-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN OPEN: More Stimulus Needed To Counter China Slowdown

EXECUTIVE SUMMARY

- NORTH KOREA’S KIM JONG UN IN RUSSIA AMID US WARNINGS NOT TO SELL ARMS - RTRS

- COUNTRY GARDEN WINS REPAYMENT EXTENSION FOR 6 ONSHORE BONDS< SOURCES SAY - RTRS

- AUSTRALIAN BUSINESS CONDITIONS BRIGHTEN AS CONSUMER MOOD SOURS- BBG

- NEW ZEALAND SEES WIDER BUDGET DEFICITS, LONG ROAD TO SURPLUS - BBG

- POLLS SHOW NEW ZEALAND OPPOSITION ON COURSE FOR ELECTION VICTORY - BBG

- MORE STIMULUS NEEDED TO COUNTER CHINA SLOWDOWN - MNI

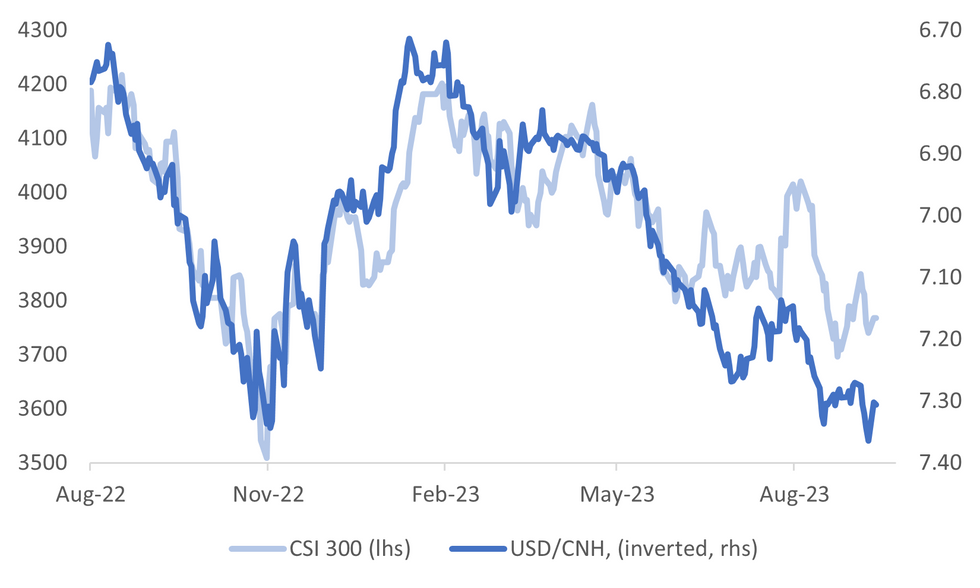

Fig. 1: CSI 300 Index & USD/CNH (Inverted)

Source: MNI - Market News/Bloomberg

U.K.

UK/CHINA: Jeremy Hunt said the UK takes any attempt to subvert its democratic processes “very seriously,” but that an escalating espionage dispute with China underscored the need for diplomatic dialog with Beijing. Members of the UK’s ruling Conservative Party are urging Prime Minister Rishi Sunak’s government to take a tougher line with Beijing, after British police confirmed over the weekend that two men were arrested under the Official Secrets Act in March accused of espionage. China denied any involvement. (BBG)

BOE: The Bank of England should look to raise rates further from current levels or risk enabling further inflation persistence which will have to be unwound eventually, external Monetary Policy Committee member Catherine Mann said Tuesday. Pushing back against recent remarks by Governor Andrew Bailey and chief economist Huw Pill, Mann said policy makers should err on the side of tighter monetary policy as holding rates at current levels would eventually lead to worse trade-offs for the economy. (MNI BRIEF)

EUROPE

UKRAINE: President Volodymyr Zelenskiy and his allies urged Ukrainians on Monday to keep their focus squarely on the war effort 18 months into Russia's invasion, an indication that authorities in Kyiv were steeling for a long campaign. Zelenskiy has long called for greater focus on the war effort and pledged to intensify a crackdown on corruption as part of Ukraine's bid to join the European Union. (RTRS)

