-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI EUROPEAN OPEN: Verbal Rhetoric On Yen Steps Up, China PMI Disappoints Again

EXECUTIVE SUMMARY

- WHITE HOUSE SAYS BIDEN, XI TO MEET AT APEC IN SAN FRANCISCO - BBG

- CHINA’S FACTORY ACTIVITY CONTRACTS IN OCTOBER - CAIXIN PMI _ RTRS

- JAPAN RAMPS UP YEN INTERVENTION WARNING AFTER BOJ-FUELED SELL-OFF - BBG

- ECB CAN’T LET UP ON RATES TOO SOON, BUNDESBANK’S NAGEL SAYS - BBG

- IMF URGES AUSTRALIA TO TIGHTEN POLICY FURTHER TO QUELL INFLATION - BBG

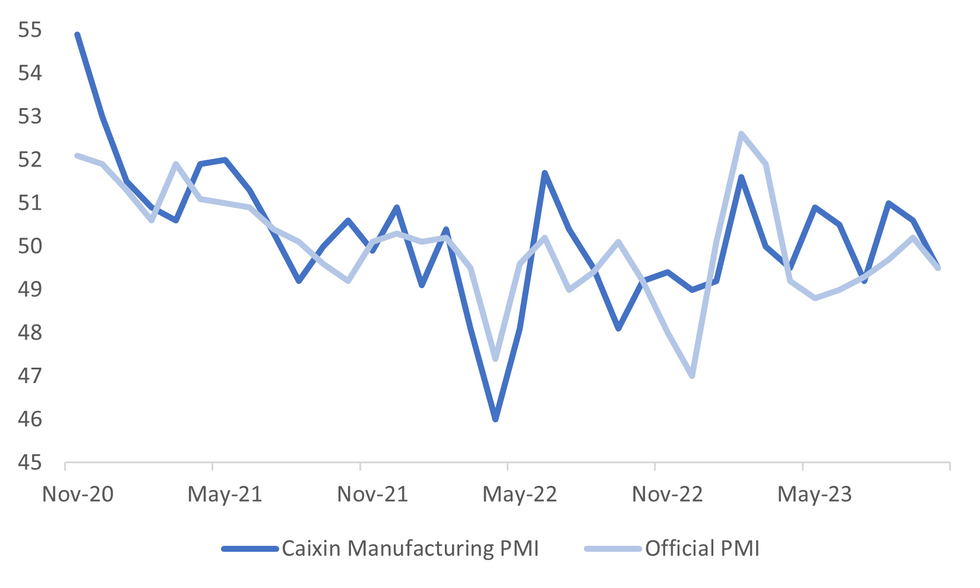

Fig. 1: Both China Manufacturing PMIs Back In Contraction Territory For October

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): Three weeks ago, Keir Starmer was praised for showing grit in a speech to lay out his pitch to be Britain’s next prime minister, taking off his jacket and rolling up his sleeves after a protester covered him with glitter.

EUROPE

ECB (BBG): The European Central Bank will need to keep borrowing costs high for some time, according to Bundesbank President Joachim Nagel. “Our tight monetary policy is working, but we mustn’t let up too soon,” the German central bank chief said Tuesday in a speech in Berlin. “Rather, the key interest rates will have to remain at a sufficiently high level for a sufficiently long time.”

UKRAINE (RTRS): Ukraine's attacks on the Russian Navy in the Black Sea have crippled Moscow's war efforts, President Volodymyr Zelenskiy said on Tuesday, seeking to rally his troops even as the outside world expects instant successes.

FRANCE/RUSSIA (BBC): “Alexei Kuzmichev: Sanctioned Russian tycoon detained in France”

FRANCE (LE MONDE): “Macron to visit Kazakhstan and Uzbekistan to bolster France's influence in the region” –

U.S.

US/CHINA (BBG): President Joe Biden will meet with Chinese leader Xi Jinping on the sidelines of the Asia-Pacific Economic Cooperation summit in San Francisco in November, White House press secretary Karine Jean-Pierre said Tuesday.

