-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Oil Spikes As US/UK Strike Houthis In Yemen

EXECUTIVE SUMMARY

- US, BRITAIN CARRY OUT STRIKES AGAINST HOUTHIS IN YEMEN - OFFICIALS

- FED’S BARKIN ON MARCH CUT - LET’S SEE THE DATA - MNI BRIEF

- LAGARDE SAYS RATES TO FALL WHEN INFLATION BATTLE WON - MNI BRIEF

- CHINA DEC CPI FALLS LESS-THAN-EXPECTED BY -0.3% Y/Y - MNI BRIEF

- CHINA EXPORTS -4.6% Y/Y IN 2023, IMPORTS -5.5% Y/Y - MNI BRIEF

- CNY STRENGTHENS, THIRD PLENUM TO DETAIL REFORM - MNI INTERVIEW

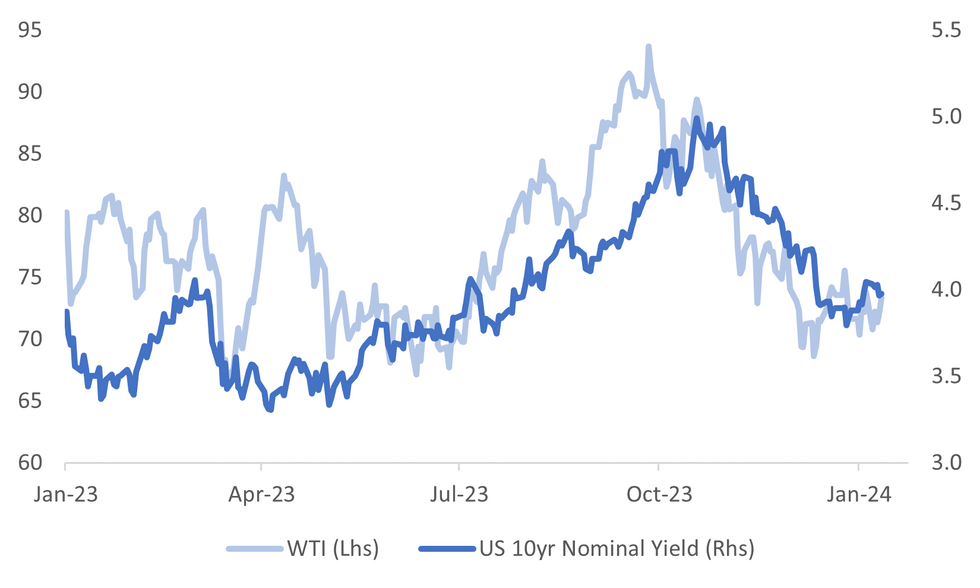

Fig. 1: WTI & US Nominal 10yr Yield

Source: MNI - Market News/Bloomberg

U.K.

MIDEAST (BBG): The US and UK launched airstrikes on more than 60 Houthi rebel targets in Yemen, sparking vows of retaliation and a rise in oil prices after weeks of attacks in the Red Sea disrupted commercial shipping.

EUROPE

ECB (MNI BRIEF): The ECB will start to lower interest rates when it is sure that it has won the battle against inflation, ECB President Christine Lagarde said Thursday night in an interview with the France 2 TV channel.

ECB (MNI BRIEF): The persistent mis-match between market pricing of ECB rate cuts and the ECB's own assessment is not a problem for policymakers, Croatian National Bank governor Boris Vujcic told an ongoing MNI livestream event.

ECB (MNI BRIEF): The ECB should cut interest rate in 25bps increments, Croatian National Bank governor Boris Vujcic told on an an ongoing MNI Connect webstream, although 50bps moves should not be excluded if warranted by incoming data.

FISCAL (MNI): Members of the European Parliament are likely to push for dilution of the tough cuts in budget deficits outlined in proposed new fiscal rules for the bloc in upcoming “Trialogue” negotiations between the legislature, member states and the European Commission, parliamentarians and a senior EU official told MNI.

FRANCE (BBG): French President Emmanuel Macron opted for continuity on economic policy by reappointing Bruno Le Maire as finance minister in a revamped government, prolonging a close partnership that has driven a pro-business reform agenda since the start of his presidency in 2017.

UKRAINE (FT): The European Commission is willing to concede to some of Hungary’s demands in order to secure a €50b support package for Ukraine, the Financial Times reports, citing unidentified senior officials.

EU/CHINA (BBG): Beijing’s latest salvo in simmering trade tensions with the European Union has added to the list of woes facing local cognac distributors struggling to shift stock amid China’s economic slowdown.

U.S.

FED (MNI BRIEF): It’s too soon for Federal Reserve officials to consider whether it will be appropriate to start cutting interest rates in March as financial markets are currently anticipating, saying he needs to see how economic data play out in coming months, Richmond Fed President Thomas Barkin told reporters Thursday.

