-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Softer China Growth Signs Weighs On Regional Risk Appetite

EXECUTIVE SUMMARY

- CHINA Q2 GDP UP 6.3% Y/Y, SLOWER THAN EXPECTED - MNI BRIEF

- CHINA’S FRAIL Q2 GDP GROWTH PUTS PRESSURE FOR MORE POLICY SUPPORT - RTRS

- YELLEN SEES CHINA DE-ESCALATION BUT NOT ON TARIFFS - BBG

- AUSTRALIAN TREASURER EXPECTS UNEMPLOYMENT RISE AS INFLATION EASES - BBG

- UK PROPERTY SELLERS CUT ASKING PRICES FOR FIRST TIME THIS YEAR - BBG

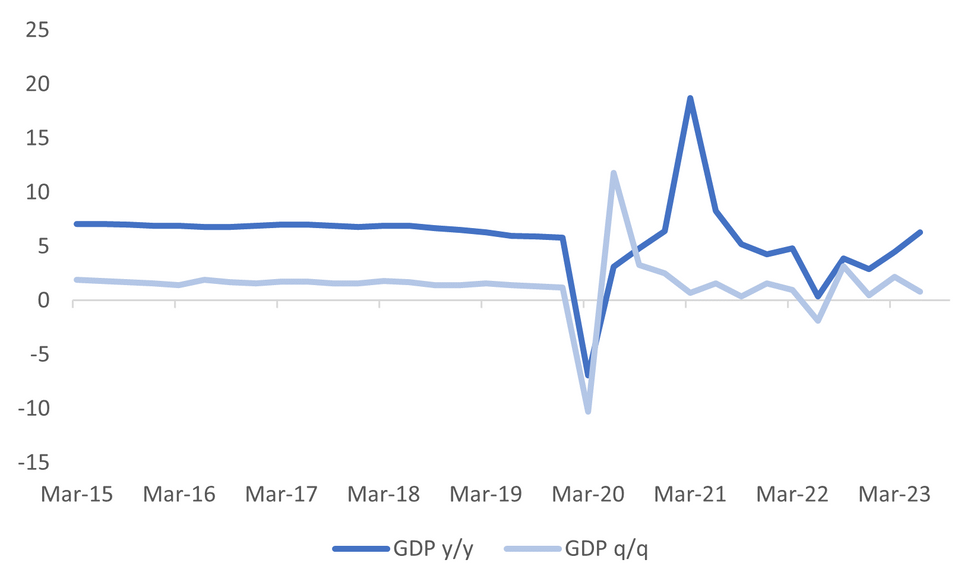

Fig. 1: China Q/Q & Y/Y GDP

Source: MNI - Market News/Bloomberg

U.K.

TRADE: The UK signed a treaty to join a Pacific trade deal on Sunday, becoming the first new member since the framework came into force and shifting attention to a list of other applicants led by China. (BBG)

INFLATION: After watching British prices surge faster than expected for four straight months, Prime Minister Rishi Sunak’s team isn’t getting its hopes up about a change in fortunes next week. (BBG)

JOBS: London workers are more uneasy about finding a new job than in any other region of England, according to a poll that indicates gloom about the outlook for the economy. (BBG)

HOUSE PRICES: UK property sellers cut their asking prices for the first time this year, an indication that a sharp jump in borrowing costs is cutting in on what buyers can afford to pay. (BBG)

HOUSING: Home ownership in the UK is about to move further out of reach, even for the nation’s wealthiest age group. (BBG)

EUROPE

RUSSIA: The Group of Seven nations have confirmed the continuation of a Russian asset freeze, Japan’s Finance Minister Shunichi Suzuki told reporters after the meeting in India. (BBG)

RUSSIA: Traffic was stopped on the Russian-built Crimean Bridge due to "an emergency" situation, Russia-installed officials said on Monday, while Ukrainian media reported blasts on the bridge. Sergei Aksyonov, a Russian-installed governor, said the emergency occurred on the 145th pillar of the bridge which links the Crimean peninsula to the Russian region of Krasnodar. He did not provide any further detail. (RTRS)

U.S.

