-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD/JPY Erases Election Rally

MNI US OPEN - RBNZ Cuts 50bps, OCR Forecast Slightly Higher

MNI China Daily Summary: Wednesday, November 27

MNI EUROPEAN OPEN: US Yields Close To Recent Highs Ahead Of CPI Print

EXECUTIVE SUMMARY

- ECB’s CRUCIAL 2024 PROJECTION TO PUT INFLATION ABOVE 3%, SOURCES SAY - RTRS

- JAPAN AUG CGPI RISE SLOWS TO 3.2% VS. JULY 3.4% - MNI BRIEF

- JAPAN PM KEEPS ECONOMY TEAM< BOOSTS WOMEN IN CABINET REVAMP - BBG

- COUNTRY GARDEN WINS VOTE TO EXTEND REPAYMENT OF SEVEN YUAN BONDS - BBG

- N.KOREA FIRES 2 SHORT-RANGE BALLISTIC MISSILES TOWARDS EAST SEA- AP

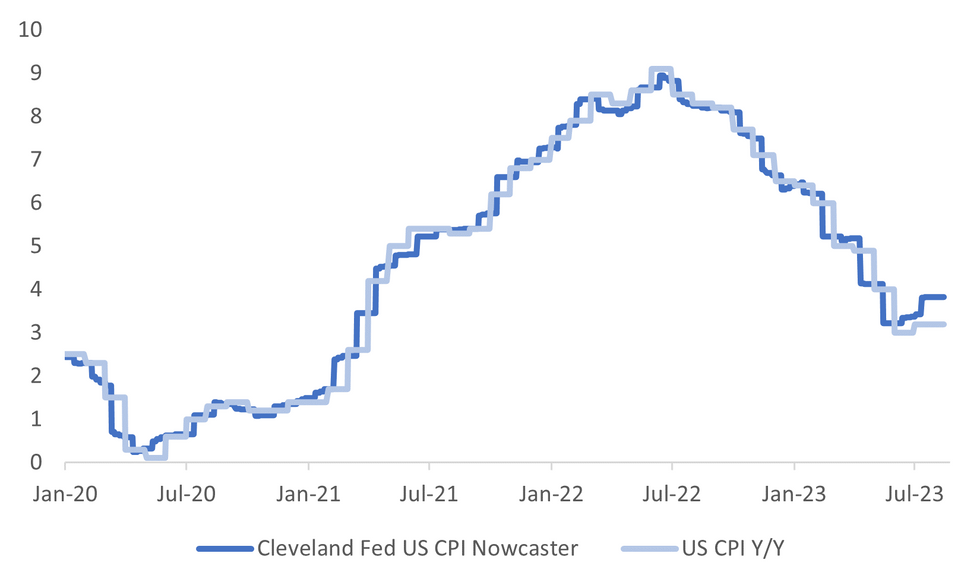

Fig. 1: US CPI Y/Y Versus Cleveland Fed CPI Nowcaster

Source: MNI - Market News/Bloomberg

EUROPE:

ECB: The European Central Bank expects inflation in the 20-nation euro zone to remain above 3% next year, bolstering the case for a tenth consecutive interest rate increase on Thursday, a source with direct knowledge of the discussion told Reuters on Tuesday. The ECB begins a two-day meeting on Wednesday, with persistently high inflation and rising recession fears pulling policymakers in opposing directions and keeping market expectations equally divided between a pause and another 25-basis-point hike. (RTRS)

RUSSIA: A Ukrainian missile attack caused a fire at the Sevastopol Shipyard in Crimea, injuring at least 24 people, according to Russia-installed Governor Mikhail Razvozhaev. The attack has sparked a fire at a “non-civilian facility” in the South Bay area of the Sevastopol Shipyard early Wednesday, Razvozhaev said on his VK social network page. At least 24 people are injured, with four in moderate condition. The fire service is working on the site. (BBG)

U.S.

