-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Crude Bid, EUR Offered, Again

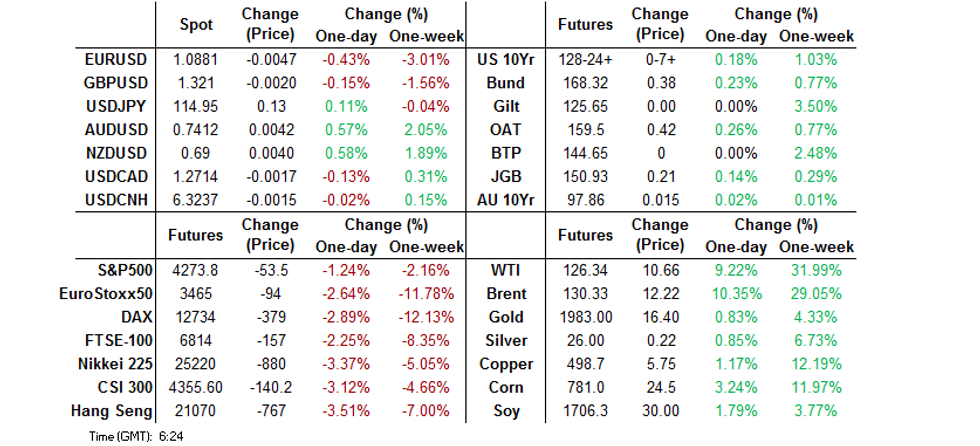

- Surging crude prices triggered stagflation-related worry in early Asia-Pac dealing, supporting core global FI markets, with the greatest impact being felt in the Tsy space. Several factors fed into this dynamic; Western discussions re: banning Russian oil (although Europe’s reliance on Russian energy complicates that matter), various U.S. delegation trips to oil producers (that have already happened, and speculation surrounding those that could happen in future) in a bid to secure alternative oil supply, Libyan crude production woes, fresh Russia-related headwinds in the ongoing Iranian nuclear talks and an “ambitious” ’22 GDP growth target out of China. Crude did pare back from fresh cycle highs pretty quickly, although WTI & Brent still sit $10-12 firmer on the day. BBG source reports pointing to the potential for the U.S. to act unilaterally when it comes to Russian oil sanctions weighed on bonds a little, as did news that Russia would re-open humanitarian corridors in Ukraine, to facilitate the safe passage of civilians (we will see if that takes place as scheduled at 07:00 London, and if they remain open after the notable violations from Russia on the ceasefire front over the weekend).

- EUR continued its descent, finding itself at the bottom of the G10 FX table in Asia, with EUR/CHF briefly trading below parity.

- In addition to Russia-Ukraine matters, German factory orders & retail sales, Norwegian industrial output & comments from BoE Dep Gov Cunliffe take focus from here.

BOND SUMMARY: Crude Gyrations Set The Tone In Asia

Surging crude prices triggered stagflation-related worry in early Asia-Pac dealing, supporting core global FI markets, with the greatest impact being felt in the Tsy space. Several factors fed into this dynamic; Western discussions re: banning Russian oil (although Europe’s reliance on Russian energy complicates that matter), various U.S. delegation trips to oil producers (that have already happened, and speculation surrounding those that could happen in future) in a bid to secure alternative oil supply, Libyan crude production woes, fresh Russia-related headwinds in the ongoing Iranian nuclear talks and an “ambitious” ’22 GDP growth target out of China. Crude did pare back from fresh cycle highs pretty quickly, although WTI & Brent still sit $10-11 firmer on the day. BBG source reports pointing to the potential for the U.S. to act unilaterally when it comes to Russian oil sanctions weighed on bonds a little, as did news that Russia would re-open humanitarian corridors in Ukraine, to facilitate the safe passage of civilians (we will see if that takes place as scheduled at 07:00 London, and if they remain open after the notable violations from Russia on the ceasefire front over the weekend).

- TYM2 last +0-07 at 128-24, 0-12 back from session highs, operating on over 200K lots ahead of London hours. Cash Tsys run 1-4bp richer on the day, with the 5- to 7-Year zone of the curve leading, while 20s lag. Note that EDH2 continues to underperform on the strip, with the contract last -1.0 on the day, albeit comfortably off early session lows. A reminder that the contract moved to the lowest levels observed since Q120 last week, even as fear re: the Russia-Ukraine conflict intensified, with some signs of worry re: funding evident in the STIR space (FRA/OIS and EUR/USD x-ccy basis at the fore). The remainder of the whites and reds trade 1.5-7.0bp firmer, a little shy of best levels, with the already outlined risk-off/stagflation dynamic supporting there. There isn’t anything of any real note on the U.S. docket on Monday, with the Fed now in its pre-meeting blackout period.

- JGB futures followed the wider impulse, given Japan’s reliance on energy imports. That left JGB futures +20 at the bell, a touch shy of best levels. Cash JGBs run 2-3bp richer across the curve, with 7s leading, as futures aid that zone of the curve’s outperformance.

