-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI US CLOSING FI ANALYSIS: Rates And Stocks Surge, Pres Elect?

US TSY SUMMARY

- Very well bid -- and yet off early morning highs. Heavy volumes (TYZ>2.7M) amid Presidential election uncertainty driving the main driver (Biden w/248 electoral votes after officially taking Wisconsin, needs 270 to win). Late count for NV and MI leaning towards Biden, heavy mail-in ballot count remains for PA.

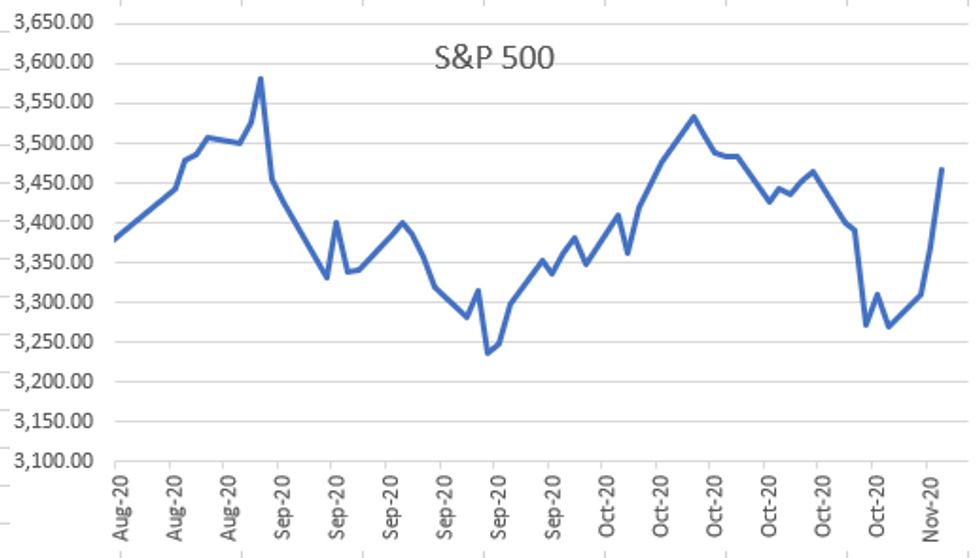

- Increasing odds of Biden win also driven huge buying spree in equities (S&Ps +92.0, NDX +452.0, Dow +535.0). Double digit bear flattening in yield curves, some fast$ accts stopped out in the move.

- Surge in buying across the curve kicked off early overnight as polling numbers ebbed and flowed for each candidate, yields bottomed out early (10YY 0.7545% low; 30YY 1.5029 low -- both still well off March all-time lows) but held range through NY session.

- Trump wants WI recount, in WI, suing to stop count of MI ballots.

- More prosaic items: ADP Private employ miss +365k vs. +650k est, possibly tempering Fri's NFP though no dealer adj's made (+590k est). Weekly claims and FOMC policy annc Thu. The 2-Yr yield is down 2.6bps at 0.1408%, 5-Yr is down 7.3bps at 0.3227%, 10-Yr is down 12.6bps at 0.7729%, and 30-Yr is down 12.6bps at 1.5545%.

