-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: French Right Win Parliamentary Elections, Majority Looks Unlikely

EXECUTIVE SUMMARY

- FAR RIGHT WINS FIRST ROUND IN FRANCE ELECTION, FINAL RESULT UNCERTAIN, EXIT POLLS SHOW - RTRS

- TOP DEMOCRATS RULE OUT REPLACING BIDEN AMID CALLS FOR HIM TO QUIT 2024 RACE - RTRS

- BOJ TANKAN: SENTIMENT RISES, SOLID CAPEX PLANS, BACKS BOJ - MNI

- BUSINESS INFLATION EXPECTATIONS SOLID - BOJ TANKAN - MNI BRIEF

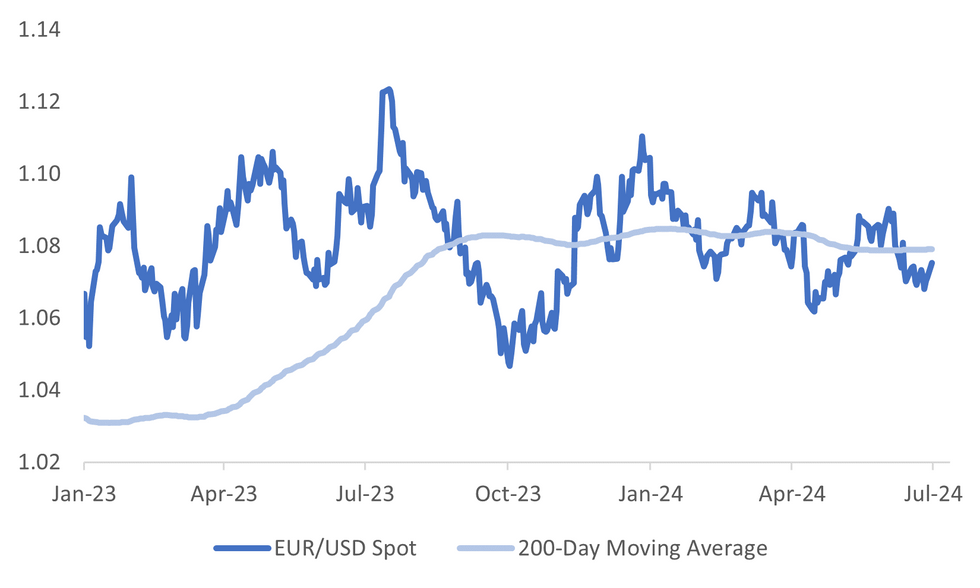

Fig. 1: EUR/USD Versus Simple 200-day MA

Source: MNI - Market News/Bloomberg

UK

POLITICS (BBG): “Opinion polls in Britain are still pointing to a crushing defeat for the governing Conservatives after 14 years in power as the election campaign reaches its final days.”

CORPORATE (BBG): “BlackRock Inc. will acquire private capital database provider Preqin for £2.55 billion ($3.2 billion) in cash, as the world’s largest money manager accelerates its push to become a major player in alternative assets.”

EUROPE

FRANCE (RTRS): “Marine Le Pen's far-right National Rally (RN) party scored historic gains to win the first round of France's parliamentary election on Sunday, exit polls showed, but the final result will depend on days of horsetrading before next week's run-off.”

EUR (BBG): “The euro strengthened as traders digested signs Marine Le Pen’s far-right party was poised to win the first round of France’s legislative election with a smaller margin than some polls had indicated.”

FRANCE (LE MONDE): “Prime Minister Attal likely to retain seat after strong first-round showing. Gabriel Attal came out on top in the 10th constituency of Hauts-de-Seine, west of Paris, in the first round of the legislative elections.”

EU (DW): “Hungarian, Czech and Austrian parties have created the Patriots for Europe grouping, which aims to secure more influence for right-leaning and far-right parties in the new European Parliament.”

EU (DW): “On July 1, Hungary, led by EU skeptic Viktor Orban, will take over the bloc's rotating presidency of the EU Council until the end of the year.”

