MNI EUROPEAN OPEN: BOJ Needs To Raise Rate To Neutral 1% - Tamura

EXECUTIVE SUMMARY

- BOJ NEEDS TO RAISE RATE TO NEUTEAL 1% - TAMURA - MNI BRIEF

- JAPAN CGPI RISES 2.5% Y/Y ON SLOWER IMPORT PRICES - MNI BRIEF

- NORTH KOREA FIREX SHORT-RANGE MISSILES IN FIRST LAUNCH IN TWO MONTHS - RTRS

- BOK TO CONSIDER TIMING FOR RATE CUT WHILE KEEPING POLICY TIGHT - BBG

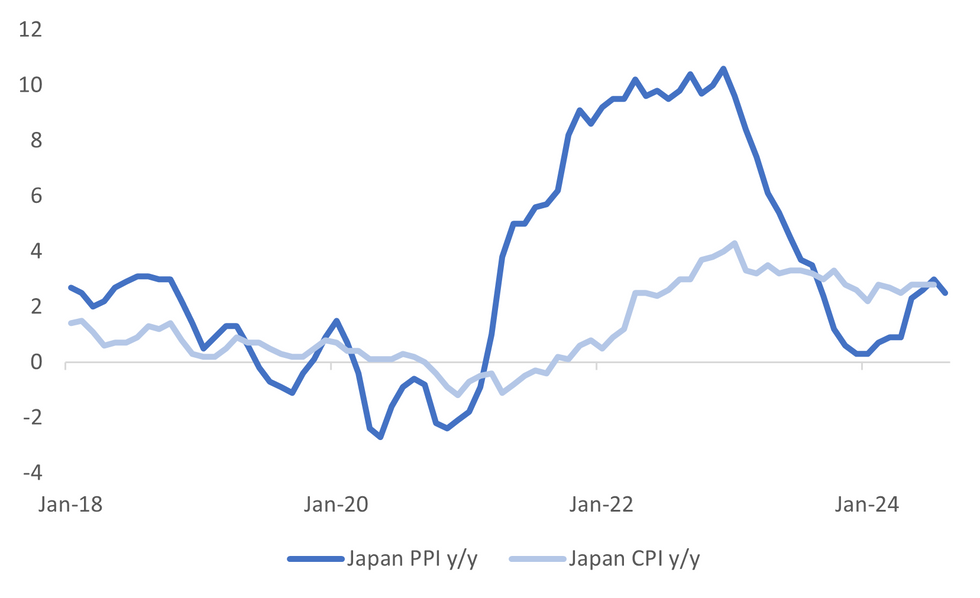

Fig. 1: Japan PPI and CPI Y/Y

Source: MNI - Market News/Bloomberg

UK

BUSINESS (BBC): “Pharmacies, pubs and banks made up half of the closures on Britain's High Streets in the first six months of this year, data suggests.”

EU (POLITICO): “EU officials and diplomats have told POLITICO they are increasingly doubtful that — beyond warm rhetoric — the new U.K. prime minister is all that keen on walking back on the Brexit breach with Europe.”

EU

ECONOMY (MNI BRIEF): Incoming euro area data are confirming the picture of subdued economic activity but also signs of a pick-up, a senior EU official said Wednesday and ahead of this weekend’s informal discussions of EU finance ministers and central bank chiefs in Budapest.

EU/CHINA (BBG): “German Chancellor Olaf Scholz joined Spanish Prime Minister Pedro Sanchez in calling for the European Union to drop its plan to impose extra tariffs on Chinese-made electric vehicles, potentially undercutting the bloc’s primary tool for pushing back against Beijing’s state-backed industry.”

BANKING (BBG): “Commerzbank AG’s executive board is reviewing its defense strategy as it prepares for a potential takeover approach by UniCredit SpA.”

UKRAINE (BBC): “The delivery of Iranian missiles to Russia has changed the debate about Ukraine using Western-provided long-range missiles against targets inside Russia, UK Foreign Secretary David Lammy has told the BBC on a visit to Kyiv. Lammy travelled to the Ukrainian capital with US Secretary of State Antony Blinken after talks in London.”

UKRAINE (POLITICO): “The White House is finalizing a plan to ease some restrictions on how Ukraine can use U.S.-donated weapons and better protect itself from Russian missiles, according to a Western official and two other people familiar with the discussions.”

US

CPI (MNI BRIEF): U.S. core CPI surprised higher in August on a housing inflation rebound, rising 0.281% last month against expectations for a 0.2% increase. Headline CPI added 0.187%, in line with expectations, the Bureau of Labor Statistics said Wednesday. That brings the 12-month rate for headline and core CPI inflation to 2.5% and 3.2%, respectively.

