-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Yuan Defense Continues via Stronger CNY Fix

EXECUTIVE SUMMARY

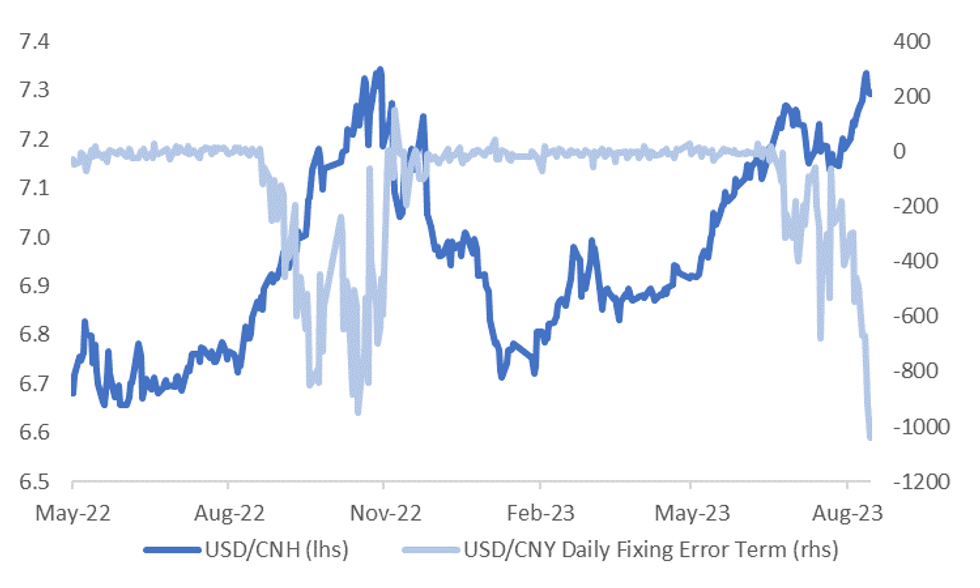

- China delivered its strongest ever pushback against a weaker yuan via its daily reference rate for the managed currency - BBG

- Lawyers for Donald Trump on Thursday asked a federal judge in Washington to schedule an April 2026 trial - BBG

- New Zealand’s central bank sees a risk that a strong housing recovery could keep inflation elevated for longer - BBG

- Europe’s natural gas reserves are almost full, though that still may not be enough to see the region through winter - BBG

Fig. 1: CNY Daily Fix Error vs USD/CNH

Source: MNI - Market News/Bloomberg

U.K.

BANKS: Rishi Sunak’s government said UK banks could face fines if they don’t preserve easy and free access to cash, a move designed to help people in rural areas, the elderly and the disabled. The Financial Conduct Authority has been given new powers to ensure banks maintain cash access without fees, the Treasury said in a statement late Thursday. It said the “vast majority” of people and businesses should be no further than three miles (4.8 kilometers) away from being able to obtain cash. (BBG)

EUROPE.

ENERGY: Europe’s natural gas reserves are almost full, though that still may not be enough to see the region through winter. The continent’s storage levels hit 90.1% capacity on Aug. 16, according to the latest data from the industry group Gas Infrastructure Europe. That’s the highest on record for the time of year, and well ahead of the European Union’s Nov. 1 goal of reaching that marker. (BBG)

U.S.

POLITICS: Lawyers for Donald Trump on Thursday asked a federal judge in Washington to schedule an April 2026 trial for the former president, on federal charges that he allegedly sought to overturn his 2020 election loss to Democrat Joe Biden. (RTRS)

BANKS: A fresh bout of US regulatory scrutiny is setting off a hiring spree at Goldman Sachs Group Inc. as the company’s leaders seek to remediate issues raised by banking supervisors. The Wall Street firm is enlisting several hundred new staffers to help address concerns from authorities including the Federal Reserve, according to people with knowledge of the matter, who asked not to be named discussing confidential plans. The back-office hiring binge comes even as the firm cuts executives from money-making ranks amid a slump in business. (BBG)

