-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A$ & Local Yields Falter Post RBA Decision

EXECUTIVE SUMMARY

- WILLIAMS SAYS FED WILL EVENTUALLY CUT RATES - MNI BRIEF

- BARKIN SAYS FED HAS TIME TO GAIN CONFIDENCE FOR CUTS - MNI

- ISRAEL SAYS A CEASE-FIRE PLAN BACKED BY HAMAS FALLS SHORT - BBG

- CHINA TO CONTAIN PROPERTY SPILLOVER- ADVISOR - MNI INTERVIEW

- RBA LEAVES RATE AT 4.35%, ADJUSTS CPI OUTLOOK HIGHER - MNI BRIEF

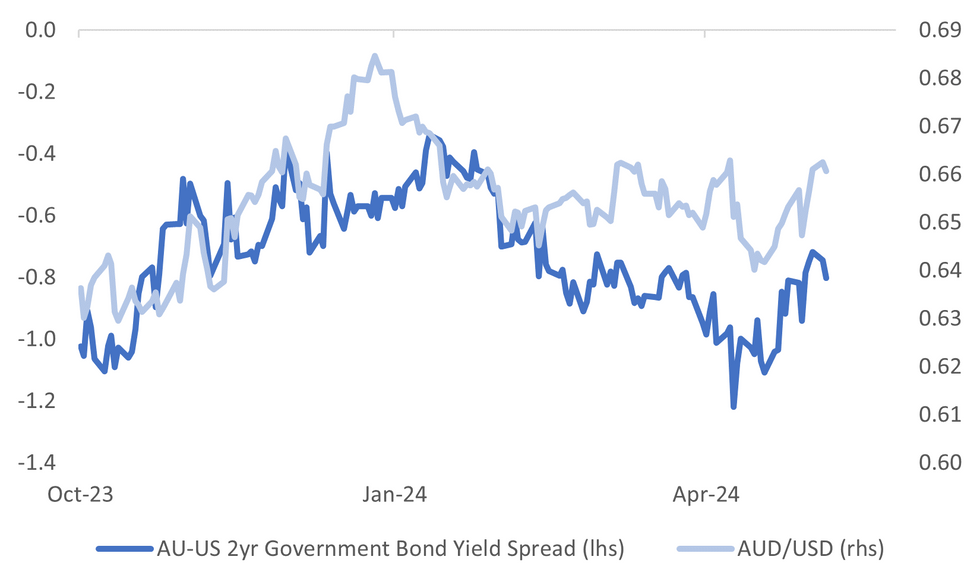

Fig. 1: AUD/USD & Local Yields Down Post RBA

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): Rishi Sunak said the next UK election may be closer than polls suggest now, raising the prospect of a hung Parliament where no party has overall control.

EUROPE

CHINA/FRANCE (XINHUA): Chinese President Xi Jinping and his French counterpart Emmanuel Macron oppose Israel’s operation in Rafah, official Xinhua News Agency reported, citing a joint statement released on Monday.

CHINA/FRANCE (YICAI): President Xi Jinping emphasised China will import more high quality French agricultural products, including ham and wine, in a meeting with President Macron in Paris. China will also extend the visa free policy for citizens of 12 countries including France, until the end of 2025.

RUSSIA (BBC): For the first time, the European Commission has proposed sanctions on Russia's powerful liquefied natural gas industry, according to documents seen by POLITICO. The measures wouldn’t directly bar Russian LNG imports to the EU. Instead, they would prevent EU countries from re-exporting Russian LNG after receiving it.

UKRAINE (POLITICO): The EU has said neutral countries can opt out of its plan to use the profits of Russia’s frozen assets to buy weapons for Ukraine, six EU diplomats told POLITICO. The proposal comes ahead of a meeting of the EU's 27 envoys on Wednesday, in which the Belgian Council presidency hopes to strike a deal to unlock funding for Ukraine.

RUSSIA (BBC): Russia has started preparations for missile drills near Ukraine simulating the use of tactical nuclear weapons in response to "threats" by Western officials.

