-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Policy Support Calls To Continue Post Weak Inflation Data

- The USD DXY index is off by 0.75% so far today, on track for its steepest drop in a month. Weakness has been across the board, with higher beta plays leading the way, aided by higher commodity prices and improved equity sentiment.

- Strength in commodities is a little at odds with much weaker China inflation data today, which suggests for further policy action will continue to grow. USD/CNH is lower, but the yuan has underperformed on crosses.

- USD/JPY sank back below 143.00 as Japan's verbal intervention stepped up. Slightly lower US yields also helped at the margin. EUR/USD is around multi-week highs, but all eyes are on today's EU energy ministers meeting. After that focus shifts to some Fed speak. Chicago Fed Pres Evans (‘23 voter), Gov. Waller (voter), and Kansas City Fed Pres George (voter) are due ahead of the pre-FOMC blackout period (Sept. 10-22).

US TSYS: Modestly Bid; Pre-FOMC Blackout Beckons

U.S.Tsys have richened as we have worked our way through the Asia-Pac session, unwinding a little of Thursday’s cheapening in the process.

- The move higher comes amidst softness in the USD (DXY), as the JPY has strengthened on fresh warnings from the likes of BoJ Gov. Kuroda and FinMin Suzuki re: yen weakness, adding to

- TYZ2 is -0-01 at 115-30 last, just shy of session highs, but coming nowhere near to approaching its peak on Thursday (116-23).

- Cash Tsys run 1.5-3.0bp richer across the curve, with the belly leading the bid. The bid in Tsys has seen 2-Year Tsy yields slip below the 3.50% mark at writing, but remain a little below recent 15-year highs observed on Sep 1 (~3.55%).

- Looking ahead, final July wholesale inventories data is due, with a final round of scheduled Fedspeak by Chicago Fed Pres Evans (‘23 voter), Gov. Waller (voter), and Kansas City Fed Pres George (voter) due ahead of the pre-FOMC blackout period (Sept. 10-22).

- Note that Pres Evans is due to speak on”career opportunities in economics”, and is unlikely to cover comments on monetary policy.

JGBS: Futures Extend Bid

JBU2 futures were bid throughout the session, tracking the wider movements in core FI markets, with a rally in the JPY (on previously-flagged comments re: recent yen weakness from BOJ Gov. Kuroda and Japanese FinMin Suzuki) after the Tokyo lunch break accelerating the move higher, taking JBU2 above the 150 mark, with the contract printing +76 ticks at 150.20 last.

- Cash JGBs run 2bp cheaper to 5bp richer across the curve, with 7s leading the way higher.

- While USD/JPY has made fresh lows below 143.00 at typing in the wake of aforementioned comments, it is worth noting that there was little by way of fresh language deployed.

- Monday will see preliminary data for machine tool orders headline the domestic data docket.

AUSSIE BONDS: Back From Early Cheaps

Aussie bonds sit a little above best levels, having unwound the bulk of their earlier losses (derived from the overnight cheapening in Aussie bond futures) throughout the Sydney session, aided by a similar move higher in Tsys.

- Cash ACGBs run 1.5bp cheaper to 2.0bp richer across the curve, twist flattening, and pivoting around 5s.

- YM is -0.5 and XM is +0.5, with both contracts operating a little below their respective overnight peaks. EFPs are little changed, while Bills run 4 ticks cheaper to 4 ticks richer through the reds.

- Little by way of a meaningful reaction was observed in ACGBs on the release of the AOFM’s weekly issuance slate. Next week will see a smaller A$800mn of ACGBs and A$1.5bn of Notes on offer (as well as A$100mn in indexed bonds), compared to A$1.1bn in ACGBS and A$2.0bn of Notes previously announced for this week.

- No economic data releases of note are scheduled for Monday.

FOREX: USD Continues To Lose Ground, JPY Plays Catch Up

The USD continues to lose ground, the DXY is now sub 109.00, fresh lows back to the start of the month. Losses for the dollar have been broad based, but this afternoon JPY has played catch up. The yen was a laggard in the first half of the session, but is now around 1% firmer versus NY closing levels. The pair is back to 142.75, (the low was just under 142.50).