- The bid in Aussie bonds lagged what we saw seen in U.S. Tsys. Could it be a case of liquidity/safe haven preference? Maybe, but it could also be what seems to be less worry re: stagflation in Australia, even as oil prices surge, given the relatively sanguine existing view on inflation (for instance, the IR strip was 2-4 ticks lower through the reds, while Eurodollars rallied, in the main). YM was unch. & XM +1.5 at the bell as a result. Note that the AU/U.S. 10-Year yield spread has moved out above 40bp. We have noted on several occasions that we are now in a zone that has generated cross-market tightener interest in recent times (and there were signs that such a dynamic began to show last week), although the heightened market uncertainty/vol. may make participants a little more reluctant to pursue such moves at present.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov ‘24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2024 Bond, issue #TB159:

- Average Yield: 1.4148% (prev. 1.4898%)

- High Yield: 1.4175% (prev. 1.4925%)

- Bid/Cover: 4.8370x (prev. 4.4130x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 34.5% (prev. 46.8%)

- Bidders 45 (prev. 44), successful 13 (prev. 18), allocated in full 8 (prev. 10)

FOREX: Prospect Of Russia Oil Embargo Rattles Markets, War Drumbeat Frightens Europe

Crude oil prices surged after U.S. chief diplomat Blinken said that the White House is in talks with European allies over a proposal to ban Russian oil imports, with later reports flagging potential for unilateral action by the Biden administration. Soaring oil prices inspired stagflationary angst, despite reports of U.S.-led diplomatic efforts to court alternative suppliers. The implications of a firmer commodity complex were weighed against lingering worry about Russia's unfolding incursion into the Ukrainian territory, which discouraged participants from taking risk.

- G10 FX space was effectively split into two halves, with Europe spooked by the potential aggravation of military/humanitarian fallout from the Russo-Ukrainian war and the rest of the world prioritising the impact of soaring commodity prices.

- Nordic FX currencies went offered alongside the Eurozone's single currency on the back of regional contagion risk, with NOK struggling to find consolation in firmer oil prices. EUR/USD hit its worst levels since mid-2020, while EUR/CHF probed the water below parity for the first time since 2015, the immediate aftermath of the abrupt removal of the franc's peg to the euro. Despite a sharp sell-off in EUR/CHF, Russia jitters have spread into Swiss franc, which underperforms all of its major peers from outside of continental Europe.

- Commodity market dynamics have taken precedence in the Asia-Pacific, inspiring notable rallies in Antipodean currencies while generating some headwinds for the yen. AUD/USD crossed above the $0.7400 figure and NZD/USD punched through the $0.6900 mark. The Aussie dollar printed its best levels against the euro since mid-2017.

- The greenback (as measured by the DXY index) extended its recent gains and printed best levels since mid-2020 before easing off. Only the commodity-tied trio of AUD, NZD & CAD fared better than the U.S. dollar.

- The Russian rouble crumbled in offshore trade, falling to a new historic low. Rapid erosion in Russia's creditworthiness amplified pressure from the potential oil embargo, as Moody's cut the nation's credit rating to Ca from B3, with negative outlook.

- German factory orders & retail sales, Norwegian industrial output & comments from BoE Dep Gov Cunliffe take focus from here.

FOREX OPTIONS: Expiries for Mar07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1085-00(E525mln), $1.1165-75(E1.2bln)

- USD/JPY: Y114.20-30($871mln), Y115.00-05($717mln)

- EUR/GBP: Gbp0.8230-35(E549mln), Gbp0.8510-15(E1.2bln)

- USD/CNY: Cny6.3000($699mln), Cny6.4000($783mln)

ASIA FX: Fallout From War In Ukraine Boosts Oil Prices Unnerving Net Importers

The U.S. threatened to impose a ban on imports of Russian oil in coordination with its allies, while press reports suggested that unilateral action is also being considered. Resultant surge in crude oil prices took its toll on net oil importers across Asia EM space, with heightened geopolitical tensions surrounding the ongoing Russian invasion further dampening appetite for riskier assets.

- CNH: Spot USD/CNH jumped in early trade and remained afloat as the PBOC set the USD/CNY reference rate at CNY6.3478, 28 pips above sell-side estimate. Headlines from China's NDRC were trickling through, with its Vice Chair noting that China will not deliver flood-like stimulus to the economy. Elsewhere, China's trade surplus topped expectations in February.

- KRW: South Korean won retreated, struck by the double whammy of general risk aversion and surging commodity prices. North Korea's ninth missile test this year may have amplified pressure to the KRW. Spot USD/KRW surged to its best levels since mid-2020.

- IDR: Spot USD/IDR re-opened on a slightly firmer footing, with fallout from the war in Ukraine in the driving seat. Higher oil prices may have shielded the rupiah from a deeper sell-off amid aversion to take risk.

- MYR: Spot USD/MYR was slightly firmer, likely responding to similar drivers as USD/IDR. Better oil prices helped prevent further ringgit sales. Note that Malaysia is expected to unveil the date of reopening its international borders this week.

