-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Trump Election Odds Rise Post Assassination Attempt

EXECUTIVE SUMMARY

- TRUMP REWRITES REPUBLICAN CONVENTION SPEECH TO FOCUS ON UNITY NOT BIDEN - WASHINGTON EXAMINER

- BIDEN URGES UNITY AFTER TRUMP WOUNDED AS CAMPAIGN SEEKS FOOTING - BBG

- BANK OF ENGLAND'S DHINGRA SAYS RATES SHOULD COME DOWN NOW - RTRS

- CHINA 2Q GDP GROWTH SLOWS MORE THAN EXPECTED TO 4.7% Y/Y - MNI BRIEF

- CHINA HOME PRICES FALL SHARPLY DESPITE LATEST RESCUE PLAN - BBG

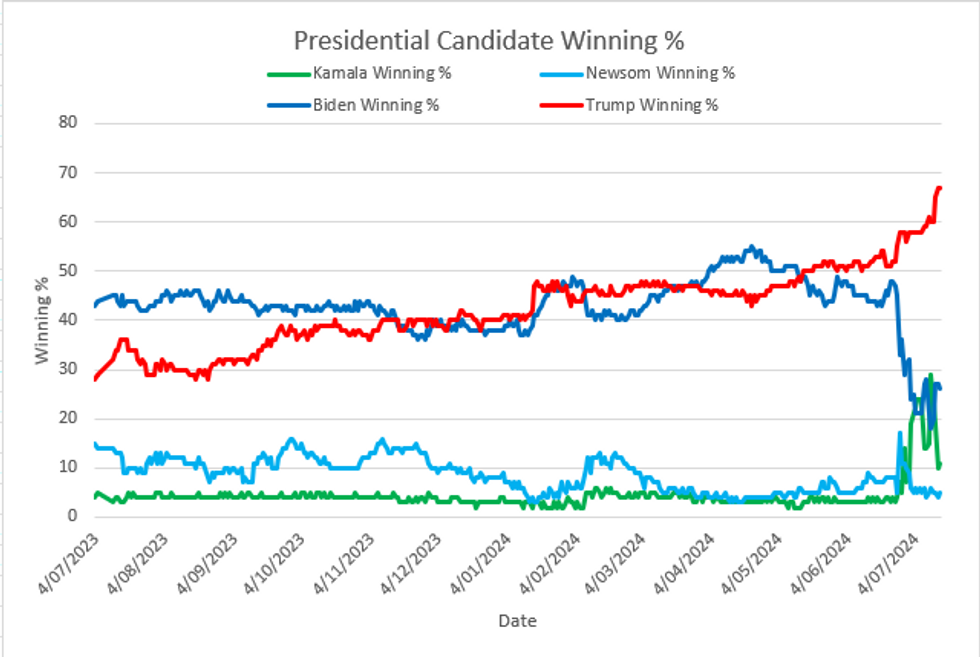

Fig. 1: US Presidential Election Odds

Source: MNI - Market News/Bloomberg

UK

BOE (RTRS): “Bank of England interest rate-setter Swati Dhingra said inflation in Britain was unlikely to rise sharply again and the central bank should bring down borrowing costs.”

HOUSE PRICES (BBG): “ Britain’s home sellers cut the prices they’re asking for properties for the first time this year as uncertainty around the election and stubbornly high mortgage rates held back confidence.”

EUROPE

ECB (MNI SOURCES): Increasing risks of weaker-than-expected eurozone growth are rising up the European Central Bank’s list of concerns, with more dovish Governing Council members arguing these are now as important a factor as geopolitical uncertainty and some hawks beginning to agree, Eurosystem sources told MNI.

SPAIN (BBG): “Spanish Prime Minister Pedro Sanchez made a strong defense of Digital Transformation Minister Jose Luis Escriva’s economic credentials, although he stopped short of endorsing him as the country’s next central bank governor.”

ITALY (MNI BRIEF): The latest data suggest that euro area GDP continued to "edge up" in Q2, driven mainly by the service sector, the Bank of Italy estimates in its latest economic bulletin published on Friday.