UKRAINE: The Biden administration is close to approving the shipment of longer-range missiles packed with cluster bombs to Ukraine, giving Kyiv the ability to cause significant damage deeper within Russian-occupied territory, according to four U.S. officials. (RTRS)

U.S

BANKING: JPMorgan Chase CEO Jamie Dimon blasted stricter capital rules proposed by U.S. regulators, telling investors on Monday that they could prompt lenders to pull back and stymie economic growth. The proposal to require banks to set aside more capital to guard against risk was "hugely disappointing" and involved a "lack of transparency" from regulators about the rationale, Dimon said at a conference in New York. (RTRS)

FED: The Federal Reserve is done raising interest rates and will likely cut them by roughly one percentage point next year, according to chief economists at some of North America’s largest banks. While the US will probably dodge a recession, economic growth looks set to slow markedly in the coming quarters, pushing up unemployment while reducing inflation, the latest forecast from the American Bankers Association’s Economic Advisory Committee shows. (BBG)

OTHER

JAPAN: Arm Holdings Ltd.’s initial public offering is already oversubscribed by 10 times and bankers plan to stop taking orders by Tuesday afternoon, according to people familiar with the matter. Arm, controlled by SoftBank Group Corp., will close its order book a day early on Tuesday, but is still planning to price its shares on Wednesday, the people said, asking not to be identified because the matter is private. It’s not uncommon for books to close early on an IPO, which often indicates strong demand. (BBG)

AUSTRALIA: Australian business conditions showed ongoing resilience to higher interest rates and elevated price pressures, while consumer confidence fell further into “deeply pessimistic” territory, highlighting the divergent responses of the corporate and household sectors to tighter policy. Business conditions, which measure sales, employment and profitability, rose 2 points to 13 in August and held above the average level since the start of the year, a National Australia Bank Ltd. survey showed Tuesday. Confidence was steady at 2 points, implying optimists outnumber pessimists. (BBG)

AUSTRALIA: Australian consumer confidence is in the worst sustained slump on record, according to a weekly survey by the ANZ Bank and pollster Roy Morgan. Consumer confidence fell 1.1 points over the week, completing six consecutive months below 80 points, something never before seen in the data. (WSJ)

NEW ZEALAND: New Zealand will avoid a double-dip recession but faces larger budget deficits and a longer road back to surplus, according to the nation’s Treasury Department. Releasing the Pre-election Economic and Fiscal Update Tuesday in Wellington, Treasury said the deficit will widen to NZ$11.4 billion ($6.7 billion) in the year ending June 2024 compared with a NZ$7.6 billion gap forecast in May’s budget. The books don’t show a surplus until 2027, a year later than previously projected. (BBG)

NEW ZEALAND: New Zealand’s main opposition National Party is on course to win the October election, according to the latest opinion poll. Support for National rose 4.3 percentage points to 40.9% in the latest Newshub-Reid Research poll published late Monday in Wellington, its best result in more than three years. Support for the ruling Labour Party fell 5.5 points to 26.8%, its lowest since 2017, when it was last in opposition. (BBG)

NORTH KOREA: North Korean leader Kim Jong Un has arrived in Russia, Japanese media reported on Tuesday, for what the Kremlin said would be a comprehensive discussion with President Vladimir Putin amid warnings from Washington they should not agree on an arms deal. Kim left Pyongyang for Russia on Sunday on his private train, the North's state media reported on Tuesday, accompanied by top arms industry and military officials and the foreign minister. (RTRS)

CHINA

STIMULUS: The Chinese government needs to adopt more aggressive expansionary macroeconomic policies, including more fiscal spending and rate cuts, to bolster demand as factory orders shrink rapidly, while authorities should implement recently announced supply-side policies as soon as possible, a former member of the People's Bank of China's Monetary Policy Committee told MNI. (MNI)

YUAN: China’s yuan has strong base to stay generally stable in the long run, China Securities Journal said in a front-page report. The PBOC has ample policy tools to safeguard yuan, and will take resolute actions against speculative bets: report, citing an unidentified person close to the regulator. (CSJ)

