-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: USD/US Yields Tracking Higher

EXECUTIVE SUMMARY

- CHINA EXPORTS TO REBOUND, STRENGTHEN GDP - ADVISOR - MNI

- JAPAN’S HOUSEHOLDS CUT BACK SPENDING AS KISHIDA MULLS MEASURES - BBG

- GOLDMAN CUTS US RECESSION CHANCES TO 15% ON IMPROVED INFLATION - BBG

- CHEVRON AUSTRALIA LNG WORKERS PLAN FULL STRIKES FROM SEP 14 - BBG

- RBA HOLDS AT 4.10%, INFLATION PASSED PEAK - MNI BRIEF

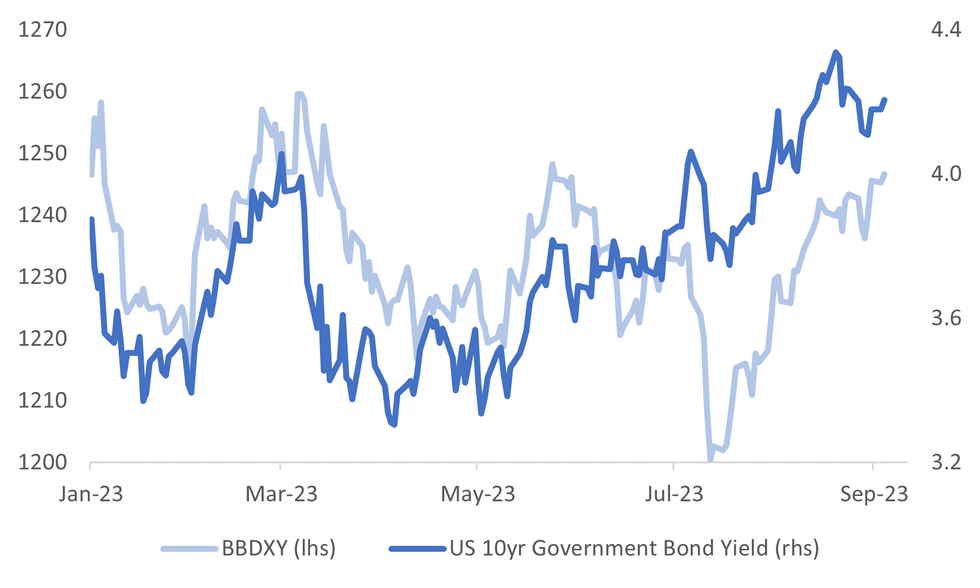

Fig. 1: USD Index & 10-year UST Yield

Source: MNI - Market News/Bloomberg

EUROPE:

RUSSIA: President Vladimir Putin said Russia is considering the possibility of accelerating construction of the so-called Far Eastern gas link to China, as well as the Power of Siberia 2 link, Interfax reported. (BBG)

MARKETS: CVC Capital Partners is nearing a deal to buy infrastructure investor DIF Capital Partners as it seeks to expand its range of offerings ahead of a potential listing, people with knowledge of the matter said. The European private equity firm could announce a deal as soon as Tuesday, the people said, asking not to be identified because the information is private. Netherlands-based DIF has around €16 billion ($17 billion) of assets under management, according to its website. (BBG)

UKRAINE: Turkish President Tayyip Erdogan said after talks with Russia's Vladimir Putin on Monday that it would soon be possible to revive the grain deal that the United Nations says helped to ease a food crisis by getting Ukrainian grain to market. Russia quit the deal in July - a year after it was brokered by the United Nations and Turkey - complaining that its own food and fertiliser exports faced serious obstacles. (RTRS)

U.S.

ECONOMY: Goldman Sachs Group Inc. now sees a 15% chance the US will slide into recession, down from 20% previously as cooling inflation and a still-resilient labor market suggest the Federal Reserve may not need to raise interest rates any further. “First, real disposable income looks set to reaccelerate in 2024 on the back of continued solid job growth and rising real wages,” Jan Hatzius, chief economist at Goldman, said in a research note. “Second, we still strongly disagree with the notion that a growing drag from the ‘long and variable lags’ of monetary policy will push the economy toward recession.” (BBG)

