-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: EUR Weakness Follows EU Election Results

EXECUTIVE SUMMARY

- FAR-RIGHT ADVANCES IN EU ELECTION, FRANCE CALLS SNAP NATIONAL VOTE - RTRS

- AWAITING FURTHER EVIDENCE, KEEPING EASING BIAS - MNI FED WATCH

- JAPAN’S SPUTTERING ECONOMY YET TO SHOW CLEAR SIGNS OF RECOVERY - BBG

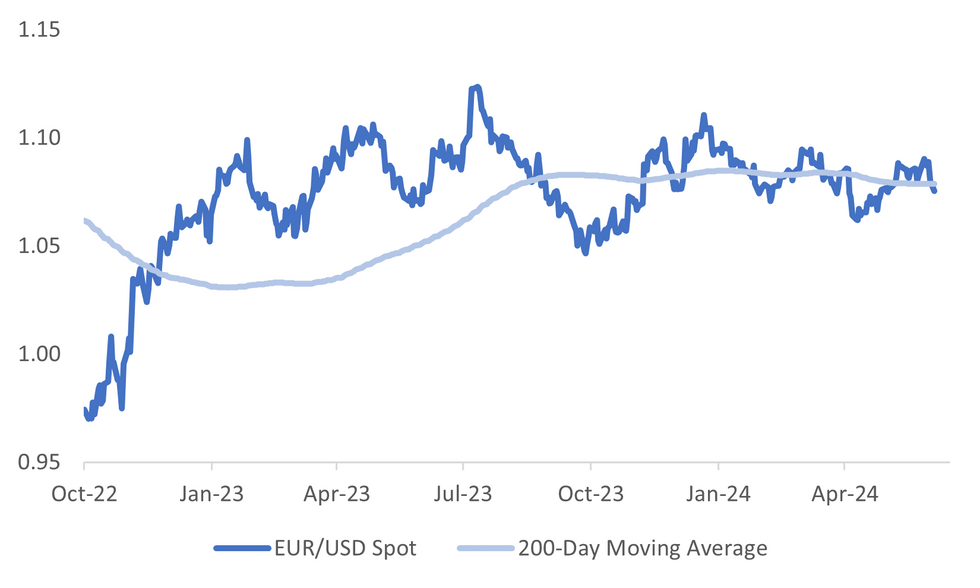

Fig. 1: EUR/USD Versus 200-day Moving Average

Source: MNI - Market News/Bloomberg

UK

POLITICS (BBG): Britain’s Labour opposition has scrapped plans to reintroduce a tax-free limit on pension saving as the five main political parties prepare to publish their manifestos this week amid questions about how they’ll pay for their campaign pledges.

ECONOMY (BBG): Climate change in Britain is delivering more rainy and extreme weather, turning a national stereotype into a headache for economists trying to predict retail and growth data.

EUROPE

EU (RTRS): Gains by the far-right in voting for the European Parliament on Sunday prompted a bruised French President Emmanuel Macron to call a snap national election and added uncertainty to Europe's future political direction.

FRANCE (BBG): After a crushing defeat in the European Parliament election on Sunday, French President Emmanuel Macron called a snap legislative ballot in a desperate bid to stop the rise of his far-right rival, Marine Le Pen.

ITALY (RTRS): Prime Minister Giorgia Meloni's arch-conservative Brothers of Italy group won the most votes in this weekend's European parliamentary election, initial results showed, boosting her standing both at home and abroad.

GERMANY (BBG): German Chancellor Olaf Scholz’s Social Democrats crashed to their worst-ever result in European Parliament elections Sunday, falling to third place behind the far-right Alternative for Germany.

ECB (MNI BRIEF): The ECB will adjust the precise path of its future rate cuts as the outlook for disinflation is confirmed, Bank of France Governor Francois Villeroy said in a statement Friday, as he noted that the current level of rates was "still significantly above the neutral level" after Thursday's reduction and would continue to bring down inflation.

US

FED (MNI FED WATCH): The Federal Reserve is expected to hold rates at 5.25%-5.5% for a seventh meeting at next week's June FOMC while acknowledging it will take longer to gain the confidence needed to lower borrowing costs later this year.

