-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Antipodean FX Outperforms On Buoyant Risk Appetite

EXECUTIVE SUMMARY

- BRAINARD SEES ‘SOLID’ US RECOVERY, DOWNPLAYS RECESSION RISKS - BBG

- GLOBAL PUBLIC DEBT HITS RECORD $92 TRILLION, UN REPORTS SAYS - RTRS

- UK PROPERTY BUYERS PULL BACK FROM MARKET AFTER JUMP IN RATES - BBG

- RBA SHOULD PAUSE RATE HIKES - EX-BOARD MEMBER MCKIBBIN - MNI

- BANK OF KOREA KEEPS POLICY RATE AT 3.5% - MNI BRIEF

- CHINA'S WORSE THAN EXPECTED EXPORTS DEAL FRESH BLOW TO ECONOMY - BBG

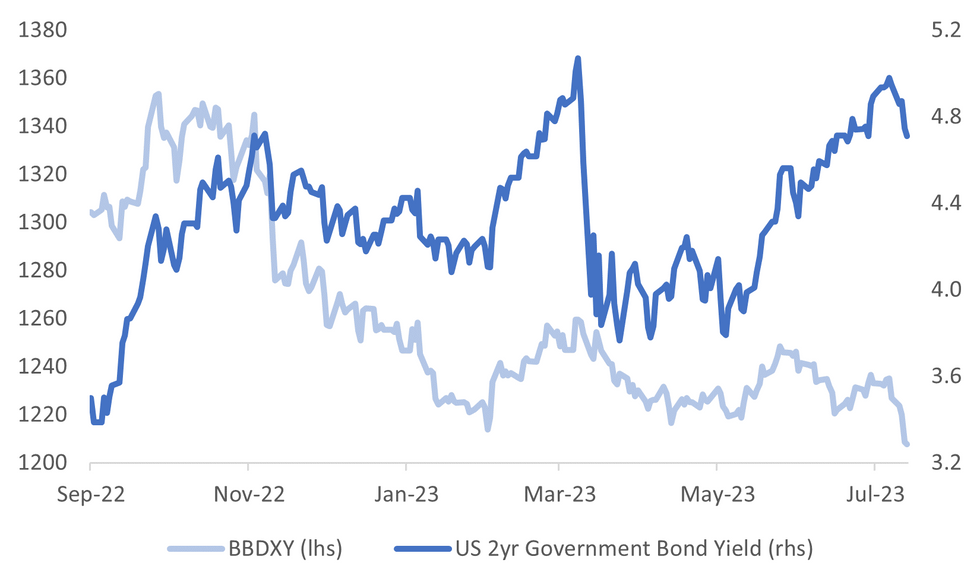

Fig. 1: BBDXY & US 2yr Government Bond Yield

Source: MNI - Market News/Bloomberg

U.K.

HOUSING: Britain’s prospective home buyers pulled back from the property market at the sharpest pace in eight months, a survey showed in a sign that higher borrowing costs are weighing on affordability. The Royal Institution of Chartered Surveyors said its index tracking house prices fell to minus 46% in June from minus 30% the month before — 11 points below the level economists had expected. A gauge of new buyer interest fell 25 points to minus 45%. (BBG)

EUROPE

UKRAINE: U.N. Secretary-General Antonio Guterres has proposed to Russian President Vladimir Putin that he extend a deal allowing the safe Black Sea export of grain from Ukraine in return for connecting a subsidiary of Russia's agricultural bank to the SWIFT international payment system, sources told Reuters. (RTRS)

U.S.

ECONOMY: President Joe Biden’s top economic adviser said US inflation is trending toward lower levels and downplayed chances of a recession hitting the US economy. White House National Economic Council Director Lael Brainard credited Biden’s policies for those developments during a Wednesday speech to the Economic Club of New York. The address was part of a series of appearances by top administration officials aimed at burnishing the president’s economic record ahead of the 2024 election. (BBG)

US/CHINA: Carlyle Group Inc. and Trustar Capital are seeking a partial exit from McDonald’s Corp.’s operations in Hong Kong and mainland China, people familiar with the matter said, in a deal that would raise $4 billion. (BBG)

