- Home

- Policy

- G10 Markets

- Emerging Markets

- Commodities

- Data

- MNI Research

- About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

- PolicyPolicy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: - G10 MarketsG10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts - Emerging MarketsEmerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

- CommoditiesCommodities

Real-time insight of oil & gas markets

- Data

- MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

- About Us

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Stagflation Fear Dominates In Asia

EXECUTIVE SUMMARY

- RUSSIA TO RE-OPEN HUMANITARIAN CORRIDORS ON MONDAY, AFTER BREAKING CEASEFIRE OVER WEEKEND

- ANOTHER ROUND OF FRESH MULTI-YEAR HIGHS FOR CRUDE, WITH SANCTIONS ON RUSSIAN CRUDE EYED

- REVIVED IRAN NUCLEAR DEAL AT THREAT AS RUSSIA PUSHES FOR GUARANTEES FOR IRAN

- CHINA SETS GDP GROWTH TARGET OF AROUND 5.5%, CUTS FISCAL DEFICIT RATIO TARGET

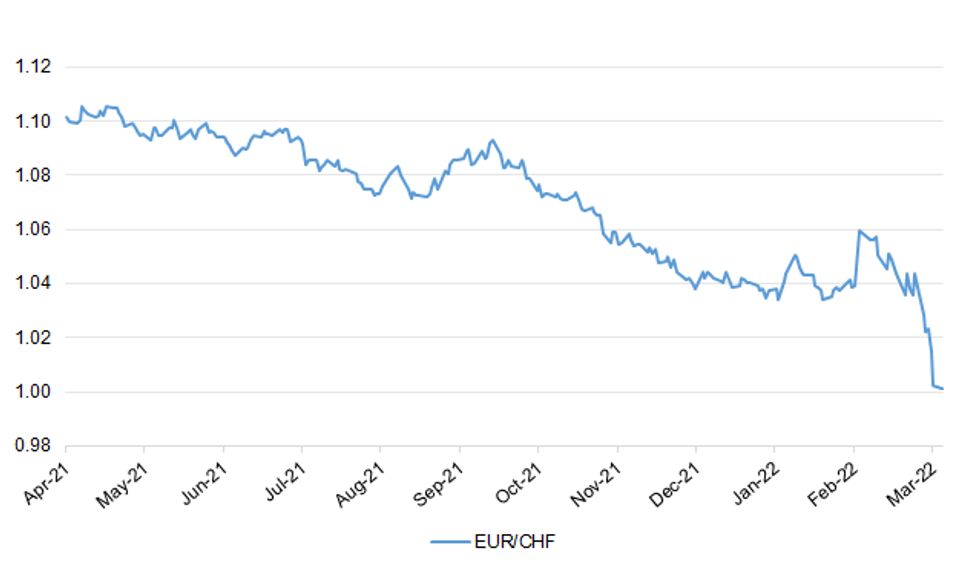

- EUR/CHF PRINTS BELOW CHF1.00, BEFORE REBOUNDING

Fig. 1: EUR/CHF

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Boris Johnson could increase the defence budget within weeks, amid fears the fallout from the Ukraine crisis will cost the exchequer tens of billions of pounds. Chancellor Rishi Sunak will deliver the spring statement on 23 March alongside the latest Office for Budget Responsibility (OBR) forecasts, which are published twice a year. The OBR is widely expected to upgrade its forecasts, giving the chancellor the option to increase public spending while staying within his limits, after the Treasury received almost £9bn more in tax receipts in January 2022 than the previous year. (Sky)

EUROPE

FISCAL: MNI: EU To Fit Defence Boost Into Fiscal Framework-Sources

- Plans to reform European Union rules on borrowing and debt could be pushed back months by the war in Ukraine, which is monopolising official attention, EU officials told MNI, adding that ways will also be sought to permit an expected big increase in defence spending - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: The Dutch finance minister has warned against watering down the EU’s borrowing rules by stripping out defence and other strategic investments, saying the bloc needed to keep its eyes on debt sustainability even as it confronts the economic challenges posed by the war in Ukraine. Sigrid Kaag said that the Netherlands was open to discussing reforms to the Stability and Growth Pact, which sets debt and deficit limits for member states, but that removing military spending or green investment from the SGP, as suggested by some member states, would entail “significant risks”. (FT)

FRANCE: French presidential candidate Marine Le Pen suffered a blow on Sunday when her niece endorsed the campaign of far-right rival Eric Zemmour. Marion Marechal outlined the reasons for her decision in an interview published in Valeurs Actuelles magazine as Zemmour prepared to hold a rally in Toulon, a symbolic choice of venue. The southern city became home to many of the French people who left Algeria after its independence, and became a right-wing bastion with strong showings in favor of Le Pen. “I’ve decided to support Eric Zemmour in the presidential election,” Marechal told Valeurs Actuelles. “I’m joining the candidate I believe today to be the best placed to carry the ideas I’ve always defended to victory.” (BBG)

IRELAND: Ireland lifted its last Covid-19 restriction, ending the requirement for international travelers to show proof of vaccination or a negative test. “Another step forward in our Covid efforts,” Minister for Health Stephen Donnelly tweeted. Face masks are still recommended but not required, according to the public health website. (BBG)

SNB: The Swiss National Bank is ready to intervene and address the rapidly strengthening franc but negative interest rates “remain necessary” for the time being, SNB Governing Board Member Andréa Maechler told Schweiz am Wochenende. The SNB is following the situation in the FX market very closely and is “ready to intervene if necessary,” Maechler said in an interview published Saturday by the Swiss newspaper. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- S&P affirmed Cyprus at BBB-; Outlook Positive