APPLE: Apple Inc. enacted its long-awaited iPhone price increase with as much subtlety as possible, part of an effort to wring more money from consumers without triggering sticker shock. On Tuesday, the company boosted the price of just one iPhone model — the top-end Pro Max, which climbs by $100 to $1,199 — while leaving the other three new versions unchanged. And even the now-costlier new phone will come with twice as much storage, letting Apple argue that it wasn’t really a price increase at all. (BBG)

OTHER

JAPAN: The y/y rise in Japan's corporate goods price index slowed to 3.2% in Aug from July's revised 3.4%, the eighth straight monthly deceleration and the lowest level since March 2021 (1.0%), indicating a slower pace of continued pass-through of cost increases, data released by the Bank of Japan showed on Wednesday. (MNI BRIEF)

JAPAN: Japanese Prime Minister Fumio Kishida will keep his finance and trade ministers in place while adding more women to his cabinet in a reshuffle Wednesday, national public broadcaster NHK and other media reported. The premier is seeking to freshen his government’s image even as he keeps a core policy team in place that can work quickly to introduce new economic stimulus measures, something he has cited as a priority. (BBG)

JAPAN: Confidence at big Japanese manufacturers fell the most in eight months, while morale in the services sector also slumped on worries a slowdown in China's economy could be a bigger drag on growth globally and at home, a Reuters poll for September showed on Wednesday. (RTRS)

NORTH KOREA: North Korean leader Kim Jong Un is expected to hold a summit with President Vladimir Putin as soon as Wednesday that could focus on weapons after the two leaders visited areas of Russia’s east. No time or venue for a meeting has been announced by either side but reports from Ria Novosti and other Russian media outlets suggested Putin may soon visit the Vostochny Cosmodrome space center in the Amur region, fueling speculation this could be the summit site. (BBG)

NORTH KOREA: North Korea fired two ballistic missiles toward the sea Wednesday, as leader Kim Jong Un rolled through Russia on an armored train toward a meeting with President Vladimir Putin. That meeting underscores how the two leaders' interests are aligning in the face of their separate, intensifying confrontations with the United States. (AP)

HONG KONG: Citibank, Standard Chartered and Hang Seng Bank will hike mortgage interest cap linked to Hibor by 0.5 percentage point starting as early as Sept. 18, Sing Tao Daily reports, citing unidentified market sources. (BBG)

SINGAPORE: Singapore sovereign wealth fund GIC Pte is “doubling down” on some sectors in China as it remains investable, even if it has become hard to make top-down allocations, according to its chief executive officer. (BBG)

NEW ZEALAND: New Zealand’s central bank and Treasury Department are at odds over whether the nation needs another recession to get inflation under control. The Treasury yesterday said the economy returned to growth in the second quarter and will continue to expand but that inflation will still retreat below 3% by the end of 2024. By contrast, the Reserve Bank last month predicted gross domestic product will shrink in the third and fourth quarters of this year, with Governor Adrian Orr saying that’s the “bare minimum” required to get inflation back into his 1-3% target band. (BBG)

NEW ZEALAND: The RBNZ is aware of an illiquidity premium in New Zealand swap rates which has implications for monetary policy transmission, Assistant Governor Karen Silk says in a speech Wednesday in Auckland. The premium emerged in late 2021 and into 2022 as offshore market participants became less willing to engage in the market. (BBG)

NEW ZEALAND: The property market seems to be finally getting some mojo back. Real Estate Institute of New Zealand data released on Wednesday morning show August was a good month for sales. Bank economists have also detected some signs of strength. Compared with a year earlier, August this year had an increase in the total number of properties sold throughout New Zealand. (NZ HERALD)

CHINA

RRR: The People's Bank of China will likely cut the reserve requirement ratio in Q4 to stabilise interbank liquidity, support credit expansion and lower the cost of banks, said Wen Bin, chief economist at China Minsheng Bank. A total of CNY2.4 trillion of medium-term lending facilities will mature this year, according to Wind Information. (Yicai)

FINANCING: More than 40 local state-owned enterprises in Jiangsu province made announcements to exit from serving as local government financing vehicles so far this year, according to the calculation of National Business Daily. They will no longer finance public-welfare projects and promise to operate independently and be responsible for their own profits and losses. This means these financing platforms have resolved all the implicit debts and will participate in government projects as a market entity in future, said Wu Zhiwu, senior director at CSCI Pengyuan.(MNI)