FED: Federal Reserve Chair Jerome Powell will speak next Friday at the Kansas City Fed’s Jackson Hole Economic Policy Symposium, the US central bank said. The Fed chief in recent years has delivered the opening keynote of the three-day conference, which will be held this year on Aug. 24-26 at the Jackson Lake Lodge in Grand Teton National Park. (BBG)

HOUSING: A recent surge in US mortgage rates has pushed affordability to the lowest level in nearly four decades. For house hunters, waiting for any relief is a risky gamble. (BBG)

OTHER

NEW ZEALAND: New Zealand’s central bank sees a risk that a strong housing recovery could keep inflation elevated for longer, underscoring policymakers’ decision this week to signal they’re in no rush to lower borrowing costs. The Reserve Bank kept the Official Cash Rate at 5.5% on Wednesday and projected a small chance of another rise in interest rates. The central bank also signaled the benchmark won’t fall below the current level until early 2025, in contrast with many economists who predict an easing in late 2024. (BBG)

NEW ZEALAND: Fonterra tumbles 13% after the world’s biggest dairy exporter lowered the 2023/24 season forecast milk price to NZ$6-$7.50/kgMS from from $6.25-$7.75 per kgMS. Global dairy trade prices have continued to fall since milk price review earlier this month, prompting the decision to cut the midpoint further. (BBG)

AUSTRALIA: Unions have set dates for members to vote on potential industrial action at Chevron Corp. and Woodside Energy Group Ltd. liquefied natural gas facilities in Australia. Any outages would threaten about 10% of global supply and a local export sector that generated an estimated A$92 billion ($59 billion) in earnings in the year to June 30. (BBG)

WHEAT: Wheat advanced following a report that a Ukrainian sea drone attempted to attack two Russian Black Sea fleet warships, a further escalation of hostilities between the two nations in the key waterway. Futures in Chicago climbed as much as 2.1% on Friday, trimming a weekly loss. The Ukrainian drone tried to attack the ships southwest of Sevastopol, but was destroyed, state-run news service Itar-Tass said, citing comments to reporters on Thursday from the Russian Defense Ministry. (BBG)

CHINA

YUAN: China delivered its strongest ever pushback against a weaker yuan via its daily reference rate for the managed currency, as it sought to restore confidence to a market spooked by disappointing data and heightened credit risks. The People’s Bank of China set its so-called fixing at 7.2006 per dollar compared to an average estimate of 7.3047 in a Bloomberg survey with traders and analysts. That was the largest gap to estimates since the poll was initiated in 2018. (BBG)

HOUSING: China’s state-owned property developers are warning of widespread losses, fueling concerns that the housing crisis is expanding from the private sector to companies with government backing. Eighteen out of 38 state-owned enterprise builders listed in Hong Kong and the mainland reported preliminary losses in the six months ended June 30, up from 11 that warned of full-year losses in 2022, according to a Bloomberg tally based on corporate filings. Two years ago, only four firms with controlling or major state shareholdings posted losses. (BBG)

HOUSING: Project mergers, acquisitions between real estate firms, and allowing strong enterprises to buy key property companies, may be effective ways of restructuring China’s housing market and cutting debt risks, according to a commentary in China’s Economic Daily. (BBG)

PROPERTY: China Evergrande (3333.HK), which is the world's most heavily indebted property developer and became the poster child for China's property crisis, on Thursday filed for protection from creditors in a U.S. bankruptcy court. (RTRS)

BRICS: Chinese President Xi Jinping will attend the BRICS summit in South Africa next week, a rare journey abroad for the leader who has preferred to stay home this year amid mounting political problems. (BBG)

CHINA MARKETS

MNI: PBOC Injects Net CNY96 Bln Friday

The People's Bank of China (PBOC) conducted CNY98 billion via 7-day reverse repos on Friday, with the rates unchanged at 1.80%. The operation has led to a net injection of CNY96 billion after offsetting the maturity of CNY2 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8167% at 09:22 am local time from the close of 1.8964% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday, compared with the close of 46 on Wednesday.