- DBRS Morningstar confirmed Spain at A, Stable Trend

OTHER

U.S./CHINA: President Joe Biden’s administration will soon start a review of the first group of tariffs on more than $300 billion in Chinese imports needed to prevent their expiration, a process likely to bring new scrutiny of their effectiveness as inflation runs at a four-decade high. The evaluation, officially known as a “review of necessity,” so far has attracted little attention. It relates to Section 301 of the Trade Act of 1974, the law that President Donald Trump used to hit China with the tariffs starting in July 2018. (BBG)

BOJ: MNI INSIGHT: BOJ Grows Concerned On Energy-Driven Price Surge

- Consumer prices are climbing faster-than-expected in Japan since January data on surging energy costs linked to the Ukraine war, leading Bank of Japan officials to likely upgrade inflation forecasts ahead and focus on the chances for wage hikes as the vital factor for sustained inflation around the targeted 2% level, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

SOUTH KOREA: An unidentified assailant struck ruling Democratic Party Chairman Song Young-gil in the head with an unknown object during campaigning in Seoul on Monday and Song was taken to a hospital with non-life-threatening injuries, party officials said. Song was campaigning in the Sinchon area for Wednesday's presidential election when the attack happened. "Chairman Song was hit in the head with an unidentified object and started bleeding, so he was taken to a nearby emergency room," a source close to Song told Yonhap News Agency. (Yonhap)

SOUTH KOREA: South Korean authorities are monitoring whether there are speculative movements offshore or whether there’s excessive anxiety among local FX market participants, according to an official in charge of FX policy. Authorities will strengthen communication with people involved in FX demand and supply. (BBG)

SOUTH KOREA: South Korea's foreign exchange authority said on Monday it is monitoring any speculative movement in the offshore market and that it will strengthen communication with major foreign exchange players in the local market. (RTRS)

NORTH KOREA: North Korea said it conducted "another important" test for reconnaissance satellite systems, state news agency KCNA reported on Sunday, a day after regional military authorities reported the launch of a ballistic missile from the country for the second time in a week. The launch drew condemnation from governments in the United States, South Korea, and Japan, which fear the North is preparing to conduct a major weapons test in coming months. They see the North's satellite launches as thinly veiled tests of ballistic missile technology banned by United Nations Security Council resolutions. (RTRS)

RUSSIA: A second attempt at evacuating civilians from Mariupol collapsed after Russians "began to regroup their forces and continued heavy shelling", the city council has said. Conditions are "extremely dangerous", it added. Earlier, the Ukrainian military said pro-Russian forces had continued shelling the areas that were meant to be safe. But Russian authorities accused Ukraine of failing to observe the limited ceasefire. It is reported only a few hundred people have managed to escape the besieged port city, while the city council had aimed to evacuate more than 200,000 people. (Sky)

RUSSIA: The Russian military will hold fire and open humanitarian corridors in several Ukrainian cities including the capital Kyiv at 1000 Moscow time (0700 GMT) on Monday, the Interfax news agency cited Russia's defence ministry as saying. The corridors, which will also be opened from the cities of Kharkiv, Mariupol and Sumy, are being set up at the personal request of French President Emmanuel Macron and in view of the current situation in those cities, it said. (RTRS)

RUSSIA: Russian Defence Minister Sergei Shoigu told U.N. Secretary-General Antonio Guterres on Friday that talks with Ukraine on peacefully ending the conflict with Russia had "not moved from the starting point," Tass news agency said. (RTRS)

RUSSIA: Russian President Vladimir Putin warned Saturday that Ukrainian statehood is in jeopardy, while Ukrainian President Volodymyr Zelenskyy made a “desperate plea” for more planes as Russian forces continued to batter strategic locations with missiles and artillery. Putin continued to blame Russia’s war against Ukraine on Ukrainian leaders, saying if they “continue to do what they are doing, they are calling into question the future of Ukrainian statehood.” But Zelenskyy urged resistance, saying Ukranians kept control of key cities in central and southeastern Ukraine. In a video address to the nation, he urged Ukrainians in cities taken over by Russian forces to fight back. “It is a special kind of heroism -- to protest when your city is occupied,” Zelenskyy said. “Ukrainians in all of our cities that the enemy has entered -- go on the offensive! You should take to the streets! You should fight!” Thousands of Ukrainians protested in cities held by Russian forces. Some climbed Russia’s military vehicles and waved Ukraine’s yellow and blue flag. (AP)

RUSSIA: Volodymyr Zelenskyy has criticised NATO for failing to impose a no-fly zone over Ukraine. In a strongly worded, emotional speech, the president told the alliance: "Starting from today everyone who dies will die because of you as well, because of your weakness, because of your disunity." Mr Zelenskyy also claimed that the absence of a no-fly zone has effectively "given the green light for the bombardment of Ukrainian cities and villages". (Sky)

RUSSIA: Russian President Vladimir Putin said on Saturday that he would consider countries imposing a no-fly zone over Ukraine as participating in the conflict. “We will immediately consider them as participants in a military conflict, and it doesn't matter members of which organizations they are,” Putin said in a meeting with flight crewmembers of Russian national airlines. “It is impossible to do it, on the very territory of Ukraine, it's possible only from the territory of some neighboring states. But any movement in this direction will be considered by us as participation in an armed conflict,” Putin added. (CNN)