US

INFLATION (MNI INTERVIEW): U.S. households generally expect inflation to keep moving lower and stay under wraps over the longer run, although uncertainty over the future path of prices remains high within some groups, the head of the University of Michigan's Survey of Consumers told MNI.

POLITICS (RTRS): “Top Democrats on Sunday ruled out the possibility of replacing President Joe Biden as the Democratic nominee after a feeble debate performance and called on party members to focus instead on the consequences of a second Donald Trump presidency.”

POLITICS (RTRS): “President Joe Biden's train-wreck debate with Republican opponent Donald Trump followed a series of decisions by his most senior advisers that critics now point to as wrong-headed, interviews with Democratic allies, donors and former and current aides show.”

CORPORATE (BBG): “The US Justice Department will charge Boeing Co. with criminal fraud, leaving the planemaker to choose between pleading guilty or taking the risk of going to trial, according to people familiar with the matter.”

OTHER

JAPAN (MNI): Japanese benchmark business sentiment rose from three months ago, the first rise in two quarters as manufacturers succeeded in transferring higher costs to retail prices, although non-manufacturers were hit by higher costs caused by the weak yen, the Bank of Japan’s June Tankan business sentiment survey released Monday showed.

JAPAN (MNI BRIEF): Japanese firms’ inflation expectations remained above 2% in June, unchanged from three months ago, supporting the Bank of Japan’s view that the price and wage norm has changed slightly, the BOJ June Tankan survey released on Monday showed.

JAPAN (MNI BRIEF): Japan's Q1 economy contracted at a faster pace than previously estimated as public investment was revised lower, updated data released by the Cabinet Office showed on Monday.

MIDEAST (RTRS): Israeli forces advanced further on Sunday into the Shejaia neighbourhood of northern Gaza and also pushed deeper into western and central Rafah in the south, killing at least six Palestinians and destroying several homes, residents said.

AUSTRALIA (BBG): “Sydney home values climbed to a record in June as strong demand and low supply overshadowed increasing pain from high borrowing costs. Melbourne declined for a third straight month.

CHINA

PMIS (MNI BRIEF): China's Manufacturing Purchasing Managers Index shrank for a second straight month in June, registering 49.5, flat from May's reading, while non-manufacturing PMI slowed to the lowest level this year, data from the National Bureau of Statistics showed Sunday.

ECONOMY (YICAI): “The government should significantly increase countercyclical policies and boost investment to drive up orders and production, following June’s PMI reading of 49.5, according to Zhang Liqun, an analyst at the China Federation of Logistics and Purchasing.

FDI (CSJ): “China is planning a series of new measures to further encourage foreign investment, including reducing access restrictions and launching a new round of pilot measures to expand the opening up of the service industry, China Securities Journal reported.”

TRAVEL (YICAI): “China air passenger volume will grow 7.0% y/y this July and August, 12.2% higher than 2019 levels, according to estimates from Flight Steward, a booking service.”

CHINA MARKETS

MNI: PBOC Net Drains CNY48 Bln Via OMO Mon; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Monday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY48 after offsetting the CNY50 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:25 am local time from the close of 2.1664% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Friday, compared with the close of 50 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1265 on Monday, compared with 7.1268 set on Friday. The fixing was estimated at 7.2566 by Bloomberg survey today.

The CFETS Weekly RMB Index was 100.04 on Jun 28, up 0.07% compared with 99.97 as of Jun 21.

The gauge, which compares the yuan to a basket of currencies from China's 24 major trading partners, has increased 2.69% this year, when compares with 97.42 on Dec. 29, 2023.

