-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Japan & Aust PMIs Improve Ahead Of Key EU/US Releases

EXECUTIVE SUMMARY

- SEVERAL FED OFFICIALS SAW ‘PLAUSIBLE’ CUT AT JULY MEETING - MNI

- LARGE DOWNWARD PRELIMINARY BENCHMARK REVISION FOR PAYROLLS- MNI US DATA

- ABOUT 60 CHINA CITIES PLEDGE TO PURCHASE UNSOLD HOMES - SECURITIES DAILY

- BOK HOLDS RATE, DOWNGRADES GDP, CPI VIEW - MNI EM BRIEF

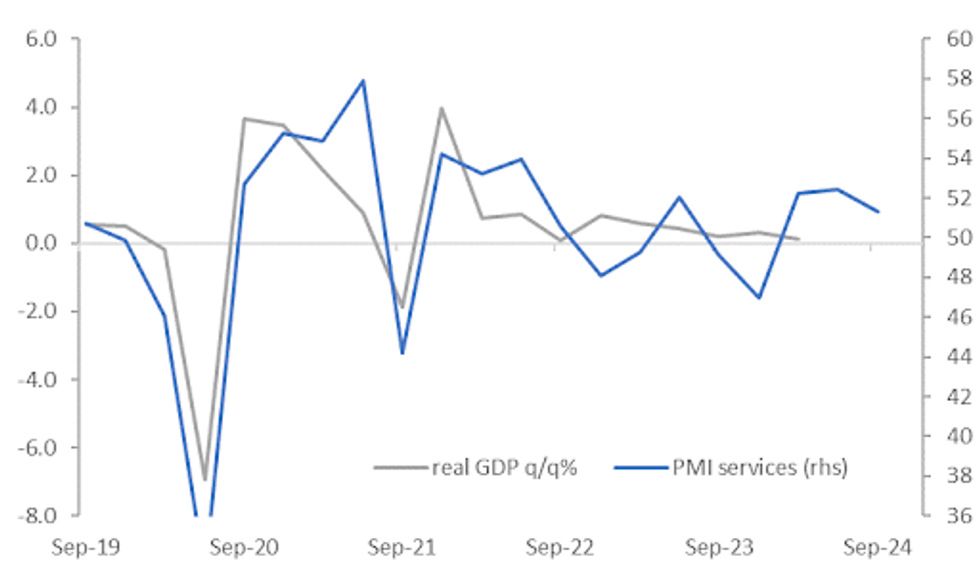

Fig. 1: Australian Services PMI & Real GDP Y/Y

Source: MNI - Market News/Bloomberg

EUROPE

ECB (MNI SOURCES): ECB Neutral Rate Debate Heats Up As Growth Weak

FRANCE (FRANCE24): “President Emmanuel Macron launches negotiations with different party leaders this Friday in a latest effort to bring an end to six weeks of political deadlock following snap legislative elections. Macron seems set on forging a broad coalition that would likely include his own defeated centre-right bloc.”

GERMANY (DW): “Ten days before elections in the eastern German states of Saxony and Thuringia, where the far-right Alternative for Germany (AfD) is predicted to secure a strong share of the votes, the CDU's national leader visited Thuringia to help campaign. Friedrich Merz reiterated that his center-right party would keep its pledge never to ally with or govern with the support of the AfD.

GERMANY (POLITICO): “German Chancellor Olaf Scholz defended his country's aid to Ukraine on Wednesday, after his government came under fire for cutting funds in a savings push. “Germany will not let up in its support for Ukraine. We will continue to support Ukraine for as long as necessary. And we will be Ukraine's biggest national supporter in Europe,” Scholz said.”

UKRAINE (POLITICO): “The EU's chief diplomat Josep Borrell today called for lifting restrictions on Ukraine using donated weapons to hit targets in Russia. "Ukraine’s Kursk offensive is a severe blow to Russian President Putin’s narrative," Borrell posted on X.”

UKRAINE (POLITICO): “Any peace deal reached between Ukraine and Russia likely won't be fair, Czech President Petr Pavel said Wednesday — but justice should be the objective nonetheless.”