MARKETS: Trade Desk Inc. will replace Activision Blizzard Inc. in the Nasdaq 100, the index provider said in a statement. Shares of Trade Desk have surged 89% this year, helped by growing expectations for its advertising technology business amid excitement over artificial intelligence. Activision Blizzard has risen 18%, lagging the Nasdaq 100’s 40% climb during a contentious $69 billion takeover plan by Microsoft Corp. (BBG)

MARKETS: The US Federal Trade Commission filed a notice in court that it intends to appeal a ruling by a federal judge in California allowing Microsoft Corp. to move forward with its $69 billion acquisition of Activision Blizzard Inc. (BBG)

POLITICS: U.S. President Joe Biden's public approval rating held steady at 40% in early July, close to the lowest levels of his presidency, as economic worries continued to trouble Americans, according to a Reuters/Ipsos poll this week. (RTRS)

FED: Senator Elizabeth Warren called on the Federal Reserve to halt interest-rate increases as the US inflation rate slid to a more than two-year low. “Take yes for an answer, Chair Powell, and let’s stop with the rate increases,” Warren, a Massachusetts Democrat, said Wednesday in an interview on Bloomberg Television’s “Balance of Power.” “Done.” (BBG)

OTHER

AUSTRALIA: The Reserve Bank of Australia runs the risk of over tightening should it hike further, as supply-side disruptions dissipate and inflation peaks, a former board member told MNI this week. Warwick McKibbin, now Australian National University economics professor and an RBA board member between 2001-2011, said in an exclusive interview that energy and shipping prices have reverted to 2019 levels and supply shocks from Covid and the Ukraine war may have self-corrected. Further hikes will continue to slow an economy already decelerating due to the supply-side adjustments, he said. (MNI)

DEBT: Global public debt surged to a record $92 trillion in 2022 as governments borrowed to counter crises, such as the COVID-19 pandemic, with the burden being felt acutely by developing countries, a United Nations report said. Domestic and external debt worldwide has increased more than five times in the last two decades, outstripping the rate of economic growth, with gross domestic product only tripling since 2002, according to the Wednesday report, released in the run up to a G20 finance ministers and central bank governors' meeting July 14-18. (RTRS)

SOUTH KOREA: The Bank of Korea on Thursday decided to keep its policy interest rate unchanged at 3.5% for the fourth consecutive meeting, amid growing concern over the weaker economy and the falling headline inflation rate, Wowkorea reported. The decision was widely expected as the country has suffered from a slower economy due to weaker exports. (MNI BRIEF)

SOUTH KOREA: BOK Governor Rhee Chang-yong ruled out an imminent rate cut, noting the Board wanted to maintain the restrictive policy stance for a considerable time and the government remained vigilant against future inflation. “Although inflation has slowed, it is forecast to pick up again to around the 3% level since August and to remain above the target level for a considerable time,” Rhee said. The BOK expects considerable time before inflation reaches the target level, he added. “In this process, the Board will judge whether the Base Rate needs to rise further while thoroughly assessing the pace of inflation slowdown, financial stability risks, economic downside risks, and monetary policy changes in major countries and its effects on the foreign exchange sector,” the governor said (MNI BOK WATCH).

CHINA

TRADE: China’s exports fell for a second straight month in June, adding to the economic pain that has slowed the nation’s recovery this year. Exports declined 12.4% in dollar terms in June from a year earlier, while imports dropped 6.8%, the customs administration said Thursday. That left a trade surplus of $70.6 billion for the month. Economists had forecast that exports would drop 10% while imports would shrink 4.1%. (BBG)

TECH: Government departments at all levels should create a market environment that supports platform enterprises, according to Premier Li Qiang. At a recent exchange meeting with company bosses, Li said platform enterprises should look forward with confidence, continue promoting innovation and better empower the real economy. Platform firms can boost demand and provide new engines for innovation and employment. Leaders from several firms attended the meeting, including Meituan, Alibaba Cloud and Douyin. (MNI)

POLICY: The People’s Bank of China will not engage in "flood irrigation," or excessive money supply, for the next stage and continue to implement prudent monetary policy, according to Governor Yi Gang. Writing recently for Economic Research, Yi said the PBOC will continue counter-cyclical and inter-cyclical measures which take into account short-term and long-term economic growth and price stability.(MNI)