PBOC Yuan Parity Higher At 7.2006 Friday Vs 7.2076 Thursday

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.2006 on Friday, compared with 7.2076 set on Thursday. The fixing was estimated at 7.3047 by Bloomberg survey today.

MARKET DATA

Japan July National CPI 3.3% Y/Y; Prior 3.3%

Japan July National Ex Fresh Food CPI 3.1% Y/Y; Prior 3.3%

Japan July National Ex Fresh Food, Energy CPI 4.3% Y/Y; Prior 4.2%

MARKETS

US TSYS: Marginally Richer In Asia

TYU3 deals at 109-21, +0-12, a 0-08 range has been observed on volume of ~97k.

- Cash tsys sit 1-2bps richer across the major benchmarks, light bull flattening is apparent.

- Tsys have firmed off session lows in early dealing, there was no obvious headline driver and the moves was seen alongside e-minis erasing early losses.

- Gains marginally extended as participants perhaps used yesterday's cheapening in TY to add fresh long positions/close out shorts.

- FOMC dated OIS remain stable; a terminal rate of 5.40% is seen in November with ~70bps of cuts by July 2024.

- UK Retail Sales headlines an otherwise thin docket on Friday.

JGBs: Richer, Near Session Highs, Tracking US Tsys

In the Tokyo afternoon session, JGB futures have pushed to a session high of 146.59. Currently, JBU3 is dealing at 146.55, +21 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined National CPI, which printed in line with expectations.

- Accordingly, local participants appear to have tracked US tsys. US tsys have firmed off session lows in dealings in the Asia-Pac session. There has been no obvious headline driver. Cash tsys yields sit 1-2bp lower across the major benchmarks.

- Cash JGBs are mixed across the curve, with yields 1.2bp lower (20-year) to 1.0bp higher (1-year). The benchmark 10-year yield is 0.6bp lower at 0.640%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- Swap rates are 0.3bp to 1.6bp lower across the curve. Swap spreads are narrower.

- Next week the local calendar is empty until Jibun Bank PMIs on Wednesday.

- Tuesday sees Liquidity Enhancement auctions for 5-15.5-year JGBs.

AUSSIE BONDS: Richer, At Sydney Session Highs, No Data, Tracking Tsys

ACGBs (YM +7.0 & XM +7.0) are richer and trading near Sydney session highs. Without domestic drivers, local participants have eyed the performance of US tsys in Asia-Pac trade.

- Tsys have firmed off session lows in dealing in the Asia-Pac session. There has been no obvious headline driver. Cash tsys sit 1-2bp lower across the major benchmarks.

- Cash ACGBs are 7-8bp richer, with the AU-US 10-year yield differential 2bp tighter at flat.

- Swap rates are 6-7bp lower with EFPs slightly wider.

- The bills strip has bull flattened with pricing flat to +7.

- RBA-dated OIS pricing is 1-5bp softer for meetings beyond October. The market currently attaches a 5% chance of a 25bp hike in September.

- (AFR) Interest rates on Aussie and US 10-year government bonds soaring above 4.25 per cent are a game changer for every asset class and reinforce the structural shift towards a higher cost of capital that commenced in early 2022. (See link)

- Next week the local calendar is very light, with Judo Bank PMIs being the only release.

- Next Wednesday, the AOFM plans to sell A$700mn of the 3.00% 21 November 2033 bond.

- European CPI headlines later today.

NZGBS: Closed Richer, Session Highs, Tracking Tsys

NZGBs closed 3bp richer, at local session highs, after an uneventful day for domestic news. Nevertheless, NZGBs have underperformed the $-bloc, with the NZ-US and NZ-AU 10-year yield differentials 1-2bp wider.

- US tsys have firmed in Asia-Pac trade, with cash tsys dealing 1-3bp richer across the major benchmarks.

- Swap rates are 1-2bp lower, with the 2s10s curve steeper.

