-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Asia Pac Equities Recover Further, US NFP In Focus

EXECUTIVE SUMMARY

- BLINKEN SET FOR TALKS WITH NETANYAHU AND CABINET - BBG

- BOJ AIMS TO GRADUALLY GUIDE RATES HIGHER - MNI

- ECB CAN’T CLOSE THE DOOR TO FURTHER HIKES, SCHNABEL SAYS - BBG

- CHINA WANTS EU COOPERATION ON GREEN TRANSITION - MNI BRIEF

- CHINA SERVICES ACTIVITY PICKS UP SLIGHTLY IN OCTOBER - RTRS

- CHINA TO ADVANCE LOCAL SPECIAL BONDS TO BOOST ECONOMY - MNI

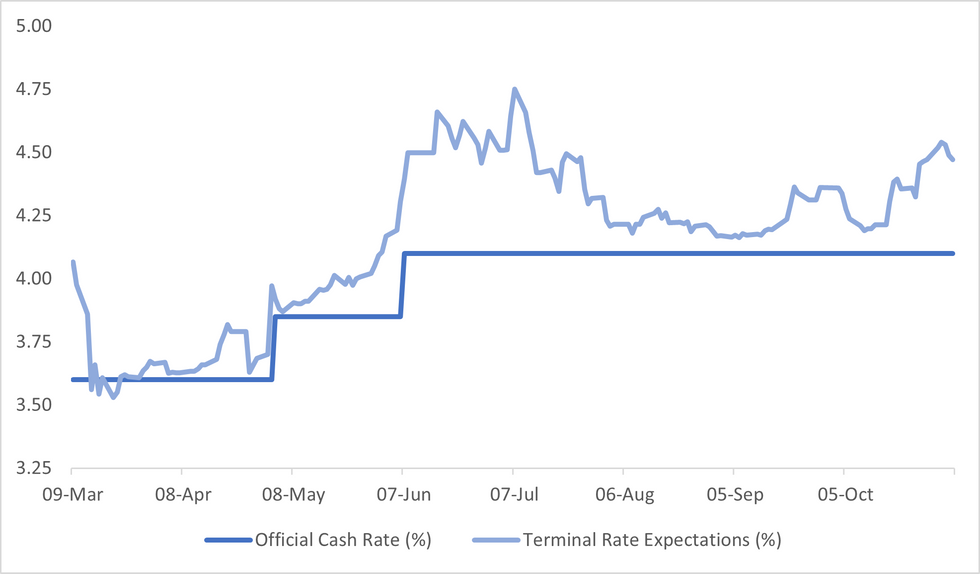

Fig. 1: RBA Official Cash Rate & Terminal Rate Expectations

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): Prime Minister Rishi Sunak said the UK will probably hold a general election next year, suggesting he’s unlikely to let the Conservative Party’s term in office run to its limit.

EUROPE

ECB (BBG): The European Central Bank’s fight against inflation might require another increase in interest rates, according to Executive Board member Isabel Schnabel. “After a long period of high inflation, inflation expectations are fragile and renewed supply-side shocks can destabilize them, threatening medium-term price stability,” she said in a speech Thursday in St. Louis. “This also means that we cannot close the door to further rate hikes.”

UKRAINE (POLITICO): Senior Ukrainian politicians appealed to Europe to not abandon the country after the Italian prime minister unintentionally disclosed during a prank call that European leaders were growing weary of Russia’s invasion of Ukraine after the country’s unconvincing counteroffensive.

U.S.

US/ISRAEL (BBG): US Secretary of State Antony Blinken heads to Tel Aviv for talks with Prime Minister Benjamin Netanyahu and his War Cabinet as Israeli troops encircled Gaza City, insisting a cease-fire isn’t on the table.

CORPORATE (BBG): Apple Inc., already facing a slowdown in China, warned that revenue in the holiday quarter will be about the same as last year, signaling that investors won’t see the growth rebound they were banking on.

MORTGAGES (BBG): Mortgage rates in the US fell for the first time in eight weeks, while sticking close to a two-decade high. The average for a 30-year, fixed loan was 7.76%, down from 7.79% last week, Freddie Mac said in a statement Thursday.

FISCAL (BBG): US Treasury Secretary Janet Yellen disputed billionaire investor Stan Druckenmiller’s assertion that her department had made “the biggest blunder in history” by not taking advantage of near-zero interest rates to sell more longer-term bonds.