RUSSIA: Russian Defence Minister Sergei Shoigu spoke by phone on Friday to United Nations Secretary-General Antonio Guterres and accepted a request from him to work more closely with the U.N. to address humanitarian issues in Ukraine, Russian news agencies said. (RTRS)

RUSSIA: Russian forces that seized Ukraine's Zaporizhzhia nuclear power plant have now placed staff running the facility under their command and restricted communications with the outside world, the U.N. nuclear watchdog said on Sunday. The International Atomic Energy Agency said it was "extremely concerned" about developments at Zaporizhzhia, Europe's largest nuclear power plant, citing information from Ukraine's nuclear regulator. "Ukraine reports that any action of plant management – including measures related to the technical operation of the six reactor units – requires prior approval by the Russian commander," the IAEA said in a statement. "In a second serious development, Ukraine has reported that the Russian forces at the site have switched off some mobile networks and the internet so that reliable information from the site cannot be obtained through the normal channels of communication," it added. (RTRS)

RUSSIA: Moscow is recruiting Syrians skilled in urban combat to fight in Ukraine as Russia’s invasion is poised to expand deeper into cities, according to U.S. officials. An American assessment indicates that Russia, which has been operating inside Syria since 2015, has in recent days been recruiting fighters from there, hoping their expertise in urban combat can help take Kyiv and deal a devastating blow to the Ukraine government, according to four American officials. The move points to a potential escalation of fighting in Ukraine, experts said. It is unclear how many fighters have been identified, but some are already in Russia preparing to enter the conflict, according to one official. (WSJ)

RUSSIA: No senior U.S. military leaders have spoken to their Russian counterparts since Russia's invasion of Ukraine started nine days ago, the Pentagon said on Friday. (RTRS)

RUSSIA: The United States is weighing whether Russia has committed war crimes but has not yet made any conclusions, the White House said on Friday, adding Moscow's attack on a nuclear power plant in Ukraine was the "height of irresponsibility." Washington was already reviewing possible Russian war crimes over evidence of Russian targeting of civilians even before it attacked one of Ukraine's nuclear plants on Thursday, White House spokeswoman Jen Psaki told reporters. (RTRS)

RUSSIA: The United States has not noticed a change in Russia's nuclear force posture after Russian President Vladimir Putin put it on high alert over the weekend, the Pentagon said on Friday. "I have no changes to speak to that we've noticed in the Russian strategic nuclear force posture," Pentagon spokesman John Kirby said. (RTRS)

RUSSIA: The US is working with Warsaw on a deal to provide Ukraine with Polish fighter jets as Kyiv ratchets up the pressure on the west to boost its air force capabilities so it can repel Russian attacks. The deal would involve Ukraine receiving Russian-made warplanes from Poland, which would in turn be given F-16s by the US. It comes amid fears Russia will increase air strikes given the slow progress of parts of its ground campaign. The White House said it was negotiating with Poland and consulting other Nato allies but there were “a number of challenging practical questions, including how the planes could actually be transferred from Poland to Ukraine”. (FT)

RUSSIA: World leaders must mount a renewed effort to ensure Russia's "horrific" invasion of Ukraine fails, Boris Johnson has said. Writing in the New York Times, the prime minister said "it is not future historians but the people of Ukraine who will be our judge". Mr Johnson set out a six-point plan, including rapidly strengthening defences in Nato countries. But Labour criticised the PM for not acting more quickly over sanctions. Ahead of a series of meetings with international leaders, the prime minister said: "Putin must fail and must be seen to fail in this act of aggression. "It is not enough to express our support for the rules-based international order - we must defend it against a sustained attempt to rewrite the rules by military force." (BBC)

RUSSIA: U.S. Secretary of State Antony Blinken spoke on Saturday with Chinese Foreign Minister Wang Yi about “Moscow’s premeditated, unprovoked, and unjustified war against Ukraine,” a U.S. State Department spokesperson said. “The Secretary noted the world is watching to see which nations stand up for the basic principles of freedom, self- determination and sovereignty,” spokesperson Ned Price said in a statement. “He underscored that the world is acting in unison to repudiate and respond to the Russian aggression, ensuring that Moscow will pay a high price,” Price added. Meanwhile, China’s foreign ministry also said that Wang spoke with Blinken on the phone. According to a statement posted on its official website, Wang “encouraged the United States, NATO, the European Union and Russia to engage in dialogue on an equal footing, face up to the contradictions and problems accumulated over the years, and pay attention to the negative impact of NATO’s continuous eastward expansion on Russia’s security environment.” (Nikkei)

RUSSIA: The Kremlin said on Saturday that the West was behaving like a bandit by cutting economic relations over the conflict in Ukraine but that Russia was far too big to be isolated as the world was much larger than just the United States and Europe. (RTRS)

RUSSIA: Russian President Vladimir Putin on Friday formally signed a law that would impose a jail term of up to 15 years for people who intentionally spread "fake" information about Russia's armed forces, TASS news agency reported. The law was drafted earlier in the day by Russia's upper house of parliament. Putin also signed a law that would means those who called for sanctions against Russia would be held criminally responsible, said Tass. (RTRS)

RUSSIA: Sweden and Finland held high-level security talks on Saturday as part of a deepening relationship between the two militarily non-aligned nations as they jointly reassess their defense policies following Russia’s invasion of Ukraine. “The security situation has altered in a dramatic way,” Swedish Prime Minister Magdalena Andersson said on Saturday in Helsinki during a news conference with her Finnish counterpart Sanna Marin ahead of their meeting with Finnish President Sauli Niinisto and the two nations’ defense ministers. “The cooperation between Sweden and Finland when it comes to the defense area has been closer and closer for a number of years,” Andersson said. “We do see a closer cooperation now than we’ve seen, maybe closer than ever.” The premiers declined to comment on potential membership in the NATO defense bloc, while saying there were no direct military threats against either Nordic country. (BBG)

