-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: USD Index +1% For The Week, As NFP Comes Into View

EXECUTIVE SUMMARY

- ISLAMIC STATE CLAIMS RESPONSIBILITY FOR DEADLY IRAN BLASTS - BBG

- RUSSIA USED NORTH KOREA MISSILES IN UKRAINE ATTACK, US SAYS - BBG

- ST LOUIS FED PICKS ALBERTO MUSALEM AS NEW PRESIDENT - MNI

- MORE BOJ WATCHERS SHIFT HIKE FORECASTS, SEEING JANUARY UNLIKELY - BBG

- N.KOREA FIRES ARTILLEY SHELLS, EVACUATION ORDER FOR S. KOREA ISLAND - AFP

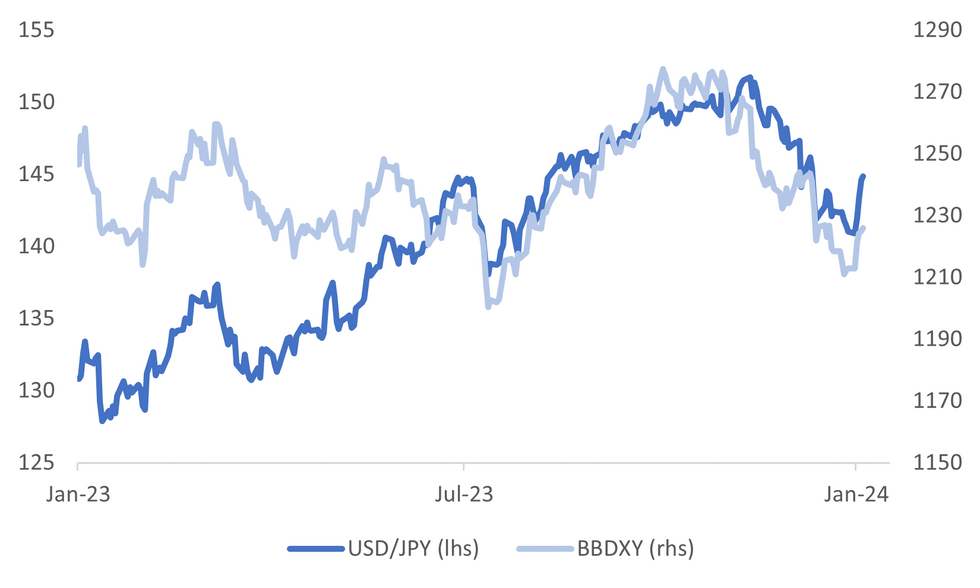

Fig. 1: USD/JPY & BBDXY Index Trends

Source: MNI - Market News/Bloomberg

U.K.

HOUSEHOLDS (BBG): UK households have gained £16 billion ($20.3 billion) from higher interest rates as returns on savings since the Bank of England started tightening policy two years ago more than offset the increased cost of debt, according to the Resolution Foundation.

RETAIL (BBG): One of the wettest Decembers on record could have hit UK retailers as fewer shoppers visited stores in the run-up to Christmas. The number of people going to shops, retail parks and malls fell 5% in the last five weeks of 2023, compared with the same period in 2022, according to the latest footfall data from the British Retail Consortium and Sensormatic IQ.

EUROPE

RUSSIA (BBG): Russia fired missiles provided by North Korea at targets in Ukraine as part of an aerial barrage in recent weeks, according to a recently declassified US intelligence assessment showing Moscow’s growing reliance on other countries to wage its war effort.

EUR (RTRS): The euro, which rose over 3% last year, its first yearly gain since 2020, was expected to capitalise on narrowing interest rate differentials and rise over 2% to trade around $1.12 in 12 months. It was trading at $1.09 on Thursday. Among other major currencies, the Japanese yen, which has dropped about 30% in the past three years, was forecast to gain 6.6% to change hands at around 135/dollar in a year.

U.S.

FED (MNI): The Federal Reserve Bank of St. Louis on Thursday named Evince Asset Management CEO Alberto Musalem to be its next president effective April 2, making him the first Latino to lead the regional Fed bank. He will be a voting member of the FOMC in 2025.

