlines how much the utility can charge electricity consumers. The National Energy Regulator of South Africa on Sept. 30 called for a pricing methodology review and discarded the so-called MYPD 5 revenue application of Eskom, which is unprofitable and struggles under about 400 billion rand ($27 billion) of debt. "This is impossible both from a legal process and timing point of view," the utility had said. (BBG)

IRAN: Iran is not ready to return to talks with world powers over its nuclear programme yet and its new negotiating team wants to first meet with the EU in Brussels in the next few weeks, a senior EU official said on Friday. (RTRS)

MIDDLE EAST: Saudi Foreign Minister Prince Faisal bin Farhan said on Friday that Iran's acceleration of its nuclear activities is putting the world in "a very dangerous place" amid efforts to bring Tehran back into a 2015 nuclear deal. (RTRS)

IRAN: Iranian and European Union diplomats will meet on Thursday in Brussels to discuss how to break a monthslong deadlock with the U.S. over how to revive the 2015 nuclear deal. (BBG)

IMF: Normalization of monetary policy will be gradual, well communicated and not a source of turmoil, Vitor Gaspar, director of fiscal affairs at the International Monetary Fund, told Nikkei in an interview. (Nikkei)

EQUITIES: Hong Kong's primary-listing market is going through a dry patch in what is normally the busiest time of the year. Several potential billion-dollar initial public offerings ranging from supermarket owner WM Tech Corp. to health-care startup We Doctor Holdings Ltd. have let their applications lapse in recent weeks as regulatory scrutiny and stock market weakness crimps listings. Large IPOs falling by the wayside are a further sign of how China's regulatory onslaught is causing a downturn in the financial hub's market for first-time share sales. President Xi Jinping's push to align companies with his vision of "common prosperity" has caused a roadblock and Hong Kong equity benchmarks are the world's worst this year. (BBG)

ENERGY: Russian gas consumption is running at a record high but Moscow is still ready to increase supplies to Europe should it receive such requests, Deputy Prime Minister Alexander Novak said on Saturday. (RTRS)

OIL: OPEC+ compliance with oil production compares with 115% in September, according to delegates with knowledge of the matter. (BBG)

OIL: Iraq's oil ministry spokesman said that an oil price above $80 is "a positive indicator" but needs long term stability. (RTRS)

OIL: UAE Energy Minister Suhail al-Mazrouei said the oil-rich Gulf state continues to invest in the energy sector to meet growing demand and ensure stability in global markets, according to a tweet from his ministry twitter account on Saturday. (RTRS)

OIL: Iranian naval forces intervened on Saturday to repel pirates who attacked an Iranian oil tanker in the Gulf of Aden, Iran's state media reported. (RTRS)

OIL: Asian demand for U.S. oil is rising as the energy crisis boosts prices for other crudes that are priced against the global Brent futures contract. China and other Asian buyers have been snapping up supertankers of American sour crudes for delivery in November and seeking more for December, according to traders. Most buyers are seeking U.S. grades that had recently slumped to the lowest levels in over a year, with an added incentive after China's government awarded millions of tons of crude oil import quotas. (BBG)

CHINA

PBOC: China will continue to implement proactive fiscal policy and prudent monetary policy to support recovery, PBOC Governor Yi Gang said at the meeting of the International Monetary and Finance Committee last week, according to a statement on the PBOC website. China's economy continues to recover with inflation generally moderate, while imports and exports are seeing robust growth, said Yi. The surplus of current account is at a reasonable range and the yuan remains stable, Yi said. China supports the transfer of SDRs to countries in need, expanding poverty reduction and growth trust, Yi said. (MNI)

PBOC/EVERGRANDE: People's Bank of China Governor Yi Gang said authorities can contain risks posed to the Chinese economy and financial system from the struggles of China Evergrande Group. The property developer's trouble "casts a little bit of concern," Yi said at a virtual meeting of the Group of 30 on Sunday. "Overall, we can contain the Evergrande risk." (BBG)

EVERGRANDE: Evergrande Group's chief executive is holding talks in Hong Kong with investment banks and creditors over a possible restructuring and asset sales, two people said, as the Chinese developer battles against default on more than $300 billion in debts. (RTRS)

FISCAL: A Chinese local government faces difficulties paying basic social services as revenues from land sales plunged following this year's curbs on housing markets, the Economic Observer reported citing an interview with an unidentified local official. The county faces as much as CNY2 billion deficit as sales of land fell by more than half from last year, the newspaper reported citing the official. The county may have difficulty paying wages this month as the authorities scramble to borrow money from other sources, including using special-purpose bonds, the official was cited as saying. While the newspaper didn't say if other regions face similar difficulties, it cited a Moody's report saying that revenue from land sales accounted for 29.2% of total local government incomes in 2020. Local governments will increasingly rely on raising debt to pay their expenditures, the newspaper said. (MNI)

