-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - 4.50% Yields In Sight as Treasury Weakness Persists

Highlights:

- Post-payrolls weakness in Treasuries persists, 4.50% yield in sight

- USD Index shrugs off yield rally as FX positioning holds short

- Data calendar typically light, US CPI the next hurdle

US TSYS: Post-Payrolls Sell-Off Continues, TY Resumes Downtrend

- Cash Tsys yields are off earlier highs but still sit 2.5-4bp higher on the day, with the sell-off led by 10s. The move extends Friday’s post-payrolls two-stage sell-off aided by hawkish Fedspeak.

- 2s build on Friday’s late clearance of 4.75% whilst 10s have seen some resistance at 4.45%, earlier poking to 4.452% before falling back to 4.442% at typing (highs since November).

- TYM4 trades at 109-05+ (- 15+) off an earlier low of 109-04 on heavy cumulative volumes of 475k. It has breached support at 109-09+ (Apr 3 low), with the resumption of the downtrend seeing focus on 109-00 after which lies Fibonacci projections starting at 108-25+.

- Data: NY Fed Inflation Expectations (1100ET)

- Fedspeak: Goolsbee (’25 voter) at 1300ET, Kashkari (non-voter) after the close at 1900ET in a moderated town hall discussion that could limit pertinent mon pol remarks.

- Bill issuance: US Tsy $70B 13W, $70B 26W Bill auctions (1130ET)

Fed Rate Path Off Highs But Still Extends Post-NFP Increase

- Fed Funds implied rates have pulled back off overnight highs but nevertheless have built on the extension on the initial post-payrolls lift seen later in Friday’s session.

- Cumulative cuts from 5.33% effective: 2bp May, 13.5bp Jun, 23bp Jul, 39bp Jul and 64bp Dec.

- The latter comes from an implied rate some 9bps higher than pre-payrolls levels, and pushes more notably above the median FOMC dot for 75bp of cuts.

- Friday saw preeminent FOMC hawks Bowman and Logan say it’s “still not yet” time/“much too soon” to talk about rate cuts.

- Ahead, a dovish Goolsbee (’25 voter) on local radio at 1300ET is the sole scheduled Fedspeaker for today. He said Apr 4 that its worth staying attuned to a deterioration in the jobs market but that the thing to watch is inflation and especially housing inflation as the most valuable near-term indicator.

MNI US Employment Insight, Apr'24: Strong Jobs Growth, But Also Strong Supply

EXECUTIVE SUMMARY

- Nonfarm payrolls growth surprised higher March (303k vs cons 214k) but unlike February’s beat, also saw a positive two-month revision even if it was entirely back in January.

- The establishment survey was generally more hawkish than expected, with a high 0.3% M/M for wage growth and hours worked also surprising higher.

- However, the u/e rate was in line as a strong bounce back in household employment only just exceeded very strong labor force growth.

- This supply side expansion helped initially contain the magnitude of the hawkish reaction although it started to gain momentum and has since seen 2Y Treasury yields clear 4.75% for the first time since Dec.

- Many analysts now see risks of cuts starting later than June, although with the exception of JPMorgan are reluctant to alter formal calls prior to Wednesday’s CPI release.

PLEASE FIND THE FULL REPORT HERE:

OI Points To Net Shorts Being Added Across The Curve On Friday

The combination of Friday’s Tsy sell off in the wake of the NFP release and preliminary open interest data points to net short setting across all major Tsy futures ahead of the weekend.

- Comments from the hawkish wing of the Fed were also seen post-data.

- Still, the net positioning swings were relatively contained.

- Potential ‘explainers’ for the limited positioning swings include already net short (albeit not stretched) positioning across the curve, as flagged in our latest CFTC CoT update and the proximity to Wednesday’s CPI release.

- Geopolitical worry may have presented another limit to the short setting.

