-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI:Largest Canada New Home Price Dip Since `09 Led By Toronto

MNI: Canadian Oct Retail Sales Rise For Fourth Straight Month

MNI POLITICAL RISK - Trump Cabinet Hits First Roadblock

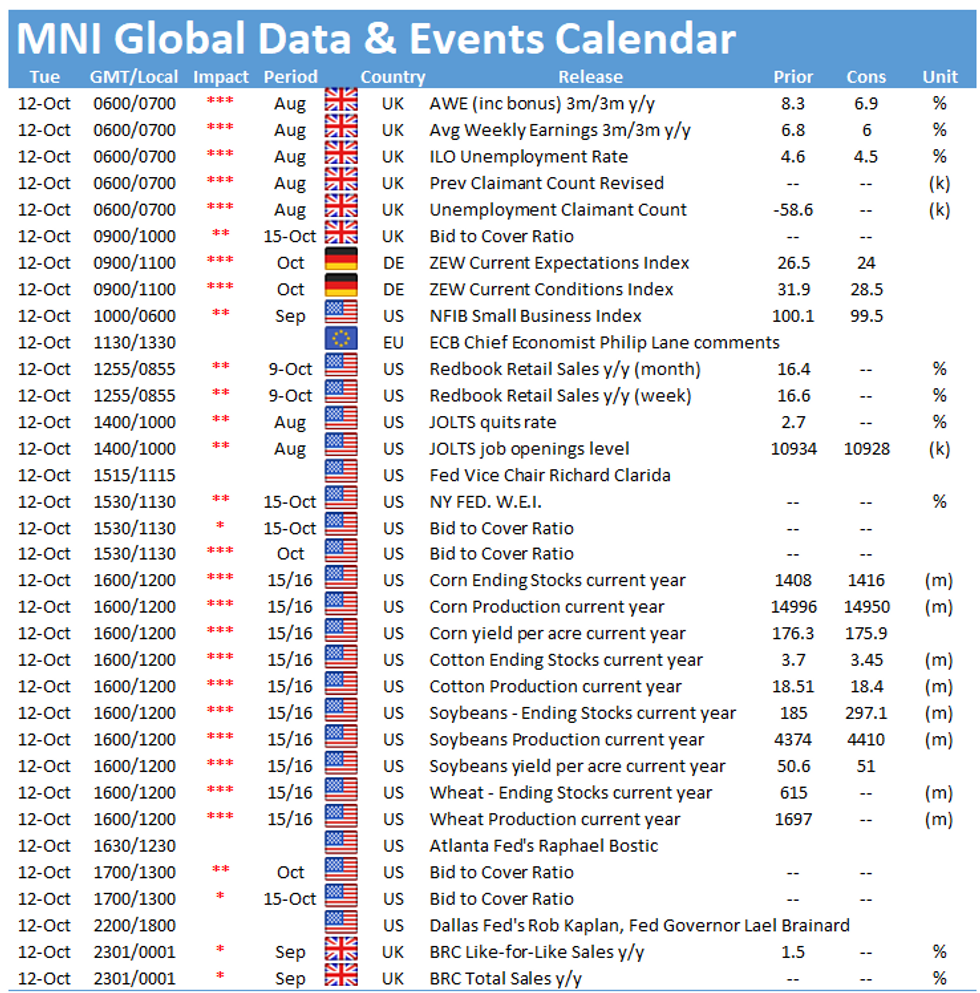

MNI Global Morning Calendar: UK Wage Growth To Slow

The UK labour market survey and the German ZEW will be closely watched Tuesday, with the U.S. JOLTS data also on the radar.

UK Aug/Sept Employment Seen Soaring; Wage Growth Moderating

The UK jobs market remained red hot in through the end of the third quarter, according to analysts, while wage growth decelerated moderately from record-high levels.

Employment rose by 234,000 in the three months to August, according to City forecasters. That would represent the biggest increase since the onset of the pandemic in early 2020, and would push the jobless rate down to 4.5% from 4.6% in the three months to July. Salaried employment rose by a record-high 241,000 in August, according to data compiled by HMRC, topping the February 2020 level, although that series has been subject to sizeable revision.

Given the anomalies in the labour market as the post-pandemic recovery, analysts will keep a close eye on the vacancy rate, which hit a record high of just over one million in the three months to August. Demand for workers continued to growth in September, according to the KPMG/REC survey, which also suggested historically-low levels of staff availability.

Analysts forecast a slowdown in earnings growth to a still-elevated 7.0% from an annual rate of 8.3% in the three months to July, with regular wage growth decelerating to 6.0% from 6.8% in the previous period. However KPMG/REC data suggest a degree of upside risk to those forecasts, with both permanent salaries and contract wages hitting record highs last month.

German ZEW seen lower (1000 BST)

Germany's ZEW sentiment indicator is seen slipping again in October, with expectations of a dip to 24 from September's 26.5. The index peaked post-pandemic at 84.4 in May, and the index has subsequently posted 4 straight declines to a post-pandemic low. However, despite the declining expectations indicator, the current conditions index has held firm, rising to 31.9 in September, although that is expected to decline to 28.5 in October.

Amongst policymakers slated to speak Tuesday are ECB Chief Economist Philip Lane, Fed Vice Chair Richard Clarida and Dallas Fed President Rob Kaplan.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.