-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

MNI EUROPEAN OPEN: USD/US Yields Slip From Recent Highs

EXECUTIVE SUMMARY

- FED’S LOGAN SAYS ‘MORE WORK’ MIGHT BE NEEDED ON RATES - MNI

- WILLIAMS SAYS R-STAR HASN’T CHANGED MUCH - MNI BRIEF

- CHINA EYES MORE PROPERTY RULE RELAXATIONS IF SALES SOFT - MNI

- CHINA TO INTERNATIONALISE YUAN AT STEADY PACE - MNI

- JAPAN Q2 GDP Revised LOWER ON WEAKER CAPEX - MNI BRIEF

- JAPAN JULY REAL WAGE DROP WIDENS TO -2.5% - MNI BRIEF

- AUSTRALIA LNG WORKERS TO BEGINB STRIKES FRIDAY AT CHEVRON SITES - BBG

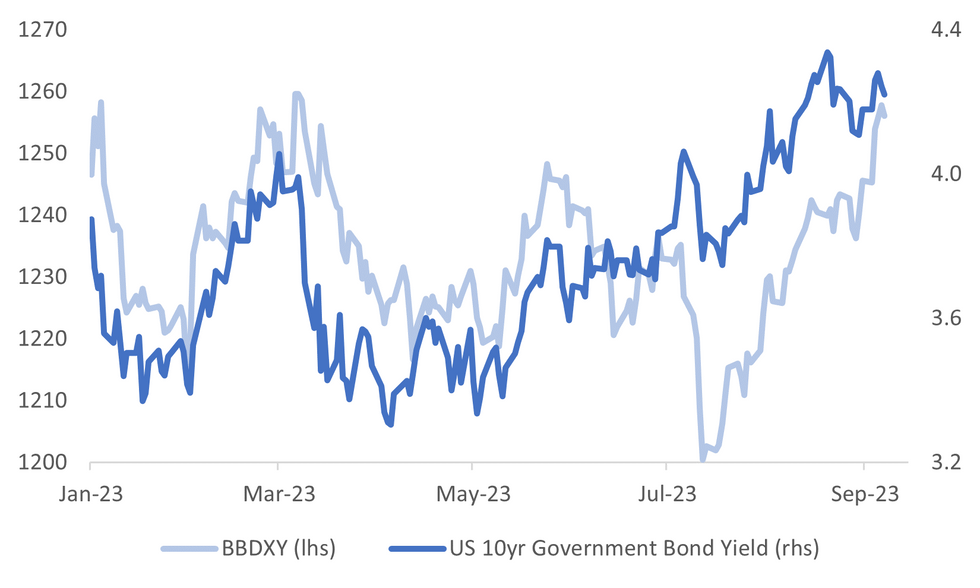

Fig. 1: US Nominal 10-year Government Bond Yield & BBDXY Index

Source: MNI - Market News/Bloomberg

U.K.

JOBS: Britain’s red-hot jobs market showed further signs of loosening in August as demand for staff fell at the fastest pace in more than three years and the number of people looking for work increased. The Recruitment and Employment Confederation’s measure of permanent staff placements dropped to 38.9, a reading below the threshold of 50 that indicates a decline. It was the 11th consecutive drop and the steepest since June 2020 during the pandemic. (BBG)

U.S.

FED: The Federal Reserve could well need to tighten monetary policy further in order to bring U.S. inflation sustainably back to the central bank’s 2% target, although policymakers can now afford to proceed more cautiously, Dallas Fed President Lorie Logan said Thursday. (MNI)

FED: New York Fed President John Williams said Thursday the post-pandemic economy will be close to the pre-pandemic economy and it appears that the long-run neutral interest rate hasn't changed much. (MNI)

APPLE: Apple Inc. is looking to stave off a crisis in China just days before the launch of its next iPhone, an already high-stakes event that will test whether new features can shake the smartphone industry out of the doldrums. The product unveiling, set to stream globally from the company’s headquarters on Tuesday, risks being overshadowed by multiple controversies in China — Apple’s largest international market. The tech titan is contending with a growing ban on iPhone use among government workers, and a contentious new phone from China’s Huawei Technologies Co. is providing homegrown competition. (BBG)