CORONAVIRUS: China's Civil Aviation Administration ordered five domestic and foreign airlines to suspend some flights from Monday after multiple coronavirus cases were found on board, it said in a statement. The carries included Air China Ltd., which had six infections detected on an inbound flight from Frankfurt to the northeastern city of Changchun, the administration said in the statement released Friday. KLM Royal Dutch Airlines, EL Al Israel Airlines and Condor Flugdienst GmbH were required to pause two flights each after cases were found on flights to Shanghai and Xi'an, it said. Shandong Airlines Co. was also required to suspend some services. (BBG)

PROPERTY: China is likely to soon implement taxes on properties given the government's oft-repeated slogan that houses are not intended to be speculated on, and that China's efforts to lean on technology and manufacturing for growth, while waning off reliance on properties, Yicai.com reported citing Luo Zhiheng, deputy head of the Yuekai Securities Research Institute. The comments followed President Xi Jinping's recent article on "common prosperity," in which Xi urged more taxes on higher incomes. However, the government is likely to proceed with caution and will apply property taxes together with income taxes and adjust for regional differences, Yicai said citing Li Xuhong, a professor at Beijing National Accounting Institute. (MNI)

ECONOMY: China is able to adopt effective policies based on changing situation to ensure stable economic development, Fu Linghui, spokesman for the National Bureau of Statistics, says at a briefing. China sees producer inflation to moderate, Fu says, without giving specific forecast. China has a pre-emptive policy to lower the potential spillover effect of developed nations' monetary policies. China is capable to achieve full-year economic targets. (BBG)

OVERNIGHT DATA

CHINA Q3 GDP +4.9% Y/Y; MEDIAN +5.0%; Q2 +7.9%

CHINA Q3 GDP +0.2% Q/Q; MEDIAN +0.4%; Q2 +1.3%

CHINA Q3 GDP YTD +9.8% Y/Y; MEDIAN +10.1%; Q2 +12.7%

CHINA SEP INDUSTRIAL OUTPUT +3.1% Y/Y; MEDIAN +3.8%; AUG +5.3%

CHINA SEP INDUSTRIAL OUTPUT YTD +11.8% Y/Y; MEDIAN +12.2%; AUG +13.1%

CHINA SEP RETAIL SALES +4.4% Y/Y; MEDIAN +3.5%; AUG +2.5%

CHINA SEP RETAIL SALES YTD +16.4% Y/Y; MEDIAN +16.3%; AUG +18.1%

CHINA SEP FIXED ASSETS EX RURAL YTD +7.3% Y/Y; MEDIAN +7.8%; AUG +8.9%

CHINA SEP PROPERTY INVESTMENT YTD +8.8% Y/Y; MEDIAN +9.5%; AUG +10.9%

CHINA SEP UNEMPLOYMENT RATE 4.9%; MEDIAN 5.1%; AUG 5.1%

NEW ZEALAND Q3 CPI +4.9% Y/Y; MEDIAN +4.2%; Q2 +3.3%

NEW ZEALAND Q3 CPI +2.2% Q/Q; MEDIAN +1.5%; Q2 +1.3%

JAPAN SEP TOKYO CONDOMINIUMS FOR SALE

NEW ZEALAND SEP SERVICES PMI 46.9; AUG 35.4

BusinessNZ chief executive Kirk Hope said that despite the improvement in the overall result for September, current restrictions still mean business as usual for most of the country is still a ways off yet. "COVID-19 and its associated lockdown/restrictions still completely dominate comments from respondents, while the key sub-indexes of Activity/Sales (45.3) and New Orders/Business (47.5) remain in contraction. At what point the PSI returns to expansion will largely depend on any upcoming changes to alert levels in the weeks ahead." BNZ Senior Economist Doug Steel said that "subdued new orders warn against expecting too much of a bounce in coming months. Of course, the spread of COVID, vaccination rates, and any restriction changes will have a very large bearing on that." (BusinessNZ/BNZ)

NEW ZEALAND SEP NON-RESIDENT BOND HOLDINGS 54.2%; AUG 53.3%

UK OCT RIGHTMOVE HOUSE PRICES +6.5% Y/Y; SEP +5.8%

UK OCT RIGHTMOVE HOUSE PRICES +1.8% M/M; SEP +0.3%

CHINA MARKETS

PBOC NET DRAINS CNY10BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.2% on Monday. The operations lead to a net drain of CNY10 billion after offsetting the maturity of CNY20 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:26 am local time from the close of 2.1174% on Friday.

