-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Maintains The Status Quo

EXECUTIVE SUMMARY

- US AND UK LAUNCH FRESH STRIKES ON HOUTHIS IN YEMEN - BBC

- POLICYMAKER CAUTION COULD IMPEDE BOARD CONSENSUS - MNI POLICY

- BOJ ON HOLD; KEEPS 1% 10-YR JGB YLD AS REFERENCE - MNI BRIEF

- CHINA MULLS STOCK RESCUE PACKAGE BACKED BY $278 BILLION - BBG

- POLICY RATE CUT STILL LIVE, RRR REDUCTION DELAYED - MNI PBOC WATCH

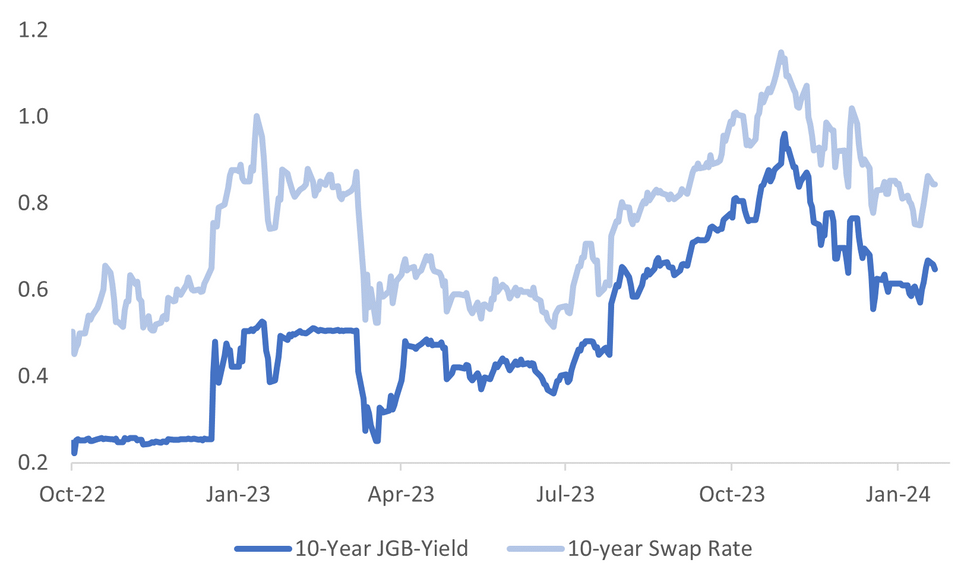

Fig. 1: Japan 10yr JGB Yield & 10Yr Swap Rate

Source: MNI - Market News/Bloomberg

U.K.

BOE (MNI INTERVIEW): Forward guidance is a powerful tool for central banks however they like to define it, a U.S. academic whose methodology has been adopted by the Bank of England told MNI.

POLITICS (BBG): Lawmakers in Britain’s upper house voted to delay the UK’s controversial plan to send migrants to Rwanda, in a decision likely to anger right-wing members of the Conservative Party and threaten Prime Minister Rishi Sunak’s vow to have planes leaving for the African nation by spring.

EUROPE

UKRAINE (BBG): European Union leaders are ready to play hardball with Hungary if Prime Minister Viktor Orban should continue to block a €50 billion ($54.5 billion) support package for Ukraine at an extraordinary summit next week, people familiar with the preparations said.

ECB (MNI ECB WATCH): The European Central Bank is expected to hold key interest rates at 4.00% this Thursday, amid signs that an early consensus is forming for a first cut of the cycle in June.

ECB (BBG): Christine Lagarde’s performance as European Central Bank chief was criticized in a staff union survey marking the halfway point of her eight-year term.

TURKEY (BBG): Turkish parliament is set to vote on Sweden’s entry into the North Atlantic Treaty Organization this week, bringing the alliance to the cusp of completing its Nordic expansion.

GREECE (DER SPIEGEL): Few births and young people , who move away: the population in Greece is sinking. That should change. Soon parents will receive an additional 400 euros for the first child – for siblings there will be an even higher bonus.

U.S.

MID EAST (BBC): The US and UK have conducted a fresh series of joint air strikes against Houthi targets in Yemen. The Pentagon said Monday's strikes hit eight targets, including an underground storage site and Houthi missile and surveillance capability.