YUAN: The People’s Bank of China will likely introduce new and forceful measures to shore up the yuan after it flagged a desire to take action when necessary on Monday, 21st Century Business Herald reported Tuesday citing traders. More wholesale investors have started to reduce CNY short positions and shifted focus to the possibility that the improved Chinese economy would attract overseas capital to enter the A-share market after the PBOC’s monetary supply data in Aug delivered positive signs. (21st Century Business Herald)

LOCAL GOVERNMENT DEBT: China will take effective action to prevent and defuse local government debt risks while balancing economic growth and high-quality development, according to Li Hongzhong, member of the Political Bureau at the CPC Central Committee. Speaking at a special government debt management review meeting, Li said local governments can raise debt to promote Chinese-style modernisation, but ensure relevant systems were in place to strengthen government debt supervision in accordance with the law. (YICAI)

HOUSING: House transaction volume in tier-one cities rebounded after Chinese authorities eased restrictions, according to the China Business Network Tuesday. More than 2,800 second-hand houses were sold in Beijing last weekend, twice the average weekend transaction volume in August, analysts said. They predicted the property market would further recover in Q4 and cities would continue to reduce tax, house-buying fees and relax relevant restrictions on mortgages. (MNI BRIEF)

HOUSING: Fuzhou, capital city of Fujian, is removing home-purchasing curbs in 5 districts to boost housing demand, Fuzhou Evening News reports on Monday citing a notice from the local housing authority. (BBG)

RRR: China’s central bank may consider cutting reserve requirement ratio for commercial lenders in the fourth quarter of this year to stabilize liquidity and credit, according to a front-page report in Securities Daily, citing analysts. (BBG)

COUNTRY GARDEN: China's largest private property developer Country Garden has won approval from its creditors to extend the repayments on six onshore bonds by three years, two sources familiar with the matter said on Tuesday. Onshore creditors voted on Monday for proposals by the distressed developer to extend repayments on eight onshore bonds worth 10.8 billion yuan ($1.48 billion) by three years. (RTRS)

CHINA MARKETS

MNI: PBOC Net Injects CNY195 Bln Tuesday via OMO

The People's Bank of China (PBOC) conducted CNY209 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY195 billion after offsetting the maturity of CNY14 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8143% at 09:22 am local time from the close of 1.9997% on Monday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday, compared with the close of 40 on Friday.

PBOC Yuan Parity At 7.1986 Tuesday Vs 7.2148 Monday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1986 on Tuesday, compared with 7.2148 set on Monday. The fixing was estimated at 7.2852 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND AUGUST CARD SPENDING RETAIL M/M 0.7%; PRIOR 0.0%

NEW ZEALAND AUGUST CARD SPENDING TOTAL M/M 0.9%; PRIOR -0.9%

NEW ZEALAND JULY NET MIGRATION SA 5786; PRIOR 5033

AUSTRALIA SEPTEMBER CONSUMER CONFIDENCE M/M -1.5%; PRIOR -0.4%

AUSTRALIA SEPTEMBER CONSUMER CONFIDENCE INDEX 79.7; PRIOR 81.0

AUSTRALIA AUGUST NAB BUSINESS CONFIDENCE 2; PRIOR 1

AUSTRALIA AUGUST NAB BUSINESS CONDITIONS 13; PRIOR 11

MARKETS

US TSYS: Little Changed In Muted Asian Session

TYZ3 deals at 109-25, unchanged from Monday's settlement levels, a 0-03+ range has been observed on volume of ~43k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys have observed narrow ranges on Tuesday with little follow through on moves, perhaps the proximity to tomorrow's CPI print is limiting activity.

- Little meaningful macro news flow crossed.

- FOMC dated OIS remain stable, a terminal rate of 5.45% is seen in November with ~50bps of cuts by July 2024.

- The UK Labour Market Report headlines in Europe, further out the only data of note today is NFIB Small Business Optimism. We also see the latest 10-Year Supply.

JGBS: Futures Off Session Lows After Stronger Than Expected Demand At 5Y Auction

In Tokyo afternoon trade, JGB futures have moved off session lows, -2 compared to the settlement levels, after 5-year supply saw better than expected demand. All the auction’s metrics were solid, with the low price beating dealer expectations, the cover ratio of 4.415x showing a notable increase from the 3.346x recorded in August and the tail shortening.

- There hasn’t been much in the way of domestic drivers to flag, with the economic data calendar empty.