PROPERTY: A spurt of home sales in China’s biggest cities is losing momentum less than two weeks after authorities loosened mortgage restrictions, raising doubts over whether the steps are enough to revive the market before a crucial busy season. While a dearth of official statistics makes it difficult to gain a comprehensive view, checks by industry watchers suggest that the rebound is fading in tier-1 cities. (BBG)

PROPERTY: Chinese real estate is now seen as the number one source for the next global credit event among investors surveyed by Bank of America Corp., even as President Xi Jinping’s government rolls out stimulus measures to stabilize the world’s second-largest economy’s ailing property sector. (BBG)

PROPERTY: China plans to include eligible urban village renovation projects in the coverage of special bonds in order to support the redevelopment, the 21st Century Business Herald reports, citing unidentified people. (BBG)

COUNTRY GARDEN: Country Garden Holdings Co. won creditor support to extend repayment on seven yuan-denominated bonds, giving the distressed Chinese developer breathing room just days after it dodged a default on dollar securities at the last minute. Holders of the securities voted in favor of the company’s plan to stretch principal repayments by three years, people familiar with the matter said, asking not to be identified discussing a private matter. (BBG)

WEALTH MANAGEMENT: Many wealth management units of commercial banks have received regulatory guidance recently about restrictions on an investment product that has been used as a fund-raising vehicle for single corporate borrowers, 21st Century Business Herald reports, citing unidentified industry sources. (BBG)

CHINA MARKETS

MNI: PBOC Net Injects CNY39 Bln Wednesday via OMO

The People's Bank of China (PBOC) conducted CNY65 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY39 billion after offsetting the maturity of CNY26 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8000% at 09:32 am local time from the close of 1.9513% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 39 on Tuesday, compared with the close of 46 on Monday.

PBOC Yuan Parity At 7.1894 Wednesday Vs 7.1986 Tuesday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1894 on Wednesday, compared with 7.1986 set on Tuesday. The fixing was estimated at 7.2808 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA IMPORT PRICE INDEX M/M 4.4%; PRIOR 0.2%

SOUTH KOREA IMPORT PRICE INDEX Y/Y -9.0%; PRIOR -13.5%

SOUTH KOREA EXPORT PRICE INDEX M/M 4.2%; PRIOR 0.1%

SOUTH KOREA EXPORT PRICE INDEX Y/Y -7.9%; PRIOR -12.8%

SOUTH KOREA AUGUST UNEMPLOYMENT RATE 2.4%; MEDIAN 2.9%; PRIOR 2.8%

SOUTH KOREA AUGUST BANK LENDING TO HOUSEHOLD TOTAL KR1075T; PRIOR KR1068.1T

NEW ZEALAND AUGUST REINZ HOUSE SALES Y/Y 9.2%; PRIOR 1.6%

NEW ZEALAND AUGUST FOOD PRICES M/M 0.5%; PRIOR -0.5%

AUSTRALIA AUGUST CBA HOUSEHOLD SPENDING M/M 0.7%; PRIOR 0.6%

AUSTRALIA AUGUST CBA HOUSEHOLD SPENDING Y/Y 2.3%; PRIOR 1.9%

JAPAN AUGUST PPI M/M 0.3%; MEDIAN 0.2%; PRIOR 0.1%

JAPAN AUGUST PPI Y/Y 3.2%; MEDIAN 3.3%; PRIOR 3.4%

JAPAN BSI LARGE ALL INDUSTRY Q/Q 5.8; PRIOR 2.7

JAPAN BSI LARGE MANUFACTURING Q/Q 5.4; MPRIOR -0.4

MARKETS

US TSYS: Narrow Ranges In Asia, CPI In View

TYZ3 deals at 109-23+, -0-04+, a 0-03 range has been observed on volume of 49k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys have observed narrow ranges in Asia with little follow through on moves, perhaps the proximity to this evening's US CPI print has limited activity.

- There was no market reaction to the latest North Korean missile test.

- FOMC dated OIS remain stable, pricing a terminal rate of 5.45%, with ~50bps of cuts by July 2024.

- The aforementioned US CPI print headlines the docket today, the MNI preview is here. We also have the latest 30-Year Supply.

Futures Holding In Positive Territory, US CPI Due, Heavy Local Calendar Tomorrow

JGB futures sit mid-range, +5 compared to settlement levels, after dealing in a relatively narrow range during the Tokyo session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined PPI and Tankan survey data.

