-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: ACGB Yields Continue To Swing, DXY Lower

- ACGB yield swings were at the fore once again, with plenty of speculation doing the rounds re: RBA yield curve targeting matters.

- The DXY moved lower as U.S. Tsy yields edged lower and the major regional Asia-Pac indices moved higher.

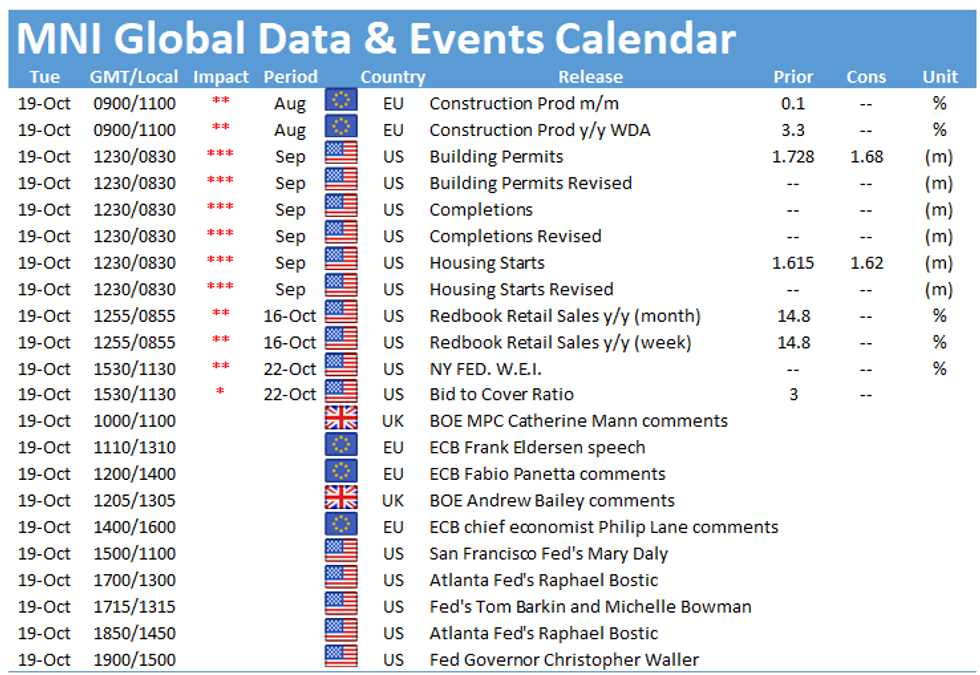

- Central bank speak headlines the broader docket on Tuesday.

BOND SUMMARY: ACGBs See Another Day Of Fierce Swings

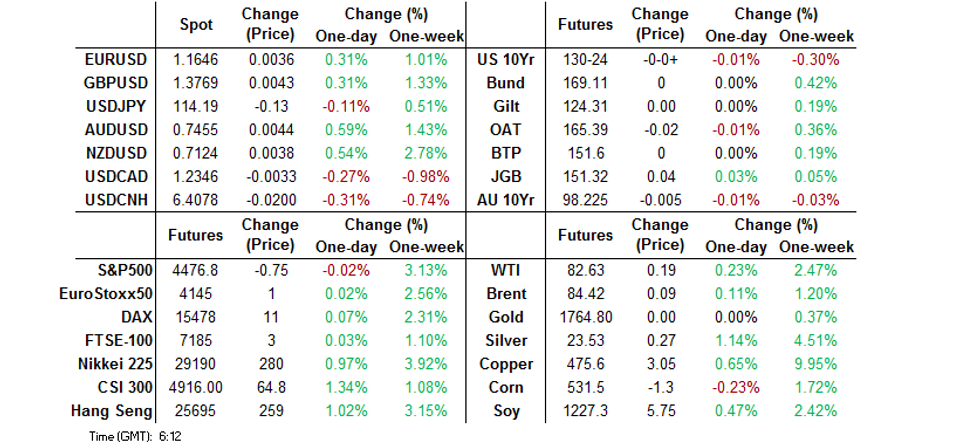

Tsys saw no tangible impact on the space as China released initial guidance on a 3-/5-/10-/30-Year multi tranche round of US$ supply, with such intentions already outlined yesterday. It looks like regional Asia-Pac investors stepped in to buy the latest leg lower, which, when coupled with spill over from ACGB price action, supported the space in overnight dealing. TYZ1 +0-02+ at 130-27, a touch off best levels, while cash Tsy trade has seen richening of ~2.5bp across the curve on the day. Tuesday's NY docket will be headlined by housing starts & building permits data, with a raft of Fedspeak also due.

- JGBs benefitted from the broader uptick in core fixed income markets, with futures last +7. Meanwhile, cash JGB trade sees super long paper richen by ~1.5bp with the curve bull flattening. The recent uptick in yields resulted in a slight narrowing of the tail at the latest round of 20-Year JGB supply, albeit by the most incremental of margins, while the low price met broader dealer expectations (as proxied by the BBG dealer poll). Ultimately demand wasn't strong, with worries surrounding the broader international fixed income environment (inflationary fear & central bank rate setting questions in some core markets) and the burden of increased JGB supply at some point in the coming months pushing the cover ratio to the lowest witnessed at a 20-Year auction since '15. 20s lagged the bid in surrounding paper as a result.

