-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Stagflation Worry Remains Evident

EXECUTIVE SUMMARY

- UKRAINE'S ZELENSKIY TELLS RUSSIA "JUST STOP THE BOMBING" BEFORE MORE CEASEFIRE TALKS

- UKRAINE POINTS TO RUSSIAN ATTACK ON KHARKIV HOSPITAL (AFP)

- PUTIN SIGNS DECREE ON TEMPORARY FINANCIAL-STABILISATION STEPS (IFX)

- RUSSIA BANS COUPON PAYMENT TO FOREIGNERS ON $29 BILLION IN BONDS (BBG)

- BOE'S SAUNDERS: UKRAINE IMPACT ON RATE DECISIONS UNCLEAR (RTRS)

- BOE’S MANN: WAGE EXPECTATIONS A SIGN INFLATION IS ‘EMBEDDED’ (BBG)

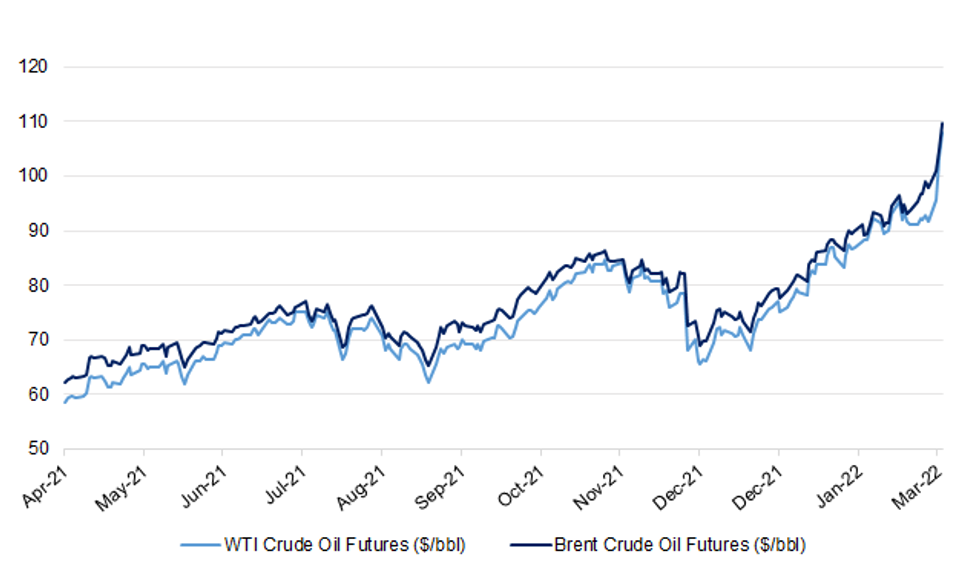

- FRESH CYCLE HIGHS FOR CRUDE FUTURES, WITH BRENT ABOVE $110.00

Fig. 1: WTI & Brent Crude Oil Futures ($/bbl)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England policymaker Michael Saunders said Russia's invasion of Ukraine is likely to push Britain's soaring inflation higher, but that it is too soon to determine the impact on monetary policy. A higher peak for inflation - which the BoE has already forecast will exceed 7% in April - would hurt incomes and spending, Saunders said in a question-and-answer session after giving a speech to the University of East Anglia on Tuesday. "It's not clear at this stage if those recent developments have any effects on the outlook for inflation two and three years out," he said when asked about the invasion. "I wouldn't want to be drawn at this stage on the question of whether there are any monetary policy implications from this." (RTRS)

BOE: Two of the Bank of England’s policy makers said there’s a need to move quickly to keep inflation in check in the U.K., affirming expectations for another interest rate increase this month. “Prompt tightening now could help limit the total scale of tightening that will be needed,” Michael Saunders said in a speech Tuesday. Catherine Mann said at a separate event that “the policy strategy it is very much a front load to counter expectations.” U.K. inflation is already at a 30-year high and is expected to rise further to 7.25% in April. Investors expect the BOE’s nine-member Monetary Policy Committee to deliver a quarter-point increase in the key rate at its next decision on March 17. (BBG)

EUROPE

FISCAL: MNI SOURCES: Brussels To Delay Decision On Fiscal Rules Return

- The EU Commission is set to delay confirming that the escape clause from the rules of the Stability and Growth Pact will end next year, even as it gives initial fiscal guidance to states on their 2023 draft budget plans Wednesday, Commission sources tell MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

SNB: The Swiss National Bank will keep intervening in foreign exchange markets to ensure price stability and needs to have lower interest rates than others to avoid an excessive appreciation of the Swiss franc, its vice chairman said in a newspaper interview. "Switzerland has always had lower rates than others since the financial crisis. It is very important for us to keep this differential to avoid an excessive appreciation of the Swiss franc," Fritz Zurbruegg said in an interview with Swiss newspaper l'agefi published on Wednesday, but conducted last week before Russia invaded Ukraine. "As soon as the situation requires it, we'll raise our interest rate," he said. "We'll keep this ability to intervene in foreign exchange markets if needed to ensure price stability," Zurbruegg said, adding the franc was a safe haven in times of crisis. Asked whether the SNB was prepared to accept parity between the euro and the franc, Zurbruegg said the central bank was looking at a basket of currencies to judge the value of the franc and not just one currency pair. (RTRS)

U.S.