- RBNZ dated OIS closed 1-2bp softer on the day for meetings beyond Apr’24. Nevertheless, pricing is 5-11bp firmer since the RBNZ decision on Wednesday. Terminal OCR expectations sit at 5.67%, just above the lower band of the 5.60-5.81% range it has traded in since the May Monetary Policy Statement.

- NZ’s central bank sees a risk that a strong housing recovery could keep inflation elevated for longer, underscoring policymakers’ decision this week to signal they’re in no rush to lower borrowing costs. “Near term, there are still some risks on the upside to inflation,” Assistant Governor Karen Silk said in an interview on Friday in Wellington. (See link)

- Next week the local calendar sees the July Trade Balance on Monday and Q2 Retail Sales Ex-Inflation on Wednesday.

- European CPI headlines later today.

EQUITIES: Asian Equities Pressured On Friday

Equities were pressured in Asia on Friday, as concerns over the Chinese economy and higher US interest rates weighed.

- The Hang Seng is down ~1%, the Index unwound an early loss as risk assets were briefly bid after the PBOC's Yuan defence continued via a stronger-than-expected CNY Fix however risk sentiment soured through the session and losses extended.

- In Japan, TOPIX is down ~0.8% and the Nikkei is ~0.6% lower.

- Chinese equities are also pressured, however they are marginally outperforming Asian peers. CSI300 is down ~0.3% and Shenzen Composite is down ~0.6%.

- Australia's ASX200 is a touch firmer.

GOLD: Up In Asia-Pac After A Slight Decline On Thursday

Gold has managed a modest ascent (+0.3%) in the Asia-Pac session, following a 0.1% decline in its closing on Thursday. The precious metal yielded to USD strength as the session progressed, culminating in a dip to $1885.08, a level that tested the March 15 low of $1885.8. As per the insights from MNI's technical team, the next potential support threshold stands at $1871.6 (March 13 low).

- The USD rose to its highest level since early June. The movement observed on Thursday added to a cumulative increase of 4% since the middle of July.

- Bullion was also pressured by higher US tsy yields. The US 10-year rate traded as high as 4.325% overnight, edging within a single basis point of the 2022 high. Meanwhile, the 30-year rate climbed to 4.42%, surpassing the peak from the previous year and attaining its highest level since 2011. The 2-year rate has maintained its position just below 5%.

- Higher bond yields are typically negative for the precious metal, which doesn’t earn interest income.

FOREX: Antipodeans Trim Gains

The Antipodeans have trimmed gains in Asia as weaker regional equities weighed on sentiment. AUD and NZD were both ~0.3% firmer after further PBOC defence of the Yuan has weighed on the greenback, before gains were trimmed.

- AUD/USD now sits a touch above the $0.64 handle, unchanged from opening levels. An intra day high of $0.6429 was reached before sentiment soured and gains were erased. The trend condition remains bearish, support comes in at $0.6365 (yesterday's low), $0.6285 (low from 4 Nov 22) and $0.6215 a Fibonacci projection.

- Kiwi is also now unchanged from opening levels, and last prints at $0.5925/30. RBNZ's Silk noted she sees housing as a reason to keep rates higher for longer, the wealth effect from rising house prices may fuel spending.

- Yen is firmer as softer US Tsy Yields weigh on USD/JPY. Headline and Core National CPI came in as expected. The uptrend in the pair remains intact, resistance comes in at ¥146.56 (high from Aug 18) and ¥146.93 (high from 8 Nov 22). Support is seen at ¥145.11 (low from Aug 15).

- Elsewhere in G-10; the greenback is marginally pressured BBDXY is down ~0.1%. EUR is marginally firmer however ranges are narrow.

- Cross asset wise; e-minis are little changed and the Hang Seng is down ~1%. US Tsy Yields are ~2bps softer across the curve.

- Retail Sales from the UK headline an otherwise thin docket today.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/08/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 18/08/2023 | 0800/1000 |  | EU | ECB's Lane appears in ECB podcast | |

| 18/08/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/08/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 18/08/2023 | 0900/0500 | * |  | US | Business Inventories |

| 18/08/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/08/2023 | 1400/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.