-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: A Generally Risk Positive Start To December

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

- EU TO LAUNCH NO-DEAL CONTINGENCY STEPS IF NO DEAL WITH UK BY MID-WEEK (RTRS)

- EUROZONE FINANCE MINISTERS REACH DEAL ON BAILOUT FUND OVERHAUL (BBG)

- 10-YEAR HIGH FOR CHINESE CAIXIN M'FING PMI

- RBA UNCHANGED AT FINAL MEETING OF 2020

- OPEC+ TALKS DELAYED AS COUNTRIES FIGHT OVER OIL OUTPUT (BBG)

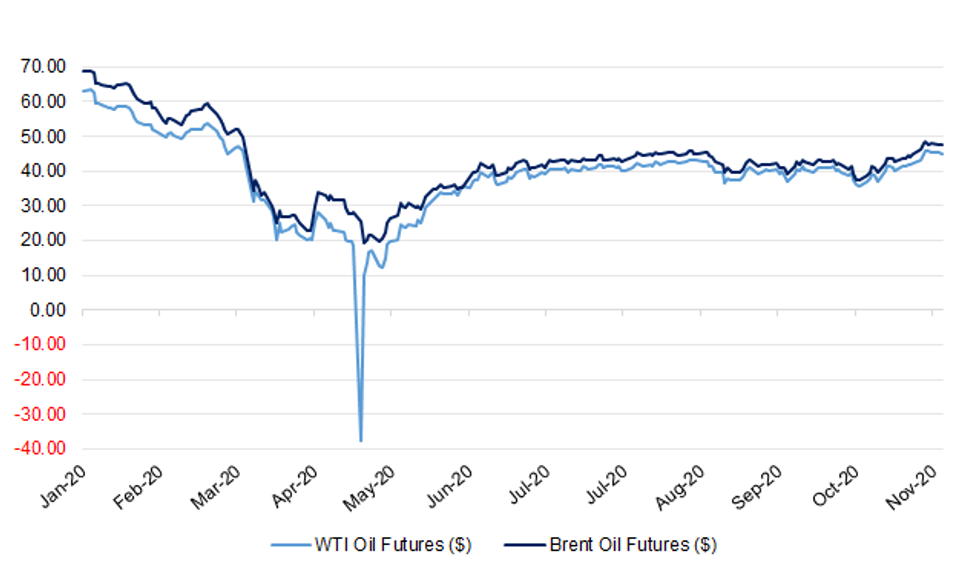

Fig. 1: WTI & Brent Oil Front-Month Futures Prices (Continuation)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: England's national lockdown has helped to bring coronavirus "back under control" but vigilance is still needed, the health secretary has said. Matt Hancock hailed the restrictions a success and said infections in England dropped by about 30% in the last week. The lockdown ends on Wednesday and will be replaced with tiered restrictions. Mr Hancock stressed the need for the regional system, saying "while we can let up a little, we can't afford to let up a lot". (BBC)

CORONAVIRUS: Boris Johnson faces a humiliating Tory revolt over his new tiers system on Tuesday after he was accused of refusing to publish any forecast of the impact it will have on the economy. Scores of backbenchers are expected to rebelwhen the tiers are put to a vote, saying they were not being given the full pictureand were being asked to back "a pig in a poke". (Telegraph)

CORONAVIRUS: Labour MPs will abstain from a key lockdown vote as Tory rebels say they are unconvinced by a "rehashed" tiers analysis. A commons is vote is set to be held on Tuesday to approve the new system of tiers, which will leave just 1% of the country with the lowest level of restrictions. Sir Keir Starmer said: "It's very important as the opposition that we act in the national interest," he said. (Sky)

CORONAVIRUS: GPs are in a row with the Government over the Covid vaccine roll-out, with doctors warning that the current plans could leave them bankrupt. (Telegraph)