YUAN: The yuan may stop depreciating against the U.S. dollar, but will not record a strong reversal in Q3, as the U.S. Federal Reserve continues to hike rates, which will support USD in the short term. China may still face economic downward pressure in Q3 with unemployment likely to rise mid-year, while the U.S. job market remains resilient with core inflation at a relatively high level, said Li Chao, chief economist of Zheshang Securities.(MNI)

ECONOMY: China is expected to consolidate economic recovery with a combination of fiscal, monetary and industrial policies in the second half of this year, China Securities Journal says in a front-page report, citing unidentified analysts. (CSJ)

ECONOMY: Recent meetings between government officials and company executives highlight China policymakers’ focus on the private sector, Securities Times reports. (BBG)

DEBT: One of China’s biggest state-run investors is adding to the chorus of warnings over debt risks at the nation’s cash-strapped developers and local government financing vehicles. The National Council for Social Security Fund, which oversees about $417 billion according to the latest available figures, has advised asset managers that handle its money to sell some bonds including those from riskier LGFVs and private developers after a review, people familiar with the matter said, asking not to be identified discussing private information. (BBG)

DEBT: China should step up efforts to resolve local government debt risks, as relaxed management of the debt could easily end up a “gray rhinoceros” event that poses huge risks to the economy, an Economic Daily commentary said.(BBG)

COMMODITIES: The Shanghai Futures Exchange seeks to expand its commodities warehouse network outside China, Reuters reports, citing three unidentified people with direct knowledge of the matter. (RTRS)

CHINA MARKETS

PBOC Net Injects CNY3 Bln Via OMOs Thursday

The People's Bank of China (PBOC) conducted CNY5 billion via 7-day reverse repos on Thursday, with the rates at 1.90%. The operation has led to a net injection of CNY3 billion after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7871% at 09:36 am local time from the close of 1.7526% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Wednesday, compared with the close of 44 on Tuesday.

PBOC Yuan Parity Lower At 7.1527 Thursday Vs 7.1765 Wednesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for the fifth trading day at 7.1527 on Thursday, compared with 7.1765 set on Wednesday. The fixing was estimated at 7.1615 by BBG survey today.

OVERNIGHT DATA

SOUTH KOREA JUNE EXPORT M/M -2.8%; PRIOR -1.5%

SOUTH KOREA JUNE EXPORT Y/Y -14.7%; PRIOR -11.3%

SOUTH KOREA JUNE IMPORT M/M -3.4%; PRIOR -3.1%

SOUTH KOREA JUNE EXPORT Y/Y -15.7%; PRIOR -12.3%

BOK 7-DAY REPO RATE 3.50%; MEDIAN 3.50%; PRIOR 3.50%

NZ JUNE REINZ HOUSE SALES Y/Y 14.6%; PRIOR -0.4%

NZ JUNE BUSINESS MANUFACTURING PMI 47.5; PRIOR 48.7

NZ JUNE FOOD PRICES M/M 1.6%; PRIOR 0.3%

NZ JUNE CARD SPENDING RETAIL M/M 1.0%; PRIOR -1.7%

NZ JUNE CARD SPENDING TOTAL M/M 1.3%; PRIOR -2.1%

AUSTRALIA JULY CONSUMER INFLATION EXPECTATIONS: 5.2%; PRIOR 5.2%

CHINA JUNE EXPORTS Y/Y -12.4%; MEDIAN 10.0%; PRIOR -7.5%

CHINA JUNE IMPORTS Y/Y -6.8%; MEDIAN -4.1%; PRIOR -4.5%

CHINA JUNE TRADE BALANCE $70.62bn; MEDIAN $74.90bn; PRIOR $65.79bn

MARKETS

US TSYS: Curve Marginally Steeper In Asia

TYU3 deals at 112-11, +0-02+, a touch off the top of the 0-05 range on volume of ~65k.

- Cash tsys sit 4bps richer to 1bp cheaper across the major benchmarks, the curve has twist steepened pivoting on 20s.

- The short end of the curve marginally extended its move seen post US CPI yesterday, TU sits above Wednesday's high.

- Ranges were narrow with little follow through on moves for the majority of the session. Little meaningful macro news flow crossed in Asia today.

- In Europe today May's GDP release from the UK provides the highlight. Further out we have June PPI and Weekly Initial Jobless Claims. Fedpseak from SF Fed President Daly crosses. We also have the latest 30-Year Supply.