RUSSIA (POLITICO): The inauguration of Vladimir Putin on Tuesday will look and feel like Groundhog Day, as the 71-year-old strongman walks down the red carpet of the Grand Kremlin Palace to pomp and applause for a fifth crowning as president. Tradition and Russian law dictate that the swearing in of a new president triggers a government reshuffle, which could shed rare light on Putin’s state of mind ahead of another six-year term.

U.S.

FED (MNI BRIEF): Federal Reserve Bank of New York President John Williams on Monday said the central bank will eventually lower rates but for the time being it is steady as she goes.

FED (MNI): Richmond Fed President Thomas Barkin said Monday a strong job market and some stickiness in inflation mean the Federal Reserve can be patient before starting to lower interest rates.

ECONOMY (MNI BRIEF): U.S. banks generally tightened lending standards for commercial and industrial loans in the first quarter and also reported weaker demand, citing a less favorable or more uncertain economic outlook, less tolerance for risk, and worsening of industry-specific problems, the Federal Reserve said in its April 2024 Senior Loan Officer Opinion Survey on Bank Lending Practices, or SLOOS.

HOUSING (MNI BRIEF): U.S. household expectations for home price inflation reaccelerated after falling last year, according to an annual New York Fed survey, with average one-year ahead expectations reaching their second highest reading in the history of the survey.

BOEING (BBC): The US has opened a new probe of troubled jet firm Boeing, after the company told air safety regulators that it might not have properly inspected its 787 Dreamliner planes. The Federal Aviation Administration (FAA) said it would look into whether staff had falsified records. It said Boeing was reinspecting all 787 jets still on the manufacturing line.

OTHER

MIDEAST (BBG): The Palestinian militant group Hamas said it had agreed to a cease-fire proposal for the Gaza Strip, but Israel’s war cabinet unanimously rejected it as “far from Israel’s necessary demands,” dashing hopes for an immediate pause in the fighting.

AUSTRALIA (MNI BRIEF): The Reserve Bank of Australia board held the cash rate steady at 4.35% Tuesday, noting services inflation had eased slower than forecast while repeating March’s message that it would not rule “anything in or out.”

CHINA

PROPERTY (MNI INTERVIEW): China will work to ensure the property sector's adjustment, expected to unfold over several years, does not spill over into the financial system, a senior policy advisor to the National Development and Reform Commission told MNI, adding authorities will launch more policies aimed at stabilising sentiment, growth and employment to boost investment and consumer spending.

BOND ISSUANCE (SECURITIES DAILY): China is expected to kick off the sale of special sovereign bonds in the second quarter, after recent politburo meeting called for faster debt issuance to step up fiscal support, Securities Daily reports, citing analysts.

HOUSING (CLS): Tier-one city Shenzhen lowered homebuying thresholds in seven non-core districts on Monday following Beijing’s move to relax home purchase limits in suburban areas late April, cls.cn reported. Homebuyers without local residency will have homebuying qualifications if they have paid one year of income tax or social security, compared to the previous three-year requirement.

MARKETS (SHANGHAI SECURITIES NEWS): Chinese mutual fund management companies are racing to launch equity-focused products this month amid optimism over the outlook for the A-share market, Shanghai Securities News reports.

CHINA MARKETS

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo Tuesday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY43 billion after offsetting the maturity of CNY440 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8059% at 09:29 am local time from the close of 1.8782% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 35 on Monday, compared with the close of 44 on the last trading day before May Day holiday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1002 on Tuesday, compared with 7.0994 set on Monday. The fixing was estimated at 7.2148 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND NINE-MONTH BUDGET DEFICIT NZ$5.04B

NZ NINE-MONTH BUDGET DEFICIT IS NZ$619M WIDER THAN FORECAST

AUSTRALIA 1Q RETAIL SALES FALL 0.4% Q/Q; EST. -0.3%; PRIOR +0.4%

JAPAN JIBUN BANK APRIL F SERVICES PMI 54.3; MARCH 54.1

JAPAN JIBUN BANK APRIL F COMPOSITE PMI 52.3; MARCH 51.7

CHINA END-APRIL FOREX RESERVES AT $3.2258T; EST. $3.2295T; PRIOR $3.2456T

CHINA END-APRIL GOLD RESERVES $148.64B

SOUTH KOREA APRIL FOREIGN EXCHANGE RESERVES $413.26B; PRIOR $419.25B

MARKETS

US TSYS: Treasury Futures Edge Higher Post RBA

- Treasury futures have ticked higher post the RBA keeping rates on hold, although we still remain inside Mondays ranges. The 10Y is trading up + 02+ from NY closing levels at 108-31, and just below Mondays highs of 109-01+.