US

POLITICS (WASHINGTON EXAMINER): “Former President Donald Trump has completely rewritten his convention speech in light of the assassination attempt against him on Saturday and will call on Thursday for a new effort at national unity. In an exclusive interview with the Washington Examiner a day after being hit by a sniper’s bullet, Trump said he wanted to take advantage of a historic moment and draw the country together.”

POLITICS (BBG): “President Joe Biden implored candidates to cool their rhetoric after the assassination attempt on Donald Trump, warning the nation was heading down a dangerous path in which violence subverts the will of Americans.”

POLITICS (BBG): Milwaukee Braces for 50,000 Arrivals and Trump After Shooting. GOP convention kicks off amid heightened security concerns. City had already been bracing for protests, disruptions.

OTHER

MIDEAST (BBG): “Israeli security officials said Sunday they were pretty confident their targeted attack against Hamas military chief Mohammed Deif was successful despite the group’s denial.”

MIDEAST (RTRS): “A senior Hamas official said on Sunday that the Islamist group has not withdrawn from ceasefire talks with Israel after this weekend's deadly attacks in Gaza that Israel said had targeted the group's military leader Mohammed Deif.”

AUSTRALIA (BBG): “Australia will deliver a second budget surplus of billions of dollars in the “mid-teens,” according to the nation’s Treasurer. “

CHINA

ECONOMY (MNI EM BRIEF): The Chinese economy slowed more than expected in Q2 to 4.7% y/y, missing the median forecast of 5.0% as insufficient domestic demand and summer flood weighed, data released by the National Bureau of Statistics on Monday showed.

HOUSE PRICES (BBG): “China’s home prices fell again in June, underscoring the challenge for policymakers to halt the property market slump that’s hurting developers and the economy.”

CREDIT (FINANCIAL NEWS): “China’s financial support for the domestic economy remains unchanged despite weaker credit supply data released Friday, the central bank-backed Financial News reported, citing unnamed analysts.”

MARKETS (SECURITIES TIMES): “China’s securities firms are upgrading their trading systems and changing business management rules to comply with latest regulatory requirements including higher margins for securities lending business, Securities Times reported Monday.”

EXPORTS (21ST CENTURY BUSINESS HERALD): “China’s exports should grow around 4% in 2024, with H2 shipments supported by a global manufacturing expansion and the U.S. starting an inventory replenishment cycle, according to Wu Chaoming, deputy director at the Caixin Research Institute.”

CHINA MARKETS

MNI: PBOC Conducts CNY100 Bln Via 1Y MLF; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY100 via 1-year MLF and CNY129 billion via 7-day reverse repo on Monday, with the rates unchanged at 2.50% and 1.80%, respectively. There are CNY2 billion reverse repo mature today and CNY103 MLF mature on Wednesday, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8113% at 09:30 am local time from the close of 1.8047% on Friday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Friday, compared with the close of 46 on Thursday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1313 on Monday, compared with 7.1315 set on Friday. The fixing was estimated at 7.2554 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND JUNE REINZ HOUSE SALES Y/Y -25.6% Y/Y; PRIOR 6.8%