OTHER

JAPAN: Japan's economy grew at 1.2% q/q, or an annualised 4.8%, a slower pace than the initial 1.5% q/q, or 6.0% annualised, Q2 estimate, second preliminary data released by the Cabinet Office Friday showed. Lower capital investment, which fell 1.0% q/q - revised down from 0.0% - drove the revision. The negative contribution from capital investments was revised to -0.2 pp from 0.0. (MNI)

JAPAN: The y/y drop of inflation-adjusted real wages, a barometer of household purchasing power, widened to 2.5% in July from a 1.6% fall in June as the consumer price index rise remained high, data released by the Ministry of Internal Affairs and Communications on Friday showed. (MNI)

AUSTRALIA: Liquefied natural gas workers at key Chevron Corp. sites in Australia will begin partial strike action Friday after talks failed to reach an agreement in a dispute that’s roiled the sector. Talks between Chevron and the unions ended without agreement, the producer company said in a statement. Chevron said it was advised that industrial action will begin on Friday at the Gorgon and Wheatstone facilities, which accounted for about 7% of global LNG supply in 2022. (BBG)

THAILAND: Thailand's economy may grow as forecast this year, helped by public consumption and investment after the formation of a new government, Deputy Finance Minister Krisada Chinavicharana said on Friday. Private consumption and tourism recovery are also helping, he told a business event. The ministry has forecast economic growth of 3.5% this year. (RTRS)

CZECH: The Czech central bank won’t make a rash decision to start cutting interest rates as there is still a number of uncertainties about inflation outlook, Deputy Governor Eva Zamrazilova told Pravo newspaper in an interview published on Friday. (BBG)

CHINA

PROPERTY: Local governments are weighing whether to scrap rules limiting the purchase of multiple houses by homeowners should the latest mortgage rule relaxations fail to stimulate sales during the Sept-Oct peak season, however, any change will likely occur in Q4, policy advisors and market analysts told MNI. (MNI)

YUAN: China will pursue steady internationalisation of the yuan due to concerns over FX stability and the limited value in holding trading partner currencies should expansion occur too rapidly, a policy advisor told MNI. Zhang Ming, senior fellow and deputy director at the Institute of Finance and Banking at the Chinese Academy of Social Science, suggested CNY would experience a more moderate pace of internationalisation to limit trading partners exchanging it for U.S. dollars, which could add instability to offshore forex markets. (MNI)

YUAN: The yuan may not see any major rebound against the dollar in the short term, and could even experience “intermittent depreciation”, as the dollar index is likely to stay strong, according to a front-page commentary in the Securities Times Friday. (BBG)

FX RESERVES: China recorded a 1.38% m/m drop in forex reserves to USD3.2 trillion in August, according to data from the State Administration of Foreign Exchange (SAFE). Officials said reserves decreased due to macroeconomic and monetary-policy expectations from major economies as well as the effects of exchange rate translation and changes in asset prices. (Yicai)

IRON ORE: Authorities have met with futures traders to discuss apparent irregular pricing in the iron ore futures market, according to the Securities Times. The National Development and Reform Commission (NDRC) told traders since mid-august regulators observed the price of futures had increased quickly without any change in fundamental supply or demand and, as a result, faced downward pressure later in the year. (Securities Times)

EQUITIES: Chinese market regulators are looking into increasing the penalty for shareholders who illegally cut stakes in listed companies, China National Radio reports on Thursday citing people familiar with the matter. (CNR)

US/CHINA: Beijing's widening curbs on iPhone use by government staff raised concerns among U.S. lawmakers on Thursday and fanned fears that American tech companies heavily exposed to China could take a hit from rising tensions between the countries. Apple closed down 2.9% Thursday -- its worst two-day percentage decline since November -- after news that Beijing has told employees at some central government agencies in recent weeks to stop using their Apple phones at work. (RTRS)

CHINA MARKETS

MNI: PBOC Net Injects CNY262 Bln Friday via OMO

The People's Bank of China (PBOC) conducted CNY363 billion via 7-day reverse repos on Friday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY262 billion after offsetting the maturity of CNY101 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8040% at 09:34 am local time from the close of 1.9508% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 43 on Thurday, compared with the close of 54 on Wednesday.

