-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN OPEN: Market Sentiment Steady As US CPI In View

EXECUTIVE SUMMARY

- US TO RESTRICT SENSITIVE INVESTMENTS IN CHINA - MNI BRIEF

- RATE TO PLATEAU, DESPITE STRONG INFLATION - EX-RBA STAFF - MNI

- JAPAN JULY CGPI RISE SLOWS TO 36.6% FROM JUNE’S 4.3% - MNI BRIEF

- STRIKES RISK 10% OF GLOBAL LNG IN THREAT OF NEW ENERGY SHOCK - BBG

- CHINA ALLOWS GROUP TOURS TO US, UK, JAPAN IN MAJOR TRAVEL BOOST - BBG

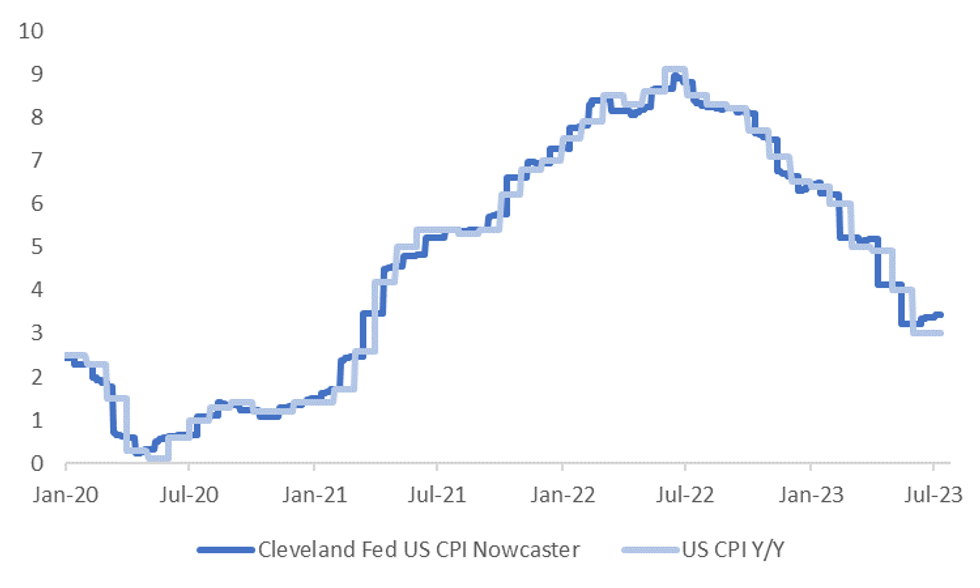

Fig. 1: US CPI vs Cleveland Fed US CPI Nowcaster

Source: MNI - Market News/Bloomberg

U.K.

HOUSE PRICES: RICS in London report the July residential market survey results today. Forecast range -60% to -40% from 8 economists. House price balance at -53 in July vs -48 in June, the lowest level since 2009. (BBG)

U.S.

US/CHINA: U.S. President Joe Biden has signed an executive order to ban certain U.S. investments in China, according to a treasury department announcement on Wednesday. The measures will prohibit U.S. persons from investments in China involving sensitive technology such as semiconductors, quantum information technologies and artificial intelligence. The Treasury department press release said policymakers had decided on “narrowly targeted action which complements our existing export control, protecting our national security while maintaining our commitment to open investment.” (MNI)

US/CHINA: President Joe Biden on Wednesday signed an executive order that will narrowly prohibit certain U.S. investments in sensitive technology in China and require government notification of funding in other tech sectors. The long-awaited order authorizes the U.S. Treasury secretary to prohibit or restrict certain U.S. investments in Chinese entities in three sectors: semiconductors and microelectronics, quantum information technologies, and certain artificial intelligence systems. (RTRS)

TECH: The U.S. Commerce Department said on Wednesday that more than 460 companies have expressed interested in winning government semiconductor subsidy funding in a bid to boost the country's competitiveness with China's science and technology efforts. The White House is marking the one-year anniversary on Wednesday of President Joe Biden's signing of the landmark "Chips for America" legislation providing $52.7 billion in subsidies for U.S. semiconductor production, research and workforce development. (RTRS)