POLITICS: First lady Jill Biden has tested positive for Covid-19, the White House said on Monday, days before President Joe Biden is scheduled to travel to the G-20 summit in India. Biden was administered a test Monday evening and was negative, White House press secretary Karine Jean-Pierre said. “The President will test at a regular cadence this week and monitor for symptoms,” she added. (BBG)

OTHER

JAPAN: Japan’s households cut back spending in July as persistent inflation continued to erode purchasing power, adding pressure on the government to ramp up aid when it unveils a fresh batch of economic measures in coming weeks. (BBG)

AUSTRALIA: The Reserve Bank of Australia board left its official cash rate at 4.1% today, its third consecutive pause, noting Australia’s inflation has passed its peak. The move was largely anticipated by the market and economists and follows last week’s lower than expected monthly CPI print, which saw headline inflation fall to 4.9%. (MNI BRIEF)

AUSTRALIA: Australia’s wheat production is likely to be lower than forecast after dry conditions and below-average rainfall in some growing regions.The government trimmed its estimate by 3% from June to 25.4 million tons, putting the crop on track for a 36% decline from the record harvest a year earlier, according to the Australian Bureau of Agricultural and Resource Economics and Sciences. Wheat is a major winter crop in Australia with planting from April and the harvest starting in November. (BBG)

LNG: Chevron Corp. liquefied natural gas workers in Australia threatened two weeks of 24-hour rolling outages at two major export plants from mid-September, in an escalation of the dispute that threatens global fuel supply. The workers have served Chevron notice that they plan full stoppages from Sept. 14, following partial strikes from Sept. 7, the Offshore Alliance grouping said Tuesday on Facebook. (BBG)

NEW ZEALAND: New Zealand Finance Minister Grant Robertson has defended the central bank’s dual mandate as “normal” and not something that’s caused inflation or interest rates to be unnecessarily high. “Adrian has said very clearly that the decisions he’s made since we changed the mandate, in particular in the last few years, have not been affected by the fact that he had the dual mandate,” Robertson said at an event Tuesday in Wellington, referring to Reserve Bank Governor Adrian Orr. “He would’ve made the same decision with or without the dual mandate.” (BBG)

NEW ZEALAND: The outlook is for growth in household consumption and investment spending remains subdued, the Treasury Dept. says in Fortnightly Economic Update published Tuesday in Wellington. (BBG)

SOUTH KOREA: South Korea's annual consumer inflation accelerated to 3.4% in August while the month-on-month rate was the fastest since early 2017, which should keep policymakers on alert for any sustained uptick in prices. The Bank of Korea (BOK) last month held interest rates steady for a fifth straight meeting, as it continued to prioritise price stabilisation amid heightened growth risks. (RTRS)

THAILAND: Thailand's central bank chief said on Tuesday that this year's economic growth and inflation were expected to be lower than previously forecast. Last month, Bank of Thailand Governor Sethaput Suthiwartnarueput had said 2023 growth could come below the central bank's 3.6% forecast and a revised figure would be published in September. Last year's growth was 2.6%. (RTRS)

COLUMBIA: Colombia's government and industry associations called on the central bank to lower interest rates on Monday and urged business leaders to resume investment decisions, in a bid to shore up the economy. Latin America's fourth-largest economy expanded 0.3% in the second quarter, much less than expected. The central bank has forecast growth of 0.9% for 2023, well below the 7.3% growth last year. (RTRS)

CHINA

GDP: China’s export growth will likely rebound later in the year and help consolidate GDP over the government's 5% target to 5.6% for 2023, while any additional policy measures should focus on reducing real-estate risk, a senior policy advisor told MNI. “Based on the current policy intensity, the growth rate should reach 5.7% in H2, bringing the whole year growth to 5.6%,” said Yu Miaojie, president at Liaoning University and a deputy to the National People's Congress. Yu also acts as a trade policy consultant to the Ministry of Commerce and participates in State Council economy advisory meetings. (MNI)

LOCAL DEBT: Chinese authorities have deployed measures to resolve local debt risks in H2, however, details are yet to be revealed, while local authorities are expected to issue more refinancing bonds within the legal debt limit to roll over some implicit liabilities. In August, refinancing bond issuance hit a new yearly high over CNY600 billion, though local governments have not used the proceeds to repay the implicit debt. (21st Century Business Herald)

SERVICES: A private survey of China’s services sector showed activity expanded at the slowest rate this year in August, as the post-Covid rebound wanes and the economy’s difficult outlook holds people back from spending. (BBG)