POLITICS (BBG): Donald Trump plans to attend two major court hearings in Washington and New York next week, showing how quickly his packed legal schedule is heating up as the Republican nominating process kicks off.

OTHER

JAPAN (BBG): More Bank of Japan watchers joined those pushing back their predictions for the end of negative rates in the wake of the New Year’s Day earthquake and recent remarks by Governor Kazuo Ueda.

SOUTH KOREA/NORTH KOREA (AFP): South Korea told civilians on Yeonpyeong Island to evacuate after North Korea fired around 200 artillery shells off its west coast, Seoul's defence ministry said Friday.

MIDDLE EAST (BBG): Islamic State claimed responsibility for Wednesday’s attack in Iran that killed scores of people and threatened to further inflame tensions in the Middle East.

BRAZIL (MNI POLICY): Brazil’s central bank is likely to maintain its strategy of reducing interest rates by a steady 50 basis points per meeting despite an apparently dovish rotation among deputy governors on the monetary policy committee, MNI understands.

CHINA

ECONOMY (BBG): A once-thriving corner of China’s commercial real estate market is showing signs of strain, adding to the gloomy outlook for property in the world’s second-largest economy. Vacancy rates for high-end logistics storage in eastern China, once among the safest bets in the country’s battered market, jumped in the fourth quarter, according to Cushman & Wakefield Plc. The rate in Shanghai alone soared to 15% from 9.8% in the third quarter, Cushman’s tally showed.

GROWTH (China Finance 40 Forum) Final consumption and net export will contribute less to GDP growth in 2024 than 2023, and will require double-digit growth in infrastructure investment to help achieve a 5% GDP, said Yu Yongding, an academic at the Chinese Academy of Social Sciences. Macro policy should aim to raise the fiscal deficit ratio significantly and increase the scale of China Government Bond issuance to provide sufficient funds for infrastructure construction, said Yu.

DEPOSIT RATES (YICAI): Banks will likely continue to lower the deposit rates to offset the squeeze on asset-side pricing caused by reductions in existing mortgage rates and resolving local-government implicit debts, said Wang Yifeng, chief banking analyst at Everbright Securities. The latest round of deposit interest-rate cuts will have limited impact on bank liability costs in 2024 and the upper limit of deposit rate self-discipline may be lowered in Q1, Wang said.

HOUSING (YICAI): First-tier cities still have considerable room to relax housing policies including purchase restrictions and loan limits, and new home sales will continue to increase steadily in 2024 with increasing high-quality housing supply providing some support, according to the China Index Academy.

REGULATION (SECURITIES TIMES): Chinese local governments’ finance sector regulators will shift its focus from “development” to “supervision” in its upcoming overhaul, Securities Times reported Friday, citing local officials it didn’t name.

MARKETS (SECURITIES TIMES): China’s listed companies will only be able to answer investor questions on online platforms during non-trading hours, Securities Times reported.

CHINA MARKETS

MNI: PBOC Drains Net CNY411 Bln Via OMO Fri; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY75 billion via 7-day reverse repo on Friday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY411 billion reverse repos after offsetting CNY486 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8000% at 09:26 am local time from the close of 1.7671% on Thursday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 54 on Thursday, compared with the close of 47 on Wednesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Higher At 7.1029 Friday vs 7.0997 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1029 on Friday, compared with 7.0997 set on Thursday. The fixing was estimated at 7.1589 by Bloomberg survey today.

MARKET DATA

JAPAN DEC MONETARY BASE Y/Y 7.8%; PRIOR 8.9%

JAPAN JIBUN DEC PMI SERVICES 51.5; PRIOR 52.0

JAPAN JIBUN DEC PMI COMPOSITE 50.0; PRIOR 50.4

JAPAN DEC CONSUMER CONFIDENCE INDEX 37.2; MEDIAN 36.5; PRIOR 36.1

MARKETS

US TSYS: Cash Bonds Little Changed Ahead Of NFP Data

TYH4 is trading at 111-29+, -0-02 from NY closing levels.

- Cash US tsys are dealing little changed in today's Asia-Pac session, ahead of the release of Non-Farm Payrolls data later today.