- Outside of comments from Japan officials on FX (notably Kuroda), we are seeing UST yields edge lower. The 2yr is down close to 2bps on the session (to 3.485%), which is likely helping at the margin.

- From a level’s standpoint in USD/JPY, we have the high 141 region, then around 140.80, the high from September 2.

- EUR/USD is above 1.0070, but has lost ground against the yen this afternoon, ahead of the key energy ministers meeting later today.

- AUD/USD is up over 1.10% to 0.6825/30, only trailing NOK as best performer on the day. Higher commodity prices (copper and iron ore) are helping the A$. China's equity property sub-index is up over 3% so far today (see this link for more details on some optimism around the sector).

- NZD/USD has tracked AUD gains, albeit with a slight lag, the pair last just above 0.6100.

- GBP/USD is just under 1.1590 matching EUR gains.

- Looking ahead, the EU energy ministers meeting will be a key focus today. Expect lighter activity in the UK as the country mourns the passing of the Queen. In the US, Fedspeak from Evans, Waller and George is all on tap. Evans won't cover monetary policy though.

AUSTRALIA DATA: Key Week Ahead For RBA Outlook

Next week contains a lot of data releases that are likely to be important for the RBA’s thinking. RBA Governor Lowe reiterated in his speech this week that the central bank will focus on incoming data, especially inflation and the labour market, but also indicators of consumer spending. Next week’s calendar covers all of those elements, including forward-looking surveys.

- On Tuesday September 13, the CBA’s measure of household spending for August will be published. Last month it rose 1.1% m/m and 12.2% y/y, showing consumer resilience in the face of cost-of-living pressures and higher interest rates. The August data will be watched closely for signs of that resilience wavering in the face of further hikes.

- Tuesday also sees the Westpac consumer confidence index for September. In August, it fell to its lowest since the Covid-impacted August 2020 reading and has suggested consumption weakness that hasn’t yet materialised. The survey doesn’t have an inflation expectations component but the Melbourne Institute publishes its measure for September on Thursday, which eased slightly to 5.9% in August. Given that the next official inflation number won’t be until the end of October, this is likely to gain a lot of attention.

- On the business side, NAB releases its business conditions survey for August also on Tuesday. So far, conditions and confidence have been holding up well and this survey is likely to be scrutinised not just for signs of a slowing economy but also for what it says about labour costs and prices.

- The August employment report prints on Thursday and is expected to show no change in the unemployment rate and a 37.5k gain in jobs after the unexpected drop in July. Any signs of easing in the tight labour market could be a red flag.

FX OPTIONS: Expiries for Sep09 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900-10(E2.2bln), $0.9950(E1.2bln), $1.0000(E1.2bln), $1.0075-00(E1.3bln)

- USD/JPY: Y139.00($1.0bln)

- USD/CAD: C$1.3100($616mln)

- USD/CNY: Cny7.00($2.5bln)

ASIA FX: USD/Asia Pairs Sink, China/HK Out On Monday

USD/Asia pairs are lower across the board, in line with the DXY -0.80% fall. Positive equity gains, coupled with slightly lower US yields have helped from a cross asset standpoint.

- USD/CNH is back sub 6.9400, -0.35% for the session so far. The fixing was again on the firm side. This week has seen the fixing bias nearly double compared to last week. China inflation printed much weaker than expected, underscoring the weak domestic demand backdrop. This hasn't impacted USD/CNH but the yuan has underperformed against G10. The US is ramping up its tech warning around investments into China, but this hasn't impacted onshore sentiment. Onshore equities are higher, led by the property sector.

- Note China and Hong Kong markets are closed on Monday.

- USD/KRW and USD/TWD are both lower in the 1 month NDF space, even with onshore markets shut today.

- USD/MYR is back below 4.5000. As expected BNM hike yesterday, but the outlook was somewhat dovish, given the central bank expects inflation to peak in Q3 and sees downside growth risks.

- USD/PHP is sharply lower, back down through 56.90, in line with broad based USD weakness. The trade figures were close to expectations in terms of the deficit (-$5.93bn) but export growth fell -4.2% y/y, well below expectations.

