-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: US Yields & Dollar Lower As NFP Comes Into Focus

EXECUTIVE SUMMARY

- POWELL: KNOW RISK OF WAITING TOO LONG TO CUT RATES - MNI BRIEF

- NO FED CUTS UNTIL H2, EX-KC FED’s HOENIG SAYS - MNI INTERVIEW

- BIDEN TAKES ON TRUMP AND REPUBLICANS IN FEISTY STATE OF THE UNION SPEECH - RTRS

- ECB's NAGEL SEES RISING CHANCE OF RATE CUT BEFORE SUMMER BREAK - BBG

- RATES ON HOLD, POINTER TO POSSIBLE JUNE CUT - MNI ECB WATCH

- CHINA TO EXTEND DEBT, REFORM LOCAL GOV TAX - MNI INTERVIEW

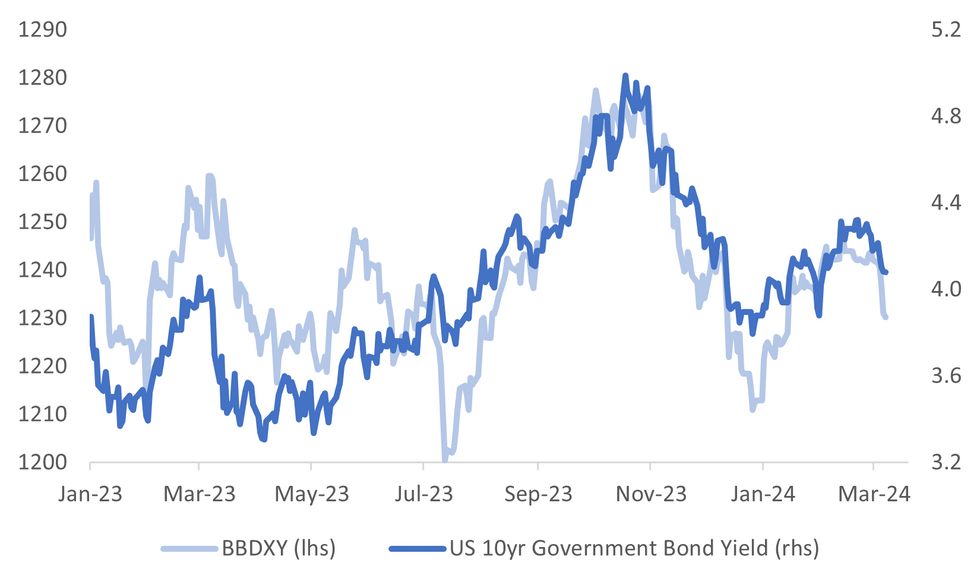

Fig. 1: USD Index And US 10yr Tsy Nominal Yield

Source: MNI - Market News/Bloomberg

U.K.

DEBT (MNI INTERVIEW): The surprise inclusion of GBP8.5 billion in medium-dated syndicated issuance in the UK’s initial 2024/25 funding plans will make it easier for the market to absorb what will be near-record overall gilt sales, Debt Management Office chief Robert Stheeman told MNI.

INFLATION (MNI INTERVIEW): Tax cuts in this week’s UK budget will boost demand but also labour supply, with a minimal and possibly not even positive overall effect on inflation and scant implications for Bank of England monetary policy, the Office for Budget Responsibility’s David Miles, a two-time Monetary Policy Committee member, told MNI.

EUROPE

ECB (MNI ECB WATCH): The European Central Bank kept its key interest rate on hold at 4% on Thursday for a fourth consecutive time, and President Christine Lagarde said that while Governing Council did not discuss rate cuts this time, policy makers are “just beginning to discuss the dialing back of our restrictive stance”.

ECB (BBG): The European Central Bank might be able lower borrowing costs before policymakers break for the summer, according to Bundesbank President Joachim Nagel.

FISCAL (MNI BRIEF): European Union states will need to start work early on 2025 budget plans, given the tough fiscal environment, a senior EU official said on Thursday.

FRANCE (BBG): France agreed to a defense pact with Moldova to help boost security as the former Soviet republic, which neighbors Ukraine, braces for possible efforts by Russia aimed at derailing its plan to join the European Union.

U.S.

FED (MNI BRIEF): Federal Reserve officials will try to avoid waiting so long to cut interest rates that they cause unnecessary employment losses, Fed Chair Jerome Powell said in testimony Thursday.