- Bloomberg consensus sees nonfarm payrolls growth of 171k in December after November’s 199k was boosted by 38k workers returning from strikes. See MNI's NFP Preview here.

JGBS: Little Changed Ahead Of US Payrolls, Holiday On Monday, Tokyo CPI On Tuesday

JGB futures have pared overnight weakness back to an uptick of +4 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Monetary Base and Jibun Bank Services & Composite PMI data. Consumer confidence is due later but is unlikely to be a market mover.

- Accordingly, local participants appear to have been content to fade overnight US tsy-induced weakness through the local session ahead of tonight’s release of US Non-Farm Payrolls.

- Bloomberg consensus sees nonfarm payrolls growth of 171k in December after November’s 199k was boosted by 38k workers returning from strikes. See MNI's NFP Preview here.

- Bloomberg reported that more BoJ watchers joined those pushing back their predictions for the end of negative rates in the wake of the New Year’s Day earthquake and recent remarks by Governor Kazuo Ueda. (See link)

- Cash US tsys are dealing little changed in today’s Asia-Pac session.

- Cash JGBs are dealing slightly mixed across the curve. The benchmark 10-year yield is 0.5bp lower at 0.610% versus the Nov-Dec rally low of 0.555%.

- Swap rates are richer across maturities, with rates 1-2bps lower. Swap spreads are tighter out to the 30-year and wider beyond.

- Next week sees a public holiday on Monday followed by Tokyo CPI on Tuesday.

AUSSIE BONDS: Cheaper, Waiting For Payrolls, CPI Monthly Next Wednesday

ACGBs (YM -5.0 & XM -6.0) remain cheaper after dealing in relatively tight ranges in today’s Sydney session. With the local calendar empty, local participants have held the negative overnight lead in from US tsys ahead of Non-Farm Payrolls later today.

- Bloomberg consensus sees nonfarm payrolls growth of 171k in December after November’s 199k was boosted by 38k workers returning from strikes. See MNI's NFP Preview here.

- Cash US tsys are dealing little changed in today’s Asia-Pac session after yesterday’s 5-8bps cheapening.

- Cash ACGBs are 5-6bps cheaper, with the AU-US 10-year yield differential 1bp tighter at +11bps.

- Swap rates are 6bps higher, with the 3s10s curve unchanged.

- The bills strip is cheaper, with pricing -2 to -7.

- RBA-dated OIS pricing is 3-6bps firmer for meetings beyond May.

- Following the Australian Government’s release of the Mid-Year Economic and Fiscal Outlook (MYEFO) in December 2023, the AOFM announced today that Treasury Bond issuance for 2023-24 is planned to be around $50 billion (of which $23.6 billion has been completed).

- Next week the local calendar heats up with the release of Retail Sales and Building Approvals on Tuesday, and Job Vacancies and November’s CPI Monthly on Wednesday.

NZGBS: Bear-Steepening To End The Week, US Payrolls Watch

NZGBs have bear-steepened into the close, with yields flat to 6bps higher. All benchmarks closed mid-range, with trading ranges relatively narrow in a data-light session. Local participants appear to have been content to take their directional lead from US tsys ahead of the release of US Non-Farm Payrolls data later today.

- Bloomberg consensus sees nonfarm payrolls growth of 171k in December after November’s 199k was boosted by 38k workers returning from strikes. See MNI's NFP Preview here.

- Cash US tsys are dealing little changed in today’s Asia-Pac session after yesterday’s 5-8bps cheapening.

- Swap rates are 5-8bps higher, with implied swap spreads wider.

- RBNZ dated OIS pricing is 2-9bps firmer across meetings beyond February. The cumulative easing by November 2024 has been scaled back to below 100bps (96bps).

- Next week, the local calendar is relatively light again, with House Prices, Commodity Prices and Building Permits as the highlights.

FOREX: Dollar Index +1% For The Week, As NFP Comes Into View

Dips in the USD have generally been supported in the part of Friday trade. The BBDXY sits near session highs in recent dealings, last just above 1225.85.

- At this stage the USD index is over 1% higher for the week, its best gain since July. Of course, we still have the US NFP report to navigate later. Recent highs in the index have run out of steam above 1226.

