-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD Strength Prompts Record Yuan Fixing Support

EXECUTIVE SUMMARY

- ‘CONCERNING’ CPI PUSHES BACK CUTS - FED’S KASHKARI - MNI BRIEF

- FED CUTS ARE NOW A MATTER OF IF, NOT JUST WHEN - WSJ

- US SEES IMMINENT MISSILE STRIKE ON ISRAEL BY IRAN, PROXIES - BBG

- OCT PRICE REVISIONS KEY TO FURTHER RATE HIKES - MNI BOJ POLICY

- CHINA MARCH CPI LOWER THAN MARKET EXPECTATION - MNI BRIEF

- CHINA RAMPS UP YUAN SUPPORT AS FIXING TOP ESTIMATES BY RECORD - BBG

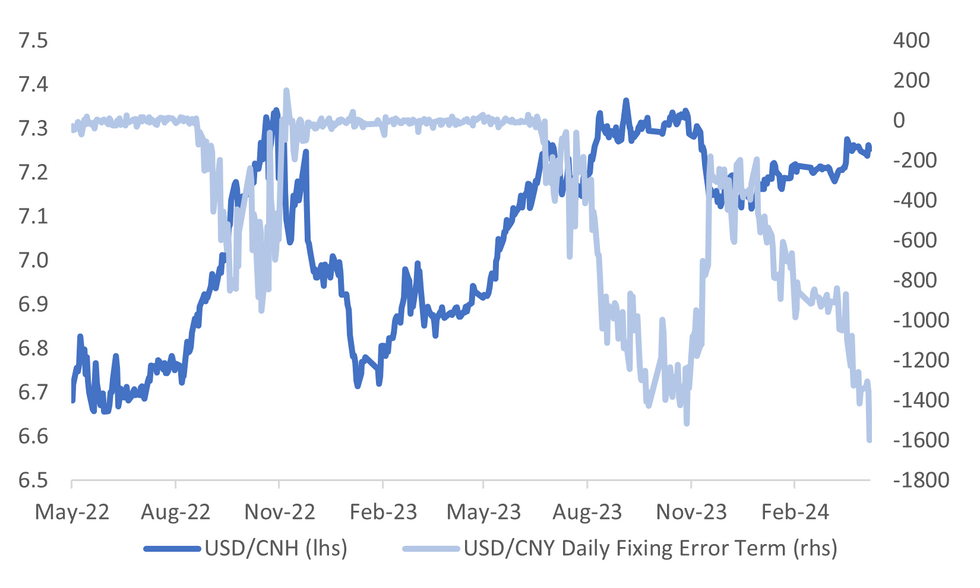

Fig. 1: USD/CNH & USD/CNY Fixing Error (USD/CNY Fixing Outcome Less Bloomberg Consensus)

Source: MNI - Market News/Bloomberg

U.K.

PROPERTY (BBG): UK property surveyors are the most optimistic they’ve been in 13 months about new buyer demand after falling mortgage rates and a rosier economic picture helped stabilize house prices.

BOE (FT): Bank of England policymaker Megan Greene says rate cuts in the UK “should still be a way off,” according to her article in the Financial Times. Says there has been encouraging news on UK wage growth and services inflation in recent months.

EUROPE

GERMANY (BBG): Levels of stress at German companies hit the highest level in almost four years, as Europe’s biggest economy faces a sustained period of slower growth.

EU (WPT): The European Parliament on Wednesday voted in favor of a major migration deal, bringing the landmark legislation close to approval as Europe's political center tries to fend off an ascendant far right ahead of key elections.

RUSSIA/UKRAINE (RTRS): Ukrainian authorities reported blasts in the country's northeastern, southern and western regions on Thursday morning, during a fresh wave of Russian missile strikes which Kyiv said damaged its power grid facilities.

U.S.

FED (MNI BRIEF): Minneapolis Fed President Neel Kashkari said Wednesday the "concerning" CPI inflation report means the central bank will likely have to wait longer before reducing interest rates.

