-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - UMichigan In Focus

MNI US MARKETS ANALYSIS - UMichigan In Focus

- Treasuries have traded fairly flat overnight while European govies have been under pressure.

- UMichigan sentiment will be in focus today

US TSYS: Looking For A Bounce In Michigan

Treasuries have traded fairly flat overnight Friday, with the short-end/belly modestly weaker.

- The only thing on the schedule that's potentially market-moving is the latest University of Michigan survey reading, though quadruple witching day for equities potentially adds some volatility into the mix.

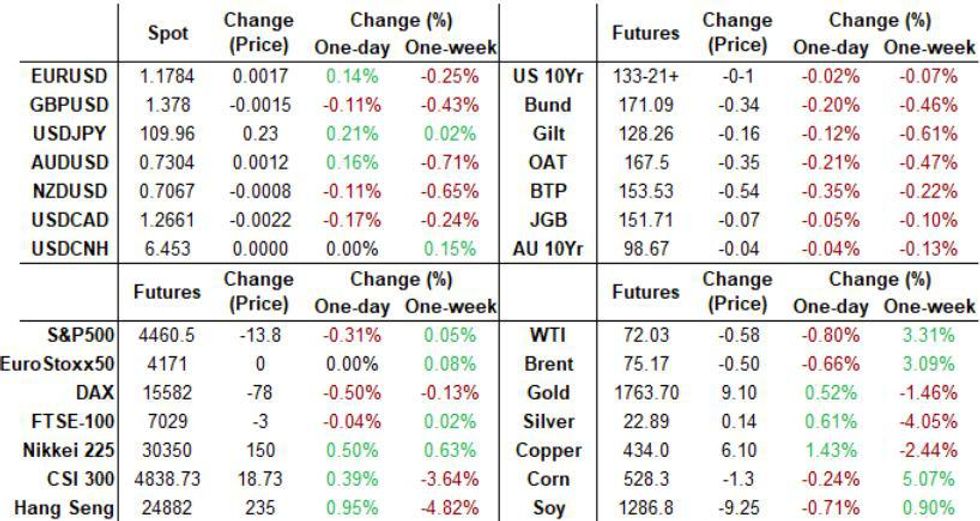

- The 2-Yr yield is up 0.4bps at 0.2237%, 5-Yr is up 0.3bps at 0.8437%, 10-Yr is down 0.3bps at 1.3345%, and 30-Yr is down 0.4bps at 1.8793%.

- Dec 10-Yr futures (TY) down 2/32 at 133-1 (L: 133-00 / H: 133-04.5).

- September UMichigan sentiment is the only data point today - a modest bounce from August's huge drop (which boosted Tsys upon release) is expected.

- No Fed speakers (of course) and no supply.

- NY Fed buys ~$2.025B of 1-7.5Y TIPS.

EGB/Gilts - Under pressure

- Another decent session volumes wise for EGBs.

- Bund has extended lower to test the 171.00 figure, printed a 170.98 low.

- Targets remains at the -0.246% yield level which equate to the 170.50

- We keep our eyes on couple of spread, he BTP/Bund spread trending below the 100bps (tighter) level and the Gilt/Bund which targets the March high at 113.4868, also the widest level since 11th November 2019.

- But decent selling clips in BTP translated in a wider BTP/Bund spread, moving back above 101bps, after investors were seen fading moves below 100bps this morning.

- Gilts are outperforming somewhat fading some the Gilt/Bund spread widening, and the spread sits 1.8bp tighter at the time of typing.

- Looking ahead, we have Quadruple Witching in Equities, BoE Bailey speaks on IMF Panel, and US Michigan is the only notable data.

- Dec Bund futures (RX) down 33 ticks at 171.1 (L: 170.98 / H: 171.32)

- Dec Gilt futures (G) down 8 ticks at 127.3 (L: 127.15 / H: 127.34)

- Dec BTP futures (IK) down 48 ticks at 153.59 (L: 153.41 / H: 154)

- Dec OAT futures (OA) down 34 ticks at 167.51 (L: 167.36 / H: 167.74

- )Italian BTP spread up 1.7bps at 101.3bps

EUROPEAN SOVEREIGN ISSUANCE UPDATE

UK AUCTION RESULTS DMO sells GBP3.5bln 1/3/6-month UKTBs

Decent cut to next week's auction size.

| Tenor | 1-month | 3-month | 6-month |

| Maturity | Oct 18, 2021 | Dec 20, 2021 | Mar 21, 2022 |

| Amount | GBP0.5bln | GBP1bln | GBP2bln |

| Previous | GBP0.5bln | GBP1.0bln | GBP2.0bln |

| Avg yield | 0.0155% | 0.0299% | 0.0317% |

| Previous | 0.0200% | 0.0309% | 0.0293% |

| Bid-to-cover | 5.27x | 3x | 2.4x |

| Previous | 2.47x | 2.51x | 2.04x |

| Next week | GBP0.5bln | GBP0.5bln | GBP1.0bln |

FOREX: USD Is Mostly Weaker This Morning

- The Dollar has been better offered this morning, a continuation of the overnight session, but still worth noting that we trade within past session's ranges.

