-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Caixin Services PMI Falls In June

EXECUTIVE SUMMARY

- JAPAN SERVICE ACTIVITY MAINTAINS BRISK PACE OF GROWTH - RTRS

- AUSTRALIA SERVICES SECTOR EXPANDS FOR THIRD STRAIGHT MONTH - BBG

- NZ EXPORT PRICES TUMBLE IN JUNE - NZH

- CAIXIN SERVICES PMI RETREATS IN JUNE - DJ

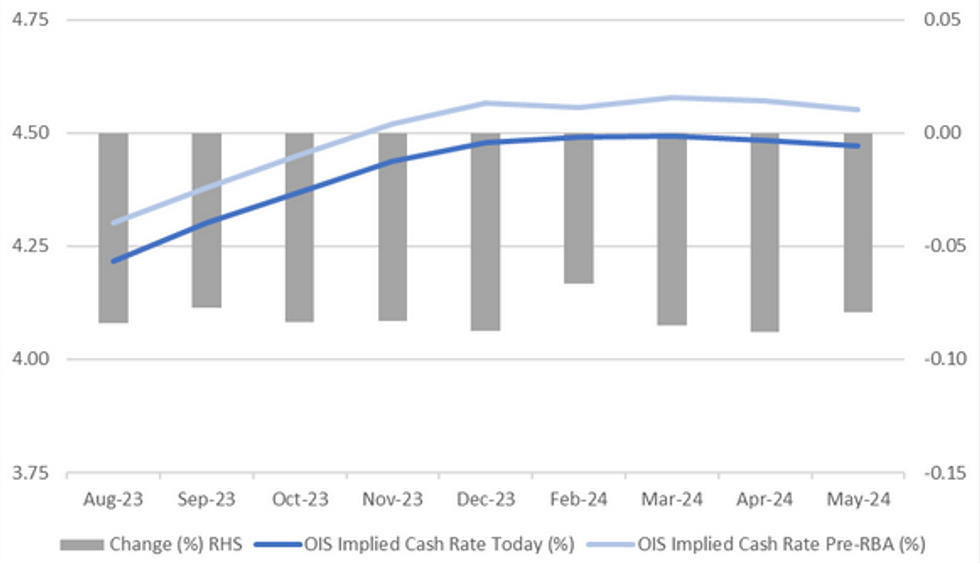

Fig. 1: RBA Dated OIS - Today vs Pre-RBA

Source: MNI - Market News/Bloomberg

U.K.

FCA: The Financial Conduct Authority has proposed setting up a single UK price feed for bond trades before it establishes one for equities, according to a statement on Wednesday. (BBG)

WATER: ESG funds that piled into green bonds sold by Thames Water Plc are now trying to figure out what the environmental, social and governance disasters threatening the future of the utility mean for their holdings. (BBG)

EUROPE

GREECE: Prime Minister Kyriakos Mitsotakis pledged to repay two years of bailout loans ahead of schedule in a confident signal to financial markets at the start of his second term in office. “We will be able before the end of the year to actually repay ahead of time,” Mitsotakis said Tuesday during an interview with Bloomberg Television in Athens. “It’s a commitment to investors.” (BBG)

FRANCE: Emmanuel Macron pledged swift government support to help mayors rebuild schools, libraries and town halls destroyed during a week of violence that swept across France after the police shooting of a teenager.Thousands of insurance claims have started to pour in as small business owners seek to repair stores and offices attacked during the riots, with Finance Minster Bruno Le Maire promising additional support for those worst hit. (BBG)

NATO: Romania’s prime minister called on German Chancellor Olaf Scholz to decide “as soon as possible” on potentially sending permanent troops to the Black Sea state to strengthen NATO’s eastern flank. (BBG)

UKRAINE: Russia and Ukraine on Tuesday accused each other of plotting to stage an attack on the Russian-held Zaporizhzhia nuclear power station, long the subject of mutual recriminations and suspicions. (RTRS)

OTHER

JAPAN: Japan’s Nuclear Regulation Authority says it found no issues with facilities for releasing treated wastewater from the Fukushima Dai-Ichi nuclear power plant. (BBG)

JAPAN: Japan's service activity maintained a brisk pace of growth in June as the relaxation of pandemic-related restrictions revived consumer demand, a private-sector survey showed on Wednesday. (RTRS)

