-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: PBOC Increases Gold Reserves

MNI BRIEF: Japan Q3 GDP Revised Up On Net Exports, Capex

MNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI EUROPEAN OPEN: How Do You Use Reddit?

EXECUTIVE SUMMARY

- WSB DEALINGS PUSH SILVER HIGHER, SOME EQUITY TRADE STILL RESTRICTED FOR U.S. RETAIL

- KAPLAN URGES EASY FED POLICY DESPITE MARKET BETS (MNI)

- BIDEN SECURITY ADVISER: U.S. MUST BE PREPARED TO IMPOSE COSTS ON CHINA (RTRS)

- ECB'S LANE: STOCKS, BANK BONDS NOT IN TOOLBOX (RTRS)

- ECB'S SCHNABEL: MORE WORRIED ABOUT INFLATION BEING TOO LOW (BBG)

- A SOFT ROUND OF CHINESE PMI DATA SEEN, IMPACTED BY COVID RESTRICTIONS

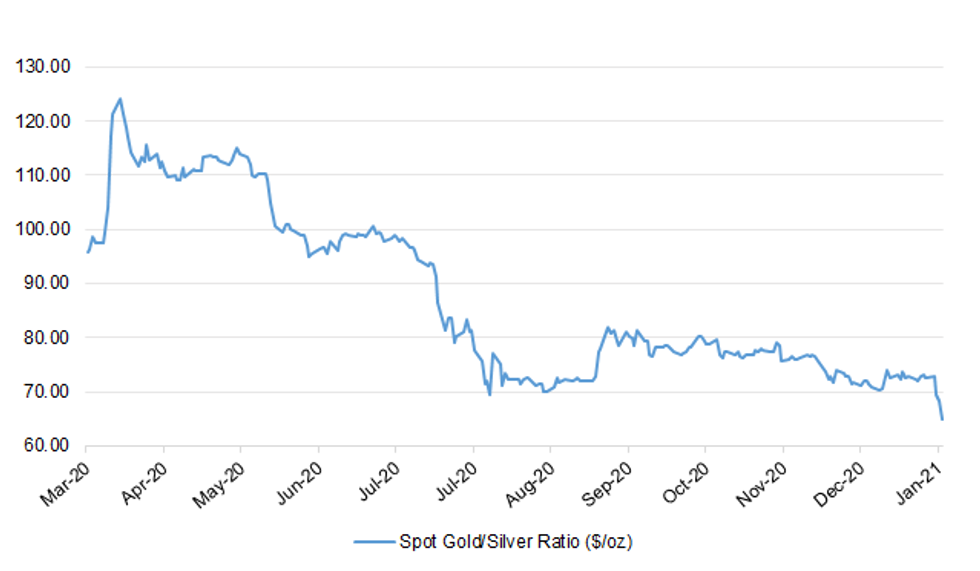

Fig. 1: Spot Gold/Silver Ratio ($/oz)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Almost 600,000 people in the UK were vaccinated against Covid-19 on Saturday, a daily record for the vaccine programme. (Guardian)

CORONAVIRUS: Britain may not be able to abandon social distancing rules this year unless a vaccine proves to be 85 per cent effective at stopping transmission of coronavirus as well as severe illness, ministers have been warned. Modelling commissioned by SPI-M, a subgroup of Sage, and passed to Downing Street suggests the UK will suffer a third huge spike in deaths unless inoculation cuts transmission significantly. Currently, most experts think efficacy against transmission will be around 60 per cent but there is huge uncertainty. (Telegraph)

CORONAVIRUS: A cabinet minister has said it's too early to predict what COVID restrictions might be in place in the second half of the year - after experts suggested measures would be needed "some time into the future". Liz Truss, the international trade secretary, told Sky News it is "not wise" to make long-term predictions and said the government would be taking decisions on a "week-by-week basis" as it continues to monitor the path of the disease. (Sky)

CORONAVIRUS: Boris Johnson will order his MPs to abstain on a Labour motion to secure the country's borders amid backbench pressure to enforce compulsory hotel quarantine for all arrivals. Labour will force a symbolic vote this afternoon calling on ministers to require all arrivals from abroad to quarantine for ten days in a hotel, to stop potentially vaccine-resistant variants of coronavirus being brought here. (The Times)

FISCAL: Britain cannot spend its way to prosperity, the Business Secretary has warned amid a growing Tory debate over state spending in the run-up to the Budget in March. (Telegraph)

FISCAL: Boris Johnson and chancellor Rishi Sunak are working on a pre-Budget "recovery plan" outlining medium term proposals to boost investment and skills as the UK emerges from the coronavirus crisis. The plan will be published in the week starting February 22, said government officials, as the prime minister releases a "road map" out of the current Covid-19 lockdown in England and starts to set out proposals to rebuild the economy. (FT)

FISCAL: Rishi Sunak is once again considering an increase in capital gains tax to bring it into line with the higher levels of income tax rates, in a blow to savers and entrepreneurs. (Telegraph)

FISCAL: A hike in fuel duty could be announced in the Budget after Conservative MPs signalled to Rishi Sunak they could live with an end to the decade-long freeze. (Telegraph)

BOE: The Bank of England has been urged to overhaul its misfiring scheme to boost small business lending as fears over a wave of insolvencies continue to grow. (Telegraph)

BOE: Cutting the UK's official interest rate below zero would fail to boost Britain's Covid-stricken economy because lenders would increase mortgage costs in response, the Bank of England has been told. The leading representative of Britain's building societies said high street lenders were not in a position to handle negative interest rates, had computer systems that were ill-equipped and that the move would be counterproductive for the British economy. (Guardian)

ECONOMY: The number of U.K. listed companies at risk of insolvency has doubled as restrictions aimed at curbing the spread of the coronavirus continue to ravage the economy. A record 35% of U.K. companies issued profit warnings last year, according to a report by the consulting firm EY. There was also a surge in the number of companies issuing three or more profit warnings in a 12-month period, a warning sign for insolvency. (BBG)

ECONOMY: Business leaders have called on the government to work with them to plot the route out of lockdown. England has been under strict rules since the beginning of January, with Boris Johnson said to be aiming to announce his road map towards easing restrictions by the week of February 22. (The Times)

ECONOMY: Households are feeling sanguine about their personal finances despite the third nationwide lockdown, a survey suggests. Consumer confidence rose by 0.3 points to 102.9 last month, according to an index compiled by YouGov and the Centre for Economics and Business Research. Any reading above 100 indicates that households are feeling optimistic. (The Times)

BREXIT: Fewer than four in every 10 lorries crossing the Channel from Dover are carrying goods to be sold abroad, according to new data which suggests that border chaos is threatening Britain's exports. (Telegraph)

BREXIT: Arlene Foster has called on Boris Johnson to invoke part of the Brexit agreement to deal with problems in the movement of goods between GB and NI. It comes as the EU reversed its decision to use the same mechanism to control the export of coronavirus vaccines from the EU into NI. Northern Ireland's first minister said the move to trigger Article 16 of the NI Protocol was an "act of hostility". (BBC)

BREXIT: Hundreds of UK companies could switch operations to countries inside the EU in what is threatening to become a dramatic exodus of investment and jobs caused by Brexit. The Observer can reveal that by 1 January this year some 500 businesses – mostly UK-owned, or UK-based with overseas owners – were already making inquiries about setting up branches, depots or warehouses in the Netherlands alone, for "Brexit-related reasons". Since then the number of inquiries from UK companies has increased further. (Observer)

SCOTLAND: Scots could have a second independence referendum by Christmas, the SNP's constitution minister has signalled. Michael Russell, architect of the SNP's road map to independence, said the vote could be held six months after Holyrood passed a referendum bill, which is expected in June. (Sunday Times)

EUROPE

ECB: The European Central Bank's chief economist Philip Lane played down the prospect of the ECB buying stocks or bank bonds as part of its pandemic-fighting efforts, saying in a newspaper interview published on Sunday these were not in its toolbox. "The ECB and the Eurosystem have many excellent monetary economists, so everything is considered at some level," Lane told German newspaper Sueddeutsche Zeitung. "But these measures are not part of our current toolbox. Our active toolbox is a combination of our short term rates, asset purchases, targeted lending and our forward guidance." (RTRS)