BREXIT: The European Union will launch contingency measures on Wednesday or Thursday if it has been unable to reach agreement by then with Britain on a trade deal, a senior EU diplomat said on Monday. The diplomat said the move would be necessary because "it will be roughly three weeks left until the end of the transition period" that ends on Dec. 31. "Companies and institutions like customs offices around the EU need to have clarity about what tariffs to impose and other measures if there is no deal and by the middle of the week we will have finally reached that point when such measures have to be spelled out," the diplomat said. "We have been postponing that moment for weeks now, but this is the limit," the diplomat said. (RTRS)

BREXIT: Britain should clarify its positions and "really negotiate" to find a Brexit deal on its future relationship with the European Union, a French presidency official said on Monday, as both sides warned each other that time was running out. "The priority is for the British to clarify their positions and really negotiate to find a deal," the French official told Reuters. "The EU also has interests to fight for, those of a fair competition for its businesses and those of its fishermen." "The Union has made a clear and balanced offer for a future partnership with Britain. We will not accept a substandard deal which would not respect our own interests," the official added. (RTRS)

BREXIT: British and European Union negotiators have the options in front of them to conclude a Brexit free-trade deal this week, Irish Prime Minister Micheal Martin was quoted as saying on Tuesday, expressing hope that they would succeed. "There is a landing zone for an agreement. It will require political will to conclude the deal and there are options to conclude the deal, and so on balance, I would be hopeful that it can be done at the end of this week," Martin told the Irish Times in an interview. "We are now really in the endgame if a deal is to be arrived at this week," said Martin, who had also expressed hope at the beginning of last week that the outline of a trade deal would be agreed within days. (RTRS)

EUROPE

EU/FISCAL: Euro-area finance ministers struck a deal on a long-planned overhaul of the region's bailout fund, according to three officials familiar with the deliberations, moving a step closer to shoring up the euro's architecture as the region deals with a devastating pandemic-induced recession. The agreement, which was signed off at a virtual meeting on Monday, caps a multi-year effort to beef up the European Stability Mechanism, which can provide 500 billion euros ($598 billion) in emergency loans to euro-area economies, according to the officials, who asked not to be identified because the talks are private. The accord foresees greater powers for the rescue fund in the design and implementation of future bailouts and reinforces the precautionary credit lines it can make available. (BBG)

FRANCE: France added 4,005 new cases on Monday, the fewest since the end of August. The number of patients in intensive care continued to decline from a peak two weeks ago while total hospitalizations resumed their decline after an uptick on Sunday. Deaths linked to the virus rose by 406 to 52,731. (BBG)

ITALY: Italy's new virus cases on Monday were the lowest in five weeks. The country reported 16,377 daily cases, compared with 20,648 on Sunday. The country's total virus deaths surpassed 55,000 on Monday, with 672 daily fatalities, compared with 541 the day before. Last Friday Italy's government decided to ease restrictions for financial capital Milan and for industrial hub Turin, following a steady reduction in the number of coronavirus cases in the last few days. (BBG)

U.S.

FED: MNI BRIEF: Fed's Powell Sees Challenging Next Few Months

- The rise in new Covid cases is "concerning and could prove challenging for the next few months," Federal Reserve Chair Jay Powell plans to tell Congress on Tuesday, while reiterating a pledge to use "our full range of tools to support the economy" - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Dallas Federal Reserve Bank President Robert Kaplan on Monday said he expects strong economic growth in the second half of next year once newly developed COVID-19 vaccines get rolled out widely, but with cases surging now he sees a "very difficult" next three to six months. "If we can see the resurgence moderate, I think you'll continue to see growth in the fourth quarter, and you might even see growth in the first quarter of next year, but right now, the trends at least in the virus don't look like they are moderating," Kaplan told Reuters in an interview. "So we're bracing ourselves here." (RTRS)

