-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI US CLOSING FI ANALYSIS: Large Month End Buying Rates and Equities (test 2)

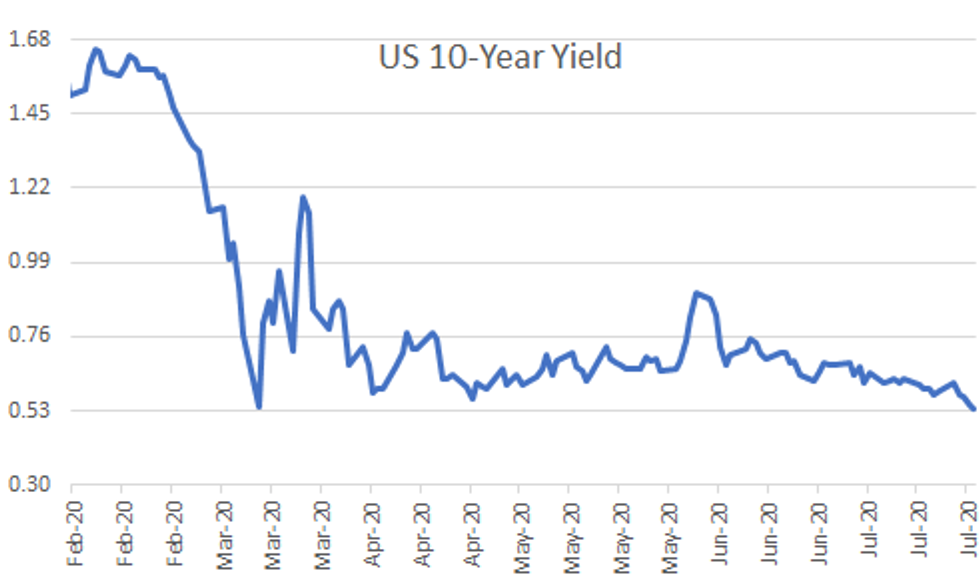

US TSY SUMMARY: Tsy ylds look to finish the month at 5M lows, 10YY still above

March 9 all-time low of 0.3137% at 0.5347% Fri; 10Y real yld/TIPS on the other

hand DID break March all-time low of -1.0083% to -1.0230% on the bell after

heavy month end buying. Tale of two session: Rates were under pressure in the

first half (as were equities).

- Sources reported large scale seller in old bonds, curves steepening in

"sloppy" early trade, was an indicator of incoming corp deals. Indeed, after

lagging last couple wks, issuance est >$30B next wk. Ultra-bonds have "been

trading well on the curve, thanks to the 20Y tightening and the Fed's buy focus

on '44 to '47 paper in their buybacks," the desk added, with "good sized seller

of '45's vs 30's the past two days to take advantage of the richness."

- Rates and equities both rebounded late on heavy buying in both: TYU volume

over 1.12M after the bell on +250k market on close (MOC) buying, USU saw +56K.

Yld curves see-sawed to mixed levels. Eminis were back near opening levels late

(3256.0 +7.25).

- The 2-Yr yield is down 0.8bps at 0.1093%, 5-Yr is down 1.7bps at 0.2138%,

10-Yr is down 1.3bps at 0.5331%, and 30-Yr is down 1.1bps at 1.1962%.

TECHNICALS:

US 10YR FUTURE TECHS: (U0) Uptrend Extends

RES 4: 141-00 1.0% 10-dma envelope

RES 3: 140-22+ High Mar 9 and key resistance (cont)

RES 2: 140-20 1.00 projection of Jun 5 - 11 rally from Jun 16 low

RES 1: 140-06 Jul 31 high

PRICE: 140-02 @ 16:23 BST Jul 31

SUP 1: 139-08 Low Jul 28

SUP 2: 139-00+ Low Jul 13

SUP 3: 138-23+ Low Jul 2 and key near-term support

SUP 4: 138-07 Low Jun 16 and reversal trigger

10yr futures continue to push higher and the outlook remains bullish. 139-25,

Mar 25 and Jul 24 high has been cleared this week. This confirms a break of a

key resistance and has also confirmed a resumption of the underlying uptrend

with attention on the March high at 140-22+. On the downside, key support has

been defined at 139-08, Jul 28 low a break of which would dent the current

bullish tone.