RUSSIA: The New Zealand Government has announced new "significant" sanctions will be placed on Russia, including oligarchs, individuals and companies responsible for or associated with the invasion of Ukraine. Cabinet met today to consider a bespoke Russian sanctions bill drafted specifically for the conflict in Ukraine. The legislation has just been announced by Prime Minister Jacinda Ardern, who said it will be a first of its kind, targeted, autonomous sanctions regime on the Russian Government. The Russia Sanctions Bill will pass under urgency this week, to provide further, extensive sanctions on Russia in response to the invasion of Ukraine, Ardern said. "A Bill of this nature has never been brought before our Parliament, but with Russia vetoing UN sanctions we must act ourselves to support Ukraine and our partners in opposition to this invasion," Ardern said. (NZ Herald)

RUSSIA: South Korea said Monday it plans to suspend transactions with Russia's central bank, joining the global move to impose additional sanctions against Moscow over its invasion of Ukraine. The government said it will announce details after consulting with related government agencies. (Yonhap)

RUSSIA: Canada, the US and the UK want Aleksei Mozhin, Russia’s representative at the IMF, to relinquish or be stripped of his title as honorary head of the executive board of the multilateral lender following the invasion of Ukraine. Canada first proposed that Mozhin give up the title of dean of the IMF board during a meeting on February 25, a day after Russia unleashed its attack, according to people familiar with the matter. The US backed the effort during the same meeting and the UK is also supportive of his removal from the position, the people added. Mozhin has been dean of the executive board since 2015, a largely honorary title conferred to the longest serving member which carries no official responsibilities or authority. Kristalina Georgieva, the managing director of the IMF, chairs the board and is responsible for calling meetings, setting the agenda and facilitating the discussion. (FT)

RUSSIA: PricewaterhouseCoopers (PwC) is to cut its Russian firm adrift from its global network in arguably the most significant exit so far by a multinational company since the Putin government's decision to invade Ukraine. Sky News has learnt that PwC, one of the world's big four accountancy firms, will announce publicly on Monday that it is cutting its Russian business adrift, a move that will affect 3,700 partners and staff in the country. The decision will pile pressure on its main rivals - Deloitte, EY and KPMG - to follow suit, but is expected to trigger a fiendishly complex process that could take months or even years to complete. (Sky)

RUSSIA: Visa and Mastercard have announced they will suspend all operations in Russia in protest at its invasion of Ukraine. But Russia's major banks, including state-backed Sberbank, have already downplayed the impact the move will have on consumers. Shoppers will still be able to use Mastercard and Visa-branded cards for purchases within Russia until they reach their expiry dates. But cards issued abroad will no longer work at businesses or ATMs in Russia. Clients will no longer be able to use their Russian Visa or Mastercard-linked cards abroad or for international payments online either. Together, the two companies control about 90% of credit and debit payments in the world, outside of China. (BBC)

RUSSIA: Index giant S&P Dow Jones Indices said Friday it is removing all stocks listed and/or domiciled in Russia from its benchmarks in light of the country’s invasion of Ukraine, further isolating the nation from the global economy. The removal, effective before the open next Wednesday, also affects Russian American depositary receipts (ADRs), S&P Dow Jones Indices said. The firm, which is the keeper of the Dow Jones Industrial Average and the S&P 500, also said it will declassify Russia as an emerging market and categorize it as a standalone group. (CNBC)

RUSSIA: Sanctions imposed on Russia will determine if international investors are able to collect debt payments on sovereign bonds denominated in foreign currencies, according to the Finance Ministry in Moscow. Residents will receive their payments on the Russian state debt in rubles regardless of the denomination currency, the ministry said in an emailed statement on Sunday. But payments to foreign investors will depend on sanctions introduced against Russia and “exemptions established by the relevant licenses and permits,” according to the statement. All debt will be serviced on time and in full amounts, the ministry said. (BBG)

RUSSIA: Senator Elizabeth Warren, a vocal critic of Wall Street, said banks are “undermining” sanctions on Russia by snapping up the nation’s corporate bonds and suggesting clients buy assets on the cheap. In a statement released late Friday, she called out market makers JPMorgan Chase & Co. and Goldman Sachs Group Inc. following a Bloomberg report that the two banks had been purchasing beaten-down bonds. Banks routinely scoop up debt because clients asked them to, or because they expect to find ready buyers. (BBG)

RUSSIA/RATINGS: Moody's downgraded Russia to Ca; Outlook Negative

IRAN: A revived nuclear deal to lift sanctions on Iranian oil sales now hangs in the balance, with Russia saying March 5 that western sanctions imposed for its invasion of Ukraine could derail an agreement that all parties had hoped to clinch in the coming days. The 11th hour demand, issued by Foreign Minister Sergei Lavrov, seeks a written guarantee that from the US that its sanctions would not impede Russia's trade with Tehran – a move that appears to try and carve out a loophole on the west's punitive measures imposed on its financial sector. US officials have not formally responded to the request, though a State Department official told S&P Global Commodity Insights that it hopes Russia will adopt a more productive stance towards the negotiations. (Platts)

