-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Delivers Widely Expected Hike, China Continues To Pare Back COVID Restrictions

EXECUTIVE SUMMARY

- BEIJING NO LONGER REQUIRES COVID TEST RESULTS TO ENTER SUPERMARKETS, BUILDINGS (RTRS)

- BEIJING CAPITAL AIRPORT DROPS NEGATIVE COVID TEST REQUIREMENT FROM TUESDAY (RTRS)

- RBA HIKES 25BP, SIGNALS MORE TO COME IN EARLY 2023 (MNI)

- BOJ'S KURODA: PREMATURE TO REVIEW POLICY FRAMEWORK (MNI)

- US, EU WEIGH CLIMATE-BASED TARIFFS ON CHINESE STEEL AND ALUMINUM (BBG)

- OIL TANKER JAM FORMS OFF TURKEY AFTER START OF RUSSIAN OIL CAP (FT)

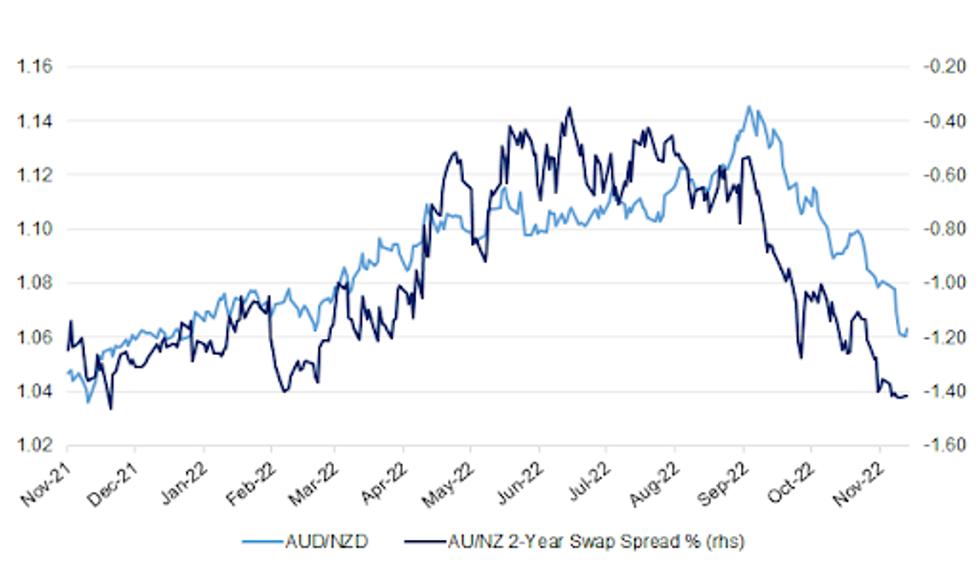

Fig. 1: AUD/NZD Vs. AU/NZ 2-Year Swap Spread

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Barclaycard said spending on its credit and debit cards rose 3.9% year-on-year in November, far behind the annual 11.1% increase in consumer prices in October that was the highest reading in 41 years. Some 94% of Britons surveyed by Barclaycard said they were concerned about the impact of soaring household energy bills on their personal finances. (RTRS)

PROPERTY/POLITICS: The government has agreed to water down housing targets for local councils, in order to put down a rebellion from Conservative MPs. (BBC)

EUROPE

ECB: European Central Bank Chief Economist Philip Lane said consumer-price growth is probably near its zenith, while acknowledging that borrowing costs will be raised again. (BBG)

U.S.

ECONOMY: The U.S. services sector's stronger-than-expected growth could mean the Federal Reserve's fight against inflation could be harder than previously expected as demand continues to hold up, Institute for Supply Management services chair Anthony Nieves told MNI Monday. (MNI)

OTHER

GLOBAL TRADE: The US and European Union are weighing new tariffs on Chinese steel and aluminum as part of a bid to fight carbon emissions and global overcapacity, according to people familiar with the matter. (BBG)

GLOBAL TRADE: The United States and the European Union on Monday cited progress addressing EU concerns about a U.S. climate law that would cut off the bloc's electric vehicles from U.S. tax credits, but failed to resolve the matter. (RTRS)