BELGIUM (POLITICO): “Belgian politics is inching toward a new crisis — again. After June elections opened a pathway to the quick formation of a new five-party national government, negotiations became bogged down this month over who ought to shoulder the burden for shrinking the country’s budgetary hole.”

US

FED (MNI): Several Federal Reserve policymakers were ready to cut interest rates as early as the central bank's last meeting in July as they focused increasingly on risks to the employment side of the mandate, minutes to the FOMC's July meeting showed Wednesday. “All participants supported maintaining the target range for the federal funds rate at 5.25 to 5.5%, although several observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision,” the minutes said.

FED (MNI INTERVIEW): Housing Inflation To Fall Slowly-Fed's Mehrotra

ECONOMY (BBC): “A labour dispute between Canada’s two main national rail carriers and workers could lead to a possible lockout as soon as Thursday morning, threatening crucial supply chains across North America.”

DATA (MNI): After taking more than 30 minutes for official public confirmation, the BLS reports that the preliminary benchmark payrolls revision is a very large -818k. It implies seasonally adjusted average monthly payrolls growth through the twelve months to Mar 2024 was closer to 174k rather than 242k seen in the current vintage.

OTHER

MIDDLE EAST (RTRS): “U.S. President Joe Biden, in a phone call with Israeli Prime Minister Benjamin Netanyahu on Wednesday, stressed the urgent need to conclude a Gaza ceasefire-for-hostages deal and pointed to upcoming Cairo talks as crucial, the White House said.”

ISRAEL (BBC): “Hezbollah has launched dozens of rockets at the occupied Golan Heights after Israeli aircraft struck deep inside Lebanon, as fears of an all-out war grow.”

SOUTH KOREA (MNI): The Bank of Korea board on Thursday decided to keep its policy interest rate unchanged at 3.50%, lowering its 2024 GDP growth outlook 10 basis points to 2.4%, according to press reports. The Bank also adjusted its 2024 CPI forecast to 2.5% against the 2.6% expected in May, while its 2025 CPI outlook remained flat at 2.1%.

INDONESIA (BBG): “Indonesian lawmakers adjourned a meeting amid online and street protests against electoral changes that would effectively favor the alliance of President Joko Widodo and his successor, Prabowo Subianto.”

CHINA

HOUSING (SECURITIES DAILY): “About 60 cities have voiced support for state-owned enterprises to buy unsold homes and turn them into affordable housing, Securities Daily reported, citing data compiled by China Index Holdings.”

BONDS (NAFMII): “China will step up investigation and punishment of illegal activities in the bond market, in a bid to prevent financial risks and maintain market orders, several major official newspapers reported, citing interviews with Xu Zhong, deputy secretary general of the National Association of Financial Market Institutional Investors, or NAFMII.”

BANKS (NFRA): “The government will support banks to optimise their asset-liability structure and improve profitability after net interest margins fell 19 basis points to 1.54% in the first half, according to Liao Yuanyuan, director at the National Financial Regulatory Administration.”

CARS (CADA): “Chinese car dealerships lost CNY1.78 million per store on average in H1, a survey from the China Automobile Dealers Association has found. Consumers' cautious behaviour slowed demand in Q2, especially for fuel vehicles, said Lang Xuehong, deputy secretary-general of the association.”

ENERGY (NDRC): “The NDRC will establish an authority to oversee energy use in fixed asset investment projects as part of measures to save energy, Securities Daily reported. Authorities will implement a new mechanism to manage energy and carbon emissions during and after project completion.”

CORPORATE (BBG): “Cosmetics retailer Sephora is cutting hundreds of staff in China, according to people familiar with the matter, as one of LVMH’s biggest brands tries to turn around a loss-making operation in the world’s second-largest economy.”

CHINA MARKETS

MNI: PBOC Net Drains CNY218.4 Bln via OMO Thursday

The People's Bank of China (PBOC) conducted CNY359.3 billion via 7-day reverse repo on Thursday, with rate unchanged at 1.70%. The operation has led to a net drain of CNY218.4 billion after offsetting the maturity of CNY577.7 billion today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.7977% at 09:51 am local time from the close of 1.8229% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 55 on Wednesday, compared with the close of 45 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1228 on Thursday, compared with 7.1307 set on Wednesday. The fixing was estimated at 7.1215 by Bloomberg survey today.