ECB: The surprisingly high first estimates of German inflation in January were based on one-time effects, European Central Bank executive board member Isabel Schnabel said in an interview with Deutschlandfunk radio, referring to the expiration of the temporary value-added tax cut among other factors. "It's not easy to measure inflation right now because our basket of goods has changed significantly," she said. "We have almost stopped consuming certain things altogether -– we're no longer eating out, going to the hairdresser or traveling." These short-term developments shouldn't be mistaken for a sustained increase in inflation, Schnabel said. The euro area faces very weak demand and it doesn't look like this is going to fundamentally change. "We continue to be more worried about inflation being too low rather than too high," she added. "I can of course not predict when interest rates might be raised -- what I can tell you, though, is that raising interest rates in the current situation would have disastrous effects." (BBG)

ECB: The continuing rise of stock markets worldwide could be the result of growing hopes of economic recovery, and does not necessarily mean that prices are overly inflated, European Central Bank governing council member Klaas Knot said on Sunday. "We definitely see high valuations," the Dutch central bank governor said in an interview on Dutch public television. "Stock markets could be preempting the roll out of vaccines and the reopening of economies. We might be entering the roaring twenties." But Knot warned individual investors against joining the recent rallies in companies such as GameStop. "If this becomes a race between individuals and professional investors, it is clear who will suffer in the end: the small investor," he said. (RTRS)

CORONAVIRUS: AstraZeneca Plc will deliver 9 million additional vaccine doses to the European Union in the first quarter of this year, European Commission President Ursula von der Leyen said Sunday. (BBG)

GERMANY: German Chancellor Angela Merkel urged citizens to remain cautious so as to make a future easing of lockdown measures possible. "Thanks to our joint efforts, the infection figures have been declining again for some time, the direction is right," Merkel said in her weekly podcast. "But at the same time, there is the very real danger from highly contagious viral mutations. That's why we have to be careful and cautious as we move through the next few weeks." (BBG)

GERMANY: Germany's health minister said he's open, in principle, to Covid-19 vaccines from Russia and China. "The crucial thing is that they need regular approval under European law," Jens Spahn told the Frankfurter Allgemeine Sonntagszeitung newspaper. "If a vaccine is safe and effective, regardless of the country in which it was produced, then it can obviously help in dealing with the pandemic." (BBG)

GERMANY: Germany's economy minister says tax increases are the wrong way to handle the costs of the coronavirus crisis and proposed selling state holdings instead. "The value of state holdings has grown considerably in recent years -- that's why we should examine which state holdings can be scaled back," Peter Altmaier told newspaper Welt am Sonntag. "This will also bring money into state coffers that we can put to good use for future investments." (BBG)

FRANCE: France will seal its borders for travelers coming from outside the European Union and close large shopping centers as part of a fresh set of measures aimed at preventing the spread of Covid-19 and avoid a more draconian shutting down of the economy. The country is doing everything to avoid a lockdown, Prime Minister Jean Castex said in a television address on Friday. He urged more people to work from home and imposed negative virus tests for everyone entering France from within the EU, except cross-border workers. (BBG)

FRANCE: France is considering investing in monoclonal antibodies as a possible Covid-19 treatment and will begin clinical protocols in the next few days, government spokesman Gabriel Attal told BFM TV. The topic has been discussed with President Emmanuel Macron and the treatment appears to work best at an early stage on people at risk of developing a severe form of the virus, he said. (BBG)

ITALY: Italian President Sergio Mattarella asked the speaker of the lower house to lead a new round of negotiations aimed at breaking the country's political deadlock. The head of state tasked Speaker Roberto Fico with exploring whether it's possible to rebuild the coalition that supported Prime Minister Giuseppe Conte. (BBG)

ITALY: Matteo Renzi, who triggered Italy's political crisis this month by pulling his Italia Viva party out of the ruling coalition, would like to see former European Central Bank chief Mario Draghi become prime minister, a party source said on Sunday. The former coalition allies are holding talks to try and overcome their differences and revive their government, which formally collapsed last week when Prime Minister Giuseppe Conte resigned. Renzi has repeatedly criticised Conte's handling of the coronavirus pandemic and subsequent economic crisis, and a party source confirmed a report in La Stampa newspaper that Italia Viva would like Draghi to become the next prime minister. "I would say that is one of our proposals," said the source, who declined to be named. La Stampa newspaper reported on Sunday that President Sergio Mattarella had already sounded out Draghi. The head of state's office swiftly denied this, saying there had been no contact between the two men during the political crisis. (RTRS)

ITALY: Both the Milan and Rome regions will fall in the so-called "yellow zone" starting Monday, the lower tier of restrictions which allows bars and restaurants to remain open during the day. Health minister Roberto Speranza warned that the easing of restriction does not mean the threat is over. His comments followed reports of crowds gathering in the central areas of large cities. (BBG)

IRELAND: The pace of growth in Ireland's manufacturing sector hit a five-month high in December as firms stockpiled ahead of neighbouring Britain's Dec. 31 departure from European Union trading rules, a survey showed on Monday. (RTRS)

SWITZERLAND: Switzerland faces a shortage of vaccines much like many of its European neighbors. The country will be able to vaccinate only 650,000 people in February rather than the planned 1.3 million, newspaper NZZ am Sonntag reported. It also quoted Interior Minister Alain Berset as saying that the goal of vaccinating everyone above the age of 75 by the end of February would probably not be met, though the target of immunizing the public by the end of June was still achievable. (BBG)

SWEDEN: Sweden's government has promised to make a swift decision regarding a request by the Public Health Agency that anyone wishing to enter the country produce a negative Covid-19 result. "We are now sending the Agency's request for a lightning-fast referral to the Police Authority, the Coast Guard and the Swedish Migration Board," said Mikael Damberg, Sweden's Minister of Home Affairs, at a press conference on Saturday. (BBG)

NORWAY: Norway extended national measures until mid-February and for Oslo to Feb. 10, Health Minister Bent Hoie said. It plans to ease curbs for schools and pre-schools in the Oslo area. Restaurants and individual stores will be allowed to reopen in Oslo. Stricter measures were introduced Jan. 23 to contain more contagious variants of the virus. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Lithuania at A; Outlook Stable

- Moody's affirmed Germany at Aaa; Outlook Stable

- DBRS Morningstar confirmed Austria at AAA, Stable Trend

- DBRS Morningstar confirmed Ireland at A (high), Stable Trend

U.S.

FED: MNI INTERVIEW: Kaplan Urges Easy Fed Policy Despite Market Bets

- Dallas Fed President Robert Kaplan said in an interview Friday it might be more difficult to predict the path of inflation after the Covid-19 pandemic but stressed that the Federal Reserve should take aggressive actions to promote a swift recovery despite potentially feeding market imbalances - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: San Francisco Federal Reserve President Mary Daly on Friday said she expects a "sharp rebound" in economic activity once more people are vaccinated against COVID-19, but the Fed's work to bring more Americans back to the workforce won't be done for some time after. "That sharp rebound will not be the end of our job," Daly told the Latino Entrepreneurship Initiative at the Stanford Graduate School of Business. "I think it's going to take one or two years to get fully back to where we were" before the pandemic-sparked recession. (RTRS)

FED: The Trimmed Mean PCE inflation rate over the 12 months ending in December was 1.7 percent. According to the BEA, the overall PCE inflation rate was 1.3 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 1.5 percent on a 12-month basis. (Dallas Fed)

ECONOMY: MNI INTERVIEW: US Unemployment +5% For Next 3 Years-Fed Fellow

- U.S. unemployment will take at least three years to decline under 5% with higher-educated workers now facing pressures the rest of the job market saw at the start of the pandemic, Washington University professor and St. Louis Federal Reserve research fellow Yongseok Shin told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: President Biden urged swift passage of his $1.9 billion coronavirus relief plan Friday, arguing during an Oval Office appearance that Americans will be "badly, badly hurt" if Congress does not pass legislation soon. (Washington Post)