OTHER

ISRAEL(RTRS): Israeli forces on Thursday encircled Gaza City - the Gaza Strip's main city - in their assault on Hamas, the military said, but the Palestinian militant group resisted their drive with hit-and-run attacks from underground tunnels.

JAPAN (MNI POLICY): The Bank of Japan will gradually guide the yield on 10-year bonds to levels above 2% if it reaches its 2% inflation target sustainably, but will also seek to ensure that the increase is slow enough to give commercial banks time to adjust, MNI understands.

AUSTRALIA (MT NEWSWRIES): Australian retail sales volumes rose 0.2% quarter over quarter to AU$98.31 billion in the third quarter. The rise followed declines of 0.6% in Q2, 0.7% in Q1 and 0.6% in Q4 2022, according to a Friday news release.

NEW ZEALAND (RTRS): Final results from New Zealand's Oct. 14 election released on Friday show the centre-right National Party will need the support of both the ACT New Zealand and NZ First parties to form a government.

CHINA

ECONOMY (RTRS): China's services activity expanded at a slightly faster pace in October, a private-sector survey showed on Friday, with sales growing at the softest rate in 10 months and employment stagnating as business confidence waned.

CHINA/EU (MNI BRIEF): China remains committed to work with EU member nations to accelerate green transformation and achieve energy conservation and emission reduction, according to Shu Jueting, spokesperson for the Ministry of Commerce.

FDI (21st Century Business Herald): China will firm efforts to attract foreign investment including more engagement and help accessing investment opportunities and policy promotions, according to Shu Jueting, spokesperson for the Ministry of Commerce (MOFCOM). Foreign investment in China from January-September was CNY919 y/y, a 8.4% decrease, MOFCOM said.

YUAN (21st Century Business Herald): The potential end of the U.S. Federal Reserve's interest rate hikes could bring overseas capital back to the A-share market and support the rebound of the yuan, 21st Century Business Herald reported, citing market insiders. The net inflow of northbound funds into A-shares exceeded CNY4 billion on Thursday. Many Wall Street investment institutions predict the yuan will rebound to 7-7.1 against the U.S. by the end of Q1 2024, as the Fed lowers its benchmark interest rate to 4.5%, which will significantly narrow the China-U.S. interest-rate spread, said an unnamed Wall Street hedge fund manager.

FISCAL (YICAI): Local governments issued CNY8.5 trillion of public bonds in the first 10 months of 2023, a new record, according to Yicai news agency. The total volume consisted of CNY4 trillion in refinancing bonds, up 74% y/y. Zhang Yu, chief macro analyst of Huachuang Securities, said the government will continue to exert strong fiscal policy in the near future with newly announced CNY1 trillion treasury bonds and advancing up to CNY2.28 trillion of bonds from 2024.

FISCAL (MNI): China will bring forward part of its roughly CNY3 trillion 2024 quota for issuance of infrastructure-backed local-government “special bonds” to the beginning of next year to ensure investment retains momentum, policy advisors and market analysts told MNI.

CHINA MARKETS

MNI: PBOC Drains Net CNY456 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY43 billion via 7-day reverse repo on Friday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY456 billion after offsetting the maturity of CNY499 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7168% at 09:55 am local time from the close of 1.8283% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 33 on Thursday, compared with the close of 40 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1796 Friday vs 7.1797 Thursday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1796 on Friday, compared with 7.1797 set on Thursday. The fixing was estimated at 7.3134 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA OCT FOREIGN RESERVES $412.87BN; PRIOR $414.12BN

AUSTRALIA OCT F JUDO BANK PMI SERVICES 47.9; PRIOR 47.6

AUSTRALIA OCT F JUDO BANK PMI COMPOSITE 47.6; PRIOR 47.3

AUSTRALIA Q3 RETAIL SALES EX INFLATION Q/Q 0.2%; MEDIAN -0.3%; PRIOR -0.6%

CHINA OCT CAIXIN SERVICES PMI 50.4; MEDIAN 51.0; PRIOR 50.2

CHINA OCT CAIXIN COMPOSITE PMI 50.0; PRIOR 50.9

MARKETS

US TSYS: Cash Re-Opens In London, NFP In View

TYZ3 deals at 107-15, -0-00+, a 0-05+ range has been observed on volume of ~59k.