FED (MNI INTERVIEW): The Federal Reserve's monetary policy stance might not be all that restrictive given persistent economic strength, suggesting the central bank will stay cautious about cutting interest rates for longer, likely into the second half of the year, former Kansas City Fed president Thomas Hoenig told MNI.

REGULATION (MNI BRIEF): Federal Reserve Chair Jerome Powell told Senate lawmakers Thursday he expects "material and broad" changes will be made to regulators' Basel III endgame proposal before the rule is reconsidered some time this year.

FED (MNI INTERVIEW): Stubborn inflation pressures are still plaguing the U.S. economy and making it harder for the Federal Reserve to cut interest rates, with uncertainty so high that even the possibility of additional rate increases cannot be ruled out, a former resident scholar at the New York Fed, told MNI.

FED (MNI INTERVIEW 2): Ballooning central bank balance sheets have also fueled a jump in financial liabilities that create new stability challenges – as evidenced by the Fed’s need to support the banking system last year as it advanced QT, ex-New York Fed resident scholar and Reserve Bank of India deputy Viral Acharya told MNI.

POLITICS (RTRS): President Joe Biden took on Donald Trump in a fiery speech to Congress on Thursday, accusing his election rival of threatening U.S. democracy and kowtowing to Russia, as he laid out his case for four more years in the White House.

MIDEAST (BBG): President Joe Biden directed the US military to establish a temporary port on the Gaza coast to ease the humanitarian crisis in the territory sparked by the Israel-Hamas war, and used his State of the Union speech to call on Israel to let more aid into the territory.

OTHER

JAPAN (BBG): Japan’s household spending shrank the most in almost three years, casting a cloud over the economy’s growth prospects as the central bank mulls the timing for a widely expected interest rate hike.

HONG KONG (BBG): Hong Kong proposed life sentences for crimes related to treason and insurrection in a draft security measure officials are seeking to fast-track into legislation.

CHINA

DEBT (MNI INTERVIEW): China will increase off-the-book special government debt issuance and extend its maturity to raise funds for medium- and long-term growth initiatives, while considering additional revenue sources for local governments to ease their fiscal challenges, a prominent policy advisor told MNI in an interview.

PRICES (21st CENTURY BUSINESS HERALD): Prices will likely return to normal levels due to expanded domestic and external demand and supply-side structural reforms, said Ning Jizhe, former director at the National Bureau of Statistics, noting the “about 3%” inflation target is a relatively reasonable level.

ECONOMY (YICAI): China’s economy would benefit from expansionary fiscal and monetary policies this year needed to address persistent low levels of CPI and PPI, according to Yu Yongding, director at the Chinese Academy of Social Sciences.

TRADE (21st CENTURY BUSINESS HERALD): China’s exports will maintain moderate growth in 2024 following the 10.5% increase during the first two months of the year, according to Zhou Maohua, a macro researcher at China Everbright Bank. Overseas buyers have increased demand and begun inventory replenishment, which has led to better than expected results, Zhou added.

LGFV (BBG): China’s local governments are selling more assets as they look for new revenue streams that may help them start to plug a massive gap left by the property crisis.

CHINA MARKETS

MNI: PBOC Conducts CNY10 Bln Via OMO Fri; Liquidity Unchanged

The People's Bank of China (PBOC) conducted CNY10 billion via 7-day reverse repo on Friday, with the rates unchanged at 1.80%. The reverse repo operation has led to no change to the liquidity after offsetting CNY10 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8352% at 10:00 am local time from the close of 1.8395% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 47 on Thursday, compared with the close of 49 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.0978 on Friday, compared with 7.1002 set on Thursday. The fixing was estimated at 7.1881 by Bloomberg survey today.