FED (WSJ): Another firmer-than-anticipated inflation report delivered a meaningful setback Wednesday to the Federal Reserve's hope that it could buoy prospects of a so-called soft landing by dialing back some of the past year's interest-rate increases.

FED (MNI): Federal Reserve officials favor reducing the pace of QT by roughly half "fairly soon" while keeping interest rates on hold until they've gained more confidence that inflation was continuing to fall toward 2%, according to the minutes of the March FOMC meeting published Wednesday.

INFLATION (MNI INTERVIEW): The Federal Reserve will be even less inclined to cut interest rates soon after the latest inflation data showed a third month of firmer-than-expected readings that included broad-based gains, former Fed board economist Steven Kamin told MNI.

ISRAEL (BBG): The US and its allies believe major missile or drone strikes by Iran or its proxies against military and government targets in Israel are imminent, in what would mark a significant widening of the six-month-old conflict, according to people familiar with the intelligence.

OTHER

MIDEAST (RTRS): Three sons of Hamas leader Ismail Haniyeh were killed in an Israeli airstrike in the Gaza Strip on Wednesday, the Palestinian Islamist group and Haniyeh's family said.The Israeli military confirmed carrying out the attack, describing the three sons as operatives in the Hamas armed wing.

US/JAPAN (RTRS): U.S. President Joe Biden and Japanese Prime Minister Fumio Kishida on Wednesday unveiled plans for military cooperation and projects ranging from missiles to moon landings, strengthening their alliance with an eye on countering China and Russia.

JAPAN (MNI POLICY): Corporate goods and services price revisions made available around October and following the publication of revised wage-hike data at smaller firms will fuel chances of a Bank of Japan rate hike later in the year, MNI understands.

JAPAN (BBG): Japan’s top currency officials warned that authorities will consider all their options for the foreign exchange market and are ready to respond to any event after the yen fell to its lowest level versus the dollar since 1990.

CANADA (MNI INTERVIEW): Canada's central bank has room to start a series of interest-rate reductions beginning in June as inflation settles down and tight monetary conditions threaten an economic soft landing, former BOC adviser Steve Ambler told MNI.

SOUTH KOREA (RTRS): South Korea's liberal opposition parties scored a landslide victory in a parliamentary election held on Wednesday, dealing a resounding blow to President Yoon Suk Yeol and his conservative party but falling just short of a super majority.

CHINA

YUAN (BBG): China signaled continued support for its currency as broad strength in the dollar kept the yuan close to a policy no-go area.

CPI (MNI BRIEF): China's Consumer Price Index ran behind market expectation, gaining 0.1% y/y in March, lower than the previous 0.7% y/y increase and underperforming the market consensus of 0.4%, data from the National Bureau of Statistics showed Thursday.

PROPERTY (ECONOMIC OBSERVER): Many Chinese cities have conducted targeted easing of rules for their home markets recently, the Economic Observer reported, citing announcements by local governments.

IPOs (ECONOMIC INFORMATION DAILY): The pace of Chinese companies’ initial public offerings (IPOs) slowed in the first quarter as the securities regulator strengthened checks of companies planning listing, the Economic Information Daily reports.

CHINA MARKETS

MNI: PBOC Injects Net CNY2 Bln Via OMO Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repo on Thursday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY2 billion as no reverse repo matures today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8057% at 09:43 am local time from the close of 1.8388% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 45 on Wednesday, compared with the close of 43 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.0968 on Thursday, compared with 7.0959 set on Wednesday. The fixing was estimated at 7.2565 by Bloomberg survey today.