FISCAL: U.S. Treasury Secretary Yellen tweeted the following on Sunday: "The President is absolutely right: The benefits of acting now — and acting big — will far outweigh the costs in the long run." (MNI)

FISCAL: President Joe Biden has invited a group of 10 Republican senators to meet with him in the coming days to discuss their alternative plan for Covid-19 economic stimulus, the White House said Sunday evening. The GOP lawmakers offered a $600 billion proposal early Sunday in a letter to Biden, responding to the $1.9 trillion plan he laid out more than two weeks ago and which Republicans have rejected. (BBG)

CORONAVIRUS: New cases reported on Sunday totalled more than 118,000, while 95,013 people are being treated in hospital for Covid-19, down from a peak in mid-January of about 132,000. There were 2,055 further deaths reported, CTP said. The CTP noted that the seven-day average number of new cases is at least 40,000 fewer than at the beginning of the month and more than 100,000 fewer than at their peak on January 12. (FT)

CORONAVIRUS: The Biden administration has increased monitoring for new variants of the coronavirus that spread more easily, including one that could become the dominant strain in the U.S. by March. The U.S. is asking each state to send at least 750 samples a week to be sequenced to determine what mutations are spreading, CDC Director Rochelle Walenksy said in a briefing with reporters Friday. (BBG)

CORONAVIRUS: A top health adviser to President Joe Biden warned Sunday that a new variant of the coronavirus circulating in the U.K. will likely become the dominant strain in the U.S. and may lead to future restrictions on in-person gatherings. Michael Osterholm, director of the Center for Infectious Disease Research and Policy at the University of Minnesota, said on NBC's "Meet the Press" that the nation's health care system must prepare for a surge in serious cases such as the one experienced recently in England. (BBG)

CORONAVIRUS: Johnson & Johnson board member Dr. Mark McClellan told CNBC Friday that there could be enough vaccinations for the entire U.S. adult population by the summer. "Assuming all of the close review of the J&J data all pans out, we're going to have the capacity between Moderna, Pfizer, J&J, to have enough vaccines available by June for the entire U.S. adult population," McClellan, a former FDA commissioner, said on "The News with Shepard Smith." (CNBC)

CORONAVIRUS: New York City restaurants could reopen their indoor dining sections at 25% capacity beginning on Feb. 14 as long as the state's Covid-19 cases remain stable following a post-holiday spike, Gov. Andrew Cuomo said. Some industry experts have said that 25% capacity for indoor dining may not be enough for restaurants to stay afloat, but Cuomo said during a press briefing that some capacity is better than none. The Democratic governor added that the number could go up if cases don't climb again amid the threat of new, highly transmissible variants of the virus. (CNBC)

CORONAVIRUS: The Chicago Teachers Union and Chicago Public Schools remained in talks Saturday about a proposed in-person reopening on Monday for kindergarten through eighth grade that the union opposes. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention issued a public health order late Friday requiring face coverings on airplanes, trains and other public transportation to contain the spread of the coronavirus. The order will go into effect on Monday at 11:59 p.m. and extends beyond the previous guidance announced by the White House. (Axios)

POLITICS: Former President Donald Trump announced that two trial lawyers will take over representing him at his upcoming impeachment trial after parting ways with his previous defense team. Attorneys David Schoen and Bruce L. Castor Jr. will head his impeachment defense, the former president announced Sunday evening. His previous attorneys, including Butch Bowers of South Carolina, departed this weekend, leaving the president without representation just over a week before his trial is to start. (BBG)

EQUITES: Robinhood's swelling popularity combined with the trading boom to prompt an unprecedented increase in Robinhood's deposit requirements. In a blog post late Friday, Robinhood said its deposit requirements related to equities rose 10-fold this week. Volatile individual securities accounted for "hundreds of millions of dollars" of the increase, the company said. Industrywide, collateral requirements rose to $33.5 billion from $26 billion Thursday, DTCC said, an increase of nearly 30%. DTCC, which is owned by Wall Street banks and other firms that use its services, clears more than $1 trillion in stock trades daily. (WSJ)

EQUITIES: Robinhood Markets Inc. reduced the number of companies with trading restrictions to eight from 50, ahead of Monday's trading session, according to an update on its website. The current list includes GameStop Corp., AMC Entertainment Holdings Inc., BlackBerry Ltd., Express Inc., Genius Brands International Inc., Koss Corp., Naked Brand Group Ltd. and Nokia Oyj. Opening new positions in these securities is limited, according to Robinhood's website, which listed the maximum number of shares and options contracts each user can hold. For those whose current holdings already exceed the limits, their positions won't be sold or closed. (BBG)

EQUITIES: Texas Attorney General Ken Paxton issued 13 civil investigative demands on Friday to Robinhood, Discord, Citadel and other trading apps that put curbs on stock trading, his office said in a statement the day after those curbs stalled a rally in shares of GameStop. The CIDs, the civil equivalent of a subpoena, were sent following a week-long slugfest in which retail investors bid up shares of video game retailer GameStop and other out-of-favor companies, resulting in huge losses to big hedge funds that had shorted those stocks. (RTRS)

EQUITIES: Robinhood Markets Inc's user agreement is likely to protect the brokerage app from a barrage of lawsuits filed by customers after it blocked a frenzied trading rally in companies such as GameStop Corp that was fueled on social media forums. The owners of internet platforms where much of the discussion took place are likewise shielded from liability for users' activity under a 25-year-old law known as Section 230. At least a dozen proposed class action lawsuits accuse Robinhood of breaching its contract with customers when it restricted trading on Thursday. (RTRS)

EQUITIES: U.S. hedge funds last week bought and sold the most stock in more than 10 years amid wild swings in GameStop Corp shares that many had bet against, but their market exposure to stocks is still near record levels, according to an analysis by Goldman Sachs Inc., According to Goldman Sachs Prime Services, this week represented the "largest active hedge fund de-grossing since February 2009. Funds in their coverage sold long positions and covered shorts in every sector," the investment bank wrote in a note late Friday. "Despite this active deleveraging, hedge fund net and gross exposures on a mark-to-market basis both remain close to the highest levels on record, indicating ongoing risk of positioning-driven sell-offs." (RTRS)

EQUITIES: Melvin Capital Management, the hedge fund that has borne the brunt of losses from the soaring stock prices of heavily shorted stocks recently, lost 53% on its investments in January, according to people familiar with the firm. (WSJ)

EQUITIES: The chief executives of Exxon Mobil Corp. and Chevron Corp. spoke last year about combining the oil giants, according to people familiar with the talks, testing the waters for what could be one of the largest corporate mergers ever. (WSJ)

OTHER

U.S./CHINA: The Biden administration will put the trade deal struck with China under Donald Trump "under review" as the broader US relationship with Beijing is assessed, the White House said on Friday. The "phase 1" trade deal signed in early 2020 paused a rapidly escalating trade war between Washington and Beijing that had rattled global markets and led to tariffs of billions of dollars on traded goods. (FT)

U.S./CHINA: Xiaomi Corp filed a complaint in a Washington district court on Friday against the U.S. Defense and Treasury Departments, seeking to remove the Chinese smartphone maker from an official list of companies with ties to China's military. (RTRS)

U.S./CHINA/HONG KONG/TAIWAN: President Joe Biden's national security adviser, Jake Sullivan, said on Friday the United States must be prepared to impose costs on China for its actions against Uighur Muslims in Xinjiang, its crackdown in Hong Kong and threats towards Taiwan. Sullivan told an event at the United States Institute of Peace that Washington needed to speak with clarity and consistency on the issues. He said it needed to be "prepared to act, as well to impose costs, for what China is doing in Xinjiang, what it's doing in Hong Kong, for the bellicosity and threats it is projecting towards Taiwan." (RTRS)

U.S./CHINA/TAIWAN: The Chinese People's Liberation Army (PLA) reportedly sent warplanes for exercises near the Taiwan Straits almost every day of the first month of 2021, and analysts said that the Chinese mainland has talked the talk by warning that"Taiwan independence" means war, and it is also walking the walk by preparing to fight the possible war through exercises, so foreign and Taiwan secessionist forces should not miscalculate. PLA warplanes entered Taiwan's self-proclaimed southwestern air defense identification zone three times on Sunday, according to the Taiwan air force's open radio communication and open-source flight trackers, Taipei-based newspaper the Liberty Times reported. This means there was only one day in January when no PLA aircraft were observed by open-source intelligence in the region, the report said. (Global Times)