- Cash tsys have been closed in today's Asian session due to the observance of a national holiday in Japan and will reopen in the London session.

- Tsys have observed a narrow range in Asia with little follow on moves, the Japanese holiday affected general liquidity.

- US Equity futures were moderately pressured in early trade as Apple's Q4 Sales Outlook disappointed. A recovery was seen from session lows however e-minis and NASDAQ futures are holding lower. There was little spillover into the Tsys and the greenback remained stable.

- The proximity to this evening's NFP also limited activity in Asia. The MNI preview is here.

- Also due today is the final print of Services PMI and the ISM Services Survey.

AUSSIE BONDS: Richer, Narrow Ranges, Awaiting US Payrolls Data

ACGBs (YM +1.0 & XM +4.5) are richer but near Sydney session cheaps after Q3 retail sales volumes unexpectedly rose 0.2% q/q in Q3. This was stronger than expected (consensus -0.3%), although the Q2 dip was revised down a touch to -0.6%. It was the first rise in quarterly retail sales volumes since Q3 last year.

- With cash tsys closed in Asia due to the observance of a national holiday in Japan, the local market traded in a narrow range in the latter part of the session ahead on US Non-Farm Payrolls later today.

- Cash ACGBs are 2-5bps richer, with the 3/10 curve flatter.

- Swap rates are 1-5bps lower, with EFPs little changed.

- The bills strip is slightly mixed, with pricing +/-1.

- Looking ahead to next week, the local calendar sees Melbourne Institute Inflation Gauge and ANZ-Indeed Job Advertisements on Monday, ahead of the RBA Policy Decision on Tuesday. Bloomberg consensus is almost unanimous (21/24 economists polled) in expecting a 25bp hike to 4.35% at next week’s meeting.

- RBA-dated OIS pricing assigns a 69% probability to a 25bp rate hike next Tuesday.

- Next Wednesday, the AOFM plans to sell A$800mn of the 2.75% Jun-35 bond.

- TCorp announces that it has increased the existing 3.00% Mar-28 benchmark bond by A$600mn via reverse enquiry.

NZGBS: Slight Twist-Flattening, Awaiting US Payroll Data

At the local close, NZGBs exhibited a slight twist-flattening of the curve, with yields 1bp higher to 2bps lower. With the domestic calendar empty today and cash tsys closed in Asia due to the observance of a national holiday in Japan, the local market largely drifted through the session ahead on US Non-Farm Payrolls later today.

- US tsy futures are dealing at 107-16+, +0-01 compared to the NY close. US equity futures sit lower as Apple’s Q4 sales outlook continues to weigh.

- Swap rates closed 1bp higher to 2bps lower, with the 2s10s curve flatter and implied swap spreads wider.

- RBNZ dated OIS pricing is little changed, with terminal OCR expectations at 5.56% (+6bps by Feb’24).

- In the final election result, the NZ Nationals need the support of 2 other parties to form government after losing 2 seats.

- Looking ahead to next week the docket is relatively light with Q4 Inflation Expectations the highlight. We also have October Mfg PMI and Card Spending.

- Next Thursday, the NZ Treasury plans to sell NZ$175mn of the 4.5% May-30 bond, NZ$225mn of the 2.0% May-32 bond and NZ$100mn of the 2.75% Apr-37 bond.

FOREX: Narrow Ranges In Asia, NFP In View

There have been narrow ranges across G-10 FX on Friday. The USD is a touch lower, BBDXY is down ~0.1%. The proximity to todays NFP print is perhaps limiting activity. Cross asset wise US Equity Futures are softer after Apple's Q4 Sales Outlook disappointed. Japanese markets are closed which has affected general liquidity.

- AUD/USD has observed a narrow $0.6425/35 range for the most part this morning. There has been little follow through on moves. Technically short term gains in AUD/USD are considered corrective. Resistance comes in at $0.6456, high from Nov 2, and $0.6501, high from Sep 29. Support is at $0.6270, low from Oct 26 and bear trigger.

- Kiwi is little changed, NZD/USD sits in a narrow range a touch below the $0.59 handle.

- Yen is also flat, technically the bullish conditions in USD/JPY are intact. Resistance comes in at ¥151.72, Oct 31 high, and ¥151.95, high from Oct 21 and major resistance. Support is seen at ¥149.78, 20-Day EMA.