MARKET DATA

AUSTRALIA MAR CBA HOUSEHOLD SPENDING Y/Y 3.4%; PRIOR 3.4%

AUSTRALIA MAR CBA HOUSEHOLD SPENDING M/M 0.2%; PRIOR -0.4%

AUSTRALIA APR CONSUMER INFLATION EXPECTATION 4.6%; PRIOR 4.3%

JAPAN MONEY STOCK M3 Y/Y 1.8%; PRIOR 1.8%

JAPAN MAR TOKYO AVG OFFICE VACANCIES 5.47%; PRIOR 5.86%

CHINA MAR CPI Y/Y 0.1%; MEDIAN 0.4%; PRIOR 0.7%

CHINA MAR PPI Y/Y -2.8%; MEDIAN -2.8%; PRIOR -2.7%

SOUTH KOREA MAR BANK LENDING TO HOUSEHOLDS KR1098.6t; PRIOR 1100.2t

MARKETS

US TSYS: Treasury Futures Edge Higher, PPI & Jobless Claims Later

- Jun'24 10Y futures have been trading in tight ranges throughout the Asian session and now trade just off intraday highs of 108-13, at 108-11+ for a gain of +05 since NY closing levels, earlier there was a Block buyer of the contract at 108-11+. 5Y futures trade up +03 at 105-10.25, just off earlier highs of 105-11.75.

- Looking at technical levels: Initial support lays at 108-06+ (2.236 proj of Dec 27 - Jan 19 - Feb 1 price swing), below here 108-05+ (Apr 10 lows) and 108-00 (round number support). While to the upside resistance holds at 109-26+ (Apr 10 high), a break back above here would open up 110-06 (Apr 4 high)

- The Cash Treasury curve has bull-steepened throughout the day with the 2Y yield now -1.9bps at 4.955%, 10Y -0.6bps to 4.538%, while the 2y10y +1.253 at -41.911.

- Cross Market - The Japanese 10Y yield has just hit its highest levels since November, with yields 2-8bps higher, ACGBs are 11-15bps higher, while NZGBs are 11-14bps higher

- Looking Ahead: PPI, Jobless Claims & Fed Speak later today.

JGBS: Futures Below March Lows, 20Y Auction Showed Mixed Results, 2YY Highest Since 2009

JGB futures are sharply weaker, -68 compared to settlement levels, and at session lows after today’s 20-year supply delivered mixed demand metrics. Today’s result was disappointing, particularly after April’s 10- and 30-year JGB supply set a positive tone for a market that had been under pressure since mid-December due to anticipated policy tightening by the BoJ.

- The 20-year yield is dealing 3bps cheaper at 1.662% in post-auction trade and less than 10bps below the cycle high set in October.

- Today’s data drop failed to be market-moving.

- According to MNI’s technicals team, a stronger reversal higher is required to signal the end of the recent corrective phase. The bull trigger has been defined at 147.74, the mid-January high. A break would resume the uptrend. Moving average studies remain in a bull-mode set-up, highlighting an uptrend.

- Cash JGBs are sharply cheaper, with the 20-40-year zone underperforming (around 9bps cheaper). The benchmark 10-year yield is 5.6bps higher at 0.862%, a fresh YTD high. The 2-year yield reached 0.272%, the highest level since 2009.

- The swaps curve has bear-steepened, with rates flat to 9bps higher. Swap spreads are mixed.

- Tomorrow, the local calendar sees Industrial Production and Capacity Utilisation data alongside BoJ Rinban operations covering 1- to 10-year JGBs.

AUSSIE BONDS: Dealing At Session Lows, Sharply Cheaper Ahead Of US PPI & Claims Data

ACGBs (YM -15.0 & XM -13.0) have extended overnight weakness and are hovering just above the lows seen during the Sydney session. Despite a relatively light domestic calendar, today's pronounced cheapening reflects the ongoing impact of yesterday's US CPI data. This trend persists despite the slight bull-steepening observed in the US yield curve during today's Asia-Pacific session. Cash US tsys are dealing flat to 3bps richer, ahead of today’s PPI and Claims data.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Household Spending and Consumer Inflation Expectations data.

- Cash ACGBs are 13-14bps cheaper, with the AU-US 10-year yield differential 4bps lower at -28bps, marking the lower end of its trading range since late 2022.