MARKET DATA

JAPAN JAN HOUSEHOLD SPENDING Y/Y -6.3%; MEDIAN -4.1%; PRIOR -2.5%

JAPAN JAN BOP CURRENT ACCOUNT BALANCE ¥438.2BN; MEDIAN -¥330.4BN; PRIOR ¥744.3BN

JAPAN JAN BOP CURRENT ACCOUNT ADJUSTED ¥2727.5BN; MEDIAN 2074.4BN; PRIOR ¥1810BN

JAPAN JAN TRADE BALANCE BOP BASIS -¥1442.7BN; MEDIAN -¥1483.2BN; PRIOR ¥115.5BN

JAPAN FEB BANK LENDING INC TRUSTS Y/Y 3.0%; PRIOR 3.1%

JAPAN FEB BANK LENDING EX-TRUSTS Y/Y 3.4%; PRIOR 3.4%

JAPAN FEB WATCHERS SURVEY CURRENT SA xx; MEDIAN 50.6; PRIOR 50.2

JAPAN FEB WATCHERS SURVEY OUTLOOK SA xx; MEDIAN 52.2; PRIOR 52.5

JAPAN JAN P LEADING INDEX CI 109.9; MEDIAN 109.7; PRIOR 110.5

JAPAN JAN P COINCIDENT INDEX 110.2; MEDIAN 110.2; PRIOR 116.0

SOUTH KOREA JAN BOP GOODS BALANCE $4240.4MLN; PRIOR $8037.4MLN

SOUTH KOREA JAN BOP CURRENT ACCOUNT BALANCE $3045.7MLN; PRIOR $7414.6MLN

MARKETS

US TSYS: Tsys Future Edge Higher, Break Initial Resistance Ahead of Employ Data

- Jun'24 10Y futures are edging higher as we come back from the break, reaching new highs of 111-24 above initial resistance, eyes will be on weather we can hold above here. Ranges have remained tight with lows of 111-19+ and highs of 111-24 where we trade now.

- Futures briefly traded above initial resistance at 111-23 (Mar 6 highs) on Thursday, a break and hold above there opens 111-27 (50% retracement of the Feb 1 - 23 bear leg) further up 112-04 (Feb 7 highs), while to the downside 110-21 (Mar 4 lows) and 110-05+/109-25+ (Low Mar 1 / Low Feb 23 and bear trigger)

- Treasury yields are roughly 1bp lower across the curve with the 2Y -0.9bp at 4.492%, 10Y is -0.6bps higher at 4.077%, while the 2y10y is +0.238 to -41.842

- Biden is spoke at the State Of Union earlier, while there was little in the way of market moving headlines he did mention he would not hesitate to order more strikes on Houthis, and that he would ban AI voice impersonation.

- Looking ahead February Employment Report.

JGBS: Off Worst Levels, Futures Back To Flat, Awaiting US Payrolls

JGB futures are little changed, +1 compared to the settlement levels, after spending most of today’s session in the red.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined household spending and current account data. Leading & Coincident Indices are due later today.

- (Bloomberg) -- Japan’s annual wage negotiations are nearing a conclusion, drawing intense scrutiny as the BoJ looks for evidence of a virtuous wage-price cycle that would allow it to exit from the world’s last negative rate regime. (See link)

- Results from today’s BoJ Rinban operations covering 1- to 10-year JGBs showed positive spreads and elevated off-cover ratios. Nevertheless, JGBS moved away from the session’s worst levels.

- Cash US tsys are dealing little changed in today’s Asia-Pac session ahead of US Non-Farm Payrolls later today.

- Cash JGBs are still cheaper, with the 20-year zone as the underperformer (+1.8bps). The benchmark 10-year yield is 0.2bps higher at 0.733% versus the February high of 0.772%.

- The 2-year JGB yield earlier rose to 0.2% for the first time since 2011. It currently sits at 0.197%.

- Swap rates are slightly lower, with swap spreads tighter.

- On Monday, the local calendar sees Q4 F GDP, February Money Stock M2 & M3 and February Machine Tool Orders data.

AUSSIE BONDS: Slightly Richer, Narrow Ranges Ahead Of US Payrolls

ACGBs (YM +2.0 & XM +1.0) are little changed after dealing in relatively narrow ranges in the Sydney session. With the domestic calendar empty, today’s session has been your typical pre-US payrolls session. US Non-Farm Payrolls is due later today.

- Bloomberg consensus sees payrolls growth of 200k for February, but two-month revisions will likely be closely watched. Please find the MNI's Preview here.

- (MNI) The BoC left its overnight rate at 5% and said it’s still too early to consider lowering the policy rate. (See MNI’s BoC Review here)

- Cash US tsys are dealing little changed in today’s Asia-Pac session after yesterday’s bull-steepening. News flow has been light today.

- Cash ACGBs are 1-2bps richer, with the AU-US 10-year yield differential 2bps higher at -9bps.

- Swap rates are 2bps lower.

- Bills strip pricing is flat to +2.

- RBA-dated OIS pricing is flat to 2bps softer across meetings. A cumulative 44bps of easing is priced by year-end.

- The local calendar is empty on Monday.