- Beyond the 1-year, the cash JGB curve has bull-flattened, with yields 0.1bp to 4.1bp lower. The benchmark 10-year yield is 0.5bp lower at 0.706% versus yesterday’s post-YCC tweak high of 0.722%.

- Today’s BoJ Rinban operations seem to have offered some bolstering influence on longer-dated JGBs. This comes after the operations saw a negative spread and a marginally diminished offer cover ratio for the JGBs with a maturity period exceeding 25 years.

- The swap curve has twist-flattened, pivoting at the 7s, with rates 0.8bp higher to 3.5bp lower. Swap spreads are wider throughout the curve.

- Tomorrow the local calendar sees International Investment Flow, Core Machine Orders, Industrial Production and Capacity Utilisation data, along with 20-year supply.

AUSSIE BONDS: Sitting Near Sydney Session Highs, US CPI Due Later Today

In roll-impacted dealing, ACGBs (YM +0.2 & XM +2.5) sit at or near Sydney session highs. CBA household spending data, just released, +0.7% m/m and +2.3% y/y versus flat and +1.3% prior. So far, the data hasn’t materially impacted the market.

- Without domestic drivers, local participants appear to have been sitting on the sideline ahead of key US CPI data later today. US tsys are holding marginally cheaper through the Asia-Pac session. Ranges remain narrow, with US tsys ~1bp cheaper across the major benchmarks.

- The cash ACGB curve has bull-flattened, with yields from flat to 2bp lower. The AU-US 10-year yield differential is 2bp lower at -14bp.

- Swap rates are flat to 2bp lower, with the 3s10s curve flatter and EFPs marginally wider.

- The bills strip is cheaper, with pricing flat to -2.

- RBA-dated OIS pricing is flat to 2bp firmer across meetings.

- Tomorrow the local calendar sees the Employment Report for August, along with Consumer Inflation Expectations data for September.

- In July, employment growth surprised materially to the downside, falling by –14.6k, with the ABS suggesting that “some changes around when people take their leave and start or leave a job” provided a partial explanation. Consensus expects a bounce back in job creation of +25k in August, with the unemployment rate unchanged at 3.7%.

NZGBS: Closed Little Changed, Narrow Ranges, Awaiting US CPI

NZGBs closed little changed after dealing in a narrow range during the local session. REINZ house price and sales, and food prices data failed, as expected, to provide a significant domestic driver.

- Annual food prices were 8.9% higher in August but lower than the 9.6% y/y seen in July. "Prices for fruit and vegetables such as tomatoes, grapes, cucumbers, and nectarines contributed the most to the overall monthly rise," said Stats NZ's consumer prices manager James Mitchell.

- Accordingly, local participants were likely on headlines and US tsys watch ahead of key US CPI data later today. Consensus is at +0.6% m/m and +0.2% m/m for headline and core respectively (3.6% y/y and 4.3%) versus prior +0.2% m/m and +0.2% m/m (3.2% y/y and 4.7%).

- US tsys are are holding marginally cheaper through the Asia-Pac session. Ranges remain narrow, with US tsys sitting ~1bp cheaper across the major benchmarks.

- Swap rates closed 1-3bp higher, with implied swap spreads slightly wider.

- RBNZ dated OIS pricing closed flat to 2bp firmer across meetings, with terminal OCR expectations steady at 5.62%.

- Tomorrow the local calendar is empty.

- Tomorrow the NZ Treasury plans to sell NZ$200mn of the 0.50% May-26 bond, NZ$200mn of the 1.50% May-31 bond and NZ$100mn of the 1.75% May-41 bond.

FOREX: Antipodeans Pressured In Asia, US CPI In View

The Antipodeans have been pressured in the Asian session, regional equities fell as crude oil trades near a 10-month high.

- AUD is the weakest performer in the G-10 space at the margins. AUD/USD is down ~0.4% and sits a touch above the $0.64 handle. Support comes in at $0.6357, low from Sep 6 and bear trigger.

- Kiwi has reversed early gains and now sits below the $0.59 handle. NZD/USD is down ~0.2%, the pair does remain well within recent ranges.

- Yen is also pressured, USD/JPY is ~0.2% firmer however we still remain below Friday's closing levels.