POLITICS (BBG): Donald Trump said he’d scrap taxes on tipped earnings for hospitality workers if he wins the White House, calibrating his message for swing-state voters in Nevada as he fights back after his felony conviction.

OTHER

ISRAEL (RTRS): Israeli minister Benny Gantz announced his resignation from Prime Minister Benjamin Netanyahu's emergency government on Sunday, withdrawing the only centrist power in the embattled leader's far-right coalition amid a months-long war in Gaza.

BRAZIL (MNI BRIEF): The Central Bank of Brazil should not overreact to financial market volatility, Deputy Governor for Monetary Policy Gabriel Galipolo said on Friday, adding the reaction function of the monetary authority considers several factors beyond swings in asset prices and exchange rates.

JAPAN (BBG): Japan’s economy showed scant sign of a clear recovery with its narrower-than-first-estimated contraction leaving plenty of reason for continued caution among policymakers as the Bank of Japan eyes the timing of its next interest rate hike.

JAPAN (BBG): Japan’s main opposition party urged Prime Minister Fumio Kishida to call a snap election to seek a fresh mandate from voters, saying the public had “completely lost trust” in his leadership over a slush fund scandal within the ruling Liberal Democratic Party.

NORTH KOREA (BBG): The sister of North Korea’s leader warned of reprisals against South Korea after it resumed loudspeaker broadcasts for the first time in years, signaling an escalation of tensions along one of the world’s most militarized borders.

AUSTRALIA (BBG/THE AUSTRALIAN): Support for Australia’s center-left Labor government has slumped after a week of poor economic news and political tensions over immigration, according to a new poll, leaving Prime Minister Anthony Albanese’s party at its equal lowest point since it won power two years ago.

CHINA

HOUSING (RTRS): China's efforts to clear massive inventory by turning unsold homes into affordable housing are unlikely to help cash-strapped developers due to the programme's limited size and potentially low prices, analysts and developers say.

MARKET DATA

JAPAN 1Q F GDP SA Q/Q -0.5%; MEDIAN -0.5%; PRIOR -0.5%

JAPAN 1Q F GDP ANNUALISED SA Q/Q -1.8%; MEDIAN -2.0%; PRIOR -2.0%

JAPAN 1Q F GDP NOMINAL SA Q/Q 0.0%; MEDIAN 0.1%; PRIOR 0.1%

JAPAN 1Q F GDP DEFLATOR Y/Y 3.4%; MEDIAN 3.6%; PRIOR 3.6%

JAPAN 1Q F GDP PRIVATE CONSUMPTION Q/Q -0.7%; MEDIAN -0.7%; PRIOR -0.7%

JAPAN 1Q F GDP BUSINESS SPENDING Q/Q -0.4%; MEDIAN -0.7%; PRIOR -0.8%

JAPAN 1Q F GDP INVENTORY CONTRIBUTION % GDP 0.3%; MEDIAN 0.2%; PRIOR 0.2%

JAPAN 1Q F GDP NET EXPORTS CONTRIBUTION % GDP -0.4%; MEDIAN -0.3%; PRIOR -0.3%

JAPAN APRIL BOP CURRENT ACCOUNT ADJUSTED ¥2524.1BN; MEDIAN ¥2081.7BN; PRIOR ¥2010.6BN

JAPAN APRIL TRADE BALANCE -¥661.5BN; MEDIAN -¥346.7BN; PRIOR ¥491.0BN

JAPAN MAY BANK LENDING INC TRUSTS Y/Y 3.0%; PRIOR 3.1

JAPAN MAY ECO WATCHERS SURVEY CURRENT SA 45.7; MEDIAN 48.5; PRIOR 47.4

JAPAN MAY ECO WATCHERS SURVEY OUTLOOK SA 46.3; MEDIAN 49; PRIOR 48.5

MARKETS

US TSYS: Treasury Futures Steady, Ranges Very Tight

- Treasury futures opened a touch lower and have since managed to trade sideways and in very tight ranges. TU is -0-01⅜ lower at 101-27¾, while TY is -04 at 109-06