IRAN: Iran's top security official Ali Shamkhani said on Monday negotiators are evaluating new components that have affected talks in Vienna on reviving Tehran's 2015 nuclear deal with Western powers. Shamkhani said in a tweet Iran is adapting initiatives to accelerate a deal. (RTRS)

OIL: US secretary of state Antony Blinken said Washington was in “very active discussions” with its European partners about a ban on oil imports from Russia, as Ukraine braced for a widening offensive against its urban centres. Restrictions on Russian oil would be a big step up in the west’s response to Moscow over its invasion of Ukraine with potentially serious ramifications for the global economy. It would also mark an about-turn by the White House, which had rejected bipartisan calls to ban Russian oil imports to the US, saying an embargo would limit global supply and raise prices for consumers. (FT)

OIL: House Speaker Nancy Pelosi says the House is exploring legislation to further isolate Russia from the global economy, including banning the import of its oil and energy products into the U.S. Amid rising gasoline prices in the U.S., the Biden administration has yet to call for an oil import ban on Russia. In a letter to Democrats released Sunday night, Pelosi says the legislation under consideration would also repeal normal trade relations with Russia and Belarus and begin the process of denying Russia access to the World Trade Organization. (AP)

OIL: The Biden administration is considering whether to prohibit Russian oil imports into the U.S. without the participation of allies in Europe, at least initially, according to two people familiar with the matter. The administration has yet to decide on a U.S. import ban, with the timing and scope of any move still fluid, according to the people, who spoke on condition of anonymity. officials have been in close contact with allies on a possible ban while also working to prepare for the domestic impact, the people said. (BBG)

OIL: The Japanese government is in discussions with the United States and European countries over the possibility of banning imports of Russian oil, Kyodo News reported on Monday. (RTRS)

OIL: President Biden’s advisers are discussing a possible visit to Saudi Arabia this spring to help repair relations and convince the Kingdom to pump more oil, Axios has learned. A hat-in-hand trip would illustrate the gravity of the global energy crisis driven by Russia's invasion of Ukraine. Biden has chastised Saudi Arabia, and the CIA believes its de facto leader, Crown Prince Mohammed bin Salman, was involved in the dismemberment of Washington Post columnist Jamal Khashoggi. (Axios)

OIL: U.S. and Venezuelan officials discussed the possibility of easing oil sanctions on Venezuela but made scant progress toward a deal in their first high-level bilateral talks in years, five sources familiar with the matter said, as Washington seeks to separate Russia from one of its key allies. Both sides used Saturday's meeting in Caracas to present what one of the sources described as "maximalist" demands, reflecting longtime tensions between the Western Hemisphere's main power and one of its biggest ideological foes. A U.S. delegation led by Juan Gonzalez - the top White House Latin America adviser - and Ambassador James Story held talks at the Miraflores palace with socialist President Nicolas Maduro and his Vice President, Delcy Rodriguez, the sources said. (RTRS)

OIL: Kremlin spokesman Dmitry Peskov warned that US plans to limit the use of Russian oil can have serious consequences. According to him, Moscow is closely monitoring the situation. "[This is] the topic we're closely monitoring," he told reporters on Saturday. "Of course, this is a situation that can pretty much disrupt the world energy markets. This can have quite serious consequences," Peskov stressed. "We are closely monitoring the development of the situation," he repeated. (TASS)

OIL: After taking a barrage of criticism for buying a cargo of Russian crude, Europe’s largest oil company Shell Plc says it’s navigating the market with government guidance. “We will continue to choose alternatives to Russian oil wherever possible, but this cannot happen overnight because of how significant Russia is to global supply,” Shell said in a statement on Saturday. “We have been in intense talks with governments and continue to follow their guidance around this issue of security of supply.” Shell, which is based in London, didn’t specify which governments it had been speaking to. An official at the U.K.’s Department for Business, Energy & Industrial Strategy declined to comment. (BBG)

OIL: Saudi Arabia's state oil producer Aramco raised its April official selling price (OSP) for all crude grades it sells to Asia in line with market expectations. The world's top oil exporter raised its April OSP to Asia for its flagship Arab Light crude to $4.95 a barrel versus Oman/Dubai crude, up $2.15 from March, the company said on Friday. The world's top oil exporter set the Arab Light OSP to Northwestern Europe at plus $1.60 per barrel versus ICE Brent, an increase of $1.70 compared to March and to the United States at plus $3.45 per barrel over ASCI (Argus Sour Crude Index), an increase of $1 over the previous month. The producer had been expected to sharply raise the April prices for Asia as global supplies tighten over financing and shipping issues from sanctions on Russia. (RTRS)

OIL: Libya’s oil production has fallen below 1 million barrels a day, as the OPEC member plunges deeper into political crisis just as prices surge following Russia’s invasion of Ukraine. Output is down to 920,000 barrels daily, Oil Minister Mohammed Oun said in a response to a query from Bloomberg. It stood at roughly 1.2 million barrels on Wednesday. State-controlled National Oil Corp. on Sunday halted shipments from the ports of Zawiya and Mellitah after militias shut down Sharara, the country’s biggest field, and El Feel. The fields serve the two western terminals, which have been put under force majeure, a clause in contracts allowing exports to be suspended. (BBG)

OIL: Alberta, Canada's main oil-producing region, can help alleviate the global oil supply crunch caused by energy disruptions, Alberta energy minister, Sonya Savage, said on Sunday. (RTRS)