PBOC Yuan Parity Higher At 7.2150 Friday Vs 7.1986 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.2150 on Friday, compared with 7.1986 set on Thursday. The fixing was estimated at 7.3260 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA JULY BOP GOODS BALANCE $4280.20MN; PRIOR $3984.6MN

SOUTH KOREA JULY BOP CURRENT ACCOUNT BALANCE $3578.8MN; PRIOR $5873.7MN

JAPAN JULY LABOR CASH EARNINGS Y/Y 1.3%; MEDIAN 2.4%; PRIOR 2.3%

JAPAN JULY REAL CASH EARNINGS Y/Y -2.5%; MEDIAN -1.4%; PRIOR -1.6%

JAPAN Q2 F GDP SA Q/Q 1.2%; MEDIAN 1.4%; PRIOR 1.5%

JAPAN Q2 F GDP NOMINAL SA Q/Q 2.7%; MEDIAN 2.7%; PRIOR 2.9%

JAPAN Q2 F GDP DEFLATOR Y/Y 3.4%; MEDIAN 3.4%; PRIOR 3.4%

JAPAN Q2 F GDP PRIVATE CONSUMPTION Q/Q -0.6%; MEDIAN -0.5%; PRIOR -0.5%

JAPAN Q2 F GDP BUSINESS SPENDING Q/Q -1.0%; MEDIAN -0.7%; PRIOR 0.0%

JAPAN Q2 F GDP INVENTORY CONTRIBUTION %GDP -0.2%; MEDIAN -0.2%; PRIOR -0.2%

JAPAN Q2 F GDP NET EXPORTS CONTRIBUTION %GDP 1.8%; MEDIAN 1.8%; PRIOR 1.8%

JAPAN JULY BOP CURRENT ACCOUNT ADJUSTED ¥2766.9BN; MEDIAN ¥2176.5BN; PRIOR ¥2345.9BN

JAPAN JULY TRADE BALANCE BOP BASIS ¥68.2BN; MEDIAN ¥165.4BN; PRIOR ¥328.7BN

JAPAN AUGUST BANK LENDING INCL TRUSTS Y/Y 3.1%; PRIOR 2.9%

JAPAN AUGUST BANK LENDING EX-TRUSTS Y/Y 3.4%; PRIOR 3.2%

JAPAN AUGUST ECO WATCHERS SURVEY CURRENT SA 53.6; MEDIAN 54.4; PRIOR 54.4

JAPAN AUGUST ECO WATCHERS SURVEY OUTLOOK SA 51.4; MEDIAN 53.4; PRIOR 54.1

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 110-06+, +0-07, a 0-11+ range has been observed on volume of ~92k.

- Cash tsys sit ~2bps richer across the major benchmarks.

- A move higher in tsys amid volatile early trade was seen alongside pressure on USD/JPY as Finance Minister Suzuki reiterated that Japan won't rule out any options to address excessive FX moves.

- Gains were marginally pared and tsys dealt narrow ranges for the remainder of the session as little macro news flow crossed.

- This morning Dallas Fed President Logan noted the Fed could well need to tighten monetary policy further in order to bring U.S. inflation sustainably back to the central bank’s 2% target, although policymakers can now afford to proceed more cautiously.

- In Europe today we have the final read of German CPI for August. Further out we have VC Barr due to cross and Wholesale Trade.

JGBS: Futures Stronger But Off Session Bests, FX Intervention Talk Impacts

JGB futures are higher but off session highs, +11 compared to the settlement levels. The move higher in JGB futures was seen alongside pressure on the USD/JPY as Finance Minister Suzuki reiterated that Japan won't rule out any options to address excessive FX moves. JBU3 hit a high of 147.03 versus its current level of 149.95.

- US tsy futures also spiked on the comments, although have subsequently pared those gains, with cash US tsys currently sitting 2-3bp richer across the major benchmarks. TYZ3 deals at 110-07, +0-07+.

- The move higher in futures was likely assisted by the previously outlined domestic data drop that was weaker than expected across the board, including labour cash earnings and Q2 (Final) GDP.

- Cash JGBs are flat to richer across the curve, with yields flat to 1.2bp lower. The benchmark 10-year yield is 1.2bp lower at 0.645%.

- Swap rates are lower across the curve, with pricing -0.1bp to -0.8bp. Swap spreads are generally tighter.