- Swap rates are 13-14bps higher, with EFPs mixed.

- The bills strip has bear-steepened, with pricing -3 to -17.

- RBA-dated OIS pricing is 9-13bps firmer for meetings beyond September. A cumulative 24bps of easing is priced by year-end.

- (AFR) Higher US inflation has dashed hopes of a local interest rate cut this year, as economists warn that borrowing costs may need to go higher to offset a “dangerous” policy cocktail of stimulus from green industrial subsidies and income tax cuts. (See link)

- Tomorrow, the local calendar is empty.

NZGBS: Closed Sharply Cheaper But Off The Worst Levels, US PPI & Claims Data Later Today

NZGBs closed sharply cheaper, with benchmark yields 13-14bps higher, despite a slight paring of losses late in the session. With the domestic data calendar empty, the move away from session cheaps likely reflected the slight bull-steepening observed in the US cash curve during today's Asia-Pacific session. Cash US tsys are dealing flat to 3bps richer.

- Today’s weekly supply saw mixed demand metrics, with cover ratios ranging from 1.8x (Apr-29) to 3.2x (May-32).

- (Bloomberg) NZ household debt-servicing costs neared a six-year high as interest rates climbed last year, adding to strains on consumer spending. Interest payments increased to 8.4% of household disposable income in the 12 months through December, Statistics New Zealand said. That’s up from 7.9% in the year ended September and is the highest since March 2018. (See link)

- Swap rates closed 14-17bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is 1-14bps firmer across meetings, with late-24/early-25 leading. A cumulative 45bps of easing is priced by year-end.

- Tomorrow, the local calendar will see BusinessNZ Manufacturing PMI, Card Spending and Food Prices data.

- The US calendar will see PPI, Jobless Claims & Fed Speak later today.

FOREX: Intervention Risks See USD/JPY Pullback, But Little Follow Through

The USD sits modestly lower against the G10 currencies, with JPY and NZD the strongest performers. At this stage though currencies have only pared a fraction of the losses seen post the US CPI print on Wednesday. US yields are off Wednesday highs, while US equity futures have recovered from earlier lows, likely weighing on the USD.

- Yen sentiment was aided in the first part of trade amid a fresh round of verbal jawboning from currency chief Kanda. The comments didn't appear to be a step up from what we have heard recently though. USD/JPY fell back through 153.00 and got to lows of 152.76, but we sit higher now, last near 152.90, only 0.15% firmer in yen terms versus end NY levels from Wednesday.

- USD/JPY overnight vols are elevated at +14.5%, but we remain sub earlier 2024 intra-session highs. A firmer JGB yield backdrop, aided by a poor 20yr auction, has helped move US-JP yield differentials off post US CPI highs, a further yen support.

- NZD/USD sits modestly higher, last above 0.5985. AUD/USD was also a touch higher, last near 0.6520. We have mainly had second tier data releases in Australia, although inflation expectations did tick higher.

- The much stronger than expected CNY fixing, coupled with lower USD/CNH levels has likely aided A$ and NZD sentiment at the margins.

- There was also some concern around Iranian related military action against Israel, but that hasn't materialised so far. This may have supported some stabilization in US equity futures.

- Looking ahead, we have the ECB decision as the main focus point in the EU session. In US trade, Fed speak, the PPI and initial jobless claims will be in focus.

ASIA EQUITIES: HK & China Equities Mixed, Off Morning Lows, China CPI Slows

Hong Kong and China equity markets have followed US Indices lower after stronger than expected US CPI overnight, although markets are off their morning lows. China Mainland equities are out-performing Hong Kong equities after the past few days of underperformance. Investors are now signaling the Federal Reserve will cut interest rates just twice this year, starting in September, less than the most recent Federal Reserve dot plot that indicated three 2024 cuts. At the start of the year, market pricing indicated six cuts were expected. Elsewhere, China Vanke has been downgraded to Junk, Fitch cut China's outlook to negative, China's market watchdog to crack down on fraudulent issuances while China CPI falls to 0.1% y/y in March.