HOUSING: Real-estate agents in Beijing and Shenzhen have encountered strong market activity after tier one cities announced recent property market relaxation policies. One agent with nine years experience told Yicai news agency the boom in activity was unparalleled and his office had worked very late each day to cope with demand. (Yicai)

PROPERTY: Chinese developer Country Garden Holdings Co. told creditors that it’s paid coupons of two dollar bonds within grace periods, the noteholders said, avoiding what would be its first default. (BBG)

CREDIT: China’s credit and loan extension may have improved in August, as evidenced by the recent increase in the interest rate of a type of short-term interbank loan, Shanghai Securities News reports Tuesday. (BBG)

CHINA MARKETS

MNI: PBOC Net Drains CNY371 Bln Tuesday via OMO

The People's Bank of China (PBOC) conducted CNY14 billion via 7-day reverse repos on Tuesday, with the rates unchanged at 1.80%. The operation has led to a net drain of CNY371 billion after offsetting the maturity of CNY385 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7513% at 09:25 am local time from the close of 1.7436% on Monday.

- The CFETS-NEX money-market sentiment index closed at 48 on Monday, compared with 39 on Friday.

PBOC Yuan Parity Lower At 7.1783 Tuesday Vs 7.1786 Monday

he People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1783 on Tuesday, compared with 7.1786 set on Monday. The fixing was estimated at 7.2739 by Bloomberg survey today.

MARKET DATA

SOUTH KOREA: AUGUST FOREIGN RESERVES $418.3BN; PRIOR $421.8BN

SOUTH KOREA AUGUST CPI M/M 1.0%; MEDIAN 0.6%; PRIOR 0.1%

SOUTH KOREA AUGUST CPI Y/Y 3.4%; MEDIAN 2.9%; PRIOR 2.3%

SOUTH KOREA AUGUST CORE CPI Y/Y 3.3%; PRIOR 3.3%

AUSTRALIA AUGUST F JUDO BANK SERVICES PMI 47.8; PRIOR 46.7

AUSTRALIA AUGUST F JUDO BANK COMPOSITE PMI 48.0; PRIOR 47.1

AUSTRALIA Q2 NET EXPORTS OF GDP 0.8; MEDIAN 0.3; PRIOR -0.2

AUSTRALIA Q2 BOP CURRENT ACCOUNT A$7.7BN; MEDIAN A$8.0BN; PRIOR A$12.5BN

UK AUGUST BRC SALES Y/Y 4.3%; PRIOR 1.8%

JAPAN JULY HOUSEHOLD SPENDING Y/Y -5.0%; MEDIAN -2.5%; PRIOR -4.2%

JAPAN AUGUST F JIBUN BANK SERVICES PMI 54.3; PRIOR 54.3

JAPAN AUGUST F JIBUN BANK COMPOSITE PMI 52.6; PRIOR 52.6

NEW ZEALAND AUGUST ANZ COMMODITY PRICES M/M -2.9%; PRIOR -2.6%

CHINA AUGUST CAIXIN SERVICES PMI 51.8; MEDIAN 53.5; PRIOR 54.1

CHINA AUGUST CAIXIN COMPOSITE PMI 51.7; PRIOR 51.9

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 110-10, -0-08+, a 0-03 range has been observed on volume of ~60k today.

- Cash tsys sit ~3bps cheaper across the major benchmarks.

- Narrow ranges have been observed in Asia today, cash tsys re-opened cheaper after closing yesterday for the Labour Day holiday.

- There was little follow through on moves, and the space looked through a weaker than forecast Caixin PMI print and RBA holding the cash rate in Australia steady.

- Eurozone PPI and ECB CPI Expectations headline in Europe today. Further out we have Factory Orders and Durable Goods as well as the latest 1-Year Supply.

JGBS: Futures Cheaper But Above Worst Levels, 10Y Auction Sees Mixed Results

JGB futures are sitting just above session lows, -12 compared to settlement levels.

- In addition to July household spending that printed weaker than expected, the key domestic driver for the local market today was the auction of 10-year JGBs.

- The 10-year supply saw higher demand (the cover ratio lifted to 4.019x from 3.636x previously), but the low price failed to meet wider expectations and the tail lengthened to the longest since April. In short, it appears as though local investors will need a higher yield and/or more time to assess the new YCC framework and the BoJ policy outlook before significantly lifting allocations to the JGB market.