CHINA

ECONOMY: China set an ambitious economic growth target for the year, putting the spotlight back on fiscal stimulus to counter risks of an ongoing property market slump and rising geopolitical tensions. While the growth goal of about 5.5% for this year is the lowest in more than three decades, it’s above the consensus forecast for expansion closer to 5% and the International Monetary Fund’s projection of 4.8%. Economists said the target implies Beijing will increase infrastructure spending, cut interest rates further and do more to stabilize housing. (BBG)

FISCAL: China is expected to increase by over CNY2 trillion overall fiscal spending from last year, which is equivalent to raising the deficit-to-GDP ratio by one percentage point to about 3.8%, even though the government has set its 2022 target of budget deficit rate lower-than-expected at 2.8% on Saturday, wrote Guan Tao, global chief economist at BOC International China in an article published on Yicai.com. The CNY2 trillion will come from profits by SOE banks, wrote Guan. China needs major projects and government-led investments to drive private investment, Guan added. (MNI)

PBOC: China should continue to cut rates and relieve the burden on the real economy in addition to tax and fee cuts, as the average interest rate on corporate loans fell by only 0.1 percentage point last year, the 21st Century Business Herald reported citing Yang Weimin, deputy director of the Economic Committee of the advisory body CPPCC. Loan rates for the household sector should also be further lowered to help boost consumption, while epidemic prevention measures should be more precise to promote the weak spending, along with more stimulus measures, Yang was cited as saying. (MNI)

PBOC: The People’s Bank of China is expected to enhance efforts to boost credit, reduce borrowing costs and prevent possible financial risks, the Shanghai Securities News reported Monday citing financial experts interpreting Premier Li Keqiang's work report delivered March 5. China's monetary policy will deploy both the overall and targeted tools to ensure ample liquidity and cheap funds, the newspaper said. China will also set up a financial stability guarantee fund to safeguard against systemic risks, it said. (MNI)

PBOC: MNI: China's 2022 GDP Target Augurs Monetary Easing - Advisors

- China will further ease monetary and fiscal policy to help the economy achieve a record-low target for growth of around 5.5% this year in the face of headwinds at home and abroad, policy advisors told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

POLICY: China can’t rely on international markets to ensure food security, President Xi Jinping told a political meeting, the state radio broadcaster reported on Sunday. China should focus on its domestic food markets, while making sure it has an appropriate level of import capacity, Xi said during a meeting attended by members of the Chinese People’s Political Consultative Conference. Xi also stressed farmland protection and technology-led development of the seed industry to help solve food security issues. Policy makers at the National People’s Congress, which runs concurrently with the CPPCC, have also stressed food security as a key issue for the nation this year, particularly after some crop prices rocketed in the wake of Russia’s invasion of Ukraine. (BBG)

PROPERTY: China’s central bank will increase financial support for rental housing and tailor its property policies to conditions in different cities as it largely affirms its stance since late year. The People’s Bank of China reiterated it will promote the real-estate sector’s healthy development, according to a Friday statement concluding a Tuesday meeting that planned financial market regulation and credit policy work in 2022. The PBOC will continue to implement its prudential management system for property financing and insist the principle that “housing is for living in, not speculation,” according to the statement. (BBG)

CORONAVIRUS: China reported its highest daily tally of coronavirus infections since the Wuhan outbreak at the start of the pandemic, as the highly transmissible omicron variant sparks multiple clusters across the country. The nation announced 214 domestic confirmed cases – defined as people who are symptomatic -- and 312 asymptomatic infections on Monday. The 526 total for a single day is a level that hasn’t been seen in two years and poses a significant challenge to the country’s steadfast adherence to a Covid Zero strategy. The Covid Zero policy has increasingly isolated the world’s most populous country from the rest of the world as western nations pivoted to living with the virus and gradually opening up. (BBG)

OVERNIGHT DATA

CHINA FEB TRADE BALANCE YTD +$115.95BN; MEDIAN +$95.00BN; JAN +$97.06BN

CHINA FEB EXPORTS YTD +16.3% Y/Y; MEDIAN +14.0%; JAN +60.6%

CHINA FEB IMPORTS YTD +15.5% Y/Y; MEDIAN +17.0%; JAN +22.2%

CHINA FEB TRADE BALANCE YTD +CNY738.80BN; MEDIAN +CNY452.80BN; JACNN +Y675.86BN

CHINA FEB EXPORTS YTD CNY +13.6% Y/Y; MEDIAN +7.9%; JAN +50.1%

CHINA FEB IMPORTS YTD CNY +12.9% Y/Y; MEDIAN +12.7%; JAN +14.5%

AUSTRALIA FEB ANZ JOB ADVERTISEMENTS +8.4% M/M; JAN -0.7%

ANZ Australian Job Ads jumped 8.4% m/m in February to a new pandemic high,1.8% above the post-Delta peak. This supports our view that labour demand will continue to rise and competition for workers intensify. (ANZ)

AUSTRALIA FEB FOREIGN RESERVES A$79.5BN; JAN A$81.1BN

CHINA MARKETS

PBOC Net Drains CNY290 Billion via OMOs Monday

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Monday. The operation has led to a net drain of CNY290 billion after offsetting the maturity of CNY300 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1132% at 09:27 am local time from the close of 2.0351% on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3478 MON VS 6.3288

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3478 on Monday, compared with 6.3288 set on Friday.