- Earlier we saw a Block flattener trade sell the 5Y buy the 30Y, while there were also a couple of TU-FV-UXY Flys going across the screen.

- The cash treasury curve is little changed today, yields are 1-2bps lower, We currently trade near sessions best levels after initially opening 0.5bps higher across the curve. The 2Y yield is now -1.7bps at 4.814%, while the 10Y yield is -1.8bps at 4.481%.

- Across local rate markets: ACGBs curve is slightly steeper yields are 6-7bps lower, NZGB curve has pivoted at the 7yr, yields are 2-6bps lower while JGBs continue to see better buying in the belly of the curve with yields 1bp higher to 2.5bps lower.

- Looking Ahead: Little on the data calendar for the week, focus will turn to Fed speakers with MN Fed Kashkari at 1130ET.

JGBS: Firmer As Onshore Markets Re-Open, 10yr Debt Supply Tomorrow

JGB futures sit close to session highs in latest dealings. We were last 144.63, +.34.

- Highs not long after the open were at 144.68. Dips back to 144.54 have been supported. Some positive bias from the RBA on hold decision has likely aided futures at the margin this afternoon.

- The broader theme has been one of catch up to a more supportive global fixed income backdrop, as onshore markets were closed through Fri last week and yesterday. We are towards the top end of the range for the past month.

- News flow has been reasonably light, with official comments focused on FX/intervention etc, while April PMI revisions were modest on the data front.

- Cahs JGBs sit lower, led by the 7-10yr parts of the curve. The 10yr is down 2.5bps to 0.875%. 10yr swap is back under 0.95% in latest dealings.

- Tomorrow, we have a quiet data calendar but the 10yr debt sale will be in focus.

AUSSIE BONDS: ACGBs Richer, Curve Slightly Steeper, RBA Keeps Rates On Hold

ACGBs (YM +7.0 & XM +6) are richer today after the RBA as widely expected kept rates on hold at 4.35%, while earlier we had Retail Sales Ex Inflation consensus is -0.3% down from 0.30% in March.

- US Tsys futures have edged a touch higher post the RBA rate decision, with curves little changed.

- The cash ACGB curve is slightly steeper post RBA with yields 6-8bps lower. The AU-US 10-year yield differential is 2.5bps lower at -15.5bps.

- Swap rates are 6-7bps lower.

- The bills strip is slightly cheaper, with pricing f4-7bps higher

- RBA-dated OIS pricing is mixed out past July, with the market pricing 10bps of easing into the year-end from an expected terminal rate of 4.31%.

- Looking ahead, Foreign Reverse at 4.30pm AEST

NZGBS: NZGBs Richer, Curve Flatter, RBA Ahead

NZGBs are 3-6bps richer and trading at the session's best levels, as we head into the close. It has been a relatively quiet session, overnight US tsys did very little. The local market is eagerly awaiting the RBA meeting coming up in just over 30 mins.

- US Tsys yields are little changed today, with futures seeing some block trade activity with a flattener and a couple of fly trades going through.

- Swap rates are 2bps higher in the front-end, with the long end unchanged to 1bps higher.

- RBNZ dated OIS pricing is 2-8bps higher today, A cumulative 45bps of easing is priced by year-end.