NEW ZEALAND PERFORMANCE SERVICES INDEX 40.2; PRIOR 42.6

CHINA 1YR MEDIUM TERM LENDING FACILITY 2.50%; MEDIAN 2.50%; PRIOR 2.50%

CHINA 1YR MEDIUM TERM LENDING FACILITY VOLUME CNY 100BN; MEDIAN 90BN; PRIOR 182BN

CHINA JUNE NEW HOME PRICES M/M -0.67%; PRIOR -0.71%

CHINA JUNE USED HOME PRICES M/M -0.85%; PRIOR -1.00%

CHINA Q2 GDP Q/Q 0.7%; MEIDAN 0.9%; PRIOR 1.6%

CHINA Q2 GDP Y/Y 4.7%; MEDIAN 5.1%; PRIOR 5.3%

CHINA JUNE INDUSTRIAL PRODUCTION Y/Y 5.3%; MEDIAN 5.0%; PRIOR 5.6%

CHINA JUNE RETAIL SALES Y/Y 2.0%; MEDIAN 3.4%; PRIOR 3.7%

CHINA JUNE FIXED ASSET INVESTMENT EX RURAL YTD Y/Y 3.9%; MEDIAN 3.9%; PRIOR 4.0%

CHINA JUNE PROPERTY INVESTMENT YTD Y/Y -10.1%; MEDIAN -10.5%; PRIOR -10.1%

CHINA JUNE RESIDENTIAL PROPERTY SALES YTD Y/Y -26.9%; PRIOR -30.5%

CHINA JUNE SURVEYED JOBLESS RATE 5.0%; MEDIAN 5.0%; PRIOR 5.0%

SOUTH KOREA MONEY SUPPLY M2 SA M/M 0.0%; PRIOR 0.4%

MARKETS

US TSYS: Tsys Futures Steady After Opening Lower, Powell To Speak Later

- Treasury futures are steady after opening trading lower, front-end quickly erased most of the early losses with TUU4 trading just -0-00¾ at 102-17⅞, while TYU4 is -0-09 at 110-29.

- Volumes surged this morning, although tapered off as the day progressed we still sit average recent average with TU 68k, FV 105k & TY 164k

- Cash trading is close today with Japan out, but looking at moves in futures the treasury curve has bear steepened, while the long-end is 4-6bps cheaper.

- Looking across volatility markets, despite the weekend events haven markets have been relatively stable with the VIX little changed. Implied volatility for September TY futures has bounced of yearly lows of 5.41 and now trades at 5.71

- Projected rate cut pricing into year end look firmer vs. early Friday (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -25.2bp (-24.1bp), Nov'24 cumulative -41.4bp (-38.5bp), Dec'24 -62.9bp (-59.6bp).

- Today, Fed Chair Powell makes his final scheduled appearance ahead of the pre-July FOMC meeting communications blackout period & Empire Manufacturing

AUSSIE BONDS: Drifted Cheaper, No Cash US Tsy Trading In Asia-Pac Today

ACGBs (YM flat & XM -2.0) have ground cheaper throughout today’s Sydney session.

- With the domestic calendar largely empty until Thursday’s release of the June Employment Report, the local market has drifted weaker.

- Expectations of sustained strong pricing at today's Jun-51 auction proved accurate, as the weighted average yield printed through prevailing mids and the cover ratio printed around levels seen at recent longer-dated auctions.

- After today’s supply, the AOFM plans to sell another A$500mn of the 3.00% 21 November 2033 bond on Wednesday and A$700mn of the 2.75% 21 November 2027 bond on Friday.

- Cash ACGBs are flat to 2bps cheaper.

- The cash AU-US 10-year yield differential, currently at +16bps, is at its highest level since February. This places it in the upper half of the +/-30bps range observed since November 2022. However, it's worth noting that cash US tsys are not trading during today's Asia-Pac session due to a public holiday in Japan.

- Swap rates are 1-2bps higher, with the 3s10s curve steeper.

- The bills strip is little changed, with pricing flat to +1.

- RBA-dated OIS pricing is flat to 2bps softer for 2025 meetings. Terminal rate expectations drop to 4.42% versus its recent high of 4.52%.

- Tomorrow, the local calendar will see the Westpac Leading Index.

NZGBS: Closed On Strong Note, Post-RBNZ Rally Continues

NZGBs closed on a strong note, with benchmark yields 4-6bps lower.

- Outside of the previously outlined Performance Services Index and REINZ House Sales, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys have been closed during today’s Asia-Pac session due to a holiday in Japan.

- Today’s move brings the cumulative post-RBNZ Decision rally to 19-29bps, with the 2/10 curve 10bps steeper.

- It is also noteworthy that the NZGB 10-year yield finished at its lowest closing level this year at 4.45%.

- On a relative basis, as well, the recent rally has been impressive, with the NZ-AU 10-year yield differential closing at +11bps, its lowest level since August 2022.

- Swap rates closed 5-6bps lower.