FED: Federal Reserve Bank of Cleveland President Loretta Mester on Tuesday said Russia’s invasion of Ukraine could push already high inflation up further even as it slows growth, competing problems for the U.S. central bank. “The unfolding event has implications for the economic outlook, adding upside risk to inflation even as it puts downside risks to the growth forecast,” Mester said at a conference on inflation hosted by her bank. “The challenge facing Fed policymakers is how to recalibrate monetary policy, reducing the accommodation from the emergency levels needed earlier in the pandemic in order now to get inflation under control and at the same time sustain the expansion and maintain healthy labor markets.” (RTRS)

FED: The economic landscape facing the Federal Reserve has changed “a lot” with shocks to oil prices and potentially supply chains that policymakers will have to account for, Atlanta Fed Reserve President Raphael Bostic said on Tuesday. “Energy is changing a lot. The ability of people and goods to move through Europe - looks like that is going to change a lot. That has implications for supply chains and a whole host of things ... There is a lot we have to figure out,” Bostic said in a Webcast event at the Atlanta Fed. (RTRS)

MNI: Fed Keeping 50 BP Option Open For Later -- Ex-Staffers

- The Federal Reserve is set to lift off from its near-zero setting with a quarter-point interest rate increase in March but 50bp hikes later this year are under consideration as inflation pressures worsen, former central bank staffers told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

INFLATION: Addressing a concerned nation and anxious world, President Joe Biden vowed in his first State of the Union address Tuesday night to check Russian aggression in Ukraine, tame soaring U.S. inflation and deal with the fading but still dangerous coronavirus. Biden outlined plans to address inflation by reinvesting in American manufacturing capacity, speeding supply chains and reducing the burden of childcare and eldercare on workers. “Too many families are struggling to keep up with the bills,” Biden said. “Inflation is robbing them of the gains they might otherwise feel. I get it. That’s why my top priority is getting prices under control.” (AP)

ECONOMY: MNI INTERVIEW: Energy Prices Pose Risk For US Mfg Growth--ISM

- Institute for Supply Management manufacturing chair Tim Fiore told MNI Tuesday rising energy prices are worrisome for U.S. manufacturers, but he added for now the Ukraine crisis will likely have only modest ripples for the industry - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

POLITICS: U.S. Senate Republican leader Mitch McConnell said on Tuesday that Republicans largely support President Joe Biden's actions toward Russia over its invasion of Ukraine, but that lawmakers have hit a snag in efforts to agree on aid to Kyiv. The White House is seeking $6.4 billion in humanitarian and security aid from Congress for Ukraine. Democrats intend to include the funding in an omnibus spending bill that lawmakers in the House of Representatives expect to vote on next week. But McConnell said talks have bogged down over the defense segment of the Ukraine aid package, which he said Democrats wanted to fund from a defense spending level agreed to before the invasion. "We're not going to do that," McConnell told reporters, adding that in an emergency, the process should be different. "We’ve hit a snag," he said. (RTRS)

OTHER

U.S./CHINA/TAIWAN: The United States stands firmly behind its commitments to Taiwan, a visiting U.S. delegation said on Wednesday, as Taiwan President Tsai Ing-wen vowed to work more closely with allies in response to what she called China's growing military threat. The delegation of former U.S. top security and defence officials has been sent by President Joe Biden and is visiting Chinese-claimed Taiwan against the backdrop of Russia's invasion of Ukraine, which is being closely watched on the democratic island. (RTRS)

RBNZ: MNI INTERVIEW: RBNZ Doesn't Need To "Front End" Hikes

- Clear forward guidance on official rates had seen commercial lenders "front load" their interest rate hikes and was a key reason why the Reserve Bank of New Zealand had opted for a 25-basis point rise after strongly considering 50-basis points at its last meeting, according to RBNZ chief economist Yuong Ha - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

RUSSIA: Russian airborne troops landed in the eastern Ukrainian city of Kharkiv on Wednesday, the Ukrainian army said, adding that there were immediate clashes. "Russian airborne troops landed in Kharkiv... and attacked a local hospital," the army said in a statement on messaging app Telegram. "There is an ongoing fight between the invaders and the Ukrainians." (AFP)

RUSSIA: Russian forces have entered the southern Ukrainian city of Kherson, but Ukraine still controls the city administration building, Ukrainian interior ministry advisor Vadym Denysenko said on television on Tuesday. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy said on Tuesday Russia must stop bombing Ukrainian cities before meaningful talks on a ceasefire could start, as a first round of negotiations this week had yielded scant progress. Speaking in an interview in a heavily guarded government compound, Zelenskiy urged NATO members to impose a no fly zone to stop the Russian air force, saying this would be a preventative measure and not meant to drag the alliance into war with Russia. Zelenskiy, who has refused offers to leave the Ukrainian capital as Russian forces advanced, also said Ukraine would demand legally binding security guarantees if NATO shut the door on Ukraine's membership prospects. (RTRS)

RUSSIA: Russia sees "no desire on the part of Ukraine" to try to find a legitimate and balanced solution to the problems between the two countries, Gennady Gatilov, the Russian ambassador to the United Nations in Geneva, told Lebanese television in an interview aired on Tuesday. Gatilov said Russia "supports diplomacy based on respect for the positions of all countries and equality, but for now we don't see that", the Russian news agency RIA quoted him as saying in the interview. Gatilov also said the time had come to remove nuclear weapons from Western and Eastern Europe, according to RIA. (RTRS)