US/CHINA: US Treasury Secretary Janet Yellen said she’s eager to build on recent improvements in US-China relations as finance chiefs from around the world gather in India to address global economic challenges in the coming days. However, she said it was premature to use Chinese trade practices and US tariffs as an area for de-escalation, signaling that both sides are still wary. The US is completing a four-year review on the trade tariffs. (BBG)

US/CHINA: This week's visit by U.S. climate envoy John Kerry to China after years of diplomatic disruptions could boost cooperation between the world's two biggest carbon polluters on the key issue of methane emissions. (RTRS)

OTHER

G7: There was "no discussion" about exchange rates at a meeting of Group of Seven (G7) finance ministers and central bank chiefs, Japanese Finance Minister Shunichi Suzuki said on Sunday, according to Kyodo News. Suzuki was speaking after a meeting in India of the G7 - the U.S., Japan, Germany, Britain, France, Italy and Canada. (RTRS)

HONG KONG: Hong Kong has condemned a US Senate Committee for passing a bill that could shut down the city’s three economic and trade offices in America if the financial hub isn’t deemed significantly autonomous from Beijing. (BBG)

AUSTRALIA: Australian Treasurer Jim Chalmers said he expects a substantial economic slowdown and for unemployment to pick up as inflation eases. “As the Reserve Bank forecasts and the Treasury forecasts have inflation moderating over the coming months, they do have a tick up in unemployment as well,” Chalmers said Sunday on ABC’s “Insiders” program. (BBG)

TURKEY: Turkey boosted its fuel taxes by almost 200% on Sunday, a move that will magnify inflationary pressures and further strain household budgets. The new special consumption taxes on different types of fuel — including gasoline and diesel — were published in the Official Gazette. (BBG)

CHINA

ECONOMY: China's GDP grew by 6.3% y/y in Q2, much lower than the market consensus of 7% though marking the quickest growth within a year when compared to the 4.5% rise in Q1, data released by the National Bureau of Statistics on Monday showed. GDP grew 0.8% over the previous quarter, slower than Q1's 2.2% q/q increase. While H1 growth was lifted to 5.5% y/y. (MNI BRIEF)

ECONOMY: China's economy grew at a frail pace in the second quarter as demand weakens at home and abroad, with the post-COVID momentum faltering rapidly and raising pressure on policymakers to deliver more stimulus to shore up activity. Chinese authorities face a daunting task in trying to keep the economic recovery on track and putting a lid on unemployment, as any aggressive stimulus could fuel debt risks and structural distortions. (RTRS)

GEOPOLITICS: President Xi Jinping has resisted crossing Washington’s red lines over arming Russia’s war machine in Ukraine. But that hasn’t stopped China edging closer to Moscow’s military in another way: direct engagement. China and the armed forces of Vladimir Putin conducted six joint military exercises together last year, the most in data going back two decades. (BBG)

HOME PRICES: China’s home prices dropped for the first time this year in June, underscoring mounting challenges to prop up a key engine of the economy. New-home prices in 70 cities, excluding state-subsidized housing, fell 0.06% last month from May, when they climbed 0.1%, National Bureau of Statistics figures showed Saturday. Prices declined 0.44% in the secondary market, according to the data. (BBG)

MORTGAGES: The banking sector is stepping up research on allowing a lower interest rate of outstanding housing mortgages following the central bank official’s comment last Friday. Zou Lan, head of the monetary policy department at the People’s Bank of China, said they will support and encourage commercial banks to independently negotiate with borrowers to change the contract, or to replace existing loans with new loans. The PBOC has not mentioned such an adjustment since the global financial crisis in 2008. Allowing discounts on outstanding loans will put pressure on the stability of banks, especially on large state-owned banks with a higher proportion of housing mortgages, so this round of reductions may start from small- and medium-sized banks, said Huaxin Securities Analyst Yang Qinqin. (Yicai)