OTHER

ISRAEL (BBG): Israel’s ground forces advanced deeper into the southern Gaza Strip on Tuesday, according to the army, with intense fighting reported in an area where tens of thousands of displaced Palestinians are sheltering.

GLOBAL (MNI): Bank for International Settlements General Manager Agustin Carstens on Monday said recent central banks' "success we have had so far must not breed complacency," even as most major institutions have signaled policy rates have likely peaked.

JAPAN (MNI POLICY): The Bank of Japan's board remains divided over whether sufficient evidence of sustainable wage inflation exists to justify a move away from negative rates, meaning Governor Kazuo Ueda's opinion will carry more weight, though officials still hope to achieve consensus, MNI understands.

JAPAN (MNI BRIEF): The Bank of Japan board on Tuesday decided to keep its yield curve control and negative interest rate policy as a virtuous cycle between wages and prices has not strengthened sufficiently to achieve the bank’s 2% target. The BOJ kept the short-term interest target at -0.1%, the long-term interest rate target at around zero percent, and the upper end of for 10-year Japanese Government Bond yields at 1% as a reference.

JAPAN (MNI BRIEF): The Bank of Japan board doubts it can achieve the 2% price target within its projection period to March 2026, however, it indicated the 2% price stability target may come into sight around April, the BOJ's Outlook Report showed Tuesday.

JAPAN (MNI BRIEF): Demand for financing by Japanese corporates via banks fell from three months ago following a fall in capital investment and the improvement of fund-raising tools, according to a senior loan officer opinion survey released by the Bank of Japan on Tuesday.

INDIA (BBG): India’s stock market has overtaken Hong Kong’s for the first time in another feat for the South Asian nation whose growth prospects and policy reforms have made it an investor darling.

CHINA

EQUITIES (BBG): Chinese authorities are considering a package of measures to stabilize the slumping stock market, according to people familiar with the matter, after earlier attempts to restore investor confidence fell short and prompted Premier Li Qiang to call for “forceful” steps.

POLICY (MNI PBOC WATCH): The People’s Bank of China could reduce its policy rates as soon as late Q1 or early Q2 should the economy continue to struggle, however, its recent injection of 7-day repo has lowered the likelihood of a reserve requirement ratio cut before Chinese New Year, economists and analysts told MNI.

POLICY (YICAI): The PBOC could still lower the LPR over March and April based on recent central bank statements, the current policy environment, and actual demand, according to Wen Bin, chief economist at Minsheng Bank. The PBOC has indicated structural tools will play a greater role by mentioning the term "optimising the supply of funds" and "improving the efficiency of fund utilisation" on multiple occasions, Wen added.

CHINA MARKETS

MNI: PBOC Drains Net CNY295 Bln Via OMO Tues; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY465 billion via 7-day reverse repo on Tuesday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY295 billion reverse repos after offsetting CNY760 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7994% at 09:38 am local time from the close of 1.8800% on Monday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 44 on Monday, compared with the close of 50 on Friday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1117 Tuesday vs 7.1105 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1117 on Tuesday, compared with 7.1105 set on Monday. The fixing was estimated at 7.2008 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA DEC PRODUCER PRICES RISE 1.2% Y/Y; PRIOR 0.6%

AUSTRALIA DEC NAB BUSINESS CONFIDENCE RISES TO -1; PRIOR -8

AUSTRALIA DEC NAB BUSINESS CONDITIONS FALL TO 7; PRIOR 9

NZ PERFORMANCE SERVICES INDEX DEC FALLS TO 48.8; PRIOR 51.1

MARKETS

US TSYS: Muted Move Post BoJ Announcement, China Equity Rally Fizzles

TYH4 is trading at 111-16+, + 00+ from NY closing levels.

• Subdued move in cash bonds post the BoJ decision. The 2yr is 1bp lower today and unchanged from prior, with the 10yr about 1.7bp lower, reflecting about a 1bp move lower since BoJ rate decision.

• China equity market rally has fizzled a bit after the Hang Seng initially rallied 3.5%, currently trading 2.7% on the day, while the CSI 300 has reversed all gain to be trading 0.20% lower today.