MARKET DATA

NEW ZEALAND MAY FILLED JOBS 2.395M; PRIOR 2.396M

NEW ZEALAND MAY FILLED JOBS UNCHANGED M/M; PRIOR -0.1%

AUSTRALIA JUNE CORELOGIC HOUSE PRICES +0.7% M/M; PRIOR +0.8%

AUSTRALIA JUDO BANK JUNE MFG PMI 47.2, PRE 47.5; MAY 49.7

AUSTRALIA MELBOURNE INSTITUTE INFLATION GAUGE JUNE +0.3% M/M; PRIOR +0.3%

AUSTRALIA MELBOURNE INSTITUTE INFLATION GAUGE JUNE +3.2% Y/Y; PRIOR +3.1%

AUSTRALIA ANZ JOB ADVERTISEMENTS JUNE -2.2% M/M; PRIOR -1.9%

JAPAN TANKAN JUNE LARGE MANUFACTURER +13; EST. +11; PRIOR +11

JAPAN TANKAN NEXT LARGE MANUFACTURER +14; EST. +11; PRIOR +10

JAPAN TANKAN JUNE LARGE NON-MANUFACTURER +33; EST. +33; PRIOR +34

JAPAN TANKAN NEXT LARGE NON-MANUFACTURER TANKAN +27; EST. +28; PRIOR +27

JAPAN TANKAN JUNE LARGE ALL INDUSTRY CAPEX +11.1%; EST. +13.9%; PRIOR +4.0%

JAPAN TANKAN JUNE SMALL MANUFACTURER -1; EST. -1; PRIOR -1

JAPAN TANKAN NEXT SMALL MANUFACTURER 0; EST. 0; PRIOR 0

JAPAN TANKAN JUNE SMALL NON-MANUFACTURER +12; EST. +13; PRIOR +13

JAPAN TANKAN NEXT SMALL NON-MANUFACTURER +8; EST. +9; PRIOR +8

JAPAN JIBUN BANK JUNE MFG PMI 50; PRE 50.1; MAY 50.4

JAPAN 1Q GDP REVISED DOWN TO -2.9% ANNUALIZED; PRE -1.8%

CHINA JUNE COMPOSITE PMI 50.5; MAY 51.0

CHINA JUNE MFG PMI 49.5; EST. 49.5; MAY 49.5

CHINA JUNE SERVICES PMI 50.5; EST. 51.0; MAY 51.1

CHINA JUNE CAIXIN MFG PMI 51.8; EST. 51.5; PRIOR 51.7

SOUTH KOREA JUNE EXPORTS +5.1% Y/Y; EST. +4.4%; PRIOR +11.5%

SOUTH KOREA JUNE IMPORTS -7.5% Y/Y; EST. -4.7%; PRIOR -2.0%

SOUTH KOREA JUNE TRADE SURPLUS $7.999B; EST. +$5.700B; PRIOR $4.855B

SOUTH KOREA S&P GLOBAL JUNE MFG PMI 52; MAY 51.6

MARKETS

US TSYS: Tsys Futures Off Earlier Lows, Curve Steepens, ISM Later Today

- Treasury futures are off earlier lows with TUU4 is -0-00¾ at 102-02¾ while TYU4 is down -0-08+ at 109-23+, tsys looks to have followed French bond futures higher throughout the day, with OATU4 up 28 ticks, amid speculation a far-right party may not secure an absolute majority in France’s legislative election, and investors weighing up a Trump Presidency.

- Volumes are above recent averages with TU 56k, FV 118k & TY 180k

- Cash treasuries have erased earlier weakness with yields now lower across the curve. The 2Y -2.5bps at 4.729%, 5Y -1.8bps at 4.359% while the 10Y is -1bps at 4.386%.

- APAC rates: NZGB yields are 1-3bps lower, ACGB yields are 2-9bps higher, while JGBs have seen selling through the belly with yields +/- 2bps.

- The increasing likelihood of a Trump presidential victory has made curve steepeners an attractive bet, as it is expected to slow growth and increase inflation. PredictIt has Trump's odds of winning at 56% although this is down from 64% during the debate, while they have Biden's odds at just 31% chance of winning.

- In-line with the steepening moves, projected rate cut pricing through year end looks steady to mildly higher vs. pre-data levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -18.6bp (-17.5bp), Nov'24 cumulative -27.6bp (-26.6bp), Dec'24 -47.3bp (-45.3bp).

- Looking ahead, S&P Global US Manufacturing PMI, ISM Manufacturing, Construction Spending MoM

JGBS: Belly Of Cash Curve Cheaper, Q1 GDP Revised Lower

JGB futures are weaker but well off session lows, -24 compared to the settlement levels.