- RBNZ dated OIS pricing is 4-5bps softer for late-2024/2025 meetings. A cumulative 65bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Non-Resident Bond Holdings data, ahead of Q2 CPI on Wednesday. Bloomberg consensus expects the annual rate to decline to 3.4% from 4.0% in Q1.

- On Thursday, the NZ Treasury plans to sell NZ$225mn of the 3.00% Apr-29 bond, NZ$225mn of the 4.25% May-34 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: USD Firms On Lower US Tsys Futures, NZD Underperforming

The USD holds firmer against all the majors, but is away from best levels. The BBDXY USD index last tracked near 1251.4 (up around 0.15%), against earlier highs of 1252.31.

- The USD was firmer from the open, as the market digested the weekend news of the Trump assassination attempt and increased odds of a Trump win in November. US President Biden called for the US political temperature to be lowered, while Trump's speech at the National Republican Convention this week will reportedly call for unity.

- US Tsy futures gaped lower at the open, providing further USD support, but there was not follow through and we sit higher in latest dealings. There is no cash Tsy trading today as Japan markets are shut. US equity futures sit 0.20-0.30% firmer at this stage.

- USD/JPY got to 158.42 earlier, but sits back at 158.00 in latest dealings, slightly higher for the session. Intervention speculation continues in the near term.

- The Kiwi is down against most G10 currencies as NZGB yields fall to their lowest since June and the USD strengthens on the back of a haven bid in the USD, while NZ Performance Services Index fell to 40.2 in June, this is the fourth consecutive monthly decline and the lowest since August 2021. NZD/USD last near 0.6100, off 0.3%. AUD/NZD is 0.22% higher today at 1.1110, after earlier testing Friday's highs of 1.1118. The AU-NZ 2yr swap continues to tick higher and now sits at -9bps, back at November 2020 levels after rallying 41bps in July.

- AUD/USD is down a touch, last near 0.6775. Weaker China GDP/retail sales data didn't impact sentiment greatly.

- NOK & SEK are off by 0.45% and 0.35% to be the worst G10 performers, although liquidity will be lighter in these pairs during Asia Pac hours.

- Looking ahead, the US Empire Survey is due. ECB speak from Lagarde is also out. Later on Fed speak from Chair Powell will be in focus (ahead of the blackout period).

ASIA STOCKS: HK & China Stocks Mixed, Third Plenum Gets Underway, Data Mixed

China & Hong Kong's equity markets are mixed today. Investors are closely monitoring the Third Plenum policy meetings that kicked off today although there has yet to be any headlines out in relation to it. While earlier the PBoC maintained it's 1yr MLF at 2.50% which was widely expected, there was also a flurry of other China data out, GDP was 4.7% vs 5.1% expected, while industrial Production was 5.3% vs 5.0% expected, and Retail Sales were well below expectations coming in at 2.0% vs 3.4%.

- Hong Kong equities are lower today with the HSTech Index is down 2.45%, property stocks are the worst performing with the Mainland Property Index down 2.63% and the HS Property Index is down 2.20% the wider HSI is down 1.40%.

- China equity markets are mixed today with the CSI 300 is 0.20% higher, small-cap indices are lower with the CSI 1000 down 0.70% and the CSI 2000 is down 1.45%, while the growth focused ChiNext is off 0.55%.

- The Biden administration imposed visa restrictions on Chinese officials for alleged human rights abuses, while Beijing sanctioned six US companies involved in arms sales to Taiwan. The US cited repression in Xinjiang, Hong Kong, and Tibet, while China claimed the arms sales violated its sovereignty. This escalation follows renewed US criticism of Beijing's support for Russia in the Ukraine conflict, with President Biden warning of potential cuts in European investment in China if this support continues.

- China's Third Plenum kicks off today until the 18th and is anticipated to consolidate existing policy directions rather than introduce and new groundbreaking shifts in a change from previous meeting. The focus will likely be on reinforcing recent policy strategies to foster long-term growth drivers, enhance stimulus effectiveness, and tackle challenges like a potential housing downturn, rising barriers to foreign markets and critical technologies, and demographic pressures. With a 5% growth target for the year, the Plenum aims to bolster economic confidence, though the absence of major new initiatives could risk disappointing expectations, according to BBG.