- NZGBs are 3-6bps lower today, with better buying in the belly of the curve with yields somewhat pivoting at the 7yr. The 2Y yield is -3.2bps at 4.711%, the 10Y -5.2bps at 4.701%

- Cross-asset NZD is little changed at 0.6013, Equities are down 0.30% while 5Y CDS is 1bp lower at 14bps

- Looking Ahead: NZ to Sell 7yr, 10yr 20yr bonds on Thursday and BusinessNZ Manufacturing PMI on Friday

FOREX: Dollar Firms As USD/JPY Recovery Continues, A$ Down Post RBA

The BBDXY sits firmer in the first part of Tuesday dealing. The USD index last near 1252.70, around 0.1% stronger for the session so far. Yen losses and an AUD dip post the RBA have been the main focus points.

- The RBA left rates unchanged as widely expected, but the statement didn't contain any hawkish shift in terms of the rates bias, while the RBA inflation outlook still has prices returning towards target unchanged from the prior meeting. This comes despite the Q1 upside inflation surprise.

- Given adjustments to market pricing this has been enough to weigh on the AUD. We are back to 0.6600, off around 0.4%, and close to session lows.

- NZD/USD is close to unchanged, last near 0.6005/10, hence the AUD/NZD cross is down to 1.0985/90.

- USD/JPY has continued to recover ground, last near 154.50. Earlier highs in the pair were at 154.65. In the absence of further intervention flows the path of least resistance in USD/JPY has been to the upside. Earlier dips to 153.85/90 were supported.

- Still to come we have RBA Governor Bullocks press conference. Later the Fed’s Kashkari speaks and March US consumer credit is released. There are also March German factory orders and euro area retail sales.

ASIA EQUITIES: China & Hong Kong Equities Head Lower, Property Rules Relaxed

Hong Kong and China equities are lower today, there has been very little in the way of headlines or economic data. Recently, Hong Kong equity markets have been outperforming since China announced measures to support them with the HSI now up 10.51% vs the CSI up just 3.41% over that period. The city of Shenzhen has relaxed home buying rules to help the struggling sectors while Investors have been buying onshore Chinese equities recently with flows via the northbound connect picking up while stock turnover in mainland equities has topped 1tln yuan for the fourth day on Monday, with high turnover a feature of prior rallies.

- Hong Kong equities are mixed today the HSTech Index is down 2.00%, taking a break from it's recent 20% rally, the Mainland Property Index is up 0.28% while the wider the HSI is down 0.85%. China onshore markets are performing slightly better today with the CSI300 down 0.17% still holding above the 200-day EMA, while small-cap indices the CSI1000 and CSI2000 are both down about 0.10%, and the ChiNext has erased earlier gains to trade down 0.30%

- China Northbound saw a 9.31b yuan inflow on Monday. Equity flow momentum is strong in the short-term with the 5-day average at 6.87b, well above the 20-day average at 0.76b and the 100-day average at 0.77b yuan.

- In the property space, the city of Shenzhen, has relaxed home buying rules in an effort to stimulate the struggling real estate market, joining other cities in similar efforts. The city has eased personal income tax and social insurance payment requirements for home buyers, allowing local families with two or more children to purchase additional homes in certain districts. This move follows previous measures implemented in February, reflecting ongoing concerns about declining home prices and property investment nationwide.

- Looking forward, it is a quiet week for economic data in the region with Hong Kong and China Foreign Reserves are due out later today and China Trade Balance on Thursday

ASIA PAC EQUITIES: Asian Equities Head Higher On US Rate Cut Bets, RBA On Hold

Asian markets are higher today, with South Korea and Japan both returning from breaks. South Korean equities are the top performing today as tech stocks traded up 1% overnight, with the market bringing forward rate cut expectations to November from December. Locally, focus today has been on the RBA where left rates on hold as widely expected. The RBA also stuck to the line of not ruling anything in or out. The forecast profile sees higher inflation in the near term but still returning to target by end 2025 and the mid point 2026, elsewhere Philippines CPI was below consensus.

- Japanese equities are higher today with the Nikkei 225 is performing better than the Topix largely due to the higher concentrations of tech names in the index. Focus is still on the JPY as it has continued it's slide again, with the USDJPY now trading back at 154.60 vs the lows made on May 3rd of 151.86, the currency may have more room to fall after comments earlier from Kanda where he said "intervention is not necessary if markets are orderly". Focus this week will be on earnings from Toyota and Tokyo Electron. The Topix is up 0.42%, while the Nikkei 225 is up 1.35%.