- Outside of the previously outlined Tankan Report and Mfg PMI, there hasn't been much in the way of domestic drivers to flag.

- (MNI) Japan's Q1 economy contracted at a faster pace than previously estimated as public investment was revised lower, updated data released by the Cabinet Office showed on Monday. The economy contracted 0.7% q/q, or an annualised -2.9%, compared to previous estimates of -0.5% q/q and an annualized -1.8%.

- Cash JGBs are 1bp richer to 2bps cheaper, with the belly of the curve underperforming. The benchmark 10-year yield is 1.1bps higher at 1.068% versus the cycle high of 1.101%.

- The move away from morning cheaps has been assisted by a bull-steepening in US tsys in today’s Asia-Pac session. Cash benchmarks are currently 1-3bps richer after being as much as 2bps cheaper in early dealings.

- (Bloomberg) “The BoJ will probably continue to purchase government bonds to some degree long after it kicks off quantitative tightening this summer, according to a former BOJ executive director.” (See link)

- The swaps curve is little changed, apart from the 40-year which is 3bps higher. Swap spreads are mixed.

- Tomorrow, the local calendar will see Monetary Base data alongside 10-year supply.

NZGBS: Closed On A Positive Note After Friday’s Holiday

NZGBs closed on a strong note, with benchmark yields 2-3bps lower compared to Thursday’s close. The local market was closed for a holiday on Friday.

- With the local calendar relatively light, the move away from morning cheaps has been assisted by a bull-steepening in US tsys in today’s Asia-Pac session. Cash benchmarks are currently 1-3bps richer after being as much as 2bps cheaper in early dealings.

- Swap rates closed 1-4bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed flat to 4bps softer across meetings, with 2025 meetings leading. A cumulative 30bps of easing is priced by year-end.

- Tomorrow, the local calendar will see the NZIER Business Opinion Survey results and Building Permits data, ahead of ANZ Commodity Prices on Wednesday.

- On Thursday, the NZ Treasury plans to sell NZ$225mn of the 1.5% May-31 bond, NZ$175mn of the 4.25% May-34 bond and NZ$100mn of the 1.75% May-41 bond.

AUSSIE BONDS: Cheaper But Off Worst Levels, RBA Minutes For June Tomorrow

ACGBs (YM -5.0 & XM -7.5) are cheaper but well above session cheaps.

- Outside of the previously outlined MI Monthly Inflation Gauge and ANZ Job Ads, there hasn't been much in the way of domestic drivers to flag.

- With the local calendar relatively light, the move away from morning cheaps has been assisted by a bull-steepening in US tsys in today’s Asia-Pac session. Cash benchmarks are currently 1-3bps richer after being as much as 2bps cheaper in early dealings.

- Cash ACGBs are 4-6bps cheaper, with the AU-US 10-year yield differential at -1bp.

- Swap rates are higher, with a steepening bias.

- The bills strip has bear-steepened, with pricing flat to -4.

- Although softer than Thursday’s levels, RBA Dated OIS remains 6-23bps firmer than pre-CPI levels. The market gives a 25bp hike in August a 43% chance versus 55% last Thursday. Terminal rate expectations also remain dramatically firmer at 4.48% versus 4.37% before the CPI data. Thursday’s high was 4.53%.

- Tomorrow, the local calendar will see the RBA Minutes of the June Policy Meeting.

FOREX: EUR/USD Rebounds Post First Election Round, Yen Underperformance Continues

EUR strength has been the main focus point in the first part of Monday trade. This has weighed on the BBDXY USD Index, which is down 0.10% to the low 1268.20/30 region.

- The single currency rallied early doors as Le Pen's far right party didn't poll as strongly as some opinion polls suggested in the first round of French parliamentary elections. Left leaning parties also vowed to bloc Le Pen's majority ambitions. EUR/USD is back to 1.0755, around 0.40% stronger for the session today.

