-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI EUROPEAN OPEN: Dollar & US Yields Holding Below Recent Highs

EXECUTIVE SUMMARY

- FED MINUTES MAKE NO MENTION OF RATE CUT DEBATE - MNI

- ISM MANUFACTURING SEEN CONTRACTING UNTIL MARCH - MNI INTERVIEW

- BLASTS KILL NEARLY 100 AT SLAIN COMMANDER SOLEIMANI’S MEMORIAL; IRAN VOWS REVENGE - RTRS

- US, PARTNERS WARN HOUTHIS AGAINST FURTHER ATTACKS IN RED SEA - BBG

- VOLATILE YUAN AHEAD AS UNCERTAINTY DOMINATES - MNI INTERVIEW

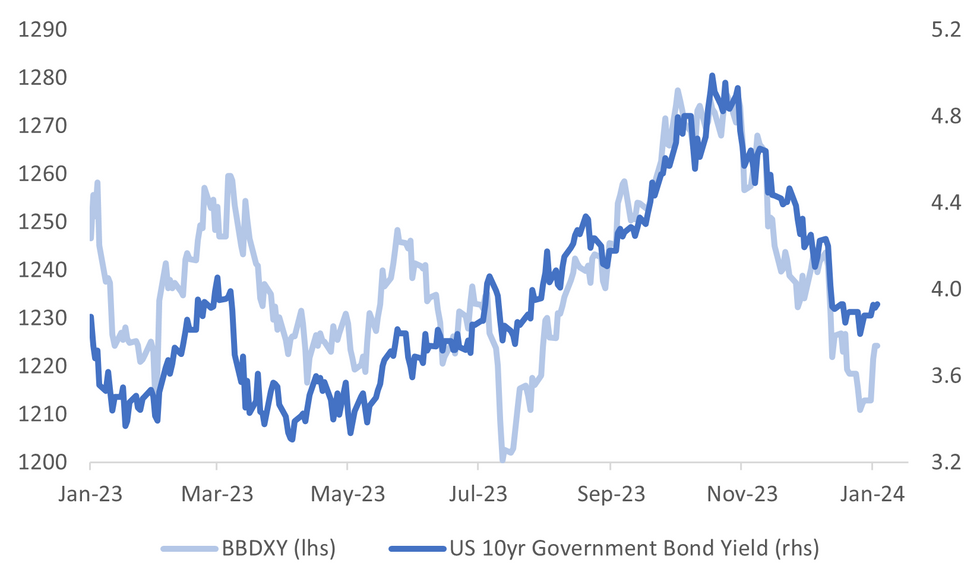

Fig. 1: BBDXY Dollar Index & Nominal US 10yr Tsy Yield

Source: MNI - Market News/Bloomberg

U.K.

INVESTMENT (BBG): British businesses are keeping their investment plans on ice because of high debt-servicing costs and a stagnant economy, a survey found. The British Chambers of Commerce warned sluggish corporate investment will be the economy’s “Achilles’ heel,” with firms reluctant to boost spending plans despite government tax breaks designed to encourage it.

POLITICS (BBG): Labour leader Keir Starmer will make his opening pitch to voters in what is widely expected to be a UK election year, declaring that Britain is “crying out for change” after 14 years of Conservative governments. In a keynote speech in the west of England on Thursday, Starmer will point to the “understandable despair of a downtrodden country” but urge people to use their vote to get Labour back into power.

EUROPE

REFORM (POLITICO): A top European politician tasked with examining the backbone of the bloc’s economic policy has outlined proposals for key reforms he will present to EU leaders. In an interview with POLITICO, former Italian Prime Minister Enrico Letta, who has been assigned to report on the state of the single market in March, pointed out overhaul opportunities that include tearing up rules on state subsidies as well as potential measures to stop poorer countries from suffering a brain drain.

RUSSIA/UKRAINE (RTRS): Ukraine and Russia on Wednesday announced their first exchange of prisoners of war in nearly five months, with more than 200 freed by each side after what both said was a complex negotiation involving mediation by the United Arab Emirates.

U.S.

FED (MNI): Minutes from the Federal Reserve’s December meeting released Wednesday did not mention any discussion about reducing interest rates later this year even though policymakers penciled in a median three rate cuts for 2024 in their quarterly projections.

ECONOMY (MNI INTERVIEW): U.S. manufacturing is likely to remain in contraction for several months but growth appears likely in the second quarter after the Federal Reserve signaled interest-rate cuts, survey chair Timothy Fiore told MNI Wednesday.