- Outside the domestic drivers, local participants have likely been on headlines and US tsys watch. Cash US tsys sit ~3bps cheaper across the major benchmarks. Narrow ranges have been observed in Asia today, as cash US tsys re-opened after yesterday's Labor Day holiday.

- Cash JGBs are cheaper across the curve, with yields 0.1bp (1-2-year) to 1.2bp (5- and 20-year) higher. The benchmark 10-year yield is 1.0bp higher at 0.654%.

- The swap curve has twist steepened, with rates 0.1bp lower to 0.8bp higher. Swap spreads are tighter across the curve.

- Tomorrow the local calendar is light, with a speech from BoJ Board Member Nakagawa as the highlight.

AUSSIE BONDS: Slightly Richer After The RBA Leaves The Cash At 4.10%, Q2 GDP Tomorrow

ACGBs (YM flat & XM -3.5) sit slightly stronger after the RBA leaves the cash rate at 4.10%, as widely expected. The market gave a 25bp hike today less than a 5% chance. Today’s RBA statement highlights are:

- Inflation has passed its peak but remains high, expected to persist for some time. Goods price inflation has eased, but service prices and rent continue to rise.

- Labour market conditions remain tight, though easing slightly, with a gradual rise in the unemployment rate expected. Wages have increased but remain consistent with the inflation target.

- The central focus is on returning inflation to the 2–3% target range and sustaining medium-term inflation expectations. There are uncertainties, especially in services price inflation and household consumption.

- Further monetary policy tightening may be necessary, depending on data and risks. The goal is to return inflation to target.

- Cash ACGBs are 1bp richer after the decision and flat to 3bp cheaper on the day. The AU-US 10-year yield differential is -9bp.

- Swap rates are 1-3bp higher on the day, with EFPs slightly tighter.

- The bills strip is little changed on the day, with pricing -1 to +2.

- RBA-dated OIS pricing is 1-2bp softer across meetings after the RBA decision.

- Tomorrow the local calendar sees Q2 GDP. The AOFM also plans to A$700mn of the Dec-34 bond.

NZGBS: Cheaper, Commodity Prices Lower, S&P Comfortable With Credit Rating

NZGBs closed on a weak note, with benchmark yields 4-7bp higher. The hasn’t been much in the way of domestic drivers to highlight other than the commodity price index (see below).

- Swap rates are 1-5bp higher, with implied swap spreads tighter.

- RBNZ dated OIS pricing is flat to 2bp softer across meetings.

- NZ Finance Minister Robertson has defended the central bank’s dual mandate as “normal” and not something that’s caused inflation or interest rates to be unnecessarily high. “The BoE, the US Fed and the RBA all have forms of mixed mandates,” Robertson said. (See link)

- NZ's commodity export prices fell 2.9% m/m (-14.2% y/y) in August versus -2.6% in July, according to ANZ. Dairy prices led m/m decline, falling 8.7%. Global demand for dairy products is weak, led by softer demand from China. At the same time, the supply of dairy products from NZ is lifting which is putting downward pressure on prices: ANZ.

- S&P Global Ratings is “reasonably comfortable” with NZ’s AA+ sovereign credit rating, Melbourne-based credit analyst Martin Foo said Tuesday in an interview broadcast by Newshub. (See link)

- Tomorrow the local calendar sees Volume of All Buildings. for Q2.

FOREX: Antipodeans Pressured In Asia

The Antipodeans have been pressured through the Asian session on Tuesday, the AUD is the weakest performer in the G-10 space however there has been little reaction thus far to the RBA leaving the cash rate at 4.10%.

- AUD/USD prints at $0.6420/25, the pair is ~0.6% lower today. The RBA noted some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe. Support comes in at $0.6365, low from Aug 17 and bear trigger, and $0.6285, low Nov 4 2022.

- Kiwi is also pressured, NZD/USD is down ~0.4% last printing at $0.5915/20. Firmer US Tsy Yields and a weaker than forecast Caixin Services PMI, as well as lower regional equities have weighed on sentiment. Bears now target the low from 25 Aug ($0.5886) which opens $0.5841 (low from 10 Nov 22).

- Yen is marginally weaker, USD/JPY is ~0.1% firmer however a ~30 pip range has persisted for much of the session and there has been little follow through on moves.