- USD/JPY dips have been supported, the pair last just above 161.00. Friday highs (161.27) remain intact, but the yen remains weaker on crosses. CFTC positioning data showed an extension of yen shorts (we aren't too far away from 2024 lows). The Tankan survey data was mixed, albeit mostly positive for large firms and the Capex outlook, suggesting the BoJ can continue to adjust accommodative settings.

- AUD/USD is near 0.6665, underperforming modestly. Second tier data today hasn't shifted the sentiment needle. NZD/USD is a touch higher, last around 0.6100. Last week trades added to long NZD positions and cut AUD shorts (per CFTC).

- In the cross asset space, US equity futures were last up close to 0.3%. US yields are lower, led by the end of the curve. Iron ore has risen, amid positive China property news but with little benefit for the A$.

- Later US June manufacturing ISM/PMI, European PMIs and preliminary June German CPIs print. Also ECB President Lagarde speaks.

CHINA STOCKS: Equities Mostly Lower, Property Stocks Higher On Promising Sales

Mainland Chinese equities fell after factory activity contracted for the second consecutive month in June, raising doubts about the country's economic recovery, while Hong Kong markets are closed for HKsar Establishment day. Property stocks have rallied on the back of data showing the nations top 100 developers posted a 36% m/m increase in contract sales, although y/y sales were still down 17%.

- China equity markets are mixed today, with the CSI 300 trading 0.22% lower, small-cap indices the CSI 1000 and CSI 2000 are both down about 0.60% while the CSI 300 Real Estate Index has surged 6.05% higher.

- China's factory activity contracted for the second consecutive month in June, with the official manufacturing PMI at 49.5, indicating weak demand and posing a threat to the country's economic growth target of around 5% for the year. Additionally, the non-manufacturing PMI fell to 50.5, reflecting ongoing challenges in the construction and services sectors amid trade tensions and a prolonged real estate crisis.

- In the property space, the downturn in China’s residential real estate sector slowed in June, with new-home sales from the top 100 developers posting a 36% m/m increase although this still equated to a 17% drop y/y, compared to May's 34% decline, following easing measures in major cities. Despite some recovery, the broader market remains weak, with funding challenges for developers and ongoing bearish sentiment among investors.

- Asian regulators have tightened controls on high-frequency and quantitative trading, raising concerns about reduced market liquidity and attractiveness. While intended to stabilize markets, the restrictions have sparked debate over their long-term impact, with some fearing they could stifle innovation and efficient asset pricing.

- Looking to next week, Tuesday we have Hong Kong Retail Sales, Wednesday we have Caixin China PMI composite & Services.

ASIA PAC STOCKS: Asian Equities Rise Led By Gains In Japanese Stocks

Asian markets are mostly higher today, there was been plenty of regional economic data out this morning which has helped support markets, although we have faded in the second half of trading. Japanese stocks are higher as yields rise, yen continues to weaken which continues to support export names, while Japanese department store operators saw significant gains, driven by strong earnings forecasts. South Korean equities are slightly higher today as easing US inflation concerns and rising political uncertainties. Meanwhile, Australian shares declined, led by losses in technology and health-related sectors. Global yields have recovered some of the early morning sell-off, with tsys future volumes well above recent averages.

- Japanese stocks rose for a second day as a jump in US yields and a stronger dollar against the yen lifted banks and exporters. The rise in US rates is expected to positively impact value stocks globally, with Japanese financials and materials stocks showing strength. Exporters, such as automobile makers and machinery producers, firmed as the euro remained stable following the first round of France’s legislative elections. Additionally, shares of department store operators J. Front Retail and Takashimaya surged by at least 11%, driven by raised full-year operating income forecasts and strong quarterly earnings. Earlier, Japan's Tankan data print was mixed. Large manufacturing sentiment was slightly better than forecast For Q2. The headline index rose to +13, versus +11 forecast and +11 prior. The Topix is 0.43% higher, while the Nikkei is 0.10% higher.

- South Korean stocks opened slightly higher amid eased concerns over US inflation and rising political uncertainties. South Korea's exports rose by 5.1% year-on-year to $57 billion in June, leading to a trade surplus of $8 billion as imports fell by 7.5% to $49 billion. This marks the ninth consecutive month of export gains and the 13th consecutive month of a trade surplus. The Kospi is 0.10% higher, while the Kosdaq is up 0.70%.