FISCAL (BBG): President Joe Biden’s top national-security officials warned Congress that stalling or dividing his $106 billion supplemental package with arms for Israel and Ukraine would embolden US enemies at a critical moment.

US/ISRAEL (BBG): The US and Israel are exploring options for the future of the Gaza Strip, including the possibility of a multinational force that may involve American troops if Israeli forces succeed in ousting Hamas, people familiar with the matter said.

OTHER

ISRAEL (RTRS): Israeli airstrikes hit a densely populated refugee camp in the Gaza Strip, killing at least 50 Palestinians and a Hamas commander, and medics struggled to treat the casualties in the enclave where food, fuel and basic supplies are running scarce.

JAPAN (BBG): Traders are piling into fresh bets against the yen, triggering pushback from Japanese authorities who are threatening once again to take action including the possibility of currency intervention.

JAPAN (MNI BRIEF): Japan's economy in Q3 will likely have fallen 0.1% q/q – or a 0.3% annualised fall – the first contraction in four quarters, due to weaker public investment and despite stronger private consumption and capital investment, economists predicted.

JAPAN (MNI BRIEF): The Bank of Japan on Wednesday offered extraordinary government bond buying operations to curb the rise in JGB yields for the first time since Oct 24.

SOUTH KOREA (RTRS): South Korea's exports in October rose in annual terms for the first time in 13 months, as shipments to the United States were robust while the weakness in China demand eased slowly.

AUSTRALIA (BBG): Australia needs to tighten monetary policy further as part of stepped up efforts to rein in inflation that include governments slowing the pace of public investment, the International Monetary Fund said in a staff report.

NEW ZEALAND (RBNZ): The full impact of previous interest rate increases globally is still to be seen. A weakening in global demand, particularly in China, has contributed to lower key commodity prices for New Zealand, and we are monitoring developments in the Middle East closely, Mr Hawkesby says.

NEW ZEALAND (BBG): New Zealand unemployment rose to the highest in two years in the third quarter and wage inflation slowed, indicating the central bank’s interest-rate increases are weakening the labor market.

NEW ZEALAND (BBG): New Zealand’s incoming prime minister, Christopher Luxon, is optimistic a new government will be formed within days of the release of final election results on Nov. 3.

CHINA

ECONOMY (RTRS): China's factory activity unexpectedly contracted in October, a private survey showed on Wednesday, raising questions over the state of the country's fragile economic recovery at the start of the fourth quarter.

POLICY (FINANCIAL NEWS/BBG): China’s twice-a-decade Central Financial Work Conference underscored strengthening financial regulation and risk prevention, including for the property sector and local government debt, as one of the key tasks for the financial sector, the PBOC-backed newspaper Financial News says in a report Wednesday.

POLICY (21st Century Herald): Authorities are expected to cut the reserve requirement ratio (RRR) of large and medium-sized banks by 50bp in Q4 to release more than CNY1 trillion of liquidity to accommodate additional bond supply, according to Ding Shuang, chief economist at Standard Chartered Greater China and North Asia.

FISCAL (21st Century Herald): Authorities need to implement further fiscal stimulus to address low enterprise production and investment given October’s declining PMI data, according to experts interviewed by 21st Century Herald. Zhang Liqun, an analyst at the China Federation of Logistics and Purchasing, said the recent issuance of government treasury bonds to support infrastructure construction will drive an increase in corporate orders through government investment, which will play a positive role in boosting domestic demand.

CHINA/US (SCMP): The US will send its delegation to China International Import Expo, a six-day event which begins in Shanghai on Sunday, South China Morning Post reported Tuesday, citing unidentified people.

CHINA MARKETS

MNI: PBOC Drains Net CNY109 Bln Via OMO Weds; Rates Unchanged

repo on Wednesday, with the rate unchanged at 1.80%. The operation has led to a net drain of CNY109 billion after offsetting the maturity of CNY500 billion reverse repos today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8016% at 09:27 am local time from the close of 2.0765% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 72 on Tuesday, compared with the close of 43 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

PBOC Yuan Parity Lower At 7.1778 Wednesday vs 7.1779 Tuesday.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1778 on Wednesday, compared with 7.1779 set on Tuesday. The fixing was estimated at 7.3295 by Bloomberg survey today.

