-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: UK GDP Data Seen Higher

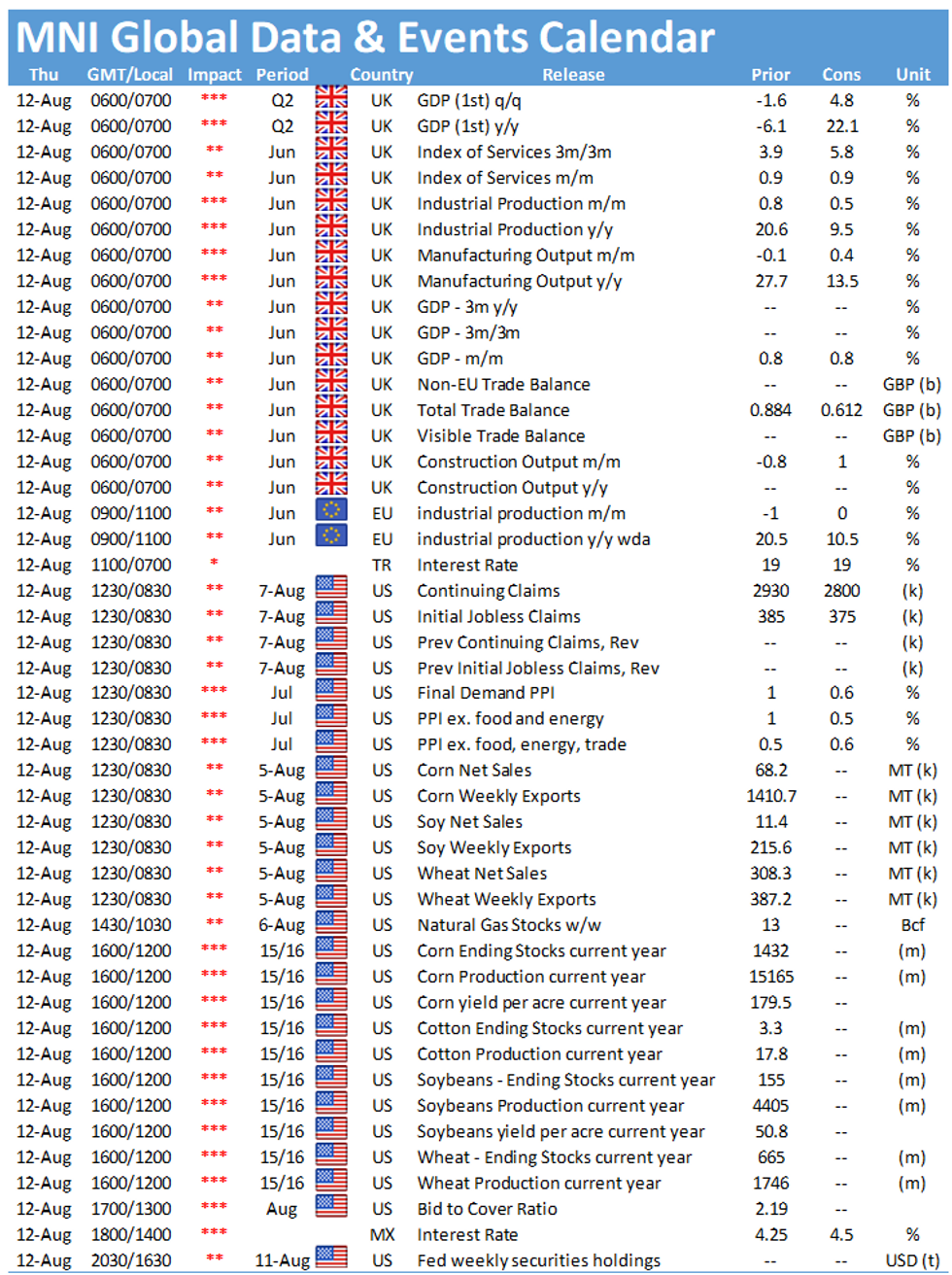

Thursday gets underway with the string of UK short-term economic indicators at 0700BST, with the UK Q2 GDP likely to dominate. At 1000BST, eurozone industrial output data is set for release, with the U.S. initial claims data expected at 1330GMT. U.S. July PPI will also be closely watched.

UK Q2 GDP Seen Higher; Manufacturing May Disappoint

UK GDP likely rose 4.8% between April and June, according to analysts, but supply bottlenecks and a global semiconductor shortage could lead to a downturn in manufacturing output. Car production declined 58% in Q2, according to the SMMT, a jaw-dropping fall in a sector that comprises 9% of the manufacturing base (and just under 1% of GDP). Production increased by 0.8% in Q1. However, auto manufacturing rebounded by 26% in June, albeit from an extraordinarily low level in May. Analysts currently forecast a 0.4% percent increase in total manufacturing between May and June.

Consumer spending is expected to rise by 5.5%, reversing a 4.6% in Q1, with Q2 retail sales, up 12.2%, likely to add 0.6% to GDP, according to the ONS. However, analysts will be closely eyeing the performance of the service sector in June (forecast to rise by 0.9% m/m) amid reports that a resurgence of the Delta Covid variant dampened consumer confidence. Analysts look for a 0.8% rise in June GDP, matching the May advance.

U.S. initial claims seen lower again

U.S. jobless claims filed through August 7 should dip slightly to 375,000 after falling to 385,000 in the week ending July 31. Continuing claims should dip to 2.8 million following a 366,000 drop to 2.9 million in the week ending July 24. Declines in initial filings for regular state programs point to some labor market improvement, though similar declines in pandemic-related programs mostly reflect decisions from many states to roll back those programs before their official September expiration.

There are no policymaker speeches slated for Thursday, although interest rate decisions from both the Turkish and Mexican central banks will be closely watched.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.