AUSTRALIA: Prime Minister Anthony Albanese has welcomed the Reserve Bank’s decision to give households a reprieve from interest rate rises as “a good thing”, as the opposition stepped up its pressure on the government to do more to fight inflation. (SMH)

AUSTRALIA: The Australian service sector expanded for the third straight month in June, with the seasonally adjusted Judo Bank Australia services PMI business activity index hitting 50.3 in the month, down from 52.1 in May, according to a Wednesday S&P Global and Judo Bank release. (MTN)

NEW ZEALAND: Export prices for meat and logs tumbled in June as slower-than-expected Chinese economic growth hit demand for New Zealand’s commodities. (NZH)

OIL: Asia’s oil refiners, responsible for meeting about a third of the world’s fuel consumption, are getting ready to go elsewhere for crude should Saudi Arabia and Russia’s latest pledged supply cuts deprive them of barrels. (BBG)

CHINA

CAIXIN SERVICES PMI: A private gauge of China's services activities retreated in June, in line with an official index that also pointed to a slower recovery in the sector. The Caixin services purchasing managers index dropped to 53.9 in June from 57.1 in May, Caixin Media Co. and S&P Global said Wednesday. Despite the fall, the index remained above the 50 mark separating expansion from contraction for a sixth month in a row. (DJ)

Shanghai Co-op: China will promote the use of local currency trade settlement among members of the Shanghai Cooperation Organisation (SCO), according to President Xi Jinping. Speaking at the SCO summit, Xi said members should focus on practical cooperation to accelerate the economic recovery, oppose protectionism and resist decoupling. China will strengthen the high-quality connections of the Belt and Road Initiative and ensure stability and smoothness in the regional industrial supply chain. Xi said Beijing wants to expand cooperation on sovereign digital currencies and promote the establishment of an SCO development bank. (MNI)

LGFVs: China's top state-owned banks are offering local government financing vehicles (LGFVs) loans with ultra-long maturities and temporary interest relief to prevent a credit crunch, reported Guru Club, a financial publisher citing anonymous sources. Banks including the Industrial and Commercial Bank of China and China Construction Bank have started to ramp up loans that mature in 25 years to qualified LGFVs in recent months, compared to the prevailing 10-year tenor for most corporate lending. Some loans have interest or principal payments waived for the first four years, though the interest will accrue later, the source said. (MNI)

CNY: Overseas portfolio investors short the yuan have increased their CNY holdings, as weakness in the currency failed to trigger a phased outflow of capital. Strong overseas demand for yuan bonds amid the sluggish global economic recovery and CNY's depreciation has made yuan assets more attractive, according to a Hong Kong private equity fund manager. Swap Connect also facilitates overseas investors holding domestic yuan bonds, as they do not need to reduce their holdings due to the widening China-U.S. interest-rate spread, the manager said. The net purchase of domestic bonds by foreign investors in June continued from May's relatively high level, while fx settlement and sales showed higher surplus than the previous month. (MNI)

SUPPLY CHAINS: Chinese leader Xi Jinping called on nations to spurn decoupling and the cutting of supply chains, one day after his nation imposed limits on exports of two key metals used to make chips to counter Western restrictions on Beijing. (BBG)

CHINA MARKETS

PBOC Drains Net CNY212 Bln Via OMOs Wednesday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Wednesday, with the rates at 1.90%. The operation has led to a net drain of CNY212 billion after offsetting the maturity of CNY214 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8367% at 09:32 am local time from the close of 1.7323% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 38 on Tuesday, compared with the close of 47 on Monday.

PBOC Yuan Parity Lower At 7.1968 Wednesday VS 7.2046 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1968 on Wednesday, compared with 7.2046 set on Tuesday.

OVERNIGHT DATA

South Korea June Foreign Reserves $421.45bn; Prior $420.98bn

Australia Jun, F Judo Bank Services PMI 50.3; Prior 50.7

Australia Jun, F Judo Bank Composite PMI 50.1; Prior 50.5

Japan Jun, F Jibun Bank Services PMI 54.0; Prior 54.2

Japan Jun, F Jibun Bank Composite PMI 52.1; Prior 52.3

China Jun Caixin Services PMI 53.9; Prior 57.1

China Jun Caixin Composite PMI 52.1; Prior 52.3

MARKETS

US TSYS: Narrow Ranges In Asia

TYU3 deals at 112-00+, +0-02+, a 0-04 range has been observed on volume of ~50k.