MARKET DATA

NEW ZEALAND 3Q EMPLOYMENT CHANGE Q/Q -0.2%; MEDIAN 0.4%; PRIOR 1.0%

NEW ZEALAND 3Q EMPLOYMENT CHANGE Y/Y 2.4%; MEDIAN 3.2%; PRIOR 4.1%

NEW ZEALAND 3Q PARTICIPATION RATE 72.0%; MEDIAN 72.5%; PRIOR 72.4%

NEW ZEALAND 3Q UNEMPLOYMENT RATE 3.9%; MEDIAN 3.9%; PRIOR 3.6%

NEW ZEALAND 3Q PVT WAGES EX OVERTIME Q/Q 0.8%; MEDIAN 1.0%; PRIOR 1.1%

NEW ZEALAND 3Q PVT WAGES INC OVERTIME Q/Q 0.9%; MEDIAN 1.0%; PRIOR 1.1%

AUSTRALIAN OCT F JUDO BANK MANUFACTURING PMI 48.2; PRIOR 48.0

AUSTRALIAN SEP BUILDING APPROVALS M/M -4.6%; MEDIAN 2.5%; PRIOR 8.1%

AUSTRALIAN SEP PRIVATE SECTOR HOUSES M/M -4.6%; PRIOR 7.2%

SOUTH KOREA OCT EXPORTS Y/Y 5.1%; MEDIAN 6.1%; PRIOR -4.4%

SOUTH KOREA OCT IMPORTS Y/Y -9.7%; MEDIAN -2.1%; PRIOR -16.5%

SOUTH KOREA OCT TRADE BALANCE $1636MN; MEDIAN –$1700MN; PRIOR $3697MN

SOUTH KOREA OCT PMI MANUFACTURING 49.8; PRIOR 49.9

JAPAN OCT F JIBUN BANK PMI MANUFACTURING 48.7; PRIOR 48.5

CHINA OCT CAIXIN PMI MANUFACTURING 49.5; MEDIAN 50.8; PRIOR 50.6

MARKETS

US TSYS: Narrow Ranges In Asia, FOMC In View

TYZ3 deals at 105-30, -0-07+, a 0-04 range has been observed on volume of ~80k.

- Cash tsys sit 1-2bps richer across the major benchmarks, light bull flattening is apparent.

- Tsys have observed narrow ranges for the most part in Asia today, moves have had little follow as the proximity to this evening's FOMC rate decision is perhaps keeping participants on the sidelines.

- The space looked through a weaker than forecast Chinese Caixin Mfg PMI print. The USD was marginally firmer in Asia and e-minis were a touch lower.

- FOMC dated OIS price no change in today's meeting, a terminal rate of ~5.45% is seen in January with ~55bps of cuts by Sep 24.

- The aforementioned FOMC rate decision headlines today's docket, the MNI preview is here. We also have US construction spending, ISM Manufacturing, job openings and light vehicle sales.

JGBS: Futures Off Session Lows After BOJ Unscheduled Bond Purchase

In Tokyo afternoon dealings, JGB futures remain weaker but off session cheaps, -20 compared to settlement levels, after the BOJ conducts an unscheduled bond purchase to buy Y300bn of 5-to-10-year and Y100bn of 3-5bn notes at market yields.

- There hasn’t been much in the way of domestic data drivers to flag today, outside of the previously outlined Jibun Bank Japan PMI Mfg data.

- Bloomberg reports that BofA believes the BOJ’s next step will probably be the removal of negative interest-rate policy and yield-curve control. BofA’s base case scenario is for the central bank to move at its January meeting. A change may come by April at the latest, they said. (See link)

- Cash JGBs are cheaper across benchmarks, with yields 0.5bp (1-year) to 3.3bps higher (30-year). The benchmark 10-year yield is 1.8bp higher at 0.966% versus the cycle high of 0.974% (set earlier today) and the BOJ’s YCC reference level of 1.0%.