- Best performer against the USD in G10, is still the AUD, up 0.33%.

- The Aussie is in the green, after we tested lowest level in AUDUSD since the 27th August yesterday.

- This is a continuation of the overnight session with some hope on the Covid, front as the country trials home quarantine for fully vaccinated people coming from abroad.

- The early risk on tone in Europe is also providing a bid.

- The Aussie is up against all majors, and also note very large option expiry with: 2.52bn at 0.7325 which could act as a magnet.

- EURUSD is small up today, on the broader USD weakness, and we have 3.14bn worth of option expiry between 1.1745/1.1800.

- Looking ahead, ECB Makhlouf, BoE Bailey are the notable speakers.

- ECB release 1st voluntary TLTRO repayments, where the Banks can pay back money drawn under TLTRO (11.05BST)

FX OPTION EXPIRY: Big expiry in AUDUSD could act as a magnet

Of note:

EURUSD: 3.14bn between 1.1745/1.1800

AUDUSD: 2.52bn at 0.7325- EURUSD: 1.1745 (1.23bn), 1.1750 (505mln), 1.1760 (211mln), 1.1800 (1.2bn)

- AUDUSD; 0.7325 (2.52bn)

- USDCAD: 1.2635 (232mln), 1.2700 (938mln)

- USDCNY; 6.43 (652mln), 6.48 (308mln)

Price Signal Summary - Bunds Head South

- In the equity space, S&P E-minis recovered yesterday but it remains too early to determine whether a move higher is a correction or the start of a recovery that resumes the uptrend. Attention remains on the key 50-day EMA at 4412.43. This average is an important support. Key resistance is unchanged at 4539.50, Sep 3 high. EUROSTOXX 50 futures remains above 4132.50, Sep 9 low. A break of this support would expose 4078.00, Aug 19 low. The bull trigger is unchanged at 4252.00, Sep 6 high.

- In FX, EURUSD's sell-off yesterday confirmed a resumption of bearish pressure. The pair has cleared Monday's low of 1.1770 resulting in a print below 1.1758, 61.8% of the Aug 20 - Sep 3 rally. Further weakness would open 1.1735, Aug 27 low. Recent activity in GBPUSD has defined short-term directional parameters at; 1.3913 as resistance, Sep 14 high and support at 1.3727, Sep 8 low. A clear breach of either level would provide a clearer directional signal. {US} The USD Index (DXY) has established a short-term support at 92.32, Sep 14 low. Technical conditions suggest scope for gains near-term.

- On the commodity front, Gold sold off sharply yesterday and the near-term outlook remains bearish. The focus is on $1724.5, 76.4% retracement of the Aug 9 - Sep 3 rally. WTI futures maintain a bullish outlook. The contract has this week cleared $71.30, the bear channel top drawn from the Jul 6 high. This reinforces current bullish conditions and opens the primary resistance and bull trigger at $74.77, Jul 7 high.

- In FI, Bund futures continue to weaken. This has opened 170.82 next, 2.764 projection of the Aug 5 - 11 - 17 price swing. Gilt futures are softer too and signal scope for an extension of the current bear cycle. The focus is on 127.09 1.764 projection of the Aug 20 - 26 - 31 price swing and 127.00 appears exposed.

EQUITIES: Retreating From Session Highs On Quadruple Witching Day

Equities performed well in the Asia-Pac session, but have retreated from early highs in European trading. Quadruple Witching expiries eyed.

- Asian stocks closed higher, with Japan's NIKKEI up 176.71 pts or +0.58% at 30500.05 and the TOPIX up 10.01 pts or +0.48% at 2100.17. China's SHANGHAI closed up 6.874 pts or +0.19% at 3613.966 and the HANG SENG ended 252.91 pts higher or +1.03% at 24920.76

- European stocks are weaker, with the German Dax down 44.85 pts or -0.29% at 15651.75, FTSE 100 up 0.31 pts or +0% at 7027.48, CAC 40 down 1.49 pts or -0.02% at 6622.59 and Euro Stoxx 50 down 13.72 pts or -0.33% at 4169.87.

- U.S. futures are lower, with the Dow Jones mini down 70 pts or -0.2% at 34679, S&P 500 mini down 13.75 pts or -0.31% at 4460.5, NASDAQ mini down 41.25 pts or -0.27% at 15476.5.

COMMODITIES: Metals Outperforming Energy

- WTI Crude down $0.61 or -0.84% at $72

- Natural Gas down $0 or -0.02% at $5.335

- Gold spot up $10.54 or +0.6% at $1763.6

- Copper up $4.7 or +1.1% at $432.75

- Silver up $0.13 or +0.57% at $23.0399

- Platinum up $15.95 or +1.7% at $952.74

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.