POLITICS (BBG): “ Taylor Swift has proven herself to be a cultural and economic force. As the US presidential race enters its final sprint, all eyes are on whether she can become a political one as well.”

OTHER

JAPAN (MNI BRIEF): Bank of Japan board member Naoki Tamura said on Thursday that the BOJ will need to raise the policy interest rate to about 1% in the second half of the projection period to March 2027.

JAPAN (MNI BRIEF): Japan's corporate goods price index rose 2.5% y/y in August, down from July’s unrevised 3.0%, as import-price rises decelerated despite posting their seventh straight gain of 2.6%, down from last month's 10.8%, data released by the Bank of Japan showed on Thursday.

NORTH KOREA (RTRS): “ North Korea fired multiple short-range ballistic missiles off its east coast on Thursday, South Korea's military said, the first such launch in more than two months.”

SOUTH KOREA (BBG): “The Bank of Korea said it will consider the timing to reduce its benchmark interest rate while keeping its policy restrictive, suggesting its cautious approach remains ahead of a key decision next month.”

AUSTRALIA (MNI INTERVIEW): RBA Rates View To Survive Productivity Miss

AUSTRALIA (BBG): “Melbourne Institute of Applied Economic and Social Research releases results of its September consumer survey. Consumers expect inflation to slow to 4.4% over the next 12 months."

NEW ZEALAND (BBG): “Rent and food prices rose in August while fuel and airfares declined, Statistics NZ said in a statement Thursday in Wellington.”

MIDDLE EAST (FRANCE24): “After meetings with Qatari and Egyptian mediators in Doha on Wednesday, Hamas released a statement assuring its "readiness" to adopt US President Joe Biden's long-gestating ceasefire deal, originally proposed in May, as pressure grows on Israeli Prime Minister Benjamin Netanyahu to bring home Israeli hostages.”

CHINA

MORTGAGES (CSJ): “Early mortgage repayments are impacting banks’ profitability and increasing operating costs, China Securities Journal reported. Outstanding mortgages in six major state-owned banks totalled CNY25.49 trillion in H1, down more than CNY320 billion from end-2023. Banks are reluctant to enforce relationship-damaging penalties, despite incurring additional manpower and resource costs needed to process early repayments, the newspaper said.”

ECONOMY (YICAI): “China should intensify macroeconomic policy regulation in H2 and work to realise the potential of domestic demand, according to Xiang Libin, deputy director at the National Development and Reform Commission.”

ECONOMY (SECURITIES TIMES): “China needs to roll out fresh counter-cyclical measures to boost domestic consumption and shore up economic growth, as external demand becomes more uncertain, Securities Times said in a front-page commentary.”

AUTOS (BBG): “China has strongly advised its carmakers to make sure advanced electric vehicle technology stays in the country, people familiar with the matter said, even as they build factories around the world to escape punitive tariffs on Chinese exports.”

CHINA MARKETS

MNI: PBOC Net Injects CNY97.5 Bln via OMO Thursday

The People's Bank of China (PBOC) conducted CNY160.8 billion via 7-day reverse repos, with the rate unchanged at 1.70%. The operation led to a net injection of CNY97.5 billion after offsetting maturities of CNY60.3 billion, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7612% at 09:31 am local time from the close of 1.8106% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 48 on Wednesday, compared with the close of 43 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1214 on Thursday, compared with 7.1182 set on Wednesday. The fixing was estimated at 7.1212 by Bloomberg survey today.