INVESTMENT: China should continue to encourage and support private investment in the construction of major national infrastructure and key projects by using national funds, said Li Yizhong, former minister of industry and information technology. The annual growth rate of private investment fell from 25% to 0.9% between 2012 to 2022, which Li thinks may have dropped too much. Cutting overcapacity does not mean reducing investment, but is necessary to improve the efficiency and effectiveness of investment which can create demand and stimulate consumption, he added. This requires further strengthening technological innovation via the establishment of research and development bases and the acceleration of key technology breakthroughs, Li said. (21st Century Business Herald)

CHINA MARKETS

PBOC Net Injects CNY34 Bln Via OMOs Monday

The People's Bank of China (PBOC) conducted conducted CNY33 billion via 7-day reverse repos and CNY103 billion via 1-year MLF on Monday, with the rates at 1.90% and 2.65%, respectively. The operation has led to a net injection of CNY34 billion after offsetting the maturity of CNY2 billion reverse repo and CNY100 billion MLF today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8944% at 09:30 am local time from the close of 1.8154% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday, compared with the close of 46 on Thursday.

PBOC Yuan Parity Lower At 7.1326 Friday Vs 7.1318 Monday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1326 on Monday, compared with 7.1318 set on Friday. The fixing was estimated at 7.1384 by BBG survey today.

OVERNIGHT DATA

NZ JUNE PERFORMANCE SERVICES INDEX 50.1; PRIOR 53.3

UK JULY RIGHTMOVE HOUSE PRICES M/M -0.2%; PRIOR 0.0%

UK JULY RIGHTMOVE HOUSE PRICES Y/Y 0.5%; PRIOR 1.1%

CHINA 1yr MLF RATE 2.65%; MEDIAN 2.65%; PRIOR 2.65%

CHINA 1r MLF VOLUMES 103bn YUAN PRIOR 237bn YUAN

CHINA Q2 GDP SA Q/Q 0.8%; MEDIAN 0.8%; PRIOR 2.2%

CHINA Q2 GDP SA Y/Y 6.3%; MEDIAN 7.1%; PRIOR 4.5%

CHINA JUNE INDUSTRIAL PRODUCTION Y/Y 4.4%; MEDIAN 2.5%; PRIOR 3.5%

CHINA JUNE RETAIL SALES Y/Y 3.1%; MEDIAN 3.3%; PRIOR 12.7%

CHINA JUNE FIXED ASSET INVESTMENT EX RURAL YTD Y/Y 3.8%; MEDIAN 3.4%; PRIOR 4.0%

CHINA JUNE PROPERTY INVESTMENT YTD Y/Y -7.9%; MEDIAN -7.5%; PRIOR -7.2%

CHINA JUNE PROPERTY SALES YTD Y/Y 3.7%; PRIOR 11.9%

CHINA JUNE JOBLESS RATE 5.2%; MEDIAN 5.2%; PRIOR 5.2%

MARKETS

US TSYS: Narrow Ranges In Asia, Cash Re-Opens In London

TYU3 deals at 112-18+, +0-00+, a 0-06 range has been observed on volume of ~33k.

- Cash tsys have been closed in Asia due to the observance of a national holiday in Japan and will re-open in the London session

- Tsy futures have observed narrow ranges and are holding marginally richer in Asia. The early move higher came alongside the USD marginally extending gains however there was little follow through and narrow ranges persisted.

- The space looked through a mixed round of Chinese monthly activity data.

- There is a thin docket in Europe today, further out we have Empire Manufacturing. The Fed has entered its policy blackout window which runs until 27 July the day after the next rate announcement.

AUSSIE BONDS: Dealing Mixed, Mid-Range, RBA Minutes Tomorrow

ACGBs are sitting mixed (YM -1.0 & XM +1.0) and in the middle of the Sydney session range. Without domestic data, local participants have likely been on headlines and US tsys watch.

