-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Norges Bank Preview - November No More Than a Placeholder

MNI Norges Bank Preview - November No More Than a Placeholder

Full article here:

Higher COVID caseload adding pressure, but November no more than a placeholder

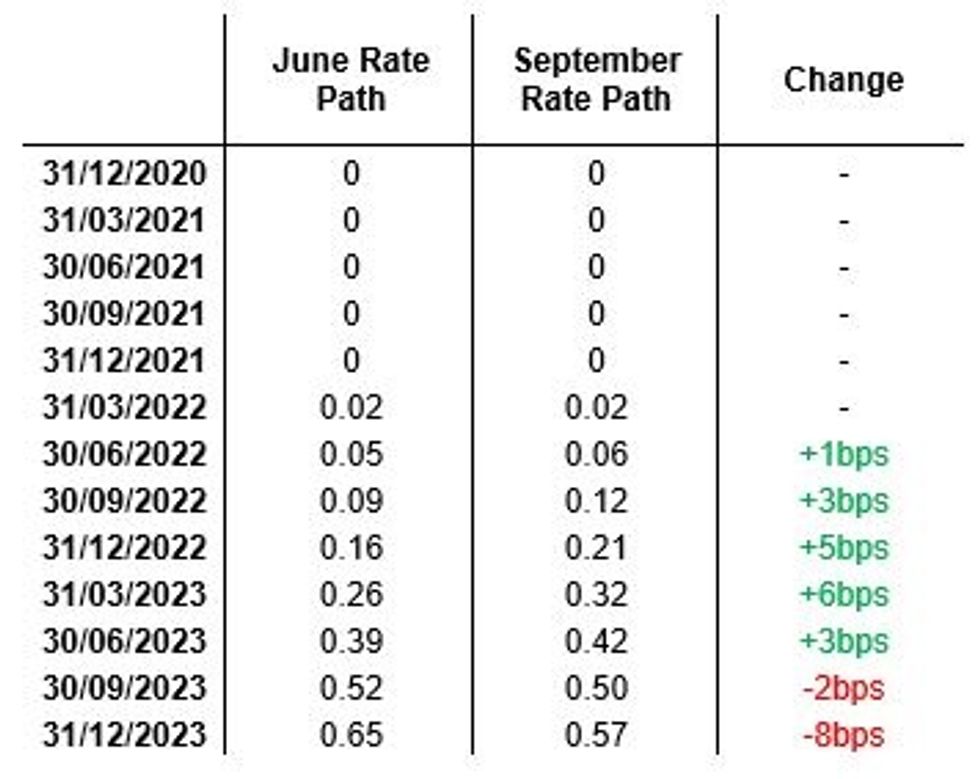

With no new rate path projections, economic forecasts or accompanying press conference, the Norges Bank are likely to follow the rate path dictated in their September meeting and keep policy unchanged Thursday.

As is the case with central banks from Australia to the US and the Eurozone, the Norges Bank are dealing with an economy still subject to COVID containment measures, restrained economic activity and an uncertain outlook for key trade partners. Nonetheless, there is little threat of the financial market fragmentation or rising instability that would prompt action at this month's Norges Bank meeting.

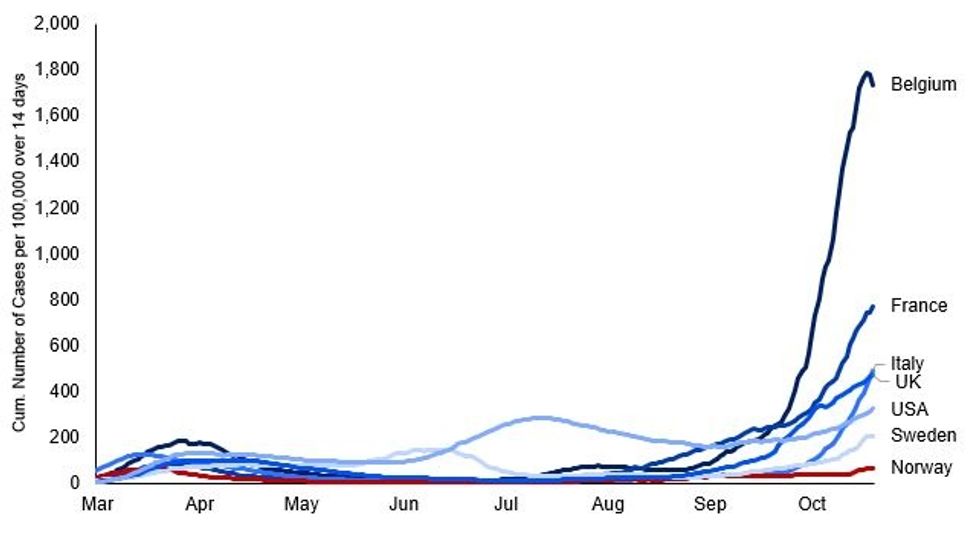

Most of Western Europe is suffering under the weight of an increasing COVID case count and declining ICU capacity. Norway is no exception. Nonetheless, the uptick in Norway's positive case count is, as of the beginning of November, far shallower and less pronounced against global peers.

While this is far from good news, it suggests the Norwegian economy could be more well placed for any post-lockdown recovery relative to its international counterparts. We expect these thoughts to be fed into the December Monetary Policy Report, at which we receive new economic forecasts and rate path projections. So, while the Bank will certainly take note of the recent rise in COVID cases and retrenchment of global growth, a cautious, albeit not activist, approach will likely be maintained.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.