FED: Senate Majority Leader Mitch McConnell set up a vote to advance the nomination of Christopher Waller to the Federal Reserve Board, potentially clearing the way for his confirmation later this week but leaving Judy Shelton's path to the Fed uncertain. McConnell took the action on Waller's nomination shortly after the Senate came into session Monday afternoon. He ignored a question about whether he would try to revive President Donald Trump's nomination of Shelton, a controversial pick whose confirmation all but collapsed before the Thanksgiving break. (BBG)

ECONOMY/FISCAL: The Department of Labor has been both miscounting the number of people receiving unemployment benefits and underpaying those under a special program instituted to address the coronavirus pandemic, according to a government watchdog report Monday. Issues dealing with the surge in those filing claims for the new programs aimed at addressing the special circumstances of the pandemic have led to some problems, the Government Accountability Office said. Mistakes have moved in both directions, with recipients sometimes undercounted and at other times overcounted due to multiple individual filings and issues particular to some states including California and Arizona. (CNBC)

FISCAL: U.S. Treasury Secretary Steven Mnuchin on Monday urged Congress to tap into $455 billion of unused emergency relief funds to fuel an additional, targeted round of pandemic economic assistance for American households and businesses. "Based on recent economic data, I continue to believe that a targeted fiscal package is the most appropriate federal response," Mnuchin said in prepared testimony to the Senate Banking Committee released ahead of a hearing scheduled for Tuesday. Mnuchin will appear alongside Federal Reserve Chair Jerome Powell. (RTRS)

FSICAL: While congressional leaders have not met about a stimulus package, a small group of Republican and Democratic senators have held discussions about a possible compromise, NBC News reported. (CNBC)

CORONAVIRUS: Moderna Inc. requested clearance for its coronavirus vaccine in the U.S. after a new analysis showed the vaccine was highly effective in preventing Covid-19, with no serious safety problems. A Moderna spokesman said in a text message late afternoon Monday that its application for an emergency-use authorization for its Covid shot had been delivered to the U.S. Food and Drug Administration. Earlier, the company had said in a statement it would seek clearance on Monday in both the U.S. and Europe. (BBG)

CORONAVIRUS: The Federal Aviation Administration said it supported the "first mass air shipment" of coronavirus vaccines last week. A United Airlines jetliner carrying Pfizer's Covid-19 vaccine arrived in Chicago on Friday, according to people familiar with the matter. The step is a first toward the widespread distribution of a vaccine as manufacturers await government approvals. (CNBC)

CORONAVIRUS: Up to one-third of the American population could be infected by the coronavirus by the end of this year, former FDA chief Dr. Scott Gottlieb told CNBC. "We're going to probably have by the end of this year, 30% of the U.S. population infected," Gottlieb said on "Squawk Box," while noting that level of prior infections could have implications for slowing the epidemic early next year as vaccines for Covid-19 potentially come onto the market. (CNBC)

CORONAVIRUS: New York Gov. Andrew Cuomo said on Monday that struggling state hospital systems must transfer patients to sites that are not nearing capacity, as rising coronavirus cases and hospitalizations strain medical resources. (Axios)

CORONAVIRUS: California Governor Gavin Newsom said hospital capacity and demand would become a more important factor in determining restriction levels for counties and that a worsening of these metrics could result in the potential introduction of a stay-at-home order. Mr Newsom said that without any intervention that meaningfully changes current trends, the state's number of hospitalisations could double or triple within the next month, and that statewide demand for beds in hospital intensive care units is projected to have outstripped supply by Christmas Eve. (FT)

POLITICS: Arizona and Wisconsin on Monday officially declared that Joe Biden defeated President Donald Trump in each of those states' elections, damaging Trump's long-shot efforts to reverse his projected loss in the Electoral College. (CNBC)

EQUITIES: Tesla will be added to the S&P 500 in a single step despite its more than $500 billion market capitalization, S&P Dow Jones Indices said on Monday, forgoing a possible phased approach that was considered to ease the impact of adding such a large company to the U.S. stock benchmark. The stock will be added at its full float-adjusted market capitalization before the open of trading on Dec. 21, the index provider said. Float-adjusted means that only shares available to the public are considered when evaluating a company's weighting. The company that Tesla will replace will be named on Dec. 11, according to a press release. (CNBC)