MARKET DATA

UK AUG. RICS HOUSE PRICE BALANCE +1%; EST. -14%; PRIOR -18%

NEW ZEALAND AUG. FOOD PRICES +0.2% M/M; PRIOR +0.4%

NEW ZEALAND AUG. TOTAL CARD SPENDING -0.2% M/M; PRIOR +0.6%

NEW ZEALAND AUG. RETAIL CARD SPENDING +0.2% M/M; PRIOR -0.1%

AUSTRALIA MELBOURNE INSTITUTE CONSUMER INFLATION EXPECTATIONS SEP. +4.4% Y/Y; PRIOR +4.5%

JAPAN AUG. PRODUCER PRICES +2.5% Y/Y; EST. +2.8%; PRIOR +3.0%

JAPAN AUG. PRODUCER PRICES -0.2% M/M; EST. 0%; PRIOR +0.5%

JAPAN Q3 BSI LARGE ALL-INDUSTRY CONFIDENCE +5.1; PRIOR +0.4

JAPAN Q3 BSI LARGE MANUFACTURER CONFIDENCE +4.5; PRIOR -1.0

JAPAN TOKYO AVERAGE OFFICE VACANCIES AUG. +4.76%; PRIOR +5.00%

MARKETS

US TSYS: Tsys Futures Slightly Lower Ahead Of US PPI Later

- Tsys futures edged slightly lower in the first half of the session, before trading in very tight ranges as we head into the European session. front-end is slightly underperforming, mirroring moves made post US CPI overnight. Focus will now turn to ECB where they are expected to lower rates by 25bps, then onto US PPI which should give a clearer pictures on whether a 25bps or 50bps cut is on the cards for next week.

- TUZ4 is -0-01 at 104-09⅛ while TYZ4 is trading -0-01+ at 115-09.

- Tsys flows: TU/UXY Block Flattener DV01 350k, UXY Block Likely Buyer DV01 450k

- Cash tsys curve continues the bear-flattening moves from overnight, with the 2yr +1.2bps at 3.654%, while the 10yr is +0.9bps at 3.668%.

- Projected rate cuts through year end remain soft vs. pre-data levels (*): Sep'24 cumulative -28.5bp (-32.7bp), Nov'24 cumulative -65.1bp (-72.5bp), Dec'24 -105.3bp (-114.5bp).

- It has been a reasonably quiet session in Asia today, with focus on BOJ's Tamura indicated that the CB needs to raise its benchmark rate more aggressively than many economists have been expecting, noting that the neutral policy rate in Japan is 1% or higher, we briefly saw the yen strengthen, while yields rose slightly, however we now trade little changed.

- Following decent demand in the 10yr auction overnight, there is a $22b 30yr bond auction later today

- Looking ahead we have US PPI and Jobless Claims a bit later.

JGBS: Cash Bonds Cheaper But Off Worst Levels

JGB futures are weaker but off session lows, -18 compared to the settlement levels.

- Outside of the previously outlined PPI, BSI Sentiment & Investment Flows, the market has had comments from BoJ Tamura to digest. His remarks came across as more hawkish than those made by Nakagawa yesterday.

- (MNI, ICYMI) BoJ's Tamura emphasised the need to raise short-term interest rates to around 1% by the latter half of the long-term forecast period through fiscal 2026 to achieve the 2% inflation target. He views the neutral rate at 1% and suggests adjusting rates based on the certainty of reaching the price goal.

- Cash US tsys are 1-2bps cheaper in today’s Asia-Pac session after yesterday’s post-CPI sell-off. The focus now turns to today's US PPI and Weekly Claims data.

- Cash JGBs are flat to 2bps cheaper across benchmarks, with the 1-year leading. The benchmark 20-year yield is 0.8bp higher at 1.680% after today’s supply.

- 20-year supply showed mixed demand metrics, with the low price failing to meet dealer expectations and the auction tail lengthening. However, the cover ratio was steady at 3.4749x versus 3.4223x previously.

- Swap rates are 1-5bps higher, with the curve steeper.

- Tomorrow, the local calendar will see Industrial Production and Capacity Utilisation data.

AUSSIE BONDS: Cheaper But Mid-Range Ahead Of US PPI & Claims Data

In roll-impacted dealings, ACGBs (YM -4.0 & XM -2.1) are weaker but off the Sydney session’s worst levels.

- Outside of the MI Inflation Expectations data, there hasn't been much by way of domestic drivers to flag.

- (MNI) MI Inflation Expectations measure eased 0.1pp in September to 4.4% y/y, in line with the series average. The measure can lead headline CPI inflation and in 2019 it averaged around 3.6%. A move below 4% in the series would be welcomed to help determine if inflation has been contained.

- Cash US tsys are 1-2bps cheaper in today’s Asia-Pac session after yesterday’s post-CPI sell-off. The focus now turns to today's US PPI and Weekly Claims data.

- Cash ACGBs are 2-4bps cheaper, with the AU-US 10-year yield differential at +21bps versus yesterday’s +24bps.

- Swap rates are flat to 2bps higher, with the 3s10s curve flatter and EFPs tighter.

- The bills strip is cheaper, with pricing -1 to -3 across contracts.

- RBA-dated OIS pricing is flat to 3bps firmer, with late 2025 leading. A cumulative 16bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

NZGBS: Closed Little Changed After Q3 Prices Data

NZGBs closed little changed and in the middle of today’s ranges.