FED (BBG): Federal Reserve Bank of Cleveland President Loretta Mester said it was premature to consider cutting interest rates as soon as the US central bank’s March meeting, emphasizing that fresh inflation data suggests policymakers have more work to do.

FISCAL (BBG): House Speaker Mike Johnson is actively discussing reneging on a spending deal with Democrats to appease his restive right flank, several Republicans said Thursday, with just eight days before a funding lapse triggers a partial government shutdown.

OTHER

MIDEAST (RTRS): The United States and Britain have launched strikes against targets linked to the Houthi movement in Yemen, four U.S. officials told Reuters on Thursday, the first strikes against the Iran-backed group since it started targeting international shipping in the Red Sea late last year.

OIL (BBG): Oil jumped as the US and allies launched airstrikes against Houthi rebels in Yemen, stepping up retaliation for attacks on ships in the Red Sea that have imperiled flows of fuel and goods through the vital waterway.

JAPAN (BBG): Japan’s share market surge has been driven in part by short-term buying from overseas investors in reaction to the weakening yen, Nomura Securities Co. executive Tetsuhiro Nishi said.

JAPAN (BBG): Bank of Japan officials are likely to discuss cutting their forecasts for inflation and economic growth and a gauge of inflation that includes energy when they gather to set policy later this month, even as their overall assessment of price trends remains intact, according to people familiar with the matter.

CHINA

PRICES (MNI BRIEF): China's Consumer Price Index fell by 0.3% y/y in December, narrowing from November's three-year low of -0.5%, while the Producer Price Index -- a measure of factory-gate inflation -- also witnessed a narrowed decline, data from the National Bureau of Statistics showed Friday.

TRADE (MNI BRIEF): China's exports registered a 4.6% y/y decline in 2023, compared with the 10.5% growth made in 2022, the first yearly decrease in seven years, data released by Customs on Friday showed.

TRADE (MNI BRIEF): China's foreign trade will remain competitive and resilient in 2024 as positive factors outweigh negatives, Wang Ling Jun, vice minister for the General Administration of Customs (GACC) said at a press conference on Friday.

YUAN (MNI INTERVIEW): China’s yuan will likely breach 7 to the dollar and possibly appreciate further in the second half of the year as a key policy conference delivers positive messages on reform and with the Federal Reserve likely to start cutting rates from June, a prominent policy advisor told MNI in an interview.

MARKET (YICAI): Some 256 funds in China have been in the process of liquidating in the past year as clients rushed to redeem investments due to the country’s weak stock market, according to a Yicai report Friday, citing data from financial information provider Wind.

NEV (BBG): Tesla Inc. cut the price of both its locally-made models in China, potentially setting the stage for further discounting as overall growth in the world’s biggest electric car market slows.

CHINA MARKETS

MNI: PBOC Drains Net CNY10 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY65 billion via 7-day reverse repo on Friday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY10 billion reverse repos after offsetting CNY75 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8348% at 09:58 am local time from the close of 1.8353% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 50 on Thursday, compared with the close of 48 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1050 Friday vs 7.1087 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1050 on Friday, compared with 7.1087 set on Thursday. The fixing was estimated at 7.1584 by Bloomberg survey today.

MARKET DATA

JAPAN NOV BOP CURRENT ACCOUNT ADJUSTED ¥1885.4bn; MEDIAN ¥2177.0bn; PRIOR ¥2621.7bn

JAPAN NOV TRADE BALANCE BOP BASIS -¥724.1bn; MEDIAN -¥533.0bn; PRIOR -¥472.8bn

JAPAN DEC BANK LENDING INCL TRUSTS Y/Y 3.1%; PRIOR 2.8%

JAPAN DEC ECO WATCHERS SURVEY CURRENT 50.7; MEDIAN 49.8; PRIOR 49.5

JAPAN DEC ECO WATCHERS SURVEY OUTLOOK 49.1; MEDIAN 49.5; PRIOR 49.4

AUSTRALIA NOV HOME LOANS M/M 1.0%; MEDIAN 1.3%; PRIOR 7.1%

AUSTRALIA NOV OWNER OCCUPIER HOME LOANS M/M 0.5%; PRIOR 8.3%

AUSTRALIA NOV INVESTOR LOANS M/M 1.9%; PRIOR 4.9%

CHINA DEC CPI Y/Y -0.3%; MEDIAN -0.4%; PRIOR -0.5%

CHINA DEC PPI Y/Y -2.7%; MEDIAN -2.6%; PRIOR -3.0%

CHINA DEC EXPORTS Y/Y 2.3%; MEDIAN 1.5%; PRIOR 0.5%

CHINA DEC IMPORTS Y/Y 0.2%; MEDIAN -0.5%; PRIOR -0.6%

CHINA DEC TRADE BALANCE $75.34bn; MEDIAN $74.95bn; PRIOR$68.40bn

MARKETS

US TSYS: Cash Bonds Cheaper After US & UK Airstrikes

TYH4 is trading at 112-10, +0-00+ from NY closing levels.