OTHER

GLOBAL TRADE: China's broadly defined export control law came into effect on Tuesday, expanding Beijing's arsenal of countermeasures to trade restrictions imposed by other countries. The law, first drafted in 2017 and approved in late October, bears resemblance to US Export Administration Regulations, including a list of controlled items like sensitive technology, military goods, dual-use items that have both civil and military uses, and a licence requirement for anyone who intends to export or re-export these goods. The regulation is widely viewed as a response to United States' restrictions on Chinese technology firms like Huawei Technologies Co., which has seen access to American technology severed amid a growing tech war between the world's two largest powers. (SCMP)

CORONAVIRUS: The World Health Organization said that governments need to take a risk-management approach to all activities that involve people congregating, including skiing, as winter approaches. "The real issues are at airports, on buses to and from ski resorts, ski lifts -- pinch points where people come together in large numbers," said Mike Ryan, head of WHO's emergencies program. (BBG)

RBA: MNI REVIEW: RBA Holds Rates But Says More QE Possible

- The Reserve Bank of Australia said Tuesday it remains prepared to expand its quantitative easing program based on the outlook for jobs and inflation although it left policy settings unchanged, citing the recovery underway. In its statement, the central bank said it is keeping the size of its bond purchase program "under review, particularly in light of the evolving outlook for jobs and inflation" - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

AUSTRALIA: Payroll jobs rose 0.4 per cent in Victoria over the fortnight to 14 November and 0.1 per cent nationally, according to figures released by the Australian Bureau of Statistics (ABS) today. Bjorn Jarvis, head of Labour Statistics at the ABS, said: "The latest data showed further signs of a recovery in Victoria with a rise in payroll jobs for the third consecutive fortnight, however they remain 5.4 per cent lower than mid-March." "Nationally, payroll jobs also rose for the third fortnight in a row, but remain 2.9 per cent lower than mid-March. (ABS)

AUSTRALIA/CHINA: One of the Communist Party's chief mouthpieces has branded Australia "evil" and warned warships carrying out patrols in the South China Sea are at risk of being attacked. An editorial published by the jingoistic Global Times tabloid newspaper said Prime Minister Scott Morrison had "lost his diplomatic manner" after China's Foreign Ministry had published a fake image slurring Australian soldiers over alleged war crimes in Afghanistan. But Five Eyes ally New Zealand rallied to Australia's support, while the Afghan government urged calm. The newspaper's editorial said Mr Morrison's demand for an apology had been "ruthlessly rejected" by the ministry and "ridiculed" by the Chinese people. "Australia now has such a rude and arrogant government and a group of political and opinion elites who don't have a clear estimation of themselves," the editorial said. (AFR)

SOUTH KOREA: South Korea's ruling and opposition parties agree to increase 2021 budget to 558t won from initial plan of 556t won, Yonhap News reports, citing parties. Additional 2.2t won will be financed from bond sale To reflect 3t won of virus-related cash handouts, 900b won in vaccine purchases. (BBG)

CANADA: MNI BRIEF: Canada Investors Balk At Super Long Bonds - Survey

- Canadian bond investors said the government should focus new bond sales on current 10-year and 30-year maturities rather than resorting to even longer-dated issuance, according to a consultation the central bank published Monday along with the government's fiscal update - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

CANADA: MNI POLICY: Canada Sees CAD382B Budget Deficit, 17.5% of GDP

- Canada's budget deficit will be a record CAD382 billion this fiscal year or 17.5% of GDP, and Finance Minister Chrystia Freeland pledged Monday to spend whatever the economy needs until the pandemic passes and fiscal "guardrails" can be restored, while locking in low interest rates with 50-year and green bonds - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

