-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Pre-U.S. CPI Positioning Apparent

- It has been a mixed session for USD/Asia FX pairs, as the market awaits the U.S. CPI print later tonight. Cross asset signals have been positive in terms of higher equities and lower UST yields, but has only had limited positive spill over to the FX space.

- Broader headline flow was limited, which left pre-U.S. CPI positioning at the fore in Asia.

- While U.S. inflation figures are set to steal the limelight, German ZEW survey & final CPI readings, as well as UK jobs market data will also cross the wires.

MNI US CPI Preview: Watch Services For Terminal Implications

EXECUTIVE SUMMARY

- Released Sep 13 0830ET, the August CPI print is expected to see similar sequential figures as July, with a second month of core at a ‘lower’ 0.3% M/M (0.31% in July) and headline at -0.1% M/M (-0.02%) after another drag from energy.

- It will take a sizeable miss to knock the FOMC off an almost fully priced 75bp hike next week, especially after VC Brainard said last week she wants to see “several” months of lower inflation before Waller upped it with wanting to see a permanent, longer-term decline having been burned by last year’s apparent easing.

- Risk of potentially larger reaction in the event of a miss after last week's Fed push of higher rates for longer saw an implied terminal Fed Funds effective rate briefly north of 4% and 2Y Ts yields hit fresh post-2007 highs, but there is scope for sizeable moves in either direction.

- Click for full analysis: USCPIPrevSep2022.pdf

US TSYS: Light Bid In Asia, With Focus On CPI

Tsys saw a bid during early Asia-Pac trade, which was consolidated after desks pointed to regional interest to fade Monday’s cheapening, pre-CPI setup and a block buy of TY futures (+2.5K) as the drivers of the uptick.

- There was a lack of overt, meaningful headline flow evident during the overnight session.

- The leaves cash Tsys 2-3bp richer across the curve, with some light bull steepening in play, while TYZ2 deals 0-01+ shy of the peak of its narrow 0-06+ range, on sub-par volume of ~47K.

- The aforementioned CPI print headlines Tuesday’s NY docket (see our full preview of that release here).

- Real wage data, the NFIB small business survey and 30-Year Tsy supply are also due Tuesday, with the latter coming on the heels of Monday’s soft 3- & 10-Year auctions (and post-CPI price action).

JGBS: Futures Through Overnight Highs; Curve Twist Flattens

JGB futures are +29 ticks at 149.00 last, printing through its overnight high after the lunch break, aided by a bid in wider core global FI markets.

- Cash JGBs run 0.5bp cheaper to 4.0bp richer across the curve, twist flattening, and pivoting around 4s.

- The bid in the super-long end may be a result of continued interest on the part of domestic life insurers and pension funds after last week saw the super-long end test/register cycle highs in yield terms, while 10-Year JGBs continue to operate just shy of the upper limit of the BoJ’s permitted trading band.

- A solid round of 5-Year JGB supply saw cover and pricing metrics improving from the previous auction, likely reflecting the attractive outright and relative value observed. A light bid in 5s was observed post-auction, with yields hitting fresh session lows.

- Looking ahead, Wednesday will see core machine orders and industrial production data on tap, with BoJ Rinban operations covering 1-3, 5-10, and 25+-Year JGBs due as well.

AUSSIE BONDS: Richer On Bid In Global Core FI

Aussie bonds print a touch shy of best levels, after benefitting from a modest bid in wider global core FI markets.

- Cash ACGBs run 1.5-5.5bp richer across the curve, with the 10- to 12-Year zone leading the way higher. YM is +3.4 and XM is +5.0, while the 3-/10-Year EFP box has flattened, with 3-Year EFP pushing wider and 10-Year EFP little changed. Bills run 1 to 5 ticks richer through the reds.

- There was little in the way of meaningful reaction to the release of a spread of business and consumer-related data points, with participants looking ahead to U.S. CPI data and Thursday’s domestic labour market report.

- There are no domestic data releases of note scheduled for Wednesday.

- Also note that RBA Governor Lowe will speak in Parliament on Friday re: the Review of the RBA’s Annual Report for 2021.

FOREX: Yen Takes Lead With Caution Evident Ahead Of U.S. CPI

Safe-haven currencies were in demand, albeit the U.S. dollar faltered against most of its G10 peers save for the Antipodeans, as participants awaited the release of U.S. CPI data later today.