- Hong Kong equities are lower today, the HSTech Index is down 1.30%, while the Mainland Property Index is off 1.15%, the HSI failed to break above March 3 highs and just shy of testing the 200-day EMA on Wednesday, and is now down 0.76% for the day. China equities are faring slightly better today, with the CSI300 unchanged, while the small cap CSI1000 is up 0.72% and the growth focused ChiNext is off 0.37%

- China Northbound flows were 4.1billion yuan on Wednesday, with the 5-day average at -2billion, while the 20-day average sits at 1.32billion yuan.

- In the property space, S&P Global Ratings downgraded China Vanke to junk status due to a cash crunch and investor scrutiny, with Moody's and Fitch also recently lowering its credit rating. Despite having enough liquidity to address this year's debt maturities, weakening property sales and margins threaten its competitiveness, and its longer-term financial position may deteriorate if planned asset sales falter. China Vanke Stocks and Bonds continued to decline after news emerged that a regional manager in Jinan is assisting in an investigation for "personal reasons," causing the stock to close at its lowest level since May 2014. This follows recent allegations of money laundering and tax evasion made against the company and its chairman.

- (Bloomberg) Fitch Cuts China Outlook to Negative on Steady Rise in Debt (See link)

- (Bloomberg) China Market Watchdog Vows to Crack Down on Fraudulent Issuances (see link)

- (Bloomberg) Chinese Cities Further Ease Home-Buying Policies, Newspaper Says (see link)

- Earlier, China's consumer prices saw slower growth in March, rising by 0.1% year-on-year, attributed to declines in food and travel costs, which widened deflation concerns after a brief respite in February. Despite an expected rise, food prices dropped by 2.7%, while non-food prices increased by 0.7%, with the core CPI slowing to 0.6% growth. Additionally, the producer-price index fell 2.8% year-on-year, in line with economist expectations, continuing an 18-month streak of deflation.

- Looking ahead, Trade Balance data is due out on Friday

ASIA PAC EQUITIES: Asian Equities Off Morning Lows, Yen Eyes 153.00

Regional Asian equities fell after higher-than-expected US inflation data supported the view the Federal Reserve may keep interest rates higher for longer, although most markets are well off their opening lows. The USD/JPY has weakened, reaching a high of 153.24 on Wednesday post US CPI and trades just below the 153.00 level at 152.93 while global yields have surged higher. South Korea has returned from their break yesterday with SK President suffering a defeat in parliamentary elections, while Taiwan exports surged in March.

- Japan equities have fallen for a second day, after US inflation data supported the view the Federal Reserve may keep interest rates higher for longer, which dampened investors’ sentiment for riskier assets. JGBs yields are near or have made new highs, while the yen rebounded slightly after weakening to levels not seen since 1990 against the dollar, investors are likely to take a cautious stance as the weakening has sparked fresh speculation Japanese authorities might step into the market to support the currency. The Japanese Finance Minister Suzuki spoke earlier where he emphasized the importance of stable FX movements reflecting fundamentals, although he refrained from commenting on daily FX fluctuations. The Nikkei 225 is down 0.55% at 39,365, while the Topix is now unchanged

- South Korean has returned from their break on Wednesday where SK President Yoon Suk Yeol has suffered a major defeat in parliamentary elections, reducing his legislative influence and facing increased opposition to his agenda. The Kospi is now unchanged for the day after opening 1.60% lower, as investors view the impact of the election results will be short-lived.

- Taiwan's exports experienced a significant surge in March, with shipments of computer hardware, particularly those supporting the global AI industry, skyrocketing by over 400% in March. This propelled overall exports to $41.8 billion, marking the fastest growth rate in two years. While semiconductors, the largest export category, saw a decline, other tech-related products thrived. Import growth, particularly in aircraft purchases, unexpectedly rose by 7.1%, contrary to economist forecasts for a contraction. The Taiex is down just 0.30%

- Australian equities are lower today, down 0.35%. Real Estate and Consumer Discretionary stocks are the worst performing sectors. The ASX200 briefly traded below the 20-day EMA however this was quickly met with buyers.