- US tsys are flat to 2bps cheaper, with a flattening bias, most likely in response to higher oil prices after US and UK airstrikes hit Houthi rebel targets in Yemen.

- Military actions against the Iran-backed group were initiated in response to a series of attacks on vessels in the Red Sea.

- These strikes signify a substantial escalation in the ongoing conflict in the Middle East, which commenced with the Hamas attack on Israel in early October. If this conflict expands, it has the potential to drive oil prices higher.

- After yesterday’s US CPI data, which was more-or-less in line with expectations, the market now awaits PPI data later today. MN Fed President Kashkari also speaks about economic conditions (1000ET).

JGBS: Futures Higher But Off Best Levels, 30Y Auction Weighs

In afternoon trade, JGB futures are richer but off the session highs, +16 compared to settlement levels, after 30-year supply showed mixed demand metrics, with the low price failing to meet dealer expectations but the cover ratio increasing to 3.003x from 2.616x in December. It is noteworthy that December’s cover was the lowest level seen at a 30-year auction since 2015. The auction tail was also shorter compared to December's auction, which had recorded the longest tail in history. The 30-year yield is ~1bp higher in post-auction dealings.

- There wasn’t much in the way of domestic data drivers to flag, outside of the previously outlined current account balance, bank lending and weekly international investment flow data.

- Cash US tsys are trading flat to 2bps higher, with a flattening bias, most likely in response to higher oil prices after US and UK airstrikes hit Houthi rebel targets in Yemen.

- After yesterday’s US CPI data, which was more-or-less in line with expectations, the market now awaits PPI data later today. Fed Kashkari also speaks about economic conditions.

- Cash JGBs are richer out to the 10-year, with the futures-linked 7-year as the best performer (-1.3bps). The benchmark 10-year yield has declined by 1.0bp, settling at 0.593%.

- Swaps curve has maintained its bull-flattening out to the 20-year, with rates 0.5bp to 1.3bps lower.

AUSSIE BONDS: Richer But Off Best Levels, US PPI Data Later Today

ACGBs (YM +6.0 & XM +3.0) sit richer, with a steepening bias, but are off the Sydney session’s best levels. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined housing loan commitments data.

- The shift away from session highs therefore seems to be more closely tied to US tsys activities during today's Asia-Pacific session. Benchmark yields are trading flat to 2bps higher.

- Cash ACGBs are 3-5bps richer, with the AU-US 10-year yield differential 1bp wider at +10bps.

- Swap rates are 2-4bps lower, with the 3s10s curve steeper.

- The bills strip has maintained its bull-flattened, with pricing +1 to +7.

- RBA-dated OIS pricing is 3-5bps softer for meetings beyond May.

- (AFR) The next chairman of the $206bn Future Fund will come from outside the organisation, and Treasurer Jim Chalmers is understood to be willing to delay an appointment to find the right leader. (See link)

- On Monday, the local calendar sees the MI Inflation Gauge, Job Advertisements and CBA Household Spending data.

- TCV has mandated NAB, UBS and Westpac for a new AUD 5.25% 15 September 2038 fixed rate benchmark bond, according to UBS. The transaction is expected to launch and price soon, subject to market conditions.

NZGBS: Very Strong Close, Outperformed The $-Bloc

NZGBs closed on a solid note, with benchmark yields 9-10bps lower. This came despite the local calendar being empty and US tsys dealing cheaper in today’s Asia-Pac session.

- US tsys are 1-2bps cheaper most likely in response to higher oil prices following US missile strikes in response to Houthi attacks.

- The NZGB 10-year managed to outperform its $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials 3-4bps tighter.

- Swap rates closed 8-12bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 1-11bps softer across meetings, with November leading. A cumulative easing of 96bps is priced by November.

- House sales provisionally fell to a record low in the three months through September, according to CoreLogic NZ.

- Next week, the local calendar is empty on Monday but sees the NZIER Business Opinion Survey on Tuesday. Card spending data is on Wednesday.

- The market awaits US PPI data later today. MN Fed President Kashkari also speaks about economic conditions.

OIL: Prices Spike Higher On US/UK Military Strikes In Yemen

Brent couldn't sustain early moves above $79/bbl, the front end benchmark last near $78.80/bbl, still +1.85% higher for the session. Earlier highs of $79.37/bbl were very close highs from Jan 4. For WTI we were last in the $73.40/bbl region, up by nearly 2%, but also off earlier highs near $74/bbl. Both benchmarks are now close to flat for the week, paring losses in recent sessions.