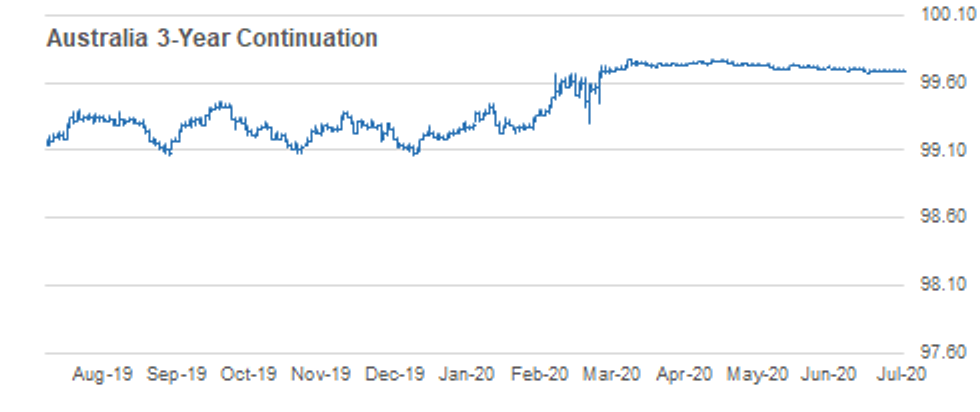

AUSSIE 3-YR TECHS: (U0) Holding Above Its Key Support

RES 3: 99.780 - High Apr 01 and bull trigger

RES 3: 99.750 - High May 21 and 22

RES 1: 99.730 - Congestion highs between Jun 15 - 22

PRICE: 99.700 @ 16:28 BST Jul 31

SUP 1: 99.680 - Low Jun 14 / Jul 22

SUP 2: 99.667 - 23.6% retracement of the March - April Rally

SUP 3: 99.597 - 38.2% retracement of the Mar - Apr rally

The short-end of the Aussie bond space traded lower recently but has held above

recent lows of 99.680, the Jul 14 low and a new low watermark. A break of this

support would signal scope for an extension lower towards Fibonacci support at

99.667 and 99.597, both Fibonacci retracement levels. On the upside, the key

hurdle for bulls remains the 99.730 congestion, highs between Jun 15 - 22. A

break would instead open 99.780, Apr 1 high further out.

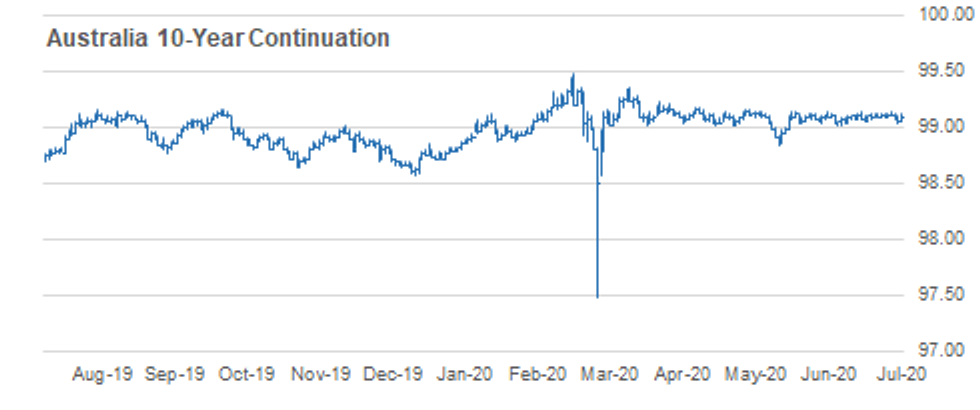

AUSSIE 10-YR TECHS: (U0) Bulls Back in Driving Seat

RES 3: 99.3600 - High Apr 02

RES 2: 99.2250 - High Apr 17

RES 1: 99.1650 - High Jul 31

PRICE: 99.1400 @ 16:26 BST, Jul 31

SUP 1: 99.0200 - Low Jul 2 and 3

SUP 2: 98.9750 - 50.0% retracement of the Jun 8 - Jul 13 rally

SUP 3: 98.9361 - 61.8% retracement of the Jun 8 - Jul 13 rally

Aussie 10yr futures crept higher into the weekly close, hitting 99.1650. This

cements the bullish focus for now, and bumps upside targets higher. This opens

99.2250, Apr 17 high. On the downside, initial key key support has for now been

defined at 99.0200, Jul 2 / 3 low. A break would expose a deeper decline towards

98.9750 instead. a Fibonacci retracement.