- Volumes: TU 45k, FV 73k TY 90k

- Tsys Flows: FV Block Seller & Buyer, TU/UXY Block Steepener

- Looking at TYU4 technical levels, initial support is at 108-27 (Jun 3 lows), with 108-04+ (Trendline drawn from the Apr low) the next target. While to the upside initial resistance is at 110-21 (June 7 highs), a break here would see a test of 110-27+ (1.00 proj of the Apr 25 - May 16 - 29 price swing)

- Cash treasury curve is slightly steeper today, with the 2Y +0.2bp to 4.891%, the 10Y +1.2bps at 4.447% while the 2y10y was +0.770 at -44.117.

- French President Emmanuel Macron and German Chancellor Olaf Scholz suffered defeats in the European Parliament elections.

- Late year rate cut projections have receded vs. late Thursday levels (*): June 2024 at -1.3% w/ cumulative rate cut -.3bp at 5.328%, July'24 at -8% w/ cumulative at -2.3bp (-5.9bp) at 5.307%, Sep'24 cumulative -13.7bp (-21.3bp), Nov'24 cumulative -20.3bp (-30.7bp), Dec'24 -37.4bp (-49.7bp).

- Looking ahead: NY Fed 1-Yr Inflation Expectations

JGBS: Futures Biased Lower, Cash Yield Curve Steeper

JGB futures currently sit close to session lows, JBM4 last at 143.51, -.47 versus settlement levels. Upticks above 143.60 have sold by the market so far today.

- Spillover from a softer US Tsy and EU bond futures backdrop have arguably been key drivers for JGB markets today. For US moves, this looks to be carry over from Friday's sharp selloff post the NFP/wages data beat.

- For EU bond futures sentiment has been rattled by the Sunday EU parliamentary election results, which showed a swing to right-wing parties, while French President Macron has called a snap legislative election.

- For JGB futures, downside focus will rest on whether we can re-test late May lows sub 143.00.

- On the data front, we had Q1 GDP revisions earlier. Q/Q growth remained at -0.5%. Business spending remained negative but not to the degree as initially reported.

- For cash JGB yields, the curve has steepened. 10yr yields sit near 1.03% up around 5bps. The 20-40yr tenors are 6-7bps higher. The 10yr swap rate is up a further 2bps to 1.055%.

- Looking ahead, it is largely second tier data head of Friday's BoJ decision.

NZGBs: Curve Steady, Yields Rise 9-10bps

NZGBs closed cheaper, with yields 9-10bps higher following large moves in the US on Friday on the back of stronger Non farm payrolls. There has been little else in the way of market moving headlines, with the market now adjusting to the rate hike percentage.

- NZGBs opened trading for the week just 5-6bps higher, although continued to sell off throughout the session and closed near session highs

- The 2yr is +9.5bps at 4.891%, 10yr +9.6bps at 4.710%

- Swaps are 2-10bps higher, curve steepened

- Headlines: Chinese Premier Li Qiang to visits NZ this week. Luxon to explore AUKUS opportunities

- RBNZ dated OIS pricing is little changed. A cumulative 24bps of easing is priced by year-end.

- looking Ahead, REINZ House Sales, BusinessNZ Manufacturing PMI & Food Prices on Friday

ASIA PAC STOCKS: Asian Equities Mixed As Many Markets Shut for Public Holidays

Asian equities traded in a narrow range today with mixed performances across the region. The MSCI Asia Pacific Index fell by up to 0.2%, with declines in South Korea, where the Kospi dropped due to reduced bets on US interest rate cuts, and in Thailand, where the SET Index hit a 3.5-year low due to a stronger dollar. Meanwhile, Japanese stocks gained as higher bond yields lifted financials and a weaker yen boosted exporters. Indian stocks swing between gains and losses as traders awaited new government announcements. Trading volumes were lower than usual with markets in China, Hong Kong, Taiwan, and Australia closed for holidays.

