-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Asia Reacts To Powell Tapering Talk

EXECUTIVE SUMMARY

- STRICTER CORONAVIRUS TESTING BEING WEIGHED FOR ALL TRAVELERS TO U.S. (WASHINGTON POST)

- SCHOLZ: GERMANY IS POISED TO ACT IF INFLATION FAILS TO EASE (BBG)

- ECB’S SCICLUNA: COVID ADDS TO PRICE PRESSURES (MNI)

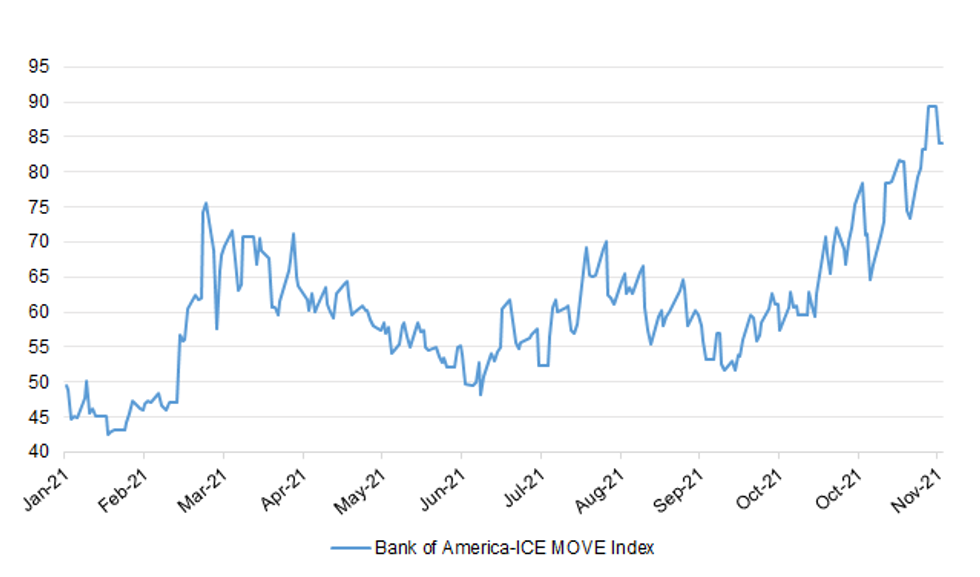

Fig. 1: Bank of America-ICE MOVE Index

Source: MNI - Market News/Deutsche Bank/Bloomberg

Source: MNI - Market News/Deutsche Bank/Bloomberg

UK

CORONAVIRUS: Boris Johnson insisted there are no immediate plans to ask Britons to curb socializing and work from home -- even after a government adviser said doing so could help limit the spread of the omicron Covid variant. The British government has tightened rules on face coverings, self-isolation and testing since the emergence of omicron cast doubt over the risk to public health if it was found to be able to evade current vaccines. But after the head of the U.K. Health Security Agency, Jenny Harries, said Tuesday people should also avoid socializing when they “don’t particularly need to,” Johnson’s government declined to endorse her suggestion. Asked if people should minimize socializing and cancel Christmas parties, Johnson told a press conference: “No. The guidance remains the same.” He also said working from home is unnecessary, and that another lockdown is “extremely unlikely” -- though he declined to rule it out completely. (BBG)

CORONAVIRUS: Covid booster jabs will be offered to everyone in England who is eligible by the end of January, Prime Minister Boris Johnson has said. Mr Johnson said the government would be "throwing everything" at the campaign so everyone can get a third jab. People will be invited to book a booster three months after their second vaccine dose. The rollout was expanded in response to the emerging Omicron variant, which could be more infectious than Delta. (BBC)

BOE: The U.K.’s top banking supervisor said restrictions on payouts are “very unlikely” to return, even as a new variant of Covid-19 threatens to prolong the pandemic. Sam Woods, chief executive officer of the Bank of England’s Prudential Regulation Authority, said at a virtual Financial Times conference that last year’s de facto ban on dividends reflected a particular set of circumstances and he doesn’t expect to see such restrictions again. The central banker also said he expects to add between 30 and 50 new staff to the PRA’s policy unit, which currently has a couple of hundred workers. The hiring reflects the unit’s broader remit now the U.K. is no longer part of the European Union’s regulatory infrastructure. (BBG)

POLITICS: Downing Street has denied claims that Boris Johnson broke coronavirus rules with parties at No 10 last Christmas. The Mirror claims the PM made a speech at a leaving do on 13 November - when the country was in the second lockdown - and allowed a festive party to proceed on 18 December when London was in the grips of Tier 3 restrictions. A No 10 spokesperson told Sky News: "COVID rules have been followed at all times." (Sky)