CANADA: MNI REALITY CHECK: Canada's Q3 GDP Rebound Won't Last

- Canada's economy faces a twisted path back from the spring lockdown, with a strong third quarter likely followed by a near stall as some regions move back into tough health restrictions. Third quarter GDP will grow at a 48% annualized pace according to economists, following a 39% decline in the second quarter. Even with the big gain, output will remain about 5% below pre-pandemic levels - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

TURKEY: Turkey's president Recep Tayyip Erdogan has announced strict new coronavirus measures in an attempt to stymie a winter resurgence of the pandemic in the nation of 83m people. A curfew would be imposed across the country, banning citizens from going out after 9pm on weekdays and forcing them to stay at home throughout the day on weekends, he said. Under-20s and over-65s will be banned from using public transport. Nurseries, which had been allowed to stay open in recent weeks even as schools closed, will be required to shut their doors. (FT)

OIL: OPEC+ talks were delayed for two days to give ministers more time to reach a deal, after a long and tense meeting on oil production broke down without agreement. The delay, set out in a letter seen by Bloomberg, was the most dramatic sign yet of the deep division inside the cartel after hours of talks on Monday yielded no result. OPEC+ ministers will now meet on Thursday rather than Tuesday to allow time for "further consultations." Talks will continue by phone. Ministers are discussing whether to increase production in January as planned or maintain the cuts that have helped create a rally in oil prices. (BBG)

OIL: An Enbridge Inc. pipeline that will help ship more Canadian crude to the U.S. Midwest received final approval, paving the way for construction to start soon on a third key export project for the oil sands after years of delays. Minnesota approved the stormwater pollution plan for Enbridge's Line 3 pipeline replacement and expansion, the project's last pending permit, the company said on Monday. Construction is expected to take six-to-nine months on a line that will add 370,000 barrels a day of capacity. (BBG)

CHINA

PBOC: China will prioritize the stability of its currency and pursue market-based interest rate reforms to improve policy transmission and ensure capital reaches the real economy, the Securities Daily reported citing an article by Governor Yi Gang of the PBOC. China needs to establish an independent central bank financial budget management system to maintain a firewall between finance and the central bank to avoid the monetization of the fiscal deficit, wrote Yi. It was important to prevent corporate credit risks being carried onto the central bank's books, which may affect the yuan's credit standing, Yi wrote. He said the PBOC will strengthen and integrate the macro-prudential management of major financial activities, markets, institutions and infrastructure. (MNI)

PBOC: The PBOC has signaled that it may keep the previously fixed-date MLF injections more flexible in the future following the CNY200 billion operation on Monday, the Economic Information Daily said citing Ming Ming, the chief fixed-income analyst with Citic Securities. The injection on Monday sought to maintain month-end liquidity and prepare for the CNY300 billion MLF rolling over on Dec 7, at a time when banks must pay required deposits to the PBOC. The PBOC normally issues MFL on the 15th day of the month. The MLF and increased fiscal spending in the coming month should help ease long-term debt pressure on banks in addition to a series of SOE bond defaults and competition to win deposits, Ming said. (MNI)

ECONOMY: China's Q4 GDP growth may accelerate to 6.6% from 4.9% in Q3 as the November PMI recorded 52.1, up 0.7 points from October and within the expansion zone for the ninth month, the Shanghai Securities News reported citing Li Chao, an economist from Zheshang Securities. Both manufacturing and non-manufacturing PMIs should continue to expand in December as consumption and service industries continue to recover, according to Tang Jianwei, a researcher from the Bank of Communications. (MNI)

DEFAULTS: A state-owned Chinese group caught up in the country's spate of defaults owes billions of dollars to lenders, raising concerns that bond market tremors could also sweep through the banking sector. According to a creditor document viewed by the Financial Times, almost 70 Chinese and foreign banks, as well as trust companies, had Rmb33.5bn ($5.1bn) in outstanding lending to Huachen Automotive Group as of last year. The revelation comes as the country's multi trillion-dollar debt markets have been rocked by defaults at government-backed companies. (FT)