MARKET DATA

AUSTRALIA JUDO BANK AUG. FLASH MFG PMI 48.7; JULY 47.5

AUSTRALIA JUDO BANK AUG. FLASH SERVICES PMI 52.2; JULY 50.4

AUSTRALIA JUDO BANK AUG. FLASH COMPOSITE PMI 51.4; JULY 49.9

JAPAN JIBUN BANK AUG. FLASH MFG PMI 49.5; JULY 49.1

JAPAN JIBUN BANK AUG. FLASH SERVICES PMI 54; PRIOR 53.7

JAPAN JIBUN BANK AUG. FLASH COMPOSITE PMI 53; PRIOR 52.5

CHINA SWIFT GLOBAL PAYMENTS JULY +4.7%; PRIOR +4.6%

MARKETS

US TSYS: Tsys Futures Steady Ahead Of Jackson Hole & Jobless Claims

- Treasury futures opened the session lower, with the 10yr testing pre-BLS levels before risk markets, lead by tech stocks saw some selling pressure. TYU4 is now back at opening levels at 113-24, while TUU4 is trading at103-11+.

- The market will now turn its focus to US Jobless claims, Jackson Hole Headlines, while BoJ's Ueda is to speak tomorrow with any hawkish comments likely to cause heightened volatility.

- Cash treasuries are trading little changed today with yields flat to 0.5bps lower. The 10yr is trading 3.797% vs overnight & yearly lows of 3.7595%

- Projected rate cuts through year end gained vs. early Wednesday levels (*): Sep'24 cumulative -33.6bp (-33.3bp), Nov'24 cumulative -65.7bp (-64.4bp), Dec'24 -101.3bp (-98.3bp).

JGBS: Steady Ahead Of BoJ Ueda’s Appearance In Parliament & Jackson Hole Symposium

JGB futures are weaker and near session cheaps, -12 compared to the settlement levels.

- Outside of the previously outlined weekly International Investment Flow and Jibun Bank PMIs, there hasn't been much in the way of domestic drivers to flag.

- Machine Tool Orders data are due later alongside an Enhanced Liquidity Auction for 5-15.5-year OTR JGBs.

- Cash US tsys are flat to 1bp cheaper across benchmarks in today’s Asia-Pac session. The market’s focus now turns to advance PMIs and initial jobless claims later today, ahead of the Jackson Hole economic symposium, which will be held Aug. 22-24. Fed Chairman Powell will speak at 1000ET Friday morning.

- Cash JGBs are slightly mixed across benchmarks, with yield swings bounded by +/- 1bp. The benchmark 10-year yield is 0.2bp lower at 0.879% versus the cycle high of 1.108%.

- Swaps are flat to 1bp higher across the curve.

- Tomorrow, the local calendar will see National CPI and Department Sales data.

- BoJ Governor Ueda is scheduled to respond to questions from lawmakers in the lower house of parliament from 0930 JT tomorrow, followed by another session in the upper house starting at 1 p.m. Each session is set to last two and a half hours.

AUSSIE BONDS: Subdued Session As Jackson Hole Vigil Continues

ACGBs (YM +1.0 & XM +0.5) are slightly stronger on a data-light session.

- Outside of the previously outlined Judo Bank PMIs, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are little changed across benchmarks in today’s Asia-Pac session. The market’s focus now turns to advance PMIs and initial jobless claims later today, ahead of the Jackson Hole economic symposium, which will be held Aug. 22-24. Fed Chairman Powell will speak at 1000ET Friday morning.

- Cash ACGBs are flat to 2bps richer, with a steeper 3/10 curve and the AU-US 10-year yield differential at +9bps.

- Swap rates are 1-2bps lower, with the 3s10s curve steeper.

- The bills strip shows pricing flat to +3.

- RBA-dated OIS pricing is flat to 2bps softer across meetings. A cumulative 21bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty apart from the AOFM’s planned sale of A$700mn of the 2.75% 21 November 2028 bond.