- Elsewhere in G-10; the Scandies are under pressure, SEK and NOK are ~0.3% lower, however liquidity is generally poor in Asia. EUR and GBP are both ~0.1% lower.

- Cross asset wise; E-minis are ~0.2% lower and the Hang Seng is down ~0.2%. CSI 300 sits 1% lower.BBDXY is a touch lower. US Tsy Yields are little changed across the curve.

- Todays US CPI report headlines todays session, the MNI preview is here.

EQUITIES: Regional Equities Tracking Weaker Ahead Of US CPI

Regional equities are tracking lower in the first part of Wednesday trade. This follows weakness in Tuesday US trade, with the Nasdaq unperforming post fresh product launches from Apple. US futures have ticked marginally lower in the Asia Pac session today. Eminis are off 0.13% to 4508, while Nasdaq futures are close to 0.10% weaker at this stage. Caution ahead of the upcoming US CPI print may also be a factor.

- At the break, the CSI 300 is down just over 1%, putting the index back to 3721 in index terms. The tech sensitive ChiNext is down around 1% as well at this stage, set for lows going back to April 2020.

- Broader tech concerns are evident in sentiment given offshore moves. A BoFA survey also noted that China's real estate market is viewed as the number 1 risk in terms of a potential credit event.

- The property sub sector is doing better today in the equity space, with Country Garden winning maturity extension for another onshore bond. The Hang Seng mainland properties index is +0.94%, while the CSI 300 real estate index is still down modestly though.

- Elsewhere, the Topix is down around 0.20% at this stage, while the Kospi is only down modestly. THe same applies for the Taiex. China's State Council has approved the Fujian coastal province to foster closer development ties with Taiwan. This may be helping sentiment at the margins.

- South East Asia markets are mostly weaker, although losses are modest at this stage. The Thai SET index off 0.55%, despite the government considering a 5-month waiver or China tourist visa's.

OIL: Crude Continues March Higher, US CPI & IEA Report Out Later

Oil prices are slightly higher during APAC trading today and holding onto Tuesday’s gains while not quite making its highs. The market is seeing the effects of OPEC’s cuts. Brent is up 0.2% to $92.25/bbl after an intraday high of $92.33. Moves below $92 have been very slight and brief. WTI is 0.3% higher at $89.08, close to the high of $89.19. The USD index is flat.

- After OPEC’s monthly report showed the group expecting a crude deficit of 3.3mbd in Q4 2023 but the US’ EIA only forecasting 230kbd, the IEA’s bulletin released later today is likely to be monitored closely.

- Official EIA US inventory data is released later today too. Bloomberg reported that US crude stocks rose 1.17mn barrels in the latest week after a couple of sharp drawdowns, according to people familiar with the API data. But inventories at Cushing fell 2.42mn. Gasoline stocks rose 4.2mn and distillate +2.59mn.

- The focus later is on the US CPI and what it is likely to mean for the Fed. It is expected to rise to 3.6% y/y from 3.2% but core should moderate to 4.3% from 4.7%. There is also the US August budget statement and euro area July IP.

GOLD: Extends Tuesday’s Weakness Ahead Of US CPI Data

Gold is slightly weaker in the Asia-Pac session, after closing -0.4% at $1913.67 on Tuesday. Bullion was pressured by an appreciation in the USD, but the move was a surprisingly large drop considering the modest movement in US Treasury yields.

- In a data and volume light New York session, ranges for US Treasuries were narrow with little follow-through on moves as participants awaited today's US CPI print. The US CPI for August will provide an update on the effectiveness of the Federal Reserve’s tightening campaign and whether further hikes are needed. Higher rates are generally negative for non-interest-bearing gold.

- From a technical standpoint, the move off the high of $1907.71 on Tuesday made a sizeable step towards support at $1903.9 (Aug 25 low).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/09/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/09/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/09/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/09/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/09/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/09/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/09/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/09/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/09/2023 | - |  | EU | EC State of the Union Address | |

| 13/09/2023 | 1230/0830 | * |  | CA | Household debt-to-income |

| 13/09/2023 | 1230/0830 | *** |  | US | CPI |

| 13/09/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 13/09/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/09/2023 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.