OVERNIGHT DATA

CHINA NOV CAIXIN MANUFACTURING PMI 54.9; MEDIAN 53.5; OCT 53.6

The Caixin China General Manufacturing PMI rose to 54.9 in November from 53.6 the previous month, the highest reading since November 2010. The Manufacturing PMI has now signaled an improvement in conditions for seven months in a row as the postepidemic economic recovery continued to pick up speed. To sum up, manufacturing recovered at a faster clip in November as supply and demand improved at the same time. Employment recovered markedly and overseas demand kept expanding. Manufacturing enterprises added to their inventories to meet demand and they were quite confident about the economic outlook for the next 12 months. The gauge for future output expectations stayed high. We expect the economic recovery in the post-epidemic era to continue for several months. At the same time, deciding how to gradually withdraw the easing policies launched during the epidemic will require careful planning as uncertainties still exist inside and outside China. (Caixin)

JAPAN OCT UNEMPLOYMENT RATE 3.1%; MEDIAN 3.1%; SEP 3.0%

JAPAN OCT JOB-TO-APPLICANT RATIO 1.4; MEDIAN 1.03; SEP 1.03

JAPAN Q3 CAPEX -10.6%; MEDIAN -12.1%; Q2 -11.3%

JAPAN Q3 CAPEX EX-SOFTWARE -11.6%; MEDIAN -11.7%; Q2 -10.4%

JAPAN Q3 COMPANY PROFITS -28.4%; Q2 -46.6%

JAPAN Q3 COMPANY SALES -11.5%; Q2 -17.7%

JAPAN NOV, F JIBUN BANK MANUFACTURING PMI 49.0; PRELIM 48.3

The Japanese manufacturing sector continued to edge towards more stable operating conditions in November. The headline PMI was pushed to its highest reading for 15 months in the latest survey period, following softer falls in both production and new orders. "Yet, concern remains that weaknesses caused by the COVID-19 pandemic persisted as both output and new orders both fell for the twenty-third month in a row. Furthermore, infection rates have surged in both domestic and international markets which resulted in a renewed fall in export orders, which dampened confidence further. (IHS Markit)

AUSTRALIA Q3 BOP CURRENT ACCOUNT BALANCE +A$10.BN; MEDIAN +A$7.1BN; Q2 +A416.3BN

AUSTRALIA Q3 NET EXPORTS/GDP -2.0%; MEDIAN -1.7%; Q2 +1.0%

AUSTRALIA OCT BUILDING APPROVALS +3.8%; MEDIAN -3.0%; SEP +16.2%

AUSTRALIA NOV AIG MANUFACTURING PMI 52.1; OCT 56.3

The Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI®) declined 4.2 points to 52.1 points (seasonally adjusted), indicating expanding conditions in November but at a slower rate than in October. Results above 50 points indicate expansion with higher results indicating a faster rate of expansion. The result largely reflects stabilisation in conditions after a bounce-back into positive territory, following Victoria's easing of activity restrictions in October. South Australia had the largest fall of any state due to lost production from the three-day shutdown. Still, it remained in positive territory because of robust agricultural conditions, which boosted demand for food & beverage and machinery & equipment manufacturers. Victoria recorded its first month of expansion since March. (AiG)

AUSTRALIA NOV, F IHS MARKIT MANUFACTURING PMI 55.8; PRELIM 56.1

Latest PMI data showed the Australian manufacturing sector regained recovery momentum midway through the fourth quarter, with output and new orders rising at faster rates in November. Reduced restrictions on business operations and personal mobility boosted business activity, with makers of consumer goods reporting particularly strong growth in production. With a sustained recovery in output and sales, the survey also indicated a return of jobs growth in November, with the rate of job creation the strongest for two years. That said, the manufacturing upturn may be constrained in the months ahead by the reduced availability of input materials due to local logistical issues and global freight capacity disruptions. (IHS Markit)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 107.5; PREV. 104.5