- The CFETS-NEX money-market sentiment index closed at 38 on Friday, compared with the close of 40 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4300 MON VS 6.4386

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4300 on Monday, compared with the 6.4386 set on Friday.

MARKETS

SNAPSHOT: Inflation Worries Linger

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 67.34 points at 29001.29

- ASX 200 up 5.023 points at 7367

- Shanghai Comp. down 12.406 points at 3559.96

- JGB 10-Yr future down 16 ticks at 151.28, yield up 0.8bp at 0.091%

- Aussie 10-Yr future down 8.5 ticks at 98.24, yield up 7.7bp at 1.732%

- U.S. 10-Yr future -0-09 at 130-22, yield up 2.98bp at 1.600%

- WTI crude up $1.24 at $83.52, Gold up $0.96 at $1768.55

- USD/JPY up 11 pips at Y114.33

- ECB CONSIDERS BOOSTING PURCHASES OF EU RECOVERY FUND DEBT (FT)

- ECB'S LAGARDE: INFLATION SPIKE IS 'LARGELY TRANSITORY' (BBG)

- BAILEY: BANK OF ENGLAND 'WILL HAVE TO ACT' ON INFLATION (BBG)

- PBOC'S YI SAYS CHINA CAN 'CONTAIN' THE RISK FROM EVERGRANDE (BBG)

- CHINA DATA MIXED, Q3 GDP PROVIDES MARGINAL MISS

- NZ CPI SURGES

BOND SUMMARY: Cheapening Apparent

Spill over from Friday's NY trade and stronger than expected CPI data out of New Zealand created some notable pressure for core FI markets during Asia-Pac hours. While there were some spurts of demand, a convincing bid never really came in, with weakness extending as we moved through the overnight session. Marginally softer than expected Chinese Q3 GDP data (accompanied by mixed monthly economic activity data) failed to provide a bid for core FI, with plenty of worry re: the Chinese economy already observed in recent weeks/months. BoE Governor Bailey also fanned rate hike speculation in the UK over the weekend, which would have provided some downward impetus.

- T-Notes breached cluster support on the sell off, to last trade -0-09+ at 130-21+, while the belly represented the weakest point of the cash Tsy curve, as the broader benchmarks cheapened by 2.5-4.0bp on the day. NY hours will see the latest round of U.S. industrial production data, which will be supplemented by Fedspeak from Quarles & Kashkari.

- JGB futures have trickled lower early this week, with the offshore impulse and lack of domestic risk events evident on Monday allowing dealers to extend on the weakness seen during the second half of Friday's Tokyo trade, which spilled into the overnight session. Futures last -15, just off early lows, and still some way above the next area of technical support (the month-to-date lows located at 150.18). The 7- to 20-Year zone of the cash JGB curve represents the weak point, cheapening by ~1bp thus far. Super-long swap spreads have seen some widening, pointing to payside flows helping the broader weakness.

- The trans-Tasman impetus from the previously flagged NZ CPI print accentuated the bear flattening witnessed overnight, leaving YM -18.0, trading through a couple of notable technical support levels, while XM sits 8.5 ticks lower on the day. Positive developments surrounding the wind back of COVID restrictions in NSW, Victoria & Queensland were also noted.

EQUITIES: Chinese Equities Struggle

Chinese mainland equities led the weakness witnessed across most of the major Asia-Pac indices, as the CSI 300 index shed over 1.0%, with worry surrounding Evergrande contagion weighing on the property sector, even as the PBoC continued to play down worry re: the systemic impact surrounding the China Evergrande situation (some read this as a signal from policymakers that a bailout would not be forthcoming). Mixed Chinese economic data did little to support the space, with the same holding true for sell-side calls re: a lower likelihood of PBoC easing in Q421. U.S. e-minis trade either side of unchanged, with the NASDAQ struggling the most owing to the uptick in U.S. Tsy yields. Some pointed to weekend comments from BoE Governor Bailey & the latest NZ CPI reading as another negative for equities i.e. via inflationary pressures.

OIL: A Fresh Week Sees A Fresh Rally

WTI prints $1.25 above settlement levels, while Brent is the best part of $1.00 better off. The well-documented energy supply issues continue to drive demand for oil-based products, contributing to tighter markets and fresh multi-year highs for crude futures.

- In terms of OPEC+ matters, BBG sources pointed to 115% compliance during the month of September re: the OPEC+ pact. Elsewhere, the Iraqi oil ministry noted that oil prices > $80bbl represent "a positive indicator," although a spokesperson for the ministry alluded to the need for long term stability in prices.

GOLD: Flat

Bullion has experienced a flat start to the week, with spot last dealing little changed, a touch shy of $1,770/oz, after sticking within the well-defined lines in the sand over the past couple of weeks. The latest uptick in U.S. Tsy yields and the broader DXY has done little for the space, with inflation worry perhaps generating some regional demand in Asia-Pac hours.