RUSSIA: Turkish presidential spokesman Ibrahim Kalin said on Tuesday that Ukrainian and Russian delegations were unlikely to meet for planned talks on Wednesday, adding Moscow's demands to end its invasion were "unrealistic". "They will most likely not meet (on Wednesday)," Kalin told broadcaster CNN Turk. "It will most likely be postponed a couple of days, we are in touch with the negotiating teams," he said, adding he hoped Russian President Vladimir Putin would end the assault by realising the economic damage it causes to Russia. (RTRS)

RUSSIA: Russia is preparing a provocation to justify the introduction of Belarusian troops, which are now concentrated on the Ukrainian border. The forces include about 300 tanks, according to the Foreign Intelligence Service of Ukraine's Facebook page. "According to available intelligence, there are now about 300 Belarusian tanks near the Belarusian-Ukrainian border. The convoy has not yet crossed the border and is waiting on the route of Pinsk-Ivanovo-Drahichyn (approximately 30 km from the State Border of Ukraine). (Jerusalem Post)

RUSSIA: President Biden spoke Tuesday with Ukrainian President Volodymyr Zelensky for more than 30 minutes, the White House said. Details on the phone call are expected to be released later in the day. On Twitter, Mr. Zelensky said he had just spoken to Mr. Biden: “The American leadership on anti-Russian sanctions and defense assistance to Ukraine was discussed. We must stop the aggressor as soon as possible. Thank you for your support!” The White House said the pair discussed the U.S.’s “sustained help for Ukraine, including ongoing deliveries of security assistance, economic support and humanitarian aid.” The two leaders “discussed how the United States, along with Allies and partners, is working to hold Russia accountable, including by imposing sanctions that are already having an impact on the Russian economy,” the White House said. (WSJ)

RUSSIA: U.S. President Joe Biden assailed Russian President Vladimir Putin, barred Russian flights from American airspace and led Democratic and Republican lawmakers in a rare display of unity on Tuesday in a State of the Union speech dominated by Russia’s invasion of Ukraine. "Let each of us if you're able to stand, stand and send an unmistakable signal to Ukraine and to the world," Biden urged Democrats and Republicans. Lawmakers who are deeply divided over taxes, voting rights and gun safety stood together to applaud Ukraine, many waving Ukrainian flags and cheering in the chamber of the House of Representatives. Several women members of Congress wore the flag's colors of yellow and blue. In a deviation from his prepared remarks, Biden said of Putin: "He has no idea what's coming." (RTRS)

RUSSIA: The United States will follow the European Union and Canada in banning Russian flights from its airspace, President Joe Biden said on Tuesday evening, in a move likely to trigger Russian retaliation. United Airlines and United Parcel Service (UPS) (UPS.N) said on Tuesday they had suspended flying over Russian airspace, joining other major U.S. carriers Delta Air Lines (DAL.N) and American Airlines. (RTRS)

RUSSIA: President Joe Biden is being pressured by lawmakers in both parties to cut off U.S. imports of Russian oil and gas to escalate the cost to Russia of its invasion of Ukraine. Massachusetts Democrat Ed Markey, who sits on the Senate Foreign Relations Committee, introduced legislation Tuesday that would ban all imports of Russian crude oil and petroleum products into the United States. Republicans led by Senator Roger Marshall of Kansas also proposed their own ban on Russian oil imports late Tuesday. (BBG)

RUSSIA: Ukrainian officials are pushing the Biden administration and lawmakers on the Hill to impose sanctions on Russian oil and gas exports and cracking down further on the energy supplies that international markets are already starting to shun. (POLITICO)

RUSSIA: Russia said on Tuesday it would retaliate over the U.S. expulsion of 12 of its diplomats at the United Nations for alleged spying. Foreign Ministry spokeswoman Maria Zakharova said the U.S. action "will not remain without a proper reaction and an answer - not necessarily symmetrical." The United States said on Monday the expelled diplomats were "intelligence operatives" who had been "engaging in espionage activities that are adverse to our national security." (RTRS)

RUSSIA: “We have, generally, not participated in these kinds of sanctions as principle,” Turkish Foreign Minister Mevlut Cavusoglu says in interview with Haberturk TV late Tuesday. Turkey hasn’t received any request to participate in sanctions. Russia has withdrawn its request for some of its warships to pass Turkish Straits after Turkey’s demand. Turkey doesn’t have to pick sides in the war. Turkey abstained from Council of Europe vote to suspend Russian representation as that decision would mean “Russian citizens wouldn’t be able to apply to” European Human Rights Court”. (BBG)

RUSSIA: The U.S. nuclear power industry is lobbying the White House to allow uranium imports from Russia to continue despite the escalating conflict in Ukraine, with cheap supplies of the fuel seen as key to keeping American electricity prices low, according to two sources familiar with the matter. The United States relies on Russia and its allies Kazakhstan and Uzbekistan for roughly half of the uranium powering its nuclear plants - about 22.8 million pounds (10.3 million kg) in 2020 - which in turn produce about 20% of U.S. electricity, according to the U.S. Energy Information Administration and the World Nuclear Association. (RTRS)

RUSSIA: European Union ambassadors agreed on Tuesday to call for an initial assessment of Ukraine’s chances of joining the 27-nation bloc. The envoys will ask the European Commission, the bloc’s executive arm, to look into the possibility, according to officials who declined to be identified speaking on a confidential issue. EU leaders are expected to discuss Ukraine’s prospects at a summit in Paris on March 10-11, the officials said. The move follows Ukrainian President Volodymyr Zelenskiy formally putting in a bid on Monday. Membership requires an arduous set of steps that can last more than a decade. (BBG)