JGBS: Futures Holding Stronger, Range Bound Tokyo Session Despite Solid Demand For 20Y Supply

JGB futures are richer, +22 compared to settlement levels, but have pared their gains in the Tokyo afternoon session. This comes despite today’s 20-year supply showing stronger demand.

- As mentioned in our preview, today's auction likely benefited from factors such as a higher outright yield, a steeper 10/20 yield curve, and the 20-year bond becoming relatively cheaper in relation to the 10/20/30-year butterfly. The allure of a new bond issue might have also played a role.

- Bloomberg reports that 10-year OIS, popular with international funds, have climbed well beyond the central bank’s ceiling for equivalent yields. That’s a sign that at least some market players think the BOJ may choose to reshape its policy of holding down 10-year yields. (See link)

- Cash JGBs exhibit a mixed performance along the yield curve, with the futures-linked 7-year zone, outperforming (1.3bp richer), while the 40-year zone underperforms (1.5bp cheaper).

- The 20-year zone is 0.8bp richer, after richening around 3bp in early post-auction trade.

- The swaps curve twist steepened, pivoting at the 20-year. Swap spreads are tighter across the curve, apart from the 7-year.

- Tomorrow the local calendar sees Industrial Production and Capacity Utilisation data for May along with BoJ Rinban operations covering 1-10-year and 25-Year+ JGBs.

AUSSIE BONDS: Sharply Richer, Narrow Range In Sydney Session, US PPI Due

ACGBs are holding sharply richer (YM +10.0 & XM +7.0) in a narrow range in the Sydney session after tracking US tsys stronger following the release of lower-than-expected US CPI data. Without meaningful domestic drivers, local market participants have been on US tsys watch ahead of June US PPI and weekly Jobless Claims data later today.

- US cash tsys sit 4bp richer to 1bp cheaper across the major benchmarks, with the curve twist steepening, pivoting on 20s. The short end of the curve marginally extended its move seen post-US CPI yesterday, Ranges have been narrow with little follow-through on moves for the majority of the session. Little meaningful macro news flow crossed in Asia today.

- Cash ACGBs are 7-9bp richer with the AU-US 10-year yield differential +3bp at +21bp.

- Swap rates are 5-8bp lower with the 3s10s curve steeper.

- The bills strip bull steepens with pricing +3 to +11.

- RBA-dated OIS pricing is 4-10bp softer for meetings beyond August.

- (ABC) Opposition Leader Peter Dutton says two of the government's potential picks to replace Philip Lowe as Reserve Bank governor would not be able to operate independently because of their established relationships with the government. (See link)

- Tomorrow the local calendar sees no data.

NZGBS: Closed On A Positive Note, Solid Demand Seen At Weekly Auction

NZGBs closed on a strong note with benchmark yields 9-11bp lower despite retail card spending rising 1% m/m in June versus -1.7% in May. Core retail card spending was however unchanged m/m. Food prices rose 1.6% in June versus +0.3% prior, while Business NZ manufacturing PMI declined to 47.5 from a revised 48.7.

- Today’s weekly auction saw solid demand for the May-31 and May-51 lines with cover ratios of 3.35x and 3.71x respectively. The cover ratio for the May-26 bond was 2.49x. The longer-dated cash lines were 2-4bp richer post-auction.

- NZ-US and NZ-AU 10-year yield differentials closed 1bp and 3bp tighter respectively.

- Swap rates closed 7-11bp lower with the 2s10s curve 1bp flatter and implied swap spreads wider.

- RBNZ dated OIS closed 6-14bp softer for meetings beyond October with terminal OCR expectations at 5.64%.

- Bloomberg reports that economists have called an end to New Zealand’s housing slump, saying the latest data show the market has found a floor and prices are starting to recover. A REINZ report released Thursday in Wellington showed house prices rose 0.4% in June while sales continued to recover. (See link)

- Tomorrow is a public holiday in NZ.

- Later today sees the market attention tuned to June US PPI and US Jobless Claims data.

FOREX: Greenback Pressured In Asia

The post-CPI move lower in the USD has marginally extended in Asia on Thursday, BBDXY has breached post CPI lows and sits down ~0.15%.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD is up ~0.5%, the pair last prints at $0.6325/30. Bulls now target the high from 11 May ($0.6385).