- Elsewhere in G-10, the Scandies are pressured although liquidity is generally poor in Asia.

- Cross asset wise; Hang Seng is down ~1.5% and e-minis are ~0.1% lower. US Tsy Yields are ~3bps higher across the curve. BBDXY is up ~0.1%.

- Eurozone PPI provides the highlight in Europe with the final read of August Services PMI from France and Germany also due.

EQUITIES: Regional Equities Tracking Lower, Higher USD/Yields Weigh

Regional equities are mostly tracking lower in the first part of Tuesday trade. Weakness has been fairly broad based, although there are some pockets of strength in South East Asia. US equity futures have ticked lower, but losses are modest at this stage. Eminis last near 4515, -0.15%, while Nasdaq futures are near 15502, off by around -0.10%.

- US cash Tsys trading has resumed post Monday's holiday, with yields continuing to rise, in a continuation of the post payrolls theme from Friday US trade. The 10yr is +3bps, near 4.21%. This has aided the USD and weighed on regional risk appetite, which has contributed to equity market losses.

- China stocks have unwound some of yesterday's rise. The CSI 300 sits 0.58% lower at the break. A weaker than expected Caixin services PMI print (51.8 versus 53.5 forecast and 54.1 prior) has weighed on the rebound theme.

- Country Garden has reportedly repaid coupons on two dollar bonds, within the allotted grace period. The HSI is down 1.51% at the break though, with the mainland properties index off by 2.73%, following yesterday's 8.21% rally.

- Japan stocks are modestly lower, the Topix off by near 0.40% at this stage, with Toyota losses weighing on sentiment. South Korean and Taiwan shares are down a touch, but largely tracking recent ranges.

- In SEA, most bourses are down modestly. Thai shares are trying to track higher after 3 sessions of losses, but the index is close to 1550 at this stage. Philippine shares have seen some support sub 6200, while August inflation data was noticeably stronger than expected due to higher rice prices.

OIL: Crude Holding Gains As Supply Cuts Expected To be Extended This Week

Oil prices have held onto their gains from recent sessions during APAC trading today. WTI is up 0.4% to $85.92/bbl, off its low of $85.65, but it has not been able to hold breaks above $86. Brent is down slightly hovering just under $89 which it hasn’t been able to breach clearly. Its intraday high was $89.11 and is currently at $88.93. The USD index is 0.2% higher.

- The supply outlook remains a key factor driving the market with Saudi Arabia and Russia expected to announce an extension of output cuts into October this week. Goldman Sachs has said that the reductions have resulted in a 2.3mbd shortfall in Q3. The US has also seen large crude inventory drawdowns and later today the API will release its latest stock data, which is likely to be monitored closely given last week’s huge 11.5mn drawdown.

- The gap between the two nearest contracts for Brent, the prompt spread, has widened this week to 75c/bbl up from 58c/bbl a week ago, according to Bloomberg.

- Later there are European/US services and composite PMIs for August as well as US July factory orders and final July durable goods orders.

GOLD: Weaker In Asia-Pac Dealing After a Steady Monday

Gold is 0.3% weaker in the Asia-Pac session, after closing within Friday’s range yesterday. With the US out for the observance of the Labor Day holiday, newsflow and market movements were limited.

- US tsy futures were weaker and European government bond yields were 2-4bp higher across benchmarks as the market wagered that the ECB will keep rates higher for longer, even as Governing Council member Mario Centeno warned his colleagues that there’s a risk of raising them too far.

- According to MNI's technicals team, the current uptrend remained intact with resistance at Friday’s high of $1953.0 after which lies $1963.3 (76.4% retrace of Jul 20 – Aug 21 bear leg).

- Nevertheless, the USD Index looks to have resumed the primary uptrend off the mid-July lows, a factor that should keep the precious metals subdued despite the OIS-implied Fed rate path softening recently.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/09/2023 | 0700/0900 |  | EU | ECB's Lagarde Speaks at Legal Conference | |

| 05/09/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/09/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/09/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/09/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/09/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/09/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/09/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/09/2023 | 1230/1430 |  | EU | ECB's Schnabel speaks at Legal Conference | |

| 05/09/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 05/09/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 05/09/2023 | 1430/1630 |  | EU | ECB's de Guindos speaks at Legal Conference | |

| 05/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 05/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/09/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 05/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.