- Swap rates are 2-4bp higher across the curve, with swap spreads wider, apart from the 30-40-year zone.

- Tomorrow, the local calendar sees Monetary Base and International Investment Flow data, along with 10-year supply.

AUSSIE BONDS: Cheaper But Well Off Lows After Building Apps Miss & NZGB Rally, FOMC Decision Due

ACGBs (YM -3.0 & XM -3.0) remain cheaper but are well above the Sydney session’s worst levels. This push away from session cheaps can be attributed to weaker-than-expected building approvals data and spillover from NZGB’s post-employment data rally. NZ Q3 employment contracted 0.2% q/q after rising 1%, the first drop since Q2'22. Nevertheless, wages looked stubborn, with Q3 labour costs rising 1.1% q/q and 4.3% y/y.

- The intraday rally in ACGBs was also assisted by US tsy dealings in the Asia-Pac session. Cash US tsys are 1-3bp richer, ahead of the FOMC decision later today.

- The cash ACGB 10-year yield is 4.96%, 3bps higher on the day, after earlier touching 5.0% for the first time since 2011.

- Swap rates are 1-2bps higher.

- The bills strip is flat to -2.

- RBA-dated OIS pricing is 2bps firmer (Feb’24) to 1bp softer (Jun’24) across meetings, with terminal rate expectations at 4.54% (+47bps by Jun’24). The expected terminal rate hit 4.58% earlier in the session.

- Tomorrow, the local calendar will see Trade Balance and Home Loan data.

- AFR reports that the IMF, in a staff report, said Australia needs to tighten monetary policy further as part of stepped-up efforts to rein in inflation that include governments slowing the pace of public investment. (See link)

NZGBS: Closed At Session Bests After Softer Labour Market Data

NZGBs closed on a strong note, with yields 5-7bps lower, after labour market data printed either below or close to expectations. Q3 employment contracted 0.2% q/q after rising 1%, the first drop since Q2'22. However, wages look stubborn, with Q3 labour costs rising 1.1% q/q and 4.3% y/y. Private wages saw growth slowing but the public sector boosted overall wage costs. Accordingly, it looks difficult for the RBNZ to meet its early 2024 forecast of 3.8% y/y. Revised projections are due at the November 29 meeting.

- Swap rates closed 8-10bps lower, with the 2s10s curve steeper. Implied swap spreads closed 3-4bps tighter.

- RBNZ dated OIS pricing closed 1-7bps softer across meetings, with late’24 leading. Terminal OCR expectations drop to 5.58% (+8bp by Feb’24).

- RBNZ released its Financial Stability Report stating that “the vast majority of [household] borrowers have been able to manage these [interest rate] increases”. Businesses continue to service debt, although the dairy and commercial property sectors are facing challenges.

- RBNZ Deputy Governor Christian Hawkesby said no decisions have been made on implementing debt-to-income restrictions.

- The local data docket is empty tomorrow.

- Tomorrow, the NZ Treasury plans to sell NZ$225mn of the May-30 bond, NZ$175mn of the May-34 bond and NZ$100mn of the May-51 bond.

FOREX: Kiwi Pressured, Yen Firmer In Asia

The NZD has been pressured in Asia today, early pressure came after the Q3 employment report and Kiwi has been see-sawing around $0.58 for the majority of today's session. The Yen is the best performer in the G-10 space, trimming Tuesdays post BoJ losses as Japanese authorities hint at possible currency intervention.

- NZD/USD is down ~0.3%, last printing at $0.5805/10. Q3 employment contracted 0.2% q/q after rising 1%, the first drop since Q2'22. However Q3 labour costs rose 1.1% q/q and 4.3% y/y.

- The Yen is up ~0.3% however at this stage the ¥151 handle remains intact. Japan's top currency official Kanda noted today that authorities are ready to act on the Yen if needed.

- AUD is a touch below opening levels, however ranges have been narrow with little follow through on moves. Technically the trend outlook is bearish, support comes in at $0.6270 low from Oct 26 and key support. Resistance comes in at $0.6406, 50-Day EMA.