OTHER

AUSTRALIA: The Reserve Bank of Australia is only likely to hike the cash rate further should price rises fall outside its expectations, ex-staffers told MNI, though they cautioned that the weakness of the local dollar has tempered the effectiveness of monetary policy in containing inflation. Jonathan Kearns, former head of the RBA’s financial stability department and now chief economist at Challenger, believes monetary policy should be tighter, but slow wage growth means the Reserve would not need to raise rates as high as other countries. (MNI)

AUSTRALIA: The Future Fund should shut and its $250 billion in assets should be sold to pay down government debt, according to a paper warning the fund will struggle to deliver the returns required to justify its existence. (AFR)

AUSTRALIA: Potential strikes at three major liquefied natural gas facilities in Australia could disrupt about 10% of global exports of the fuel and deliver a new energy price shock across Asia and Europe. Workers at Chevron Corp. and Woodside Energy Group Ltd. facilities in Australia have voted to approve industrial action at the North West Shelf, Wheatstone and Gorgon operations, and some walkouts could begin as soon as next week under labor rules. (BBG)

JAPAN: The year-on-year rise in Japan's corporate goods price index slowed to 3.6% in July from June's revised 4.3% for the seventh straight deceleration, indicating that upstream cost increases have peaked, data released by the Bank of Japan Thursday showed. (MNI)

JAPAN: China’s government will allow group tours to Japan from Thursday, Nikkei reports, citing unidentified people. Chinese embassy in Tokyo notified Japan’s Foreign Ministry of the move on Wednesday. (NIKKEI)

JAPAN: China has indicated a positive stance on a possible summit meeting between Premier Li Qiang and Japanese Prime Minister Fumio Kishida on the sidelines of the ASEAN meeting in Indonesia in Sept. Kyodo reports, citing unidentified officials from both sides. (BBG)

NEW ZEALAND: New Zealand farm confidence in July slumped to the lowest since Federated Farmers began conducting its six-monthly survey in 2009, the farmer lobby group says in emailed statement. A record net 80% of farmers consider that current economic conditions are bad compared with 65% in the previous survey in January. A net 70% of farmers expect economic conditions will worsen in the next 12 months, down from 82%. (BBG)

NEW ZEALAND: ANZ Bank has lowered its forecast for Fonterra’s 2023-24 milk price to NZ$7.15 per kilogram milksolids, from NZ$7.75, economist Susan Kilsby says in emailed note. Says forecast for 2022-23 price is unchanged at NZ$8.20 Economic conditions in China have deteriorated further and their demand for dairy products has eased, while at the same time its stocks of milk powder have increased. (BBG)

NORTH KOREA: North Korean leader Kim Jong Un called for military drills and a boost in the production of weapons and equipment at a key military committee meeting, according to state media KCNA. The Central Military Commission of the Workers’ Party of Korea appointed Ri Yong Gil as new chief of the general staff to replace Pak Su Il. (KCNA)

ECUADOR: Ecuador presidential candidate Fernando Villavicencio was killed on Wednesday evening during a campaign event in northern Quito and a suspect in the crime later died of injuries sustained in a shoot-out, authorities said. Local media reported Villavicencio had been shot, but Ecuador's police and Interior Ministry did not respond to repeated requests for comment about the details of the killing. (RTRS)

CHINA

INFLATION: China’s consumer and producer price indexes are likely to bottom out and rebound as domestic demand recovers, China Securities Journal cites analysts as saying in a report. Prices likely to stay mild due to ample supply, providing good environment for implementing proactive macroeconomic policies. Pork prices are likely to stabilize; core CPI may gradually return to historical average as various policy support takes effect: citing China Minsheng Bank analyst Wen Bin. (CSJ)

