-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Tech Losses Drive Regional Equities Lower

EXECUTIVE SUMMARY

- KILLING OF HAMAS DEPUTY LEADER IN BEIRUT RAISES RISK OF GAZA WAR SPREADING - RTRS

- MAERSK DECIDES THE RED SEA IS TOO UNSAFE FOR ITS SHIPS NOW - BBG

- US PUBLIC DEBT TOPS $34TRLN AS CONGRESS HEADS INTO FUNDING FIGHT - RTRS

- AUSTRALIA TO LOOK AT FURTHER COST-OF-LIVING RELIEF IN BUDGET - BBG

- CHINA NEWSPAPER SAYS MORE POLICIES TO STABILIZE ECONOMY COMING - ECONOMIC DAILY

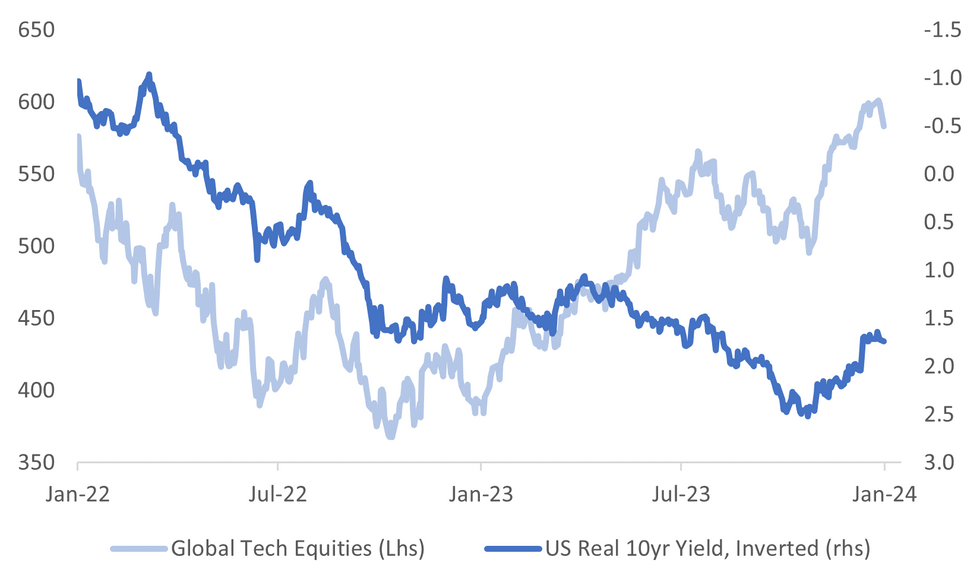

Fig. 1: US Real Yield (Inverted) & Global Tech Equities

Source: MNI - Market News/Bloomberg

U.K.

INFLATION (BBC): "Some of our costs have gone up 250%". That is the reality for Thomas O'Brien, boss of family-run Boxer Gifts, which designs games and seasonal presents. Their products are made in China so the Leeds-based firm relies heavily on global shipping. But attacks on commercial vessels in the Red Sea have prompted long diversions to avoid one of the world's busiest shipping lanes.

EUROPE

MARKETS (FT): Airbus is working on an offer worth up to €1.8b for Atos’s big data and cyber security unit, Financial Times reports, citing unidentified people with knowledge of the situation.

BANKING (FT): EU regulators will look further into links between banks and other financial firms, the Financial Times reports, citing Jose Manuel Campa, chair of the European Banking Authority.

GERMANY (Der Spiegel): "Collateral damage would be very high": The Federal Government's Commissioner for Eastern Europe thinks little of a ban on the AfD. According to Carsten Schneider, this would have little chance and would strengthen solidarity with the party.

TURKEY (ECONOMIST): Consumer prices were 62% higher in November than in the same month last year. Data released on Wednesday are expected to show that they rose further last month.

RUSSIA (BBG): Russia’s seaborne crude exports ended the year on a high, as four-week average shipments climbed to the highest since early November and weekly flows jumped to the most since July.

U.S.

FISCAL (RTRS): The U.S. federal government's total public debt has reached $34 trillion for the first time, the U.S. Treasury Department reported on Tuesday as members of Congress gear up for another series of federal funding battles in coming weeks.

COMMODITIES (BBG): The US has become the world’s biggest exporter of liquefied natural gas for the first time, with 2023 shipments overtaking leading suppliers Australia and Qatar.

CORPORATE (BBG): Apple Inc. got itself a new bear as expectations of soft demand for its latest iPhone prompted analysts at Barclays Plc to downgrade the stock. Shares fell 3.6% on Tuesday, their biggest one-day percentage drop since September, and the decline erased more than $107 billion in market value.

US/ISRAEL(RTRS): The U.S. State Department on Tuesday slammed recent statements from Israeli Ministers Bezalel Smotrich and Itamar Ben-Gvir that advocated for the resettlement of Palestinians outside of Gaza, calling the rhetoric "inflammatory and irresponsible."

POLITICS (RTRS): Donald Trump on Tuesday appealed a decision from Maine’s top election official disqualifying him from the state’s Republican presidential primary ballot next year over his role in the Jan. 6, 2021, attack on the U.S. Capitol, a court filing showed.