TECHNICALS

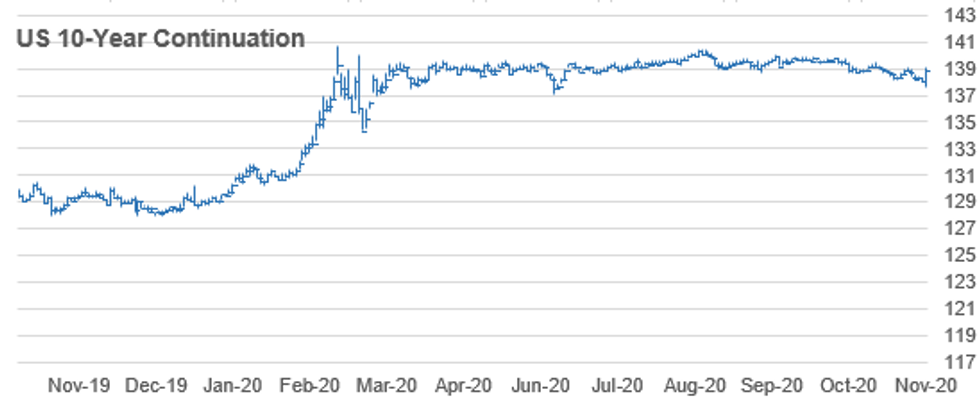

US 10YR FUTURE TECHS: (Z0) Sharp Rally Off The Day Low

- RES 4: 139-07+ High Oct 16

- RES 3: 139-03 High Oct 28 and the bull trigger

- RES 2: 139-27+ 1.0% 10-dma envelope

- RES 1: 139-01 High Nov 4

- PRICE: 138-22 @15:53 GMT Nov 4

- SUP 1: 138-09+ 50% retracement of today's range

- SUP 2: 137-20+ Intraday low

- SUP 3: 137-15 1.382 proj of Aug 4-28 decline from Sep 3 high

- SUP 4: 137-08 1.500 proj of Aug 4-28 decline from Sep 3 high

Treasuries rallied sharply off the overnight low of 137-20+. Price probed but failed to convincingly break trendline resistance at 138-29, drawn off the Oct 2 high. A clear break of the trendline though is still required to signal a reversal. Attention is on resistance at 139-03, Oct 28 high and the near-term bull trigger. A break would confirm a breach of the trendline and strengthen a bullish outlook. Key support has been defined at 137-20+.

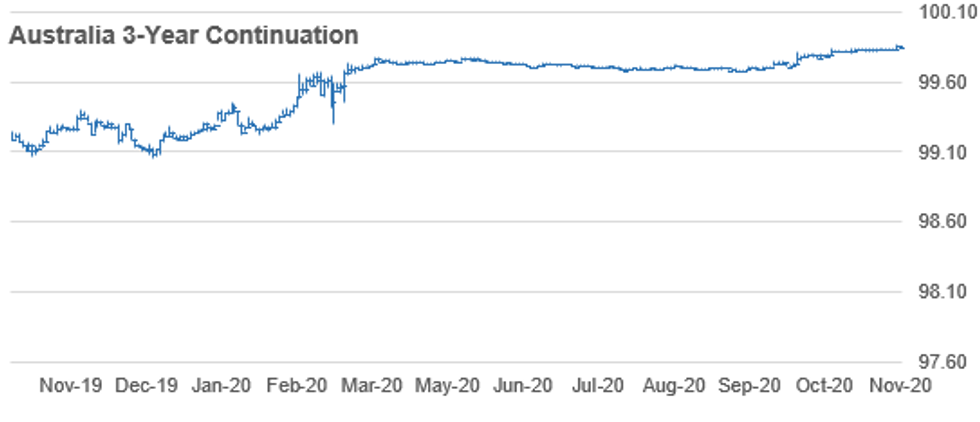

AUSSIE 3Y

AUSSIE 3-YR TECHS: (Z0) Another Lurch Higher on RBA

- RES 3: 100.00 - Psychological round number

- RES 2: 99.886 - 3.0% Upper Bollinger Band

- RES 1: 99.860 - All time High Nov 3 and the bull trigger

- PRICE: 99.845 @ 16:07 BST Nov 4

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

Aussie 3yr futures got further support Tuesday as the RBA cut their 3-yr yield target, boosting prices to new alltime highs up at 99.860. This further confirms bullish trend conditions. A break of 99.860, the Nov 3 high opens 99.889. Support is at 99.760.

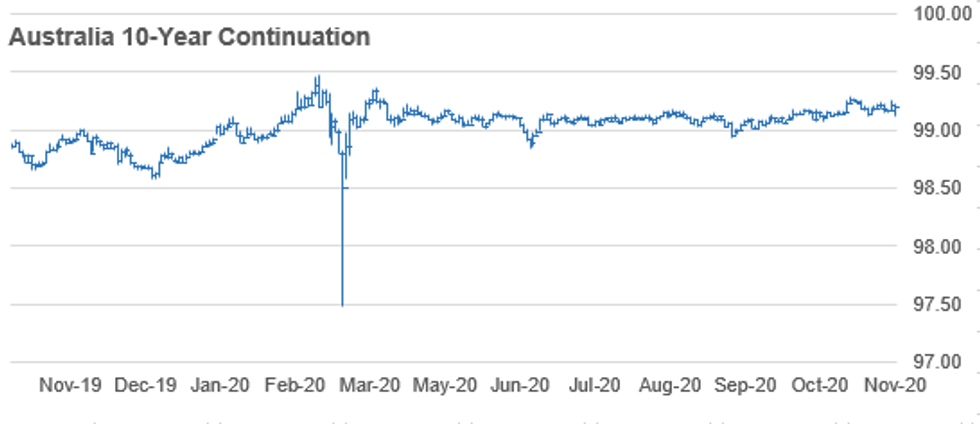

AUSSIE 10Y

AUSSIE 10-YR TECHS: (Z0) Rallies Remain Sold

- RES 3: 99.480 - High Mar 10 and the all-time high

- RES 2: 99.360 - High Apr 2 (cont)