U.S./CHINA/TAIWAN: Chinese military aircraft simulated missile attacks on a US aircraft carrier during an incursion into Taiwan's air defence zone three days after Joe Biden's inauguration, according to intelligence from the US and its allies. (FT)

U.S./CHINA/CANADA: Huawei Chief Financial Officer Meng Wanzhou's request to loosen the bail terms set during her release from jail in 2018 has been rejected, a Canadian judge ruled on Friday, as she fights a U.S. extradition case. Meng is facing charges of bank fraud in the United States for allegedly misleading HSBC about Huawei's business dealings in Iran, causing the bank to violate U.S. sanctions. (RTRS)

GEOPOLITICS: Chinese survey vessels are increasing their research in the Asia Pacific region, as Beijing steps up efforts to increase its maritime interests. (Nikkei)

GEOPOLITICS: The U.S. military said on Friday that Chinese military flights in the past week in the South China Sea "at no time" posed any threat to a U.S. Navy aircraft carrier strike group in the region but fit a pattern of destabilizing and aggressive behavior by Beijing. "The Theodore Roosevelt Carrier Strike Group closely monitored all People's Liberation Army Navy (PLAN) and Air Force (PLAAF) activity, and at no time did they pose a threat to U.S. Navy ships, aircraft, or sailors," the U.S. military's Pacific Command said in a statement. (RTRS)

GLOBAL TRADE: The UK is applying to join a free trade area made up of 11 Asia and Pacific nations, under its post-Brexit plans. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership - or CPTPP - includes Australia, Canada, Japan and New Zealand. In total, it covers a market of around 500 million people, generating more than 13% of the world's income. (BBC)

CORONAVIRUS: Mexican health authorities are conducting studies into whether a mutation of the Covid-19 virus detected in the western state of Jalisco is a serious new variant or whether it is the strain first found in South Africa. (FT)

CORONAVIRUS: Moderna has asked the U.S. Food and Drug Administration for permission to fill its Covid-19 vaccine vials with up to five additional doses to ease a bottleneck in manufacturing, according to a person familiar with the matter. The change would allow Moderna to put 15 doses in the same size vials now cleared to hold 10, alleviating pressure on the part of the manufacturing process known as fill/finish, said the person, who declined to be named because the application isn't yet public. (CNBC)

CORONAVIRUS: Novartis AG will be able to deliver "substantial amounts" of the Pfizer Inc. and BioNTech SE Covid-19 vaccine, Chief Executive Officer Vas Narasimhan told Swiss newspaper Schweiz am Wochenende. The company has also been working on agreements to assume production of key parts of vaccines and putting them into vials, largely in Europe, but also in Asia. (BBG)

CORONAVIRUS: Pfizer CEO: High possibility future variant will elude vaccines. (BBG)

CORONAVIRUS: French President Emmanuel Macron raised doubts about the efficacy of the Covid-19 vaccine from AstraZeneca Plc and the University of Oxford for older patients, calling it "quasi-ineffective" for people over the age of 65. The French leader said preliminary information on the vaccine isn't encouraging for people between the ages of 60 and 65. (BBG)

CORONAVIRUS: Novavax Inc expects to produce up to 150 million COVID-19 vaccine doses monthly by May or June, its chief executive told Reuters on Friday, a day after reporting interim data that showed its shot to be 89% effective in a UK trial. (RTRS)

CORONAVIRUS: CanSino Biologics Inc. was informed by an independent committee that its vaccine has successfully met its primary safety and efficacy criteria in an interim analysis of the Phase III clinical trial, the Chinese company said in exchange filing. The late-stage clinical trial has vaccinated more than 40,000 volunteers in 78 trial sites in five countries. (BBG)

CORONAVIRUS: Some of the biggest companies in Dubai formed an alliance to move 2 billion doses of Covid-19 vaccines around the globe this year. Emirates Airline, ports operator DP World Plc and Dubai Airports have teamed up to speed up the distribution of inoculations through the Gulf trade and tourism center. The move "will particularly focus on emerging markets, where populations have been hard hit by the pandemic, and pharmaceutical transport and logistics are challenging," the government's media office said. (BBG)

CORONAVIRUS: The European Union hastily amended new vaccine controls seeking to limit exports to Northern Ireland, retreating from a plan that provoked outrage and reignited the tensions that almost wrecked Brexit negotiations. Just hours after the bloc announced the controversial new measures, the European Commission issued a statement to clarify that it will "ensure that the Ireland/Northern Ireland Protocol is unaffected." The initial plan included an option for the EU to invoke an emergency clause in the Brexit deal to prevent vaccines going from the bloc to Northern Ireland. The threat of restrictions between the Republic of Ireland and Northern Ireland was met with dismay in Dublin, London and Belfast, with all sides pressuring the EU to reverse course. (BBG)

CORONAVIRUS: Britain stands ready to help the EU with its vaccination crisis, the vaccines minister said after Brussels abandoned its threat to block supplies at the border. In an exclusive interview with The Telegraph, Nadhim Zahawi said the focus is now on "collaboration" with the EU, adding that Britain has gone "out of our way" to help Brussels with its production problems and "will continue to do so". (Telegraph)

CORONAVIRUS: The European Union's drastic plan to restrict exports of Covid-19 shots is more of a political ploy as prospects of successfully suing AstraZeneca Plc for reining in supplies of its vaccine appear slim, lawyers and trade experts said. (BBG)

CORONAVIRUS: China's top respiratory disease expert Zhong Nanshan has said he will appear with Anthony Fauci, the US President's chief medical adviser, at an online forum in March – the first public discussion of the Covid-19 pandemic between the two. Zhong told a press conference after a Covid-19 control event in Guangzhou on Sunday that they "share some similar views" and would discuss the pandemic at an online event hosted by a British university. (SCMP)

HONG KONG: There could be more lockdowns soon in Hong Kong, Chief Secretary Matthew Cheung said, according to a report Sunday by local media RTHK. Cheung said that the government's goal is reduce the number of Covid-19 cases to zero and it may launch various operations to impose mandatory tests in the future. (BBG)

HONG KONG: Hong Kong's government is likely to extend social distancing measures for two weeks, spanning the upcoming Lunar New Year holidays Feb. 12-15, Sing Tao Daily reports, citing unidentified people. (BBG)

HONG KONG: Large international corporations doing deals in Asia are considering excluding Hong Kong from legal contracts over concerns China's tightening grip may impact rule of law in the territory, according to interviews with corporate advisers across the region. (FT)

HONG KONG: China said Friday it will no longer recognize the British National Overseas passport as a valid travel document or form of identification amid a bitter feud with London over a plan to allow millions of Hong Kong residents a route to residency and eventual citizenship. (TIME)

JAPAN: Three new types of the U.K. coronavirus strain, previously not detected in Japan, were discovered in patients at the Tokyo Medical and Dental University Hospital, according to a research group studying Covid-19 cases at the hospital. (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga is making final arrangements to announce a government plan to extend the state of emergency on coronavirus outbreak, broadcaster FNN reports, without attribution. Today's announcement will come ahead of an official decision Tuesday. Emergency expected to be extended by 3-4 weeks. (BBG)

AUSTRALIA: Prime Minister Scott Morrison will commit $1.9 billion to ramp up vaccinations at hospitals, surgeries and pharmacies in a pledge to protect health while weaning the economy off the "blank cheque" of endless federal payments. (Sydney Morning Herald)

AUSTRALIA: Josh Frydenberg says the Australian labour market has outperformed expectations but he has declined to make a new prediction on the outlook for unemployment until the May budget. The treasurer remains adamant the JobKeeper wage subsidy will end in March as planned, even though he concedes some regions in Australia are still doing it tough. "There is a lot of uncertainty out there both domestically and globally and the job is far from done," the treasurer told the ABC's Insiders program on Sunday. He said 90 per cent of Australians who lost their job last year are now back at work, which has seen the jobless rate fall to 6.6 per cent. "The labour market has outperformed expectations," Mr Frydenberg said. Even so, he was reluctant to rule out the jobless rate reaching 7.5 per cent in the March quarter as predicted in the mid-year budget review that was released in December. "Let's wait and see," he said. (SBS)