• As a reminder the BOJ Ueda presser is still to come

• US data is light on tonight, with Richmond Fed Manufacturing index, and Tsy 2Y note sales the only things to note

JGBS: Post-BoJ Rally Pared

JGB futures have pared post-BoJ decision gains to be dealing +4 compared to settlement levels.

- As largely expected, the BoJ delivered no changes in policy, forward guidance or its explicit easing bias. There have also been no signals regarding the termination of the Negative Interest Rate Policy (NIRP). The upper bound reference on long-term yields was also maintained at 1%.

- In terms of forecasts, FY24 Core CPI has been downwardly revised to 2.4% y/y from 2.8% but FY25 has been upwardly revised slightly to 1.8% from 1.7% previously. FY24 & FY25 Core Ex-Energy CPI forecasts were left unchanged at 1.9%.

- A more hawkish development would have been if the 2025 forecast was at or above 2%.

- Cash JGBs have maintained their twist-flattening, pivoting now at the 3s, but the rally at the long end has been pared. The 40-year yield is 3.7bps lower at 2.004% versus a low of 1.98%.

- The benchmark 10-year yield is 1.2bps lower at 0.646% versus a post-BoJ low of 0.635%.

- The swaps curve has bull-flattened, with rates flat to 3bps lower. Swap spreads are generally wider.

- Tomorrow, the local calendar sees Trade Balance and Jibun Bank PMIs (P) data, along with BoJ Rinban Operations covering 1-25-year JGBs.

AUSSIE BONDS: Richer & At Highs, BoJ Decision Adds Support

ACGBs (YM +4.0 & XM +3.5) are richer and at Sydney session highs after business conditions eased in the final month of last year and confidence remained at below-average levels.

- The key driver of global bonds in today’s Asia-Pac session however was the BoJ Policy Decision. As largely expected, the BoJ delivered no changes in policy, forward guidance or its explicit easing bias. There were also no signals regarding the termination of the Negative Interest Rate Policy (NIRP). Long-end JGB yields gapped lower on the decision but that move has largely been unwound.

- US tsys are dealing ~1bp richer on the day after being largely unchanged in pre-BoJ trade.

- Cash ACGBs are 4-5bps richer, with the AU-US 10-year yield differential 1bp tighter at +10bps.

- Swap rates are 5-6bps lower.

- The bills strip is flat to +5, with the reds leading.

- RBA-dated OIS pricing is flat to 4bps softer across meetings, with Sep-Dec leading. A cumulative 40bps of easing is priced by year-end.

- Tomorrow, the local calendar sees Judo Bank PMIs (P) and the Westpac Leading Index.

- Tomorrow, the AOFM plans to sell A$800mn of the 3% November 2033 bond.

NZGBS: Richer, Q4 CPI Tomorrow

NZGBs closed 3bps richer across benchmarks after relatively narrow trading ranges. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Performance of Services Index.

- Global bond trading was subdued ahead of the BoJ Policy Decision, which has just been released. As expected, the BoJ left policy and forward guidance unchanged. The afternoon session for JGB trading commenced after the local close.

- US tsys are largely unchanged on the day, with the 10-year around 1bp lower.

- Elsewhere, there was a slight risk on move post-China equity news, as China mulls a stock market rescue package. Spillover was somewhat limited for global bonds.

- Swap rates closed 1-4bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 5bps softer across meetings, with Aug-Dec leading. A cumulative 93bps of easing is priced by year-end.

- ICYMI, the RBNZ has begun consultation on activating debt-to-income restrictions and loosening loan-to-value ratios for residential lending.

- Tomorrow, the local calendar sees Q4 CPI. Bloomberg consensus expects headline CPI to rise 0.5% q/q and 4.7% y/y, lower than the RBNZ forecast at 0.8% q/q and 5.0% y/y and down from Q3’s 1.8% q/q and 5.6% y/y.

FOREX: USD/JPY Reverses Post BoJ Gains, AUD & NZD Firm On Higher Equities

The USD is modestly softer. AUD and NZD have rallied on a firmer regional equity, mainly led by HK, amid fresh rescue hopes in the space from the China authorities. USD/JPY rose initially post the BoJ outcome, but is now back lower. The BBDXY sits down a little over 0.10%, last near 1235.40.