CORPORATE (RTRS): U.S. bankruptcy filings surged by 18% in 2023 on the back of higher interest rates, tougher lending standards and the continued runoff of pandemic-era backstops, data published Wednesday showed, although insolvency case volumes remain well below the level seen before the outbreak of COVID-19.

CORPORATE (BBG): ByteDance Ltd.’s TikTok aims to grow the size of its US e-commerce business tenfold to as much as $17.5 billion this year, according to people familiar with the matter, posing a bigger threat to Amazon.com Inc.

OTHER

MIDDLE EAST (BBG): More than a dozen countries warned the Houthis, a Yemen-based rebel group backed by Iran, against continuing their attacks on shipping in the Red Sea, which have disrupted global commerce and triggered a limited military response from the US.

IRAN (RTRS): Two explosions killed nearly 100 people and wounded scores at a ceremony in Iran on Wednesday to commemorate commander Qassem Soleimani who was killed by a U.S. drone in 2020, Iranian officials said, blaming unspecified "terrorists".

COMMODITIES (BBG): China has regained the title of world’s biggest buyer of liquefied natural gas, as a further rebound in deliveries threatens to tighten supply of the heating and power plant fuel.

CHINA

YUAN (MNI INTERVIEW): The yuan will experience swings in 2024 as it grapples with several domestic and international factors, such as the ability of China’s support policies to boost sentiment, potential Federal Reserve interest-rate cuts and the performance of the U.S. economy, a prominent economist told MNI in an interview.

RATINGS (BBG): Four Chinese bad-debt managers were downgraded by Fitch Ratings Inc. on concern over their financial situation and expectations of reduced government support.

FISCAL (PEOPLE’S DAILY): China will ensure larger fiscal spending in 2024 to stimulate domestic demand better, mainly by targeting a certain deficit size and transferring some funds from the budget stabilisation fund, said Finance Minister Lan Foan in an interview. China will continue to arrange appropriate scale of local government special bonds to drive investment, under the principle of keeping the government’s overall leverage ratio stable, Lan noted.

INVESTMENT (21st CENTURY BUSINESS HERALD): China’s fixed-asset investment growth may rebound moderately in 2024 amid the narrowing decline in real-estate investment and favourable policies recently introduced by some provinces, 21st Century Business Herald reported citing analysts. Economic powerhouses including Guangdong, Zhejiang and Jiangsu provinces have kickstarted major projects in the first week of 2024.

SHIPPING (YICAI): The Red Sea crisis may trigger container shortages, which could spread to Asian ports by mid-to-late January, and port congestion as large ships have already found it hard to dock at domestic ports, pushing up shipping costs, Yicai.com reported, citing market insiders.

LGFVs (BBG): China’s local government financing vehicles need to pay back a record amount of maturing local bonds this year, testing the limits of a central government program to help them refinance their debt and avoid default.

TECH (XINHUA/BBG): Chinese Premier Li Qiang visited Wuhan-based chipmaker Yangtze Memory Technologies and Huagong Laser during a two-day trip in Hubei province, according to a Xinhua report posted on the central government’s website.

CHINA MARKETS

MNI: PBOC Drains Net CNY585 Bln Via OMO Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY15 billion via 7-day reverse repo on Thursday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY585 billion reverse repos after offsetting CNY600 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8009% at 10:00 am local time from the close of 1.7706% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Wednesday, compared with the close of 42 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.0997 Thursday vs 7.1002 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0997 on Thursday, compared with 7.1002 set on Wednesday. The fixing was estimated at 7.1488 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA DEC FOREIGN RESERVES $420.15BN; PRIOR $417.08BN

AUSTRALIA DEC F JUDO BANK SERVICES PMI 47.1; PRIOR 47.6

AUSTRALIA DEC F JUDO BANK COMPOSITE PMI 46.9; PRIOR 47.4

JAPAN DEC F JIBUN BANK PMI MFG 47.9; PRIOR 47.7

CHINA DEC CAIXIN SERVICES PMI 52.9; MEDIAN 51.6; PRIOR 51.5

CHINA DEC CAIXIN COMPOSITE PMI 52.6; PRIOR 51.6

MARKETS

US TSYS: Cash Bonds Dealing Little Changed

TYH4 is trading at 112-13, -0-03+ from NY closing levels.

- Cash US tsys are dealing little changed in today's Asia-Pac session, with local participants digest yesterday’s release of the December FOMC Minutes.