MARKETS

SNAPSHOT: Stagflation Fear Dominates In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 796.26 points at 25189.21

- ASX 200 down 72.227 points at 7038.6

- Shanghai Comp. down 62.371 points at 3385.278

- JGB 10-Yr future up 19 ticks at 151.08, yield down 2.2bp at 0.141%

- Aussie 10-Yr future up 1.5 ticks at 97.860, yield down 1.4bp at 2.136%

- U.S. 10-Yr future +0-07 at 128-24, yield down 2.55bp at 1.705%

- WTI crude up $10.13 at $125.81, Gold up $13.24 at $1983.9

- USD/JPY up 14 pips at Y114.96

- RUSSIA TO RE-OPEN HUMANITARIAN CORRIDORS ON MONDAY, AFTER BREAKING CEASEFIRE OVER WEEKEND

- ANOTHER ROUND OF FRESH MULTI-YEAR HIGHS FOR CRUDE, WITH SANCTIONS ON RUSSIAN CRUDE EYED

- REVIVED IRAN NUCLEAR DEAL AT THREAT AS RUSSIA PUSHES FOR GUARANTEES FOR IRAN

- CHINA SETS GROWTH TARGET OF AROUND 5.5%, CUTS FISCAL DEFICIT RATIO TARGET

- EUR/CHF PRINTS BELOW CHF1.00, BEFORE REBOUNDING

BOND SUMMARY: Crude Gyrations Set The Tone In Asia

Surging crude prices triggered stagflation-related worry in early Asia-Pac dealing, supporting core global FI markets, with the greatest impact being felt in the Tsy space. Several factors fed into this dynamic; Western discussions re: banning Russian oil (although Europe’s reliance on Russian energy complicates that matter), various U.S. delegation trips to oil producers (that have already happened, and speculation surrounding those that could happen in future) in a bid to secure alternative oil supply, Libyan crude production woes, fresh Russia-related headwinds in the ongoing Iranian nuclear talks and an “ambitious” ’22 GDP growth target out of China. Crude did pare back from fresh cycle highs pretty quickly, although WTI & Brent still sit $10-11 firmer on the day. BBG source reports pointing to the potential for the U.S. to act unilateral when it comes to Russian oil sanctions weighed on bonds a little, as did news that Russia would re-open humanitarian corridors in Ukraine, to facilitate the safe passage of civilians (we will see if that takes place as scheduled at 07:00 London, and if they remain open after the notable violations from Russia on the ceasefire front over the weekend).

- TYM2 last +0-07 at 128-24, 0-12 back from session highs, operating on over 200K lots ahead of London hours. Cash Tsys run 1-4bp richer on the day, with the 5- to 7-Year zone of the curve leading, while 20s lag. Note that EDH2 continues to underperform on the strip, with the contract last -1.0 on the day, albeit comfortably off early session lows. A reminder that the contract moved to the lowest levels observed since Q120 last week, even as fear re: the Russia-Ukraine conflict intensified, with some signs of worry re: funding evident in the STIR space (FRA/OIS and EUR/USD x-ccy basis at the fore). The remainder of the whites and reds trade 1.5-7.0bp firmer, a little shy of best levels, with the already outlined risk-off/stagflation dynamic supporting there. There isn’t anything of any real note on the U.S. docket on Monday, with the Fed now in its pre-meeting blackout period.

- JGB futures followed the wider impulse, given Japan’s reliance on energy imports. That left JGB futures +20 at the bell, a touch shy of best levels. Cash JGBs run 2-3bp richer across the curve, with 7s leading, as futures aid that zone of the curve’s outperformance.

- The bid in Aussie bonds lagged what we saw seen in U.S. Tsys. Could it be a case of liquidity/safe haven preference? Maybe, but it could also be what seems to be less worry re: stagflation in Australia, even as oil prices surge, given the relatively sanguine existing view on inflation (for instance, the IR strip was 2-4 ticks lower through the reds, while Eurodollars rallied, in the main). YM was unch. & XM +1.5 at the bell as a result. Note that the AU/U.S. 10-Year yield spread has moved out above 40bp. We have noted on several occasions that we are now in a zone that has generated cross-market tightener interest in recent times (and there were signs that such a dynamic began to show last week), although the heightened market uncertainty/vol. may make participants a little more reluctant to pursue such moves at present.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov ‘24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2024 Bond, issue #TB159:

- Average Yield: 1.4148% (prev. 1.4898%)

- High Yield: 1.4175% (prev. 1.4925%)

- Bid/Cover: 4.8370x (prev. 4.4130x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 34.5% (prev. 46.8%)

- Bidders 45 (prev. 44), successful 13 (prev. 18), allocated in full 8 (prev. 10)

EQUITIES: Red Day As Stagflation Worries Weigh

Major Asia-Pac equity indices sit 1.0% to 2.9% weaker, building on a negative lead from Wall St. Worry from heightened tension surrounding the Russia-Ukraine conflict continues to mix with stagflation fear surrounding elevated commodity prices, seeing high-beta equities from various sectors again come under pressure, while broadly lending a bid to commodity-related stocks. Note that news that Russia is set to open humanitarian corridors in Ukraine has just crossed, resulting in some light risk-positive price action.

- The ASX200 finished 1.0% lower, weakening to a lesser extent than major regional peers. The ASX200’s energy and materials sub-indices again outperformed (+5.3% and +1.0% respectively), while the richly valued healthcare sub-index led losses.

- The Hang Seng Index brings up the rear amongst regional equity indices, trading 2.9% weaker at levels not witnessed since Jul ’16. Financials struggled, with steep losses seen in index heavyweights HSBC and Standard Chartered. China-based tech underperformed as well, with the Hang Seng Tech sitting 3.5% lower at typing, hitting fresh all-time lows (since inception in Jul ’20).