EUROPE

ECB: MNI INTERVIEW: Covid Adds To Price Pressures - Malta's Scicluna

- Upside risks to the eurozone inflation outlook will continue to build so long as the Covid pandemic persists, the governor of the Central Bank of Malta told MNI in an interview, in which he also called for the European Central Bank to avoid any abrupt reduction in monetary stimulus in March - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GERMANY: The country reported a total of 67,186 new infections, compared to 45,753 the day before, according to the country’s public health authority RKI. New deaths linked to Covid-19 rose by 446, bringing the total to 101,790. The seven-day incidence rate fell to 442.9 per 100,000 people. (BBG)

GERMANY: Germany’s incoming chancellor, Olaf Scholz, said his government will need to take action if inflation doesn’t ease from its current high. Rising prices in Europe’s biggest economy are a result of generous government spending to address the coronavirus pandemic as well as spiking energy costs, and they can’t be accepted over the longer term, Scholz said Tuesday in an interview with Bild TV. He referred to analysts’ predictions that inflation, now at 6%, is set to ease. “If that isn’t the case, we have to do something,” Scholz said, without specifying what that action might entail. “We should not be aiming for high inflation like we have today,” he said, adding that price developments “must be very, very closely monitored.” (BBG)

ITALY: Italy’s Banca Monte dei Paschi di Siena SpA said it is in contact with the country’s Finance Ministry to restart talks with the European Union’s Directorate General for Competition. Paschi did not giver further details in its statement. The lender is working to restore its profitability while preparing a new business plan after talks between the Finance Ministry -- its largest stakeholder -- and UniCredit SpA on a sale of the bank ended abruptly last month. (BBG)

FINLAND: Finland is set to mandate social and health-care staff to take vaccinations against the coronavirus and plans to widen the use of Covid passports beyond bars and restaurants, Krista Kiuru, the minister overseeing the pandemic response efforts, told reporters in Helsinki on Tuesday. (BBG)

U.S.

FED: Federal Reserve Bank of St. Louis President James Bullard says Tuesday in a research note that speeding up the wind down of Fed asset buying is likely a good idea amid the current inflation jump. With the Fed having started the taper process, "only recently has monetary policy become better positioned for the second scenario, in which inflation does not naturally moderate," Bullard writes. If inflation doesn't moderate, the Federal Open Market Committee "would have to begin to taper asset purchases sooner and at a faster pace, and the Committee would need to begin to contemplate increasing the policy rate sooner," he writes. (Dow Jones)

FED: “We are facing another economic challenge: higher food prices. Transportation and labor costs -- along with supply-chain disruptions -- are driving up the price of many staples, such as beef, poultry, eggs, peanut butter, and produce,” New York Fed President John Williams says. (BBG)

FED: Federal Reserve officials are not happy with elevated inflation running above the central bank's 2% target and it would not be a success for those inflation levels to be repeated next year, Fed Vice Chair Richard Clarida said on Tuesday. "No one is happy when inflation is running at 4% or 5% when our goal is 2%," Clarida said during a conversation with Cleveland Fed President Loretta Mester. "This is not a success, this year, and I wouldn't consider a repeat next year of inflation at this level a success." (RTRS)

FED: The Democratic chairman of the Senate Banking Committee said Tuesday that he is talking with the White House about nominating Richard Cordray, who was the first director of the Consumer Financial Protection Bureau, to be the Federal Reserve’s top banking regulator. Sen. Sherrod Brown, D-Ohio, told CNBC that he’s spoken to the Biden administration about Cordray and others who could serve as the Fed’s vice chair for supervision and fill other vacancies on the central bank’s Board of Governors. “I know Rich Cordray well. I like him,” Brown said. “I’m talking to the White House about him and a number of other people.” (CNBC)

FED: Key Republicans are warning President Biden not to nominate Richard Cordray, a progressive and former director of the Consumer Financial Protection Bureau, to be the top banking regulator on the Federal Reserve. Sen. Pat Toomey (D-Pa.) is indicating the GOP will use a potential Cordray nomination to re-litigate his tenure at the CFBP, an agency devised by Sen. Elizabeth Warren (D-Mass.) and fiercely opposed by most Republicans. (Axios)

FISCAL: The nonpartisan Congressional Budget Office on Tuesday echoed a warning by Treasury Secretary Janet Yellen that the federal government could run out of money after mid-December if lawmakers fail to raise the debt limit. The CBO noted that the Treasury plans to transfer $118 billion to the Highway Trust Fund on Dec. 15 -- a move that follows the passage of President Joe Biden’s infrastructure package earlier this month. (BBG)

FISCAL: The top Democrat and the top Republican in the U.S. Senate voiced confidence on Tuesday that they would pass legislation raising the federal government's $28.9 trillion debt limit soon, averting a catastrophic default. (RTRS)