- Bloomberg reports that Japan’s bond market is increasingly pricing in the prospects for an end to the central bank’s negative interest-rate policy, boosting short-term borrowing costs. The nation’s OIS suggest the BoJ will end the negative rate policy in January, compared with September 2024 seen after the last policy meeting in July, based on data compiled by Bloomberg. (See link)

- Cash JGBs are mixed across the curve, with yields 1.3bp lower (5-year) to 1.2bp higher (2-year).

- The benchmark 10-year yield is 0.2bp higher at 0.711%, after reaching a post-YCC tweak high of 0.722%.

- Swap rates are 0.4bp to 1.1bp higher across the curve, with the belly underperforming. Swap spreads are wider beyond the 2-year.

- Tomorrow the local calendar sees PPI (Aug) and BSI Large Industry (Q3) data, along with BoJ Rinban operations covering 1-3-year, 5-10-year and 25-year+ JGBs.

AUSSIE BONDS: Off Session Cheaps With JGBs After A Stronger Than Expected 5Y JGB Auction

In roll-impacted trading, ACGBs (YM +0.8 & XM +1.9) are near session highs after dealing in a relatively narrow range during the Sydney session. The previously outlined consumer and business confidence data failed to be a market mover.

- Accordingly, local participants have likely had their attention focused on the JGB market and any spillover to US tsys after yesterday’s heavy session.

- After extending weakness in morning trade, JGBs have moved away from session cheaps after 5-year supply saw stronger than expected demand.

- US tsys have also pared early Asia-Pac weakness, with benchmark yields flat to 1bp richer.

- Cash ACGBs are 1-2bp richer, with the AU-US 10-year yield differential 1bp lower at -14bp.

- Swap rates are 2-3bp lower across the curve.

- Bills strip pricing is flat to +2.

- RBA-dated OIS pricing is flat to 2bp softer across meetings.

- (AFR) Australia’s building industry will fall 160,000 homes short of the country’s 1.2 million target over the next five years, even after a renewed surge of apartment investment triggered by a shortage of dwellings and rising prices, Master Builders Australia forecasts show. (See link)

- Tomorrow the local calendar will see CBA Household Spending data.

- The AOFM has no plan to sell nominal bonds tomorrow.

NZGBS: Closed Slightly Richer After The Release Of The PEFU

NZGBs are 1-2bp richer after the Treasury released its pre-election budget economic and fiscal update, which gives a starting point for the government that will follow the October 14 elections. Polls currently suggest that there will be a change of government.

- The updated projections show a better growth outlook over the forecast horizon with lower unemployment, but the current account deficit has been revised higher. While inflation has been revised down for FY23 it is now expected to be higher in FY24.

- The fiscal outlook has deteriorated with the surplus pushed out one year to FY27.

- New Zealand Debt Management revised the government bond program for 2023/24 to NZ$36 billion, NZ$2 billion higher than published in the Budget Economic and Fiscal Update 2023. The forecast NZGB programs for 2024/25 and 2026/27 have also been increased, by NZ$3 billion and NZ$4 billion respectively. The forecast for the 2025/26 year is unchanged.

- Swap rates are 2-3bp lower.

- RBNZ dated OIS pricing is little changed on the day, with terminal OCR expectations steady at 5.62%.

- Tomorrow the local calendar sees REINZ House Prices and Food Prices, along with a speech from RBNZ Assistant Governor Silk on liquidity.

EQUITIES: HK Markets Recoup Earlier Losses As Property Developer Sentiment Improves

Regional equity market trends are mixed again in the first part of trading. This comes despite positive leads from US/EU markets in Monday trade. US futures are up from earlier lows, but haven't breached Monday session highs. Eminis (Dec contract) were last near 4535, after an earlier low just under 4530. Nasdaq futures track at 15662.

- The HSI has erased earlier losses to sit around flat at the break. Property sector sentiment improved as the session progressed as Country Garden reportedly received approval to extend repayment on six yuan bonds by 3 years. Real estate developers were down 2%, but now sit close to 3% higher.

- Optimism around EV car demand is also spurring gains after a positive outlook was posted by analysts at Citic Securities. The HS China Enterprise index has largely unwound earlier losses.