The relaxation in lockdown restrictions in South Australia drove a bounce in consumer confidence. Confidence is above the neutral 100 level in South Australia, after slipping below in the previous week. Ahead of the holiday season, the 'time to buy a major household item' subindex surged to its highest level since 1 March. Perceptions of economic conditions, both current and future, are the highest in more than a year. This could bode well for economic activity and spending over the coming weeks. (ANZ)

AUSTRALIA NOV CORELOGIC HOUSE PRICE INDEX +0.7%, OCT +0.2%

SOUTH KOREA Q3, F GDP -1.1% Q/Q; MEDIAN -1.3%; PRELIM -1.3%

SOUTH KOREA Q3, F GDP +2.1% Y/Y; MEDIAN +1.9%; PRELIM +1.9%

SOUTH KOREA NOV TRADE BALANCE US$5.930BN; MEDIAN US$7.000BN; OCT $5.825bn

SOUTH KOREA NOV EXPORTS +4.0%; MEDIAN +7.5%; OCT -3.8%

SOUTH KOREA NOV IMPORTS -2.1%; MEDIAN +7.5%; OCT -3.8%

SOUTH KOREA NOV IHS MARKIT MANUFACTURING PMI 52.9; OCT 51.2

November data provided a further signal that the South Korean manufacturing sector continued to recover well following earlier COVID-19 related disruption. The latest Manufacturing PMI reading was the highest since February 2011 and indicated that operating conditions. have improved solidly throughout the fourth quarter so far. Both output and new orders rose further in the latest survey period as manufacturers reported more stable operating conditions and the release of pent-up demand. Furthermore, international demand saw a stronger rise in November, driven by key export markets in the Asia Pacific Region. (IHS Markit)

CHINA MARKETS

PBOC Net Drains CNY50 Billion via OMOs Tue

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with rates unchanged at 2.2% on Monday. This resulted in a net drain of CNY50 billion given the maturity of CNY70 billion repos today, according to Wind Information.

PBOC Sets Yuan Parity Higher at 6.5921; Up 6.74% Y/Y

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5921 on Tuesday, compared with the 6.5782 set on Monday.

MARKETS

BOND SUMMARY Mixed Performance For Core FI

Tuesday made for another tight Asia-Pac session for T-Notes, last -0-01 at 138-04+, with a rally in global equity markets keeping a lid on the space during the session. The cash space saw some light twist steepening. Eurodollar futures sit -0.5 to +0.5 through the reds, with a ~22K lift in EDH2 providing the dominant flow.

- JGB futures edged higher during Tokyo trade, last +6, with the long end underperforming as the curve bull steepened amid supply headwinds in the form of today's 10-Year and Thursday's 30-Year JGB supply. Today's auction saw solid price metrics, with the low price coming in a touch above dealer estimates, alongside a narrow tail, although the cover ratio slipped to the lowest level seen at a 10-Year JGB auction since September (with the September level representing a multi-year low).

- There was no movement for the Aussie bond space over the release of the RBA's latest monetary policy decision. The guidance passage was a cut & paste from the previous statement, while the Bank's language surrounding its purchase scheme and impact on the AUD was very matter of fact. Elsewhere, its tone surrounding the local economy was still cautious, while it flagged the broader risk backdrop as the driver behind the bid in AUD/USD (which is of course well documented). It was also keen to stress the need for an appropriate monetary-fiscal policy mix. All in all, it was very vanilla, with little of note to go off. Now we move to the Governor's appearance in Canberra tomorrow. YM -0.5, XM -2.5. Swaps have generally narrowed marginally vs. ACGBs across the curve.