CORONAVIRUS: White House chief medical advisor Dr. Anthony Fauci said Tuesday that 226 cases of the highly mutated omicron Covid-19 variant have been detected across 20 countries so far, but U.S. officials haven’t confirmed a case in the states yet. The variant, which first emerged in South Africa about a week ago, has more than 30 mutations to the spike protein alone. That’s the key part of the virus that allows it to bind to human cells and infect the body. It also makes scientists worry that it could evade vaccine protection or may be far more infectious than the already highly contagious delta variant that’s caused a surge in cases across globe in recent months. (CNBC)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention is considering tightened travel recommendations and rules as health officials try to slow the Covid-19 omicron variant’s entry to the U.S. The agency is looking measures such as narrowing the testing window for travelers into the country and adding quarantine requirements in certain cases, CDC Director Rochelle Walensky said Tuesday on a call with reporters. It’s also expanding surveillance programs at four major airports to test for Covid from specific international arrivals. (BBG)

CORONAVIRUS: The Biden administration is preparing stricter testing requirements for all travelers entering the United States, including returning Americans, to curb the spread of the potentially dangerous omicron variant, according to three federal health officials. As part of an enhanced winter covid strategy Biden is expected to announce Thursday, U.S. officials would require everyone entering the country to be tested one day before boarding flights, regardless of their vaccination status or country of departure. Administration officials are also considering a requirement that all travelers get retested within three to five days of arrival. (Washington Post)

CORONAVIRUS: A Food and Drug Administration advisory panel on Tuesday narrowly endorsed the use of Merck and Ridgeback Biotherapeutics’ oral Covid treatment pill, despite questions about the drug’s effectiveness, safety and whether it would help the virus mutate into even more dangerous variants. The FDA’s Antimicrobial Drugs Advisory Committee voted 13 to 10 to recommend emergency authorization of molnupiravir, an oral antiviral drug initially hailed as a potential game changer in the battle against Covid since it can be taken at home instead of at a hospital like other treatments. It’s designed to treat adults with mild to moderate symptoms of Covid-19 who are at high risk of severe disease. The 800 milligram pill is taken every 12 hours for five days after symptom onset. (CNBC)

CORONAVIRUS: Pfizer Inc.’s chief executive said the company has asked the U.S. to allow Covid-19 booster shots for people age 16-17, a move that would expand access to additional doses amid worry about the new omicron virus variant. (BBG)

OTHER

GLOBAL TRADE: The European Union will seek to mobilize 300 billion euros ($340 billion) in public and private infrastructure investments by 2027 to offer developing countries an alternative to China’s massive Belt and Road program. The EU’s “Global Gateway,” which will be unveiled on Wednesday, outlines spending on digital, transport, energy and health projects, according to the final draft of the strategy seen by Bloomberg. And while it doesn’t mention China explicitly, the proposal offers a counter to Beijing’s overseas development plan that critics say has pushed countries to unsustainable levels of indebtedness. “The EU will offer its financing under fair and favorable terms in order to limit the risk of debt distress,” according to the document. (BBG)

JAPAN: Chief Cabinet Secretary Hirokazu Matsuno said Wednesday that the government will deny re-entry to foreign nationals -- even those holding residency -- returning from these 10 countries: Angola, Botswana, Eswatini, Lesotho, Malawi, Mozambique, Namibia, South Africa, Zambia and Zimbabwe. The latest is part of stricter measures to be rolled out from Thursday, public broadcaster NHK reported earlier. Separately, Yonhap reported that a man confirmed as Japan’s first omicron case had transferred planes in South Korea’s Incheon international airport. (BBG)

JAPAN: Japan’s largest business lobby, Keidanren, won’t seek a blanket increase in wages in its annual spring negotiation round, Nikkei reports, without saying where it got the information. Cites growing variation in company performance amid coronavirus pandemic. Puts highest priority on business continuity and maintaining employment for companies whose profits haven’t yet recovered. Companies with strong performance will be asked to address Prime Minister Fumio Kishida’s request to boost workers’ pay by 3% or more. (BBG)

BOJ: MNI BRIEF: BOJ's Adachi Sees Inflation Up, But No Stagflation

- Bank of Japan board member Seiji Adachi on Wednesday said that there is higher probability that the inflation rate will rise in Japan but no risk of stagflation - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SOUTH KOREA: The emerging omicron variant across the globe has put South Korea on high alert. On Tuesday, the first suspected case of the omicron coronavirus variant was detected in the country, but health authorities said further tests were required. The KDCA said the results of the genetic sequencing tests will be released later in the day. The authorities also said they are mulling over whether to do genetic sequencing tests on all entrants from overseas. (Yonhap)