AUSTRALIA: The Australian city of Perth has begun a snap five-day lockdown after a security guard working at a quarantine hotel tested positive for coronavirus. Western Australia - the state of which Perth is the capital - had not had a case of locally acquired coronavirus for 10 months. (BBC)

AUSTRALIA: Australia's inoculation strategy remains on track with first deliveries of the BioNTech/Pfizer vaccine expected in late February and all eligible residents to be offered a jab by October, the government said on Monday. (FT)

AUSTRALIA: A Chinese state-controlled newspaper says Beijing will reject the Morrison government's offer to reset trade ties as it accused the prime minister of taking a "combative" approach and trying to portray Australia as a victim after billions of dollars of its exports were hit with unofficial trade sanctions. (Australian Financial Review)

AUSTRALIA/NEW ZEALAND: New Zealanders can again travel to Australia after the federal government resumed the trans-Tasman travel bubble from 2pm on Sunday. (SBS)

SOUTH KOREA: South Korea will extend social distancing restrictions imposed during its worst coronavirus spread for another two weeks, as new infections resurged last week and reversed a downward trend. The alert for the greater Seoul area, where half of the country's population live, will be maintained at the second-highest level of 2.5 for the additional two-week period, Prime Minister Chung Sye-kyun said in a meeting Sunday. A ban on gatherings of more than four people will also be extended amid concerns around the upcoming Lunar New Year holiday. Current measures were due to expire Jan. 31 and the extension would take the restrictions through to Feb. 14, the end of the holiday. Cafes and restaurants will be required to close at 9 p.m., and gatherings at clubs and karaoke bars remain banned. (BBG)

NORTH KOREA: North Korea's former acting ambassador to Kuwait believes Kim Jong Un will not give up his nuclear arsenal, but may be willing to negotiate an arms reduction for relief from the international sanctions crippling Pyongyang's economy. In his first interview since defecting to the South more than a year ago, Ryu Hyeon-woo told CNN that "North Korea's nuclear power is directly linked to the stability of the regime" -- and Kim likely believes nuclear weapons are key to his survival. (CNN)

SINGAPORE: Singapore will suspend its Reciprocal Green Lane arrangements with three countries including Malaysia for a period of three months from Feb 1, the republic's Ministry of Foreign Affairs (MFA) said. The other two countries are Germany and South Korea, it said in a statement here, today. (Straits Times)

CANADA: Canadian Prime Minister Justin Trudeau unveiled measures to tighten travel restrictions on international travel. The country's largest airlines have agreed to suspend flights to the Caribbean and Mexico for three months, Trudeau said at a press conference in Ottawa. (BBG)

CANADA: The Alberta government is planning to lift some restrictions, including allowing restaurants to reopen in-person dining and gyms to reopen with limited capacity. Industry and government officials confirmed to CBC News that these amendments to the current COVID-19 health measures are expected to be announced Friday afternoon by Premier Jason Kenney. (CNBC)

CANADA: U.S. Treasury Secretary Janet Yellen and her Canadian counterpart on Friday underscored the importance of working closely together on economic policy, national security and climate change, the governments said in separate statements. (RTRS)

TURKEY: Turkish President Recep Tayyip Erdogan replaced two deputy finance ministers in another reshuffle of policy makers.Deputy finance ministers Osman Dincbas and Bulent Aksu were removed, and will be replaced by Cengiz Yavilioglu and Sakir Ercan Gul, according to a presidential decree published in the official gazette on Saturday. The latest changes followed those in November, when central bank Governor Murat Uysal was fired by Erdogan, and the leader's son-in-law Berat Albayrak resigned from his duties as finance minister. Feridun Hadi Sinirlioglu, who has served as permanent representative of Turkey to the United Nations since 2016, will become a key adviser to Erdogan and a special envoy to the permanent mission of Turkey to the UN as an ambassador. (BBG)

TURKEY: Turkey's Minister of Foreign Affairs will pay a visit to northern Cyprus on Feb. 1-2, according to a statement published by the ministry. Mevlut Cavusoğlu will meet with the Turkish-controlled northern Cyprus authorities to discuss common agendas, particularly the Cyprus issue, according to the statement. (BBG)

MEXICO: "I'm appearing here so there are no rumors or misunderstandings," Mexico's President Andres Manuel Lopez Obrador, known as AMLO, said in a video posted online late Friday. "I'm well." In the video, AMLO walked through the national palace and said he would have to continue resting. He said he's been following the distribution of vaccines and conditions at hospitals in Mexico, confirming other official remarks that he's continued to govern while stricken with the virus. (BBG)

MEXICO: Mexico's central bank will probably send the government a small fraction of the 300 billion-peso ($15 billion) foreign exchange surplus that President Andres Manuel Lopez Obrador has hoped for, after a comeback of the peso at the end of 2020 reduced the institution's profits. The bank, known as Banxico, will likely transfer to the Treasury just 20 billion to 30 billion pesos, according to two people familiar with the matter. The final figure has not yet been decided and it could be as low as zero, they said, declining to be named discussing private affairs. (BBG)

BRAZIL: Brazilian truckers remain split over the merits of a nationwide strike on Feb. 1 due to rising diesel prices, a senior truck union leader told Reuters on Friday, predicting there would not be a major stoppage. (RTRS)

RUSSIA: Riot police broke up protests across Russia on Sunday in support of Kremlin critic Alexei Navalny, detaining more than 5,000 people who had braved the bitter cold and the threat of prosecution to demand he be set free. (RTRS)

RUSSIA: A close ally of jailed Russian opposition leader Alexey Navalny urged U.S. President Joe Biden to take punitive action against a wider group of associates of President Vladimir Putin, saying current sanctions aren't sufficient to stop the Kremlin from cracking down on political opponents and violating human rights. (BBG)

RUSSIA: Secretary of State Anthony Blinken has condemned the "persistent use of harsh tactics" by Russian authorities on peaceful protesters who took to the streets across Russia on Sunday to call for the release of opposition leader Alexei Navalny. (CNBC)

SOUTH AFRICA: South Africa has secured an additional 20 million coronavirus vaccines manufactured by Pfizer, national newspaper The Sunday Times reported on Sunday, citing an interview with the health minister. (RTRS)

SOUTH AFRICA: South African President Cyril Ramaphosa and Deputy President David Mabuza, who chairs the Inter-Ministerial Committee on Vaccines, will receive South Africa's first consignment of Covid-19 vaccine on Feb. 1, according to a statement from the Presidency. The first phase of the vaccine rollout programme will prioritize around 1.2 million frontline health workers, according to the statement. (BBG)

SOUTH AFRICA: A leader of South Africa's biggest labor movement accused the ruling African National Congress of failing to act on corruption, highlighting the fragility of a political alliance that's been in place since the end of apartheid. "What is most concerning is the ANC's refusal to engage on extending the ban on public servants and the executive from doing business with the state," Bheki Ntshalintshali, general secretary of the Congress of South African Trade Unions, wrote in a column in the Sunday Times. "The longer the ANC shies away from addressing the root causes behind the scourge of corruption the more it continues to allow the looting." (BBG)

IRAN: If Iran comes back into full compliance with its obligations under the 2015 nuclear deal, the U.S. would do the same, State Department says in an emailed statement. "But we are a long way from that point as Iran is out of compliance on a number of fronts," State Dept says. (BBG)

IRAN: Jake Sullivan, the White House national security adviser, warned of "an escalating nuclear crisis" with Iran as the Biden administration seeks to salvage the multinational agreement that President Donald Trump abandoned. Tehran is moving "closer and closer to having enough fissile material" for a nuclear weapon, Sullivan said at an event at the U.S. Institute of Peace on Friday. Returning to the deal intended to limit Iran's nuclear program is a "critical early priority" for the new administration, he said. (BBG)

