-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Aug 6

MNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Aug 6

by Tom Lake

Today's Major COVID-19 Headlines And Latest Data

- German Health Minister Jens Spahn announced on August 6 that all individuals travelling to Germany from high-risk countries will be required to take a COVID-19 test on entry from August 8 onwards. The move comes as Germany recorded 1,285 new cases on August 5, the highest daily total since April 30. After an outbreak in July at a meat processing plant, Spahn stated today that most new spikes have come due to travellers arriving from abroad, as well as lax social distancing observance.

- Japanese Prime Minister Shinzo Abe reiterated his stance that the reintroduction of a state of emergency was not necessary, despite a continued spike in new cases in the country. Japan has recorded over 1,000 new cases per day for six of the past seven days, but Abe said a state of emergency was not required as the number of severe cases and fatalities has been far lower than during the country's first wave outbreak in April and May.

- US President Donald Trump has had video clips removed from his Facebook and Twitter pages for spreading what the firms called "harmful COVID misinformation". Facebook deleted a clip of Trump saying children were "almost immune" to the virus in a Fox News interview, while Twitter froze a Trump campaign account until the same clip was deleted from its feed.

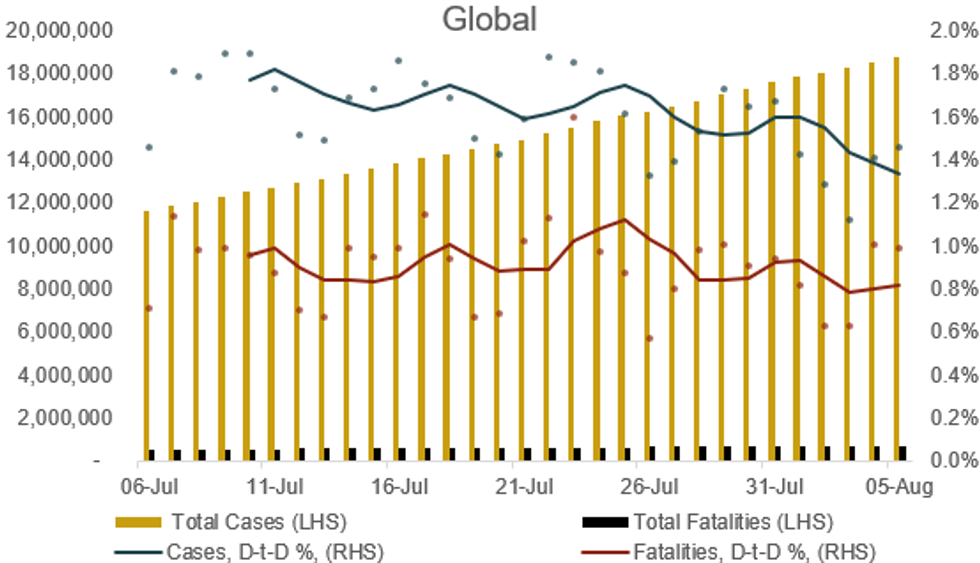

- Global increase in cases (daily) – Yesterday: 1.5%. Seven-day average: 1.4%

- Global increase in fatalities (daily) – Yesterday: 1.0%. Seven-day average: 0.8%

MNI INTERVIEW: July US Service Sector Strength Won't Last -ISM – U.S. service sector strength seen in July should soon taper off if business restrictions meant to corral the spread of Covid-19 in the U.S. aren't completely reversed in the next few months, the chair of the Institute for Supply Management's monthly services barometer told MNI Wednesday. On MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com

Chart 1. COVID-19 Cases and Fatalities, Nominal and % Chg Day-to-Day (5dma)

Source: JHU, MNI. As of 0530BST August 6. N.b. Each dot represents a single day's figures, data for past month

Source: JHU, MNI. As of 0530BST August 6. N.b. Each dot represents a single day's figures, data for past month

Full article PDF attached below:

MNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Aug 6.pdf

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.