-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equities Rally Overnight, Chinese Easing At The Fore

- The realisation of and perception re: greater chances of further policy easing in China supported broader risk appetite overnight.

- The RBA is seemingly willing to look through the risks presented by omicron, while the re-ordering of some of its views within the statement caught the eye of some.

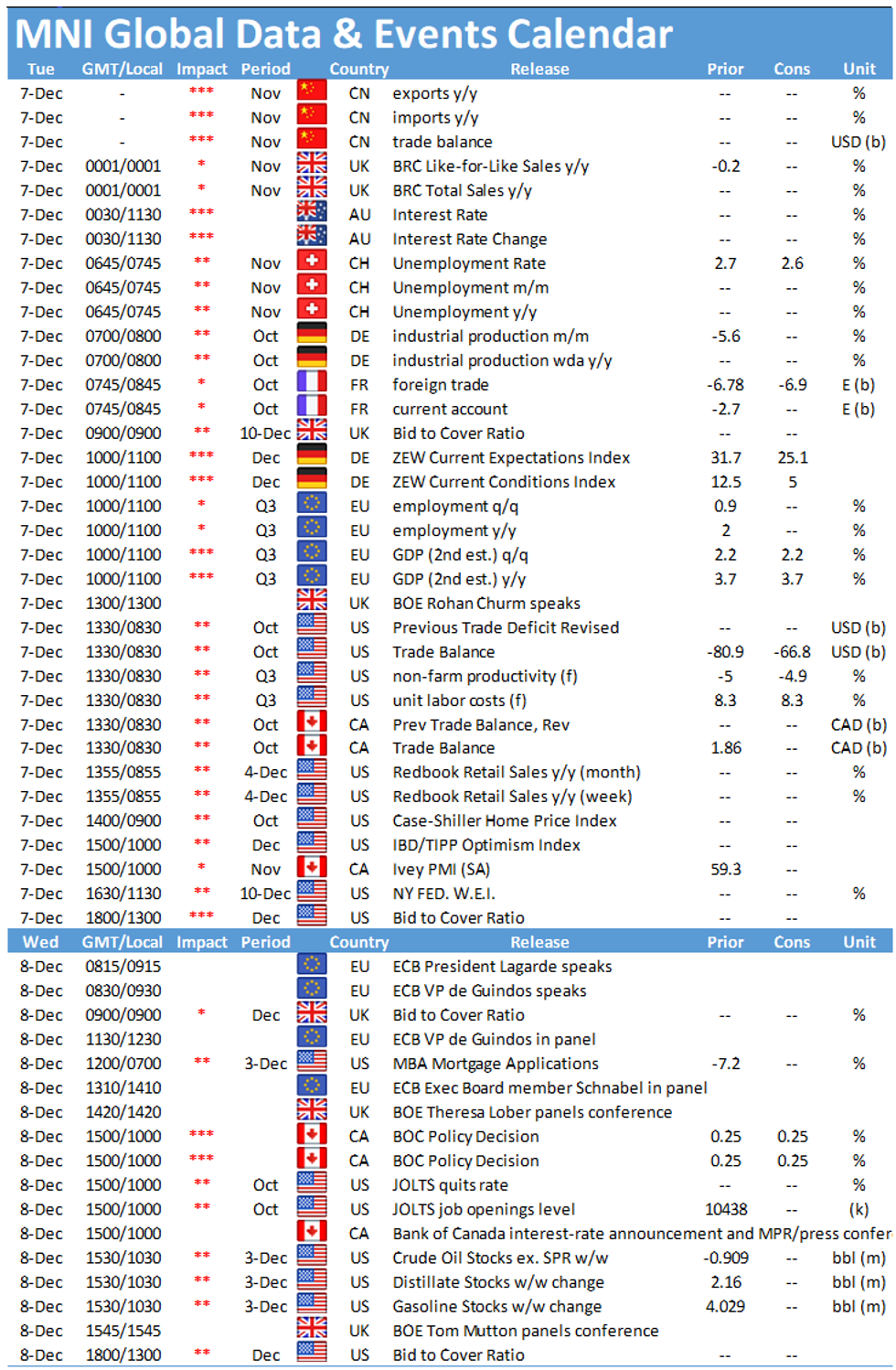

- The final EZ GDP for Q3, latest German ZEW survey & industrial output readings, as well as U.S. & Canadian trade data take focus from here.