FOREX: Kiwi Holds Firm After CPI Beat, Despite Return Of Mild Cautious Feel

The kiwi went bid after New Zealand's Q3 CPI data poured fuel on fears of an inflationary blowout. Headline inflation rate printed at +4.9% Y/Y, the fastest pace in a decade, overshooting the RBNZ's projection from their latest MPS (+4.1%) as well as consensus forecast (+4.2%) and estimates of all economists surveyed by BBG. The release boosted RBNZ tightening bets and the OIS strip now prices ~37bp worth of OCR hikes at the Reserve Bank's next monetary policy meeting, while BNZ said they see the odds of a 50bp hike in November at "just a tad under 50:50."

- The RBNZ released their preferred metric of core inflation after the main inflation report hit the wires. Sectoral factor model inflation accelerated to +2.7% Y/Y in Q3, moving further above the mid-point of the Reserve Bank's target range.

- NZD/USD briefly showed above a key layer of resistance from the 200-DMA/descending trendline drawn off Feb 2021 high, but struggled to make much headway beyond there and trimmed gains.

- Strong domestic inflation data allowed NZD to withstand pressure applied to the broader high-beta FX space by negative risk sentiment. The kiwi's Antipodean cousin AUD led losses in G10 FX space as a result.

- Sterling showed a modicum of strength in early trade, after BoE Gob Bailey said that the central bank will "have to act" to tame inflation, but gave away initial gains as defensive flows kicked in.

- Safe havens USD and JPY traded on a firmer footing as mildly cautious mood took hold. USD/JPY went offered into the Tokyo fix but recouped losses later on, oscillating in close proximity to multi-year highs printed last Friday.

- The yuan looked through a mixed bag of China's quarterly GDP data and monthly economic activity indicators.

- Today's economic docket includes speeches from Fed's Quarles & Kashkari, ECB's de Cos & BoE's Cunliffe as well as U.S. industrial output & Canadian housing starts.

FOREX OPTIONS: Expiries for Oct18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-20(E757mln), $1.1655(E551mln)

- AUD/USD: $0.7425(A$640mln)

- USD/CAD: C$1.2450($740mln)

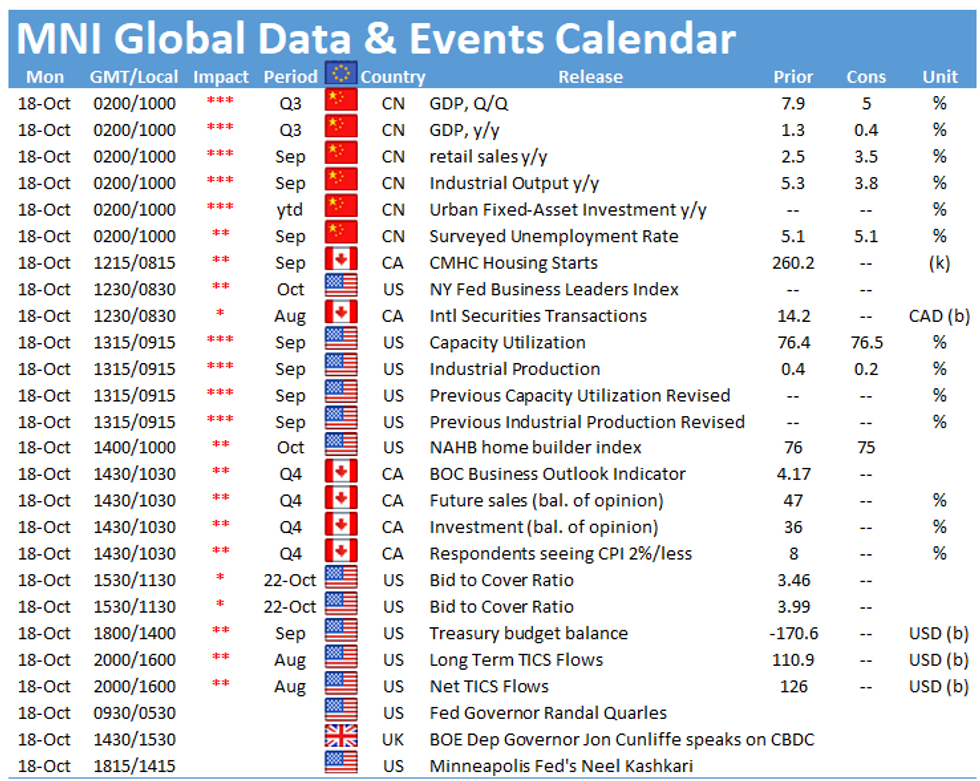

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.