TRAVEL: China lifted a ban on group travel to a slew of countries including the US, UK, Australia, South Korea and Japan, in a major relaxation of travel restrictions that’s set to boost the global tourism market. The resumption of group tours will start immediately on Thursday, according to a statement issued by the Ministry of Culture and Tourism. The easing applies to all travel agencies and online platforms across the country, it said. (BBG)

TRADE: China made the biggest downgrade on record to the value of a monthly export figure, a move that could paint a more flattering picture of trade data in months to come amid weak global demand. The customs authority slashed $10.6 billion from the March data, when exports surprisingly jumped, as it reduced the overall value of exports for 2022 and early this year. The adjustment creates a lower base of comparison for year-on-year changes, resulting in more favorable growth rates for troubled exports. (BBG)

TECH: Baidu, ByteDance, Tencent and Alibaba made orders worth $5b for Nvidia chips vital for artificial intelligence systems, Financial Times reports, citing two unidentified people close to Nvidia. (FT)

MOFCOM: The U.S.'s recent action to restrict sensitive technology investment in China deviates from the market economy and fair competition principles, according to China’s Ministry of Commerce (MOFCOM). In an online statement, the ministry said China was concerned the actions would disrupt global industrial and supply chain security and reserved the right to take countermeasures. (MNI)

DEBT: China should transform urban investment platforms into ordinary operating state-owned enterprises and form clear boundaries between government and urban investment to prevent new hidden debt from accumulating, according to Yicai. Experts interviewed by the news outlet said, despite the government making strong efforts to prevent hidden debt, local authorities' involvement in activities such as unauthorised borrowing and providing guarantees remained an issue. (Yicai)

COMMODITIES: China is extending its ambition to have a greater say in iron ore pricing, a perennial bugbear for a nation that relies heavily on imports to feed its vast steel industry. China Mineral Resources Group, the state-owned giant established last year to consolidate the country’s purchases, is studying ways to expand into the spot market for ore, in addition to managing longer term contracts, according to an interview with Chairman Yao Lin in China Metallurgical News, a state-owned outlet. (BBG)

CHINA MARKETS

PBOC Net Injects CNY2 Bln Via OMOs Thursday

The People's Bank of China (PBOC) conducted CNY5 billion via 7-day reverse repos on Thursday with the rate unchanged at 1.90%. The operation has led to a net injection of CNY2 billion after offsetting the maturity of CNY3 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9000% at 09:25 am local time from the close of 1.7475% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Wednesday, the same as the close of Tuesday.

PBOC Yuan Parity At 7.1576 Thursday Vs 7.1588 Wednesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1576 on Thursday, compared with 7.1588 set on Wednesday. The fixing was estimated at 7.2030 by BBG survey today.

MARKET DATA

UK JULY RICS HOUSE PRICE BALANCE -53%; MEDIAN -51%; PRIOR -48%

JAPAN PPI M/M 0.1%; MEDIAN 0.2%; PRIOR -0.1%

JAPAN PPI Y/Y 3.6%; MEDIAN 3.5%; PRIOR 4.3%

JAPAN JULY TOKYO AVG OFFICE VACANCIES 6.46; PRIOR 6.48

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 111-08+, -0-04, a 0-04+ range has been observed on volume of ~48k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys have ticked lower through the Asian session, however ranges remain narrow with little follow through.

- The proximity to this evening's July US CPI print has perhaps limited activity in Asia.

- FOMC data OIS remains stable, a terminal rate of 5.40% is seen in May with ~70bps of cuts by July 2024.

- There is a thin docket in Europe today, further out the latest US CPI print headlines. The MNI preview of the event is here. Fedspeak from SF Fed President Daly and Atlanta Fed President Bostic also crosses. We also have the latest 30-Year supply.

JGBs: Futures Holding Weaker, Narrow Range Ahead Of US CPI & Jobless Claims

In the Tokyo afternoon session, JGB futures are holding the morning’s early losses, -29 compared to settlement levels, after trading in a narrow range.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined annual PPI miss and weekly international investment flow data that showed offshore investors were large sellers of Japanese bonds.