- Bloomberg reports that the continued weakness in the yen could put the BoJ under political pressure to trim the amount of its debt-purchase operations, according to Barclays chief yen rates strategist Ebihara. “The BoJ could realistically reduce its JGB purchases at a pace needed to avoid a net increase in its holdings in 2024”. (See link)

- On Monday, the local calendar is light, with M2 & M3 Money Stocks as the only releases.

AUSSIE BONDS: At Session Highs, Tracking Tsys In Asia-Pac But Outperforming

ACGBs (YM +8.0 & XM +8.0) are at Sydney session highs after US tsy futures strengthened during Asia-Pac dealing. TYZ3 moved higher alongside pressure on the USD/JPY as Finance Minister Suzuki reiterated that Japan won't rule out any options to address excessive FX moves. However, that gain in US tsy futures was subsequently pared, with cash US tsys currently sitting 2-3bp richer across the major benchmarks.

- Cash ACGBs are 7-8bp richer, with the AU-US 10-year yield differential 2bp lower at -14bp.

- Swap rates are 6-8bp lower.

- The bills strip has seen a bull flattening, with pricing +1 to +6.

- RBA-dated OIS pricing is flat to 1bp softer across meetings.

- Get ready for a world of more volatile inflation, gyrating interest rates and greater economic uncertainty. That was the warning from departing RBA Governor Lowe. Lowe said, “The increased prevalence of supply shocks, deglobalisation, climate change, the energy transition and shifts in demographics means either steeper supply curves or more variable supply curves.” (See link)

- Next week the local calendar is empty on Monday, ahead of Westpac Consumer Confidence and NAB Business Confidence on Tuesday, CBA Household Spending on Wednesday and the August Employment Report on Thursday.

- Next week the AOFM plans to sell A$150mn of 1.25% 21 August 2040 index-linked bond.

NZGBS: Outperforming $-Bloc Counterparts Ahead Of The Pre-Election Fiscal Update

NZGBs closed the session at their highest levels, with benchmark yields showing a decline of 3-6bp. In the absence of domestic catalysts, local market participants appear to have been influenced by developments in US tsys during the Asia-Pac session. Nevertheless, NZGBs have outperformed their counterparts in the $-bloc, which is noteworthy as it precedes the Pre-Election Economic and Fiscal Update scheduled for Tuesday.

- NZ-US and NZ-AU 10-year yield differentials have narrowed by 5bp and 3bp, respectively. Both differentials had been widening until about a week ago, aligning with speculation that NZ’s fiscal situation was deteriorating beyond what was anticipated in the recent NZ budget. The recent outperformance of NZGBs over the past week appears to be driven by position adjustments or investors capitalising on more favourable entry points.

- Swap rates are 1-8bp lower, with the implied 2s10s swap spread box flatter.

- RBNZ dated OIS pricing is little changed across meetings out to May’24 and 1-3bp softer beyond.

- Next week the local calendar is empty on Monday, ahead of the Pre-Election Economic and Fiscal Update and Retail Card Spending on Tuesday.

- On Thursday 14 September, the NZ Treasury plans to sell NZ$200mn of the 0.5% May-26 bond, NZ$200mn of the 1.50% May-31 bond and NZ$100mn of the 1.75% May-41 bond.

FOREX: USD Marginally Pressured In Asia

The greenback is marginally pressured in Asia as US Tsy Yields tick lower. An early move lower in USD/JPY spilled over into the wider space, however the move didn't follow through and the pair sits unchanged.

- USD/JPY printed an early session low at ¥146.59 in volatile trade as Finance Minister Suzuki reiterated that Japan won't rule out any options to address excessive FX moves. Losses were pared through the session and the pair sits at ¥147.20/25.

- Kiwi is leading the bid in Asia, NZD/USD is up ~0.3%. The pair briefly dealt above the $0.59 handle however the move didn't follow through and gains were marginally pared.

- AUD/USD is ~0.2% firmer benefiting from the general move lower in the greenback. The pair was unable to breach the $0.64 handle and remains well within recent ranges.

- Elsewhere in G-10, EUR and GBP are both up ~0.2%. The Scandies are firmer however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is down ~0.2% and 2-Year US Tsy Yields are ~2bps lower. E-minis are a touch firmer, and markets in Hong Kong were closed for the morning due to a rainstorm.