GLOBAL TRADE: India is exploring options to bring some of Apple’s iPad production to the country from China, according to two sources close to the Indian government. (CNBC)

U.S./CHINA/TAIWAN: The US has proposed selling Taiwan as many as 100 of its most advanced Patriot air-defense missiles along with radar and support equipment in a deal valued at $882 million, according to a State Department notice obtained by Bloomberg News. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Tuesday that it was premature for the BOJ to review its policy framework as the 2% price target hadn’t been achieved. (MNI)

BOJ: The Bank of Japan (BOJ) may abandon its 10-year bond yield cap as early as next year on growing prospects that inflation and wages will overshoot expectations, said Takeo Hoshi, an academic with close ties to incumbent central bank policymakers. (RTRS)

RBA: The Reserve Bank of Australia quashed hopes for a new year's pause in its tightening campaign, saying it "expects" to raise rates over the period ahead after hiking rates 25bp to 3.1% on Tuesday. (MNI)

AUSTRALIA: Treasurer Jim Chalmers has maintained it wants to avoid windfall taxes. with the preference being a regulatory outcome such as price caps. (AFR)

NORTH KOREA: North Korea said on Tuesday it had ordered military units to fire more artillery shells into the sea, the North's official KCNA news agency reported, in response to South Korea's ongoing drills across the border. (RTRS)

NORTH KOREA: South Korea plans to revive a reference to the North Korean regime and its military as an "enemy" in its defense white paper to be published next month under the conservative administration of President Yoon Suk-yeol, government sources said Tuesday. (Yonhap)

UKRAINE: UN Security Council will hold a meeting on Tuesday to discuss “humanitarian issues and protection of children” in Ukraine, Russian Deputy Envoy to UN Dmitry Polyanskiy says on Telegram. (BBG)

RUSSIA: Ukraine executed its most brazen attack into Russian territory in the nine-month-old war on Monday, targeting two military bases hundreds of miles inside the country, using unpiloted drones, according to the Russian Defense Ministry and a senior Ukrainian official. (New York Times)

SOUTH AFRICA: South Africa's ruling party said it would tell its lawmakers to reject a report that President Cyril Ramaphosa may have committed misconduct over a stash of cash in his farm, giving him a lifeline as he faced the biggest scandal of his career. (RTRS)

ENERGY: Eastbound gas flows resumed on the Yamal-Europe pipeline to Poland from Germany, data from pipeline operator Gascade showed on Monday. (RTRS)

ENERGY: The Netherlands has weighed into the European Union's debate on whether to cap gas prices with an alternative proposal that would cap gas prices but only for government-owned or state-supported buyers. (RTRS)

ENERGY: The Biden administration is convening a virtual meeting on Thursday with oil and gas executives to discuss how the United States can support Ukrainian energy infrastructure, according to a letter seen by Reuters. (RTRS)

OIL: The White House on Monday said it believes a price cap on Russian crude will lock in a global discount for such oil and hinted that the U.S. and its allies could tweak the $60-a-barrel limit should energy markets shift. (WSJ)

OIL: The White House said on Monday that it was not surprised by Russia's reaction to the West's price cap on oil from the country. (RTRS)

OIL: Two tankers were heading to Russia on Monday expecting to be filled with Russian crude as a price cap on its oil exports from a coalition of Western countries went into affect. (CNBC)

OIL: A traffic jam of oil tankers has built up in Turkish waters after western powers launched a “price cap” targeting Russian oil and as authorities in Ankara demanded insurers promise that any vessels navigating its straits were fully covered. (FT)

OIL: Venezuela last month exported 619,300 barrels per day (bpd) of crude and fuel as a resumption of shipments to Europe and the restart of oil processing plants lifted sales by 16% over October, according to documents and Refinitiv Eikon data. (RTRS)

OIL: Chevron Corp. will formally take over operational control of a key Venezuelan oil-processing facility this week during a joint visit to the site by company and government representatives, according to a person familiar with the plan. (BBG)

CHINA

CORONAVIRUS: China is reporting fewer Covid-19 cases as a wave that started to accelerate last month appears to be tailing off amid a pullback in the sweeping testing regime that saw a negative result needed to even enter a public park. (BBG)