- Another busy session for Aussie bonds saw futures trade lower at the re-open, before a rally surrounding speculation that the RBA may need to step in to reinforce its yield targeting scheme in the coming days and a steady message in the RBA's October meeting minutes (reinforced by more detail surrounding gradual inflationary pressures). The space has since faded from best levels. That leaves YM & XM 0.5 tick above their respective settlements, with the swings in futures from bear flattening to bull steepening now fully unwound. Cash ACGB trade has seen some twist flattening of the curve.

FOREX: Kiwi Defends Its Pole Position In G10 FX Space

Risk sentiment was robust in Asia, lending support to high-beta FX. The kiwi led gains in G10 FX space despite a slight moderation in RBNZ tightening bets, with the OIS strip now pricing 32bp worth of rate hikes at the next monetary policy meeting. A clean bullish technical break in NZD/USD seemingly inspired a fresh round of demand for the pair, which spilled over to other kiwi crosses.

- Spot NZD/USD cleared the 200-DMA/descending trendline drawn off Feb 2021 high, which coincided at $0.7101 today, and rallied to a fresh one-month high.

- Commodity-tied currencies were in demand, even as crude oil futures were steady. CAD was the odd one out, struggling to garner strength.

- Firmer risk sentiment reduced demand for safe haven currencies. The DXY retreated to worst levels in two weeks, as the greenback underperformed.

- The global data docket is fairly light today, but this scarcity will be somewhat compensated by plenty of central bank rhetoric. Speeches are due from a number of Fed, ECB, BoE, Riksbank & Norges Bank members.

FOREX OPTIONS: Expiries for Oct19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550-65(E1.0bln), $1.1600-15(E1.0bln)

- USD/JPY: Y113.50-70($718mln), Y113.80-00($520mln)

- GBP/USD: $1.3685-00(Gbp871mln), $1.3740-55(Gbp646mln)

- AUD/USD: $0.7350(A$661mln)

- USD/CAD: C$1.2550-70($701mln)

ASIA FX: KRW Leads Gains In Risk-On Trade, CNH Prints Best Levels In Four Months

Most Asia EM currencies outperformed the greenback owing to broader risk-on flows, with participants looking through simmering geopolitical tension on the Korean peninsula.

- CNH: Offshore yuan rallied to its best levels in four months, even as breakdown data from China's Q3 GDP report provided some underwhelming insights. China's real-estate and construction sectors contracted for the first time since the onset of the pandemic. Spot USD/CNH descended into the CNH6.4000 area, bringing this round figure into focus.

- KRW: The won was the best performer in the Asia EM basket as broader risk-on flows outweighed the latest missile tests conducted by North Korea. Japan's PM Kishida said that the DPRK launched two ballistic missiles into the East Sea, while JoongAng reported that the test may have been of submarine-launched projectiles.

- IDR: USD/IDR was happy to hold yesterday's range ahead of the announcement of Bank Indonesia's monetary policy decision. Policymakers are expected to stand pat.

- THB: The baht garnered some strength after Thailand reported its lowest daily count of new Covid-19 infections in three months. The Cabinet may discuss economic support measures today.

- PHP: The peso firmed along most regional peers. BSP Gov Diokno noted that policymakers do not see any changes to monetary policy settings through the rest of this year.

- SGD: USD/SGD retreated on the back of broader market impetus, reaching lowest levels in a month.

- INR & MYR: Markets in India & Malaysia were shut in observance of local public holidays.

EQUITIES: Asia-Pac Equities Find Some Poise

The major Asia-Pac equity indices have found some poise on Tuesday, with the Hang Seng outperforming, as that particular index rallies by ~1.5%. U.S. e-minis are little changed on the day. Some desks have pointed to hope surrounding U.S. quarterly earnings and buoyancy for tech shares as U.S. Tsy yields ticked lower as supportive factors during the session, countering inflationary worry, at least for now.

GOLD: A Touch Firmer In Asia

A softer USD and a downtick in U.S. Tsy yields has allowed bullion to move higher during Asia-Pac trade, with spot last dealing the best part of $10/oz firmer on the day, just below $1,775/oz. Monday provided a fairly limited session for gold, with the DXY retracing from best levels of the day, while our weighted U.S. real yield monitor saw a modest uptick. Participants await the next meaningful macro input, with the technical picture little changed.

OIL: Back From Monday's Highs, Bullish Techs Still In Play

WTI & Brent crude futures trade a little over $0.10 firmer on the day, with a softer USD and uptick in regional equity indices supporting crude during Asia-Pac dealing.

- In terms of the broader energy supply picture, Monday revealed reports of continued OPEC+ overcompliance re: the group's production pact, while Russia noted that it will not send extra natural gas to Europe in November, both of which are positive inputs for crude prices.

- Still, crude fell back from best levels of the day, with WTI finishing marginally higher vs. Friday's close, while Brent shed ~$0.50 vs. its own Friday settlement, as a lack of clear direction when it came to broader risk appetite, and perhaps a degree of exhaustion, hampered crude as we moved through the session.

- Monday also saw the White House note that it continues to press OPEC members re: supply issues owing to rising fuel prices.

- The latest batch of API crude inventory estimates headline on Tuesday.

- From a technical perspective, our in-house technical analyst notes that bullish conditions remain intact, with WTI bulls looking to $84.97, while Brent bulls look to $86.55

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.