- Japanese stocks have rebounded due to rising bond yields, benefiting financial firms. This movement comes amid speculation that the Federal Reserve will maintain its current policy stance and that the Bank of Japan may tighten its policies. Exporters, particularly automakers and machinery firms, gained from a weaker yen against the dollar. The Topix is up 0.90%, the Topix Bank Index is up 1.39% while the Nikkei 225 is up 0.83%

- South Korea’s Kospi index dropped by up to 1.2%, following its best weekly performance in four months, due to rising Treasury yields and diminishing rate cut expectations after strong US nonfarm payroll growth. Samsung, LG Energy Solution, and Celltrion were the main contributors to the decline. Nearly all sectors saw losses, except for machinery and food. Last week, the Kospi gained 3.3%, marking its best weekly advance since early February. The small-cap Kosdaq Index fell by as much as 0.6%.

- Elsewhere in SEA, New Zealand Equities closed down 0.65%, Singapore equities are 0.29% lower, Malaysian equities are down 0.17%, Philippines Equities are 0.90% lower, while Indonesian & Indian equities are up about 0.20%.

FOREX: EUR Weakness Follows EU Elections, USD Supported Elsewhere

USD strength has carried over from Friday's session into the first part of Monday trade. The BBDXY index is up a further 0.20%, last tracking around 1265.3. This puts the index back close to early May levels.

- EUR/USD weakness was evident from early trading, as weekend parliamentary elections showed firm support for right-wing parties and placed fresh clouds over the French near term outlook. Legislative elections were called for the end of this month by President Macron following his party's poor results from the Sunday elections.

- The currency is tracking to fresh lows near 1.0750 in recent dealings, off a further 0.4% so far today. We are below key short term support (1.0788, May 30 low), with 1.0724 (the May 9 low) a potential downside target.

- Yen initially outperformed EUR, but is also tracing weaker. USD/JPY is back to 157.10/15, firmer by 0.25%. May 29 highs at 157.71 is a key upside focus point. We had Q1 GDP revisions data out earlier, but there weren't any major shifts relative to the initial print (q/q growth remained at -0.5%).

- US yields have ticked higher, lending some further support to USD/JPY. Regional equity sentiment is mixed. Japan stocks are the main positive.

- AUD/USD is a little higher, but still sub 0.6590. Australian markets have been closed today, while China and Hong Kong markets are also out. NZD/USD is close to 0.6100, little changed for the session.

- Looking ahead, it is a relatively quiet start to the week data wise.

OIL: Modestly Higher Ahead Of Key Event Risks This Week

Oil benchmarks are marginally higher in the first part of Monday dealings. Brent has been unable to recapture the $80/bbl handle but still sits +0.355 higher, unwinding Friday's modest loss. WTI front month is around $75.80/bbl, showering a similar trajectory.

- Broadly oil benchmarks maintain ranges from the latter stages of last week. For Brent, we are sub all key EMAs, with the 20-day at $81.57/bbl the nearest on the topside. Earlier June lows rest at $76.76/bbl.

- Goldman Sachs expected Brent to recover to $86/bbl in Q3, as the market gets pushed into deficit (see this link for more details).

- Outside of this week's Fed meeting, note we also have monthly reports from OPEC and the International Energy Agency due on Tuesday and Wednesday respectively.

GOLD: Largely Holding Friday Losses

Gold has largely tracked sideways in the first part of Monday Asia Pac trade, we remain sub $2300. This leaves us holding the bulk of Friday's near 3.5% fall. We ended last Friday losing close to 1.5% for the week.

- The USD is mostly firmer today, as EUR weakness and yen losses have pushed the BBDXY index up a further 0.20% to 1264.80. EUR weakness is reflected of renewed political concerns following the weekend parliamentary elections. This may be driving some risk aversion in markets, a likely gold support at the margins.

- From Friday we also had China FX reserves which showed a further reduction in gold buying.

- Levels wise for gold, a further correction lower could see early May lows near $2277 targeted. Further south is the 100-day EMA close to $2240. Friday highs from last week were near $2387.75. The 50-day EMA rests close to $2313.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/06/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 10/06/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 10/06/2024 | 0800/1000 | * |  | IT | Industrial Production |

| 10/06/2024 | - |  | JP | Economy Watchers Survey | |

| 10/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 10/06/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.