-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: PBoC Leans Against CNY Strength, RBA Unch.

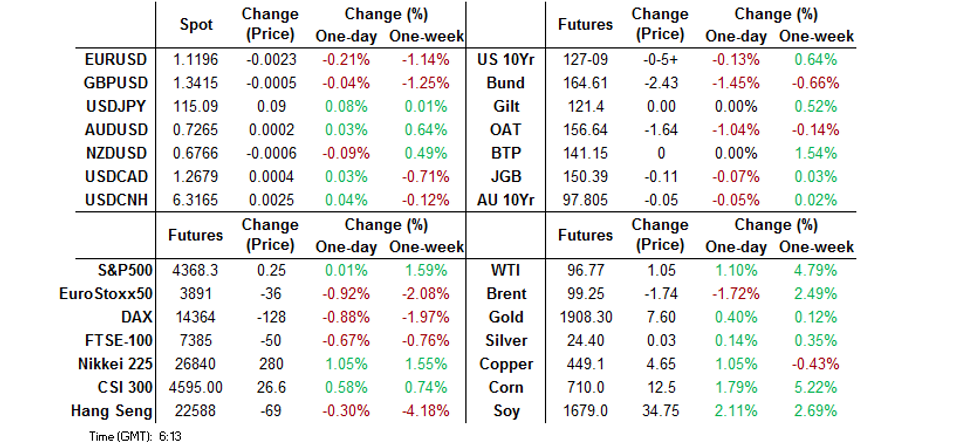

- Firmer than expected PMI data out of China was apparent overnight, while the RBA jiggled around its statement to flag increased headline inflationary pressure and risks surrounding Ukraine (while leaving its monetary policy settings unchanged, as expected). The DXY nudged higher, supported by an uptick in U.S. Tsy yields, although major FX pairs stuck to tight ranges, as the DXY consolidated above Monday's base.

- The latest USD/CNY mid-point fixing showed the PBoC leaning against CNY strength after yesterday's reports of state-owned banks buying USD/CNY around CNY6.3100.

- German CPI, Canadian GDP and a slew of PMI readings from across the globe will take focus later in the day, alongside speeches from Fed's Bostic & Mester, BoE's Mann & Saunders and Norges Bank's Bache.

BOND SUMMARY: Asia Fades The Latest Rally

Asia-Pac participants were seemingly keen to fade some of Monday’s NY Tsy richening (which was in part related to month-end index extension dynamics) allowing core FI markets to move off of their Monday/early Asia peaks. Surprise expansionary readings for both the Chinese official and Caixin manufacturing PMI prints added a further source of (light) pressure, with the official nonmanufacturing PMI release also topping wider expectations.

- This leaves TYM2 -0-05+ at 127-08+ ahead of European hours, operating a little off the base of its 0-09 overnight range, on ~150K lots. Cash Tsys run 2.5-3.5bp cheaper across the curve. NY hours will see the latest ISM m’fing survey headline, while Fedspeak will come via Mester (’22 voter) & Bostic (’24 voter).

- JGB futures traded above yesterday’s settlement levels for the duration of Tokyo dealing, but finished shy of best levels, +9. Cash JGBs were as much as 1.5bp richer out to the 20-Year sector, with the 7- to 10-Year zone leading, as a smooth 10-Year auction helped support. 30+-Year paper was marginally cheaper on the day, as the curve twist steepened. Wires ran headlines noting that the Japanese government is set to nominate Hajime Takata, an economist at Okasan Securities, and Naoki Tamura, of Sumitomo Mitsui, to replace outgoing BoJ board members Kataoka & Suzuki, whose terms finish on 23 July. Kataoka is the dovish stalwart on the board, with initial suggestions pointing to a less dovish makeup if these nominations are ratified. There wasn’t much in the way of market reaction to the report.

- ACGBs unwound their overnight and early Sydney firming ahead of the RBA decision, with the day’s big event ultimately producing nothing in the way of tangible market reaction. The Bank left its monetary policy settings unchanged, as expected, tipping its hat to the risks posed by the Russia-Ukraine conflict, while it sounded a little more worried re: the short-term inflationary impulse. Still, it referenced its prior forecasts when it came to underlying inflation The statement introduced references to wider employee compensation measures (outside of WPI), which although new to the post-meeting statement, had been covered by Governor Lowe in recent rounds of rhetoric (some noted that this gives the RBA more wiggle room when it comes to a quicker lift off, if deemed necessary). YM was unch., with XM -5.0 at the bell, a little off worst levels of Sydney dealing.