- South Korean equities have soared higher after returning from a break on Monday, hopes of an earlier Fed rate cut are helping spur chip names higher. Samsung and SK Hynix are the the biggest contributors to the market gains. There is little in the way of economic data out for the next week in South Korea, with focus largely on global events and corporate earnings. The Kospi is up about 2.00%, trading well above all moving averages, while there are increasing greens bars for the MACD indictor and the 14-day RSI has ticked up to 58.

- Taiwan equities are higher today, with semiconductor names the top performing sector. The Taiex is now up 6.71% from lows made the day of the Israel/Iran conflict, and now comfortably trades above all major EMA's while the 14-day RSI sits at 58.5 and the MACD has increasing green bars indicating buyers are in control. Looking ahead focus will turn to CPI due out later today with consensus of 2.20% up from 2.14% in March. The Taiex is up 0.36%.

- Australian equities have benefitted from the RBA keeping rates on hold, the ASX200 was trading 0.77% higher prior to the announcement, and now trades up 1.20% Earlier we had Retail Sales Ex Inflation come in below expectations at -0.4% vs -0.3% and down from 0.40% in 4Q.

- Elsewhere in SEA, New Zealand equities are down 0.25%, Indonesian equities continue to see foreign investors selling, although the market has held up relatively well and trades unchanged today. Malaysian equities are making new all-times-highs, while foriegn investors continue to buy the market is up 0.75% today, Singapore equities are up 0.10%, while Philippines CPI missed estimates earlier coming in at 3.8% vs 4.1% with the PSEi down 0.20%

OIL: Geopolitics Driving Oil Prices Again As Gaza Negotiations To Continue

Oil prices are off their intraday highs and began to moderate as the US dollar rose. They are still up moderately during the APAC session. Negotiations on a Gaza truce will continue in Egypt after Hamas responded. A deal is likely to drive crude lower as the geopolitical risk premium unwinds further. The USD index is up 0.1%.

- WTI is up 0.3% to $78.71/bbl after falling to $78.55 following a high of $79.02. Brent is 0.3% higher at $83.57 after a low of $83.36 and a high of $83.82.

- Geopolitics are currently the focus of energy markets. A “softened” version of the US/Egyptian brokered proposal has been agreed to by Hamas, according to Reuters. This amended offer has been unanimously rejected by Israel’s war cabinet but it will send negotiators back to Egypt. Israel has begun operations in Rafah.

- Last week the US recorded a strong crude inventory build and so the API data released later today will be monitored closely given the upcoming driving season. The EIA also releases its Short-Term Energy Outlook today. BP and Aramco release earnings as well which may include commentary on the outlook.

- Later the Fed’s Kashkari speaks and March US consumer credit is released. There are also March German factory orders and euro area retail sales.

GOLD: Consolidates Monday's Gains

Gold has been relatively steady in the first part of Tuesday trade. We were last near $2324.5, close to the middle part of the rough $2320-$2330 range observed so far in Tuesday trade. Current levels are little changed versus end NY levels from Monday trade (where gold prices rose nearly 1%).

- Supports for gold have come from fresh Mid East tensions, around uncertainty on peace prospects.

- USD sentiment has been more stable today, while US yields are down a touch, providing some offset.

- Goldman Sachs has reiterated its $2700 forecast for end 2024, stating strong EM central bank demand will aid the bullion backdrop (see this BBG link).

- Levels wise, we are above the 20-day EMA, last near $2315.55, while dips sub $2280 have been supported. Recent highs from late April rest around $2352.6.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/05/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 07/05/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 07/05/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 07/05/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/05/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 07/05/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 07/05/2024 | 0900/1100 | ** |  | EU | Retail Sales |

| 07/05/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/05/2024 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/05/2024 | 1530/1130 |  | US | Minneapolis Fed's Neel Kashkari | |

| 07/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 07/05/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/05/2024 | 1900/1500 | * |  | US | Consumer Credit |

| 07/05/2024 | 1930/1530 |  | CA | BOC Sr Deputy Rogers at House Public Accounts committee (no text) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.