RUSSIA: European Union ambassadors agreed to exclude seven Russian banks from the SWIFT financial-messaging system but spared the nation’s biggest lender Sberbank PJSC and a bank part-owned by Russian gas giant Gazprom PJSC. VTB Bank PJSC and Bank Rossiya are among the banks that face a ban from the messaging system that enables trillions of dollars worth of transactions around the world, according to officials familiar with the decision. The measures in response to Russian leader Vladimir Putin’s invasion of Ukraine are expected to be adopted overnight. The other institutions included on the EU list are Bank Otkritie, Novikombank, Promsvyazbank PJSC, Sovcombank PJSC and VEB.RF, said the officials, who asked not to be identified because the decision was private. (BBG)

RUSSIA: Russia's invasion of Ukraine has prompted Italy to put on hold its share of financing for the $21 billion Arctic LNG 2 project led by privately-owned Russian gas producer Novatek, two sources close to the matter told Reuters on Tuesday. (RTRS)

RUSSIA: Britain on Tuesday froze the assets of four top Belarusian army officials for destabilising Ukraine and undermining or threatening its sovereignty and independence after Russia invaded Ukraine. Andrei Burdyko, Victor Gulevich, Sergei Simonenko and Andrey Zhuk are now subject to an asset freeze, as per the government's notice here. Two defence companies - JSC 558 Aircraft Repair Plant and JSC Integral - were also added. (RTRS)

RUSSIA: The government has launched an urgent review into how to reduce Britain’s exposure to Russian gas imports and Kremlin-backed energy companies following the invasion of Ukraine, according to people familiar with the situation. UK business secretary Kwasi Kwarteng met the bosses of some of the UK’s biggest energy groups on Friday as part of the review, which energy industry leaders said would require a close examination of ties between Russia’s Gazprom and the public and private sectors in Britain. National Grid’s John Pettigrew, Chris O’Shea of Centrica and ScottishPower head Keith Anderson were among chief executives who met Kwarteng, according to people close to the talks. (FT)

RUSSIA: Canada ratcheted up pressure on Russia for its invasion of Ukraine by shutting ports to Russian-owned ships and saying on Tuesday that holdings of all Russian oligarchs and companies in the country are under review. Canada has announced a slew of measures to isolate Russia, including imposing sanctions on Russian President Vladimir Putin, closing Canadian airspace to Russian planes, banning oil imports and forbidding Canadian financial institutions from dealing with the Russian central bank, acting in tandem with other Western countries. (RTRS)

RUSSIA: Almost half of the world’s container ships will no longer go to and from Russia, roiling trade in everything from food and metals to clothes and electronic goods. Shipping giants A.P Moller-Maersk A/S and MSC Mediterranean Shipping Co. said they’re halting trade in the region, joining Hapag-Lloyd AG and Asia’s Ocean Network Express Pte in stopping services. They’re among the latest in a growing list of companies ceasing business with or exiting Russia following its invasion of Ukraine. The moves threaten to pile more strain on exports of Russian goods -- as highlighted in surging prices of crucial commodities like aluminum. But it’s also leaving the nation increasingly isolated from world markets. Russian firms will have to find new ways to import commodities and other goods as well as shipping ship out raw materials, threatening even higher costs to consumers. (BBG)

RUSSIA: Europe is winding down and selling units of Sberbank of Russia PJSC’s business in the region a day after regulators said they were likely to fail in the wake of sanctions imposed over Russia’s invasion of Ukraine. (BBG)

RUSSIA: Credit Agricole SA has put new business linked to Russia on hold as the war in Ukraine prompted wide sanctions on President Vladimir Putin’s government, according to people familiar with the matter. The French bank has put a pause on providing financing to new business related to Russia, including financing of projects and movements of commodities, said the people, who asked not to be identified because the information is private. The decision comes as lenders are concerned about widening of sanctions, which are already some of the harshest ever imposed. (BBG)

RUSSIA: Some Russian oil companies have stopped banking with sanctioned lenders including VTB and Sberbank and switched to those that do not face restrictions, including Rosbank, Unicredit and Raiffeisen, five people familiar with the matter told Reuters. (RTRS)

RUSSIA: Russian President Vladimir Putin signed a decree introducing temporary economic measures to ensure the country's financial stability, the Kremlin announced Tuesday. These measures will be taken in response to anti-Russian sanctions by the United States, other countries and international organizations, according to the decree. Among the measures, Russia will ban the outflow of foreign currencies in an amount exceeding the equivalent of 10,000 U.S. dollars starting Wednesday. Effective since Wednesday, restrictions regarding transactions of securities, real estate and loans will be imposed on foreigners associated with countries that have taken anti-Russian actions. (Xinhua)

RUSSIA: The Russian central bank has banned coupon payments to foreign owners of ruble bonds known as OFZs in what it called a temporary step to shore up markets in the wake of international sanctions. The Bank of Russia issued the instruction to depositaries and registries as part of a raft of measures announced this week that included a freeze on local security sales by foreigners. It could leave foreign investors who held almost 3 trillion rubles ($29 billion) in the debt at the start of February unable to collect income on their holdings, which are already blocked from sale by restrictions. The next coupon payment on OFZ bonds is due tomorrow on notes maturing in 2024, according to data compiled by Bloomberg. (BBG)