CANADA: Canada tightened travel restrictions meant to contain the spread of the omicron variant of Covid-19 as it identifies more suspected cases already in the country. The government will now require all air travelers into Canada -- from countries other than the U.S. -- to test at the airport, whether they are vaccinated or not, Health Minister Jean-Yves Duclos said Tuesday at a press conference. Canada is also considering new testing rules for travelers from the U.S. by both land and air if needed. (BBG)

TURKEY: Turkey's economy is expected to grow by over 10 percent by the end of year 2021. "Our (year-end growth) expectation is at least 10, but it can exceed it," Turkey's President Recep Tayyip Erdogan told TRT in an exclusive and wide-ranging interview on Tuesday evening. He said government's focus on increasing investment, employment, production and export and lowering interest would boost economic growth. He said: "Interest is the cause, inflation is the result. We are lowering the interest rate, and we will see the inflation decrease." Erdogan reaffirmed his stance that he would not allow high interest rates to stifle growth. "Our aim is to open the way for 50,000 new jobs by enabling 11,000 of our companies to benefit from low-cost loans with a total amount of 10 billion Turkish liras in a short time," he added. Erdogan said it is time for long-term investments for foreign investors and those who make long-term investments in Turkey have always won. "We have prepared two important support packages. We will provide access to loans up to 100,000 liras for new employment to our companies with less than 50 employees." (TRT World)

BRAZIL/RATINGS: S&P affirmed Brazil at BB-; Outlook Stable

RUSSIA: Russian president Vladimir Putin warned the west against crossing Moscow’s “red lines” in Ukraine and said Nato was threatening Russia’s security by holding exercises and deploying weapons near its borders. Putin told an investment forum on Tuesday that Moscow had developed hypersonic missiles and would be forced to respond “if Nato continued to expand its infrastructure”, including through the alliance’s potential deployment of its own similar missile systems. (FT)

RUSSIA: White House Press Secretary Jen Psaki said on Tuesday the White House remains "deeply concerned" about heightened rhetoric around a reported Russian military buildup on Ukraine's border. Psaki also said she had no new details regarding a possible meeting between President Joe Biden and Russian counterpart Vladimir Putin. (RTRS)

IRAN: Senior European diplomats warned on Tuesday that negotiations to revive nuclear talks could be terminated if Iran moved to produce weapons-grade nuclear fuel. “It would seriously imperil the process” if Iran did something “as provocative as going to 90% enrichment,” said a senior diplomat from the three Western European nations that are participating in the talks—Britain, France and Germany. (WSJ)

MIDDLE EAST: The Saudi-led coalition fighting the Houthis in Yemen has destroyed an explosive-laden boat used by the Iran-aligned group in the south of the Red Sea on Wednesday, Saudi state TV said. The explosive-laden boat was launched from Yemen's Hodeidah, it added. The coalition had earlier destroyed a drone which took off from Sanaa international airport. (RTRS)

OIL: The U.S. is trying to re-focus its energy relationship with top Middle East OPEC countries, notably Saudi Arabia, after a period of tension between Washington and Riyadh over high oil prices. Amos Hochstein, the top American energy diplomat, held meetings this week with officials in the Middle East, including Saudi Energy Minister Prince Abdulaziz bin Salman on Tuesday. “We discussed areas where the U.S. and Saudi Arabia can partner to invest in the energy transition and collaborate to build a 21st century clean energy architecture,” Hochstein said. (BBG)

OIL: The Biden administration expressed frustration Nov. 30 that US retail gasoline prices have not yet reflected the sharp drop in crude futures brought in recent days by the omicron variant's threat to the demand outlook. White House Press Secretary Jen Psaki added that the administration remains in "regular touch" with OPEC and again urged the producer bloc to increase oil supply at its Dec. 1 meeting. "We continue to convey that we are hopeful they will release supply to meet the demand out there in the market place," Psaki said during a press briefing. (Platts)

OIL: The Organization of the Petroleum Exporting Countries (OPEC) and its allies will supply the global market with enough oil, Algeria's energy minister said on Tuesday, urging caution over fears about the impact of the Omicron coronavirus variant. The OPEC+ group of producers will take all necessary measures as it aims for balanced market fundamentals for both producers and consumers, Algerian state news agency APS quoted minister Mohamed Arkab as saying. (RTRS)

OIL: OPEC will begin its first formal discussions over its next secretary general when it meets Dec. 1, with heavyweight Saudi Arabia thought to back a change as the producer group struggles to contain a volatile oil market and withstand energy transition pressures. Sources told S&P Global Platts that Riyadh is supporting the candidacy of Kuwait's former No. 2 OPEC envoy, Haitham al-Ghais, to replace incumbent Mohammed Barkindo, who remains popular with several African countries. Barkindo, who has held his post for six years, cannot stand for another term but may be asked to remain if a successor cannot be agreed. "The Saudis are pushing for a change," one OPEC source said, asking not to be named. (Platts)