- Cross asset wise; US Equity futures are off session lows however e-minis remain ~0.2% lower. US Tsy Yields are 1-2bps lower across the curve. BBDXY is up ~0.1%.

- The highlight of today's session is the latest FOMC rate decision.

EQUITIES: Japan Outperforms, Weaker Data Weighs On China/HK

Japan markets are the clear outperformers in Asia Pac trade so far in Wednesday trade. Mixed trends are evident elsewhere. US futures are down but away from session lows. Eminis were last near 4206, off close to 0.15%. Earlier dips sub 4200 were supported. Nasdaq futures are also weaker (last -0.10%), but likewise away from earlier lows.

- Some late earnings disappointment from the NY session on Tuesday has weighed on US futures, but overall ranges have been tight. Proximity to the upcoming Fed meeting later may be leaving participants in wait and see mode.

- Japan's Topix is up around 2% at this stage, putting the index back above 2300 (levels last seen in the first half of October). The electrical appliances sector and transportation have been the strongest contributors to the rise.

- A weaker yen/dovish BoJ backdrop will be aiding sentiment for some these sectors. The yen is slightly stronger today though as the authorities raised their verbal rhetoric around FX weakness.

- Hong Kong and China markets sit close to flat at the break. This is away from session lows, which came after a weaker than expected Caixin manufacturing PMI print (49.5). The CSI 300 is near 3574.

- South Korea's Kospi is nearly 1% higher, while the Taiex is +0.30% firmer.

- In SEA, Indonesian markets continued their recent volatility, the JCI off 1% so far today. Thailand stocks are also weaker, down 0.40%.

OIL: Crude Range Trading Ahead Of Fed

Oil prices are marginally higher in the APAC session after falling on Tuesday. They have been range trading ahead of the Fed decision later today. The USD index is slightly higher.

- Brent is 0.3% higher at $85.25/bbl. It reached a high of $85.58 before the Caixin China PMI but was already declining before the data was published. It fell to a low of $85.14 after the release. WTI is up 0.2% to $81.14/bbl after an intraday low of $81.03. With China’s PMI below 50, there is limited upside to crude as it is the largest importer.

- The attention of the oil market has returned to demand, particularly with the Fed and payrolls this week, as the situation in Israel/Gaza seems to be contained for now. US Secretary of State Blinken will return to the region including Israel to continue his efforts to ensure the conflict doesn’t spread.

- BP has said that gasoline and diesel is currently oversupplied, according to Bloomberg.

- Bloomberg reported that US crude inventories rose 1.35mn barrels in the latest week according to people familiar with the API data. The official EIA data is out later.

- Markets are looking to today’s Fed meeting and press conference (see MNI Fed Preview). Also October US ADP employment and manufacturing ISM print.

GOLD: Second Consecutive Day Of Decline Unwinds Friday’s Gaza-Invasion-Induced-Surge

Gold has weakened further (-0.3%) in the Asia-Pac session, after closing 0.6% lower at $1983.88 on Tuesday. Price action this week has effectively unwound Friday’s surge sparked by news of Israel’s ground invasion of Gaza. Bullion hit $2000 for the first time since May on Friday.

- Higher US Treasury yields on Tuesday, following a slightly higher-than-expected employment cost index, weighed on the precious metal. Higher rates are typically negative for non-yielding bullion.

- Attention now turns to the FOMC’s policy meeting decision later today.

- According to MNI’s technicals team, the outlook still suggests the yellow metal could head northbound with resistance at $2009.4 (Oct 27 high) but support is seen at $1943.2 (20-day EMA) should some geopolitical de-escalation be seen.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/11/2023 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/11/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 01/11/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/11/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 01/11/2023 | 1230/0830 | ** |  | US | Treasury Quarterly Refunding |

| 01/11/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/11/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/11/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/11/2023 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 01/11/2023 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 01/11/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/11/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 01/11/2023 | 2015/1615 |  | CA | BOC Governor testifies at Senate hearing |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.