- (Bloomberg) “New Zealand’s central bank will cut interest rates further and faster than it says it will as the economy contracts and inflation slows, according to investors and some economists.” (See link)

- (MNI) As NZ does not yet have a monthly aggregate CPI series, the release of certain components accounting for around 45% of the total is watched closely. Q3 average annual rates are generally lower, apart from food and overseas air travel, which signals that inflation is on track to moderate towards the RBNZ’s 2.3% y/y forecast.

- August food prices rose 0.2% m/m and 0.4% y/y, down from 0.6% y/y. It continues to be held down by fruit & vegetable prices which fell 0.8% m/m and -12.2% y/y. But groceries and restaurant meals saw price rises and are running at 2.4% y/y and 3.6% y/y respectively.

- Swap rates are flat to 1bp higher.

- RBNZ dated OIS pricing closed 2-4bps firmer across meetings, with May-25 leading. A cumulative 78bps of easing is priced by year-end.

- Tomorrow, the local calendar will see REINZ House Sales and BusinessNZ Manufacturing PMI data.

FOREX: Safe Havens Underperform Amid Equity Gains/Higher US Yields

There has been a modest risk on tone in G10 FX in the first part of Thursday trade. Both yen and CHF are down marginally against the USD, while AUD and NZD have ticked higher. The better equity tone, led by the tech sector, has been a standout so far today. The BBDXY USD index is little changed, last near 1235.50.

- USD/JPY has had a range of 142.23-142.95 so far today. We pushed higher in early trade amid a tick up in US yields, led by the front end. Also weighing at the margins was a slightly weaker than expected August PPI print. However, hawkish rhetoric from BoJ board member Tamura that the central bank needs to raise rates to at least a neutral rate of 1% spurred a USD/JPY turn around.

- This afternoon, with US yields holding positive, led by the front end, coupled with higher US equity futures and strong regional equity gains has supported FX risk appetite USD/JPY was last near 142.80, off 0.30% for the session. CHF has slipped around 0.10%.

- AUD and NZD are both up around 0.20% versus the USD. AUD/USD ticking up to 0.6690, with consumer inflation expectations data proving sticky. AUD/JPY is up, back near 95.50. Recent lows were at 93.59.

- NZD/USD has firmed back to 0.6150. Earlier data suggested Q3 average inflation rates are signalling a return to the RBNZ's target. This may have aided higher AUD/NZD levels at the margin (hitting highs of 1.0893), but we sit slightly lower in latest dealings.

- Helping the A$ at the margins is a further pick in metal prices, with iron ore back near $94/ton, while copper is also up.

- Later US August PPI, budget and jobless claims print. Core PPI is expected to hold steady at 2.4% y/y. The ECB announces its decision today, which will be accompanied by updated staff forecasts and a press conference. It is expected to cut rates 25bp.

ASIA PAC STOCKS: Tech Stocks Lead Asian Market Higher, Following Nvidia's Comments

Asian markets are trading higher today, driven by a tech-fueled rally originating from Wall Street. Semiconductor and related equities saw notable gains after Nvidia's CEO, Jensen Huang, highlighted surging demand for its products. Japanese stocks advanced sharply, with the Nikkei 225 rising more than 3% as a pause in the yen's strengthening benefited exporters like Hitachi and Toyota Motor. South Korea's Kospi also climbed 1.2%, led by gains in tech stocks, including Samsung Electronics and SK hynix. The recent U.S. inflation data has dampened hopes for a large 50 basis-point rate cut from the Federal Reserve, but markets still anticipate a more modest 25bp cut, which is supporting broader market sentiment.

- US equity futures are testing the overnight highs. NQU4 Eminis +0.15% while S&P 500 Eminis +0.05%.

- Asian tech stocks lead the way higher today, with Samsung +0.90%, Sk Hynix +6%, TSMC +4.80%, Tokyo Electron + 3.80%

- Hong Kong Equities are outperforming China Mainland stocks today with the HSI +0.90%, while CSI 300 is flat and hovers right on the yearly lows made in February, see chart.

- South Korea continues to see selling from of tech stocks from foreign investors with a $120m outflow so far today, there has however been better buying seen in auto names.

- Taiwan's Taiex is the top performing market in the region today, with TSMC +4.80% & Hon Hai +4.20% contributing to majority of the gains.

ASIA STOCKS: HK Equities Outperform, China Equities Struggle On IB Crackdown

Chinese & Hong Kong equities are mixed today with the CSI 300 Index giving up early gains and now testing yearly lows, as reports surfaced that investment bankers are being detained or required to surrender their passports, quickly dampening market sentiment and despite efforts by Chinese authorities to implement stimulus measures, slow execution has hindered progress, especially in addressing property sector challenges with many property indices trading at all time lows, and property bonds struggling to find a bid. While investors expect possible government support from the National Team if equities hit a 5-year low although it may only temporarily delay a further decline.