CORONAVIRUS: China's capital Beijing no longer requires people that enter supermarkets and commercial buildings to show negative COVID-19 tests on their mobile phones, the city government said in a statement on Tuesday. (RTRS)

CORONAVIRUS: The Beijing Capital International Airport no longer requires a negative COVID-19 test result for entry to terminals, starting from Tuesday, state media said. (RTRS)

CORONAVIRUS: China is not ready to declare the end of the emergency phase of the Covid-19 pandemic, and it is necessary to continuously optimise control measures, said Xinhua News Agency in a commentary. (MNI)

PBOC: The PBOC is not expected to cut its MLF policy rate in December as the easing of Covid restrictions and recent lowering of the reserve requirement ratio (RRR) will support the economy until year-end, according to Shanghai Securities News citing economists. (MNI)

MARKETS/CAPITAL FLOWS: Chinese assets are attracting more overseas institutional investors amid the continuous easing of China’s Covid control measures, the introduction of real estate support policies, as well as the weakening of U.S. dollar, Yicai.com reported. (MNI)

CHINA MARKETS

PBOC NET DRAINS CNY78 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) on Tuesday injected CNY2 billion via 7-day reverse repos with the rates unchanged at 2.00%. The operation has led to a net drain of CNY78 billion after offsetting the maturity of CNY80 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7900% at 9:29 am local time from the close of 1.6009% on Monday.

- The CFETS-NEX money-market sentiment index closed at 47 on Monday vs 44 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.0746 TUES VS 7.0384 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.9746 on Tuesday, the lowest level since September 21, compared with 7.0384 set on Monday.

OVERNIGHT DATA

JAPAN OCT HOUSEHOLD SPENDING +1.2% Y/Y; MEDIAN +0.9%; SEP +2.3%

JAPAN OCT LABOUR CASH EARNINGS +1.8% Y/Y; MEDIAN +2.0%; SEP +2.2%

JAPAN OCT REAL CASH EARNINGS -2.6% Y/Y; MEDIAN -2.2%; SEP -1.2%

AUSTRALIA Q3 CURRENT ACCOUNT -A$2.3BN; MEDIAN +A$6.0BN; Q2 +A$14.7BN

AUSTRALIA Q3 NET EXPORTS/GDP -0.2%; MEDIAN -0.5%; Q2 +1.0%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 82.7; PREV 83.1

Consumer confidence softened 0.5% last week after a 5.6% gain over the previous three weeks. The decline in confidence in both ‘current’ and ‘future financial conditions ‘and ‘future economic conditions’ was almost offset by greater confidence in ‘current economic conditions ‘and whether ‘it is a good time to buy a major household item.’ (ANZ)

NEW ZEALAND Q3 VOLUME OF ALL BUILDINGS +3.8% Q/Q; MEDIAN +0.8%; Q2 +4.6%

UNITED KINGDOM NOV BRC SALES LIKE-FOR-LIKE +4.1% Y/Y; OCT +1.2%

MARKETS

US TSYS: Modestly Cheaper In Light Session

TYH3 deals +0-01 at 113-28+, just off the base of its narrow 0-06+ Asia-Pac range, on volume of ~71k.

- Cash Tsys trade 0.5-1.5bps cheaper across the major benchmarks, with some modest bear steepening in play.

- Spill over from ACGs in post-RBA trade helped apply some light pressure, as did reports of the Philippines seeking proposals for a multi-tranche round of USD-denominated bond issuance.

- Participants looked through Covid headlines from China as Bloomberg reported that Beijing would become the latest city to relax restrictions related to testing requirements for entry into some public spaces.

- Looking ahead, there is a thin docket in Europe today, with German factory orders providing the highlight there. The New York calendar is equally limited and will be headlined by U.S. trade balance data.

JGBS: Curve Twists Flatter, Futures Little Changed

JGB futures hit the bell +1 after wider moves in core global FI markets saw the contract unwind the uptick witnessed in the early part of the Tokyo session. Wider cash JGBs sit 2bp cheaper to 2bp richer as the curve twist flattens, pivoting around 30s.