- RES 1: 99.290 - High Oct 16

- PRICE: 99.225 @ 16:28 BST Nov 4

- SUP 1: 99.116 - 50-dma

- SUP 2: 99.055 - Low Sep 18 and 21

- SUP 3: 98.970 - Low Sep 8

Aussie 10y futures remain bullish despite the intraday pullback Tuesday. The break above 99.180, an area of congestion reflecting highs in Sep and early October confirmed a resumption of the uptrend that started on Aug 28. Attention turns to 99.300 and 99.360. The latter is the Apr 2 high (cont). The near-term bull trigger is 99.290, Oct 16 high. On the downside, firm trend support is at 99.075, Oct 5 low.

YEN 10Y

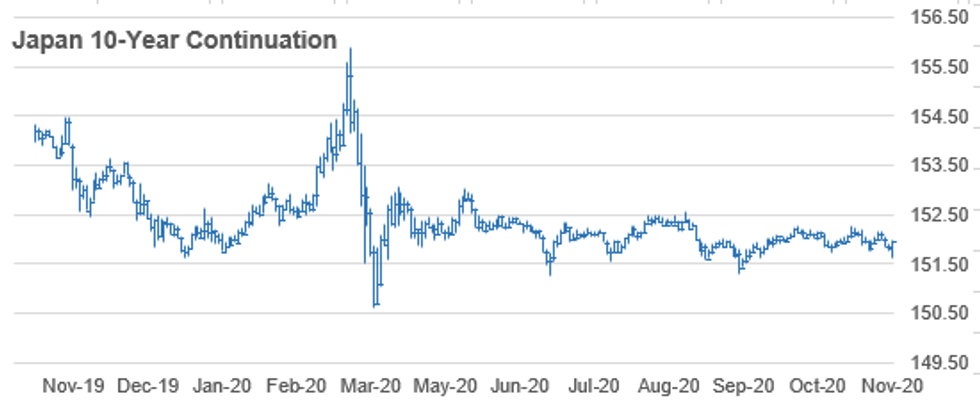

JGB TECHS: (Z0) Bouncing with Global Bonds

- RES 3: 152.55 - High Aug 5 (cont)

- RES 2: 152.36- 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 152.06 @ 16:10 BST Nov 4

- SUP 1: 151.75 - Low Oct 08 and trend support

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

On the US election results, JGBs rallied sharply alongside global bond markets. Having topped 152.00 last week, reestablishing the recent positive outlook, JGBs faded slightly earlier in the week, but the Wednesday rally helps provide some support from here. Attention remains on 152.29, Sep 4 high, a key resistance and the bull trigger. A break of this level would confirm a resumption of the uptrend and open 152.36, a Bollinger band objective and 152.55, Aug 5 high (cont).

TSY FUTURES CLOSE: Very Well Bid On Election Uncertainty

Very well bid -- and yet off early morning highs, double digit bear flattening in yield curves. Update:

- 3M10Y -12.544, 67.496 (L: 65.818 / H: 84.372)

- 2Y10Y -10.551, 62.153 (L: 60.331 / H: 76.756)

- 2Y30Y -10.812, 139.967 (L: 134.837 / H: 157.635)

- 5Y30Y -6.114, 122.166 (L: 116.912 / H: 133.018)

- Current futures levels:

- Dec 2Y up 1.62/32 at 110-13.87 (L: 110-11.87 / H: 110-14.12)

- Dec 5Y up 10.25/32 at 125-27.5 (L: 125-12.25 / H: 125-28.25)

- Dec 10Y up 28.5/32 at 138-31.5 (L: 137-20.5 / H: 139-01)

- Dec 30Y up 2-18/32 at 174-19 (L: 170-07 / H: 175-03)

- Dec Ultra 30Y up 5-01/32 at 219-12 (L: 210-12 / H: 220-30)

US EURODOLLAR FUTURES CLOSE: Sharply Higher, Long End Leads, Heavy Volumes

Mirroring Tsy futures, Eurodollar futures sharply higher across the strip, long end outperforming. Lead quarterly hold modest bid since 3M LIBOR set +0.00750 to 0.23225% (+0.01650/wk). Currently:

- Dec 20 +0.005 at 99.755

- Mar 21 +0.010 at 99.795

- Jun 21 +0.010 at 99.80

- Sep 21 +0.020 at 99.805

- Red Pack (Dec 21-Sep 22) +0.020 to +0.035

- Green Pack (Dec 22-Sep 23) +0.040 to +0.060

- Blue Pack (Dec 23-Sep 24) +0.070 to +0.110

- Gold Pack (Dec 24-Sep 25) +0.115 to +0.140

US DOLLAR LIBOR

Latest settles

- O/N -0.00050 at 0.08150% (+0.00012/wk)

- 1 Month -0.00150 to 0.13613% (-0.00412/wk)

- 3 Month +0.00750 to 0.23225% (+0.01650/wk)

- 6 Month -0.00013 to 0.24375% (+0.00162/wk)

- 1 Year -0.00087 to 0.33313% (+0.00300/wk)

US TSY SHORT TERM RATES

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $58B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $146B

- Secured Overnight Financing Rate (SOFR): 0.10%, $948B

- Broad General Collateral Rate (BGCR): 0.07%, $350B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $317B

- (rate, volume levels reflect prior session)

- Fri 11/06 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Next week's purchase schedule:

- Mon 11/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/10 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 11/12 1010-1030ET: Tsys 7Y-20Y, appr $3.625B

- Fri 11/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Fri 11/13 Next forward schedule release at 1500ET

OUTLOOK: Thursday Look Ahead

- US Data/Speaker Calendar (prior, estimate)

- 05-Nov 0730 Oct challenger layoff plans

- 05-Nov 0830 31-Oct initial jobless claims (751k, 735k)

- 05-Nov 0830 31-Oct continuing claims (7.756M, 7.200M)

- 05-Nov 0830 Q3 non-farm productivity (p) (10.1%, 5.6%)

- 05-Nov 0830 Q3 unit labor costs (p) (9%, -11.0%)

- 05-Nov 1030 30-Oct natural gas stocks w/w

- 05-Nov 1130 US Tsy 4W-Bill auction

- 05-Nov 1130 US Tsy 8W-Bill auction

- 05-Nov 1400 FOMC Rate announcement

- 05-Nov 1430 Fed Chair Powell Post-FOMC conference

- 05-Nov 1630 4-Nov Fed weekly securities holdings

PIPELINE: Issuers remain sidelined amid US Presidential Election uncertainty

EURODOLLAR/TREASURY OPTIONS

Eurodollar Options:

- Block, 15,000 Blue Mar 91/93 put spds, 4.5 vs. 99.515/0.25%

- -50,000 Green Mar 96/97/98 call flys, 5-4.5

- -10,000 Dec 97 straddles, 3.5

- +2,500 Blue Mar 95 calls, 11.5 vs. 99.515/0.52%

- 6,500 Dec 98 calls, cab

- +3,000 Green Mar 95 puts, 3.0

- +2,500 short Mar 96/97 put spds vs. Green Mar 93/96 put spd, 0.0 net for bear curve (Reds/Greens) flattener

- -2,000 Blue Sep 90/98 put over risk reversals, 3.5 vs. 99.385/0.34%

- -1,000 Blue Dec 95 straddles, 14.0

- Overnight trade

- -25,000 Blue Nov 93/95 put spds, 2.0

- +7,500 Blue Nov93 puts, 0.5

- +8,250 Blue Jan 90/91/93 broken put flys, 3.5

- +4,000 Blue Jan 92/93 put spds, 2.5

- +4,000 Blue Dec 97/100 call spds, 1.0

- Block, +7,000 Blue Dec/Blue Mar 95/96 1x2 call spd strip, 3.5

- Block, +8,880 Blue Nov 93/95 put spds, 2.0

- Block, +4,500 Blue Mar 95/96 1x2 call spds, 0.5

- Block, +15,000 TYF 136.5/139.5 strangles, 30 vs. 138-29/0.10%

- -6,000 TYF 136.5/137/138 broken put tree w/TYZ 137 puts, 7/64 cr

- over +40,000 TYZ 137.5 puts, 8-5

- 3,500 TYZ 137/138 put spds, 9/64

- +1,500 TYZ 141 calls, 2/64

- -10,000 TYF 126 puts, 15.5/64

- -2,700 USZ 177 calls, 24-23

- Overnight trade

- -10,000 FVF 126 puts, 15.5/64

- Other salient flow:

- -20,000 TYZ 138 puts from 16-14

- Over 16,000 wk1 TY 139.5 calls, 17/64

- +6,000 TYZ 139.75 calls, 9/64

- Block, -12,000 TYZ 138 puts vs. TYF 137 puts, 1/64 net db

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.