- CPI Monthly data for July will be released next Wednesday.

NZGBS: Cheaper, $-Bloc Underperformance Continues, Q2 Real Retail Sales Tomorrow

NZGBs closed slightly weaker, with benchmark yields rising by 1bp. Despite narrow trading ranges during a data-light session, NZGBs ended the day at their lows.

- Additionally, NZGBs continued to underperform relative to their $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials widening by 2bps.

- Today's performance suggests an ongoing reversal of much of the post-RBNZ rate cut rally. While the 2-year yield remains 12bps lower than pre-RBNZ levels, it has climbed 14bps since Friday’s close. Similarly, the 10-year yield is 4bps lower than pre-RBNZ levels but has risen 6bps since Friday.

- The weekly government bond tender was cancelled today as is standard practice given the bond syndication of the new May-36 earlier in the week.

- Swap rates are little changed.

- RBNZ dated OIS pricing is little changed. A cumulative 72bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Q2 Retail Sales Ex Inflation data.

- Before then, the market will be focused on advance PMIs in Europe and the US and US initial jobless claims.

FOREX: Yen Crosses Weighed By Mixed Equity Trends, But Overall Ranges Tight

Overall G10 ranges have been tight in the part of Thursday trade. As has been the case this week the USD was softer in the first part of trade, but follow through hasn't been evident. The USD BBDXY index last near 1230.60, little changed for the session.

- Cross asset signals have lent some USD support, albeit at the margins. US equity futures sit modestly lower, while regional equities have been mixed (despite the positive cash lead from Wednesday offshore trade). US yields are close to flat at this stage, with aggregate swings modest after Wednesday's move lower at the front end.

- USD/JPY has seen some volatility, but has respected recent ranges. Dips sub 145.00 have been supported, while highs were at 145.64. The slight weaker equity tone has likely lent some support to yen on crosses this afternoon.

- AUD/USD and NZD/USD have both ticked lower. The A$ was last 0.6730/35, NZD is back to 0.6150. Commodities are mostly weaker at the margin, likely weighing on commodity FX.

- AUD/JPY has edged down to 97.60/65, with recent highs above 99.00 capping the pair.

- On the data front we had better preliminary PMIs out of Australia and Japan, but more so on the services side. Market sentiment wasn't moved.

- Coming up, US/European August flash PMIs as well as US jobless claims and Chicago & Kansas indices are out. Later the Jackson Hole Symposium starts but markets will be waiting for Fed Chair Powell’s speech on Friday. The ECB July meeting account is also published today.

ASIA STOCKS: Asian Equities Pare Gains As Investors Book Profits Ahead Of CB Speak

Asian equities opened stronger this morning following dovish signals from the FOMC minutes but later gave up most of their gains. The HSTech lost half of its early rally, and mainland China indexes edged lower. South Korea's Kospi slipped as the won weakened, influenced by a the BOK leaving rates unchanged and more dovish stance. Japanese equities remained narrowly mixed, retreating from their best levels. While the broader MSCI Asia Pacific Index initially rose by 0.4%, gains were tempered by declines in markets such as China, Indonesia, and Taiwan with investors booking profits on tech stocks. Traders are now focused on Jackson hole headlines, Jobless Claims while BoJ Ueda is to speak tomorrow.

- Japanese equities have given up most of the session gains, with tech stocks almost erasing all gains, as investors look to book profits, while the yen is trading back at 145.00. Earlier, Jibun Bank PMI rose to 53.0 for August, vs 52.5 prior. The Nikkei is up 0.10%, while the TOPIX is now down 0.25% after the TOPIX Banks Index fell about 1.50%.

- China & Hong Kong equities are swinging between losses and gains while property continues to struggle with major property benchmarks trading at or close to all time lows. Elsewhere China has launched an investigation into EU dairy imports in response to tariffs imposed on China's EV and Pork exports. The HSI is up 0.40%, HSTech is 0.80% higher, while in China the CSI 300 is down 0.13%, property indices are mixed with Mainland Property Index down 2.40% while the CSI 300 Real Estate Index is up 1.10%

- South Korean equities have given all gains made this morning with KOSPI now flat after Samsung dropped -0.40% & SK Hynix fell -0.70%, small-caps are underperforming with the KOSDAQ down 0.80%. Foreign investors have been slightly better sellers this morning, with most of the selling coming from tech names.