- USD/JPY is leading the move higher, threatening to test above 145.00 (last 1244.90/95). US Tsy futures remain close to Thursday lows, but haven't broken to the downside yet. Data on Dec PMI revisions hasn't moved sentiment.

- AUD and NZD are down by less at this stage. AUD/USD is near 0.6700 in latest dealings, which is close to Thursday lows. NZD/USD is just under 0.6230, also close to Thursday lows.

- Looking ahead, highlights will be Eurozone inflation figures and the US employment report. Additionally, German retail sales, UK construction PMI and Canada jobs data are all scheduled.

EQUITIES: Japan Shares Outperform, Volatile Start For HK/China Shares

Regional equities are mixed as the US NFP comes into view. Japan markets are among the best performers, while Hong Kong and China markets have been volatile through the first part of trade. US equity futures tried to go higher in the first part of trade, but there was no follow through. Eminis last tracked at 4734, +0.10%, while Nasdaq futures are around 0.06% higher.

- Japan indices are seeing broad based gains, the Topix +0.80% and the Nikkei 225 up by nearly the same. The yen trend remains weaker, while BBG noted sell-side analysts are reducing the likelihood of an end to negative rates.

- Hong Kong and China bourses opened lower before recovering sharply. At the break, the HSI is off -0.14% (we were down by 1% at the lows), while the CSI 300 is marginally firmer (+0.17%).

- BBG noted this morning the attractive valuation of local equities relative to local bond yields, so this may have helped at the margin. Data related stocks have risen in China after the government encouraged investment and IPOs in the sector (BBG).

- South Korea's Kospi is weaker but up from session lows, the index last -0.30%. Headlines crossed earlier that the South Korean military ordered the evacuation of the island of Yeonpyeong, which is near the broader with North Korea (RTRS).

- In SEA, outside of weaker Thailand stocks (-0.35%), markets are firmer.

OIL: Holding +1% Higher For The Week

Brent crude has tracked tight ranges for the first part of Friday trade. We were near $77.85/bbl for the front month contract, slightly above Thursday closing levels. At this stage, we are tracking higher for the week, with a gain of just over 1%. The WTI front month benchmark is also higher for the week (+1.3%) and last tracking at $72.60/bbl.

- Pressure came on Thursday from large US product builds, while strong non-OPEC production is also evident. This is outweighing support from a larger than expected draw in US crude stocks and continued disruption in the MENA region.

- Oil prices are not reacting much to Red Sea escalations and geopolitical tensions because fundamentals are softer for crude right now according to Energy Aspects Director Amrita Sen.

- Brent crude remains broadly within recent ranges, with lows year to date coming around $75//bbl, but hasn't been able to break back above $80/bbl on the topside. Still a gain this week is impressive for the week given the strong USD rebound.

GOLD: Heading For A Weekly Drop Ahead Of US Payrolls Data

Gold is slightly higher in the Asia-Pac session, after closing 0.1% higher at $2043.65 on Thursday.

- Bullion is poised for its first weekly drop in a month on increasing signs the Federal Reserve will be slower to start easing policy than was anticipated at the end of last year.

- On Thursday, US Treasuries continued their recent cheapening trend, fueled by a rethink of aggressive rate hike bets, stronger data, profit-taking, and supply.

- Cash US Treasuries finished 5-8bps cheaper, with the curve steeper, following higher-than-expected ADP Employment Change data (164k vs 125k est) and lower-than-expected Initial Jobless Claims (202k vs. 216k est). The market now awaits Non-Farm Payrolls data later today.

- According to MNI’s technicals team, moving average studies are still in a bull-mode position despite the weakness seen this week. Key support lies at $1973.2, the Dec 13 low.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/01/2024 | 0700/0800 | ** |  | DE | Retail Sales |

| 05/01/2024 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/01/2024 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 05/01/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 05/01/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/01/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 05/01/2024 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 05/01/2024 | 1330/0830 | *** |  | US | Employment Report |

| 05/01/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 05/01/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/01/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 05/01/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 05/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 05/01/2024 | 1830/1330 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.