- Elsewhere in the region, the CSI300 prints 2.4% lower to trade at levels last seen in Jul ‘20, on track for a fourth straight day of losses. Sharp declines were again seen in high-valuation consumer staples equities (particularly amongst Chinese liquor stocks), with only marginal gains observed in the index’s energy and utilities sub-indices.

- U.S. e-mini equity futures are 0.9% to 1.6% worse off at typing, trading a touch above worst levels heading into European hours.

OIL: Higher As Russian Energy Embargo Discussed

WTI is +$8.40 and Brent is $9.80 at writing, printing ~$124.10 and ~$127.90 respectively. Both benchmarks have backed away from fresh multi-year highs lodged earlier in the session ($130.50 for WTI and $139.13 for Brent), although worry re: Ukraine continues to mix with concerns over tightness in global crude supplies in ‘22.

- To recap, crude caught a strong bid in Asia as U.S. Secretary of State Blinken stated on Sunday that the U.S. and its European allies are discussing possible sanctions on Russian energy exports (estimated at ~5mn bpd in 2021). Reuters source reports have also suggested that European nations have recently become “more open” to a ban on Russian energy products, while the White House was also said to be working on plans for their own embargo.

- Elsewhere, indirect U.S-Iran nuclear talks have hit a potential roadblock, as Moscow demanded written guarantees over the weekend that western sanctions on Russia arising from its invasion of Ukraine, will not impede Russo-Iranian trade and collaboration. Positive developments in the IAEA’s nuclear investigation over the weekend (that would have removed one of the final hurdles to an Iranian nuclear deal) were largely overshadowed by the Russian demand, with Iranian officials quoted by RTRS as saying that “this move is not constructive for Vienna nuclear talks”.

- Finally, Libyan oil production has declined by ~330K bpd, following a militia-led occupation of some of the country’s oilfields (Sharara and El Feel).

GOLD: Fresh Cycle Highs On Elevated Ukraine Risk

Gold deals ~$19 firmer to print $1,989.7/oz at typing, backing away from nineteen-month highs made earlier in the Asian session ($2,000.86/oz).

- A surge in stagflation worry lent support to the precious metal, following a rally in major crude benchmarks to multi-year highs in early Asia-Pac dealing (highest since Jul’ 08 for both WTI and Brent).

- To recap, the weekend saw reports pointing to an escalation in Russian attacks on Ukrainian cities, while a steady stream of western companies announced plans to pull out of Russia (e.g. KPMG, PwC, Linklaters), with the latter development helping to underscore the intensifying impact of western sanctions on Russia. Rhetoric between all parties continues to support bullion, with Russian President Putin saying that western sanctions on Russia were “akin to a declaration of war”, while vowing to continue military operations in Ukraine until Kyiv surrenders.

- Looking ahead, Russian and Ukrainian negotiators have confirmed that they will meet later today for a third round of talks.

FOREX: Prospect Of Russia Oil Embargo Rattles Markets, War Drumbeat Frightens Europe

Crude oil prices surged after U.S. chief diplomat Blinken said that the White House is in talks with European allies over a proposal to ban Russian oil imports, with later reports flagging potential for unilateral action by the Biden administration. Soaring oil prices inspired stagflationary angst, despite reports of U.S.-led diplomatic efforts to court alternative suppliers. The implications of a firmer commodity complex were weighed against lingering worry about Russia's unfolding incursion into the Ukrainian territory, which discouraged participants from taking risk.

- G10 FX space was effectively split into two halves, with Europe spooked by the potential aggravation of military/humanitarian fallout from the Russo-Ukrainian war and the rest of the world prioritising the impact of soaring commodity prices.

- Nordic FX currencies went offered alongside the Eurozone's single currency on the back of regional contagion risk, with NOK struggling to find consolation in firmer oil prices. EUR/USD hit its worst levels since mid-2020, while EUR/CHF probed the water below parity for the first time since 2015, the immediate aftermath of the abrupt removal of the franc's peg to the euro. Despite a sharp sell-off in EUR/CHF, Russia jitters have spread into Swiss franc, which underperforms all of its major peers from outside of continental Europe.

- Commodity market dynamics have taken precedence in the Asia-Pacific, inspiring notable rallies in Antipodean currencies while generating some headwinds for the yen. AUD/USD crossed above the $0.7400 figure and NZD/USD punched through the $0.6900 mark. The Aussie dollar printed its best levels against the euro since mid-2017.

- The greenback (as measured by the DXY index) extended its recent gains and printed best levels since mid-2020 before easing off. Only the commodity-tied trio of AUD, NZD & CAD fared better than the U.S. dollar.

- The Russian rouble crumbled in offshore trade, falling to a new historic low. Rapid erosion in Russia's creditworthiness amplified pressure from the potential oil embargo, as Moody's cut the nation's credit rating to Ca from B3, with negative outlook.

- German factory orders & retail sales, Norwegian industrial output & comments from BoE Dep Gov Cunliffe take focus from here.

FOREX OPTIONS: Expiries for Mar07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1085-00(E525mln), $1.1165-75(E1.2bln)

- USD/JPY: Y114.20-30($871mln), Y115.00-05($717mln)

- EUR/GBP: Gbp0.8230-35(E549mln), Gbp0.8510-15(E1.2bln)

- USD/CNY: Cny6.3000($699mln), Cny6.4000($783mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/03/2022 | 0645/0745 | ** |  | CH | unemployment |

| 07/03/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 07/03/2022 | 1500/1500 |  | UK | BOE Cunliffe at Lords European Affairs Committee | |

| 07/03/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/03/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/03/2022 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.