- Note that the sell off has extended further today, as the reassessment of the short-term Fed policy path continues and after the weekend failed to provide a meaningful escalation in geopolitical tension.

| 05-Apr-24 | 04-Apr-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,851,494 | 3,846,648 | +4,846 | +180,624 |

| FV | 6,109,704 | 6,092,363 | +17,341 | +726,056 |

| TY | 4,368,421 | 4,346,936 | +21,485 | +1,384,062 |

| UXY | 2,034,505 | 2,033,933 | +572 | +49,634 |

| US | 1,527,849 | 1,523,195 | +4,654 | +596,247 |

| WN | 1,600,882 | 1,597,579 | +3,303 | +654,708 |

| Total | +52,201 | +3,591,329 |

OI Points To Net Short Setting In SOFR Futures Following NFPs & Hawkish Fedspeak

Friday’s move lower in SOFR futures and preliminary OI data point to net short setting as the dominant positioning factor through the blues.

- Pockets of long cover were also seen.

- The labor market report was the major catalyst for the move, with comments from the hawkish wing of the Fed also factoring in post-data.

- Note that the sell off has extended further today, as the reassessment of the short- to medium-term Fed policy path continues and after the weekend failed to provide a meaningful escalation in geopolitical tension.

- ~62.5bp of Fed cuts are priced through year end, with odds of a 25bp cut through the end of the June FOMC essentially 50/50.

| 05-Apr-24 | 04-Apr-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRH4 | 974,187 | 967,410 | +6,777 | Whites | +8,866 |

| SFRM4 | 1,181,434 | 1,167,720 | +13,714 | Reds | +28,960 |

| SFRU4 | 987,236 | 994,313 | -7,077 | Greens | +17,154 |

| SFRZ4 | 1,146,565 | 1,151,113 | -4,548 | Blues | +1,725 |

| SFRH5 | 727,459 | 726,941 | +518 | ||

| SFRM5 | 800,819 | 782,168 | +18,651 | ||

| SFRU5 | 685,463 | 676,626 | +8,837 | ||

| SFRZ5 | 664,500 | 663,546 | +954 | ||

| SFRH6 | 506,376 | 494,422 | +11,954 | ||

| SFRM6 | 520,655 | 517,673 | +2,982 | ||

| SFRU6 | 373,864 | 369,417 | +4,447 | ||

| SFRZ6 | 357,928 | 360,157 | -2,229 | ||

| SFRH7 | 241,016 | 234,627 | +6,389 | ||

| SFRM7 | 198,643 | 197,939 | +704 | ||

| SFRU7 | 164,194 | 159,952 | +4,242 | ||

| SFRZ7 | 197,461 | 207,071 | -9,610 |

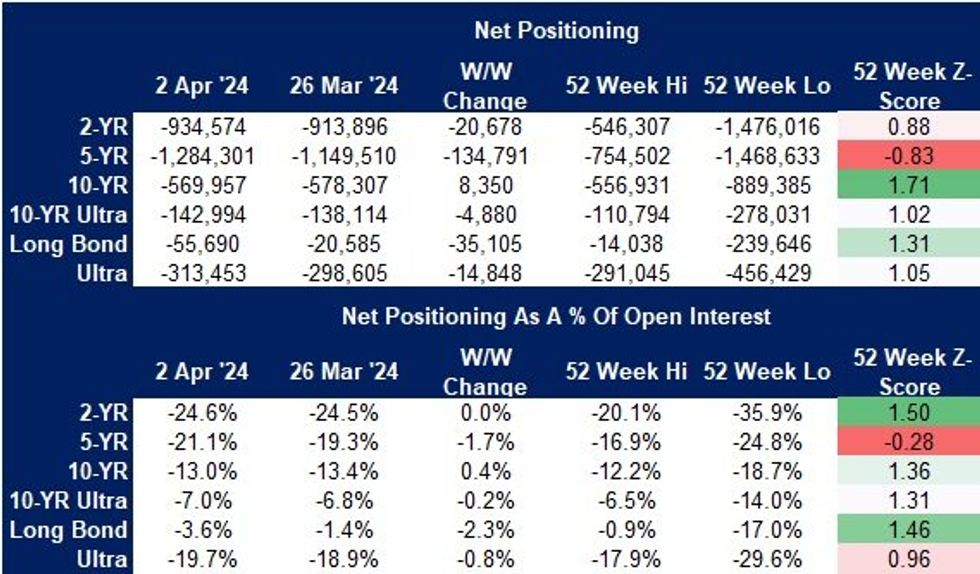

CFTC Report Points To Pre-NFP Additions To Net Shorts In Most Contracts

Friday’s CFTC CoT report showed non-commercial net shorts being added across most Tsy futures contracts as of Tuesday April 2. Modest net long setting in TY futures provided the exception.