- USD/IDR is lower, back to 14852, -45.5 figs for the session. BI officials noted that they haven't been intervening much in the FX markets and that FX demand/supply is manageable.

CNH: CNY Fixing Error Nearly Doubles In A Week

The USD/CNY fixing came in at 6.9098, versus a Bloomberg consensus of 6.9484.

- Relative to the Bloomberg estimate, the fixing was -386pips in USD/CNY terms. This is slightly firmer compared to yesterday's outcome of -395pips and Wednesday's -454pip outcome.

- Still, there has been a clear step up in the fixing bias this week. The cumulative error is -1516pips, compared to -870pips for the whole of last week.

- USD/CNH is lower, post the fix, but broader USD sentiment is also helping (DXY -0.50%). The pair is sub 6.9450, fresh lows back to early Tuesday.

- Note inflation data is coming up soon. Also note that Monday is a holiday for China.

CHINA DATA: Policy Support Calls To Continue Post Weak Inflation Data

China inflation surprised meaningfully on the downside in August. Headline CPI printed at 2.5% y/y, versus 2.8% expected. Outside of food (+6.1% y/y), price pressures remain muted. Services CPI up just 0.7%, while core was unchanged at +0.8% y/y. Only one sub sector out of eight (recreation and education) recorded a rise in y/y momentum.

- The first chart below overlays core CPI versus the 2yr government bond yield. Whilst bond yields look to break 2.00%, today's CPI data is only likely to see calls for further policy support grow.

Fig 1: China Core CPI Versus 2yr Government Bond Yield

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

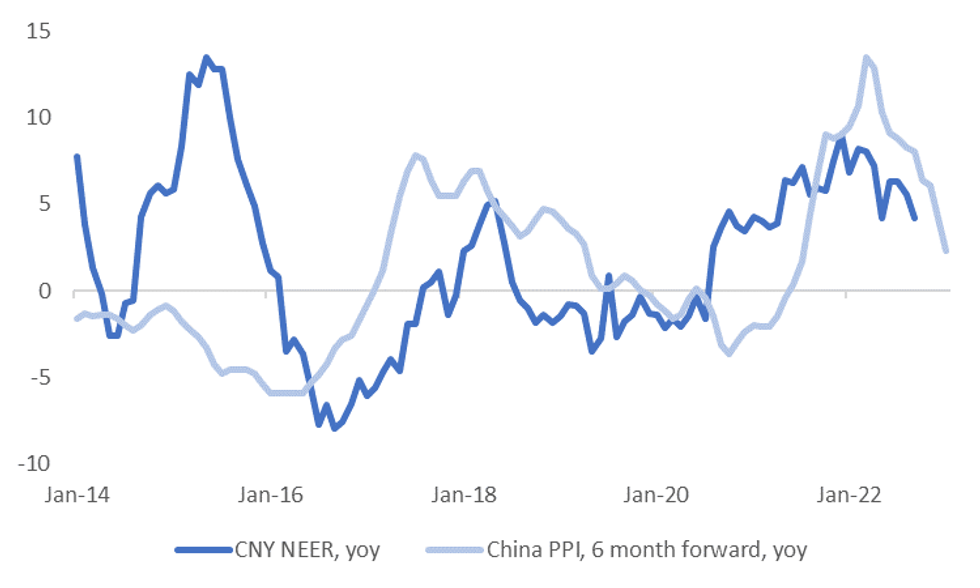

- For the PPI, the downside surprise was even larger at 2.3% y/y versus +3.2% expected. Outside of mining and raw materials, price pressures were modest. Base effects suggest continued downside PPI momentum in the months ahead.

- The second chart below updates the one we presented this morning for today's PPI outcome.

- It reinforces the point around less need for CNY NEER strength, as upstream price pressures continue to moderate.

- USD/CNH has popped back above 6.9500 post the inflation prints, versus an earlier low close to 6.9430. It is underperforming broader USD selling on the day, with DXY losses now beyond 0.5%, while CNH has only firmed by 0.15/0.20% so far today.