OIL: OPEC+ should keep increasing oil production to safeguard the global economic recovery, International Energy Agency Executive Director Fatih Birol said at a briefing in Paris. (BBG)

CHINA

ECONOMY: China is likely to exceed the targeted economic growth this year as it continues to recover with employment, inflation, and international balance of payments stable, Vice Premier Liu He said in a video speech on Tuesday at the Hamburg Summit, according to a Xinhua News Agency report. China's growth target this year was set at 6% in March. China promises to further improve its business environment next year, ease market access and promote fair competition, Liu said. China will maintain the continuity, stability and sustainability of its macro policy, and support private and small companies, Liu said. China is fully confident in its economy next year, said Liu. (MNI)

ECONOMY: China should maintain a core area to supply key natural resources such as lithium and nickel and create a reliable system of reserves and delivery to sustain its industrialization and shift toward an electricity-powered economy, the Economic Daily said in its front-page editorial. The global supply of these minerals may be difficult to match the surging demand for cleantech, and the supplying regions are also highly concentrated, said the official newspaper. The security of mineral supply has been elevated to a national-level strategy at the recently convened Politburo meeting, said the commentary under the pseudonym of Jin Guanping. The background of the issue was due to the global shift to clean energy, boosting demand for lithium, nickel, cobalt, and molybdenum, while the electrification raised the demand for copper, said the newspaper. (MNI)

BANKS: Chinese banks are rushing to raise short-term debt through negotiable certificates of deposit traded in the interbank market, foreshadowing a boost in lending as the economy slows. Commercial lenders have issued a net total of almost 831 billion yuan ($130 billion) of NCDs in November, the highest since February 2017, data compiled by Bloomberg shows. This could indicate banks are preparing to accelerate loans to customers after the People’s Bank of China encouraged lenders to step up credit support to the economy and relaxed some restrictions on property financing. “Banks’ liabilities have been tight throughout this year, so they must increase liabilities first when they plan to grant more loans,” said Tan Songheng, a fixed-income manager at the Bank of Sanxiang Co. Ltd. (BBG)

PROPERTY: China's housing sales may gradually pick up in March after prices plunged in Q4, Yicai.com reported citing CITIC Securities. Marginal easing of purchase rules and incentives by some local authorities failed to significantly improve the housing market downturn, the newspaper said. In November, the sales of the top 100 developers totaled CNY845.03 billion, a sharp drop of nearly 40% y/y, the newspaper said citing data by CRIC China. China may not significantly relax housing policy nor further tighten, given the central government's stance against speculating on houses, the newspaper said citing insiders. (MNI)

CREDIT: Chinese developers are facing $12 billion in trust payments coming due in December, posing a major challenge for the sector whose liquidity squeeze has spooked global markets. The firms have already this year defaulted on more than $10 billion of these high-yielding, short-term products, which had been deemed to be a legitimate, safe and predictable place to park money for mainly wealthy Chinese and institutions. That comes on top of at least $10.9 billion of potential losses in other wealth products at developers, including China Evergrande Group, which has angered employees and tens of thousand people across China. (BBG)

CORONAVIRUS: The country, which remains focused on restoring its Covid Zero status even as the world turns its attention to check the omicron variant, reported 91 new local infections in Inner Mongolia on Wednesday. An outbreak in a border town continued to pick up steam, with all of the newly transmitted cases were found in the city of Hulunbir, which is close to Russia and Mongolia. (BBG)

OVERNIGHT DATA

CHINA NOV CAIXIN MANUFACTURING PMI 49.9; MEDIAN 50.6; OCT 50.6

To sum up, the manufacturing sector remained stable overall in November. Increased downward pressure and easing inflationary pressure were prominent features of the economic situation. From late October to mid November, there were sporadic new Covid outbreaks in several Chinese regions, which had a negative impact on the economy and particularly supressed the demand side. After the shortage of power was alleviated, the supply side began to recover. But due to weak demand, the supply recovery was limited, and the foundation of the recovery was not solid. The government’s measures to stabilize commodity supplies and prices began to bear fruit, which significantly eased cost pressures on manufacturing enterprises. But the gauges of input costs and output prices remained in expansionary territory, showing inflationary pressure still remained. “Policymakers should still focus on supporting small and midsize enterprises. They should also pay attention to problems including deteriorating employment, limited growth of household income and weak purchasing power for consumer goods. In addition, the prices of some raw materials remained high. Enterprises are still facing high cost pressures. Policymakers should treat inflation seriously. (Caixin)