- Taiwanese equities are higher today with TSMC again contributing the most. AI continued to drive Taiwan's stock market, making it the top-performing market in the Asia-Pacific so far this year, with with TSMC climbing 63% and Hon Hai Precision Industry jumping 105%. Earlier S&P Global PMI Mfg jumped to the highest levels since March 2022 at 53.2 from 50.9, while the Taiex is up 0.20% this morning.

- Australian equities are lower this morning, with Financials and Health care stocks offsetting gains in Materials and Real estate. Earlier this morning, Judo Bank PMI Mfg fell to its lowest levels since 2020m while MI inflation ticks slightly higher to 3.2% y/y from 3.1% and ANZ-Indeed Job Ads fell 2.2% from 1.9% (revised) prior. Eyes will now be on the RBA minutes tomorrow. the ASX200 is down 0.40%

- Elsewhere, New Zealand equities are 0.55% higher, Indonesian equities are 0.70% higher although S&P Global PMI fell to 50.7 from 52.1, the JCI is now up 6.45% from recent lows, Thailand Equities are 0.35% higher, Indian equities are 0.30% higher, Malaysian equities are 0.20% higher, Philippines equities are 0.05% higher while Singapore equities are up 0.15%

OIL: Crude Starts Week Higher On Better China Manufacturing PMI & Geopolitics

After falling moderately on Friday, oil prices are higher during APAC trading today driven by a pickup in China’s Caixin manufacturing PMI and geopolitical uncertainty in the Middle East, US and Europe. WTI is up 0.3% to $81.82/bbl after breaking above $82 briefly. Brent is also 0.3% higher at $85.30/bbl after a high of $85.49. The USD index is down 0.1%.

- China’s Caixin manufacturing PMI for June rose to 51.8 from 51.7, higher than expected and the highest in three years. Uncertainty over the strength of China’s economy has concerned oil markets as the country is the world’s largest crude importer and so this data will be welcomed. However the official manufacturing PMI released Sunday was stable at 49.5, still in contractionary territory.

- In terms of geopolitics, right-wing National Rally’s win in first round elections in France could not only derail French reform but also destabilize the European Union depending on second round results on July 7. Tensions between Israel and Hezbollah in Lebanon have also escalated. In addition, US President Biden’s weak performance in last week’s election has clouded the election outlook.

- The market remains optimistic on oil with prompt spreads suggesting the market is tight and money market net longs increasing, according to Bloomberg.

- Later US June manufacturing ISM/PMI, European PMIs and preliminary June German CPIs print. Also ECB President Lagarde speaks.

GOLD: Steady Despite Benign US Inflation Data

Gold is little changed in the Asia-Pac session, after closing basically unchanged at $2326.75 on Friday. Friday’s move left the yellow metal marginally higher on the week.

- Bullion was steady on Friday despite news that the Fed’s preferred measure of underlying US inflation, the core PCE deflator index, rose 2.6% from a year ago — the slowest pace since March 2021.

- The US short term interest rate market shows traders attach a 58% chance of a rate cut being implemented by September.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, a bear threat in gold remains present and the yellow metal continues to trade closer to its recent lows. A clear break of the 50-day EMA, at $2,318.4, would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/07/2024 | 0630/0830 | ** |  | CH | Retail Sales |

| 01/07/2024 | 0715/0915 | ** |  | ES | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0750/0950 | ** |  | FR | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0755/0955 | ** |  | DE | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0800/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 01/07/2024 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 01/07/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0830/0930 | ** |  | UK | BOE M4 |

| 01/07/2024 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/07/2024 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/07/2024 | 1200/1400 | *** |  | DE | HICP (p) |

| 01/07/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (final) |

| 01/07/2024 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/07/2024 | 1400/1000 | * |  | US | Construction Spending |

| 01/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 01/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/07/2024 | 1900/2100 |  | EU | ECB's Lagarde speech at ECB forum on Central Banking |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.