RUSSIA: Moscow Exchange trading regime for March 3 will be published tomorrow before 9am Moscow time, central bank says in website statement. (BBG)

RUSSIA: Franklin FTSE Russia ETF has suspended the creation of new shares until further notice. The buying and selling of shares of FLRU currently remains available on the secondary market. The value and liquidity of Russian securities and the Russian currency have experienced significant declines after sanctions. (BBG)

RUSSIA: No equity securities listed and/or domiciled in Russia will be added to indexes, even if they’re otherwise eligible, until further notice, S&P Dow Jones says. (BBG)

RUSSIA: Stoxx, the operator of Deutsche Börse’s Qontigo indices, is to axe 61 Russian companies from its indices, the most concrete move yet by an index provider in the wake of Moscow’s invasion of Ukraine. The list includes most leading Russian companies, such as Gazprom, Lukoil, Sberbank, Rusal and Aeroflot. Overseas-listed American and global depositary receipts issued by Aeroflot, Sberbank and X5 Retail are also on the list of index constituents that will be deleted on March 18. (FT)

RUSSIA: Trustees of the New York City police pension fund voted on Tuesday to divest Russian company securities, supporting a resolution brought by city Comptroller Brad Lander, his office said. The fund held $42.5 million of Russian securities as of Feb. 25, Lander's office said. (RTRS)

RUSSIA: Glencore Plc, the world’s biggest commodity trader, followed some of the world’s largest companies in reviewing its business ties with Russia as the fallout from the invasion of Ukraine intensifies across global commodities markets. While Glencore stopped short of exiting its investments, the company said it was reviewing its shareholdings in two of Russia’s biggest companies as well as its wider trading operations in the country. (BBG)

RUSSIA: Apple Inc. halted sales of the iPhone and its other highly prized technology products in Russia following the country’s invasion of Ukraine, saying the company stands “with all of the people who are suffering as a result of the violence.” The tech giant said Tuesday that it stopped exporting products into the country’s sales channel last week, ahead of pausing sales. It’s also removing the RT News and Sputnik News applications from App Stores outside of Russia and has disabled traffic and live-incident features in Ukraine as a “safety and precautionary measure” for citizens there. (BBG)

RUSSIA: Alphabet Inc's Google confirmed on Tuesday that it had removed Russian state-funded publishers such as RT from its news-related features, including the Google News search tool, following Russia's invasion of Ukraine and various sanctions against Russia. Kent Walker, Google's president of global affairs, said earlier Tuesday in a blog post that "in this extraordinary crisis we are taking extraordinary measures to stop the spread of misinformation and disrupt disinformation campaigns online." Google already had restricted news companies funded by the Russian government from advertising tools and some features on YouTube. (RTRS)

RUSSIA: U.S. airplane manufacturer Boeing Co (BA.N) said on Tuesday it was suspending parts, maintenance and technical support for Russian airlines as well as major operations in Moscow after Russia's invasion of Ukraine. "As the conflict continues, our teams are focused on ensuring the safety of our teammates in the region," a Boeing spokesperson said. The announcement came a day after Boeing said it had paused operations at its Moscow Training Campus and temporarily closed its office in Kyiv. (RTRS)

RUSSIA: The global Internet domain non-profit known as ICANN confirmed Tuesday that it has received a letter from the Ukrainian government asking it to remove Russian domains from the global Internet. “We can confirm that we’ve received the letter and are reviewing it,” said spokeswoman Angelina Lopez. “We have no further comment at this time.” (CNBC)

SOUTH AFRICA: A South African judicial panel that’s spent almost four years probing in South Africa recommended that law enforcement agencies conduct further investigations into Mineral Resources and Energy Minister Gwede Mantashe, saying there was a “reasonable prospect” that he could be implicated in corruption. The recommendation was made a third report of findings by the panel by Acting Chief Justice Raymond Zondo, which was presented to President Cyril Ramaphosa on Tuesday. Zondo heard testimony that services company Bosasa paid for security upgrades at Mantashe’s private home, and that it paid millions of rand in bribes to other ruling party and state officials to secure government contracts. Mantashe has denied any wrongdoing. (BBG)

SOUTH AFRICA: South African President Cyril Ramaphosa’s son, Andile, was cleared of wrongdoing by a judicial panel into state graft. Acting Chief Justice Raymond Zondo said, in a third report of findings by the panel relating to the state’s relations with services company Bosasa, that no alleged conduct by the South African leader’s son fell within its terms of reference. Andile Ramaphosa denied wrongdoing in evidence to the panel.

OIL: The US and its allies have agreed to a release of 60 million barrels from their reserves, the White House and International Energy Agency announced Tuesday, as leaders seek to dampen the effect of Russia's invasion of Ukraine on gas prices at home. Half of that total -- 30 million barrels -- will come from the US Strategic Petroleum Reserve, and the other half will come from allies in Europe and Asia. Those other allies include Germany, the United Kingdom, Italy, the Netherlands and other major European countries, as well as Japan and South Korea. (CNN)

OIL: Russian oil trade was in disarray on Tuesday as producers postponed sales, importers rejected Russian ships and buyers worldwide searched elsewhere for needed crude after a raft of sanctions imposed on Moscow over the war in Ukraine. The knock-on effects of sanctions were felt all across the oil market on Tuesday. Russia's key Urals oil grade was bid at a discount of more than $18 below physical Brent crude, the primary worldwide benchmark, a record in the post-Soviet era. Even at that price, traders have been unable to find willing buyers. (RTRS)

