-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

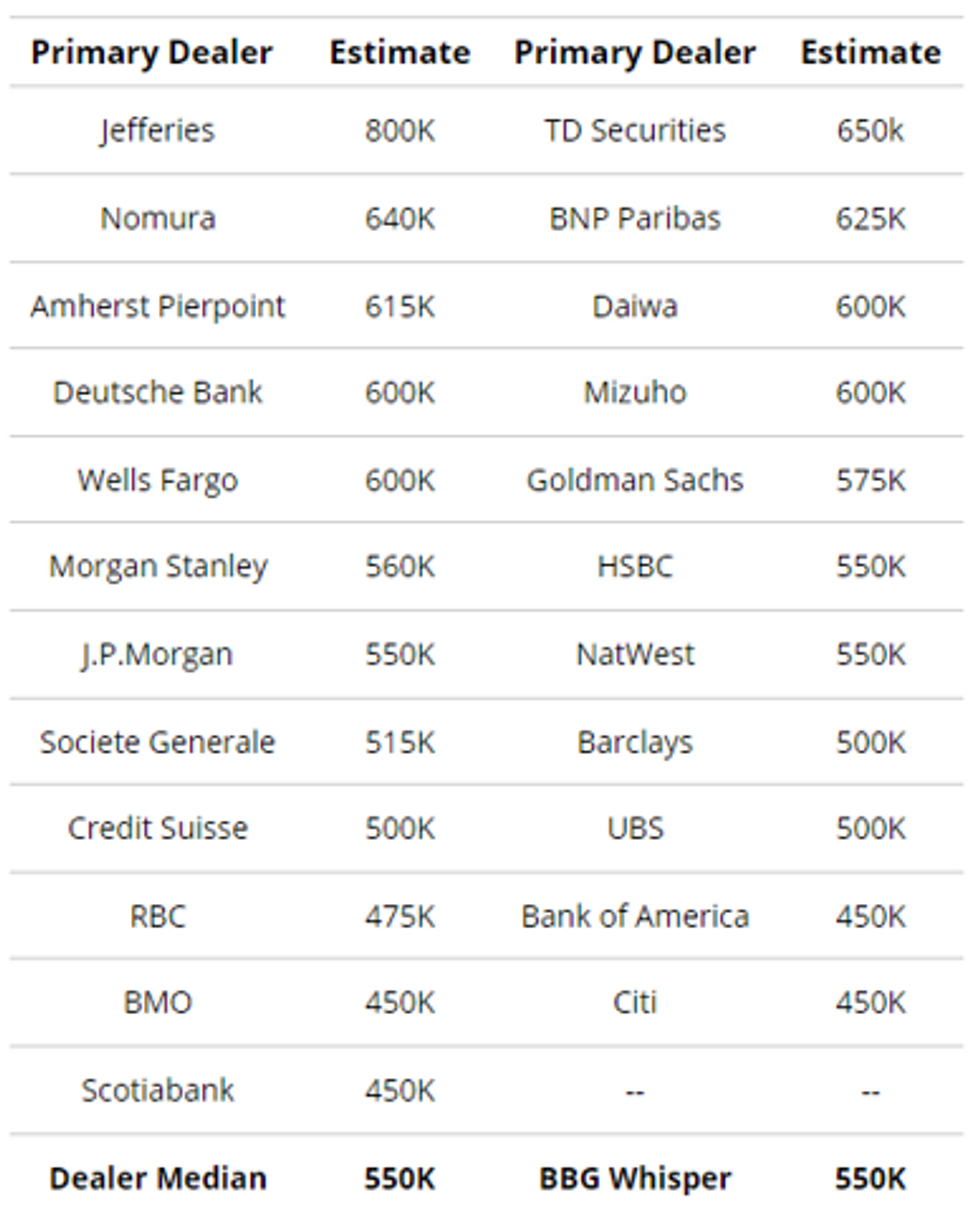

Free AccessMNI PREVIEW (1/3): Nov Nonfarm Payrolls Seen +550K

November nonfarm payrolls are expected to have risen by 550k, vs 531k in October, per both the MNI Dealer Median and Bloomberg survey median (the Bloomberg “Whisper” survey is 559k).

- FULL MNI PREVIEW PDF HERE:https://roar-assets-auto.rbl.ms/documents/12844/US...

- The MNI dealer range is 450k-800k; BBG survey range is 375k-800k.BBG avg is 545k with standard deviation of 71k (so roughly speaking, a figure below 400k or above 680k would be considered a noteworthy surprise).

- The unemployment rate is seen falling 0.1pp to 4.5%, with average hourly earnings +0.4% M/M (unch), and the participation rate picking up 0.1pp to 61.7%.

- The main market focus on this month’s payrolls report is whether job gains are sufficient to keep the Fed on track to decide at the December FOMC meeting to quicken the pace of its asset purchase taper.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.