JAPAN Q3 CAPITAL SPENDING +1.2% Y/Y; MEDIAN +1.5%; Q2 +5.3%

JAPAN Q3 CAPITAL SPENDING EX-SOFTWARE +2.2% Y/Y; MEDIAN +3.0%; Q2 +3.6%

JAPAN Q3 COMPANIES PROFITS +35.1% Y/Y; Q2 +93.9%

JAPAN Q3 COMPANIES SALES +4.6% Y/Y; Q2 +10.4%

MNI BRIEF: Japan Capex Dip To Lead To Downward Q3

- Combined capital investment by non-financial Japanese companies, excluding software, fell 1.1% q/q in the third quarter of 2021, reversing a Q2 gain, a quarterly survey released by Ministry of Finance on Wednesday showed, heralding a possible downward revision in Q3 GDP - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN NOV, F JIBUN BANK MANUFACTURING PMI 54.5; PRELIM 54.2; OCT 53.2

The Japanese manufacturing sector continued to see an improvement in operating conditions midway through the fourth quarter of 2021, as November PMI data pointed to the quickest improvement in the health of the sector since January 2018. The pace of expansion quickened as firms recorded stronger growth in both output and new orders. That said, anecdotal evidence indicated supply chain disruption continued to hinder activity within the sector. Firms recorded a sustained and marked deterioration in lead times in November. Moreover, material shortages and logistical disruptions contributed to a rapid rise in average cost burdens, as input prices rose at the fastest pace since August 2008. Beyond the immediate future, Japanese manufacturers remained confident that output would rise over the coming 12 months. Firms were hopeful that an end to the COVID-19 pandemic would accelerate the launch and mass production of new products, amid a broad-based boost to demand in both domestic and international markets. This is in line with the IHS Markit forecast of a 5.3% rise in industrial production in 2022. (IHS Markit)

AUSTRALIA Q3 GDP -1.9% Q/Q; MEDIAN -2.7%; Q2 +0.7%

AUSTRALIA Q3 GDP +3.9% Y/Y; MEDIAN +3.0%; Q2 +9.5%

AUSTRALIA NOV CORELOGIC HOUSE PRICE INDEX +1.1% M/M; OCT +1.4%

AUSTRALIA NOV, F MANUFACTURING PMI 59.2; PRELIM 58.5; OCT 58.2

Improvements in the COVID-19 situation, both domestically and in the region, enabled Australia’s manufacturing sector to expand faster in November. That said, supply chain issues affected foreign demand, inventory building efforts and contributed to a significant rise in work outstanding for Australian manufacturers. Business sentiment likewise was affected by these supply issues. Once again, the accumulation of supply chain issues may be linked to reopening-related surge in demand and it will be worth monitoring whether these clear in the short- to medium-term, especially in the context of price pressures. On the flip side, overall growth momentum only improved, helping to provide some relief from supply concerns. (IHS Markit)

NEW ZEALAND OCT HOME-BUILDING APPROVALS -2.0% M/M; SEP -2.0%

SOUTH KOREA NOV TRADE SURPLUS +$3.087BN; MEDIAN +$2.000BN; OCT +$1.782BN

SOUTH KOREA NOV EXPORTS +32.1% Y/Y; MEDIAN +27.2%; OCT +24.1%

SOUTH KOREA NOV IMPORTS +43.6% Y/Y; MEDIAN +39.6%; OCT -37.7%

SOUTH KOREA NOV MANUFACTURING PMI 50.9; OCT 50.2

South Korean manufacturers continued to report that supply chain disruption and material shortages had hindered production and demand midway through the fourth quarter of the year. Despite the headline PMI rising slightly in November, this masked a second successive contraction in output levels, while new order growth broadly stagnated as supply shortages hit demand, most notably in the automotive and semiconductor industries. Moreover, sustained shortages of raw materials and delivery delays placed further strain on manufacturer cost burdens. Average input prices rose at the sharpest pace in the history of the survey, which contributed to an acceleration in factory gate inflation as firms south to pass higher prices to clients in an effort to protect margins. Despite headwinds from ongoing supply chain disruption, positive sentiment rose sharply in November. The degree of optimism was the highest since August and was marked overall. Confidence was underpinned by hopes that supply chain pressure would ease and the recovery in global demand would accelerate the launch and mass production of new products. This is in line with IHS Markit's projection that industrial production will rise by 6.1% in 2022. (IHS Markit)