- Elsewhere in SEA, New Zealand equities are down 0.60%, a few markets have returned from their breaks with Singapore down 0.40%, Philippines down 0.80%, Thailand equities are also down 0.63%.

OIL: Firms As Middle East Conflict Concerns Outweigh Higher USD/US Inventory Build

Brent crude sits just off session highs in recent dealings, last near $90.75/bbl. This is close to 0.30% stronger versus end Wednesday levels in NY (Wednesday gains were +1.19%). WTI is above $86.45/bbl, having followed a similar trajectory so far in Thursday trade.

- Sentiment remains on edge amid fears of a strike on Israel from Iran or a proxy. In US trade on Wednesday, per Bloomberg, the US and its allies believe that "major missile or drone strikes by Iran or its proxies against military and government targets in Israel are imminent," in retaliation for an Israeli airstrike on an Iranian diplomatic compound in Damascus on April 1.

- Earlier headlines also crossed that Iran was closing down its airspace due to military drills, also this was later removed and denied by local new agencies.

- Risks of an escalation in the Middle East conflict outweighed a higher yield backdrop, firmer USD (post the stronger than expected CPI) and also rising US crude stockpiles, which was reported on Wednesday.

- A bull theme in WTI futures remains intact and the next objective is $89.08, a Fibonacci projection. If cleared, this would pave the way for a climb towards the $90.00 handle further out. On the downside, initial firm support to watch lies at $83.03, the 20-day EMA.

GOLD: Rebounds After Yesterday’s US CPI-Induced Dip

Gold is 0.4% higher in the Asia-Pac session, after closing 0.8% lower at $2334.04 on Thursday. Yesterday's move came after stronger-than-expected US CPI data, fuelled a further scaling back of the US Federal Reserve rate cuts, and prompted a large sell-off in US tsys. Iranian missile threat headlines had a fleeting positive impact.

- CPI inflation: m/m (0.4% vs. 0.3% est), y/y (3.5% vs. 3.4% est); CPI Ex Food and Energy m/m (0.4% vs. 0.3% est), y/y (3.8% vs. 3.7% est).

- US Treasuries bear-flattened, with the 2-year yield finishing 23bps higher at 4.97%. The US 10-year yield increased 18bps to 4.54%, a fresh YTD high, and more than 70bps above January levels.

- The March FOMC Minutes reflected concerns that inflation’s progress toward its 2 per cent target might have stalled, and restrictive monetary policy may need to be maintained for longer than anticipated.

- The market now has around 40bps of Fed easing priced for this year, well below the 75bps median projection by policymakers at the March FOMC. The first 25bp rate cut has been pushed back to November, from July ahead of the inflation data.

- According to MNI’s technicals team, the trend condition in gold remains bullish and the next objective is $2376.5, a Fibonacci projection. Initial firm support is at $2234.8, the 20-day EMA.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2024 | 0600/0800 | ** |  | NO | Norway GDP |

| 11/04/2024 | 0800/1000 | * |  | IT | Industrial Production |

| 11/04/2024 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 11/04/2024 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 11/04/2024 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 11/04/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 11/04/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/04/2024 | 1230/0830 | *** |  | US | PPI |

| 11/04/2024 | 1245/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 11/04/2024 | 1245/0845 |  | US | New York Fed's John Williams | |

| 11/04/2024 | 1400/1000 |  | US | Richmond Fed's Tom Barkin | |

| 11/04/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/04/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/04/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/04/2024 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 11/04/2024 | 1600/1200 |  | US | Boston Fed's Susan Collins | |

| 11/04/2024 | 1630/1730 |  | UK | BOE's Greene at Delphi Economic Forum on Greece | |

| 11/04/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.