- The spike today has reflected joint US/UK joint military strikes in Yemen targeting the Houthis. This is in response to attacks on commercial ships by the Houthis over recent months.

- The US & UK authorities have stated the strikes aren't designed to escalate tensions, but this will be a focus, particularly around risks of Iran becoming more involved in a broader conflict.

- Elsewhere, China crude import volumes rose in Dec, with 2023 being a record year for imports as the country emerged from Covid lockdown conditions.

- This, along with a softer USD sentiment, has likely aided oil at the margins.

EQUITIES: Mixed Trends, Nikkei 225 +6% For The Week

Regional equities are mixed as we approach the weekend. Japan markets are higher, albeit with more modest gains compared to recent sessions. Trends are mixed elsewhere. US equity futures are down, but up from session lows. Eminis are off 0.14% but remain above 4800, Nasdaq futures are down around 0.10%. The US/UK military strikes on Yemen (in response to Houthi attacks on Red Sea commercial shipping) has likely added some risk aversion at the margins.

- The Nikkei 225 is up around 1%, the index on track for its best week in nearly 2 years. The Topix is up a more modest 0.20% at this stage. Foreign investors bought local shares last week, and will have likely done so this week.

- China markets are down slightly at the break. The CSI 300 off 0.17%. Inflation data and trade figures for Dec were slightly better than expected but are unlikely to shift the macro needle. At this stage, the consensus looks for a 10bps cut in 1yr MLF on Monday.

- The HSI is close to flat at the break.

- South Korea shares continue to underperform, the Kospi off 0.70% at this stage. Offshore investors are net sellers today, -$254mn in outflows, after strong inflows yesterday likely associated with the Lee family selling Samsung shares.

- Taiwan's Taiex is close to flat, as Saturday's election comes into focus.

- In SEA, most markets are up outside of Singapore, although gains are modest at this stage.

FOREX: USD Off Lows, A$ & Yen Marginally Higher

The USD index is down, but up from lows, with the BBDXY last near 1223.25 (earlier lows at 1222.58). The main focus today has been the spike in oil prices after the US & UK military strikes on Yemen, targeting the Houthis. Oil prices are off highs, but US yields are a touch higher (more so at the front end), which may have aided the USD from lows.

- AUD/USD got to highs of 0.6714, but we now sit back at 0.6700, around +0.20% higher for the session. To the extent higher oil prices boosts broader energy prices, the oil spike can be seen as a positive. A more cautious equity tone has likely trimmed risk appetite though. Housing finance figures were close to expectations.

- NZD/USD has largely followed the A$ trajectory, the pair last just above 0.6240.

- USD/JPY saw lows of 144.85, with some haven demand evident on the military strike headlines. However, the slightly firmer US yield backdrop has likely kept dips supported. The pair last near 145.00, around 0.20% stronger in yen terms for the session.

- Looking ahead, attention turns to UK growth figures and then US December PPI data.

GOLD: Higher On Haven Demand Following Yemen Airstrikes

Gold is slightly higher in the Asia-Pac session, after closing 0.2% higher at $2028.91 on Thursday, having bottomed out at $2013.4 to test support at $2013.2 (50-day EMA).

- Bullion was helped higher on Thursday by a softer USD index and lower US Treasury yields following US CPI data.

- Today’s strength however appears linked to haven demand as US and UK airstrikes hit Houthi rebel targets in Yemen.

- Military actions against the Iran-backed group were initiated in response to a series of attacks on vessels in the Red Sea.

- These strikes signify a substantial escalation in the ongoing conflict in the Middle East, which commenced with the Hamas attack on Israel in early October. If this conflict expands, it has the potential to drive bullion prices higher.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 12/01/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 12/01/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 12/01/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 12/01/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 12/01/2024 | 0745/0845 | *** |  | FR | HICP (f) |

| 12/01/2024 | 0745/0845 | ** |  | FR | Consumer Spending |

| 12/01/2024 | 0800/0900 | *** |  | ES | HICP (f) |

| 12/01/2024 | 1230/1330 |  | EU | ECB's Lane Speech + Q&A at REBUILD Annual Conference | |

| 12/01/2024 | - | *** |  | CN | Trade |

| 12/01/2024 | - | *** |  | CN | Money Supply |

| 12/01/2024 | - | *** |  | CN | New Loans |

| 12/01/2024 | - | *** |  | CN | Social Financing |

| 12/01/2024 | 1330/0830 | *** |  | US | PPI |

| 12/01/2024 | 1500/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/01/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2024 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2024 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.