- Non-commercial net shorts across the curve remain comfortably off the extremes seen over the last year, in both outright and % of OI terms.

- A reminder that the strong ISM manufacturing survey was released on the Monday April 1 and would have factored heavily into the short setting seen in most contracts.

- Elsewhere, the reaction to Wednesday’s soft ISM services survey will not be captured until next week’s data, with the same holding true for Friday’s NFP release. The latter triggered another round of hawkish Fed repricing.

Source: MNI - Market News/CFTC

Source: MNI - Market News/CFTC

CFTC: EUR Position Slides Further, Exposing Markets to Potential Squeeze

- EUR positioning faded further in the week-ending 2nd April, putting the net EUR position at new yearly lows of 2.5% of open interest. This keeps the EUR as the currency with the lowest Z-score among those surveyed, at -2.51 on a % of open interest basis. The report filing coincides with the bottom of the pullback into the Apr 2 session at 1.0725.

- GBP and AUD positioning improved on the week, both by 2.5% of open interest, however the AUD position remains resolutely net short, while GBP remains net long. As such, while the AUD net position has improved, it remains only just above the largest net short on record, printed the prior week.

- The USD Index net position has consolidated at lows, with outright position now short of 1,896 contracts, the lowest since 2021.

Full details here:

EUROPE ISSUANCE UPDATE:

7/10-year EU bond results

- E2.267bln of the 3.125% Dec-30 EU-bond. Avg yield 2.868% (bid-to-cover 1.09x)

- E2.392bln of the 3.00% Dec-34 EU-bond. Avg yield 3.061% (bid-to-cover 1.13x)

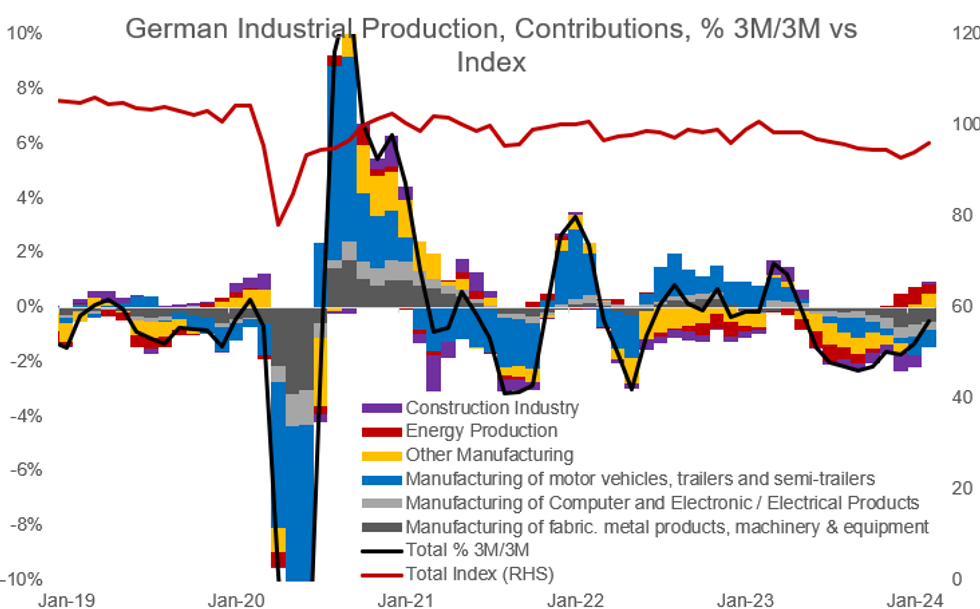

GERMAN DATA: Industrial Production Ticking Higher, But Outlook Remains Clouded

German industrial production exceeded expectations in February with a second consecutive monthly uptick of 2.1% M/M (highest since January 2023; vs +0.5% cons/+1.3% prior revised from +1.0%) but is still clearly in negative territory on a yearly comparison at -4.9% Y/Y (vs -6.8% cons/-5.3% prior revised from -5.5%).