BOND SUMMARY: Core FI Weak Overnight

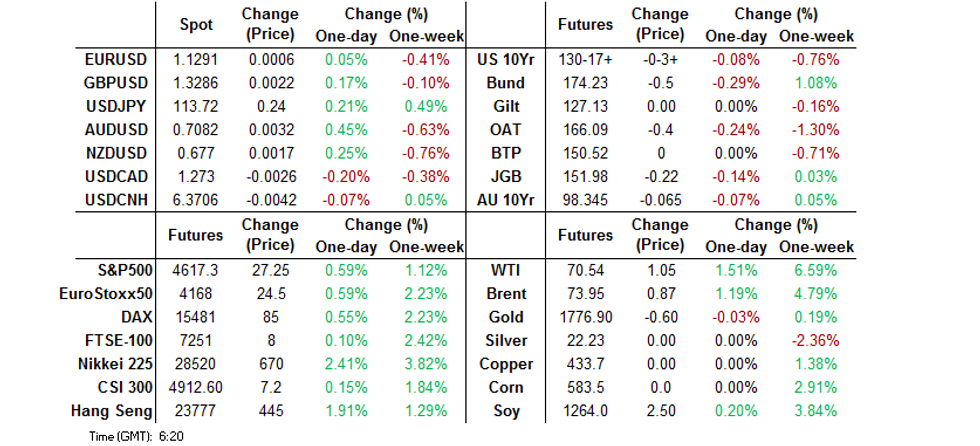

The broader risk-positive move, aided by the realisation of and expectations re: further easing from within the Chinese policymaking sphere, in addition to some post-RBA spill over from the ACGB space, weighed on the U.S. Tsy space in Asia. TYH2 -0-03 at 130-18 as a result, with cash Tsys running 1.0-1.5bp cheaper across the curve, led by the belly. A 6K FV futures block sale (the second instance of such flow in as many Asia-Pac sessions) aided the momentum. 3-Year Tsy supply headlines the NY docket on Tuesday.

- Today’s 30-Year JGB auction provided a marginal miss vs. broader sell-side expectations, with the cover ratio edging lower when compared to the previous 30-Year auction, printing just below the 6-auction average. This means the auction was on the softer side of the scale but wasn’t dreadful by any stretch of the imagination. Futures printed a new session low in the wake of the supply, extending their morning weakness, before hitting the closing bell -21, just off session lows. 7s led the weakness observed across the cash JGB curve, cheapening by ~2bp, with more modest losses (up to 1bp) witnessed elsewhere on the curve.

- Aussie bonds extended lower in the wake of the latest RBA decision. The Bank played down worry re: the omicron COVID strain and rolled forward expectations for the Australian economy moving back to the pre-COVID growth path, while there was some rearranging when it came to the time-related references surrounding economic forecasts, which were moved away from the final guidance paragraph. This made for a modestly hawkish market reaction. That left YM -8.5 and XM -6.5 come the bell. Note that desks pointed to some receiving flow in 1-Year/1-Year forward swaps as a supportive for red Bill contracts ahead of the decision, in what seemed to be pre-decision positioning for a dovish outcome. This evaporated on the above developments. EFPs narrowed on the day.

FOREX: Lack Of RBA Worry Re: Omicron Aids AUD, China's Policy Shift Props Up Risk Appetite

The lack of any notable sense of worry surrounding the Omicron coronavirus variant in the RBA statement lent a modicum of support to the Australian dollar, as broader headline flow failed to provide much to write home about. The AUD tops the G10 scoreboard as we type, further supported by a mild risk-on feel, evidenced by an uptick in all three main U.S. e-mini futures. Signs of a more supportive stance of Chinese policymakers may have played a role here.

- Market sentiment has improved a tad, despite the ongoing geopolitical tension surrounding Russian troop buildup near the Ukrainian border. The leaders of the U.S. and Russia will hold a phone call on the matter today, while BBG reported that the White House is considering banking sanctions if Russia launches an offensive.

- The yen extended yesterday's losses, hitting its worst levels against the greenback this month. Subdued demand for safe haven assets worked against the JPY.

- USD/CNH operated below neutral levels, albeit by a narrow margin, in the wake of a 50bp cut to China's RRR delivered on Monday. The Securities Times reported that the PBOC will cut the relending rate for SMEs by 25bp from today. Separately, Monday's meeting of the CPC Politburo concluded with signals of an imminent easing of real estate curbs and a pledge to stabilise the economy in the coming year, while Premier Li noted that there is still room for various monetary policy tools.

- Final EZ GDP, German ZEW Survey & industrial output, U.S. & Canadian trade data take focus from here.