STIR: Fed OIS Off Monday’s Lows, But Still Lower Than Friday’s Close

It wasn’t only OIS pricing re: the odds of a 50bp hike at the March FOMC meeting that took a hit on Monday (with weekend developments surrounding the Russia-Ukraine conflict and related sanctions on Russia applying pressure). FOMC dated OIS now prices ~5.5x 25bp (~138bp) rate hikes during calendar ‘22, back from over 170bp of tightening that was briefly priced in during mid-February. There has been a modest bounce in FOMC dated OIS tightening pricing during early Asia dealing, but we are talking a matter of a handful of bp at each meeting, nowhere near unwinding Monday’s shift lower.

Fig.1: Tightening Priced Into Dec ’22 FOMC Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

JGBS AUCTION: Japanese MOF sells Y2.1126tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1126tn 10-Year JGBs:

- Average Yield 0.179% (prev. 0.175%)

- Average Price 99.23 (prev. 99.27)

- High Yield: 0.180% (prev. 0.176%)

- Low Price 99.22 (prev. 99.26)

- % Allotted At High Yield: 57.0000% (prev. 97.0987%)

- Bid/Cover: 3.235x (prev. 3.269x)

FOREX: PBOC Leans Against Wind Of Yuan Appreciation, Market Sentiment Stabilises

The greenback crept higher in tandem with U.S. Treasury yields as market sentiment stabilised, with Monday's unrest caused by sweeping Western sanctions against Russia now in the rearview mirror. Demand for the Japanese yen and Swiss franc waned as safe haven assets lost their allure. High-beta FX were generally better bid, albeit the kiwi dollar retreated amid thin local headline flow.

- Spot USD/RUB edged lower but remained comfortably above the RUB100 mark. Japan confirmed it was joining sanctions against Russia, which would limit the CBR's access to tens of billions of dollars worth of its yen-denominated FX reserves. Bloomberg data showed that the indicative bid-ask spread for USD/RUB was the widest since at least early November.