- The early bid was aided by soft domestic spending and wage data, an uptick in U.S. Tsys and BoJ Governor Kuroda reiterating the need for continued monetary easing, as he once again pointed to the BoJ’s goals and stressed that now is not the time to debate the BoJ’s policy framework/an exit from ultra-loose settings (after BoJ board member Tamura pointed to the need for such discussions “at the right time”).

- Flattening held even against a lukewarm round of 30-Year JGB supply, which saw the cover ratio soften and price tail widen vs. last month’s offering, albeit conducted at lower prevailing yields. Note that the low price also printed below wider dealer expectations. The richness we flagged on the 20-/30-40-Year butterfly pre-auction was probably an impediment for demand. 30s cheapen a touch post-auction, while JGB futures tick lower (albeit with some of those moves representing catch up vs. U.S. Tsy price action in the Tokyo lunch break).

- Looking ahead, the latest round of BoJ Rinban operations and comments from BoJ’s Nakamura headline the Tokyo docket on Wednesday.

JGBS AUCTION: 30-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y728.0bn 30-Year JGBs:

- Average Yield: 1.481% (prev. 1.561%)

- Average Price: 98.32 (prev. 96.71)

- High Yield: 1.489% (prev. 1.567%)

- Low Price: 98.15 (prev. 96.60)

- % Allotted At High Yield: 26.9014% (prev. 60.1443%)

- Bid/Cover: 3.001x (prev. 3.282x)

AUSSIE BONDS: Holding Cheaper After Lack Of Overt Dovish RBA Pivot

After some early two-way price action it was the lack of an overt dovish pivot in the RBA’s post-meeting statement guidance paragraph that accompanied the widely expected 25bp hike, along with the market adjustment given that 21bp of tightening was priced pre-meeting, that applied some pressure to ACGBs, leaving the space cheaper at the bell.

- YM settled -7.0, while XM was -3.0, with wider cash ACGBs were 2-9bp cheaper, as the curve bear flattened.

- Bills were 6-10bp cheaper through the reds, while RBA terminal rate pricing adjusted 10bp or so higher vs. pre-meeting levels, hovering just above 3.65%, with 12bp or so of tightening priced for the Bank’s Feb ’23 meeting.

- The RBA’s statement reaffirmed the recent messaging in that more tightening is expected, albeit with the Bank in a data-dependent stance and not operating on a pre-set course. The Bank also sounded a little more wary re: the health of the global economy and re: the outlook for household consumption.

- Tomorrow’s local docket will be headlined by Q3 GDP data (after we saw a surprise current account deficit and a smaller than expected detraction for GDP from net exports in today’s releases) and A$900mn of ACGB Nov-33 supply.

NZGBS: A Touch Cheaper On The Day On Wider Impetus

Cash NZGBs extended the early cheapening that was derived from the move in U.S. Tsys on Monday, although the move lagged that seen in their U.S. counterpart, which then allowed them to grind cheaper through the day.

- That left the major NZGB benchmarks running 3.5-4.5bp cheaper at the bell, with some light bear steepening in play.

- Meanwhile, swaps rates ran 2-7p higher on the day, with that curve flattening, resulting in mixed swap spread performance across the curve.

- RBNZ dated OIS still prices just over 60bp of tightening for the first RBNZ meeting of ’23, with a terminal cash rate of ~5.35% priced, a touch higher on the day.

- Any post-RBA meeting, trans-Tasman adjustment may kick in early on Wednesday, although the post-meeting cheapening in ACGBs has only been relatively limited.

- The domestic docket is empty on Wednesday.

EQUITIES: Asia Mixed After Negative Lead From Wall St.

Asia-Pac equity indices traded in mixed fashion, initially struggling in the wake of the negative lead from Wall St. on the back of strong U.S. data and a move higher in Fed terminal rate pricing.

- However, some differentiation then crept in, with a round of weakness for the JPY supporting the Nikkei 225, which sits 0.4% higher into the bell.

- Meanwhile, the paring back of COVID test requirements to enter some public venues in the Chinese capital city of Beijing allowed Chinese equities to bounce from worst levels, leaving the CSI 300 sitting marginally higher on the day at typing.

- The Hang Seng was the weakest major regional index, last -1.0%.