IRAN: The new U.S. Iran envoy spoke with British, French and German officials on Thursday as the United States explores how to revive the 2015 nuclear deal former U.S. President Donald Trump abandoned, two sources familiar with the matter said on Friday. (RTRS)

METALS: Retail sites were overwhelmed with demand for silver bars and coins on Sunday, suggesting the Reddit-inspired frenzy that roiled commodities markets last week is spilling over into physical assets. Sites from Money Metals and SD Bullion to JM Bullion and Apmex, the Walmart of precious metals products in North America, said they were unable to process orders until Asian markets open because of unprecedented demand for silver. (BBG)

OIL: OPEC and its partners estimate they implemented 99% of their agreed oil-supply curbs in January, according to a delegate who asked not to be named. The 23-nation alliance known as OPEC+ aimed to withhold 7.2 million barrels a day of crude from the market this month -- about 7% of global supplies. They agreed to increase production by 500,000 barrels from December as part of a plan to ease the cuts. (BBG)

OIL: The Biden administration is revoking dozens of invalid drilling permits issued by agency workers without the approval of political appointees, despite a temporary order for such reviews. The Interior Department on Friday notified affected oil and gas producers that roughly 70 permits governing onshore wells were improperly issued and that the companies need to seek new approvals. (BBG)

OIL: American oil executives began a pushback against some of President Joe Biden's climate policies by making the case that fossil fuels from U.S. shale have a lower carbon footprint than imports. (BBG)

OIL: Guards at two oil terminals in eastern Libya have given the country's Tripoli-based government just over a week to pay overdue salaries or they will go on strike. (Argus Media)

CHINA

CORONAVIRUS: Health authorities in China reported 33 new locally transmitted cases of Covid-19 on Monday, the lowest level in more than three weeks. (FT)

LOCAL GOV'T BONDS: China should cap this year's issuance of local govt bonds at CNY3 trillion and focus on resolving risks in previously issued debts, the Securities Daily reported citing Zhang Yiqun, a member of the Society of Public Finance. China should establish the scope and usage of government financing bonds while providing policy tools to help transform existing debts, the Daily said citing Zhang. (MNI)

CREDIT: Chinese firms have rushed to cancel domestic bond sales after a cash squeeze in the nation's money market pushed up borrowing costs sharply. They shelved about 35.24 billion yuan ($5.5 billion) of onshore bond sales last week, up 58% from the previous week, according the data compiled by Bloomberg. It also marks the highest amount since the week that ended Nov. 20, after a surprise bond default by a state-run coal miner spooked investors and led a wave of repayment failures by government-linked firms late last year. (BBG)

PROPERTY: More Chinese cities, particularly those with fast rising home prices, are likely to further tighten housing regulations, the China Securities Journal reported citing analysts. Mortgage approvals may also be tightened as easing monetary policies are withdrawn, the newspaper said. Some banks are tightening quotas, delaying lending, and even raising mortgage rates, reflecting regulators' hardening stance on containing bubbles and controlling risks in the real estate market, the newspaper said. (MNI)

IP: China will step up protection of its intellectual property (IP) rights including enhancing the legal system to promotes awareness, as doing so will ensure future development, President Xi Jinping wrote in the QiuShi Magazine. China will protect its national security while increasing international collaboration and competition in the field of IP, said Xi. (MNI)

OVERNIGHT DATA

CHINA JAN M'FING PMI 51.3; MEDIAN 51.6; DEC 51.9

CHINA JAN NON-M'FING PMI 52.4; MEDIAN 55.0; DEC 55.7

CHINA JAN COMPOSITE PMI 52.8; DEC 55.1

CHINA JAN CAIXIN M'FING PMI 51.5; MEDIAN 52.6; DEC 53.0

MNI DATA IMPACT: Caixin China Jan PMI Drops To 7-Month Low

- The Caixin China PMI for January dropped 1.5 points to 51.5 from the previous month, the lowest level since July 2020, indicating a slower recovery in manufacturing activities, according to publisher Caixin in an email announcement on Monday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN JAN, F JIBUN BANK M'FING PMI 49.8; FLASH 49.7

The Japanese manufacturing sector slipped back into contraction territory at the start of the year, as the headline PMI fell slightly below the neutral 50.0 threshold in January as a rise in COVID-19 infections and issuance of a state of emergency dampened operating conditions. Despite broad stabilisation in December, the decline in January meant that the sector has not registered growth since April 2019. Japanese manufacturers indicated a renewed fall in output levels in the latest survey period, after steadying in December. Moreover, firms were further discouraged to replace voluntary leavers in the sector as staffing levels reduced in January, reversing the fractional expansion in December. Nonetheless, the short-term prospects for the Japanese manufacturing sector appear to be turning a corner, with firms reporting a stable level of new orders. Businesses were also optimistic that the pandemic would subside over the coming year, triggering a wider economic recovery in Japan which would boost output levels. IHS Markit estimates industrial production will grow 7.1% in 2021, although this is from a lower base and does not fully recover the output lost in 2020. (IHS Markit)

JAPAN JAN VEHICLE SALES +6.8% Y/Y; DEC +7.4%

AUSTRALIA JAN AIG M'FING PMI 55.3; DEC 52.1

The Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI®) increased by 3.2 points to 55.3 points (seasonally adjusted), indicating a stronger improvement in conditions over the summer holiday period (December 2020 and January 2021*) compared to November 2020. Results above 50 points indicate expansion, with higher results indicating a faster rate of expansion. Australian manufacturing suffered severe disruptions in output, sales and activity during Q2 and Q3 of 2020 due to the COVID-19 pandemic but has been in recovery since September. Manufacturing businesses reported stronger and more broad-based recovery over the (normally quiet) summer holiday period. Five of the six manufacturing sectors included in the Australian PMI® reported positive trading conditions (results over 50 points, trend) during December 2020 and January 2021, with the strongest results reported from manufacturers in machinery & equipment and chemicals, pharmaceuticals, cleaning, rubber, petroleum & related products. (AiG)

AUSTRALIA JAN, F MARKIT M'FING PMI 57.2; FLASH 57.2

Australia's manufacturing recovery moved up a gear in January, with output and order book growth hitting multi-year highs. Firms also grew more optimistic about the outlook, rebuilding warehouse inventories and taking on more staff. However, the burgeoning expansion was accompanied by a survey record increase in raw material costs, as increasing numbers of suppliers hiked prices amid the surge in demand and shipping costs jumped higher. Hopefully the supply and demand imbalance will prove short-lived as more capacity comes on stream, allowing price pressures to cool again, but there remains some uncertainty as to how much pent-up demand exists, and how far prices might rise. More encouragingly, firms reported brighter future prospects linked to expectations of the successful vaccine roll-out boosting demand, notably from export markets, setting the scene for the recovery to build further in 2021 from January's solid start. (IHS Markit)

AUSTRALIA JAN ANZ JOB ADVERTISEMENTS +2.3% M/M; DEC +8.6%

ANZ Job Ads rose for an eighth straight month in January. While the pace of growth slowed to 2.3% m/m, we do not think this is cause for concern. Job Ads is heading in the right direction and is now 5.3% higher than its pre-pandemic level. Other labour market indicators are also looking positive, including NAB's employment index, which improved dramatically in the December business survey. Overall, the indicators suggest solid employment gains should continue into H1 2021, and hopefully alleviate the effect of the end of JobKeeper in March, although it will be harder if that support is not replaced by more targeted assistance. Importantly though, the headline labour market numbers mask disparities, with lower paid workers still worse off. (ANZ)