OIL: The CPC pipeline that ships 1.2% of the world's oil from Kazakhstan to global markets has been caught in Russian sanctions problems in recent days as buyers avoid its oil because of mixture with Russian grades and loadings from a Russian port, traders said. Five traders, who spoke with Reuters on condition of anonymity, said buyers have been avoiding CPC for delivery in late March. They said CPC exports oil from Russia's Novorossiisk port and mixes it with Russian grades, which deterred most buyers and made it difficult to find insurance for the ships. (RTRS)

CHINA

PBOC: MNI BRIEF: PBOC Remains Policy Prudent To Keep Yuan Stable

- China's monetary policy will remain prudent and flexible and increase credit expansion to counter external shocks and downward domestic pressures that will help keep the yuan stable, the People's Bank of China said on its social media account - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

YUAN: The yuan may not continue to appreciate should the Federal Reserve starts rate hike this month, despite its recent rally coming at a time when China's trade surplus is at a record high and global risk aversion rises on geopolitical conflicts, the Shanghai Securities News reported citing analysts. The strong foundation of the yuan will not fade away quickly in 2022, but may become more flexible in depreciation so to help balance the divergence between China-U.S. monetary policies, the newspaper said citing Zhong Zhengsheng, chief economist of Ping An Securities. Both onshore and offshore yuan reached the 6.31 mark against the U.S. dollar on Tuesday, with the intraday highs hitting 6.3048 and 6.3071 respectively, hitting new highs again since April 2018, the newspaper said.

FISCAL: Chinese local governments are expected to issue over CNY430 billion special-purpose bonds in March to help advance infrastructure investment to stabilize economic growth, the China Securities Journal reported citing Gao Ruidong, chief economist at Everbright Securities. The issuance of such bonds has been significantly accelerated with a total of CNY877.5 billion sold in the first two months, the newspaper said. Among all, over CNY470 billion were invested in infrastructure projects mainly in the areas of municipal facilities, transportation, water conservancy and environmental protection, which largely increased compared to last Q4, the newspaper cited Gao as saying. (MNI)

DIGITAL YUAN: China will soon unveil its third batch of digital yuan pilot cities, likely to include Fuzhou, Xiamen, and Hangzhou cities, the Shanghai Securities News reported. The pace of opening personal digital yuan wallets has far exceeded expectations, jumping to 20.87 million from 26.1 billion in H2 2021, and the figure will significantly increase following the promotion in Winter Olympics, the newspaper said citing analysts. The pilot program is expected to expand to more cities, with the fourth and fifth batch of pilot cities likely to follow, the newspaper cited analysts as saying. (MNI)

OVERNIGHT DATA

JAPAN Q4 CAPITAL SPENDING +4.3% Y/Y; MEDIAN +2.9%; Q3 +1.2%

JAPAN Q4 CAPITAL SPENDING EX SOFTWARE +5.5% Y/Y; MEDIAN +4.4%; Q3 +2.2%

JAPAN Q4 COMPANY PROFITS +24.7% Y/Y; MEDIAN +19.3%; Q3 +35.1%

JAPAN Q4 COMPANY SALES +5.7% Y/Y; Q3 +4.6%

JAPAN FEB MONETARY BASE +7.6% Y/Y; JAN +8.4%

JAPAN FEB MONETARY BASE END OF PERIOD +Y663.9TN; DEC +Y663.2TN

AUSTRALIA Q4 GDP SA +3.4% Q/Q; MEDIAN +3.5%; Q3 -1.9%

AUSTRALIA Q4 GDP +4.2% Y/Y; MEDIAN +4.1%; Q3 +4.0%

NEW ZEALAND JAN BUILDING PERMITS -9.2% M/M; DEC +0.4%

NEW ZEALAND Q4 TERMS OF TRADE INDEX -1.0% Q/Q; Q3 +0.4%

NEW ZEALAND FEB CORELOGIC HOUSE PRICE INDEX +25.2% Y/Y; JAN +27.5%

SOUTH KOREA FEB MARKIT M’FING PMI 53.8; JAN 52.8

February data provided evidence that the South Korean manufacturing sector remained robust despite the surge in COVID-19 cases related to the Omicron variant. The latest Manufacturing PMI reading was the strongest for eight months and pointed to a solid expansion in operating conditions. The acceleration came amid quickening growth rates for both new orders and production, which rose at the steepest rates since last June and July respectively. Moreover, there was a renewed acceleration in growth of foreign demand, which rose at the quickest pace since last April. The latest data provided an indication that supply chain disruption continued to hold back activity. The impact of shortages has been clear in rising raw material prices, which is now feeding into prices charged for manufactured goods. In an effort to protect margins, firms passed higher costs on to clients, with factory gate charges rising at the sharpest pace in the survey history. South Korean manufacturers were positive that the risks posed by ongoing shortages and disruptions would ease and allow for a broad recovery in demand. As such, the degree of business optimism strengthened in February to the highest for a year. This is broadly in line with current IHS Markit estimates for industrial production to grow 2.2% in 2022. (IHS Markit)

SOUTH KOREA JAN INDUSTRIAL PRODUCTION +4.3% Y/Y; MEDIAN +6.4%; DEC +7.4%

SOUTH KOREA JAN INDUSTRIAL PRODUCTION +0.2% M/M; MEDIAN -1.5%; DEC +3.7%

SOUTH KOREA JAN CYCLICAL LEADING INDEX CHANGE -0.1; DEC -0.2

UK FEB BRC SHOP PRICE INDEX +1.8% Y/Y; JAN +1.5%

CHINA MARKETS

PBOC NET DRAINS CNY190 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Wednesday. The operation has led to a net drain of CNY190 billion after offsetting the maturity of CNY200 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:34 am local time from the close of 1.9855% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday vs 53 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3351 WEDS VS 6.3014

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3351 on Wednesday, compared with 6.3014 set on Tuesday.