- The final read of August CPI from Germany provides the highlight in Europe today.

EQUITIES: Tech Sensitive Bourses Lower, China's CSI 300 Back Tracking Towards August Lows

Regional equities are tracking lower in Asia Pac trade on Friday. Weakness is broad based and follows US and EU losses in Thursday trade. US futures sit around flat in terms of latest levels. Eminis last at 4456.5, lows for the session came in at 4451. Nasdaq futures have followed a similar trajectory, last near 15285 (lows near 15250).

- China shares look set to end the week on a soft note. At the break, the CSI 300 is down 0.80%, near 3728.5 in index terms. August lows just under the 3700 aren't too far away.

- The CSI 300 real estate sub index is down a further 1.05% at this stage, set to end the week down. The MNI Policy team note the authorities could ease housing restrictions further if sales down rebound in coming months. Further easing isn't likely until Q4 though (see this link). China energy stocks are also on the back foot, with higher oil input costs potentially weighing on profitability.

- Note Hong Kong markets have remained closed today due to the rainstorm alert.

- Tech sensitive plays are underperforming in the region, following US losses in Thursday trade (Nasdaq -0.89%, SOX off 2%), as sentiment has been dented by China's iPhone ban for the government sector.

- The Topix is off ~1.00% in Japan, the Kospi -0.60% in South Korea and Taiex -0.20% at this stage.

- In SEA, Thai stocks are trying to move higher, but aren't far away from the 1550 level. Indian stocks are tracking modestly higher at this stage, +0.30%.

OIL: Tracking Down Again, But Still Higher For The Week

The modest downward trajectory evident for Brent crude from Thursday's session has extended in the first part of Friday trade. We now sit back near $89.30/bbl, down a further 0.65%, after Thursday's -0.75% loss. We still sit higher for the week, +0.90% (with last week's Friday's closing levels at $88.55/bbl). WTI is back near $86.20/bbl having followed a similar trajectory so far in Friday trade. This benchmark is tracking firmer for the week as well (+0.80%). Broader risk appetite has been less supportive from the equity space today, although USD indices are tracking modestly lower.

- The modest pullback in the past two sessions looks like a consolidation rather than the start of a sharp pull back, particularly given on-going supply news (larger than expected draw for US crude stocks in the EIA weekly petroleum summary (-6.31m vs -2.35m expected) from Thursday).

- Still, some sell-side banks are cautious around extending the bullish outlook too far. JPMorgan analysts still don’t see oil prices breaching $100 in 2023, absent a major geopolitical event, due in large part to the demand outlook in 4Q despite the OPEC+ cut extension. Separately, RBC have Brent forecast to average 91$/bbl and WTI at $86.50/bbl in 4Q although $100/bbl could be within reach.

- Also note, Saudi Arabia is set to increase crude supplies to China in 2024 to meet demand at new refineries, sources told Platts at the APPEC conference in Singapore.

- For Brent, this week's lows came in close to $88/bbl, while the 20-day EMA is back at ~$86.63/bbl. On the topside, recent highs at $91.15/bbl remain intact.

GOLD: Extends Thursday’s Gains in Asia-Pac Dealing

Gold is 0.3% higher in the Asia-Pac session, after closing +0.2% at $1919.77 on Thursday. The drag from a modestly stronger US dollar was offset by lower tsy yields.

- A mid-session reversal in US tsys left them 1-7bp richer across the major benchmarks on Thursday. The curve steepened. US tsys were briefly pressured as the latest round of US data continued to show a robust labour market.

- Initial Jobless Claims came out lower than expected (216k, 234k est). Meanwhile, Unit Labor Costs printed higher than expected at +2.2% vs. +1.9% est.

- Nonetheless, the US dollar is headed for its eighth consecutive weekly gain, with a stronger greenback generally negative for gold.

- According to MNI’s technical team, gold is holding above support at $1903.9 (Aug 25 low), with resistance seen at $1931.4 (50-day EMA).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/09/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 08/09/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 08/09/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 08/09/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 08/09/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/09/2023 | 1300/0900 |  | US | Fed Vice Chair Michael Barr | |

| 08/09/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/09/2023 | 1500/1100 |  | US | San Francisco Fed's Mary Daly | |

| 08/09/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.