- Cash tsys sit 1-3bps richer across the major benchmarks, the curve has bull steepened.

- Tsys richened in early dealing as cash tsys re-opened after being closed for the observance of a US holiday yesterday, before marginally paring gains.

- The space looked through a weaker than forecast Caixin Services PMI print and narrow ranges persisted for the majority of the session.

- In Europe today we have the final print of European Services PMIs, further out we have Factory Orders and Durable Goods before the FOMC minutes of the June meeting cross. Fedspeak from NY Fed President Williams is also due.

JGBs: Futures Cheapen In Afternoon Trade, 30-Year Supply Tomorrow

JGB futures are weaker, -5 compared to the settlement levels, after trading in a relatively narrow range in the Tokyo session.

- Apart from the previously mentioned Jibun Bank Services and Composite PMI data, which failed to have an impact on the market as anticipated, there have been few notable domestic drivers to highlight.

- The cash US tsys curve bull steepens in Asia-Pac trade with yields 0.1-2.9bp lower across the major benchmarks. Tsys looked through a weaker than forecast Caixin Services PMI print and narrow ranges persisted for the majority of the session.

- Cash JGBs are richer across benchmarks but the richening has lessened in Tokyo afternoon trade in line with this morning’s BoJ Rinban that showed higher and positive spreads, and higher offer cover ratios for the shorter end operations. The 10-25 operations saw a negative average spread but a higher cover ratio.

- The benchmark 10-year yield is 1.7bp lower at 0.369%, after yesterday’s 10-year auction showed solid demand with the low-price exceeding forecasts, the cover ratio reaching a four-month high of 4.024x, and the tail narrowing to its lowest level in four months.

- The swaps curve has twist flattened with swap spreads wider.

- Tomorrow the local calendar sees International Investment Flows (Jun 30) along with 30-year supply.

AUSSIE BONDS: Slightly Richer, Narrow Range, PM Albanese Welcomes RBA Pause

ACGB are slightly higher in Sydney afternoon trade (YM +1.0 & XM +1.5) after trading in a relatively narrow range.

- Cash ACGBs are 1-2bp richer across benchmarks after the latest round of ACGB Nov-33 supply sees firm pricing, with the weighted average yield printing 0.84bp through prevailing mids and the cover ratio rising above 4.70x.

- Swap rates are 1-3bp lower with the 3s10s curve steeper.

- The bills strip is little changed with pricing flat to +1.

- RBA-dated OIS pricing is 1-2bp softer today after it closed yesterday 7-8bp softer across meetings. The market currently attaches a 58% chance of a 25bp hike at the August meeting, which follows the release of Q2 CPI data on July 26.

- (AFR) PM Anthony Albanese has welcomed the Reserve Bank’s decision to give households a reprieve from interest rate rises as “a good thing”. (See link)

- Sky News believes Department of Finance Secretary Jenny Wilkinson is the likely replacement for RBA Governor Lowe if his term is not renewed in September.

- Tomorrow the local calendar sees the May Trade Balance with a resilient export performance expected.

- Later today, FOMC June Meeting Minutes are published, Fed Williams speaks and May US Factory Orders print.

NZGBS: Cheaper But Off Worst Levels, Labour Pool Expanding Quickly

NZGBs closed 2-3bp cheaper across benchmarks but off session cheaps in line with movements in US tsys and ACGBs in Asia-Pac trade. With the local calendar light for the remainder of the week, local participants are likely to continue to seek guidance from abroad.

- The RBNZ policy meeting is scheduled for Wednesday next week with the market attaching a 12% chance of a 25bp hike. Terminal OCR expectations currently sit at 5.67% versus the current OCR of 5.50%.

- Swap rates are flat to 6bp higher with the 2s10s curve steeper, and the implied swap spread box 4bp steeper.

- The ANZ commodity price index declined 2.3% m/m (-14.9% y/y) in June in NZD terms (1.2% m/m lower in USD) led by the meat, skins and wool sub-category.

- NZ’s pool of labour is expanding at the fastest pace in almost three years as the nation’s re-opened border allows more foreign workers to enter the market, said StatsNZ. (See link)

- Tomorrow the NZ Treasury plans to sell NZ$250mn of the 0.5% 15 May 2026 bond, NZ$200mn of the 2.0% 15 May 2032 bond and NZ$50mn of the 1.75% 15 May 2041 bond.