- Major benchmarks are mixed with the HSI up 1%, property indices have found some support today and trade unchanged, Tech stocks are higher on the back of the prospect of OpenAI's potential $150 billion valuation with the HSTech Index is 1.40% higher, though investors may remain cautious after the Ant Financial IPO collapse. Banking stocks track US peers higher following last night CPI, with the HS Mainland Banking Index +1.10%.

- China is intensifying its crackdown on investment bankers, with at least three top bankers detained since August, and several brokerages requiring employees to hand in passports and seek approval for travel. The crackdown is raising concerns about the future of China's $1.7t brokerage industry, as IPO activities and revenue have sharply declined amidst economic struggles.

- Looking ahead we have Hong Kong PPI & Industrial Production later today, while on Saturday we have Chinese Industrial Production & Retail Sales.

OIL: Crude Continues Recovery But Pessimistic IEA Report Could Change That

Oil prices have continued to climb during APAC trading today after rising over 2% on Wednesday buoyed by better risk sentiment and concerns over the impact of Hurricane Francine on the energy sector. Prices are currently little changed on the week despite Tuesday’s sharp sell off.

- Brent is up 0.6% to $71.05/bbl after a high of $71.08, while WTI is 0.5% higher at $67.68/bbl, close to the peak of $67.72 but still down 8% this month.

- The IEA’s monthly report is published today and it tends to be less optimistic than OPEC on the crude outlook. Pessimistic demand projections may spook markets already nervous about a demand slowdown.

- EIA inventories rose 833k barrels last week, the first increase since mid-August, with gasoline up 2.31mn and distillate +2.31mn. Both gasoline and distillate demand were lower as the holiday season finished.

- Hurricane Francine made landfall in Louisiana today. 39% of Gulf of Mexico oil production has been shut because of the storm, according to US Bureau of Safety and Environment Enforcement. The question now is how long the outage will last. Also around eight land-based refineries may be impacted.

- Later US August PPI, budget and jobless claims print. Core PPI is expected to hold steady at 2.4% y/y. The ECB announces its decision today, which will be accompanied by updated staff forecasts and a press conference. It is expected to cut rates 25bp.

GOLD: Near All-Time Highs Ahead Of US PPI & Claims Data

Gold is steady in today’s Asia-Pac session, after closing 0.2% lower at $2511.76 on Wednesday. Earlier in yesterday's session it had risen briefly to a peak of $2,529, close to last month’s record high.

- Yesterday, US CPI data drove US Treasury yields higher and the curve flatter. The 2-year finished 5bps higher at 3.64% after hitting a new 2-year low earlier in the session. The 10-year was up 1bp at 3.65% in spite of a very successful auction. The curve closed in positive territory for a fourth straight day.

- US Core CPI surprised higher in August on a housing inflation rebound, rising 0.281% last month against expectations for a 0.2% increase. The annual rates for Headline and Core CPI were 2.5% and 3.2% respectively.

- While chances of a 50bp rate cut next week by the FOMC has fallen off, markets still have Thursday's PPI and weekly claims data to absorb.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, the trend condition is unchanged, and the primary direction remains up despite bullion continuing to trade in a range over recent weeks. Sights remain on $2,536.4 next, a Fibonacci projection.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/09/2024 | - |  | EU | European Central Bank Meeting | |

| 12/09/2024 | 0600/0800 | *** |  | SE | Inflation Report |

| 12/09/2024 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/09/2024 | 1000/1100 | ** |  | UK | Gilt Outright Auction Result |

| 12/09/2024 | - |  | UK | OBR Fiscal Risks and Sustainability Report | |

| 12/09/2024 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 12/09/2024 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 12/09/2024 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 12/09/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 12/09/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/09/2024 | 1230/0830 | *** |  | US | PPI |

| 12/09/2024 | 1230/0830 | * |  | CA | Building Permits |

| 12/09/2024 | 1230/0830 | * |  | CA | Household debt-to-income |

| 12/09/2024 | 1245/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 12/09/2024 | 1345/1545 |  | EU | Eurosystem staff macroeconomic projections publications | |

| 12/09/2024 | 1415/1615 |  | EU | ECB Podcast: Lagarde presents the latest monetary policy decisions | |

| 12/09/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 12/09/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/09/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/09/2024 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/09/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/09/2024 | 1800/1400 | ** |  | US | Treasury Budget |