- TCorp has priced a new A$2.5bn 4.75% 20 Feb-37 benchmark bond via syndication. The final price for the transaction is 90.50bps over the 10-year bond futures contract, equivalent to 79.20bps over the ACGB 3.75% 21 April 2037. Joint lead managers for the transaction are BofA Securities, Deutsche Bank, NAB and Westpac.

NZGBS: Closed Slightly Richer Ahead Of US Payrolls Later Today

NZGBs closed well off session cheaps, 2-3bps richer across benchmarks. With the domestic calendar empty, local participants were content to sit on the sidelines ahead of US Non-Farm Payrolls later today.

- Bloomberg consensus sees payroll growth of 200k for February, but two-month revisions will likely be closely watched. Please find the MNI's Preview here.

- Swap rates closed 5-7bps lower, with implied swaps spreads 3-4bps tighter.

- RBNZ dated OIS pricing closed flat to 4bps softer across meetings, with Feb-25 leading. A cumulative 55bps of easing is priced by year-end.

- Recently released quarterly indicators that feed into Q4 GDP have resulted in BNZ Economics nudging up its estimate to +0.1%. Against strong population growth of 0.6% for the quarter, this would represent another significant contraction in GDP per capita, with the economy experiencing conditions similar to the depths of the GFC on this basis.

- Next week, the local calendar sees Card Spending on Tuesday, Food Prices on Wednesday, Net Migration on Thursday and BusinessNZ Manufacturing PMI on Friday.

- Also, RBNZ Governor, Adrian Orr and Chief Economist, Paul Conway will speak about the February Monetary Policy Statement at separate events over 12-14 March 2024.

FOREX: Strong Regional Equities Keep USD Upside Limited, As NFP Comes Into Focus

The USD index (BBDXY) sits marginally lower in latest dealings, last near 1230.2. We are up from earlier multi week lows at 1229.45.

- Early sentiment appeared as a carry over from US trade on Thursday, with yen strength in focus. USD/JPY got to fresh lows of 147.53, but we sit back near 147.85 now. Moves above 148.00 have drawn selling interest from the market.

- Data was mixed with real household spending comfortably below estimates (-6.3% versus -4.1% forecast and -2.5% prior). The market and BoJ may look through the print to a degree given positive wage growth signals for this year. Current account figures were stronger though.

- AUD/USD tried to break higher in early trade, but ran out of steam above 0.6630. Dips have been supported though and we were last a touch lower at 0.6625. A better regional equity tone in Asia Pac, amid broad based gains, except for onshore China markets, has aided sentiment this afternoon.

- NZD/USD has trailed somewhat, the pair last unchanged near 0.6175. The AUD/NZD cross is challenging the 100-day EMA at 1.0734.

- Recent sharp USD losses may be giving rise to some caution in the market around extending these moves further, particularly with the US NFP print coming up later. Canadian employment data will also cross later.

ASIA EQUITIES: HK Equities Out-Perform, Biotech Recovers After Thursday's Sell Off

Hong Kong and China equities are mixed today with HK markets out-performing. Comments from Powell on Thursday regarding potential rate cuts this year, though not new or unexpected, have contributed to the market's upward momentum.

- Hong Kong equity markets show positive gains today, with biotech names reversing some losses from Thursday, marking a 1.94% increase and emerging as the top-performing sector. The Mainland Property Index is up by 0.50%, the HSTech Index records a 1.00% gain, and the HSI experiences a 1.10% increase. China equities are underperforming the moves higher by HK markets and now trade mixed with the CSI300 down 0.15% while the CSI1000 is up 0.35%

- China Northbound flows were -2.1b yuan on Thursday, with the 5-day average to -2.88b, while the 20-day average sits at 2.31b yuan. While investors pulled $109m from the 2nd largest Chinese focused ETF (iShares MSCI China ETF) on Thursday, the most since Dec 22nd.

- In the property space, China Vanke continues to face pressure as several major insurers seek to protect their privately issues debt over concerns of potential liquidity stress. Chinese property developer Kaisa Group will be in court this morning over a wind-up petition. While Hong Kong's recently scrapping of property curbs have caused a spike in property sales with Henderson Land Development selling 190 of 208 apartments with the units receiving over 7,300 applications meaning they were oversubscribed by 34 times.

- Looking ahead China has CPI & PPI due out on Saturday, while the NPC meeting continues

ASIA PAC EQUITIES: Asian Equities Higher Led by Tech and Financials

Regional Asian equities are higher today and are on track to make it seven straight weeks of gains, tech stocks have been rallying again on dovish signals from the US Fed as well as optimism around the AI space.