- U.S. Tsy yields faltered across the curve, applying pressure to the greenback, after a NY Fed survey released Monday indicated a sharp drop in consumer inflation expectations. The BBDXY index traded on a heavier footing, but struggled to challenge yesterday's lows.

- Softer U.S. Tsy yields amplified demand for the yen, which remains sensitive to moves in interest rate differentials. The spread between U.S./Japan 10-Year yields shrank ~2.0bp in the Tokyo session, while 2-year gap narrowed ~3.7bp.

- A degree of caution was evident across G10 FX space as the JPY outperformed in the Asia-Pac bloc, while the CHF paced gains in the European sub-basket, with unwillingness to take on more risk ahead of the U.S. CPI print likely in play.

- The yen may have drawn some incremental support from comments from ex-BoJ member Kataoka, who was known as a staunch dove. The former policymaker said that the BoJ could be able to start policy normalisation in mid-2023, albeit he conceded that it would be a "miracle" and his comments did the rounds after being originally made last Friday.

- The yen still sits atop the G10 pile at typing. Although spot USD/JPY held yesterday's range, option skews indicated growing bearish sentiment among option traders. One-month skews fell to its lowest point since Aug 4 as the short-end led declines.

- The Antipodeans sold off while holding narrow ranges, despite a fairly resilient backdrop for the Australian economy painted by a slew of local data signals. Weakness in the space coincided with an uptick in USD/CNH.

- The CNH weakened amid domestic COVID headwinds and concerns around holiday spending momentum, even as the PBOC delivered the fourteenth consecutive stronger than expected yuan fixing. A notable decrease in the error term (actual fixing less average sell-side estimate) may have added pressure to the yuan.

- While U.S. inflation figures are set to steal the limelight, German ZEW survey & final CPI reading, as well as UK jobs market data will also cross the wires.

MARKET INSIGHT: EUR/USD Cheap To Short Term Fair Value, But Risks Still Loom

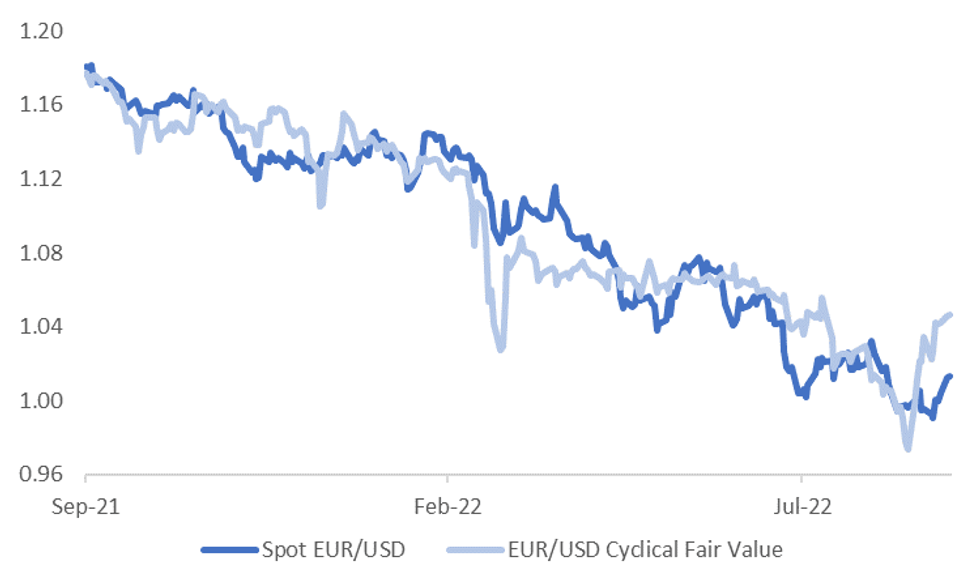

At face value, the EUR/USD rebound looks to have further to run. The first chart below plots spot EUR/USD against a simple cyclical fair value metric. The fair value metric is made up of the EU-US 2yr swap rate differential and the Citi relative terms of trade indices for the two blocs.

- The current fair value estimate sits above 1.04, versus current spot at 1.0130. The improvement in the fair value in recent weeks reflects higher swap rate differentials and a turnaround in the relative terms of trade outlook (albeit from depressed levels).

- Note the fair value regression is based off the past year of data and has an R^2 of 87%.