- US tsys are sitting at session lows in Asia-Pac trade, with no obvious headline driver. This leaves cash tsys ~1bp cheaper across the major benchmarks.

- The cash JGB curve has bear steepened with yields flat to 3.2bp higher. The benchmark 10-year yield is flat at 0.584%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- The swaps curve has also bear steepened. Swap spreads are wider apart from the 40-year.

- Tomorrow is a public holiday in Japan.

- Later today, the US calendar sees CPI and Initial Jobless Claims data along with Fedspeak from SF Fed President Daly and Atlanta Fed President Bostic. There is also the latest 30-year supply.

AUSSIE BONDS: Subdued Trading Ahead Of US CPI

ACGBs (YM -4.0 & XM -3.5) are weaker but above Sydney session lows as global bond markets await today’s US CPI data.

- Consensus puts core CPI inflation at 0.2% m/m in July in what’s likely only a minor uptick from the unrounded 0.16% m/m in June. Analysts see two conflicting (and familiar) drivers on the month: airfares (upside) and used cars (downside). Some expect the Fed’s closely watched core services ex-housing measures to firm from particularly weak flat or near flat readings in June but to still help the trend moderate. See the MNI CPI preview here.

- US tsys have cheapened in Asia-Pac trade, sitting at session lows, with no obvious headline driver. The move aligns with JGBs moving lower. This leaves cash tsys ~1bp cheaper across the major benchmarks.

- Cash ACGBs are 3-4bp cheaper with the AU-US 10-year yield differential 2bp wider at +1bp.

- The 3s10s swaps curve bear flattens, with rates 2-3bp higher.

- The bills strip bear steepens, with pricing -1 to -4.

- RBA-dated OIS pricing is little changed, with terminal rate expectations at 4.23%.

- Tomorrow RBA Governor Lowe’s final appearance before the House of Representatives standing committee on economics headlines.

- In addition to US CPI data later today, the US calendar sees Initial Jobless Claims data.

NZGBS: Cheaper, Mixed Outcomes For Weekly Supply, US CPI Due

NZGBs closed 2-3bp weaker, mid-range, as global bonds braced for today’s US CPI data.

- US tsys are sitting at session lows in Asia-Pac trade, with no obvious headline driver. This leaves cash tsys ~1bp cheaper across the major benchmarks.

- In terms of the weekly supply, outcomes were varied. The auction of NZ$275 million worth of May-26 bonds and NZ$75 million of the 2.75% Apr-37 bonds witnessed decreased cover ratios (2.77x and 2.01x respectively). Conversely, the sale of NZ$150 million of May-32 bonds experienced an elevated cover ratio (3.01x). Nevertheless, the lines were 2-3bp richer in post-auction trading.

- Swap rates are 2-3bp higher with the 2s10s curve flatter.

- RBNZ dated OIS pricing is flat to 3bp softer, with '24 meetings leading.

- Tomorrow the local calendar sees July’s Manufacturing PMI and Food Price Index.

- In addition to US CPI data, the US calendar sees Initial Jobless Claims along with Fedspeak from SF Fed President Daly and Atlanta Fed President Bostic. There is also the latest 30-year supply.

GOLD: Steady Ahead Of US CPI

Gold is slightly higher in the Asia-Pac session, after closing 0.6% lower on Wednesday. The move was surprisingly large considering the USD index moved lower on the day.

- That said, short-end US tsy yields were higher. Nervousness over the potential for stronger-than-expected US CPI data today, which could keep the FOMC on a tightening path, appeared to encourage some position squaring. See the MNI CPI preview here.

- Core inflation is expected to fall, extending a downward trend that Bloomberg consensus believes will support a pause in monetary tightening when the Fed next meets in September. The market attaches a 17% chance of a 25bp hike at the 20 September FOMC meeting.

OIL: Crude Range Trading Ahead Of US CPI Data

Crude has been range trading during the APAC session as markets wait for July US CPI data out later but has held onto most of Wednesday’s gains. WTI is down 0.1% to $84.30/bbl and has held above $84. Brent is 0.2% lower at $87.42 after a low of $87.29. The USD index is flat.