- There has been little by way of meaningful newsflow today, other than better than better-than-expected China Caixin PMI services.

- The market’s focus now turns to ADP private employment later today, followed by December employment data on Friday.

JGBS: Subdued Open To The New Year, US ADP Data Due Later Today

In Tokyo afternoon dealings on the first local session of the year, JGB futures are stronger, +11 compared to settlement levels on Friday.

- The session has been data-light, with Jibun Bank Japan PMI Mfg (F) as the sole release.

- ICYMI, BoJ Governor Ueda said that he hopes wages and inflation will rise in a balanced manner this year. He added that the BOJ will be fully prepared to support the financial system after the earthquake in northwestern Japan earlier this week. (See Bloomberg link)

- Cash US tsys are dealing flat to 2bps cheaper in today's Asia-Pac session as participants digest yesterday’s December FOMC Minutes, ahead of the release of US ADP private employment later today and December employment data on Friday.

- Cash JGBs are dealing mixed, with yields 0.1bp lower to 2.4bps higher. The benchmark 10-year yield is 0.7bp higher at 0.621% versus the Nov-Dec rally low of 0.555%.

- Swaps are little changed across maturities, with swap spreads narrower.

- Tomorrow, the local calendar sees Monetary Base, Jibun Bank PMI Composite & Services and Consumer Confidence data.

AUSSIE BONDS: Slightly Richer, Narrow Ranges, US ADP Data Due Later Today

ACGBs (YM +1.0 & XM +1.0) are slightly richer, after dealing in relatively narrow ranges in today’s Sydney session. With the domestic data calendar light apart from the previously outlined Judo Bank Services & Composite PMI data, local participants appear to have sat on the sidelines ahead of the release of US ADP private employment later today and December employment data on Friday.

- Cash US tsys are dealing little changed in today's Asia-Pac session as participants digest yesterday’s release of the December FOMC Minutes.

- (AFR) A multi-month surge in iron ore prices is poised to deliver Treasurer Jim Chalmers as much as $18 billion in extra tax revenue. (See link)

- Cash ACGBs are 2bps richer, with the AU-US 10-year yield differential 3bps tighter at +10bps.

- Swap rates are little changed, with EFPs 2-3bps wider.

- The bills strip is little changed, with pricing flat to -1.

- RBA-dated OIS pricing is little changed, with 56bps of easing priced by end-2024.

- Tomorrow, the local calendar is empty.

NZGBS: Twist-Steepening, 10Y Underperformance Vs. $-Bloc

NZGBs have twist-steepened into the close, with yields 1bp lower to 4bps higher. The 5 and 10-year benchmarks closed at session cheaps, despite the lack of newsflow locally.

- On a relative basis, the NZGB 10-year has also underperformed its $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials respectively 8bps and 9bps wider.

- Cash US tsys are dealing little changed in today's Asia-Pac session as participants digest yesterday’s release of the December FOMC Minutes. The market’s focus now turns to ADP private employment later today, followed by December employment data on Friday.

- Swap rates closed 3-4bps firmer, with short-end implied swap spreads wider.

- RBNZ dated OIS pricing closed flat for meetings out to July and 3-5bps firmer beyond. 106bps of easing is priced by November.

- Tomorrow, the local calendar is empty.

EQUITIES: Japan Markets Recoup Early Losses, China Equity Weakness Extends

Regional equities are mixed in Thursday trade to date. On the downside China equity losses are a standout, with the CSI 300 down 1.40% at the break. Japan markets, on the first trading day of 2024, have pared losses as the session progressed. US equity futures sit marginally higher at this stage. Eminis were last near 4751, +0.10%, with Nasdaq futures up by a similar amount.

- The CSI 300 is off by 1.4% at the break. Sentiment not buoyed by a much stronger than expected Caixin services PMI result. Aggregate markets continue to unwind the late 2023 rally.

- The real estate sub index is down a further 2.40%, making fresh cyclical lows, with little respite for the under pressure sector. Fitch downgraded the outlook for a number of China national asset management companies on expectations of reduced government support.

- The HSI is off nearly 0.50% at the break.

- Japan markets opened lower, playing catch up to the softer global equity trend since the start of the year, but we are comfortably away from lows. The Topix sits +0.30% higher, the Nikkei 225 down -0.75%. Weaker yen levels are likely helping at the margin, although airline stocks have been pressured in the wake of the recent crash.