Fig 1: EUR/USD Still Below Simple Simple Cyclical Fair Value

Source: Citi/MNI - Market News/Bloomberg

Source: Citi/MNI - Market News/Bloomberg

- Interestingly though, recent correlations suggest the relative terms of trade back drop is a more important driver of EUR/USD, rather than yield differentials. A trend that has been evident in other parts of 2022 as well.

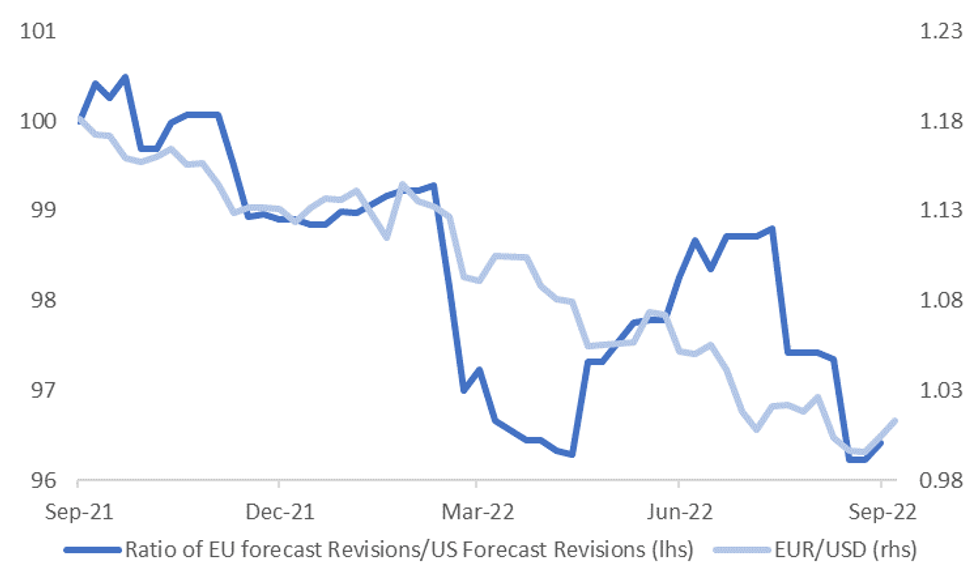

- This is closely linked with another key driver of the EUR/USD outlook, relative growth prospects between the EU and US. The second chart below overlays EUR/USD against the ratio of EU growth revisions to US growth reversions, sourced from J.P. Morgan.

- Not surprisingly, J.P. Morgan economists have revised down their EU growth projections more than the US, most notably in recent months. This has been the broader trend from other economists as well.

- The potential for an energy supply induced recession in the EU area certainly can't be discounted as we approach year end. A further sharp downward revision to the EU growth outlook, relative to the US, would weigh on the EUR/USD rebound, all else equal.

- On this basis, the market may be reluctant to take EUR/USD quickly back to the implied level of short term fair value, particularly ahead of the northern hemisphere winter.

Fig 2: EUR/USD Versus Relative J.P. Morgan Growth Revisions (EU to US)

Source: J.P. Morgan/MNI - Market News/Bloomberg

Source: J.P. Morgan/MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Sep13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0050(E1.3bln), $1.0100(E628mln), $1.0175(E1.0bln) USD/JPY: Y142.00($640mln)

- GBP/USD: $1.1500(Gbp647mln)

- NZD/USD: $0.6300(N$718mln)

- USD/CNY: Cny6.8500($997mln)

ASIA FX: USD/CNH Rebounds, INR Outperforms

It has been a mixed session for USD/Asia pairs, as the market awaits the US CPI print later tonight. Cross asset signals have been positive in terms of higher equities and lower UST yields, but has only had limited positive spill over to the FX space.

- USD/CNH looked set to break below 6.9100 early, but negative covid headlines and concern around consumer holiday spending weighed at the margin. The pair has pushed back above 6.9250. The CNY fixing was again firmer than expected, but less so compared to last week.

- USD/KRW couldn’t get much beyond 1372 in early trade, rebounding back to 1376/77. Onshore equities are up strongly (+2.6%), but this is largely catch up after onshore markets were closed for the past 2 sessions. The South Korea authorities will continue to monitor FX markets closely.

- USD/INR is tracking to fresh multi-week lows. The pair was last at 79.10/15, around 0.50% down on yesterday's close. Chatter of possible Indian bond inclusion in global indices is aiding sentiment, while onshore equities are +0.5% up at this stage.