- AUD/USD is ~0.4% firmer, the pair has extended gains through the session and sits at session highs. A move above 0.6828 a retracement level, would open up mid June highs around 0.6900.

- Yen is little changed, USD/JPY briefly dealt below its post CPI lows before support was seen and losses were pared.

- Elsewhere in G-10 EUR and GBP are ~0.2% firmer and CHF printed its highest level in 8 years. USD/CHF sits at 0.8650/60.

- Cross asset wise; regional equities and US equity futures are firmer benefitting from the improving risk sentiment. Hang Seng is up ~2.5% and e-minis are up ~0.3%. 2 Year US Tsy Yields are ~4bps lower.

- In Europe today we have May GDP from the UK, further out US PPI and Initial Jobless Claims cross.

EQUITIES: Strong Gains For Most Asia Pac Indices On Positive Wall St Spillover/China Optimism

Asia Pac equities are virtually a sea of green in Thursday trade. At this stage only Indonesian markets are tracking lower within the region. The HSI is the strongest performer, while US futures have seen positive gains so far. Eminis were last near 4518, +0.24% for the session, building on positive momentum from Wednesday's US session. Nasdaq futures are outperforming, +0.40%, showing greater sensitivity to lower US yield moves.

- Outside of positive global equity sentiment post the US CPI miss, HK and China shares have also been buoyed by the focus of the authorities on stimulating the private sector. This follows meetings between senior China tech officials and China's Premier. President Xi Jinping has also stated the country should open up to more foreign investment earlier in the week.

- At the break, the HSI is up 2.49%, with the tech sub-index +3.43%. The China Enterprise index is +2.48% higher, while the CSI 300 is +1.12% higher at the break.

- Tech sensitive plays are doing better elsewhere as well, the Taiex +1.40%, the Kospi slightly weaker at +0.80%, but the Kosdaq is +1.50%. Japan shares are also up +1.5% for Nikkei 225.

- In SEA trends are slightly more mixed. Singapore stocks are +1.60%, but flat in Malaysia. Thailand shares are a touch higher, as the market focuses on the parliament PM vote. Indonesian shares are down a touch.

OIL: Brent Consolidates Above $80/bbl

Brent crude has spent most of the session pushing higher. We were last in the $80.40/45/bbl region, with highs at $80.54/bbl, against an earlier low near $80/bbl. This puts us +0.40% higher for the session and follows Wednesday's aggregate gain of 0.89%. At this stage, Brent is tracking comfortably higher for the week. WTI is currently at $76/bbl, which is +0.34% firmer for the session.

- The technical back drop looks positive for oil, as Brent consolidates gains above the $80/bbl level. Late April highs just above $83/bbl may present as the next upside target, although the 200-day EMA around $82.30/bbl has to be cleared first.

- China June trade data showed solid y/y gains for crude oil (+11.7% and oil product (+44.7%) imports in volume terms. This may help sentiment at the margin.

- Looking ahead we have the IEA and OPEC oil market reports on tap.

GOLD: 3-Week High After US CPI Undershoot

Gold is +0.2% in the Asia-Pac session, after rising to the highest in three weeks following lower-than-expected US inflation data. The CPI report fuelled speculation that the forthcoming 25bp hike from the Federal Reserve would be the final one. The market places the chance of a July Fed hike at 90%, but the odds of further hikes softened. November cumulative tightening eased to 30bp from 35bp.

- US headline inflation declined from 4% to 3% in June, marking the slowest rate of inflation since March 2021. The market expected 3.1%. Core inflation also fell short of expectations, printing 4.8%. The decrease was primarily driven by softer airfare, hotel costs, and a decline in used vehicle prices. Notably, prices for core services ex-rent experienced a modest annualized growth rate of 2.9% during the three months leading up to June.

- The dollar and US tsy yields dropped following the report, boosting bullion, which closed 1.3% higher.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/07/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/07/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/07/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/07/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/07/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/07/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/07/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/07/2023 | - | *** |  | CN | Trade |

| 13/07/2023 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 13/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/07/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/07/2023 | 1230/0830 | *** |  | US | PPI |

| 13/07/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/07/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/07/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 13/07/2023 | 2245/1845 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.