- PHP: Spot USD/PHP roared through the PHP52 figure on its way to its best levels since mid-2019. BSP Gov Diokno said higher oil prices may boost inflation this year (albeit he played down potential for impact on the peso, referring to the BSP's hefty FX reserves), while the government pledged targeted fuel subsidies.

- THB: The baht sold off sharply as the Russian attack on Ukraine and its implications for the global oil market played into the pre-existing concerns about rising living costs and cast doubt on hopes of swift and strong recovery in the global tourism industry.

- INR: The Indian rupee fell to its lowest point on record, with one analyst speaking with Bloomberg dubbing the situation in the oil market "the policy maker's nightmare."

EQUITIES: Red Day As Stagflation Worries Weigh

Major Asia-Pac equity indices sit 1.0% to 2.9% weaker, building on a negative lead from Wall St. Worry from heightened tension surrounding the Russia-Ukraine conflict continues to mix with stagflation fear surrounding elevated commodity prices, seeing high-beta equities from various sectors again come under pressure, while broadly lending a bid to commodity-related stocks. Note that news that Russia is set to open humanitarian corridors in Ukraine has just crossed, resulting in some light risk-positive price action.

- The ASX200 finished 1.0% lower, weakening to a lesser extent than major regional peers. The ASX200’s energy and materials sub-indices again outperformed (+5.3% and +1.0% respectively), while the richly valued healthcare sub-index led losses.

- The Hang Seng Index brings up the rear amongst regional equity indices, trading 2.9% weaker at levels not witnessed since Jul ’16. Financials struggled, with steep losses seen in index heavyweights HSBC and Standard Chartered. China-based tech underperformed as well, with the Hang Seng Tech sitting 3.5% lower at typing, hitting fresh all-time lows (since inception in Jul ’20).

- Elsewhere in the region, the CSI300 prints 2.4% lower to trade at levels last seen in Jul ‘20, on track for a fourth straight day of losses. Sharp declines were again seen in high-valuation consumer staples equities (particularly amongst Chinese liquor stocks), with only marginal gains observed in the index’s energy and utilities sub-indices.

- U.S. e-mini equity futures are 0.9% to 1.6% worse off at typing, trading a touch above worst levels heading into European hours.

GOLD: Fresh Cycle Highs On Elevated Ukraine Risk

Gold deals ~$19 firmer to print $1,989.7/oz at typing, backing away from nineteen-month highs made earlier in the Asian session ($2,000.86/oz).

- A surge in stagflation worry lent support to the precious metal, following a rally in major crude benchmarks to multi-year highs in early Asia-Pac dealing (highest since Jul’ 08 for both WTI and Brent).

- To recap, the weekend saw reports pointing to an escalation in Russian attacks on Ukrainian cities, while a steady stream of western companies announced plans to pull out of Russia (e.g. KPMG, PwC, Linklaters), with the latter development helping to underscore the intensifying impact of western sanctions on Russia. Rhetoric between all parties continues to support bullion, with Russian President Putin saying that western sanctions on Russia were “akin to a declaration of war”, while vowing to continue military operations in Ukraine until Kyiv surrenders.

- Looking ahead, Russian and Ukrainian negotiators have confirmed that they will meet later today for a third round of talks.

OIL: Higher As Russian Energy Embargo Discussed

WTI is +$8.40 and Brent is $9.80 at writing, printing ~$124.10 and ~$127.90 respectively. Both benchmarks have backed away from fresh multi-year highs lodged earlier in the session ($130.50 for WTI and $139.13 for Brent), although worry re: Ukraine continues to mix with concerns over tightness in global crude supplies in ‘22.

- To recap, crude caught a strong bid in Asia as U.S. Secretary of State Blinken stated on Sunday that the U.S. and its European allies are discussing possible sanctions on Russian energy exports (estimated at ~5mn bpd in 2021). Reuters source reports have also suggested that European nations have recently become “more open” to a ban on Russian energy products, while the White House was also said to be working on plans for their own embargo.

- Elsewhere, indirect U.S-Iran nuclear talks have hit a potential roadblock, as Moscow demanded written guarantees over the weekend that western sanctions on Russia arising from its invasion of Ukraine, will not impede Russo-Iranian trade and collaboration. Positive developments in the IAEA’s nuclear investigation over the weekend (that would have removed one of the final hurdles to an Iranian nuclear deal) were largely overshadowed by the Russian demand, with Iranian officials quoted by RTRS as saying that “this move is not constructive for Vienna nuclear talks”.

- Finally, Libyan oil production has declined by ~330K bpd, following a militia-led occupation of some of the country’s oilfields (Sharara and El Feel).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/03/2022 | 0645/0745 | ** |  | CH | unemployment |

| 07/03/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 07/03/2022 | 1500/1500 |  | UK | BOE Cunliffe at Lords European Affairs Committee | |

| 07/03/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/03/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/03/2022 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.