Fig 2: China PPI & CNY NEER YoY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Higher In Asia; Chinese Developers Gain On Latest Policy Move

Virtually all Asia-Pac equity indices are firmer at writing, largely tracking a positive lead from Wall St.

- Chinese and Hong Kong stocks have outperformed ahead of the long weekend (both stock markets will be closed for a holiday on Monday), aided by the better-than-expected Chinese CPI beat that added to expectations from some quarters for increased policy support.

- The Hang Seng leads peers, trading 2.2% higher, on track to snap a six-session streak of lower daily closes, coming after the benchmark had recorded fresh eight-month lows on Thursday. The property (+2.8%) sub-gauge leads the way higher, adding to a strong showing from China-based tech (HSTECH: +2.3%).

- The bid in Chinese developers comes on the back of a Securities Daily report detailing that at least 24 Chinese cities have allowed parents to fund home purchases for their children with their provident funds. The Hang Seng Mainland Properties Index accordingly sits 5.3% better off at writing.

- The Nikkei 225 deals 0.6% firmer, recording fresh two-week highs after building on yesterday’s 2.3% higher close. Virtually every industry sector is in the green at writing, with gains in healthcare and utilities equities countering uniformly shallow losses observed across the index’s losers.

- E-minis sit 0.2-0.4% better off, just off their respective, freshly made one-week highs at writing.

GOLD: Working Away From Thursday’s Lows; $1,700/oz Holds As 75bp Fed Hike Increasingly Priced

Gold deals ~$7/oz firmer to print $1,716/oz at typing, extending a move off of Thursday’s trough at writing (~$1,704.1/oz, following the ECB’s policy decision and Powell’s speech).

- Gold has largely kept above $1,700/oz in recent sessions as pricing for a 75bp hike at the Sep FOMC has continued to firm, with yesterday’s better-than expected weekly jobless claims data marginally contributing to the case for a 75bp move.

- Chicago Fed Pres Evans (‘23 voter) on Thursday stated that the Fed could “very well do 75 in September”, adding to the market’s firmer expectations for such a move after Fed Chair Powell earlier did little to push back against the idea at the upcoming FOMC.

- Total known ETF holdings of gold are on track for a 13th consecutive weekly decline, taking the measure to levels last witnessed in mid-Feb, pointing to persistent weakness in investor interest for bullion.

- From a technical perspective, previously-identified technical levels remain in play for gold, with a clear break of initial resistance at $1,726.7 (6 Sep high) eyed, while support is located at $1,681.0 (Jul 21 low and bear trigger).

OIL: On Track For Lower Weekly Close; OPEC+ Reaction Eyed As Crude Dips Below $90

WTI and Brent deal ~$0.40 firmer apiece, operating just shy of their respective Thursday peaks at writing.

- Both benchmarks however sit a short distance above recently made eight-month lows, remaining on track for a second consecutive lower weekly close amidst an uptick in wider worry re: energy demand and increases in U.S. crude stockpiles.

- Looking ahead, some will be watching for reactions from OPEC+ as WTI and Brent have dipped below $90 this week, keeping in mind their recent 100K bpd cut to production quotas - a numerically insignificant decrease, that served more to signal the group’s intent to defend higher crude prices.

- The latest round of U.S. inventory data saw a significantly large, surprise build in crude stockpiles, more than unwinding the large decline observed last week, and corroborating prior reports of API estimates.

- There was a marginal, surprise build in gasoline and distillate stockpiles, while Cushing hub stocks declined.

- The White House on Thursday stated that it is “too early to say” if SPR releases will continue past the original 180mn bbls earmarked. WTI and Brent nudged lower after but ultimately failed to record fresh lows, likely owing to the lack of details surrounding the remarks.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/09/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 09/09/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 09/09/2022 | - |  | EU | ECB Lagarde & Panetta in Eurogroup & informal Ecofin Meetings | |

| 09/09/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/09/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 09/09/2022 | 1400/1000 |  | US | Chicago Fed's Charles Evans | |

| 09/09/2022 | 1600/1200 |  | US | Kansas City Fed's Esther George | |

| 09/09/2022 | 1600/1200 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.