-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

MNI Global Morning Briefing

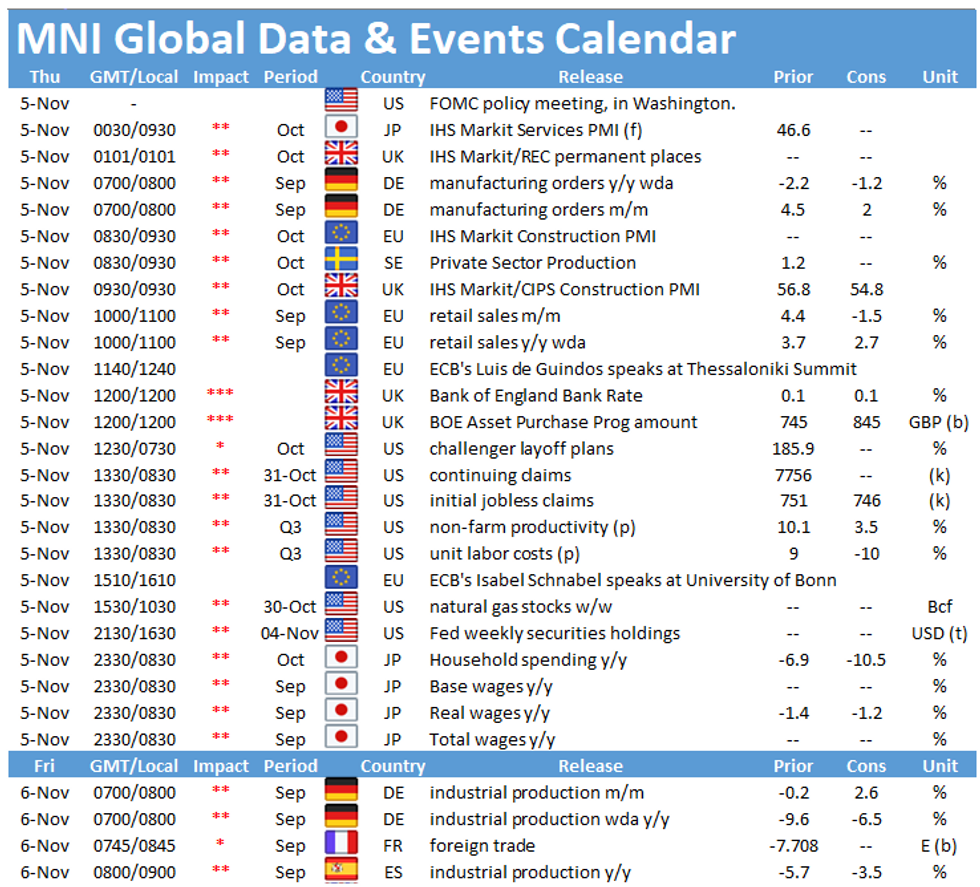

Thursday morning kicks off with the release of German factory orders and the BOE's interest rate decision both due at 0700GMT, followed by EZ retail sales at 1000GMT. In the US the FOMC policy statement will closely watched at 1900GMT.

German factory orders forecast to rise again

Industrial orders are projected to rise again in September, although at a slower pace of 2.0%. This would mark the fifth consecutive increase of monthly factory orders. However, in August monthly orders are still 3.6% below February's pre-crisis level. Orders ticked up 4.5% in August, mainly due to a sharp rise in orders from Eurozone countries, while domestic orders only grew by 1.7%. Annual orders are expected to decline by 1.2% in September after dropping 2.2% in the previous month.

Survey evidence is in line with market forecasts looking for another increase. Germany's manufacturing PMI increased further in October on the back of a record growth of new orders. The renewed lockdown in Germany is likely to have a smaller impact on the manufacturing sector as firms are allowed to stay open.

BOE may boost QE

The BOE meets amid a sharp increase in Covid-19 infections and a service-driven slowdown, boosting expectations that Threadneedle Street's policymakers will ease policy further. While too early for the Bank to move towards negative rates -- the consultation period doesn't end until mid-November -- the BOE will likely further increase levels of QE. With no firm guidance on the MPC's rule of thumb, estimates range from GBP55 billion to GBP100 billion of additional firepower.

EZ retail sales seen falling

Retail sales in the Eurozone are forecast to decline by 1.5% in September on a monthly basis, following an increase by 4.4%. August's uptick was driven by non-food sales with mail orders and internet sales rising sharply. State level data is in line with expectations. Germany's retail sales dropped 2.2% in September, while Spanish sales eased 0.3%. The stricter restrictions introduced in November are likely to weigh heavily on spending in the coming months as non-essential shops are forced to close again in several countries.

FOMC Policy Decision likely to see no change

No change in policy is anticipated at the meeting two days after the presidential election and will not include an SEP update. Rates are on hold near zero and asset purchases are expected to continue at the current pace. Sources expect a detailed discussion of future balance sheet policy options that include ramping up QE, shifting purchases toward longer maturities, yield curve control and expanding the purchases of non-Treasury assets. The release of the meeting minutes after a three-week delay should shed more light on that.

The main events to look out for besides the policy decisions of the BOE, Norges Bank and the FED are speeches by ECB's Luis de Guindos and Isabel Schnabel.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.