- Spot USD/IDR has added 21 figs and last deals at IDR14,863 as the rupiah underperforms its peers from the Asia EM basket despite positive cross-asset signals. Comments from FinMin Indrawati, who urged Bank Indonesia to remain cautious while tightening monetary policy, may be weighing on the IDR.

- USD/PHP is down from earlier highs. The pair is back close too unchanged at 56.86. President Marcos extended the state of calamity related to the COVID-19 pandemic by another three months but also signed a decree making mask wearing optional outdoors. The Philippines was one of the last countries in Asia which required masking up outdoors.

EQUITIES: Bid Extends Ahead Of U.S. CPI; Chinese Biotech Sinks On Biden Order

Most Asia-Pac equity indices are firmer at typing, with Chinese, Hong Kong, and South Korean markets largely outperforming peers on their first day back from the extended holiday, as tech and high-beta equities have led gains ahead of the U.S. CPI reading later today.

- The CSI300 is 0.7% firmer at writing, hitting fresh three-week highs earlier in the session on outsize gains in the high-beta consumer staples sub-index (+2.1%). Chinese developers notably underperformed, with the CSI300 Real Estate Index trading 0.5% lower despite recently announced policy support measures, keeping in mind wider uncertainty in the space ahead of the CCP’s 20th Party Congress in mid-October.

- Elsewhere, Chinese biotech stocks on both Hong Kong and Chinese mainboards such as WuXi Biologics (-18.4%) and Porton Pharma Solutions (-9.3%) came under severe pressure in the wake of U.S. Pres. Biden’s order on Monday re: support for the U.S. biotech industry, aimed at reducing reliance on China.

- The KOSPI (+2.6%) was the region’s best performer, with the heavyweight Electrical and Electronic Equipments sub-gauge (+4.0%) contributing the most to gains, as the sector played catch-up to a similar region-wide bid on Monday following source reports of potential White House curbs on exports of chips to China.

- E-minis sit 0.1% better off apiece, having held just shy of their respective three-week highs made on Monday through the Asian session.

GOLD: Consolidating Ahead Of U.S. CPI

Gold deals $1/oz weaker to print ~$1,723/oz, extending a pullback from Monday’s best levels at writing.

- To recap, gold closed ~$8 firmer on Monday after briefly touching its highest level for September (at $1,735.1/oz), recording a two-session streak of higher daily closes ahead of the U.S. CPI reading due today.

- On the latter, the NY Fed Aug survey of consumer expectations pointed to a decline in inflation expectations across the board for another month (1-Year expectations dipped to 5.7% from 6.2% in June), raising hope from some quarters that Tuesday’s CPI reading will point to a peak in inflation.

- Sep FOMC dated OIS continue to price in just under 75bp of tightening at that meeting, with a significant surprise to today’s CPI reading likely required to shift the needle, given Fedspeak voicing support for a 75bp move prior to the Fed’s media blackout period.

- From a technical perspective, gold’s recent gains are considered corrective, following the recent breach of support at $1,727.8 (Aug 22 low). Support is seen at $1,681.0 (21 Jul low and bear trigger), while initial resistance is located at ~$1,754.7 (50-Day EMA).

OIL: Back From Lows; OPEC, IEA Monthly Reports Eyed

WTI and Brent sit ~$0.20 firmer apiece, back from dealing >$1 softer earlier, but remaining comfortably below Monday’s one-week highs at writing.

- To recap, both benchmarks closed ~$1 firmer on Monday for a third straight higher daily close, extending a move off of their recent, respective eight-month lows amidst persistent worry re: tightness in global crude supplies.

- On the latter, U.S. DOE data on Monday showed emergency oil reserves at their lowest levels since Oct ‘84, coming as participants are eyeing the White House for further releases of SPR crude when the current 180mn bbl programme ends in October.

- Elsewhere, hope surrounding an Iranian nuclear deal continues to dim, with U.S. Secretary of State Blinken stating earlier that a U.S.-Iran deal in the near-term was “unlikely”.

- Turning to China (and demand-related worry), state media announced that domestic travel over the long weekend had dropped by over one-third on a Y/Y basis, with air travel being the hardest-hit. Focus on that front now turns to the Golden Week holiday in October.

- Looking ahead, OPEC will publish their monthly oil market report later today ahead of the International Energy Agency’s (IEA) monthly report on Wednesday, while some will be watching.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/09/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 13/09/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/09/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/09/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/09/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/09/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/09/2022 | 1230/0830 | *** |  | US | CPI |

| 13/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/09/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 13/09/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/09/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.