- The BoJ meeting came and went without any dramatic changes from the central bank. There were some modest tweaks to the inflation and growth forecasts. Core CPI for 2025 was kept under 2%, a more hawkish development would have been to raise this to 2% or higher.

- Still, the central bank sees itself gradually moving towards its inflation goal by the end of the projection period, albeit with uncertainty. For USD/JPY we got to a high of 148.55 post the meeting outcome, but we now sit back near 148.00. We still have Ueda's press conference to come.

- AUD/USD is up around 0.40%, last close to session highs, but unable to breach the 0.6600 in a sustainable fashion. Positive spill over from HK equity gains are likely helping at the margin. Iron ore is also higher, last above $131/ton. USD/CNH is also around 0.30% lower, last near 7.1710/20.

- NZD/USD is back close towards 0.6100, up 0.30% for the session, but is trailing the AUD modestly.

- Looking ahead, focus for the Tuesday session shifts to UK public finances data, the prelim Eurozone consumer confidence release and the latest ECB bank lending survey. In the US the Richmond Fed Index is out.

EQUITIES: China Equity Rescue Package, BoJ Rate Decision

Regional equities are mostly higher, with HK leading the way today, post news that China may look to support the equity market through a rescue package. US futures have been muted today, Nasdaq futures just holding onto gains up 0.10%, while Eminis were last near 0.01% higher.

- Japan has been dominated today by the BoJ rate decision, as the BoJ maintains policy rate at -0.1%, equity market sold off post the announcement. The Nikkei 225 was up as much at 0.73% prior to the decision and has since sold off to trade just 0.20% higher, while the Topix is now only marginally higher at this stage.

- Hong Kong and Mainland China indices have been active today, on the back of the news that China may look to stimulate the Equity market through a $278b rescue package (BBG). However, the rally has fizzled as investors suspect it may not be enough to have a real impact, the Hang Seng was up 3.5% at one stage to currently settle at 2.7% higher, while CSI is hovering around the unchanged levels for the day, after a 5% fall in the Hang Seng Mainland properties index yesterday the news of a rescue package has helped eras most of those loses to be trading 3.10% higher today.

- Elsewhere in Asia, equity markets the Taiex opened trading up 0.30% but has slowly given all gains back today to trade 0.15% higher. MSCI Sing up 0.67%, while India (Nifty 50 up 0.37%) became the world's fourth largest share market for the first time, overtaking Hong Kong.

- In Australia, the ASX 200 is up around 0.50%, largely on the back of the China Equity rescue package, with Australian business conditions data showing confidence remains weak. In SEA markets, markets are largely up between 0.20%-0.50% with the exception of Indonesia, which is 0.20% lower currently.

OIL: Crude Little Changed, US/UK Strike Houthis

Oil prices are little changed during APAC trading today and have been moving in a narrow range. WTI is flat at $74.73/bbl, but close to its intraday high of $74.82. Brent has broken through $80 during the session but is just below at $79.97, after a high of $80.10. The USD index is 0.1% lower.

- The US and UK hit Houthi sites on Monday in defence of commercial shipping. Ongoing geopolitical tensions in the Red Sea are providing a floor for oil prices. The market is also sensitive to any further Ukrainian attacks on Russian oil and gas infrastructure.

- Whereas IEA forecasts of plentiful supply have been putting a lid on how far crude can rally. US industry-sourced inventories are released later today and the recent cold snap may drive a further decline as production and refining were impacted by the weather.

- Another quiet calendar today with January US Richmond/Philly Fed indices released and euro area preliminary consumer confidence.

GOLD: Steady, Paring Of Rate Cut Expectations Weighs

Gold is steady in the Asia-Pac session, after closing 0.4% lower at $2021.70 on Monday.

- Bullion has come under pressure recently as rate cut expectations for the Federal Reserve have been scaled back.

- Fed speakers are in blackout ahead of next week’s FOMC meeting.

- The market is currently assigning less than a 50% chance to a 25bp rate cut in March. This compares to the near 70% chance seen a week ago.

- According to MNI’s technicals team, support for the precious metal is seen at $2001.9 (Jan 17 low).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/01/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 23/01/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/01/2024 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 23/01/2024 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 23/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/01/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/01/2024 | 2145/1045 | *** |  | NZ | CPI inflation quarterly |

| 24/01/2024 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/01/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.