UK NOV BRC SHOP PRICE INDEX +0.3% Y/Y; OCT -0.4%

MNI BRIEF: UK Nov Shop Prices See First Rise In 30

- UK shop prices rose by an annual rate 0.3% in November, the first increase since May of 2019, according data released by the British Retail Consortium on Wednesday. That follows a 0.4% decline in October. Food prices accounted for much of the pick up in retail inflation, rising by 0.6% between October and November. That took the annual rate up to 1.1%, the fastest pace since November of 2020, from 0.5% in October. Non-food prices declined by an annual rate of 0.1%, a much shallower decline than the 1.0% fall recorded in October, and the smallest fall since May of 2019. The BRC data will add to fears that the Bank of England has dramatically underestimated the acceleration in inflation as the recovery continues, with policymakers warning any severe impact from the new coronavirus variant could boost price pressures - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CHINA MARKETS

PBOC NET DRAINS CNY90 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rates unchanged at 2.2% on Wednesday. The operation has led to a net drain of CNY90 billion after offsetting the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1771% at 09:25 am local time from the close of 2.3950% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Tuesday vs 68 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3693 WEDS VS 6.3794 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3693 on Wednesday, compared with 6.3794 set on Tuesday.

MARKETS

BONDS: Core FI Off Worst Levels, But Post-Powell Pressure Dominates In Asia

The early selling impetus witnessed in Asia, based on regional reaction to Fed Chair Powell’s hawkish round of Tuesday rhetoric and soothing tones from the Chinese policymaking sphere when it comes to economic growth in ’21, has faded a little, although TYH2 is still -0-08 on the day, printing 130-18 (0-07 off session lows). Cash Tsy trade sees the major benchmarks print 2.0-2.5bp cheaper across the curve, with the belly leading the weakness, as you would expect in the wake of Powell tipping his hat to the potential for a swifter tapering process. A 2.5K block sale of TY futures headlined on the flow side during Asia-Pac hours. Eurodollar futures are flat to 7.0bp cheaper through the reds, but operate off lows, tracking Tsys. The latest ADP employment print and ISM m’fing survey reading will cross during the NY session.

- JGB futures were 6 ticks lower at the close, following the broader impulse of core global FI markets. Meanwhile, the major cash JGB benchmarks ran flat to 1bp cheaper across the curve, with 10s leading the weakness. Japanese Q3 capex data was a touch softer than expected, but that had no notable impact on the market. Elsewhere, BoJ board member Adachi flagged personal opinion re: economic benefits of a weaker JPY, in the context of the recent moves in the currency, while noting that the central bank does not target specific FX levels. Adachi also suggested that the BoJ would only conduct deeper monetary easing if it needed to address tail risks.

- Aussie bond futures failed to push lower in the wake of Q3 GDP data, which wasn’t as bad as broader exp., and ground away from lows thereafter. That left YM -6.0 and XM -4.0 come the bell. There was little else of note in the local space on Wednesday, outside of a A$1.0bn round of ACGB Apr-33 supply, which passed smoothly, but wasn’t as firm as we have become accustomed to in recent times (in line with the recent trend when it comes the granular demand metrics witnessed at ACGB auctions).

EQUITIES: Flat To Higher In Asia

The combination of a signal that Chinese economic growth would top the official target in ’21 (accompanied by continued focus on supporting SMES via steady and stable macro policy, courtesy of Vice Premier Liu He) and the previously flagged bid in oil prices supported the major regional equity indices during the Asia-Pac session. Still, it wasn’t all rosy when it came to China, with the latest Caixin manufacturing PMI survey revealing a softer than expected reading (which represented marginal contraction).

- The previously flagged supportive factors helped markets regain some poise after Omicron worry and the prospect of swifter Fed tapering applied pressure to the broader equity space on Tuesday. The ASX 200 was the exception to the broader rule, registering marginal losses, with the consumer staples, real estate and utilities sectors providing the major drags there. E-minis nudged higher, with the S&P 500 contract adding ~1%.

GOLD: Pops Higher

Spot gold trades as high as $1,795/oz, with no obvious headline flow to trigger the pop higher. U.S. Tsy yields are back from earlier peaks, while the USD remains on the defensive vs. the riskier currencies in the G10 space. Bullion last +$15/oz at $1,790/oz.

- A reminder that Tuesday’s losses (which have now been partially reversed) came in the wake of Fed Chair Powell’s hawkish commentary. Powell pointed to considerations re: a faster tapering process and the retirement of the word transitory when it comes to describing inflation. This allowed bullion to unwind the early Omicron-inspired bid.

- Our weighted U.S. real yield monitor pushed higher post-Powell, while the DXY saw an initial spike higher, before giving back most of those gains.

- Spot last deals little changed, just shy of the $1,780/oz marker, after showing below the Nov 24 low post-Powell. Key support at the Nov 3 low ($1,759.0/oz) remains intact.