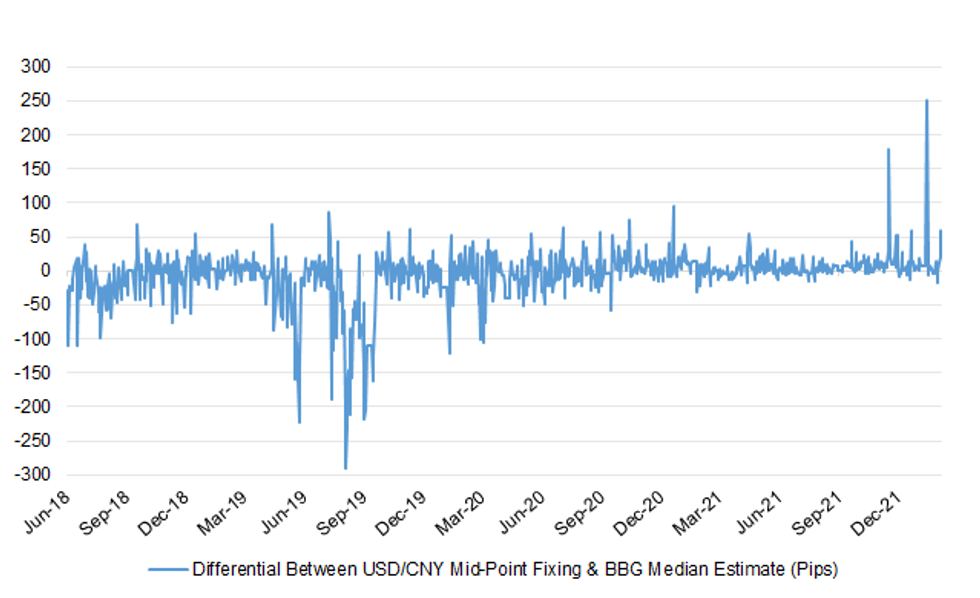

- The PBOC signalled its discomfort with recent yuan appreciation via the daily fixing of USD/CNY reference rate. The mid-point of permitted trading band for the yuan was set at CNY6.3014, 59 pips above sell-side estimate. The weaker than expected fixing came on the heels of a Reuters report noting that "major Chinese state-owned banks were buying dollars in the onshore spot currency market on Monday, in what appeared to be attempts to defend the yuan from rising past the 6.31 per dollar level." Spot USD/CNH clawed back its initial losses even as the results of official & Caixin PMI surveys showed that China's manufacturing sector unexpectedly avoided contraction in February.

- German CPI, Canadian GDP and a slew of PMI readings from across the globe will take focus later in the day, alongside speeches from Fed's Bostic & Mester, BoE's Mann & Saunders and Norges Bank's Bache.

FOREX OPTIONS: Expiries for Mar01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100-10(E572mln), $1.1200-10(E844mln), $1.1264-75(E1.2bln), $1.1345-60(E1.4bln)

- USD/JPY: Y114.70($507mln), Y115.70-80($581mln)

- AUD/USD: $0.7150-60(A$521mln), $0.7190-05(A$682mln)

ASIA FX: PBOC Throws Sand Into Gears Of Yuan Appreciation, Chinese PMIs Top Forecasts

The PBOC signalled its discomfort with recent yuan appreciation via the daily fixing of yuan reference rate, while broader sentiment in the region improved on the back of stabilising Russia worry and better than expected PMI data released out of China.

- CNH: Offshore yuan gave away its initial gains as the PBOC set its central USD/CNY mid-point at CNY6.3014, 59 pips above sell-side estimate. The bearish bias in today's fixing of USD/CNY reference rate was not particularly large by historical standards, but it showed that China's central bank intends to reign in yuan strength. Separately, China's PMI data (official & Caixin) showed that the local manufacturing sector has returned into expansion, beating analysts' expectations.

- IDR: Spot USD/IDR went offered, even as Indonesia's CPI inflation slowed more than expected to +2.06% Y/Y, near the lower end of the central bank's target range (+3.0%-4.0% Y/Y). Indonesia's onshore markets re-opened after a public holiday.

- MYR: The ringgit firmed on the back of renewed appetite for EM currencies. Malaysian Health Minister Khairy said testing requirements will be relaxed for some travellers from Thursday.

- PHP: Spot USD/PHP faltered. The Philippines' manufacturing sector has moved off from a standstill in February, according to the latest Markit PMI Survey.

- THB: The baht traded on a slightly firmer footing. PM Prayuth chaired a Cabinet meeting, with ministers expected to discuss economic measures to contain the fallout from the Russia crisis.

- Markets in South Korea and India were shut in observance of local public holidays.

CNY: PBoC Leaning Against CNY Strength?

Not as low a USD/CNY mid-point fixing as expected from the PBoC (CNY6.3014). The mid-point fixed above the CNY6.3000 mark even with broader sell side expectations looking for a sub-CNY6.3000 fix (BBG median of CNY6.2955). This comes after a RTRS sources report noted that state-owned Chinese banks were buying USD vs. CNY on Monday, in what seemed to be an attempt to stop a break below the CNY6.3100 level (USD/CNY closed Monday trade at CNY6.3092, troughing at CNY6.3065, while USD/CNH traded as low as CNH6.3072 on Monday). For reference the deviation between the USD/CNY mid-point fixing wasn't large by historical standards, although it seems like the authorities are leaning against the wind (at least at the margin) when it comes to yuan strength.

Fig. 1: Differential Between USD/CNY Mid-Point Fixing & BBG Median Estimate (Pips)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Higher In Asia As Volatility Ebbs

Most major Asia-Pac equity indices are firmer at typing, with a lack of escalation in the Russia-Ukraine conflict during the Asian session allowing participants to strike a more optimistic tone.

- The Nikkei 225 leads regional peers, adding 1.5% at typing, and is on track to record gains for a third straight session. Large caps, particularly those with a focus on exports, such as Fast Retailing Co and Tokyo Electron, lead gains within the index, shrugging off a slowdown in the Feb Jibun Bank M’fing PMI reading (52.7 vs Jan 55.4).