JGB TECHS: (U0): Slips Into Friday Close

RES 3: 153.06 - High Mar 31 and key resistance

RES 2: 152.77 - 200-dma

RES 1: 152.50 - High Jul 17 and the bull trigger

PRICE: 152.27 @ 16:31 BST, Jul 31

SUP 1: 151.57 - Low Jul 2 and key support

SUP 2: 151.26 - Jun 8 low

SUP 3: 150.61 - Low Mar 19 and key support

JGBs were sold into the Friday close on little news, but price action more

closely resembled bullish exhaustion rather than any trend change. Prices look

most likely to consolidate from here, with resistance at 152.50 capping any

progression of the bullish theme. Key support has been defined at 151.57, Jul 2

low.

TSY FUTURES CLOSE: Rates bounced off second half lows on late month end buying.

TYU volume over 1.12M after the bell on +250k market on close (MOC) buying,

USU saw +56K. Yld curves see-sawed to mixed levels. Update:

- 3M10Y -0.807, 44.18 (L: 41.198 / H: 47.125)

- 2Y10Y -0.135, 42.182 (L: 40.52 / H: 44.374)

- 2Y30Y +0.059, 108.496 (L: 106.197 / H: 111.416)

- 5Y30Y +0.771, 98.242 (L: 95.787 / H: 100.13)

- Current futures levels:

- Sep 2Y up 0.875/32 at 110-15.75 (L: 110-14.625 / H: 110-15.875)

- Sep 5Y up 2.25/32 at 126-3.75 (L: 125-31.75 / H: 126-04.5)

- Sep 10Y up 3/32 at 140-3.5 (L: 139-28 / H: 140-06)

- Sep 30Y up 2/32 at 182-12 (L: 181-21 / H: 182-26)

- Sep Ultra 30Y up 4/32 at 227-27 (L: 226-08 / H: 228-24)

MONTH END EXTENSIONS: Final Bloomberg-Barclays US month-end index extension; forecast

summary compared to the avg increase for prior year and the same time in 2019.

TIPS 0.13Y; Govt inflation-linked, 0.22.

| EST | 1Y AVG | LAST YR | |

| US TSYS | 0.09 | 0.09 | 0.06 |

| AGENCIES | 0.05 | 0.04 | 0.09 |

| CREDIT | 0.08 | 0.12 | 0.08 |

| GOVT/CREDIT | 0.08 | 0.10 | 0.07 |

| MBS | 0.06 | 0.07 | 0.05 |

| AGGREGATE | 0.08 | 0.09 | 0.06 |

| LONG GOV/CREDIT | 0.07 | 0.09 | 0.07 |

| INTERMEDIATE CR | 0.08 | 0.10 | 0.07 |

| INTERMEDIATE GOV | 0.08 | 0.08 | 0.06 |

| INTERMEDIATE GOV/CR | 0.08 | 0.09 | 0.07 |

| HIGH YIELD | 0.10 | 0.11 | 0.05 |

US TSYS/SUPPLY: Preview next week's auction schedue:

DATE TIME AMOUNT SECURITY (CUSIP)/ANNC

-------------------------------------------------

03 Aug 1130ET $54B 13W Bill (912796TP4)

03 Aug 1130ET $51B 26W Bill (9127963W7)

04 Aug 1130ET $30B 42D Bill (912796TU3)

04 Aug 1130ET $30B 119D Bill (9127962G3)

06 Aug 1130ET TBA 4W Bill 04 Aug Annc

06 Aug 1130ET TBA 8W Bill 04 Aug Annc

US EURODLR FUTURES CLOSE: At/Near Session Highs

Near where the session started actually, futures back to steady in the short

end, Reds through Golds firmer. Update:

Sep 20 steady at 99.780

Dec 20 steady at 99.745

Mar 21 +0.005 at 99.830

Jun 21 +0.005 at 99.850

Red Pack (Sep 21-Jun 22) +0.005 to +0.010

Green Pack (Sep 22-Jun 23) +0.010 to +0.015

Blue Pack (Sep 23-Jun 24) +0.010 to +0.015

Gold Pack (Sep 24-Jun 25) +0.010 to +0.010

US DOLLAR LIBOR: Latest settles:

O/N +0.0022 at 0.0872% (+0.0023/wk)

1 Month -0.0007 to 0.1549% (-0.0177/wk)

3 Month -0.0022 to 0.2487% (+0.0019/wk)

6 Month -0.0087 to 0.3061% (-0.0122/wk)

1 Year -0.0079 to 0.4486% (-0.0109/wk)

STIR: Federal Reserve Bank of New York EFFR for prior session:

Daily Effective Fed Funds Rate: 0.10% volume: $47B

Daily Overnight Bank Funding Rate: 0.09%, volume: $151B

US TSYS: REPO REFERENCE RATES:

* Secured Overnight Financing Rate (SOFR): 0.10%, $942B

* Broad General Collateral Rate (BGCR): 0.08%, $392B

* Tri-Party General Collateral Rate (TGCR): 0.08%, $378B

(rate, volume levels reflect prior session)

FED: NY Fed operational purchase

Tsy 2.25Y-4.5Y, $8.801B accepted of $24.940B submitted

Next week's schedule

* Tue 08/04 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

* Wed 08/05 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

* Thu 08/06 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

OUTLOOK: *** US Data/speaker calendar (prior, estimate):

03-Aug ---- Jul NA-made light vehicle sales SAAR (13.05M, 14.0M)

03-Aug 0945 Jul IHS Markit Mfg Index (final) (51.3, 51.3)

03-Aug 1000 Jul ISM Mfg Index (52.6, 53.6), New Orders (56.4, 55.2)

03-Aug 1000 Jun construction spending (-2.1%, 1.0%)

03-Aug 1130 US Tsy $54B 13W Bill auction (912796TP4)

03-Aug 1130 US Tsy $51B 26W Bill auction (9127963W7)

03-Aug 1230 STL Fed Pres Bullard on eco/mon-pol

03-Aug 1300 Richmond Fed Pres virtual eco/mon-pol roundtable

03-Aug 1400 Chi Fed Pres Evans virtual eco/mon-pol roundtable

PIPELINE: Limited Friday issuance. Expect surge in high-grade issuance next week

as latest earnings cycle winds down, estimated $20-30B.

Date $MM Issuer (Priced *, Launch #)

07/31 $210M *Kobe City 5Y +50

-

$2.5B Priced Thursday; $21.5B total/wk

07/30 $1.25B *Enterprise Products Op $250M 30Y +140, $1B 52Y +205

07/30 $750M *Truist Financial 7Y +75

07/30 $500M *Nordic Inv Bank 2Y +3

EURODOLLAR/TREASURY OPTIONS

Eurodollar options:

Another +10,000 Dec 97/98 1x2 call spds, 1.75, >23k total

3,950 Red Dec'21 98 puts vs. Red Mar'22 98 straddles

buyer short Sep 96/97 put spds 0.5 vs. 99.83

over +13,000 Dec 97/98 1x2 call spds, 1.75

over +10,000 Sep 97/98 call spds, 3.75

+15,000 short Dec 98/100/100.12 call flys, 1.0

More modest put trade:

2,000 Green Sep 96/97 put spds

total 3,500 Blue Oct 93/95 put spd

3,600 Jun 95/96/97 put flys

Upside call skew bid over corresponding OTM puts resumes

after decent pick-up Thursday. Overnight recap:

over +13,000 Dec 97/98 1x2 call spds, 1.75

over +10,000 Sep 97/98 call spds, 3.75

+15,000 short Dec 98/100/100.12 call flys, 1.0

5,000 Sep 97 puts, 1.0

2,500 Green Oct 95/96 put spds w/Blue Oct 93/95 put spd

Tsy Options:

-7,000 FVU 126/126.5 call spds 3.5 over FVV 126.5/127 call spd

+1,500 FVZ 126 calls, 38-38.5

US TSY OPTIONS: Scale 5Y Call Seller

* -5,000 FVU 125.75 calls, 25.5-25/64, Unwind

* 7,000 FVV 126.5/126 2x1 call spds soon after

* 5,000 wk2 TY 140/140.5 1x2 call spds, 1/64

As the month end..............>

GLOBAL MARKET/OPINION: As the month end approaches, there is a lot of talk of a

significant rebalance by balanced fund/pension funds but the impetus for this

has faded somewhat as equities declined this week.

- To give some perspective for Europe, the eurostoxx index has provided a

negative 3.9% total return so far this month and the Bloomberg-Barclays

aggregate bond index has lost 0.16%. Looking at monthly swings between bonds and

equities over the past ten years, this would be in the 74th percentile that

favours buying equities. It is the largest flow to European equities since June

2016.

- In the US, the situation is also stretched with the S&P providing a negative

2.7% total return and the Bloomberg-Barclays aggregate bond index down 0.99%.

Looking at monthly swings between bonds and equities over the past ten years,

this would be in the 88th percentile that favours buying equities i.e. one of

the largest switches back to equities and largest since Jan 2016.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.