OIL: Firmer Since Settlement

Broader risk assets have recovered some poise since Tuesday’s settlement, which has allowed WTI & Brent crude futures to add a little over $2.00 vs. their respective settlement levels. There hasn’t been much in the way of overt headline flow to facilitate such a move after yesterday’s notable downtick in prices.

- The major benchmarks still sit the best part of $20 shy of their cycle highs.

- Goldman Sachs reiterated their view that the recent fall in prices is “excessive,” yet understandable “in the context of low year-end liquidity and risk appetite.”

- The weekly API crude inventory estimates revealed a slightly shallower than expected drawdown in headline crude stocks, coupled with an uptick in gasoline & distillate inventories, as well as a build in stocks at the Cushing hub. On net, that report appeared a little bearish, but had no lasting impact on prices.

- Weekly DoE inventory data and the heavily awaited OPEC meeting (ahead of Thursday’s OPEC+ gathering) headline on Wednesday. Re: the latter, focus will be on any language pointing to a deviation from the previously outlined plan i.e. a cumulative 400K bpd lift in production from OPEC+ pact participants in January, which would be deemed a response to the recent coordinated stockpile release from some of the major oil consuming nations. Note that questions remain re: the ability of some of the participating producers when it comes to enacting the outlined lift in production.

FOREX: Commodity-Tied Dollar Block Tops G10 As Oil & Equities Nudge Higher

The commodity-tied dollar block topped the G10 FX leader board in Asia, benefitting from an uptick in e-minis & crude oil futures, as well as reassuring policymaker rhetoric surrounding Chinese economic growth & macro policy settings. This of course comes after Tuesday’s frenetic session, which saw Omicron worry and hawkish communique from Fed Chair Powell in the driving seat.

- Broader headline flow was relatively limited, with firmer than expected Australian GDP and a slightly softer than expected Caixin manufacturing PMI print out of China doing little for price action.

- That left the previously outlined themaes at the fore, which resulted in pressure for the JPY, CHF, EUR & USD.

- USD/CNH stuck to a tight range, with bears becoming a little more fixated on the YtD low.

- Final Eurozone m’fing PMI readings are set to headline in European hours, while the latest ADP employment and ISM m’fing releases will cross during the NY session.

FOREX OPTIONS: Expiries for Dec01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1400(E1.0bln)

- EUR/GBP: Gbp0.8400(E1.7bln)

- AUD/USD: $0.7165(A$782mln)

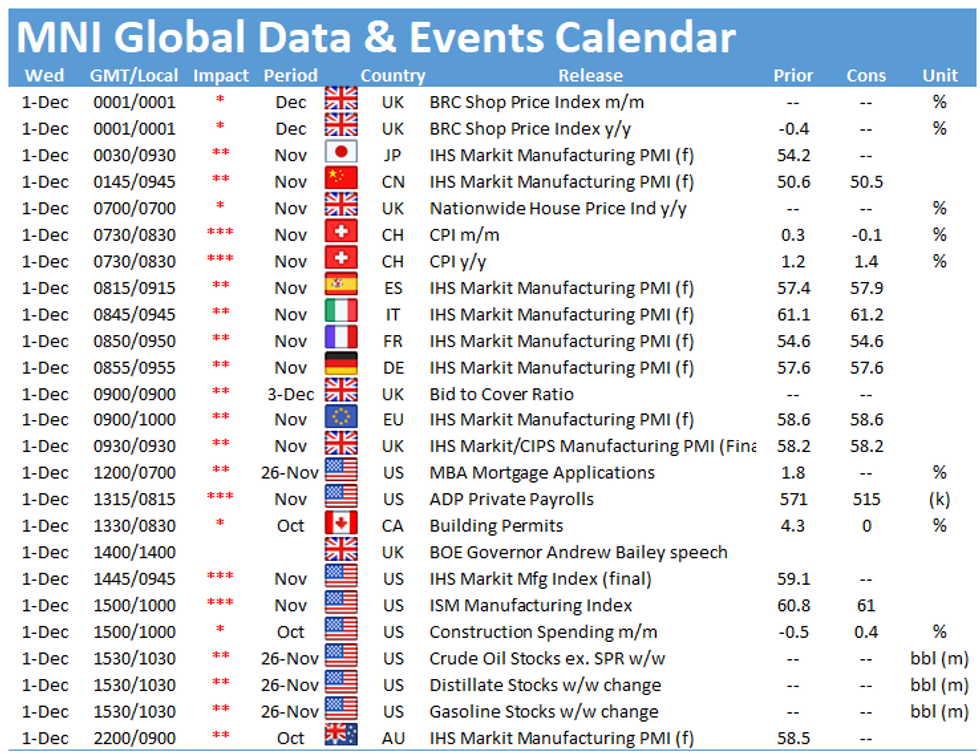

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.