-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI Global Morning Briefing

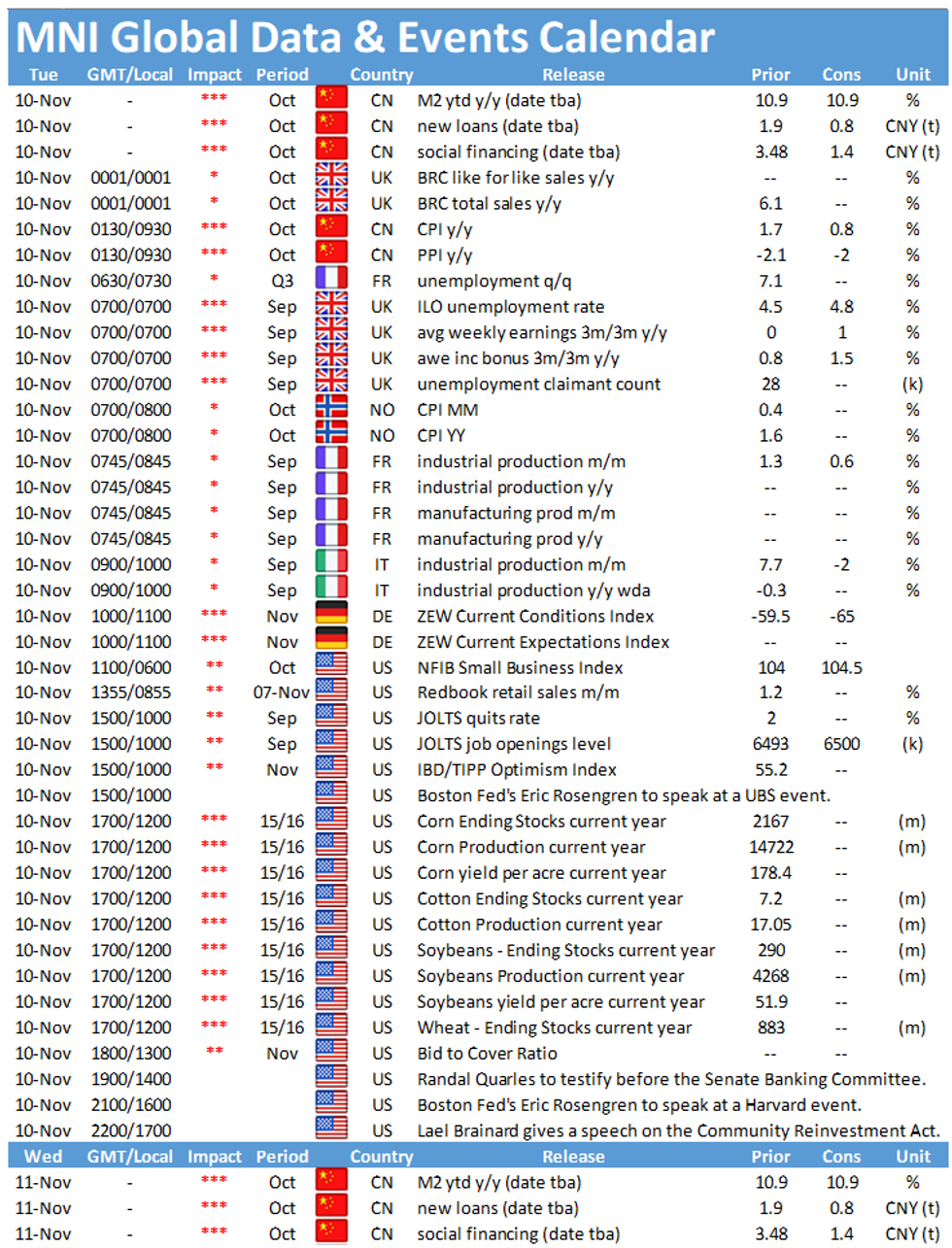

Tuesday kicks off with the release of the UK labour report at 0700GMT followed by the ZEW survey at 1000GMT. In the US the release of the NFIB small business optimism index at 1100GMT is worth noting.

UK unemployment rate seen edging higher

The UK's unemployment rate is forecast to edge up in September to 4.8%, up from August's 4.5%. The employment rate ticked down slightly in August to 75.6%, while the economic inactivity rate remained unchanged at 20.8%. Last month's report showed that the number of payroll employees increased by 20,000 which was the first increase since the start of the year, however, since the beginning of the pandemic 673,000 jobs have been lost according to PAYE data. Average weekly hours of work ticked up slightly to 27.3 in August, marking the second successive increase, but they remain below pre-pandemic levels. Looking ahead, due to the second lockdown another decline in average weekly hours of work is likely. Moreover, the extension of the furlough scheme will prevent a steeper rise of unemployment in the coming months.

Survey evidence suggests a muted outlook. The KPMG/REC jobs report showed a decline in permanent placements in October and an increase in candidate supply due to reported redundancies. The report also noted a downtick of vacancies in October following an uptick in September. The CIPD/Adecco Group labour market outlook survey for autumn 2020 showed a marginal improvement of conditions with employment intentions increasing in Q4 compared to the previous quarter, however they remain below pre-crisis levels. Intentions to make redundancies eased modestly in Q4 but remain elevated. Moreover, the survey was conducted before the announcement of the new lockdown measures in England.

ZEW expectations and current conditions expected to ease

Both the ZEW current conditions and the expectations index are forecast to decline in November. Current conditions are seen at -65.0 in November following an increase of 6.7 points to -59.5 in October. Expectations fell sharply, down by 21.3 points, in October to 56.1 and markets expect the index to show another strong decline of 11.8 points to 44.3 in November. The rising infection rates across Europe and subsequent stricter restrictions weigh heavily on economic activity and sentiment. While Germany's economy is likely to fare slightly better due to an only partial lockdown, France is likely to see a more severe downturn as rules are stricter. Nevertheless, the positive momentum seen in August and September clearly ended when Covid-19 cases started to rise in early autumn.

US NIFB small business optimism index seen slightly higher

The NIFB Optimism index increased 3.8 points in September to 104.0 with nine out of ten components showing a monthly uptick. In October markets are looking for another uptick to 104.4 which would be the highest level since November 2019. The survey noted that small businesses saw an increase in footfall in October, however they are still struggling financially, and they are uncertain regarding the outlook. Survey evidence is in line with market forecasts. The IHS composite PMI signalled a robust expansion in business activity in October which was driven by a sharp increase in the service sector.

The events calendar throws up a busy schedule on Tuesday including speeches by Fed's Rob Kaplan, Boston Fed's Eric Rosengren, along with Fed Governors Randal Quarles and Lael Brainard.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.