FOREX OPTIONS: Expiries for Dec07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1325-30(E518mln), $1.1350-70(E1.6bln), $1.1535-50(E650mln)

- USD/JPY: Y113.90-00($1.0bln)

- GBP/USD: $1.3250(Gbp452mln)

- AUD/USD: $0.7100(A$1.0bln), $0.7200(A$606mln)

- USD/CAD: C$1.2735-55($1.4bln)

ASIA FX: China's Policy Shift Weighs On USD/Asia Crosses

Signs of change in China's policy stance took focus in the wake of Monday's 50bp cut to the RRR. On that day, Premier Li pointed to more room for monetary policy tools, including the RRR, while the Politburo signalled the easing of curbs on real estate. The Securities Times reported today that the PBOC will cut the relending rate for SMEs by 25bp. Spillover from China's growing readiness to take supportive policy steps pressured most USD/Asia crosses.

- CNH: The yuan firmed a tad in light of China's latest policy moves. Monthly trade data were ignored, as a marginal beat in exports in conjunction with a solid beat in imports generated a miss in headline trade surplus. Both imports and exports hit fresh record highs.

- KRW: Spot USD/KRW wavered. The rate clawed back its opening loss, only to swing back into negative territory. South Korea's daily Covid-19 cases stayed under 5,000 but critical cases hit a fresh all-time high.

- IDR: The rupiah garnered some strength on the back of broader risk-on impetus, while domestic headline flow provided little to rock the boat.

- MYR: Spot USD/MYR operated below yesterday's close, even as Malaysia's Plantation Minister warned against the impact of labour shortage on domestic palm sector.

- PHP: A beat in Philippine CPI inflation provided a tailwind to the peso, as BSP Gov Diokno admitted that price growth will breach the target this year, before returning to within the target range in 2022 and 2023. Diokno reiterated that Bangko Sentral is ready to maintain its accommodative stance, but is also committed to guarding against any price risks.

- THB: Spot USD/THB traded on a slightly softer footing, as local markets reopened after a public holiday. Thailand's daily Covid-19 cases fell to a five-month low, although officials reported the first Omicron case yesterday.

CHINA: What To Look For Next After RRR Cut Announcement

A quick reminder that the effective date of the PBoC's 50bp RRR cut (announced Monday) is 15 December. The move is set to free up ~CNY1.2tn in liquidity. 15 December is also the day that CNY950bn of MLF matures. The PBoC has said part of the funds released by the RRR cut will be used by banks to meet MLF obligations. Eyes now move to net MLF liquidity dynamic on that date.

- A report in the Securities Times (published Tuesday) has suggested that the RRR cut may result in the PBoC cutting its benchmark LPR in the near future. This is the view of Zheng Houcheng, head of the research institute at Yingda Securities. The next monthly LPR fixing comes on 20 Dec.

EQUITIES: Equities Higher In Asia On Chinese Data & Expectations For Further Policy Support

Regional equities firmed in Asia-Pac hours, initially benefitting from the positive Wall St. lead, Monday’s RRR cut announcement on the part of the PBoC and expectations for greater focus on growth-friendly policy on the part of the broader Chinese policymaking sphere in the wake of Monday’s Politburo meeting. This was further bolstered by Securities Times source reports, which flagged a 25bp cut in PBoC relending rates covering SMEs & the rural sector, the latest leg of targeted support for those areas of the economy. Stronger than expected Chinese export and import data provided another tailwind for risk assets.

- The broader risk-positive mood, coupled with the USD/JPY uptick witnessed since yesterday’s Tokyo close, facilitated outperformance for the Nikkei 225, which added a little over 2%.

- Elsewhere, Chinese tech was one of the major beneficiaries from the issues flagged above.

- E-minis nudged higher, adding ~0.5%, benefitting from the broader risk-positive move.

- A sense of caution re: the impending Biden-Putin phone call did little to hamper broader risk appetite.

GOLD: Little Changed Overnight

Guarded optimism surrounding the threat to life on the part of the omicron COVID strain and the latest round of easing from the PBoC has done little for gold, with bullion sticking to a narrow range early this week. Spot last deals little changed, hovering just shy of the $1,780/oz mark. Familiar technical lines in the sand remain in play, with participants looking ahead to Friday’s U.S. CPI print and next week’s FOMC decision (which headlines a loaded G10 central bank docket ahead of the Christmas break).

OIL: WTI Retakes $70

WTI & Brent crude futures sit ~$0.70 & ~$0.60 above their respective settlement levels, although most, if not all, of the gains were realised around the settlement period. WTI has now reclaimed the psychological $70.00 barrier, with mortality fears re: the omicron COVID strain receding. Chinese crude import data was also supportive for prices.

- From a technical perspective, bulls now look for a move above the Nov 30 highs in each contract.

- Focus now moves to the weekly API crude inventory estimates, due late on Tuesday.

UP TODAY (Times Local/GMT)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.