- Brent is up 16% since the start of July and prices have broken above the previous 2023 high in April. There are signs supply is tightening with OPEC+ cutting output, US stocks declining and building tensions in the Black Sea. Futures contracts are signalling tighter supply too.

- Demand concerns persist though, especially from China, but potential LNG shortages from planned strike action in Australia heading into the northern hemisphere winter could increase demand for oil (see MNI’s Australian Strike Risk Pushing Gas Prices Higher, Inflation Risk).

- OPEC publishes its monthly report later today with the IEA’s due tomorrow.

- The focus later is on July US CPI which is expected to rise to 3.3% y/y from 3% with core down 0.1pp to 4.7% (see MNI’s US CPI preview here). The Fed’s Daly, Bostic and Harker also speak.

FOREX: Greenback Little Changed In Asia, CPI In View

The USD is little changed in Asia, ranges have been narrow with little follow through on moves.

- Kiwi is ~0.2% firmer and is the best performer in the G-10 space at the margins. NZD/USD prints at $0.6065/70, the pair remains well within recent ranges. Bulls first look to break yesterday's high ($0.6095) and the 20-Day EMA ($0.6140).

- AUD/USD is also up ~0.2% and last prints at $0.6535/40. Tuesday's low in AUD/USD reinforces bearish conditions, support comes in at $0.6497, the Aug 8 low, and $0.6458, low from May 31 and bear trigger. Resistance comes in at $0.6610, the high from Aug 10.

- Yen is a touch softer, USD/JPY is marginally higher than opening levels. July PPI was softer than expected printing at 0.1% M/M vs 0.2% exp.

- Elsewhere in G-10, GBP is marginally lower and EUR is little changed from opening levels.

- Cross asset wise; US equity futures are firmer, a post-market rise in Disney has supported the space. The Hang Seng is down ~1%. BBDXY is flat, US Tsy Yields are a touch firmer across the curve.

- The July US CPI print headlines today's docket, the MNI preview is here.

EQUITIES: Most Regional Markets Tracking Lower, Japan Shares Outperforming

Outside of Japan, Asia Pac region stock markets are mostly weaker. China and HK markets track lower. US equity futures are higher though. Eminis were last around 4503, up from recent lows in the 4480/4490 region, which is still offering support. We are +0.40% firmer, but remain comfortably below Wednesday session highs around 4536. Nasdaq futures are +0.43% higher, but this unwinds less than half of Wednesday's cash index loss. Focus remains very much on the upcoming US CPI print.

- In Hong Kong the HSI is off by close to 1% at the break. The HSTECH index is off by 1.50%. Late US time on Wednesday, US President Biden signed an executive order around US investment limits in China technology. This may be weighing on sentiment, but has been well telegraphed and some commentators suggest it is not as limiting as feared.

- Mainland China shares have also tracked lower. The CSI 300 is down nearly 0.50% at the break. The real estate sub index is close to flat. Some support is coming from higher energy stocks, which is flowing from the oil bounce.

- Japan shares are bucking these trends, with the Topix +0.70% firmer, and Nikkie 225 at +0.60% higher at this point. Top contributors to the rise have been car makers Honda and Toyota.

- South Korean shares are seeing less outperformance compared to yesterday, with the Kospi off by ~0.40%. The Taiex is down 1.20% in Taiwan, in line with fresh weakness in the SOX index in recent sessions.

- Australian shares are a touch higher, while most markets are modestly lower in SEA. Indian shares are around -0.30% lower at this stage, with the RBI decision due shortly.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/08/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 10/08/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 10/08/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 10/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 10/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/08/2023 | 1230/0830 | *** |  | US | CPI |

| 10/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 10/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/08/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/08/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 10/08/2023 | 1900/1500 |  | US | Atlanta Fed's Raphael Bostic | |

| 10/08/2023 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 10/08/2023 | 2015/1615 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.