- Japan equities are higher today with banking names leading the way, the Topix Bank Index is up 2.60% as strong Japan trade data makes the chances for a rate hike grow. The Topix is up 0.83%, while the Nikkei is trading just below the 40,000 level up 0.88% today. The Yen has surged 1.5% over the past week

- South Korean equities are 0.90% higher today as tech stocks rally following dovish remarks from Powell on Thursday with SK Hynix, Samsung Electronics and Samsung Biologics the top performers, while the Kospi is on track to finish the week up 1.70%.

- Taiwan equities are higher today although well of earlier highs made on the open, the Taiex at one point was 1.83% higher now trading just 0.40% better for the day the top contributor to the move has been TSMC who will be releasing February sales figures shortly.

- Australian equities are higher today following one from US moves on Thursday, the dovish tone for Powell has helped push the market higher. Financials are the top performing sector, with just Commercial & Professional Services stocks in the red, the ASX200 has closed 1% higher.

- Elsewhere in SEA, NZ closed 1% higher, Thailand equities continue to see foreign investors selling with Thursday marking 8 out of 10 days of net outflows although equities are 1% higher today,

OIL: Higher, But Modestly Lower For The Week Amid Mixed Supply/Demand Signals

The active Brent futures (K4) is marginally higher in the first part of Friday dealing. Last near $83.45/bbl, this is 0.55% firmer on end Thursday levels, but little changed versus end levels from last week. We have had a little over 20cent range since the open, as markets await the US NFP print later. For WTI (J4) we were last near $79.50/bbl, up nearly 0.80% for the session so far, but slightly lower for the week.

- To a large extent oil is being buffeted by the weaker USD trend, which has emerged this week and is supportive, against signs of higher non-OPEC supply. The China demand outlook remains uncertain as well.

- The head of China's CNPC stated that the country has entered a period of lower growth for oil. That is, demand will still rise, but at a reduced pace compared to prior (see this BBG link).

- Disruptions from the Keystone pipeline (service the US from Canada) raised supply concerns on Thursday, but the operator said it was only temporarily paused and there was no crude released (BBG).

- Elsewhere, Kuwait Petroleum Corp is swapping cargoes with suppliers in order to avoid sailing via the Red Sea, KPC’s CEO Sheikh Nawaf Al-Sabah said, cited by Bloomberg. Industry consultant FGE stated that Brent can rise to $90/bbl by Q3 (see this BBG link).

- The technical backdrop for Brent looks supportive, with focus on March 1 highs at $84.34/bbl.

GOLD: Slightly Weaker After Another Record High On Thursday

Gold is slightly weaker in the Asia-Pac session, after closing 0.5% higher at $2159.98 on Thursday after pushing to a fresh record high of $2164.78.

- The precious metal was supported by lower US Treasury yields and further weakness for the USD index.

- US tsys rallied through technical resistance early in the NY session after lower-than-expected Unit Labor Costs (0.4% vs. 0.7% est). Weekly jobless claims were largely in line: (216k vs. 217k est) while Continuing Claims rose (1.906M vs. 1.880M est; prior down-revised to 1.898M from 1.905M)). Additional data: Nonfarm Productivity (3.2% vs. 3.1% est); Trade Balance (-$67.4B vs. -$63.5B est).

- No new insight from Fed Chairman Powell on Thursday as he repeated yesterday's policy testimony to Congress.

- Bullion has added more than 6% over the last seven sessions.

- (Bloomberg) The precious metal’s sharp jump “has surprised us in its intensity, and outpaced cues” from foreign exchange and rates markets, said JPMorgan Chase & Co. analysts including Gregory Shearer in a note.

- The next resistance is $2177.6 (Fibonacci projection), according to MNI's technicals team.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/03/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 08/03/2024 | 0700/0800 | ** |  | DE | PPI |

| 08/03/2024 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 08/03/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 08/03/2024 | 0800/0900 | ** |  | ES | Industrial Production |

| 08/03/2024 | 0900/1000 | ** |  | IT | PPI |

| 08/03/2024 | 1000/1100 | *** |  | EU | GDP (final) |

| 08/03/2024 | 1000/1100 | * |  | EU | Employment |

| 08/03/2024 | 1200/0700 |  | US | New York Fed's John Williams | |

| 08/03/2024 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 08/03/2024 | 1330/0830 | *** |  | US | Employment Report |

| 08/03/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/03/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.