- The Hang Seng underperformed, sitting 0.3% softer at typing, on track for a fourth consecutive lower daily close. This came as authorities announced a lockdown of Hong Kong to conduct mandatory COVID-19 testing. The heaviest losses were observed in the utilities (-1.0%) and real estate sub-indices (-1.0%), with the former now trading at levels not witnessed since Mar ’21. For the latter, sentiment in China-based real estate developers suffered as February home sales data from independent real estate research firm China Index Academy suggested that momentum in the sector is still weak (30 out of 100 cities reported a rise in the prices of new homes, against 44 in January).

- U.S. e-mini equity index futures are little changed into European hours.

GOLD: Marginally Softer In Asia

Gold is ~$4 worse off, printing $1,905.0/oz at typing. The precious metal trades well clear of Friday and Monday’s troughs, with worry surrounding an ongoing escalation in the Russia-Ukraine conflict continuing to support haven demand.

- To recap, planned European shipments of lethal weaponry to Ukraine and the increasingly visible impact of western sanctions on Russia (i.e. the Ruble’s plunge and the Russian CB doubling interest rates on Monday) has drawn strong rhetoric and retaliatory sanctions from Russia, with participants wary of further escalation re: more sanctions from western powers on Russia (noting that Russian President Putin ordered nuclear deterrent forces to be on “high alert” on Sunday over “aggressive statements” made by leading NATO powers).

- Worry re: a nuclear escalation has however eased from its extremes, after the U.S. indicated that they would not elevate their own nuclear posture in response.

- Russia-Ukraine talks held on Monday yielded no breakthroughs, although both delegations have indicated that there will be a second round of negotiations after consultations with their respective leaderships.

- Looking to technical levels, gold trades within its bull channel (drawn from the Aug 9 ’21 low), with the outlook remaining bullish despite recent volatility. Resistance is situated at ~$1,940.1 (top of bull channel), while support is seen at $1,878.4 (Feb 24 low and key short-term support).

OIL: Underpinned In Asia

WTI and Brent are +$0.90 at writing, printing ~$96.60 and ~$98.90 respectively.

- To recap, both benchmarks have backed away from Monday’s best levels, as the latest round of western sanctions on Russia have largely spared Russian energy exports, easing earlier worries re: disruptions to global oil supplies. A note that difficulties still remain for energy exports as several banks have halted trade financing for Russian commodities over the past week, with participants assessing the possible impediment to the movement of crude out of Russia.

- Crude has managed to shake off Monday’s BBG sources report, which suggested that the U.S. and its allies are discussing a co-ordinated release of up to 60mn bbls of crude from emergency reserves, with a decision expected “within days”.

- Uncertainty remains when it comes to the prospects of an Iranian nuclear deal, with a Reuters source report on Monday stating that the Iranian position has “become even more uncompromising”, suggesting that the country wants “to open issues that had already been agreed”. The U.S. has also since stated a willingness to pull out of talks should Iran show “intransigence to making progress”.

- From a technical perspective, resistance for WTI and Brent remains intact at their Feb 24 highs of $100.54 and $105.79, respectively, while support is seen at $90.06 (Feb 23 low and key support) for WTI, and $96.00 (Feb 25 low) for Brent.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/03/2022 | 0730/0730 |  | UK | DMO Gilt Operations Announcement W/C 4/11 April | |

| 01/03/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2022 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 01/03/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/03/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/03/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/03/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/03/2022 | 1000/1100 | *** |  | DE | Saxony CPI |

| 01/03/2022 | - |  | EU | ECB Panetta at G7 Finance Ministers/CB Governors Meeting | |

| 01/03/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/03/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 01/03/2022 | 1300/1400 |  | EU | ECB Lagarde visits Chancellor Scholz | |

| 01/03/2022 | 1330/0830 | * |  | US | construction spending |

| 01/03/2022 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 01/03/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/03/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2022 | 1830/1830 |  | UK | BOE Saunders speech at East Anglia University | |

| 01/03/2022 | 1900/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/03/2022 | 1900/1900 |  | UK | BOE Mann panels Cleveland Fed discussion | |

| 01/03/2022 | 1900/1400 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.