-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI Global Morning Briefing

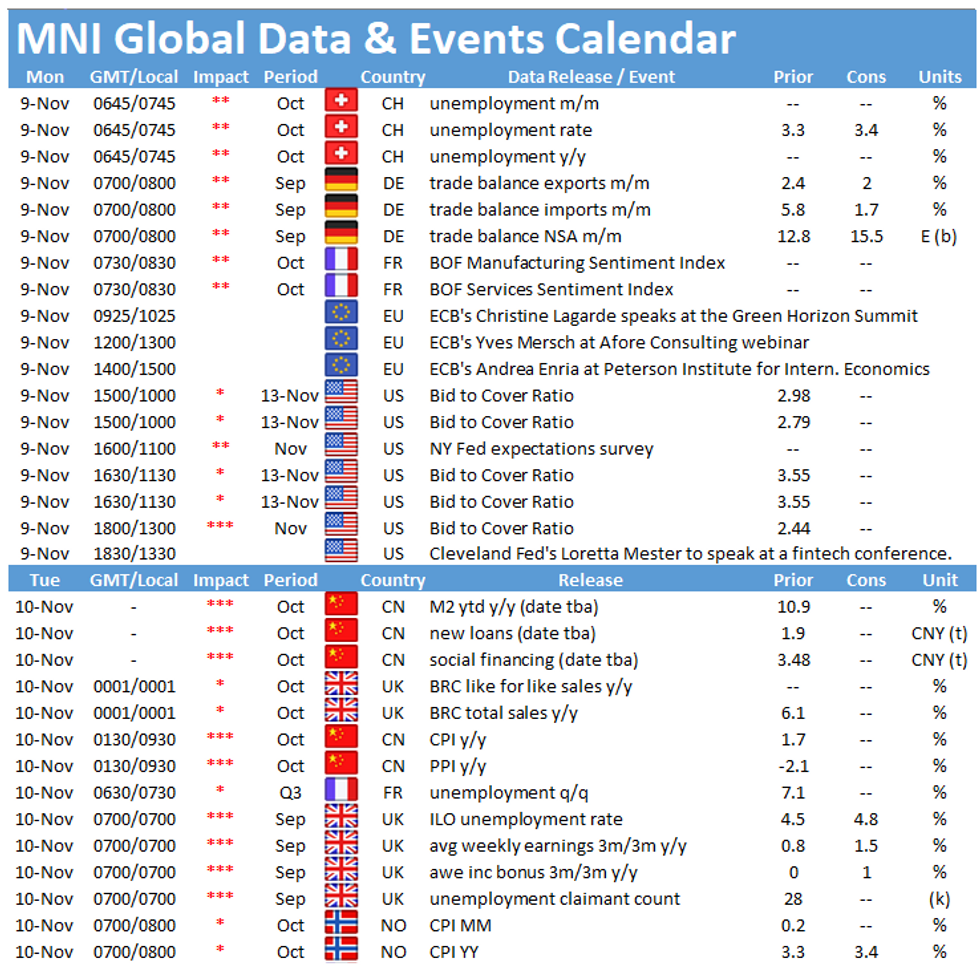

The main events to look out for in Europe on Monday include the Swiss unemployment figures at 0645GMT and the German trade balance at 0700GMT. There are no data publications scheduled for the North Americas.

Swiss unemployment expected to edge higher

The seasonally adjusted jobless rate ticked down by 0.1pp to 3.3% in September and markets look for a small increase to 3.4% in October. The number of unemployed people declined by 1.7% in September, however it is still 49.9% higher than in the same period a year ago. Vacancies eased in September both on a monthly and an annual basis by 0.9% and 8.9%, respectively. The KOF employment indicator improved slightly in October, however it remains in negative territory and firms continued to report planned reductions of staff levels. Moreover, the survey noted that most participants gave their assessment at the beginning of October before new restrictions had been introduced.

German trade surplus forecast to shrink slightly

The seasonally adjusted German trade surplus narrowed marginally in August to EUR 15.7bn, down from EUR 18.0bn recorded in July, while the unadjusted trade balance recorded EUR 12.8bn. In September, markets expect the unadjusted trade surplus to expand to EUR 15.5bn. Exports ticked up 2.4% in August, while imports rose 5.8% in the same period. Exports are expected to rise to 2.0% in September, while imports are seen edging up to 1.7%. Survey evidence is in line with market forecasts. The German manufacturing PMI ticked up again in October and noted an increase in new export orders. The Ifo export expectations index rose significantly in September before it eased in October. The survey shows that export expectations differ between sectors. While food and textile exporters expect exports to decelerate, producers of electronic and optical devices as well as the chemical industry look for an uptick in exports.

The are several events to look out for on Monday including speeches by ECB's Christine Lagarde, Yves Mersch and Andrea Enria as well as by Cleveland Fed's Loretta Mester. BOE Governor Andrew Bailey and Chief Economist Andy Haldane are also scheduled to speak.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.