- E-minis firmed at the margin, with the aforementioned COVID testing news in Beijing providing some cushion after yesterday’s weakness.

GOLD: China’s Easing Of Covid Restrictions Supports Bullion

MNI (Australia) - Gold prices are slightly higher today after falling 1.6% on Monday. The stronger-than-expected services ISM overnight weighed on gold as the USD strengthened and UST yields rose but it has been supported today by further easing of Covid restrictions in China.

- Bullion is up 0.2% today to around $1772.80/oz, after reaching an intraday high of $1776.34. It has been trading in a $10 range, as the DXY is around its NY close.

- Gold is back below the psychologically important $1800 level. Support is at $1747.40, 20-day EMA ,and key resistance is $1807.90, August 10 high.

- With the Fed in blackout, there is little going on overnight. The only data of note is the US trade balance for October.

OIL: Oil Prices Up Slightly On More Optimistic Chinese Demand Outlook

MNI (Australia) - Oil prices are up 0.5% during the session after two days of weakness, but have been trading in a very narrow range of less than a dollar. The DXY is flat. News of further easing of Covid-related restrictions in China boosted crude on hopes of increased demand.

- WTI is trading around $77.35/bbl after reaching a high of $77.88 and a low of $77.26. It broke support of $78.40 overnight and the next level to watch is $73.38. Brent is around $83.10 after a high of $83.68 and low of $83.08.

- The market is assessing how the oil price cap on Russia will impact supply over the long term. Apart from some ships stranded near Turkey, there has so far been minimal disruption, according to Bloomberg. Currently the price cap of $60/bbl is above where Urals crude prices are and while that continues, the cap is unlikely to have much impact.

- Time spreads suggest that near-term supply is unproblematic.

- With the Fed in blackout, there is little going on overnight. The only data of note is the US trade balance for October and the API inventory data.

FOREX: AUD Tops The Pile After No Overt Dovish Pivot From RBA

A round of USD weakness on the latest rollback of COVID testing restrictions re: entry to some public venues in the Chinese capital of Beijing and a degree of fading Monday’s price action provided the impetus in early Asia-Pac dealing.

- JPY then gave back its early gains and more, sitting bottom of the G10 FX pile as we move towards London hours, leaving USD/JPY ~70 pips off its session base, last trading around Y137.00. This came after continued pushback from BoJ Governor Kuroda re: the need to debate an exit from extra loose policy settings, which may have had some extra weight given heightened talk/speculation re: the potential for such a move in recent days/weeks.

- At the other end of the table we saw the AUD, which was initially supported by the aforementioned COVID testing situation re: some Beijing public venues, while a lack of an overt dovish tweak in the guidance paragraph in the latest RBA post-meeting statement (which accompanied the widely expected 25bp hike) allowed the AUD to rally further.

- The remainder of the majors are little changed vs. the USD into London hours.

- USD/CNH struck to a relatively restricted range, operating around session highs, just below CNH6.98, unable to latch onto the previously outlined COVID headline flow and another moderation in China’s daily new COVID case count.

- German factory orders & trade balance data from North America will cross Tuesday. Comments from Riksbank’s Floden are also slated.

FX OPTIONS: Expiries for Dec06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0415-35(E1.6bln), $1.0550(E787mln), $1.0575-00(E746mln)

- USD/JPY: Y140.00($1.7bln), Y143.00($1.5bln)

- GBP/USD: $1.1780-00(Gbp707mln)

- AUD/USD: $0.6800-20(A$1.1bln), $0.6875-00(A$1.7bln)

- NZD/USD: $0.6370(N$587mln)

- USD/CAD: C$1.3380($1.3bln)

- USD/CNY: Cny7.0000($1.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/12/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/12/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/12/2022 | 0830/0930 |  | DE | S&P Global Germany Construction PMI | |

| 06/12/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/12/2022 | 1130/1130 | ** |  | UK | Gilt Outright Auction Result |

| 06/12/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 06/12/2022 | 1330/0830 | ** |  | US | Trade Balance |

| 06/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/12/2022 | 1400/1500 |  | EU | ECB Publication of Monthly APP/PEPP update | |

| 06/12/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.