-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS-Dutch PM Wins 4th Term

The incumbent governing coalition in the Netherlands could re-form as a majority following a good night for Prime Minister Mark Rutte's centre-right liberal People's Party for Freedom and Democracy (VVD). In the likely event that Rutte leads the next government it will be a watershed moment, marking the first time a Dutch prime minister has been elected to four consecutive terms in office. With Germany Chancellor Angela Merkel due to stand down at the September federal election, this will make Rutte the second-longest serving EU head of government after Hungarian Prime Minister Viktor Orban.

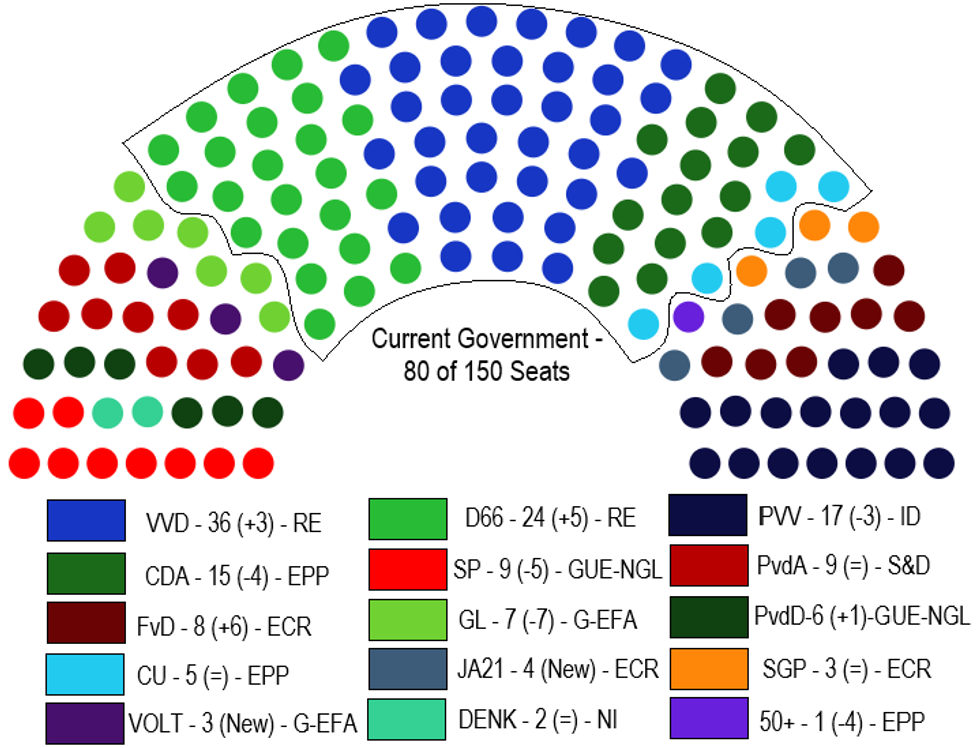

Preliminary results give the four governing parties: Rutte's VVD, the pro-EU liberal Democrats 66 (D66), the centrist Christian Democratic Appeal (CDA), and the social conservative Christian Union (CU), 80 seats in the 150-seat House of Representatives. These numbers are likely to change as results come in, but not enough to deny the government a majority. The government could reform (it is the first time since 1998 that a governing coalition has been re-elected as a majority), but talks could take some weeks or even months.

Preliminary Results of March 15-17 General Election, Seats in House of Representatives Source: APN, MNI. N.b. APN seat projection with 63% of votes counted, seat totals likely to change.

Source: APN, MNI. N.b. APN seat projection with 63% of votes counted, seat totals likely to change.

- Implications for Government: Gains for D66 at the expense of the CDA could mean D66 taking over the finance ministry, usually an office afforded to the second-largest party in a coalition government. The CDA are the most 'frugal' of the governing parties with regards to the EU and level of spending it would be willing to countenance. D66 is much more pro-integrationist and may offer a softer tone on issues such as EU budget, Stability and Growth pact. It should be noted, though, that the Dutch government will remain a key part of the 'frugal four', and that there will be no sudden shift in The Hague towards softer stance on EU spending.

- Implications for the Right: A mixed night for the Dutch right. The main right-wing nationalist Party for Freedom (PVV) of Geert Wilders lost three seats and drops to the position of the third-largest party in parliament. The populist, COVID-skeptic Forum for Democracy (FvD) made notable gains, winning an additional six seats lifting its total to eight, while the libertarian, anti-immigration JA21 entered parliament with four seats, so an overall increase in representation for the populist right.

- Implications for the Left: While D66 made notable gains, the party is firmly towards the centre of the centre-left spectrum, supported by graduates and urban liberals. The other leftist parties all either lost ground or stood still in a poor night for the Dutch left.

- On the EU, there is an increasingly evident schism in Dutch society. Eurosceptic parties on the right recorded a net gain of seven seats, while the most pro-EU parties and even those supporting eurofederalism gained eight seats. This came at the expense of parties such as the CDA, SP and GL that are neither overtly eurosceptic nor vocal integrationists. While this is unlikely to manifest in a 'Nexit' movement to take the Netherlands out of the EU any time soon, it could lead to a more vocal and bitter narrative in Dutch politics, with a moderate centre-right government being buffeted by both the populist right calling for less EU integration and a staunchly pro-EU liberal left (potentially assisted by the second-largest party in government) advocating for greater EU engagement.

MNI POLITICAL RISK ANALYSIS – Netherlands Election Preview.pdf

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.