- On balance, China's Q2 GDP print, and mixed June activity data, are likely to see calls for policy support continue. Q2 GDP was as expected at +0.8% q/q, but the y/y number softer at +6.3%, versus +7.1% expected. However, the data didn’t appear to have any lasting impact on ACGBs.

- Cash ACGBs are flat to 1bp richer.

- The 3s10s swap curve has twist flattened with rates 1bp lower to 2bp higher. EFPs are 1bp wider.

- The bills strip is cheaper with pricing -1 to -4.

- RBA-dated OIS pricing is little changed across meetings.

- Tomorrow sees the release of the RBA Minutes for the July meeting. The market will be looking for more details about the July pause.

- The AOFM has selected Structuring Advisors to assist with establishing the Australian Sovereign Green Bond program. The AOFM and the Treasury will be working with National Australia Bank and UBS. The first green bond issuance will occur in mid-2024, with the Australian Government Green Bond Framework to be released well in advance.

NZGBS: Closed On A Strong Note, Q2 CPI On Wednesday

NZGBs closed on a strong note with benchmark yields 4-5bp richer. The local market has played catch-up to global bond market developments following Friday’s public holiday.

- On the domestic data front, NZ’s performance of services index fell to 50.1 in June from 53.3 in May. Three of five sub-indexes printed above 50 with employment dipping to 49.1, and inventories dropping to 47.3. At the margin, this, along with China’s underwhelming economic data, would have supported the strengthening through the session.

- On balance, China's Q2 GDP print, and mixed June activity data, are likely to see calls for policy support continue. Notwithstanding the base effect impact on today's outcomes.

- US tsy futures were little changed in Asia-Pac trade, with cash tsys closed due to a Japanese public holiday.

- Swap rates are 5-7bp lower with the 2s10s curve 2bp flatter.

- RBNZ dated OIS pricing is 1-3bp firmer for ’24 meetings with terminal OCR expectations at 5.63%.

- Tomorrow the local calendar is light ahead of Q2 CPI data on Wednesday. BBG consensus expects headline CPI to print +0.9% q/q in Q2 with the annual rate dropping to 5.9% y/y from 6.7%.

- Tomorrow also sees the release of the RBA Minutes for the July meeting.

FOREX: Antipodeans Pressured After Chinese Data

The AUD and NZD are pressured in Asia on Monday, early pressure extended after a mixed round of Chinese data. Q2 GDP was as expected in q/q terms (+0.8%), but weaker in y/y terms (6.3%, versus 7.1% forecast)Industrial Production was firmer than expected but Retail Sales was a touch softer than forecast in June.

- AUD/USD prints at $0.6805/10, the pair is ~0.4% softer today. Support comes in at $0.6784, the low from July 13, and $0.6713, the 20-Day EMA.

- Kiwi is also pressured, early losses marginally extended after risk sentiment soured post the Chinese data. NZD/USD prints at $0.6345/50, support comes in at the 13 July low ($0.6290).

- Yen is marginally firmer, however ranges remain narrow with little follow through on moves. Japanese markets have been closed for the observance of a national holiday on Monday.

- Elsewhere in G-10 EUR and GBP are a touch lower, BBDXY is up ~0.1%.

- Cross asset wise; US Tsy futures are marginally firmer and e-minis are down ~0.1%. WTI futures are pressured down ~0.8%.

- Empire Mfg from the US is the highlight of an otherwise thin docket on Monday.

EQUITIES: China Markets Weaken, Amid Signs Of Softer Activity In Retail/Property

Most regional equity markets are tracking lower in the first part of Asia Pac dealing for Monday. China markets are down over 1%, although Hong Kong markets are out due to a storm, so this is likely impacting liquidity to some extent. Japan markets are also out today for a local holiday. US futures are a touch weaker at this stage, Eminis off by ~0.1% to 4532, Nasdaq futures down by a similar amount.