- At the break, mainland shares sit modestly higher. The CSI 300 +0.10% to 3771 in index terms.

- Japan shares are firmer, the Topix +0.60% at this stage. Toyota has been the strongest performer, while local bank stocks have added modestly to yesterday's +5% gain. Japan yields have ticked modestly higher, although a 5-yr debt auction went well.

- Elsewhere trends are mixed. The Kospi is off by 0.55%, while the Taiex is outperforming, +0.85%. There was a better tone to some tech related shares in US trade on Monday, but it wasn't led by semiconductors (with the SOX only modestly higher).

- In SEA Thai stocks are higher by 0.50%, but modest losses are being seen elsewhere.

FOREX: Narrow Ranges In Muted Asian Session

The greenback has observed narrow ranges in a muted Asian session on Tuesday, moves have been limited with little follow through.

- AUD/USD is ~0.1% firmer, dealing at $0.6435/40. The pair has observed a narrow range for the most part and sits a touch off session highs. Technically the latest bounce is considered corrective. Support comes in at $0.6357, low from Sep 6 and bear trigger. Resistance is at $0.6449, 20-Day EMA.

- Kiwi is little changed, NZD/USD has consolidated yesterday's gains above the $0.59 handle in a narrow range today.

- Yen is a touch pressured, however recent ranges remain intact. USD/JPY is ~0.1% firmer, last printing at ¥146.75/80. The trend condition remains bullish and any weakness is considered corrective. Resistance is at ¥147.87, high from Sep 7, and ¥148.40, high from Nov 4 2022. Support comes in at ¥145.07, high from Jun 30.

- Elsewhere in G-10; GBP is a touch firmer and EUR is marginally lower.

- Cross asset wise; BBDXY is ~0.05% lower and US Tsy Yields are ~1bp lower across the curve. E-minis are little changed, as is the Hang Seng.

- The July UK Labour Market Report provides the highlight in Europe today.

OIL: Crude Stronger On Improved Sentiment, Brent At $91

Oil prices are around 0.5% stronger during APAC trading today as risk sentiment improved on the back of a positive Hang Seng and a lifeline to Country Garden. WTI is close to its intraday high at $87.70/bbl and has traded above $87.20. Brent has breached $91 briefly and is currently trading around that level. The USD index is flat.

- The market has focused on the tightness of crude supply and later API data on US inventories are scheduled. US stocks have fallen sharply over the last few weeks. Also OPEC+ and the US’s EIA publish their monthly outlook reports today. The IEA’s is due on Wednesday. European diesel prices have risen strongly as Russia reduces shipments.

- The demand outlook has also improved with the US currently looking like it is headed for a soft landing and stronger crude imports into China.

- Later there is the August US NFIB small business optimism index, UK wages/employment and September euro area ZEW. The focus is on Wednesday’s US CPI.

GOLD: Small Gain After USD Declines

Gold is little changed in the Asia-Pac session, after closing +0.2% at $1922.30 on Monday. The gain in the precious metal was limited considering a sizeable -0.5% decline in the USD index.

- The USD's remarkable winning streak, after 8 straight weeks of gains, faced a significant challenge on Monday as the People's Bank of China intensified its efforts to protect the yuan. Meanwhile, the Bank of Japan dropped hints of a potential policy shift, causing the yen to surge in value. A strengthening dollar typically exerts a bearish pressure on gold, given that the precious metal is denominated in US currency.

- Bloomberg reports that as weakness in the yen looks set to continue into next year, prospects for gold priced in the Japanese currency have rarely looked so good. (See link)

- Gold investors are looking ahead to a US CPI report due midweek, which will help inform the outlook on the Federal Reserve’s interest-rate path.

- From a technical standpoint, bullion quickly reversed a clearance of resistance at $1930.5 (50-day EMA), according to MNI's technicals team. A more concerted push is required to open a key resistance at $1953.0 (Sep 4 high).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/09/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 12/09/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 12/09/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/09/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 12/09/2023 | 0905/1105 | *** |  | DE | ZEW Current Conditions Index |

| 12/09/2023 | 0905/1105 | *** |  | DE | ZEW Current Expectations Index |

| 12/09/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/09/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/09/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.