MARKETS

SNAPSHOT: Stagflation Worry Remains Evident

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 421.48 points at 26420.47

- ASX 200 up 20.152 points at 7116.7

- Shanghai Comp. down 11.809 points at 3476.959

- JGB 10-Yr future up 58 ticks at 151.18, yield down 3.9bp at 0.137%

- Aussie 10-Yr future up 11.5 ticks at 97.92, yield down 11.3bp at 2.075%

- U.S. 10-Yr future -0-03+ at 128-20, yield up 0.17bp at 1.729%

- WTI crude up $4.6 at $108, Gold down $10.26 at $1934.45

- USD/JPY up 12 pips at Y115.05UKRAINE'S ZELENSKIY TELLS RUSSIA "JUST STOP THE BOMBING" BEFORE MORE CEASEFIRE TALKS

- UKRAINE POINTS TO RUSSIAN ATTACK ON KHARKIV HOSPITAL (AFP)

- PUTIN SIGNS DECREE ON TEMPORARY FINANCIAL-STABILISATION STEPS (IFX)

- RUSSIA BANS COUPON PAYMENT TO FOREIGNERS ON $29 BILLION IN BONDS (BBG)

- BOE'S SAUNDERS: UKRAINE IMPACT ON RATE DECISIONS UNCLEAR (RTRS)

- BOE’S MANN: WAGE EXPECTATIONS A SIGN INFLATION IS ‘EMBEDDED’ (BBG)

- FRESH CYCLE HIGHS FOR CRUDE FUTURES, WITH BRENT ABOVE $110.00

BOND SUMMARY: Squeezing Higher Into European Hours

Fresh cycle highs for crude oil futures (Brent printed above $111.00) applied pressure to U.S. Tsys in early Asia dealing, although the space has since recovered from session cheaps. This came as crude futures moved off their peak (although WTI & Brent are still ~$5/bbl firmer on the session), while reports of Russian troops entering Kharkiv through the air did the rounds (with Ukraine pointing to an attack on a hospital). U.S. President Biden’s assertions re: Russia e.g. “Putin will pay a high price over the long run,” having a limited impact on wider price action. Biden also tried to assure the U.S. public that he will do everything he can to combat inflation, in what was his first State of the Union address. We have also seen Russian banks start to wind up some of their European entities. TYM2 -0-02 at 128-20+, moving to fresh session highs into European hours (aided by a 3K block buy in the contract). Cash Tsys run 2.5bp richer to 1.0bp cheaper, twist steepening. Note that FOMC dated OIS now prices ~23bp of tightening at the Fed’s March meeting i.e. a 25bp hike is not fully priced in, while ~118bp of tightening is priced in for calendar ’22 i.e. less than 5x 25bp rate hikes. ADP employment data headlines the economic release docket during NY hours (ahead of Friday’s NFP reading, cue discussions/debate re: correlation between the two), with Fedspeak from Powell (day 1 of his testimony on the Hill), Bullard & Evans, as well as commentary from NY Fed’s Logan (on asset purchases), also due.

- JGB futures went out at best levels, adding 62 ticks on the day, although it wasn’t all one-way traffic after a solid round of richening during the overnight session. Cash JGB trade saw the major benchmarks richen by 2-5bp on the day, with 7s outperforming, owing to the bid in futures.

- ACGBs ticked higher into the close, with Tsys off worst levels, although the space had been a little more reluctant to go offered than its U.S. counterpart, perhaps pointing to some early signs of cross market demand. YM +10.0 & XM +11.5 at the close, with the 7- to 10-Year zone of the cash curve outperforming on the day. The space looked through virtually in line with exp. Q4 domestic GDP data.

AUSSIE BONDS: The AOFM sells A$300mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

The Australian Office of Financial Management (AOFM) sells A$300mn of the 1.75% 21 June 2051 Bond, issue #TB162:

- Average Yield: 2.6294% (prev. 2.4794%)

- High Yield: 2.6325% (prev. 2.4825%)

- Bid/Cover: 2.8167x (prev. 1.9400x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 76.9% (prev. 80.0%)

- Bidders 64 (prev. 44), successful 25 (prev. 25), allocated in full 17 (prev. 18)

EQUITIES: Lower As Inflationary Concerns Weigh

Most of the major Asia-Pac equity indices trade lower at writing, following a negative lead from Wall St. High-beta stocks across several sectors bore the brunt of the downward pressure, amidst intensifying concerns re: higher inflation. Conversely, broad gains were witnessed in energy stocks across the region, as the major crude oil benchmarks registered another round of fresh multi-year highs.

- The Hang Seng is 1.1% worse off at typing, taking the index back to two-year lows as the fallout from a widening COVID-19 outbreak in Hong Kong weighs on sentiment. The financials sub-index leads losses (-2.0%), with steep declines witnessed in large caps such as HSBC (-5.0%) and Hong Kong Exchanges and Clearing (-2.2%).