- The Scandies are marginally outperforming in the space however moves have not yet followed through and liquidity is generally poor in Asia.

- October’s NFP print provides the highlight today, the docket is relatively light in Europe with French Industrial Production the standout release.

EQUITIES: Asia Pac Equities Continue Recovery, US Futures Weighed By Apple

Regional equity markets are a sea of green in Friday trade, with solid gains across the board. This follows strong gains in US and EU markets during Thursday trade. US equity futures are lower in the first part of Friday trade, largely thanks to Apple losses post a disappointing earnings update late in Thursday trade. Eminis are down 0.07%, last near 4333, Nasdaq futures are underperforming, off 0.25% at this stage. We also have the US NFP print later.

- Note Japan markets are closed today.

- In Hong Kong, the HSI is up over 2% at the break, led by the tech sub-index (+2.31%). In China, the CSI is up 0.86% at the break, putting the index ack to 3585 levels. Markets largely ignored the weaker than expected Caixin services PMI print (although the index remain in expansion territory).

- Northbound stock connect flows are tracking higher, +6.84bn yuan at this stage.

- The Kospi is +0.80% higher, away from session highs. Offshore and institutional investors have been net buyers, while retail investors have been sellers. The Taiex is around 0.50% firmer.

- The ASX 200 is up over 1%, with financials and materials leading the move higher.

- In SEA, gains are broad based, with Singapore markets (+2%), and the returning Philippines bourse, +1.2% the standouts.

OIL: Recovers Further Ground, But Still Down Sharply For The Week

The bias in oil benchmarks has been to push higher in the first part of Friday trade. Brent was just off session highs last near $87.20/bbl. This is close to Wednesday session highs ($87.24/bbl), but we haven't breached this level yet. Brent is 0.35% firmer, following Thursday's 2.62% gain, but we are still down nearly 3.7% for the week at this stage. WTI was last near $82.85/bbl, following a similar trajectory but off 3.15% for the week.

- The broader risk on tone in regional Asia Pac equities has likely aided the oil bid, although the USD is only down slightly against the majors.

- The focus in the near term will be on US Secretary Of State Blinken's trip to Israel today (due to arrive 10am local time/8am BST). This comes after Israel stated it had encircled the Gaza Strip's largest city, while Blinken will reportedly ask Israel to minimize causalities in Gaza (see this RTRS link).

- After this, later on we get the US NFP report, while next Tuesday we get an update on China trade, which will include details around oil imports.

GOLD: Headed For Its First Weekly Decline On Fading Haven Demand

Gold is steady in the Asia-Pac session, after closing +0.2% at $1985.78 on Thursday.

- Bullion seems to be on track for its first weekly decline in four, as the demand for safe-haven assets wanes while the Middle East conflict remains contained.

- The reduction in the conflict premium has outweighed the decrease in Treasury yields and indications that the Federal Reserve is shifting away from policy tightening.

- Notably, the 10-year US Treasury yield experienced an 8bp drop on Thursday, closing at 4.66%. This marks a cumulative decrease of 36bps since it reached its highest level since 2007 last week, peaking at 5.02%.

- The market now looks ahead to Non-Farm Payrolls data this evening. It will be watched for its impact on the Fed’s rate path.

- From a technical standpoint, gold’s current level neither troubles support at $1950.4 (20-day EMA) or resistance at $2009.4 (Oct 27 high). Nevertheless, the trend outlook appears bullish, according to MNI’s technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/11/2023 | 0700/0800 | ** |  | DE | Trade Balance |

| 03/11/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/11/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 03/11/2023 | 0900/0900 |  | UK | BoE's Hauser speech at Watchers' conference | |

| 03/11/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 03/11/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 03/11/2023 | - |  | UK | BoE APF Q3 Report | |

| 03/11/2023 | 1200/0800 |  | US | Fed's Michael Barr | |

| 03/11/2023 | 1215/1215 |  | UK | BoE's Pill MPR National Agency Briefing | |

| 03/11/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 03/11/2023 | 1230/0830 | *** |  | US | Employment Report |

| 03/11/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/11/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/11/2023 | 1600/1600 |  | UK | BoE's Haskel panellist at Watchers' Conference | |

| 03/11/2023 | 1645/1245 |  | US | Minneapolis Fed's Neel Kashkari | |

| 03/11/2023 | 1930/1530 |  | US | Fed's Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.