OTHER

MIDEAST (RTRS): Israel killed Hamas deputy leader Saleh al-Arouri in a drone strike in Lebanon's capital Beirut on Tuesday, Lebanese and Palestinian security sources said, raising the potential risk of war in Gaza spreading well beyond the Palestinian enclave.

SHIPPING (BBG): Denmark's Maersk (MAERSKb.CO) and German rival Hapag-Lloyd (HLAG.DE) said on Tuesday their container ships would continue to avoid the Red Sea route that gives access to the Suez Canal following a weekend attack on one of Maersk's vessels.

AUSTRALIA (BBG): Prime Minister Anthony Albanese says at first press conference of the year in Sydney on Wednesday. “Our priority will be to provide cost of living relief whilst taking pressure off inflation. I have asked treasury and finance to come up with further propositions that we’ll consider in the lead-up to the May budget”

AUSTRALIA (BBG): Australia’s central bank says meetings with industry and community groups suggest rising prices and elevated interest rates are weighing on consumption and broader economic growth, according to internal documents dated from September through November.

CHINA

POLICY (ECONOMIC DAILY/BBG): China will issue more policies to stabilize expectations, growth and employment to ensure synchronized impact on the economy, Economic Daily says in a front page commentary Wednesday.

POLICY (YICAI): The People's Bank of China made CNY350 billion in loans to policy banks through its pledged supplementary lending (PSL) facility in December, according to a statement on its website Tuesday which did not specify the use of the loans. The market expects PSLs may be used to support the construction of "three major projects", namely affordable housings, urban village renovation and pubic infrastructure, which requires large amounts of medium and long-term low-cost funds. Ming Ming, chief economist at CITIC Securities estimated the scale may expand further.

RRR (CHINA SECURITIES JOURNAL/BBG): Chinese central bank may continue cutting interest rates and banks’ reserve ratios this year, similar to what it did in 2023, China Securities Journal reported, citing Huang Wentao, chief economist with China Securities Finance Co.

PROPERTY (BBG): Some holders of China Fortune Land Development Co. dollar bonds have received less than a third of the payments due Dec. 31 from a debt restructuring agreement, according to people familiar with the matter.

PROPERTY (YICAI): Developers will face higher debt repayment pressure in 2024, as the financing scale of real-estate companies shrinks for the third consecutive year, Yicai.com reported. Despite repeated support pledged by authorities and loose financing policies, the total new financing of typical developers fell by 28% y/y throughout 2023, compared to the 34% and 24% declines in 2022 and 2021, according to data by China Real Estate Information Corporation.

REFORM (21st Century Business Herald): The National Development and Reform Commission will accelerate the legislative process of the Private Economy Promotion Law and improve multi-level communications with private enterprises, said NDRC Director Zheng Shanjie at a meeting in Jinjiang city on Tuesday.

CHINA MARKETS

MNI: PBOC Drains Net CNY558 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY14 billion via 7-day reverse repo on Wednesday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY558 billion reverse repos after offsetting CNY572 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:29 am local time from the close of 1.7640% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 42 on Tuesday, compared with the close of 35 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1002 Wednesday vs 7.077 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1002 on Wednesday, compared with 7.0770 set on Tuesday. The fixing was estimated at 7.1467 by Bloomberg survey today.

MARKETS

US TSYS: Remain Within Tuesday Ranges Ahead Of ISM and Fed Minutes

US Tsy futures have drifted lower this afternoon but remain within recent ranges. TYH4 last tracked at 112-07+, -02. This is at session lows but highs at 112-12 point to a tight range through the first part of Wednesday trade. Volumes rest at just over 42k.

- We have had no cash US Tsy trading today with Japan markets still closed as part of new year celebrations. Trading will resume in London.

- Tsy bears will focus on Tuesday lows at 1112-04.

- Looking ahead we have Fed’s Barkin speaking on the economic outlook and the December 13 meeting minutes are published. December US ISM data and November JOLTS job openings are also released.

AUSSIE BONDS: Yields Firm On Global Spill Over

Aussie bond futures have tracked tight ranges. XM sits off by -5, while YM is down by -7, with the latter seeing slightly more downside as the session progressed. This looks to be largely following the weakening in core yields through Tuesday's session.

- On the domestic front, there has been little domestic news flow, with PM Albanese stating that the upcoming May budget will consider further cost of living relief for households. This came after internal RBA documents showing such pressures weighed on growth through the second half of 2023 (BBG).

- In the cash ACGB space, yields are 4.5-6bps higher, sitting near session highs. Slightly larger yield gains have been seen at the front end.

- The local data calendar is quiet until tomorrow's PMI revisions for Dec, but these prints are unlikely to move market sentiment. Next week delivers retail sales for Nov and CPI for Dec (Wednesday), which will be of greater focus for local markets.

NZGBS: Local Yields Play Catch Up As Onshore Markets Return

New Zealand government yields continued to track higher for much of the session, as local markets played catch up after being shut for yesterday's session. The 10yr yield has climbed 12bps to sit back at 4.44%, close to late 2023 levels. Similar rises in yield terms have been seen across other parts of the curve, except for the 2yr, +5bps.