- The Chinese CSI300 deals 1.0% softer, as richly valued consumer staples, healthcare, and consumer discretionary stocks struggled on the day. The tech heavy ChiNext sits 1.8% lower at typing, with new-energy stocks dragging the index lower.

- The ASX200 broke the regional trend, lodging modest gains, with the high weighting of the buoyant materials and energy sectors resulting in outperformance for the index.

- U.S. e-mini equity index futures sit ~0.5% firmer apiece at writing, trading just below session highs ahead of European hours.

OIL: Fresh Eight-Year Highs In Asia As Sanctions On Russia Bite

WTI and Brent are ~$5.00 higher at typing, back from best levels after briefly showing above $109.00 & $111.00, respectively, with crude registering another round of fresh cycle highs during Asia-Pac hours. Both benchmarks have caught a strong bid as it becomes clear to participants that western sanctions on Russia have had a larger than expected impact on Russian crude exports.

- To elaborate, Russia’s Ural oil grade trades at discounts to Brent not witnessed in the post-Soviet era, as several buyers have opted to avoid Russian oil altogether despite relevant carve-outs and exceptions in the current range of western sanctions. Reuters source reports have quoted traders in the U.S. as saying that “people are not touching Russian barrels”, citing concerns that they did not want to be seen as “buying Russian products and funding a war against the Ukrainian people.”

- Elsewhere, the IEA announced a release of 60mn bbls of crude from strategic stockpiles on Tuesday, but this has done little to curb rises in oil prices, keeping in mind that global oil consumption is estimated to be over 90mn bpd.

- The latest round of U.S. API inventory reports crossed on Tuesday, with reports pointing to a surprise drawdown in U.S. crude stocks, a wider than expected drawdown in gasoline stocks, as well as a drawdown in stocks at the Cushing hub. Meanwhile, there was a modest, surprise build in gasoline stocks..

- Looking ahead, EIA data is due later on Wednesday (1530GMT).

- OPEC+ meets later today as well, with the group set to stick to its pre-prescribed cumulative output increase of 400K bpd in April (keeping in mind that some members continue to face well-documented issues in hitting production quotas).

GOLD: Lower In Asia

Gold is ~$10/oz lower, printing ~$1,935/oz at writing. The precious metal has backed away from Tuesday’s best levels ($1,950.1/oz) in Asia-Pac dealing, with the move lower facilitated by U.S. real yields edging away from three-month lows.

- Gold continues to trade at elevated levels as worries rise re: the economic impact of the latest round of western sanctions on Russia, with a reduction in market expectations re: the pace of Fed tightening during ’22 evident in recent sessions (just under 25bp of tightening is now priced for the March FOMC, with a cumulative ~125bp of tightening priced for calendar ‘22 i.e. 5x 25bp rate hikes). Note that Fed Chair Powell is due to testify on the Hill later today (as well as on Thursday).

- The technical outlook remains bullish, resistance for gold is seen at $1,974.3/oz (Feb 24 high). Support is situated some distance away, at $1,878.4 (Feb 24 low and key short-term support).

FOREX: Oil Fuels Rally In Commodity Currencies, Safe Havens Lose Appeal

Major commodity-tied currencies staged a rally as crude oil prices extended gains amid supply concerns fuelled by the ongoing Russian assault on Ukraine. The Antipodeans led gains overnight, with CAD and NOK breathing down their necks.

- Safe havens lost their allure as U.S. e-mini futures operated in the green. The yen and franc were among the worst G10 performers, while the greenback was little changed.

- This is not to say that the Russo-Ukrainian war was forgotten. The rouble was indicated lower in offshore trading, with USD/RUB adding more than 1.5 figure and oscillating around the RUB110 mark.

- Contagion risk continued to sap strength from the SEK, which landed at the bottom of the G10 pile. EUR/SEK came within a whisker of its near two-year high printed on Tuesday.

- U.S. ADP employment change, German unemployment & flash EZ CPI as well as a monetary policy decision from the BoC take focus from here. The central bank speaker slate is tightly packed, with a congressional testimony from Fed Chair Powell providing the main highlight.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/03/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 02/03/2022 | 0855/0955 | ** |  | DE | unemployment |

| 02/03/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 02/03/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/03/2022 | 1000/1100 |  | EU | ECB Schnabel at BMAS roundtable | |

| 02/03/2022 | 1100/1200 |  | EU | ECB de Guindos Q&A at Universidad Carlos III | |

| 02/03/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/03/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 02/03/2022 | 1400/0900 |  | US | Chicago Fed's Charles Evans | |

| 02/03/2022 | 1430/0930 |  | US | St. Louis Fed's James Bullard | |

| 02/03/2022 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 02/03/2022 | 1500/1000 |  | US | Fed Chair Pro Tempore Jerome Powell | |

| 02/03/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/03/2022 | 1600/1700 |  | EU | ECB Lane lecture at Hertie School Berlin | |

| 02/03/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 02/03/2022 | 1830/1830 |  | UK | BOE Tenreyro speech to Economic Research Council | |

| 02/03/2022 | 1900/1400 |  | US | Fed Beige Book | |

| 02/03/2022 | 2000/2000 |  | UK | BOE Cunliffe speech at Oxford Union | |

| 02/03/2022 | 2130/1630 |  | US | New York Fed's Lorie Logan | |

| 03/03/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.