- China markets were weaker from the open, and faltered further post the Q2 GDP update and June monthly activity prints. These updates showed weaker than expected GDP y/y momentum, while discretionary spending and the housing market lost traction in June.

- At this stage the CSI 300 is off by 1.09% at the break, the Shanghai Composite slightly more. Financial stocks are also under pressure post reports from late last week the PBoC may open the door for mortgage refinancing, which may put pressure on interest margins per J.P. Morgan reports.

- Elsewhere, the Kospi has given back some of last week's gains, down 0.58% at this stage, while the Taiex is outperforming, sitting closer to flat. It's a similar story for the ASX 200.

- In SEA most markets are down, although losses aren't much beyond 0.50%. Indonesia's benchmark is outperforming, +0.40% at this stage.

OIL: Crude Down Again As Supply Disruptions Ease

Oil prices are down around 0.9% during APAC trading today as output at a Libyan oil field resumed and expectations of further Fed tightening firm. Prices were trending lower before the mixed activity data from China but have been moving sideways since then. The USD index is flat.

- WTI is down 0.9% to $74.75/bbl off the intraday low of $74.61. It reached a high of $75.14, but hasn’t been able to hold breaks above $75. Brent is 0.9% lower at $79.16 after a high of $79.56 and low of $79.02. $79 is providing support.

- Annual Q2 China GDP disappointed as well as retail sales but IP was stronger than expected. Also apparent June oil demand was 14% higher on a year ago, according to Bloomberg. China is the world’s largest oil importer.

- Higher crude prices in the last week have meant that the Urals crude price has risen above the $60 price cap, which is likely to complicate the purchase and shipping of Russian oil.

- Today is quiet with no Fed speakers but there is a pre-recorded welcome from ECB’s Lagarde and Panetta and Lane speak. On the data front, there is only the US Empire manufacturing index for July, which is expected to decline.

GOLD: Softer In Asia-Pac After Edging Lower On Friday

Gold is 0.2% lower in the Asia-Pac session, after edging lower on Friday as US tsys reversed cheaper following solid consumer sentiment data. The UofM’s preliminary July consumer sentiment index easily beat expectations rising to 72.6 from 64.4 in June. Additionally, 1Y inflation surprisingly increased to +3.4% (consensus +3.1%) after +3.3%; 5-10Y inflation increased a tenth to +3.1% (consensus +3.0%), back at the top end of the 2.9-3.1% range seen since Aug’21 and one-tenth off the high since 2011.

- Year-end rate hike projections firmed on heavy short-end selling, with the Fed terminal rate holding at 5.395% for Nov'23. The market continues to price around a near 95% chance of a 25bp hike at the July FOMC. Reminder, the Federal Reserve entered a policy blackout at midnight Friday, running through July 27, the day after the next rate announcement.

- Prior to Friday’s data, bullion had been supported by the positive trend in US tsys due to the growing belief in a 'soft-landing' narrative for the US economy. This narrative gained momentum as evidence of cooling inflation emerged, with producer and consumer prices falling more than anticipated in June.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Period | Flag | Country | Release |

| 17/07/2023 | 0800/1000 | ** | Jun |  | IT | Italy Final HICP m/m |

| 17/07/2023 | 0800/1000 | ** | Jun |  | IT | Italy Final HICP y/y |

| 17/07/2023 | 1230/0830 | * | May |  | CA | Intl Securities Transactions |

| 17/07/2023 | 1230/0830 | ** | May |  | CA | Wholesale Sales |

| 17/07/2023 | 1230/0830 | ** | Jul |  | US | Empire Manufacturing Index |

| 17/07/2023 | 1530/1130 | * | 21-Jul |  | US | Bid to Cover Ratio |

| 17/07/2023 | 1530/1130 | * | 21-Jul |  | US | Bid to Cover Ratio |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.