- This looks to be largely reflective of catch up following a weaker start to core bond markets since the start of the year. US easing odds for March have been trimmed modestly versus levels from mid last week.

- There has been little news flow out of NZ, with house price data for Dec due later in London hours. The data calendar is empty for the rest of the week,

- In the swap space, the 2yr yield sits close to 4.60%, against recent lows near 4.50%.

EQUITIES: Tech Leading Region Lower, Some Pockets Of Strength In China Gaming Sector

Regional equities have mostly tracked lower, following the negative lead from US markets in Tuesday trade. Losses have been prominent among tech sensitive plays, as core yields have found a base since the start of the year. US equity futures haven't exhibited a strong trend, with the main indices sitting modestly lower. Eminis were last near 4784 (-0.06%), while Nasdaq futures sit -0.12% lower.

- The Kospi is off 2% following yesterday's highest close since mid 2022. The Taiex is also down sharply, off 1.75% at this stage. The higher more in US real yields and some paring of early 2024 US rate cut expectations has taken gloss of the tech space in recent sessions.

- Hong Kong markets are also down, led by the tech sector. The HSI sits -1.22% weaker at the break. The tech sub index is off by nearly 2.4%.

- In China, the CSI 300 sits 0.51% down at the break. There have been some pockets of strength in the gaming space. This follows reports of a regulator who oversees the sector being removed in China. Tencent and NetEase curbed earlier weakness in Hong Kong, but this hasn't improved aggregate index performance.

- Another property developer reportedly hasn't fulfilled payments which were due for a dollar bond at the end of last year (per BBG).

- In SEA, losses are generally more modest, with most bourses off by less than 0.50% at this stage.

FOREX: USD Off Tuesday Highs, But Tight Ranges Prevail Ahead Of Data/FOMC Mins

The USD has drifted lower as the session has progressed, but the USD index is only fractionally below Tuesday closing levels. The BBDXY last tracked near 1221, off by 0.05%.

- We saw some early strength in the index as US Tsy futures saw a modest dip in early trade but there was no follow through. Highs for the BBDXY came in 1222.12.

- USD/JPY sits near 141.90 in recent trade, unable to break above Tuesday highs in early trade (near 142.20). Current levels are little changed for the session.

- AUD/USD has drifted a little higher, last near 0.6770, but this is only marginally firmer for the session. NZD/USD has fared slightly better, up 0.25%, to 0.6265/70, finding some support around the 0.6250 region.

- Other cross asset moves have been modest. Regional equities are lower, led by the tech space, following US moves in Tuesday trade. US equity futures sit down a touch.

- Looking ahead, Spanish and German unemployment data will cross on later, along with Swiss manufacturing PMI. A busy data docket in the US will be highlighted by ISM Manufacturing figures and November JOLTS data. The minutes of the Federal Reserve’s December meeting will also be released.

OIL: Crude Little Changed Ahead of Fed Minutes & ISM

After sliding around 1.5% on Tuesday, oil prices are little changed during APAC trading and have been range trading. Weak risk appetite and continued excess supply worries are outweighing persistent risks to shipping in the Red Sea. The USD index is down slightly after rising sharply yesterday.

- WTI is moderately lower at $70.35/bbl after a high of $70.70 earlier. Brent has been trading sideways for much of the session and is currently around $75.86.

- Given the market’s focus on supply, US inventory data is released by the API today and the EIA on Thursday.

- On the demand front, China has front-loaded the allocation of oil import quotas for 2024. The market will monitor trade data closely to see if the move boosts demand from refiners.

- There have been further reports today of missiles being fired in the southern part of the Red Sea but no damage has been related.

- Later the Fed’s Barkin speaks on the economic outlook and the December 13 meeting minutes are published. December US ISM data and November JOLTS job openings are also released. These events could all potentially be important in shaping the Fed outlook but the focus of the week is likely to be Friday’s December payroll data.

GOLD: Bullion Trading Higher, This Week’s US Data Will Be Important

Gold prices are up 0.3% during APAC trading today to around $2064.85/oz after falling 0.2% on Tuesday. They are close to their intraday high of $2065.60. Bullion is off its late December record high as markets reduce Fed rate cut expectations and data this week will be important for the outlook. The USD index is down slightly after rising sharply yesterday.

- Gold continues to move well above support at $2034.60, the 20-day EMA.

- Later the Fed’s Barkin speaks on the economic outlook and the December 13 meeting minutes are published. December US ISM data and November JOLTS job openings are also released. These events could all potentially be important for bullion as they may shape the Fed outlook but the focus of the week is likely to be Friday’s December payroll data.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/01/2024 | 0855/0955 | ** |  | DE | Unemployment |

| 03/01/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/01/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/01/2024 | 1330/0830 |  | US | Richmond Fed's Tom Barkin | |

| 03/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 03/01/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 03/01/2024 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 03/01/2024 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 03/01/2024 | 1900/1400 | *** |  | US | FOMC Meeting Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.