EQUITIES: Sentiment Turns Sour After Weaker Than Expected Caixin Services PMI

Regional equities unwound early gains after weaker than expected Caixin Services PMI weighed on risk sentiment.

- In China the CSI300 is down ~0.6% and the Shanghai Composite is down ~0.5%. Hong Kong's Hang Seng is ~1.4% lower

- Elsewhere in Asia; Nikkei is down ~0.3% in Japan. South Korea's KOSPI is ~0.2% softer. The ASX200 is down ~0.4%.

- US Equity futures are a touch lower, however moves have been limited thus far.

OIL: Crude Lower As Awaits Key Events & China PMIs Disappoint

Oil prices are down during APAC trading following a close to 2% rise on Tuesday, as the market is awaiting key events later and China’s June PMI data showed growth slowed more than expected. WTI is down 0.6% to $70.87/bbl, off the intraday low of $70.78. It reached a high earlier of $71.20. Brent is also 0.6% lower at $75.77, close to the low of $75.72, and off the high of $76.15. The USD index is 0.1% higher.

- The announcement of supply cuts for August supported oil on Tuesday but demand worries are never too far away and PMI data from China provided further evidence that growth may disappoint.

- There are signs of market tightening with the Brent spread between two nearest futures contract returning to backwardation, which is bullish.

- Saudi energy minister Prince bin Salman is scheduled to speak on Wednesday at the 8th OPEC International Seminar. In June he said he would do “whatever is necessary” to steady prices. The market will watch his comments closely given recent moves. Official Saudi Aramco selling prices are also published this week. Weekly US API crude/fuel inventory data are released today.

- Later the FOMC June meeting minutes are published and the Fed’s Williams speaks. European/UK services/composite PMIs for June and May US factory orders print.

GOLD: Recent Gains Are Considered Corrective

Gold is slightly softer in the Asia-Pac session, after closing up 0.2% on Tuesday during the Independence Day holiday in the US.

- In subdued trading, gold treaded water as traders directed their attention towards the upcoming US nonfarm payrolls report on Friday. This report is expected to provide new insights into the monetary policy direction of the Federal Reserve. Gold prices have experienced a decline of approximately 6% since reaching a peak in May 2023, influenced by the heightened hawkish rhetoric from the Fed.

- According to the MNI technicals team, trend conditions in gold remain bearish and the latest short-term gains are considered corrective. Fresh trend lows last week reinforce current bearish conditions, confirming a resumption of the downtrend and extending the price sequence of lower lows and lower highs. The focus is on $1885.8, the Mar 15 low. Key resistance is $1985.3, the May 24 high. Initial resistance is at $1933.9, the 20-day EMA.

- Elsewhere, holdings in gold-backed exchange-traded funds have fallen for 11 straight days, according to data compiled by Bloomberg. (See link)

FOREX: USD Marginally Firmer In Muted Asian Session

The greenback is marginally firmer in a muted Asian session, the USD firmed off early session lows and marginally extended gains after a weaker than forecast Caixin Services PMI. However ranges remain narrow with little follow through.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD prints at $0.6190/95 ~0.1% firmer today, early gains were pared a touch after meeting resistance above $0.62. AUD/NZD is holding below $1.08 and is down ~0.2%.

- AUD is marginally pressured, the pair faced resistance ahead of the $0.67 handle with losses marginally extending after the aforementioned Caixin PMI print. The pair sits at touch above session lows at $0.6685/90.

- Yen is little changed from opening levels, ranges have been narrow with little follow through on moves.

- Elsewhere in G-10; GBP and EUR are down ~0.1%.

- Cross asset wise; US Tsys are a touch firmer and BBDXY is up ~0.1%. E-minis are down ~0.1%, the Hang Seng is down ~1.3%.

- The FOMC minutes of the June policy meeting provide the highlight of todays docket. Also due are the final prints of European PMIs.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/07/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/07/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/07/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 05/07/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/07/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/07/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/07/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/07/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/07/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/07/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/07/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 05/07/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 05/07/2023 | 1800/1400 | * |  | US | FOMC Statement |

| 05/07/2023 | 2000/1600 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.