AUSTRALIA DEC HOME LOANS VALUE +8.6% M/M; MEDIAN +4.0%; NOV +5.6%

AUSTRALIA DEC INVESTOR LOAN VALUE +8.2% M/M; NOV +6.0%

AUSTRALIA DEC OWNER-OCCUPIER LOAN VALUE +8.7% M/M; NOV +5.5%

AUSTRALIA JAN CORELOGIC HOUSE PRICE INDEX +0.7% M/M; DEC +0.9%

AUSTRALIA JAN MELBOURNE INSTITUTE INFLATION +1.5% Y/Y; DEC +1.5%

AUSTRALIA JAN MELBOURNE INSTITUTE INFLATION +0.2% M/M; DEC +0.5%

AUSTRALIA JAN COMMODITY INDEX AUD 110.1; DEC 105.1

AUSTRALIA JAN COMMODITY INDEX SDR +19.7% Y/Y; DEC +12.7%

SOUTH KOREA JAN TRADE BALANCE +$3.960BN; MEDIAN +$4.000BN; DEC +$6.772BN

SOUTH KOREA JAN EXPORTS +11.4% Y/Y; MEDIAN +9.8%; DEC +12.6%

SOUTH KOREA JAN IMPORTS +3.1% Y/Y; MEDIAN +2.4%; DEC +2.2%

SOUTH KOREA JAN MARKIT M'FING PMI 53.2; DEC 52.9

South Korean manufacturers began 2021 in a similar vein to the way the previous year ended. The latest Manufacturing PMI indicated a sustained improvement in the health of the sector, with the strongest expansion in the manufacturing sector for close to a decade. The overall improvement at South Korean manufacturers was driven by solid growth in output - the strongest seen since February 2011, and the fifth rise in succession. Firms also reported that new business inflows from domestic and international clients continued to increase in January, albeit at a slower pace than December. In order to keep pace with strengthening production and demand, manufacturers reported a substantial increase in input purchasing activity, although this was also related to significant supply chain disruption leading to delays in receiving inputs. Manufacturers in South Korea continued to signal strong optimism for the year ahead, as the impacts of COVID-19 dissipate further, and demand for new products gathers momentum. IHS Markit currently forecasts industrial production to expand 2.4% in 2021. (IHS Markit)

CHINA MARKETS

PBOC NET INJECTS CNY98BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged on Monday. This resulted in a net injection of CNY98 billion after the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:34 am local time from 3.1587% at Friday's close.

- The CFETS-NEX money-market sentiment index closed at 68 on Friday vs 75 on Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4623 MON VS 6.4709

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4623 on Monday. This compares with the 6.4709 set on Friday.

MARKETS

SNAPSHOT: How Do You Use Reddit?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 406.19 points at 28068.67

- ASX 200 up 56.541 points at 6663.9

- Shanghai Comp. up 3.387 points at 3486.456

- JGB 10-Yr future down 6 ticks at 151.77, yield up 0.6bp at 0.060%

- Aussie 10-Yr future down 3.0 ticks at 98.835, yield up 2.3bp at 1.156%

- U.S. 10-Yr future +0-03 at 137-04, yield up 1.7bp at 1.083%

- WTI crude up $0.22 at $52.42, Gold up $13.55 at $1861.05

- USD/JPY up 2 pips at Y104.70

- WSB DEALINGS PUSH SILVER HIGHER, SOME EQUITY TRADE STILL RESTRICTED FOR U.S. RETAIL

- KAPLAN URGES EASY FED POLICY DESPITE MARKET BETS (MNI)

- BIDEN SECURITY ADVISER: U.S. MUST BE PREPARED TO IMPOSE COSTS ON CHINA (RTRS)

- ECB'S LANE: STOCKS, BANK BONDS NOT IN TOOLBOX (RTRS)

- ECB'S SCHNABEL: MORE WORRIED ABOUT INFLATION BEING TOO LOW (BBG)

- A SOFT ROUND OF CHINESE PMI DATA SEEN, IMPACTED BY COVID RESTRICTIONS

BOND SUMMARY: Caution Evident, But Core FI Generally Insulated

Focus continues to fall on the dealings/knock on impact of the Wall Street Bets retail trader group in the U.S., with worry re: their ability to create volatility evident at the Asia-Pac re-open, as markets traded defensively. This added to a sense of caution that started with the softer than expected official Chinese PMI data releases over the weekend (with a miss for the Chinese Caixin m'fing PMI also witnessed during Monday trade). U.S. Tsys looked through the broader noise, with bulls unable/unwilling to force an extension after Friday's late uptick. A sense of calm then came to the fore, albeit with nothing in the way of notable headline flow, as e-minis more than pared their losses and the USD surrendered its early gains. T-Notes last print +0-03, at 137-04, while cash trade has seen some bear steepening, with 30s running ~2.5bp cheaper on the day. T-Note volume is healthy enough, nearing 110K, although there has been little in the way of standout flow observed during Asia-Pac hours.

- JGB futures unwound some of the weakness that was seen during the final overnight session of last week, last -6, stabilising around best levels of the session with U.S. Tsys working off of their own intraday highs. Cash JGB trade saw yields print little changed, although there was some bias for ever so modest cheapening given the moves seen in U.S. Tsys on Friday. Meanwhile, longer dated (30- & 40-Year) swap spreads continued the widening that was seen on Friday. Local news flow has been limited, with the Sankei suggesting that Japan will extend its regional COVID states of emergency to March 7.

- Early Sydney trade saw Aussie bond futures off of their Friday lows, given the aforementioned risk factors and news of a 5-day lockdown in Perth, on the back of an isolated positive COVID test in the city. Elsewhere, comments from Australian PM Morrison pointed to a government cognisant of the need for medium term fiscal prudence. YM -1.0, XM -3.0, with ranges fairly tight after the early uptick from overnight lows.

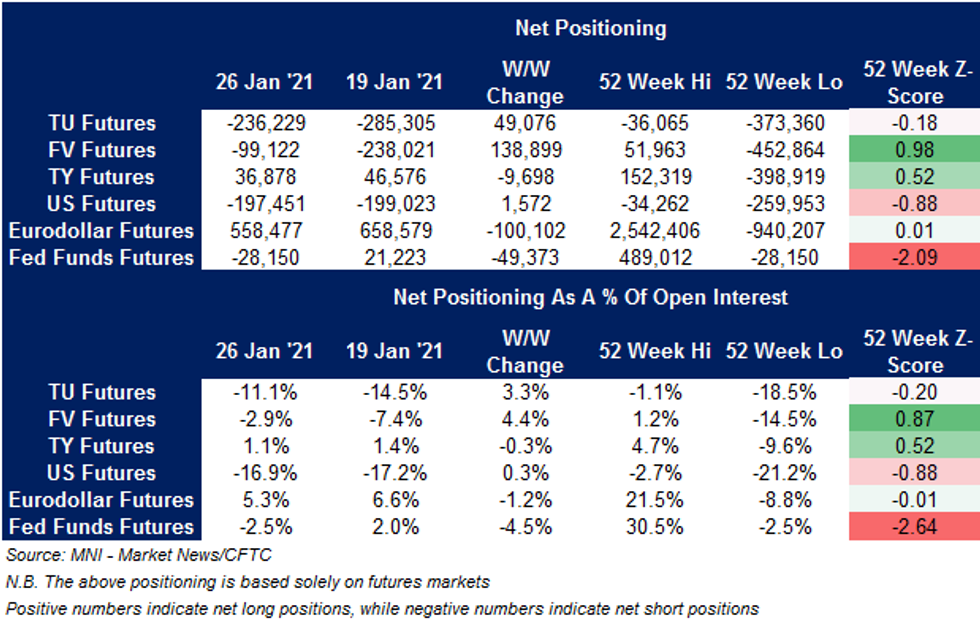

US TSYS: CFTC Shows Trimming Of Net Short Exposure In Shorter Dated Tsy Futures

The latest CFTC CoT report revealed a relatively sizeable trimming of FV net short positions ahead of last week's FOMC decision, with the data covering the week through Tuesday. This allowed the net short covering witnessed in the previous week to extend, with FV net shorts now at the lightest level witnessed since late August. Elsewhere, some light trimming of TU short exposure was seen.

EQUITIES: Bourses Reverse Fortunes, Green Into European Open

Asia-Pac equities are in the green to start the week, recovering from a negative start. Positive sentiment was given a boost by reports that AstraZeneca would increase supplies of its vaccine to Europe and start delivery earlier, reversing its earlier advice which had seen the EU impose export controls on the vaccine.

- Indices in China were the laggards in the region; PMI data showed the pace of recovery slowed in January. The PBOC injected CNY 98bn for the second session, which helped alleviate concerns of a cash crunch and lowered repo rates from multi-year highs.