- Looking ahead, focus will be on any headlines from the Third Plenum.

ASIA PAC STOCKS: Asian Equities Off Earlier Lows, ASX Hits Record Highs, Japan Out

Asian equity markets are mixed today as markets digests the attempted assassination of Trump and US rate cut expectations grow with the market now pricing a 91% chance of a cut in September. Australian equities have hit their highest ever level, while Taiwan & South Korean equities are both lower as investors look to book some profits after a stellar run of late, foreign investors have been better sellers of local tech stocks over the past few sessions.

- Japan is out today for Marine Day, Japanese equity futures are 0.20-0.30% higher today after falling 1-3% on Friday.

- South Korean stocks are lower today as foreign investors sell tech stocks, while local investors purchase tech. Elsewhere Money supply jumped 0.50% in May from -0.3% prior. The Kospi is 0.06% lower, while the Kosdaq is little changed.

- Taiwanese stocks opened higher this morning with moves from TSMC dictating index moves. TSMC will released earnings later this week, with analysts expecting a 30% jump in profit. Equity flows saw the largest outflow in two weeks on Friday, as foreign investors took profit on tech stocks. Currently the Taiex is down 0.20%

- Australian equities are higher today with the ASX200 breaking 8,000 for the first time and trades up 0.63% today.

- Elsewhere, New Zealand equities are 0.10% higher, Malaysian equities are 0.40% higher, Philippines equities are 1% higher, Indian equities are 0.30% Singapore equities are little changed while Indonesian equities are 0.60% lower.

OIL: Largely Tracking Sideways, Firmer USD A Cap Today

Brent crude sits little changed in the first part of Monday trade, last above $85.15/bbl. Earlier we had a brief dip sub $84.50/bbl, but no follow through. Front month WTI was last around $82.40/bbl, slightly up for the session but well within recent ranges.

- For front month Brent, we remain clustered around key EMAs. The lowest is the 200-day near $83.90/bbl. Beyond that lies mid June lows just under $82/bbl. Recent highs rest at $87.95/bbl, recorded on July 5.

- Focus remains on fall out on the Trump assassination attempt from the weekend and increased odds of a Trump Presidency. This has aided USD sentiment (with Tsy futures lower), which may be curbing oil sentiment at the margins.

- Elsewhere, we had weaker than expected China activity and Q2 GDP figures. IP growth remains more of a positive, against a softer consumer backdrop.

- Prompt spreads still suggest a near term supportive backdrop, while the technical picture for WTI is holding up. For WTI futures, sights are on $85.27, the Apr 12 high and a bull trigger. Initial firm support to watch is $80.01, the 50-day EMA.

GOLD: Steady In Asia Despite Assassination Attempt

Gold is steady in the Asia-Pac session, after the attempted assassination of former US president and Republican contender Donald Trump over the weekend.

- On Friday, bullion closed 0.2% lower at $2411.43 after higher-than-expected US PPI data.

- The weekly gain of 1% nevertheless kept the yellow metal around its highest level since May 22.

- PPI increased 0.2% m/m, and core prices rose by 0.4%, above the 0.2% median forecast. The pickup in core PPI was driven by a jump in retail and wholesale margins and is unlikely to be sustained, according to analysts. Also, most of the inputs for the core PCE deflator support forecasts for a tame print, well below the Fed’s June FOMC forecast.

- US Treasuries ended the week with a bull-steepening. The US 2-yield yield was down 6bps, with the 10-year down 3bps.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, the breach of $2,387.8, the Jun 7 high, has opened key resistance at $2,450.1, the May 20 high. Initial support to watch lies at the 50-day EMA, at $2,336.2.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/07/2024 | 0700/0900 |  | EU | ECB's Lagarde and Cipollone in Eurogroup meeting | |

| 15/07/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/07/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/07/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/07/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/07/2024 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 15/07/2024 | 1435/1035 |  | US | San Francisco Fed's Mary Daly | |

| 15/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/07/2024 | 1630/1230 |  | US | Fed Chair Jerome Powell |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.