- Overall this is a strong report, especially when considering the upward revision of last month, and was driven by strong developments in the construction and automotive industries. The less volatile 3M/3M measure also improved to -0.5% (vs -1.4% prior), which while still negative was the highest value since May 2023.

- Looking at individual components of production ex-energy and construction, the uptick was broad-based, with intermediate goods +2.5% M/M (vs +4.3% prior), investment goods +1.5% M/M (vs -1.5% prior), durable goods +3.0% M/M (vs +1.1% prior), non-durable goods +1.6% M/M (vs +4.0% prior) and consumption goods +1.9% (vs +3.4% prior).

- A split across industries shows strength especially in construction with its highest monthly increase since March 2021 (+7.9% M/M, vs +2.9% prior) as well as in automotive (+5.7% M/M, vs -4.0% prior, highest increase since August 2023) and pharmaceutical production (+6.4% M/M, vs -0.8% prior). There were some weaker sectors, also, however: energy production for instance came in at -6.5% M/M (vs -2.7% prior).

- Despite the strong IP figures, the outlook for German industrial activity remains clouded.

- Other hard data and surveys suggest no rebound is imminent, with February's factory orders surprising to the downside, manufacturing PMI falling to a 5-month low in March, and the March EC manufacturing confidence survey plumbing the lowest levels since the pandemic. Even the construction production growth appears at odds with very weak construction PMI.

- MNI's median of sellside analysts' estimates of Y/Y industrial production hasn't changed in the past month after downward revisions earlier in the year and sees continued falls through Q3 2024 (-5.5% Y/Y Q1, -3.6% Q2, -0.3% Q3, +1.9% Q4).

MNI, Destatis

MNI, Destatis

FOREX: US Yields Continue March Higher, But USD Unphased

- The dollar takes up the midpoint of the G10 table so far Monday, shrugging off a continued rise in the US 10y yield, which rose to another recovery high at 4.4520% today as markets continue to gravitate toward fewer Fed rate cuts this year than initially envisaged. Just over 2 x 25bps rate cuts are now priced for this calendar year, down from over seven rate cuts priced at the beginning of 2024.

- CHF is the poorest performer so far, a move that's keeping the uptrend in EUR/CHF underpinned. Cycle highs at 0.9849 remain the bull trigger, a break above which puts the cross at the best levels since April last year.

- Scandi currencies are among the session's best performers, with NOK shrugging off the pullback in oil prices. EUR/NOK trades close to last week's lows, with the striking of a sizeable wage deal with labour unions adding to domestic inflationary pressure and possibly restricting the Norges Bank's space with which to ease policy this year.

- The schedule for Monday is typically muted, with few datapoints for markets to digest ahead of the US CPI report on Wednesday. Central banks are similarly quiet, however BoE's Breeden and Fed's Goolsbee set to make appearances.

Expiries for Apr08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0685-00(E1.1bln), $1.0750(E1.2bln), $1.0800(E746mln)

- USD/JPY: Y150.00($605mln), Y151.85($719mln), Y153.00($544mln)

- GBP/USD: $1.2630-40(Gbp626mln)

- EUR/GBP: Gbp0.8706-10(E526mln)

EQUITIES: Eurostoxx Pullback Deemed Corrective

The trend condition in S&P E-Minis remains bullish, however, the recent move lower highlights a corrective cycle and last week's sell-off reinforces this condition. The contract has breached bull channel support drawn from the Jan 17 low, and cleared the 20-day EMA. The uptrend in Eurostoxx 50 futures remains intact and last week’s pullback is considered corrective. The break of support around the 20-day EMA - at 4965.40 - suggests potential for a deeper retracement near-term.

COMMODITIES: Gold Trend Condition Remains Bullish

The trend condition in Gold remains bullish and the yellow metal is again trading higher and starts the week on a bullish note. This maintains the price sequence of higher highs and higher lows and note that moving average studies are in a bull-mode condition. A bull theme in WTI futures remains intact and last week’s rally reinforces current condition, confirming a resumption of the uptrend. The contract has traded through $84.87, the Sep 15 ‘23 high, paving the way for a climb towards the $90.00 handle further out.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/04/2024 | 1530/1630 |  | UK | BOE's Breeden Panellist at 'Towards the future of the monetary system' | |

| 08/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 09/04/2024 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/04/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 09/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/04/2024 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/04/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.