JGBS AUCTION: 10-Year Auction Results

Japanese MOF sells Y2.0956tn 10-Year JGBs:

- Average Yield 0.019% (prev. 0.046%)

- Average Price: 100.79 (prev. 100.53)

- High Yield: 0.021% (prev. 0.047%)

- Low Price: 100.77 (prev. 100.52)

- % Allotted At High Yield: 69.6232% (prev. 73.1880%)

- Bid/Cover: 3.425x (prev. 4.125x)

EQUITIES: Comfortably Bid As December Trading Gets Underway

Tuesday represented a Asia-Pac session for equity markets as participants put money to work during the first trading session of December. The risk-positive tone was aided by a 10-Year high in the Chinese Caixin manufacturing PMI although the bid was in play well before then.

- Late Monday saw some generally positive news flow on the vaccine front:

- Moderna requested clearance for its coronavirus vaccine in the U.S.

- Elsewhere, a CNBC source report noted that the FAA said it supported the "first mass air shipment" of coronavirus vaccines last week.

- This came after Wall St.'s major indices recovered from their respective Monday troughs.

- Nikkei 225 +1.6%, Hang Seng +0.9%, CSI 300 +1.6%, ASX 200 +1.3%.

- S&P 500 futures +33, DJIA futures +262, NASDAQ 100 futures +109.

GOLD: Familiar Themes, Familiar Levels

Gold managed to bounce from previously outlined technical support on Monday ($1,763.5/oz) as U.S. real yields edged lower. This allowed bullion to overcome the DXY's correction from worst levels of the day. Elsewhere, ETF holdings of gold have continued their recent slide. Little has changed on the fundamental and technical fronts with the aforementioned drivers continuing to come under scrutiny.

OIL: Drama

The broader risk-positive tone has allowed the major crude benchmarks to hold within their respective recent ranges, with WTI & Brent ~$0.30 lower vs. settlement levels at typing.

- Monday saw the OPEC ministerial meeting extended for 48 hours as the cartel looks to form a consensus ahead of the now delayed OPEC+ ministerial meeting. BBG reports noted that "ministers are discussing whether to increase production in January as planned or maintain the cuts that have helped create a rally in oil prices." Earlier in the day there seemed to be some gravitation towards a 3-month extension of the current production levels, although it seems that tensions were running high during Monday's discussions. Still, general market consensus points to some form of a deal being struck in the coming days.

FOREX: USD Retreats As Asia Sees Mild Risk On Tone

Another fairly quiet Asia-Pac session to start December, though at least a measure of a broader risk-on tone was evident as Asia-Pac equity indices and U.S. e-minis pushed slightly higher and the USD gave back some of the gains seen in European/NY hours. There was a decent docket of regional data today, notably with PMIs improving in Australia, Japan, and China. South Korean export data was encouraging also which helped support the risk on tone.- Dallas Fed President Kaplan spoke briefly during the session, he said the next 3-6 months will be difficult but expects growth in Q4 and Q1.

- In China the yuan strengthened modestly, USD/CNH last down around 0.12% at 6.5672 and matching its lowest level from yesterday. China Caixin PMI for November rose to 54.9, the highest level since 2010. Coupled with yesterday's beat in official manufacturing PMI this indicates a strong recovery from the pandemic.

- AUD/USD rose around 0.3% to 0.7365, the pair shrugged off an unchanged, vanilla RBA rate announcement. The pair has gradually moved higher during Asia hours as the greenback weakens and broader equity markets rally at the start of a new month. There was also some positive news on the local COVID front, with Western Australia set to reopen its borders to Victoria and NSW on Tuesday 8 December.

- Looking to Europe, GBP and EUR both moved higher against the dollar to the tune of approximately 0.25%, GBP is supported by positive sounding Brexit comments from Ireland's Prime Minister Martin.

FOREX OPTIONS: Expiries for Dec1 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E1.2bln), $1.1850-60(E545mln), $1.1900(E509mln), $1.1950(E642mln), $1.2000-10(E995mln)

- USD/JPY: Y103.00($504mln), Y104.85-00($1.0bln)

- GBP/USD $1.2800(Gbp511mln), $1.3215-30(Gbp545mln)

- EUR/GBP: Gbp0.8900(E630mln)

- USD/CNY: Cny6.6275($574mln-USD puts)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.