- Taiwanese equities have erased all gains with the Taiex now trading 0.50% lower, with banking and property sectors the worst performing following the central bank's request for lenders to reduce their concentration of real estate loans. The central bank's directive, aimed at improving credit resource management, triggered concerns over tighter financial conditions. TSMC is currently trading down 0.85% after initially opening 0.60% higher.

- Australian equities are slightly higher driven primarily by gains in mining and real estate stocks. The ASX200 index is on track for its longest winning streak since February 2015, and trades 0.25% higher today. New Zealand healthcare stocks are underperforming today with the NZX50 down 0.25%.

- Asian EM equities are mixed with Indonesia's JCI down 0.35%, Singapore's Straits Times down 0.35% while Thailand's SET is 0.05% higher, Philippine's PSEi is up 1.10% and Malaysia's KLCI is up 0.13%, India's Nifty 50 is 0.20% higher

OIL: Crude Still Under Downward Pressure Ahead Of PMIs & Jackson Hole

Oil prices are off today’s lows to be little changed as global demand worries continue to weigh on benchmarks. Brent is little changed at $76.02/bbl after a low of $75.77, key support is at $75.05. WTI is down 0.2% to $71.80 after a low of $71.58, briefly below the bear trigger at $71.67 again. Algorithmic selling has exacerbated downward pressures. If they continue, OPEC may abandon plans to reduce output cuts from October. The USD index is slightly higher.

- There was an 818k downward revision to US payrolls announced Wednesday and the FOMC July minutes signalled that it is looking at cutting rates at its September 18 meeting. These have added to market nerves regarding the strength of the US economy at a time of disappointing growth in China.

- Despite concerns over US demand, EIA data showed another crude drawdown of 4.65mn barrels last week, and gasoline stocks fell 1.61mn and distillate 3.3mn. Crude inventories are down 34.7mn barrels since the start of July to their lowest level since the end of January.

- There is no update on Gaza ceasefire negotiations.

- Later the Jackson Hole Symposium starts but markets will be waiting for Fed Chair Powell’s speech on Friday. The ECB July meeting account is published today and US/European August flash PMIs as well as US jobless claims and Chicago & Kansas indices are out.

GOLD: Weaker Despite Dovish FOMC Minutes

Gold is 0.4% lower in today’s Asia-Pac session, after closing broadly unchanged at $2512.56 on Wednesday.

- Expectations for the FOMC to begin easing policy on September 18 were reinforced by the BLS's downward revisions to nonfarm payrolls and dovish FOMC minutes. Lower rates are typically positive for gold, which doesn’t pay interest.

- The Bureau of Labor Statistics reported that US payroll growth in the year to March was preliminarily revised down by 818k or 68k per month.

- The July FOMC minutes signaled that participants were eyeing a cut in September, with "several" seeing it as "plausible" to cut already in July. There weren't many clues in the minutes on future monetary policy beyond that, with no mention of a potential >25bp cut.

- Focus turns to the KC Fed-hosted Jackson Hole economic symposium will be held Aug. 22-24, with Fed Chairman Powell speaking at 1000ET Friday morning.

- According to MNI’s technicals team, conditions remain bullish for the yellow metal after delivering an all-time high on Tuesday. Note that moving average studies remain in a bull-mode set-up and this continues to highlight a dominant uptrend. The focus is on a climb towards $2536.4 next, a Fibonacci projection.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2024 | 0600/0800 | ** |  | NO | Norway GDP |

| 22/08/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 22/08/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 22/08/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 22/08/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/08/2024 | 1130/1330 |  | EU | Account of ECB MonPol meeting in July | |

| 22/08/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 22/08/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/08/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (Flash) |

| 22/08/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 22/08/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/08/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/08/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/08/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 22/08/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/08/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/08/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.