- Hong Kong was the beneficiary as mainland shares struggled, Japan and South Korea also saw some strong gains – the latter boosted by strong export data and a robust electronics sector.

- US futures saw similar price action to their Asia-Pac counterparts, a sharp initial drop retraced as the session wore on. The market endured its worst week since October last week, the uptick today has been attributed to participants gingerly returning to market.

OIL: Crude Futures Higher On Supportive Supply Picture

Oil is higher to start the week; WTI up $0.22 at $52.42, brent is up $0.33 at $55.38. The increase follows 2 consecutive declines on a weekly basis, after 3 weeks of increases to start off 2021.

- The OPEC+ group estimates it has implemented 99% of its agreed supply reductions in January, according to an unnamed delegate in Bloomberg reports. The compliance data is preliminary and will be reviewed on Tuesday by the group's Joint Technical Committee.

- As we enter a new month, participants also consider the start of the voluntary output cut by Saudi Arabia. The oil giant pledged to reduce output by an additional 1m bpd in February and March.

- Also helping generate supportive supply conditions was Chevron, the company said it would wait under the outcome of the pandemic and the effects of OPEC+ output cuts were clearer before resuming increased shale output.

- Upside was tempered by weak PMI figures from China.

- Market looks ahead to the Feb. 3 OPEC Joint Ministerial Monitoring Committee for fresh cues on supply outlook, as Russia plans to cut Urals exports by 20% in February.

METALS: Wall Street Bets Does It Again

Gold has received support from the rally in silver, although the former remains confined to the range witnessed on Friday, last printing a little under $15/oz better off on the day, above the $1,860/oz mark, after pulling back from best levels of the day during Friday's NY session.

- Silver is trading the best part of $1.50/oz firmer, just below $28.50/oz after trading as high as $29.02/oz after the Asia-Pac re-open (a level not seen since August). As we flagged at the backend of last week, the Wall Street Bets retail trader group in the U.S. switched its focus to short interest in the SLV fund after success targeting smaller cap equity names earlier last week. The recent rally seen in spot silver garnered further steam in Asia, with weekend reports noting that retail websites were overwhelmed with demand for silver bars and coins, pointing to some knock-on impact for the broader silver space, stemming from the aforementioned retail trader dealing.

- This has left the spot Gold/Silver ratio operating at levels not witnessed since '14.

FOREX: Risk Aversion Fades Away, Sterling Takes Lead

Risk regained poise even as early Asia-Pac trade saw a sense of caution inspired by the recent moves from GOP Senators re: fiscal matters (seemingly diminishing odds for a bipartisan solution), assessment of the retail market dynamics as well as wider than expected slowdown in expansion indicated by China's official PMI surveys released over the weekend and followed by a miss in Caixin M'fing PMI. Initial risk-off moves were reversed and commodity-tied FX clawed back losses. AUD recovered after taking a hit from the announcement that the city of Perth will enter a five-day lockdown, in reaction to the detection of a new Covid-19 case.

- GBP outperformed in the G10 basket amid suggestions that official data will confirm that all residents of eligible care homes in England have been offered a Covid-19 jab, in what PM Johnson has hailed as a "crucial milestone." The news came after UK Trade Sec Truss said that the UK's vaccine supply is secure and the inoculation campaign can proceed as planned. On a different front, the UK is set to launch a bid to join the CPTPP, a transpacific trading bloc. Sterling rose to its best levels since Jun 2020 vs. the Swiss franc, which was the main laggard in G10 FX space.

- The redback took a hit after China's overnight repo rate pulled back from multi-year highs as the PBoC continued to inject liquidity ahead of the LNY holidays. USD/CNH chewed into last Friday's losses, which took the rate to three-week lows. Disappointing Caixin PMI data helped the redback cement weakness showed in the lead-up to the release. Another softer than expected PBoC fix provoked little reaction.

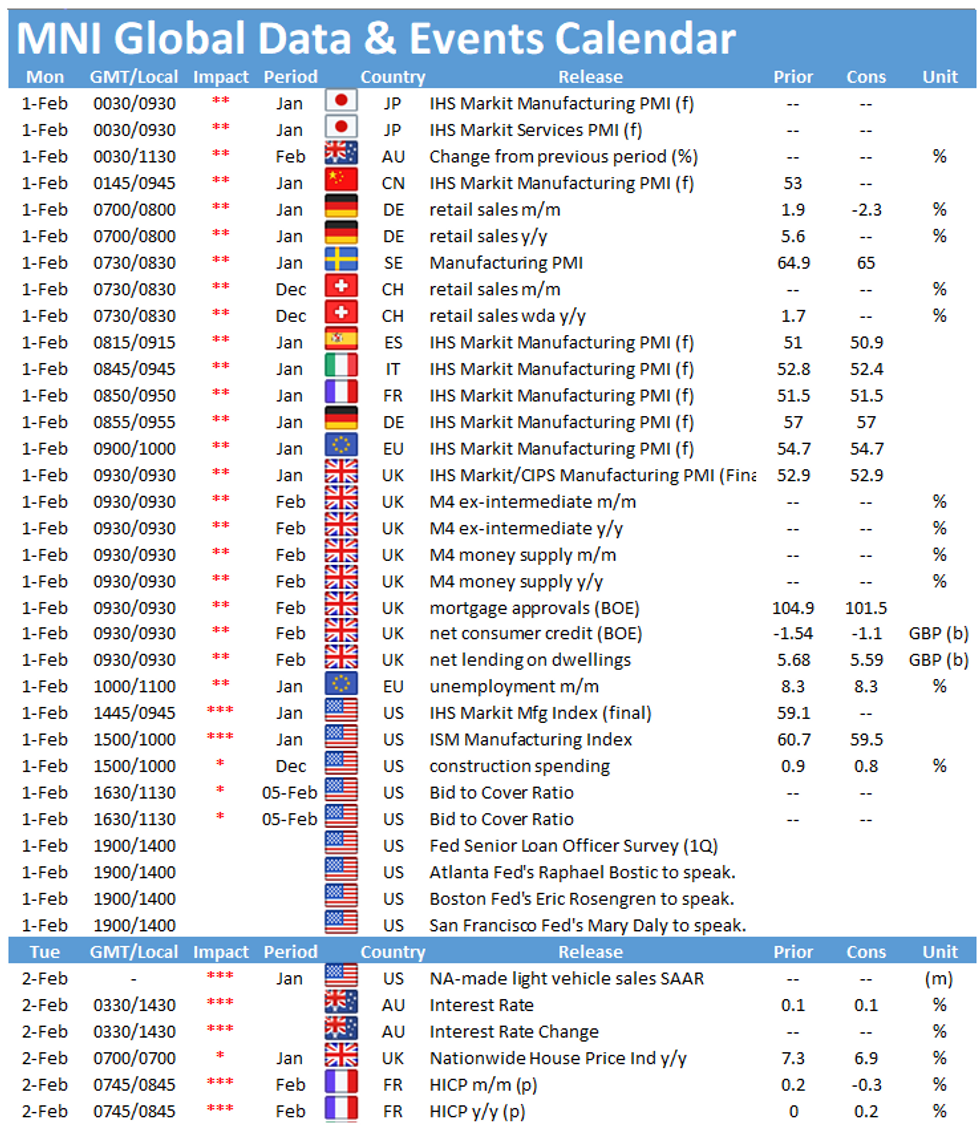

- M'fing PMI readings from across the globe, EZ unemployment, German retail sales and comments from Fed's Kashkari, Kaplan, Bostic & Rosengren take focus from here.

FOREX OPTIONS: Expiries for 1 Feb NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E1.5bln), $1.2220-30(E1.2bln-EUR puts), $1.2300-05(E786mln)

- USD/JPY: Y102.30-50($805mln), Y104.45-60($924mln), Y104.75-78($504mln), Y105.50($500mln)

- GBP/USD: $1.3550(Gbp547mln)

- AUD/JPY: Y77.50(A$600mln), Y79.10(A$605mln), Y83.00(A$614mln)

- USD/CNY: Cny6.4835-00($530mln)

- USD/MXN: Mxn20.82($580mln), Mxn21.00($720mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.