- The Kospi continues to correct lower, off a further 0.90%, while the Taiex in Taiwan has seen a more muted fall (off 0.15%).

- In SEA, Philippines stocks have outperformed, up 1%. The bourse will reportedly offer new products to retail investors, while IPOs are expected to rise this year (see this link). Trends are mixed elsewhere.

FOREX: Dollar Index Close To Unchanged, Yen Marginally Weaker, NZD Firms

The BBDXY sits slightly lower in latest dealings versus end NY levels from Wednesday. The index was last under 1224, but has maintained tight ranges overall. Yen has underperformed at the margins, most notably against the NZD.

- Early trade saw USD/JPY dip to 142.86, but this was short lived and we climbed back towards 143.50 as the session progressed. We were last near these levels, with Wednesday highs (143.70/75) still intact. There was a modest PMI revision for Dec, while onshore equities have pared losses as the session progressed (in the first trading session for the year).

- BoJ Governor Ueda stated that he hopes wages and inflation rise in a balanced fashion this year. He also stated the financial system will be supported in the wake of the recent earthquake.

- NZD/USD has recovered from earlier lows, the pair last near 0.6265/70, around 0.30% firmer than Wednesday NY closing levels. Recent dips below the 20-day EMA (0.6245) have been supported. Local news flow has remained light.

- AUD/USD sits near 0.6740 slightly above end Wednesday levels.

- Cross asset moves in the US space have been muted, with US bond and equity futures relatively steady.

- Looking ahead, markets receive a host of Eurozone inflation prints for December. US ADP employment and jobless claims are notable releases in the US, although the focus will quickly turn to non-farm payrolls on Friday.

OIL: Ongoing Middle East Tensions May Add War Premium To Crude

Oil prices have held onto the 3.5%-plus gains made on Wednesday during the APAC session today, as the factors driving it higher haven’t dissipated and US data showed a large stock drawdown. WTI is up 0.7% to $73.22/bbl, off the intraday low of $72.90. Brent is 0.5% higher at $78.62. The USD index is flat.

- Crude rose yesterday on OPEC reiterating its commitment to market stability, a terrorist attack in Iran adding to tensions in the region, shutdowns at Libyan oil fields worth 365kbd and the US announcing it will buy 3mn barrels for its SPR while last week there was a large US stock drawdown.

- The US and its allies have warned the Houthis that there will be consequences if they don’t stop attacking ships in the Red Sea. The UN said that 18 companies have now rerouted ships. There is a risk that if the situation deteriorates, a war risk premium will be added to oil prices again, which Goldman Sachs estimates could be $3-4/bbl. It expects Brent to stay in the $70-90/bbl range over 2024, according to Bloomberg.

- Bloomberg reported that US crude stocks fell 7.418mn barrels in the latest week, according to people familiar with the API data. But gasoline inventories rose 6.913mn and distillate 6.686mn. The official EIA data is out later today.

- Later the US December ADP employment and jobless claims print. There are also final S&P Global US/Europe composite/services PMIs for December. There are also preliminary December German and French CPIs.

GOLD: Down For The Fourth Consecutive Day

Gold has registered a slight uptick in the Asia-Pac session, partially recovering from a 0.8% decline that brought it to a closing price of $2041.49 on Wednesday. The strength of the dollar played a pivotal role in Wednesday's decline, marking the fourth consecutive day of diminishing gold values.

- US Treasuries finished little changed on Wednesday. The NY session saw choppy trading after the December FOMC Minutes release. The minutes were balanced but with a dovish tone as officials noted diminished inflation and the need to start a discussion of QT wind down.

- Data released on Wednesday showed the ISM Manufacturing Index remaining in contraction territory for a 14th month at the end of 2023. Job openings eased in November to the lowest level since early 2021.

- The market’s focus now turns to ADP private employment later today, followed by December employment data on Friday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/01/2024 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 04/01/2024 | 0745/0845 | *** |  | FR | HICP (p) |

| 04/01/2024 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 04/01/2024 | 0900/1000 | *** |  | DE | Saxony CPI |

| 04/01/2024 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/01/2024 | 0930/0930 | ** |  | UK | BOE M4 |

| 04/01/2024 | 0930/0930 |  | UK | BOE's Monthly Decision Maker Panel data | |

| 04/01/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/01/2024 | 1300/1400 | *** |  | DE | HICP (p) |

| 04/01/2024 | 1315/0815 | *** |  | US | ADP Employment Report |

| 04/01/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 04/01/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 04/01/2024 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 04/01/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/01/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.